8963 11

Diunggah oleh

OSDocs2012Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

8963 11

Diunggah oleh

OSDocs2012Hak Cipta:

Format Tersedia

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 1 of 6

Exhibit 6

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 2 of 6

MEMORANDUM

To: Patrick A. Juneau, Esq. Claims Administrator From: Class Counsel Matter: In re: Deepwater Horizon MDL No. 2179 Re: Request for Formal Policy Statement: Monthly Revenue Date: December 16, 2012

Despite the focus of the Settlement Agreement negotiated, agreed to, noticed, and submitted for approval by BP, on monthly revenue, and the insistence by BP on the submission of month-by-month profit and loss statements, (or alternate source documents), BP has now questioned the Program,1 and argued in numerous Appeals,2 that some Claimants should have their Monthly Revenue averaged out over a number of months, or even years. Further, BP suggests that Costs incurred either before or after the Compensation Period be matched to Revenue received during the Compensation Period. And, finally, BP attempts to resurrect its suggestions of an inquiry into potential alternative causation. Class Counsel therefore respectfully request a formal Policy Statement. Specifically: 1. When a business keeps its books on a cash basis, revenue is earned during the month of receipt, irrespective of when the contract was entered or services were performed. When a business keeps its books on an accrual basis, and/or has prepared and submitted its monthly P&Ls on an accrual basis to the Settlement Program, revenue is earned during the month that such revenue is both earned and is realized or realizable. For example, if a construction firm receives and books a lump sum payment in Month 1 to cover work performed in Months 1-3, the entire lump sum payment is treated as revenue during Month 1for purposes of the BEL Causation and Compensation Frameworks. 3. The corresponding variable expenses associated with monthly revenue are the expenses that are expended or incurred during the Benchmark and Compensation months in question.

1 2

2.

See, e.g., E-Mail from Dan Cantor to Mike Juneau, re: Accountant Questions (Dec. 11, 2012). See, e.g.,

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 3 of 6

For example: If August is a Benchmark / Compensation month for either Causation and/or Compensation Purposes, the variable expenses are the variable expenses that are incurred and booked in August, even if they might arguably relate to revenue that is not received and booked until November. For example: Where a claimant retail establishment purchases large amounts of inventory during Month 1, the inventory (Costs of Goods Sold) that was incurred / expended and booked in Month 1 is treated as Month 1 costs, even if the inventory was sold during Months 2-4. For example: Claimant is a construction company that maintains its books on a cash basis and purchases $40 in materials in June, and then performs half of the job in July and half in August, incurring $20 dollars in labor costs in each month, and gets paid $100 for the job in September. For purposes of the BEL framework, the $100 revenue is earned in September, while the $40 costs are incurred in June. For example: Claimant is a law firm representing a personal injury plaintiff on a contingency fee basis. Attorneys spend $250 to file the case in June, 20 hours and $150 in computer research costs submitting briefs in July, and 30 hours and $500 taking depositions in August. In September, a settlement is reached, and the Firm receives a $10,000 contingency fee payment, plus reimbursement of the $900 in expenses. For purposes of the BEL framework, $250 in costs would be incurred in June; $150 in costs would be incurred in July; $500 in costs would be incurred in August; and $10,900 in revenue would be earned in September. For example: Claimant is a farmer who plants his crop in April and books associated labor and material costs of $100 getting the crop in the ground. Between May and September the farmer books $40 in monthly expenses maintaining and nurturing the crop ($200 total for the 5 months), and then incurs and books $100 in labor costs for October when the crop is harvested. The harvested crop is taken to market and sold for $1,000 on November 27 with all revenue recorded in that month against $100 in selling costs. For purposes of the BEL framework, there would be costs of $100 in April; costs of $40 in May, June, July, August and September; costs of $100 in October; costs of $100 in November; and revenue of $1,000 in November. 4. Where a Claimant ceases a line of business during the Benchmark Period, such revenue from the terminated line of business is included in the BEL calculation. For example: Claimant rented commercial properties in 2007 but sold those properties at the beginning of 2008, for the purposes of the BEL Framework, the 2007 revenue from the properties would be included in the Causation and/or Compensation calculation(s).

