Literatur A

Diunggah oleh

Bojan DodošHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Literatur A

Diunggah oleh

Bojan DodošHak Cipta:

Format Tersedia

Atkinson, R. D.

: ''Expanding the R&E tax credit to drive innovation, competitiveness and prosperity''; The Journal of Technology Transfer 32(6); str. 617-628; 2007 Bei, E., Dabi, M.: ''Analiza ulaganja poslovnog sektora Republike Hrvatske u istraivanje i razvoj'', pregledni rad, Revija za sociologiju, Vol.39 No.1-2, lipanj 2008., str. 69-84 Bejakovi, P.: ''Financiranje istraivanja i razvoja''; Financijska teorija i praksa 27(2), 2003; str. 181-212 Bloom, N., Griffith, R., Van Reenen, J.: ''Do R&D tax credits work? Evidence from a panel of countries 1979 1997''; Journal of Public Economics 85 (2002) 131, Institute for Fiscal Studies and University College London Carvalho, A: ''Why are tax incentives increasingly used to promote private R&D?'', CEFAGE-UE Working Paper 2011/04, January 2011 , Universidade de vora, CEFAGE, Portugal Commission of the European Communities (2006): ''Towards a more effective use of tax incentives in favour of R&D'', SEC(2006) 1515 final Brussels, 22.11.2006, http://ec.europa.eu/taxation_customs/resources/documents/workdoc_tax_incentives_en.pdf Deloitte: 2012 Global Survey of R&D Tax Incentives; Deloitte Publishing, 2012 Elschner, C., Ernst, C.,: The Impact of R&D Tax Incentives on R&D Costs and Income Tax Burden; Discussion Paper No. 08-124; European Center for Economic Research; 2008; ftp://ftp.zew.de/pub/zewdocs/dp/dp08124.pdf Ernst & Young Publication: Worldwide fiscal stimulus - tax policy plays a major role; EYG no. DL0109, 2009. Eurostat: Research and development: annual statistics; Bruxelles, 2011 European Commission: Comparing Practices in R&D Tax Incentives Evaluation; European Commission: Directorate General Research; Brussels; October 31, 2008 European Commission: Design and Evaluation of Tax Incentives for Business Research and Development; European Commission: Directorate General Research; Brussels; November 15, 2009 European Commission: Science, technology and innovation in Europe; Eurostat Pocketbooks, 2011 Guellec, D. and B. van Pottelsberghe de la Potterie (2000): The Impact of Public R&D Expenditure on Business R&D,OECD Science, Technology and Industry Working Papers, 2000/04, OECD Publishing, http://www.oecd-ilibrary.org/content/workingpaper/670385851815 Guellec, D. and B. van Pottelsberghe de la Potterie: ''Does goverment support stimulate private R&D?''; OECD Economic Studies No. 29, 1997/II; http://www1.oecd.org/eco/productivityandlongtermgrowth/2733427.pdf Hodi, S: ''Stimulacija poreznih poticaja za istraivanje i razvoj''; Zbornik radova: Skrivena javna potronja: sadanjost i budunost poreznih izdataka, str. 151-161; Institut za javne financije, Zagreb, 10. veljae 2012., http://www.ijf.hr/upload/files/file/skrivena_javna_potrosnja/hodzic.pdf Griffith, R: ''How important is business R&D for economic growth and should the government subsidise it?''; The Institute for Fiscal Studies, October 2000, Briefing Note No. 12; http://www.ifs.org.uk/bns/bn12.pdf Griffith, R., Sandler, D., Van Reenen, J.: Tax Incentives for R&D; Fiscal Studies (1996) vol. 16, no. 2, str. 21-44 Holland, D., Vann1, R.J.: Income Tax Incentives for Investment; Tax Law Design and Drafting (volume 2; International Monetary Fund: 1998; Victor Thuronyi, ed.) Chapter 23, Income Tax Incentives for Investment; 1998

