AP 5902Q Liabs Supporting Notes

Diunggah oleh

Emms Adelaine TulaganHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AP 5902Q Liabs Supporting Notes

Diunggah oleh

Emms Adelaine TulaganHak Cipta:

Format Tersedia

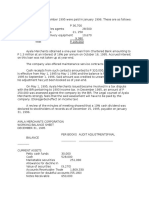

PROBLEM NO.

1 - Cavaliers Corporation

1 Warranty payable, 3/31/04

Add warranty expense accrued during 2004-2005

Total

Less payments during 2004-2005

Warranty payable, 3/31/05

252,000

630,000

882,000

537,000

345,000

2 Bond discount, 10/1/99 (P5,000,000 x .04)

Discount amortization, 10/1/99 to 3/31/05 (P200,000/10 x 5.5)

Bond discount, 3/31/05

200,000

(110,000)

90,000 D

3 Bond interest payable, 10/1/04 to 3/31/05 (P5,000,000 x 12% x 6/12)

4 Notes payable - current (maturing up to 3/31/06)

Accounts payable

Estimated warranty payable (see no. 1)

Cash dividends payable (5 million shares x P0.30)

Accrued interest:

Notes payable

Bonds payable (see no. 3)

Total current liabilities

5 Bonds payable:

Face value

Unamortized bond discount (see no. 2)

Notes payable - non current

Total non current liabilities

300,000 B

2,400,000

560,000

345,000

1,500,000

340,000

300,000

5,000,000

(90,000)

PROBLEM NO. 2 - Pirates' Music Emporium

Question No. 1 - A

Warranty expense (P5,400,000 x 2%)

108,000

Question No. 2 - D

Estimated liability from warranties, 1/1/05

Add warranty expense for 2005

Total

Less actual expenditures for 2005

Estimated liability from warranties, 12/31/05

136,000

108,000

244,000

164,000

80,000

Question No. 3 - A

Premium expense [(1,800,000 x 60%)/200 x P14]

75,600

Question No. 4 - D

Inventory of premium, 1/1/05

Add premium purchases (6,500 x P34)

Total premium available

Less premiums issued (1,200,000/200 x P34)

Inventory of premium, 12/31/05

39,950

221,000

260,950

204,000

56,950

Question No. 5 - C

Estimated premium claims outstanding, 1/1/05

Add premium expense for 2005

Total

Less premiums issued (1,200,000/200 x P14)

Estimated premium claims outstanding, 12/31/05

44,800

75,600

120,400

84,000

36,400

640,000

5,445,000 C

4,910,000

2,700,000

7,610,000 D

PROBLEM NO. 3 - Spurs Company

Date

Voucher No.

Creditor

Nov. 27

Dec. 02

11

20

21

797

821

829

836

842

Duncan Supply Co.

Ginobili Distributors

Parker Sales

Mohamed Dealers

Bowen Merchandising

22

31

856

865

Horry Mercantile

Jackson Traders

Amount

Per sked

78,400

19,600

44,100

17,150

22,050

Amount

As adjusted

80,000

45,000

22,500

Discount

Lost

1,600

900

450

80,850

78,400

340,550

80,850

78,400

306,750

2,950

Note: All invoices dated prior to Dec. 22 are not entitled to discount anymore.

Adjustment

Purchase discount lost

Vouchers payable

8,000

Unpaid vouchers as adjusted

Balance of control account (P1,645,000-P1,309,500-P36,750)

Total purchase discount lost

8,000

306,750

298,750

8,000

Analysis

Original net vouchers payable

Less cancelled vouchers

Net vouchers payable

Less net vouchers payable still unpaid (P340,550-P36,750)

Payment that should have been made if all dicounts were taken

Less actual cash disbursements (per control account)

Dicount lost on paid vouchers

Dicount lost on unpaid vouchers

Total purchase discount lost

1,645,000

36,750

1,608,250

303,800

1,304,450

1,309,500

5,050

2,950

8,000

ANSWERS: 1) B; 2) B; 3) C; 4) C

PROBLEM NO. 4 - Bulls Finance Company

Question no. 1 - A

Total bonds issued

Face value of bonds retired {P216,000/[1.05 + (.12 x 3/12)]}

Adjusted balance of bonds payable, 12/31/03

1,600,000

200,000

1,400,000

Question no. 2 - C

Unamortized bond premium, 12/31/03 (P80,000 x 14/16 x 20/25)

Question no. 3 - B

Nominal interest

P1,400,000 x 12%

P200,000 x 12% x 9/12

Total

Less premium amortization

Bonds retired (P80,000/25 x 2/16 x 9/12)