Page 2

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 4 of 6

Discussion Averaging the revenue; attempting to correlate specific revenue to specific expenditures in previous or subsequent months; and/or eliminating revenue based on changes in the Class Members business: Was not suggested by BP during negotiations; Is not supported by the terms of the Settlement Agreement; Would require substantial documentation and other information beyond what is contemplated or provided for in the Settlement Agreements Documentation requirements; Violates the established Policy precluding an inquiry by the Program into potential alternative causes; 3 Is impractical and unworkable; Is inconsistent with BPs prior focus and insistence on Monthly Profit & Loss statements; Is inconsistent with the Claims Administrators Policy regarding the use and restatement of Profit & Loss statements; 4 Assumes and/or implies that attorneys only work on one case at a time; that construction firms only work on one project at a time; and that retailers only purchase and sell one batch of inventory at one time; 5

See E-MAIL FROM JUDGE BARBIER , RE MEETING TODAY RE NON -PROFITS AND SIP Dec. 12, 2012; ANNOUNCEM ENT OF POLICY DECISIONS REGARDING CLAIM S ADM INISTRATION , Oct. 10, 2012, No.2; LETTER FROM MARK HOLSTEIN TO PAT JUNEAU , Sept. 28, 2012. See ANNOUNCEM ENT OF POLICY DECISIONS REGARDING CLAIM S ADM INISTRATION , Sept. 25, 2012, No.1(c) (If the claimants profit and loss statements for a year were prepared on a Cash Basis, the claimant may be permitted but is in no way required to restate such statements on an Accrual Basis in connection with the submission of a Business Economic Loss claim). BPs hypotheticals, which implicitly suggest that its not fair to assign revenue and costs to the months in which such revenue was actually earned and such costs actually incurred, ignore the rest of the claimants business. For example, the attorney will continue to expend costs during the Compensation Period with respect to other cases on which revenue may not be recognized for years, if ever. A construction company may expend costs for new projects even as it collects for work and materials provided in connection with old projects. A retailer will often continue to stock its shelves with different inventories of different product lines that are purchased and sold at different times.

5 4

Page 3

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 5 of 6

Doesnt account for the possibility that a business line (and the associated revenue and/or expenses) may have been added by the Claimant prior to or during the Compensation Period;6 and, To the extent unfavorable, is inconsistent with Settlement Agreement Section 4.3.8.

The primary reference to monthly profit and loss statements is in Exhibit 4A to the Agreement, which states that the claimant is required to produce: Monthly and annual profit and loss statements (which identify individual expense line items and revenue categories), or alternate source documents establishing monthly revenues and expenses for the claimed Benchmark Period, 2010 and, if applicable, 2011. Profit and loss statements shall identify the dates on which they were created. The Claims Administrator may, in his discretion, request source documents for profit and loss statements. If there is a discrepancy between amounts reflected in a tax return and comparable items reflected in a profit and loss statement for the same period, the Claims Administrator may request the claimant to provide additional information or documentation.7 This provision is supplemented by the Definition of Contemporaneous which provides that: Contemporaneous or Contemporaneously prepared records or documentation shall mean documents or other evidence generated or received in the ordinary course of business at or around the time period to which they relate; in the case of financial statements, this shall include all periodic financial statements regularly prepared in the ordinary course of business. In addition, contemporaneous or contemporaneously prepared evidence or documentation, even if not proximate in time to the event or occurrence to which it relates, shall include (1) documentation that is based on or derived from other data, information, or business records created at or about the time of the event, occurrence or item in question, (2) a statement that is consistent with documentation created at or about the time of the event, occurrence or item in question, or (3) would support a reasonable inference that such event, occurrence, or other item in question

BP implicitly complains that revenue associated with a line of business that was discontinued during the Benchmark Period should not be included in the BEL calculation. However, it is just as plausible that a claimant may have added a line of business during the Benchmark Period and/or during the Compensation Period, which would result in additional revenue and expenses during the Compensation Period, as compared with the Benchmark Period.

7

Exhibit 4A, Item 4.