Hutschenreiter, G.,: ''Tax incentives for research and development''; Austrian Economic Quarterly, (2), str.7485., 2002 Kesner-kreb, M.,: ''Porezni poticaji''; Financijska teorija i praksa, 25 (4), str. 633-636., 2001 Koowattanatianchai, N., Charles, M.B., Eddie, I.: Accelerated depreciation: establishing a historical and contextual perspective; Paper prepared for: Asia-Pacific Economic and Business History Conference 2009, 1820 February 2009, Gakushuin Univerisity, Tokyo Lisac Beljan, S.: Porezni poticaji za istraivanje i razvoj, magistarski rad, Zagreb, 2008. imovi, H.: ''Porezni poticaji za izgradnju konkurentnosti'', Serija lanaka u nastajanju Ekonomskog fakulteta u Zagrebu, 08-03 valjek, S.: ''Porezni poticaji za istraivanje i razvoj'', Promjene u sustavu javnih prihoda : zbornik radova Znanstvenog skupa odranog 27. oujka 2003. u Zagrebu, str. 301-307;Hrvatska akademija znanosti i umjetnosti, 2003. valjek, S.: R&D tax incentives in Croatia: beneficiaries and their benefits; Zbornik radova: Skrivena javna potronja: sadanjost i budunost poreznih izdataka, str. 117-131; Institut za javne financije, Zagreb, 10. veljae 2012., http://www.ijf.hr/upload/files/file/skrivena_javna_potrosnja/hodzic.pdf OECD: Science, Technology and Industry Outlook; OECD Publishing, 2011 OECD: Frascati Manual:proposed standards practice for surveys on research and experimental development; Paris: OECD, 2002 OECD: The International Experience with R&D Tax Incentives, OECD, United States Senate Committee on Finance, September 2011, http://www.finance.senate.gov/imo/media/doc/OECD%20SFC%20Hearing %20testimony%209%2020%2011.pdf OECD: Tax incentives for research and development: trends and issues; OECD Publishing 2002, http://www.metutech.metu.edu.tr/download/tax%20incentives%20for%20R&D.pdf Tassey, G.: ''Tax incentives for innovation: time to restructure the R&E tax credit''; The Journal of Technology Transfer 32(6); str. 605-615., 2007. Thomson, R.: Measures of R&D Tax Incentives for OECD Countries; Melbourne Institute Working Paper Series; Working Paper No. 17/12, 2012. Warda, J.: ''Tax treatment of business investments in intellectual assets: an international comparison; OECD Publishing, STI Working Paper 2006/4; 2006. Warda, J: ''Measuring the Value of R&D Tax Provisions'', Prepared for: The OMC Working Group on Design and evaluation of fiscal measures to promote business research, development and innovation; Brussels, June 28, 2005.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- WHO List of Essential Drugs 18th - EML - Final - Web - 8jul13Dokumen45 halamanWHO List of Essential Drugs 18th - EML - Final - Web - 8jul13DandaliBelum ada peringkat

- WHO List of Essential Drugs 18th - EML - Final - Web - 8jul13Dokumen45 halamanWHO List of Essential Drugs 18th - EML - Final - Web - 8jul13DandaliBelum ada peringkat

- KaleidaGraph Manual Version 3.6Dokumen325 halamanKaleidaGraph Manual Version 3.6aNIGRO131Belum ada peringkat

- TeggggDokumen1 halamanTeggggBojan DodošBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Sample Municipal OrdinanceDokumen4 halamanSample Municipal Ordinanceniki100% (2)

- People Vs AustriaDokumen2 halamanPeople Vs AustriaKier Arque100% (1)

- Books Villains of All Nations Atlantic Pirates in The Golden AgeDokumen4 halamanBooks Villains of All Nations Atlantic Pirates in The Golden AgeVoislav0% (3)

- Updates On Jurisprudence (SPL)Dokumen33 halamanUpdates On Jurisprudence (SPL)cathy1808Belum ada peringkat

- Yujuico V Atienza DigestDokumen1 halamanYujuico V Atienza DigestHannah SyBelum ada peringkat

