IMF Urges Obama To Address Foreclosure Crisis

Diunggah oleh

josephshalabyJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IMF Urges Obama To Address Foreclosure Crisis

Diunggah oleh

josephshalabyHak Cipta:

Format Tersedia

IMF Urges Obama to Address Foreclosure Crisis By Joseph Shalaby The problems of the administration of President Barack Obama

to address the foreclosure crisis show the slow housing debt is recovered from deep recessions, the International Monetary Fund (IMF) said in a report.

The agency cited the failure of government flagship program to prevent such liens, in a report released Tuesday on household debt.

The IMF said that fewer than 1 million mortgages have been changed in the United States under the Home Affordable Modification Program, HAMP, against the Government's initial target of between three and four million.

Nearly 8 million Americans are facing foreclosure since the bubble burst in residential construction.

The report noted that the HAMP offered limited incentives to banks and tightened the criteria for application to the program. He said, moreover, it did not reduce monthly mortgage payments to make them affordable enough in many cases - only 11% of permanent modifications included decreases in the amount mortgaged.

The IMF stressed that the government tried to improve other assistance programs in February to increase the number of people eligible and increase the incentives for banks to offer reductions.

However, the IMF warned that millions of American's remain at risk of losing their homes and governmental procedures have not reached the magnitude of the measures taken during the Great Depression.

"Some 2.5 million properties are subject to foreclosure and another 1.5 million are in default. Figures are amazing," said Daniel Leigh, lead author of the IMF report, in a press conference. "There remains a need to do something."

One of the main reasons for the low number of mortgage reductions is that Fannie Mae and Freddie Mac, which fund half of U.S. mortgages, have not reduced the value of debts in cases where homeowners at risk of foreclosure.

Edward DeMarco, the federal regulator that oversees the accounts of Fannie Mae and Freddie Mac, the mortgage banks seized by the federal government, opposed the idea of reducing the amount of the mortgage on the grounds that it would jeopardize the taxpayer funds, despite pressure from lawmakers and the White House.

On Tuesday, DeMarco said his agency would consider the idea.

In other news, Goldman Sachs Group Inc and Morgan Stanley will pay $ 557 million in cash and other assistance to troubled borrowers to conclude a case-by-case foreclosure required by U.S. regulators.

The U.S. Federal Reserve said Wednesday that the two banks will pay $ 232 million to eligible borrowers and 325 million in credits modifications and forgiveness.

The agreement is similar to the 8,500 million dollars that materialized the Fed, the Office of the Comptroller of the Currency and other banking service 10 January 7.

The Fed had ordered Goldman and Morgan Stanley to revise foreclosures conducted by mortgage services business both acquired investment banks before the subprime mortgage crisis.

Joseph Shalaby is a licensed real-estate broker and licensed mortgage agent since 2002. He is a nationally-known mortgage expert and has specialized in mortgage loans for people with bankruptcies, foreclosure and with other credit issues, as well as commercial mortgages. He is currently the Vice President of the Retail Lending division for PacificBanc Mortgage, a premier nationwide mortgage lender.

Tags: Obama, Foreclosures, IMF

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Electronic Banking and Lockbox 052114Dokumen56 halamanElectronic Banking and Lockbox 052114Chaitra Muralidhara100% (4)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokumen12 halamanStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVARIKUTI RAJASEKHARBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Personal Financing Products PDFDokumen10 halamanPersonal Financing Products PDFNurulhikmah RoslanBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Internal/External Communication Analysis of Apna BankDokumen14 halamanInternal/External Communication Analysis of Apna Bankanon_350499717Belum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Most Expensive Currency - Google SearchDokumen1 halamanMost Expensive Currency - Google SearchAbdulla JamalBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Kokila Lavanya (Financial A.Y 22-23)Dokumen1 halamanKokila Lavanya (Financial A.Y 22-23)mexop31426Belum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- 68774Dokumen7.077 halaman68774Monish RaoBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Acc204 Quiz 2Dokumen2 halamanAcc204 Quiz 2Judy Ann ImusBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Burgundy Fees and Charges 14 08Dokumen8 halamanBurgundy Fees and Charges 14 08ShipaBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Ir 219Dokumen2 halamanIr 219Shaun LeeBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Bahria University Bahria University: Allied Bank Limited Allied Bank LimitedDokumen1 halamanBahria University Bahria University: Allied Bank Limited Allied Bank LimitedHamza Bin TahirBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Banking TheoryDokumen299 halamanBanking TheoryMohammedBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Punjab National Bank Punjab National Bank Punjab National BankDokumen1 halamanPunjab National Bank Punjab National Bank Punjab National BankHarsh ChaudharyBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- BSP Says New Charter Gives It More Flexibility: Lawrence AgcaoiliDokumen21 halamanBSP Says New Charter Gives It More Flexibility: Lawrence AgcaoiliJeff MadridBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Household Finance Handbook Chapter 2018 07 23Dokumen115 halamanHousehold Finance Handbook Chapter 2018 07 23Verónica Isabel Armas AyarzaBelum ada peringkat

- G.P Fund Calculation SheetDokumen4 halamanG.P Fund Calculation SheetOfficial SAGBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 500 Usd To Idr - Google SearchDokumen1 halaman500 Usd To Idr - Google SearchparamagandiBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Transaction History - 2024-01-26 - 63013852470Dokumen6 halamanTransaction History - 2024-01-26 - 63013852470www.phumudzofrance99Belum ada peringkat

- 1 Paving Asacom KrajanDokumen24 halaman1 Paving Asacom KrajanMuhammad AfifBelum ada peringkat

- Quiz 1 - Semana 1 - PDFDokumen6 halamanQuiz 1 - Semana 1 - PDFLeonardo AlzateBelum ada peringkat

- Session 1 - Grameen BankDokumen5 halamanSession 1 - Grameen BankagyeyaBelum ada peringkat

- The Role of National BankDokumen19 halamanThe Role of National BankМурат Мусуралиев100% (2)

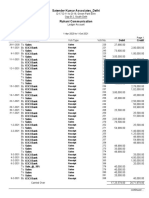

- Satender Kumar Associates - DelhiDokumen7 halamanSatender Kumar Associates - DelhiAVS & AssociatesBelum ada peringkat

- TPH Day - 1 - R18 WITH OUT NOTES PAGEDokumen85 halamanTPH Day - 1 - R18 WITH OUT NOTES PAGEPRAVIN JOSHUA100% (7)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- CITI Bank BahrainDokumen12 halamanCITI Bank BahraincontactBelum ada peringkat

- Evolution of Investment Banking in IndiaDokumen3 halamanEvolution of Investment Banking in IndiaChsudarshanDhaveji100% (2)

- Lesson 1 BANKING - Banking and Financial InstitutionDokumen4 halamanLesson 1 BANKING - Banking and Financial InstitutionAngela MagtibayBelum ada peringkat

- Annamalai University Annamalai University Annamalai University Annamalai UniversityDokumen148 halamanAnnamalai University Annamalai University Annamalai University Annamalai UniversityMALU_BOBBYBelum ada peringkat

- Wifi Billing PDFDokumen4 halamanWifi Billing PDFAnonymous W7QujJdDqBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDokumen2 halamanSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)