Remaining bonds (P80,000/25 x 14/16)

Bond interest expense

Question no. 4 - A

Redemption price (P200,000 x 1.05)

Book value of bonds retired

Face value

Unamortized bond premium

(P80,000 x 2/16 x 20.25/25)

Loss on bond redemption

56,000

168,000

18,000

186,000

300

2,800

3,100

182,900

210,000

200,000

8,100

208,100

1,900

Anda mungkin juga menyukai

- Retail DirectoryDokumen21 halamanRetail DirectoryAnuj GuptaBelum ada peringkat

- Ap 5908Dokumen6 halamanAp 5908Aiko E. Lara100% (1)

- Part 4C (Quantitative Methods For Decision Analysis) 354Dokumen102 halamanPart 4C (Quantitative Methods For Decision Analysis) 354Noel Cainglet0% (1)

- Mcqs - Marketing Management - 201 Unit I-Product: Dnyansagar Institute of Management and ResearchDokumen108 halamanMcqs - Marketing Management - 201 Unit I-Product: Dnyansagar Institute of Management and ResearchSAURABH PATILBelum ada peringkat

- CPAR - Auditing ProblemDokumen12 halamanCPAR - Auditing ProblemAlbert Macapagal83% (6)

- Buying and SellingDokumen67 halamanBuying and Sellinganne89% (19)

- Auditing FinalMockBoard ADokumen11 halamanAuditing FinalMockBoard ACattleyaBelum ada peringkat

- T5 Price Lecture Slides S3.20Dokumen54 halamanT5 Price Lecture Slides S3.20Khoa Cao100% (1)

- Quiz NPO Multiple ChoiceDokumen4 halamanQuiz NPO Multiple ChoiceLJ Aggabao0% (1)

- IAS 36 Impairment of AssetsDokumen29 halamanIAS 36 Impairment of AssetsEmms Adelaine TulaganBelum ada peringkat

- M3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYDokumen5 halamanM3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYReginald ValenciaBelum ada peringkat

- PO Osna 4700002842Dokumen2 halamanPO Osna 4700002842vijen33Belum ada peringkat

- The Language of Business Correspondence in English 2007Dokumen424 halamanThe Language of Business Correspondence in English 2007duythienddt100% (1)

- MANAGEMENT ADVISORY SERVICES TOPICSDokumen19 halamanMANAGEMENT ADVISORY SERVICES TOPICSNovie Marie Balbin AnitBelum ada peringkat

- Market Study of Roxy PaintDokumen22 halamanMarket Study of Roxy PaintMd. Syed Delwer RahmanBelum ada peringkat

- 2 Accounts ReceivableDokumen5 halaman2 Accounts ReceivableTricia Mae FernandezBelum ada peringkat

- Hoba 2019 QuizDokumen10 halamanHoba 2019 QuizJo Montes0% (1)

- University of The Visayas Applied Auditing Audit of Liabilities Problem No. 1Dokumen4 halamanUniversity of The Visayas Applied Auditing Audit of Liabilities Problem No. 1stillwinms100% (1)

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDokumen9 halamanSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesBelum ada peringkat

- AP 5902 Liability Supporting NotesDokumen6 halamanAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Raptor Pos ManualDokumen174 halamanRaptor Pos ManualAnonymous kylAQXFJs100% (3)

- Entertainment & Discount PolicyDokumen5 halamanEntertainment & Discount PolicyChris FongBelum ada peringkat

- White Corporation Depreciation CalculationsDokumen8 halamanWhite Corporation Depreciation CalculationsAlbert Macapagal100% (2)

- AP 59 1stPB - 5.06Dokumen9 halamanAP 59 1stPB - 5.06xxxxxxxxx0% (1)

- PRTC 1st Preboard Solution GuideDokumen48 halamanPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Accounting for Liquidation and Foreign ExchangeDokumen8 halamanAccounting for Liquidation and Foreign Exchangeprecious mlb100% (1)

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Dokumen10 halamanCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADBelum ada peringkat

- Jpia Cup p1Dokumen65 halamanJpia Cup p1RonieOlarte100% (1)

- MA PresentationDokumen6 halamanMA PresentationbarbaroBelum ada peringkat

- Solution To AP05 - InvestmentsDokumen17 halamanSolution To AP05 - InvestmentsmarkBelum ada peringkat

- Auditing Problems AP 007 to 010 SolutionsDokumen6 halamanAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenBelum ada peringkat

- CPA REVIEW: Calculating Depreciation and Estimated LiabilityDokumen41 halamanCPA REVIEW: Calculating Depreciation and Estimated LiabilityalellieBelum ada peringkat