- V-MGB MC 2018-01Dokumen24 halamanV-MGB MC 2018-01Pauline Mae100% (1)

- Drilon v. Lim G.R. No. 112497, August 4, 1994cruz, JDokumen2 halamanDrilon v. Lim G.R. No. 112497, August 4, 1994cruz, JMingBelum ada peringkat

- Federal BureaucracyDokumen25 halamanFederal BureaucracyPeped100% (3)

- Admin Law - Cases Set 1 - Full TextDokumen297 halamanAdmin Law - Cases Set 1 - Full TextSinetch EteyBelum ada peringkat

- Disaster Management System in Different Legal, Political and Social SystemsDokumen25 halamanDisaster Management System in Different Legal, Political and Social SystemsKashmir WatchBelum ada peringkat

- Roberto Brillante v. CADokumen2 halamanRoberto Brillante v. CAanalyn100% (2)

- Balochistan Problems SolutionsDokumen42 halamanBalochistan Problems SolutionsalokBelum ada peringkat

- Philippine Politics and Governance: Lesson 6: Executive DepartmentDokumen24 halamanPhilippine Politics and Governance: Lesson 6: Executive DepartmentAndrea IbañezBelum ada peringkat

- Filed ComplaintDokumen45 halamanFiled ComplaintMcKenzie Stauffer0% (1)

- Libya-Pakistan Relations: History of Foreign RelationsDokumen5 halamanLibya-Pakistan Relations: History of Foreign RelationsAliBelum ada peringkat

- Class 8 PPT1 India After IndependenceDokumen15 halamanClass 8 PPT1 India After IndependencePulkit SabharwalBelum ada peringkat

- Ra 876Dokumen1 halamanRa 876정정Belum ada peringkat

- 500.social Science Bullets PDFDokumen522 halaman500.social Science Bullets PDFMarimarjnhio67% (3)

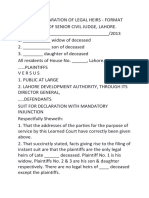

- Suit For Declaration of Legal HeirsDokumen3 halamanSuit For Declaration of Legal Heirssikander zamanBelum ada peringkat

- Affidavit of CohabitationDokumen1 halamanAffidavit of CohabitationJude Thaddeus EstoquiaBelum ada peringkat

- Constitutional Law 1Dokumen203 halamanConstitutional Law 1Mikee BornforThis MirasolBelum ada peringkat

- G.R. No. 78164 July 31, 1987 - TERESITA TABLARIN, ET AL. v. ANGELINA S. GUTIERREZ: July 1987 - Philipppine Supreme Court DecisionsDokumen31 halamanG.R. No. 78164 July 31, 1987 - TERESITA TABLARIN, ET AL. v. ANGELINA S. GUTIERREZ: July 1987 - Philipppine Supreme Court DecisionsJeunice VillanuevaBelum ada peringkat

- Legal Research ReviewerDokumen18 halamanLegal Research ReviewerRache Gutierrez50% (2)

- Kaytrosh ResumeDokumen1 halamanKaytrosh ResumeJ.P. KaytroshBelum ada peringkat

- B-I - Political ScienceDokumen14 halamanB-I - Political ScienceANAND R. SALVEBelum ada peringkat

- Gravador v. MamigoDokumen2 halamanGravador v. MamigoGenevieve Kristine ManalacBelum ada peringkat

- 2 Perez v. CatindigDokumen5 halaman2 Perez v. Catindigshlm bBelum ada peringkat

- CO Vs HRET G.R. No. 92191-92Dokumen2 halamanCO Vs HRET G.R. No. 92191-92Howard TuanquiBelum ada peringkat

- Cooperatives in The Socio Economic Development of The PhilippinesDokumen14 halamanCooperatives in The Socio Economic Development of The PhilippinesyenBelum ada peringkat

- Babcock Vs Jackson Full TextDokumen10 halamanBabcock Vs Jackson Full TextSyElfredGBelum ada peringkat