Chapter 17 Solutions

Diunggah oleh

Dominickdad0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

137 tayangan4 halamanAccounting 551

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAccounting 551

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

137 tayangan4 halamanChapter 17 Solutions

Diunggah oleh

DominickdadAccounting 551

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

Chapter 17 Solutions

EXERCISE 17-1 (510 minutes)

(a) 1

(b) 2

(c) 1

(d) 2

(e) 3

(f) 2

EXERCISE 17-2 (1015 minutes)

(a)

January 1, 2012

Debt Investments (Held-to-Maturity)

300,000

Cash..

(b)

December 31, 2012

Cash.

Interest Revenue..

(c)

300,000

30,000

30,000

December 31, 2013

Cash.

Interest Revenue..

30,000

30,000

EXERCISE 17-9 (1015 minutes)

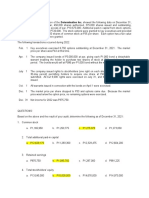

(a) The portfolio should be reported at the fair value of $54,500. Since the cost of the portfolio is $53,000,

the unrealized holding gain is $1,500, of which $200 is already recognized. Therefore, the December 31,

2012 adjusting entry should be:

Fair Value Adjustment (Available-for-Sale)..

Unrealized Holding Gain or LossEquity.

1,300

1,300

EXERCISE 17-9 (Continued)

(b) The unrealized holding gain of $1,500 (including the previous balance of $200) should be reported as

an addition to stockholders equity and the Fair Value Adjustment (Available-for-Sale) account balance of

$1,500 should be added to the cost of the securities account.

WENGER, INC.

Balance Sheet

As of December 31, 2012

Current assets:

Equity investments. $54,500

Stockholders equity:

Common stock..

xxx,xxx

Paid-in capital in excess of par

Common stock.

xxx,xxx

Retained earnings

xxx,xxx

Accumulated other comprehensive income..

1,500*

Total stockholders equity..

$xxx,xxx

*Note: The unrealized holding gain could also be disclosed.

(c) Computation of realized gain or loss on sale of stock:

Net proceeds from sale of security A.. $15,300

Cost of security A 17,500

Loss on investments ($ 2,200)

January 20, 2013

Cash.

Loss on Sale of Investments.

2,200

Equity Investments (Available-for-Sale).

17,500

15,300

EXERCISE 17-12 (1520 minutes)

Situation 1: Journal entries by Hatcher Cosmetics:

To record purchase of 20,000 shares of Ramirez Fashion at a cost of $14 per share:

March 18, 2012

Equity Investments (Available-for-Sale)..

280,000

Cash.

280,000

EXERCISE 17-12 (Continued)

To record the dividend revenue from Ramirez Fashion:

June 30, 2012

Cash

Dividend Revenue ($75,000 X 10%).

7,500

To record the investment at fair value:

December 31, 2012

Fair Value Adjustment (Available-for-Sale)..

Unrealized Holding Gain or LossEquity..

20,000

20,000*

*($15 $14) X 20,000 shares = $20,000

Situation 2: Journal entries by Holmes, Inc.:

To record the purchase of 25% of Nadal Corporations common stock:

January 1, 2012

7,500

Equity Investments (Nadal Corp.).

Cash [(30,000 X 25%) X $9].

67,500

67,500

Since Holmes, Inc. obtained significant influence over Nadal Corp., Holmes, Inc. now employs the equity

method of accounting.

To record the receipt of cash dividends from Nadal Corporation:

June 15, 2012

Cash ($36,000 X 25%)

Equity Investments (Nadal Corp.)..

9,000

9,000

To record Holmess share (25%) of Nadal Corporations net income of $85,000:

December 31, 2012

Equity Investments (Nadal Corp.)

Revenue from Investment (25% X $85,000)..

21,250

21,250

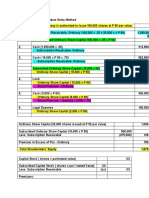

EXERCISE 17-16 (1520 minutes)

(a)

December 31, 2012

Equity Investments (Available-for-Sale)..