Page 4

Case 2:10-md-02179-CJB-SS Document 8963-11 Filed 03/20/13 Page 6 of 6

actually occurred.8 Nothing in these provisions or elsewhere in the Settlement Agreement specifies the accounting method which must be used to create the monthly profit and loss statements. While the Settlement Agreement does not necessarily dictate the use of Generally Accepted Accounting Principles, (and, indeed, intentionally departs from GAAP in several respects), it is significant to note in this context that both the cash basis of accounting and the accrual basis of accounting are accepted bases for determining when to book revenue. Both are well recognized methods of accounting. The tax law (Internal Revenue Code) was established essentially under the cash basis, with situations where modified cash or accrual accounting is used. Financial reporting for investors and creditors is primarily accrual based. Under cash basis accounting, revenue is recognized when cash is received. Under accrual accounting, revenue is recognized when it is both (i) earned and is (ii) realized or realizable. The attempt to match expenses to revenue bears resemblance to research and development (R&D) costs. Companies engage in R&D activities (i.e. incur expense) knowing that the incidence (and certainly the amount) of future benefit (i.e. revenue) is uncertain. Because these expenses cannot be effectively correlated with future revenue, Statement of Financial Accounting Standards No. 2 (1974) Accounting for Research and Development Costs requires that the R&D expenditures be expensed immediately as incurred. With respect to attorney contingency fees in particular, the appropriate guidance for such contingencies is contained in the source document FASB Statement No. 5 Accounting for Contingencies as well as in the FASB Accounting Standards Codification (which was implemented in 2009) under FASB ASC 450-10. Contingencies are defined as an existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss (loss contingency) to an entity that will ultimately be resolved when one or more future events occur or fail to occur. In accordance with these standards, virtually all plaintiff law firms maintain their books on a cash basis; case costs are booked when incurred (irrespective of whether or when they might be recovered from the client and/or defendant); fees (and case cost reimbursements) are booked as revenue (and taxed as income) in the month in which they are received (irrespective of when the work was performed).9 A prime failure of BPs proposal is that there is no way to calculate the revenue that should be reported in the relevant periods for cases in which expenses are incurred, but payment has not yet been received. That is, while BP wants to allocate current revenues to prior periods, the fallacy of that methodology is shown by the impossibility of allocating future revenues to current periods.

8 9

Section 38.38.

See, e.g., FASB STATEM ENT NO . 5 (1975), 17(a) (Contingencies that might result in gains usually are not reflected in the accounts since to do so might be to recognize revenue prior to its realization).

Page 5

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Sony SL HF-900 Owners ManualDokumen53 halamanSony SL HF-900 Owners ManualThomas Christoph100% (1)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- BP's Proposed Findings - Combined FileDokumen1.303 halamanBP's Proposed Findings - Combined FileOSDocs2012Belum ada peringkat

- HESI's Proposed FOF and COLDokumen335 halamanHESI's Proposed FOF and COLOSDocs2012Belum ada peringkat

- To's Proposed FOF and COLDokumen326 halamanTo's Proposed FOF and COLOSDocs2012Belum ada peringkat

- PSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013Dokumen72 halamanPSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013OSDocs2012100% (1)

- BP's Post-Trial BriefDokumen72 halamanBP's Post-Trial BriefOSDocs2012Belum ada peringkat

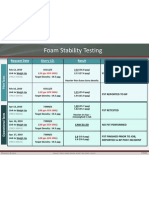

- Foam Stability Testing: Request Date Slurry I.D. Result CommentsDokumen1 halamanFoam Stability Testing: Request Date Slurry I.D. Result CommentsOSDocs2012Belum ada peringkat

- Plaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013Dokumen199 halamanPlaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013OSDocs2012Belum ada peringkat

- Circa 2003Dokumen1 halamanCirca 2003OSDocs2012Belum ada peringkat

- Exterior: Circa 2003Dokumen1 halamanExterior: Circa 2003OSDocs2012Belum ada peringkat

- USAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)Dokumen121 halamanUSAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)OSDocs2012Belum ada peringkat

- Macondo Bod (Basis of Design)Dokumen23 halamanMacondo Bod (Basis of Design)OSDocs2012Belum ada peringkat

- Driller HITEC Display CCTV Camera System: Source: TREX 4248 8153Dokumen1 halamanDriller HITEC Display CCTV Camera System: Source: TREX 4248 8153OSDocs2012Belum ada peringkat

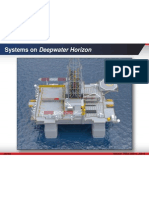

- Systems On Deepwater Horizon: Source: TREX-30014, 30015 D6753Dokumen1 halamanSystems On Deepwater Horizon: Source: TREX-30014, 30015 D6753OSDocs2012Belum ada peringkat

- Webster:: Trial Transcript at 3975:2-4Dokumen1 halamanWebster:: Trial Transcript at 3975:2-4OSDocs2012Belum ada peringkat

- DR Gene: CloggedDokumen1 halamanDR Gene: CloggedOSDocs2012Belum ada peringkat

- Arnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"Dokumen5 halamanArnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"OSDocs2012Belum ada peringkat

- April 20, BLOWOUT: BP Misreads Logs Does Not IdentifyDokumen22 halamanApril 20, BLOWOUT: BP Misreads Logs Does Not IdentifyOSDocs2012Belum ada peringkat

- Laboratory Results Cement Program Material Transfer TicketDokumen13 halamanLaboratory Results Cement Program Material Transfer TicketOSDocs2012Belum ada peringkat

- Production Interval: 14.1-14.2 PPG M57B Gas Brine GasDokumen1 halamanProduction Interval: 14.1-14.2 PPG M57B Gas Brine GasOSDocs2012Belum ada peringkat

- End of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateDokumen1 halamanEnd of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateOSDocs2012Belum ada peringkat

