Cir Vs Enron Digest

Diunggah oleh

janpaul12Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cir Vs Enron Digest

Diunggah oleh

janpaul12Hak Cipta:

Format Tersedia

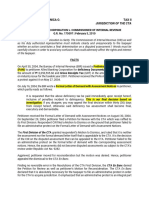

COMMISSIONER OF INTERNAL REVENUE VS.

ENRON SUBIC POWER CORPORATION Facts: In this petition for review on certiorari under Rule 45 of the Rules of Court, petitioner Commissioner of Internal Revenue (CIR) assails the November 24, 2004 decision of the Court of Appeals (CA) annulling the formal assessment notice issued by the CIR against respondent Enron Subic Power Corporation (Enron) for failure to state the legal and factual bases for such assessment. Enron, a domestic corporation registered with the Subic Bay Metropolitan Authority as a freeport enterprise filed its annual income tax return for the year 1996 on April 12, 1997. It indicated a net loss of P7,684,948. Subsequently, the Bureau of Internal Revenue, through a preliminary five-day letter, informed it of a proposed assessment of an alleged P2,880,817.25 deficiency income tax. Enron disputed the proposed deficiency assessment in its first protest letter. On May 26, 1999, Enron received from the CIR a formal assessment notice requiring it to pay the alleged deficiency income tax of P2,880,817.25 for the taxable year 1996. Enron protested this deficiency tax assessment. Due to the non-resolution of its protest within the 180-day period, Enron filed a petition for review in the Court of Tax Appeals (CTA). It argued that the deficiency tax assessment disregarded the provisions of Section 228 of the National Internal Revenue Code (NIRC), as amended, and Section 3.1.4 of Revenue Regulations (RR) No. 12-99 by not providing the legal and factual bases of the assessment. Enron likewise questioned the substantive validity of the assessment. In a decision dated September 12, 2001, the CTA granted Enrons petition and ordered the cancellation of its deficiency tax assessment for the year 1996. The CTA reasoned that the assessment notice sent to Enron failed to comply with the requirements of a valid written notice under Section 228 of the NIRC and RR No. 1299. The CIRs motion for reconsideration of the CTA decision was denied in a resolution dated November 12, 2001. The CIR appealed the CTA decision to the CA but the CA affirmed it. ISSUE: WHETHER OR NOT Enron was informed of the legal and factual bases of the deficiency assessment against it and that the notice of assessment in question complied with the requirements of the NIRC and RR No. 12-99? HELD: NO. The advice of tax deficiency, given by the CIR to an employee of Enron, as well as the preliminary five-day letter, were not valid substitutes for the mandatory notice in writing of the legal and factual bases of the assessment. These steps were mere perfunctory discharges of the CIRs duties in correctly assessing a taxpayer. The requirement for issuing a preliminary or final notice, as the case may be, informing a taxpayer of the existence of a deficiency tax assessment is markedly different from the requirement of what such notice must contain The law requires that the legal and factual bases of the assessment be stated in the formal letter of demand and assessment notice. Thus, such cannot be presumed. Otherwise, the express provisions of Article 228 of the NIRC and RR No. 12-99 would be rendered nugatory. There was no going around the mandate of the law that the legal and factual bases of the assessment be stated in writing in the formal letter of demand accompanying the assessment notice.

We note that the old law merely required that the taxpayer be notified of the assessment made by the CIR. This was changed in 1998 and the taxpayer must now be informed not only of the law but also of the facts on which the assessment is made. Such amendment is in keeping with the constitutional principle that no person shall be deprived of property without due process. In view of the absence of a fair opportunity for Enron to be informed of the legal and factual bases of the assessment against it, the assessment in question was void.

Anda mungkin juga menyukai

- Cir Vs Fitness by DesignDokumen2 halamanCir Vs Fitness by DesignAnonymous 5MiN6I78I0Belum ada peringkat

- CIR vs. Enron Subic Power CorporationDokumen1 halamanCIR vs. Enron Subic Power CorporationArthur Archie TiuBelum ada peringkat

- Cir vs. Metro Super Rama DigestDokumen3 halamanCir vs. Metro Super Rama DigestClavel TuasonBelum ada peringkat

- Allied Banking Corporation v. CIR (Exception To Requisite of Filing An Admin Protest Before Appeal To CTA)Dokumen11 halamanAllied Banking Corporation v. CIR (Exception To Requisite of Filing An Admin Protest Before Appeal To CTA)kjhenyo218502Belum ada peringkat

- Miramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Dokumen2 halamanMiramar Fish Company, Inc. V Cir G.R. No. 185432, June 04, 2014 Perez, J.Kate GaroBelum ada peringkat

- CIR vs. Transitions Optical Philippines, IncDokumen13 halamanCIR vs. Transitions Optical Philippines, IncJoy Ben-at100% (1)

- BPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentDokumen2 halamanBPI vs. CIR Prescriptive Period for Deficiency Tax AssessmentJP Murao IIIBelum ada peringkat

- Philippine Bank of Communications Vs Commissioner of Internal RevenueDokumen2 halamanPhilippine Bank of Communications Vs Commissioner of Internal RevenueNFNL100% (1)

- Bpi vs. Cir G.R. No. 139736. October 17, 2005: HeldDokumen7 halamanBpi vs. Cir G.R. No. 139736. October 17, 2005: HeldLAW10101Belum ada peringkat

- CIR Vs V.Y. Domingo JewellersDokumen2 halamanCIR Vs V.Y. Domingo JewellersStar AlvarezBelum ada peringkat

- Allied Bank v. CIR Case DigestDokumen4 halamanAllied Bank v. CIR Case DigestCareenBelum ada peringkat

- RCBC Estopped from Questioning Validity of WaiversDokumen2 halamanRCBC Estopped from Questioning Validity of WaiversVINCENTREY BERNARDOBelum ada peringkat

- Cir Vs United Salvage and Towage Case DigestDokumen1 halamanCir Vs United Salvage and Towage Case DigestjovifactorBelum ada peringkat

- Tax Refund Denied for Lack of Official ReceiptsDokumen2 halamanTax Refund Denied for Lack of Official ReceiptsDianne Bernadeth Cos-agon100% (1)

- Pilmico-Mauri Foods Corp. vs. CIR Tax CaseDokumen3 halamanPilmico-Mauri Foods Corp. vs. CIR Tax CaseNathallie CabalunaBelum ada peringkat

- Samar-I Electric Cooperative v. CIRDokumen2 halamanSamar-I Electric Cooperative v. CIRTzarlene Cambaliza100% (1)

- Lepanto Consolidated Mining Company vs Hon. Mauricio B. AmbanlocDokumen2 halamanLepanto Consolidated Mining Company vs Hon. Mauricio B. AmbanlocFreah Genice TolosaBelum ada peringkat

- PAL v. CIR (GR 198759)Dokumen2 halamanPAL v. CIR (GR 198759)Erica Gana100% (1)

- ECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)Dokumen2 halamanECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)KriszanFrancoManiponBelum ada peringkat

- RTC's Authority to Issue Injunction Against Collection of Local TaxesDokumen3 halamanRTC's Authority to Issue Injunction Against Collection of Local TaxesMarife MinorBelum ada peringkat

- Kepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsDokumen2 halamanKepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsJeremiah Trinidad100% (2)

- Case Digests For Taxation 2Dokumen15 halamanCase Digests For Taxation 2Marie Mariñas-delos ReyesBelum ada peringkat

- Fernandez vs. FernandezDokumen1 halamanFernandez vs. FernandezKitchie San PedroBelum ada peringkat

- Commissioner Vs Kudos Metal DigestDokumen1 halamanCommissioner Vs Kudos Metal Digestminri721Belum ada peringkat

- CIR v. Hantex Trading Co., Inc.Dokumen3 halamanCIR v. Hantex Trading Co., Inc.Junmer OrtizBelum ada peringkat

- 304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Dokumen9 halaman304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Jopan SJ100% (1)

- BPI vs. CIRDokumen2 halamanBPI vs. CIRAldrin TangBelum ada peringkat

- Fishwealth Canning v. CIRDokumen1 halamanFishwealth Canning v. CIRRia Kriselle Francia PabaleBelum ada peringkat

- Pagcor Vs BIR Case DigestDokumen2 halamanPagcor Vs BIR Case DigestLean Manuel ParagasBelum ada peringkat

- PAGCOR v BIR tax case ruling on fringe benefitsDokumen7 halamanPAGCOR v BIR tax case ruling on fringe benefitsJohn Evan Raymund Besid100% (1)

- Anie - Tax ReviewDokumen28 halamanAnie - Tax ReviewAnie Guiling-Hadji GaffarBelum ada peringkat

- Cir v. Cta and Petron CorporationDokumen2 halamanCir v. Cta and Petron CorporationLara YuloBelum ada peringkat

- CIR v. First Express PawnshopDokumen16 halamanCIR v. First Express PawnshopHansel Jake B. PampiloBelum ada peringkat