1,250,000

Cash.

1,250,000

June 30, 2013

Cash

Dividend Revenue..

40,000

40,000

December 31, 2013

Cash

40,000

Dividend Revenue ($50,000 X $.80)..

40,000

Fair Value Adjustment (Available-for-Sale)

100,000

Unrealized Holding Gain or Loss

Equity..

$27 X 50,000 = $1,350,000

$1,350,000 $1,250,000 = $100,000

100,000

EXERCISE 17-16 (Continued)

(b)

December 31, 2012

Equity Investments (Handerson Stock) 1,250,000

Cash..

1,250,000

June 30, 2013

Cash.

40,000

Equity Investments (Handerson Stock).

40,000

December 31, 2013

Cash.

Equity Investments (Handerson Stock).

40,000

Equity Investments (Handerson Stock)

146,000

Revenue from Investment

(20% X $730,000)..

(c)

40,000

146,000

Fair Value Method

Investment amount (balance sheet)

Dividend revenue (income statement)

Revenue from investment

(income statement)

*$1,250,000 + $146,000 $40,000 $40,000

$1,350,000

80,000

Equity Method

*$1,316,000*

0

146,000

Anda mungkin juga menyukai

- CPA Exam Prep:Bus Envr & Cncpt-Q2Dokumen7 halamanCPA Exam Prep:Bus Envr & Cncpt-Q2DominickdadBelum ada peringkat

- AC557 W7 HW Questions AnswersDokumen2 halamanAC557 W7 HW Questions AnswersDominickdadBelum ada peringkat

- ACCT557 Week 7 Quiz SolutionsDokumen7 halamanACCT557 Week 7 Quiz SolutionsDominickdad100% (2)

- ACCT557 Week 5 Quiz-SolutionsDokumen4 halamanACCT557 Week 5 Quiz-SolutionsDominickdad100% (3)

- ACCT-557-Ambrosia Corporation'sDokumen2 halamanACCT-557-Ambrosia Corporation'sDominickdadBelum ada peringkat

- Pension Information-ACCT 557Dokumen5 halamanPension Information-ACCT 557DominickdadBelum ada peringkat

- Acct557 w7 HW DemarcoDokumen8 halamanAcct557 w7 HW DemarcoDominickdadBelum ada peringkat

- ACCT557 Week 5 Quiz-SolutionsDokumen4 halamanACCT557 Week 5 Quiz-SolutionsDominickdad100% (3)

- ACCT551 Week 7 Quiz AnswersDokumen3 halamanACCT551 Week 7 Quiz AnswersDominickdad100% (2)

- AC557 W5 HW Questions/AnswersDokumen5 halamanAC557 W5 HW Questions/AnswersDominickdad100% (3)

- Acct557 w6 HWDokumen6 halamanAcct557 w6 HWDominickdadBelum ada peringkat

- Accounting For Leases NotesDokumen6 halamanAccounting For Leases NotesDominickdadBelum ada peringkat

- ACCT551 - Week 7 HomeworkDokumen10 halamanACCT551 - Week 7 HomeworkDominickdadBelum ada peringkat

- A2 - Optional Practice QuestionsDokumen5 halamanA2 - Optional Practice QuestionsDominickdadBelum ada peringkat

- ACCT557 W2 AnswersDokumen5 halamanACCT557 W2 AnswersDominickdad86% (7)

- Questions 1 Running Head: End-of-Chapter QuestionsDokumen5 halamanQuestions 1 Running Head: End-of-Chapter QuestionsDominickdadBelum ada peringkat

- Acc505 Quiz 2 ExampleDokumen3 halamanAcc505 Quiz 2 ExampleDominickdad100% (3)

- FIN515 Week 2 HomeworkDokumen3 halamanFIN515 Week 2 HomeworkDominickdadBelum ada peringkat

- Questions 1 Running Head: End-of-Chapter QuestionsDokumen5 halamanQuestions 1 Running Head: End-of-Chapter QuestionsDominickdadBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Ca Q&a Dec 2018 PDFDokumen392 halamanCa Q&a Dec 2018 PDFBruce GomaBelum ada peringkat