- This Study Resource Was: Easy RoundDokumen9 halamanThis Study Resource Was: Easy RoundAiziel OrenseBelum ada peringkat

- Cpar - Ap 09.15.13Dokumen18 halamanCpar - Ap 09.15.13KamilleBelum ada peringkat

- CEBU CPAR CENTER - 1st PreboardDokumen24 halamanCEBU CPAR CENTER - 1st PreboardMary Alcaflor BarcelaBelum ada peringkat

- Quiz 1 ConsulDokumen4 halamanQuiz 1 ConsulJenelyn Pontiveros40% (5)

- Naqdown – Elimination Auditing ProblemsDokumen5 halamanNaqdown – Elimination Auditing ProblemsJohn Paulo SamonteBelum ada peringkat

- F3Dokumen2 halamanF3Kimberly PadlanBelum ada peringkat

- Finals SWDokumen115 halamanFinals SWAira Jaimee GonzalesBelum ada peringkat

- Audit of EquityDokumen5 halamanAudit of EquityKarlo Jude Acidera0% (1)

- Guerrero - Advanced Accounting 1 PDFDokumen2 halamanGuerrero - Advanced Accounting 1 PDFJc Quesada60% (5)

- PPE NotesDokumen4 halamanPPE Notesaldric taclanBelum ada peringkat

- Accounting 502 - Quiz 1 December 3, 2018: Not Required. (2 Points Each)Dokumen4 halamanAccounting 502 - Quiz 1 December 3, 2018: Not Required. (2 Points Each)Trish Dela CruzBelum ada peringkat

- This Is RealDokumen17 halamanThis Is RealCheemee LiuBelum ada peringkat

- ACC410 Week 1 AssignmentDokumen3 halamanACC410 Week 1 AssignmentbitofpatienceBelum ada peringkat

- AUDIT OF INVESTMENTS GAINS AND LOSSESDokumen6 halamanAUDIT OF INVESTMENTS GAINS AND LOSSESZyrelle DelgadoBelum ada peringkat

- Lease & PensionDokumen11 halamanLease & PensionNicole Pangilinan100% (2)

- Cebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSDokumen9 halamanCebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSLoren Lordwell MoyaniBelum ada peringkat

- BAFINAR Quiz 6 R FinalDokumen4 halamanBAFINAR Quiz 6 R FinalJemBelum ada peringkat

- Quiz 2 - Corp Liqui and Installment SalesDokumen8 halamanQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburBelum ada peringkat

- UST AMV ACC 4 QUIZ 1 INVESTMENT EQUITY SECURITIESDokumen9 halamanUST AMV ACC 4 QUIZ 1 INVESTMENT EQUITY SECURITIESMildred Angela DingalBelum ada peringkat

- Day 1 financial statement reviewDokumen12 halamanDay 1 financial statement reviewneo14Belum ada peringkat

- Seatwork-Hedging of A Net Investment in Foreign OperationDokumen1 halamanSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacBelum ada peringkat

- Acct. 162 - EPS, BVPS, DividendsDokumen5 halamanAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueBelum ada peringkat

- Exercise-Receivables-Block BDokumen2 halamanExercise-Receivables-Block BSittieAyeeshaMacapundagDicaliBelum ada peringkat

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Dokumen20 halamanPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesBelum ada peringkat

- AudTheo Salosagcol 2018ed Ansv1 PDFDokumen13 halamanAudTheo Salosagcol 2018ed Ansv1 PDFDanica Gravito100% (1)

- AUDITINGDokumen11 halamanAUDITINGMaud Julie May FagyanBelum ada peringkat

- Auditing ProblemsDokumen9 halamanAuditing ProblemsJillBelum ada peringkat

- CHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Dokumen2 halamanCHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Maryferd SisanteBelum ada peringkat

- C36 Planning-W RevisionsDokumen23 halamanC36 Planning-W RevisionsNicole Johnson100% (1)

- AFAR Review Net Asset AcquisitionDokumen12 halamanAFAR Review Net Asset AcquisitionThom Santos Crebillo100% (1)

- Financial Accounting 2 Chapter 1 SolmanDokumen17 halamanFinancial Accounting 2 Chapter 1 SolmanElijah Lou ViloriaBelum ada peringkat

- Answers - V2Chapter 1 2012Dokumen10 halamanAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- CH 3 Vol 1 AnswersDokumen17 halamanCH 3 Vol 1 AnswersGeomari D. Bigalbal100% (2)