- CIR vs Philam Life Prescription RefundDokumen1 halamanCIR vs Philam Life Prescription RefundRaquel Doquenia100% (1)

- RCBC Vs CIR, GR No. 168498, April 24, 2007Dokumen1 halamanRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonBelum ada peringkat

- CIR Vs AsalusDokumen1 halamanCIR Vs AsalusGracee MedinaBelum ada peringkat

- CIR v. Fitness by DesignDokumen4 halamanCIR v. Fitness by DesignJesi CarlosBelum ada peringkat

- Samar-I Electric Coop V CIR (2014) DigestDokumen2 halamanSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- Cir v. TransitionsDokumen1 halamanCir v. TransitionsaypodBelum ada peringkat

- Oceanic Wireless v. CIRDokumen2 halamanOceanic Wireless v. CIRlesterjethBelum ada peringkat

- Court Rules Tax Court Had Jurisdiction in Estate Tax CaseDokumen9 halamanCourt Rules Tax Court Had Jurisdiction in Estate Tax CaseKevin MatibagBelum ada peringkat

- Adamson vs. CADokumen2 halamanAdamson vs. CAAices Salvador100% (2)

- Hi Yield Realty V CADokumen1 halamanHi Yield Realty V CAkpcsamsonBelum ada peringkat

- Aznar Vs CtaDokumen2 halamanAznar Vs CtarobbyBelum ada peringkat

- Republic Vs AcebedoDokumen2 halamanRepublic Vs AcebedoMaria Raisa Helga YsaacBelum ada peringkat

- NBI-Microsoft Corp. vs. Judy Hwang, Et. Al., G.R. No. 147043, June 21, 2005.Dokumen2 halamanNBI-Microsoft Corp. vs. Judy Hwang, Et. Al., G.R. No. 147043, June 21, 2005.Vel June De LeonBelum ada peringkat

- 20 BPI vs. CIR (GR No. 139736, October 17, 2005)Dokumen41 halaman20 BPI vs. CIR (GR No. 139736, October 17, 2005)Alfred Garcia100% (1)

- BIR Vs GMCCDokumen9 halamanBIR Vs GMCCiamchurkyBelum ada peringkat

- CIR v. CitytrustDokumen2 halamanCIR v. Citytrustpawchan02Belum ada peringkat

- Republic V Acebedo G.R No. L-20477 March 29, 1968Dokumen2 halamanRepublic V Acebedo G.R No. L-20477 March 29, 1968PJ HongBelum ada peringkat

- Antam Pawnshop Corp. vs. CIRDokumen1 halamanAntam Pawnshop Corp. vs. CIRPaolo AdalemBelum ada peringkat

- Republic vs. Lopez DigestDokumen2 halamanRepublic vs. Lopez DigestHailin QuintosBelum ada peringkat

- Digest ProvremDokumen2 halamanDigest ProvremMark DungoBelum ada peringkat

- Rizal Commercial Banking vs. CIRDokumen3 halamanRizal Commercial Banking vs. CIRMarife MinorBelum ada peringkat

- Samar-I Electric Cooperative vs. CirDokumen2 halamanSamar-I Electric Cooperative vs. CirRaquel DoqueniaBelum ada peringkat

- Lim Tian Teng Sons Tax CaseDokumen1 halamanLim Tian Teng Sons Tax CasedonsiccuanBelum ada peringkat

- CIR v. Cadiz Sugar FarmersDokumen6 halamanCIR v. Cadiz Sugar Farmersamareia yap100% (1)

- Estate Tax Dispute Over Deficiency and PenaltiesDokumen2 halamanEstate Tax Dispute Over Deficiency and PenaltiesChaMcbandBelum ada peringkat

- CIR v. ENRONDokumen3 halamanCIR v. ENRONsherry sakuraiBelum ada peringkat

- CIR vs Enron Subic Power - Assessment Notice RequirementsDokumen4 halamanCIR vs Enron Subic Power - Assessment Notice RequirementsWinnie Ann Daquil Lomosad-MisagalBelum ada peringkat

- Introduction To Maritime LawDokumen13 halamanIntroduction To Maritime Lawplatonalexandru67% (3)

- Wetzel Et Al v. Douglas County Housing Authority Et Al - Document No. 16Dokumen4 halamanWetzel Et Al v. Douglas County Housing Authority Et Al - Document No. 16Justia.comBelum ada peringkat

- Malabanan Case DigestDokumen7 halamanMalabanan Case DigestKarla MT50% (4)

- 1965 Alabama Literacy TestDokumen6 halaman1965 Alabama Literacy TestMichael AllardBelum ada peringkat