- Technical Aptitude Test 1Dokumen6 halamanTechnical Aptitude Test 1dhinesh01Belum ada peringkat

- Consolidated AccountsDokumen59 halamanConsolidated Accountsamar odiyilBelum ada peringkat

- Accounting Revision QuestionsDokumen46 halamanAccounting Revision QuestionsshailohBelum ada peringkat

- Financial Accounting - All QsDokumen21 halamanFinancial Accounting - All QsJulioBelum ada peringkat

- Baliwag Polytechnic College: Financial Accounting and Reporting A. AlmineDokumen3 halamanBaliwag Polytechnic College: Financial Accounting and Reporting A. AlmineCain Cyrus MonderoBelum ada peringkat

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDokumen28 halamanConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NBelum ada peringkat

- Review 105 - Day 7 Theory of AccountsDokumen11 halamanReview 105 - Day 7 Theory of AccountsKathleen PardoBelum ada peringkat

- QuestionsDokumen3 halamanQuestionslois martinBelum ada peringkat

- Multiple Choice On Cash Flow StatementDokumen7 halamanMultiple Choice On Cash Flow StatementLongtan JingBelum ada peringkat

- ch04 PDFDokumen52 halamanch04 PDFerylpaez69% (13)

- FM - Fundamental Analysis 2Dokumen20 halamanFM - Fundamental Analysis 2Lipika haldarBelum ada peringkat

- Audit of The Capital Acquisition and Repayment CycleDokumen20 halamanAudit of The Capital Acquisition and Repayment Cycleputri retno100% (1)

- Soal Kuis Ch.11Dokumen3 halamanSoal Kuis Ch.11Siti Robi'ahBelum ada peringkat

- Valix Chapter 20Dokumen22 halamanValix Chapter 20criszel4sobejanaBelum ada peringkat

- Alti, A. (2006) PDFDokumen30 halamanAlti, A. (2006) PDFtiti fitri syahidaBelum ada peringkat

- CH 5 SolutionDokumen21 halamanCH 5 SolutionJoe MichaelsBelum ada peringkat

- Patricia Eklund's participative budgeting proceduresDokumen11 halamanPatricia Eklund's participative budgeting proceduresirga ayudiasBelum ada peringkat

- Analysis of Financial State MentDokumen13 halamanAnalysis of Financial State MentAbdul RehmanBelum ada peringkat

- 6971 - Investment AssociateDokumen2 halaman6971 - Investment AssociateMarjhon TubillaBelum ada peringkat

- BST Worksheet Class 11Dokumen26 halamanBST Worksheet Class 11btsqueen62Belum ada peringkat

- Complete Financial Statements With SCF Direcdt MethodDokumen23 halamanComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoBelum ada peringkat

- SM Chapter 11Dokumen91 halamanSM Chapter 11mas aziz100% (1)

- CH 14 Solutions To Selected End of Chapter ProblemsDokumen5 halamanCH 14 Solutions To Selected End of Chapter Problemsbobhamilton3489Belum ada peringkat

- MULTIPLE CHOICE (1 Point Each)Dokumen10 halamanMULTIPLE CHOICE (1 Point Each)Mitch RegenciaBelum ada peringkat

- Quiz Chapter 4 Consol. Fs Part 1Dokumen7 halamanQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroBelum ada peringkat

- Warren SM ch.13 FinalDokumen38 halamanWarren SM ch.13 FinalDipra DewBelum ada peringkat

- Group 3 FS Forecasting Jollibee SourceDokumen43 halamanGroup 3 FS Forecasting Jollibee SourceChristian VillarBelum ada peringkat

- Solution - Hand Out - Problems 9 10 11 12 13 14 15Dokumen16 halamanSolution - Hand Out - Problems 9 10 11 12 13 14 15Anne Clarisse ConsuntoBelum ada peringkat

- Accounting For Branches and Combined FSDokumen112 halamanAccounting For Branches and Combined FSEcka Tubay100% (1)