- Vol 2 CH 1Dokumen20 halamanVol 2 CH 1lee jong sukBelum ada peringkat

- Gat Prin & Pract of Fin Acct Nov 2006Dokumen10 halamanGat Prin & Pract of Fin Acct Nov 2006samuel_dwumfourBelum ada peringkat

- Understanding Cash Flow Problems and SolutionsDokumen14 halamanUnderstanding Cash Flow Problems and SolutionsAlka DwivediBelum ada peringkat

- 2014 Volume 2 CH 1 Solution ManualDokumen10 halaman2014 Volume 2 CH 1 Solution ManualGabriel Dave AlamoBelum ada peringkat

- CH 3 Vol 1 AnswersDokumen17 halamanCH 3 Vol 1 Answersjayjay112275% (4)

- Financial Accounting Baysa and Lupisan 2008 Volume 2 EditionDokumen21 halamanFinancial Accounting Baysa and Lupisan 2008 Volume 2 EditionAsfjaslkf Dsgsdhsd0% (2)

- FA Mod1 2013Dokumen551 halamanFA Mod1 2013Anoop Singh100% (2)

- International Accounting StandardsDokumen49 halamanInternational Accounting StandardsShin Hye ParkBelum ada peringkat

- Philippine CPA Review - Summary of The Old Conceptual Framework Issued by The Accounting Standards Council (ASC)Dokumen8 halamanPhilippine CPA Review - Summary of The Old Conceptual Framework Issued by The Accounting Standards Council (ASC)Emms Adelaine Tulagan0% (1)

- Auditing - RF-12 Quiz BowlDokumen12 halamanAuditing - RF-12 Quiz BowlWilson CuasayBelum ada peringkat

- Jose RizalDokumen1 halamanJose RizalEmms Adelaine TulaganBelum ada peringkat

- Final Exam For Law 104Dokumen9 halamanFinal Exam For Law 104Emms Adelaine TulaganBelum ada peringkat

- Lynda EbookDokumen2 halamanLynda EbookEmms Adelaine TulaganBelum ada peringkat

- 5 04 Sales Pricing EngineDokumen47 halaman5 04 Sales Pricing EngineGyanu Kumar100% (1)

- Merchandising Accounting GuideDokumen54 halamanMerchandising Accounting GuideApril SasamBelum ada peringkat

- AP 5902Q Liabs Supporting NotesDokumen2 halamanAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganBelum ada peringkat

- Project Frond SideDokumen8 halamanProject Frond SideDilip MenonBelum ada peringkat

- Tip 21a01-05Dokumen3 halamanTip 21a01-05Melissa R.Belum ada peringkat

- MKT501 (50 Solved MCQS)Dokumen24 halamanMKT501 (50 Solved MCQS)Nadir AliBelum ada peringkat

- Marketing Short Questions Paper WiseDokumen20 halamanMarketing Short Questions Paper WiseMalik Naseer AwanBelum ada peringkat

- Unit - 4 - Subsidiary BookaDokumen17 halamanUnit - 4 - Subsidiary BookaHANY SALEMBelum ada peringkat

- Cost PriceDokumen13 halamanCost PriceRakesh RakeeBelum ada peringkat

- Chapter 7 Pricing StrategiesDokumen30 halamanChapter 7 Pricing StrategiestafakharhasnainBelum ada peringkat

- Introduction To AccountingDokumen22 halamanIntroduction To AccountingAnamika Singh PariharBelum ada peringkat

- Valuation of Goods Under Central Excise ActDokumen25 halamanValuation of Goods Under Central Excise ActMukul Singh RathoreBelum ada peringkat

- Journal Entry Questions - 1Dokumen2 halamanJournal Entry Questions - 1Areeb Suhail Anjum Ansari100% (1)

- Sales Promotion MethodsDokumen6 halamanSales Promotion MethodsShirish Kumar SrivastavaBelum ada peringkat

- BM Las q1 w5 8 FinalDokumen35 halamanBM Las q1 w5 8 FinalKatrina BinayBelum ada peringkat

- PRICINGDokumen39 halamanPRICINGZain AbidinBelum ada peringkat

- Short Term ReceivablesDokumen13 halamanShort Term Receivableskrisha milloBelum ada peringkat

- Lecture Notes On MerchandisingDokumen4 halamanLecture Notes On MerchandisingmoBelum ada peringkat

- Marketing Management: Dr. Mehdi HussainDokumen13 halamanMarketing Management: Dr. Mehdi HussainMd. Mehedi HasanBelum ada peringkat

- Cash Discount: What Is A Cash Discount? Definition of Cash DiscountDokumen12 halamanCash Discount: What Is A Cash Discount? Definition of Cash DiscountHumanityBelum ada peringkat