- Your Laws and Your Rights Edited by DR VIjay Kumar Bhatia PDFDokumen136 halamanYour Laws and Your Rights Edited by DR VIjay Kumar Bhatia PDFDivakar good56% (18)

- Co Kim Chan VDokumen3 halamanCo Kim Chan V8LYN LAWBelum ada peringkat

- Legal Opinion For Mr. Peter BanagDokumen2 halamanLegal Opinion For Mr. Peter BanagMark Avner Acosta50% (2)

- USA v. Approximately $2,274.34 in U.S. Currency, Et Al - Document No. 4Dokumen4 halamanUSA v. Approximately $2,274.34 in U.S. Currency, Et Al - Document No. 4Justia.comBelum ada peringkat

- People Vs Dela CruzDokumen1 halamanPeople Vs Dela CruzSherby Mae BautistaBelum ada peringkat

- Pp. v. Johnson, Pp. V Bariquit.1Dokumen2 halamanPp. v. Johnson, Pp. V Bariquit.1Josephine BercesBelum ada peringkat

- Landmark Technology v. Bridgestone AmericasDokumen18 halamanLandmark Technology v. Bridgestone AmericasPriorSmartBelum ada peringkat

- Montana Firearms Freedom Act Transcript of ProceedingsDokumen81 halamanMontana Firearms Freedom Act Transcript of ProceedingsAmmoLand Shooting Sports NewsBelum ada peringkat

- Beckett V SarmientoDokumen15 halamanBeckett V SarmientoEmary GutierrezBelum ada peringkat

- Malayan Vs Philippines FirstDokumen1 halamanMalayan Vs Philippines FirstDi ko alamBelum ada peringkat

- Cruz v. CA-digestDokumen4 halamanCruz v. CA-digestEloisa SalitreroBelum ada peringkat

- Patrick Crusius ArraignmentDokumen1 halamanPatrick Crusius ArraignmentAnonymous AWI0cmBelum ada peringkat

- Endicott Law Is Necesarilly VagueDokumen8 halamanEndicott Law Is Necesarilly VagueClari PollitzerBelum ada peringkat

- Suspension of Bigamy Case Denied Due to Lack of Prejudicial QuestionDokumen3 halamanSuspension of Bigamy Case Denied Due to Lack of Prejudicial QuestionMaria Jennifer Yumul BorbonBelum ada peringkat

- In Re Judge QuitainDokumen15 halamanIn Re Judge Quitainada mae santoniaBelum ada peringkat

- Chingkoe Vs ChingkoeDokumen2 halamanChingkoe Vs ChingkoeMigen SandicoBelum ada peringkat

- Employer Designation Application: Atlantic Immigration PilotDokumen10 halamanEmployer Designation Application: Atlantic Immigration PilotJHON VILLAMILBelum ada peringkat

- Set 5 No. 4Dokumen6 halamanSet 5 No. 4Czarina SarcedaBelum ada peringkat

- Contract of Lease (Pro Forma)Dokumen4 halamanContract of Lease (Pro Forma)iamsmileBelum ada peringkat

- Maurice Dufour Proceedings Against de Gaulle and Col. Passy For TortureDokumen5 halamanMaurice Dufour Proceedings Against de Gaulle and Col. Passy For Tortureeliahmeyer100% (1)

- Herminigildo Inguillo and Zenaida Bergante, Vs - First Philippine Scales, Inc. And/Or Amparo POLICARPIO, Manager, G.R. No. 165407 June 5, 2009 FactsDokumen6 halamanHerminigildo Inguillo and Zenaida Bergante, Vs - First Philippine Scales, Inc. And/Or Amparo POLICARPIO, Manager, G.R. No. 165407 June 5, 2009 FactsNowell SimBelum ada peringkat

- People vs. MejiaDokumen13 halamanPeople vs. MejiaJeremiah TrinidadBelum ada peringkat

- Dela Cruz v. PeopleDokumen2 halamanDela Cruz v. PeopleNoreenesse Santos100% (2)

- UP Law Criminal Law Reviewer 2013 - Book 2Dokumen142 halamanUP Law Criminal Law Reviewer 2013 - Book 2JC100% (28)

- Similar Fact Evidence Mugs PDFDokumen39 halamanSimilar Fact Evidence Mugs PDFLara YoungBelum ada peringkat

- PALS Civil Law (Persons, Property & Oblicon)Dokumen124 halamanPALS Civil Law (Persons, Property & Oblicon)Lyndon MondayBelum ada peringkat