- Webster:: Trial Transcript at 4136:17-18Dokumen1 halamanWebster:: Trial Transcript at 4136:17-18OSDocs2012Belum ada peringkat

- Webster:: Trial Transcript at 4015:14-16Dokumen1 halamanWebster:: Trial Transcript at 4015:14-16OSDocs2012Belum ada peringkat

- Thrusters: Propulsion (PROP)Dokumen1 halamanThrusters: Propulsion (PROP)OSDocs2012Belum ada peringkat

- Transocean 2009 Annual Report: D6732 Source: TREX-5649Dokumen3 halamanTransocean 2009 Annual Report: D6732 Source: TREX-5649OSDocs2012Belum ada peringkat

- Engines: Electrical Power Generation (ELPG) Emergency Shutdown System (ESD)Dokumen1 halamanEngines: Electrical Power Generation (ELPG) Emergency Shutdown System (ESD)OSDocs2012Belum ada peringkat

- Major DWH Maintenance Timeline: April 20, 2010 Rig in ServiceDokumen7 halamanMajor DWH Maintenance Timeline: April 20, 2010 Rig in ServiceOSDocs2012Belum ada peringkat

- BP September 2009 Audit: Total Items 188Dokumen3 halamanBP September 2009 Audit: Total Items 188OSDocs2012Belum ada peringkat

- Time Out For Safety Think Start: D6731 Source: TREX-4942Dokumen1 halamanTime Out For Safety Think Start: D6731 Source: TREX-4942OSDocs2012Belum ada peringkat

- BP Is The OperatorDokumen1 halamanBP Is The OperatorOSDocs2012Belum ada peringkat

- Lloyd's Report - Appendix C: Deepwater Horizon Summary ReportDokumen1 halamanLloyd's Report - Appendix C: Deepwater Horizon Summary ReportOSDocs2012Belum ada peringkat

- Health, Safety & Environment: Refer NumberDokumen2 halamanHealth, Safety & Environment: Refer NumbergilBelum ada peringkat

- Donation Drive List of Donations and BlocksDokumen3 halamanDonation Drive List of Donations and BlocksElijah PunzalanBelum ada peringkat

- Introduction Into Post Go-Live SizingsDokumen26 halamanIntroduction Into Post Go-Live SizingsCiao BentosoBelum ada peringkat

- Possession: I. A. Definition and Concept Civil Code Art. 523-530 CasesDokumen7 halamanPossession: I. A. Definition and Concept Civil Code Art. 523-530 CasesPierrePrincipeBelum ada peringkat

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Dokumen11 halamanDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiBelum ada peringkat

- Petitioner's Response To Show CauseDokumen95 halamanPetitioner's Response To Show CauseNeil GillespieBelum ada peringkat

- Fletcher Theophilus Ato CVDokumen7 halamanFletcher Theophilus Ato CVTHEOPHILUS ATO FLETCHERBelum ada peringkat

- HP Sustainability Impact Report 2018Dokumen147 halamanHP Sustainability Impact Report 2018Rinaldo loboBelum ada peringkat

- WHO Partograph Study Lancet 1994Dokumen6 halamanWHO Partograph Study Lancet 1994Dewi PradnyaBelum ada peringkat

- Starkville Dispatch Eedition 12-9-18Dokumen28 halamanStarkville Dispatch Eedition 12-9-18The DispatchBelum ada peringkat

- Mpi Model QuestionsDokumen4 halamanMpi Model QuestionshemanthnagBelum ada peringkat

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDokumen11 halamanPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- Ramp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Dokumen2 halamanRamp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Genevieve GayosoBelum ada peringkat

- Modulation and Frequency Synthesis X Digital Wireless RadioDokumen233 halamanModulation and Frequency Synthesis X Digital Wireless Radiolcnblzr3877Belum ada peringkat

- Introduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions ManualDokumen12 halamanIntroduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions Manualethelbertsangffz100% (34)

- Brief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical AnalysisDokumen67 halamanBrief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical Analysisanon_136103548Belum ada peringkat

- MWG Installation 7.6.2 IG INSTALLATION 0516 en - PDDokumen64 halamanMWG Installation 7.6.2 IG INSTALLATION 0516 en - PDjbondsrBelum ada peringkat

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDokumen4 halamanLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarBelum ada peringkat

- Effects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese WhiteDokumen5 halamanEffects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese Whitepranjals8996Belum ada peringkat

- 1grade 9 Daily Lesson Log For Demo 1 4Dokumen5 halaman1grade 9 Daily Lesson Log For Demo 1 4cristy olivaBelum ada peringkat

- Syed Hamid Kazmi - CVDokumen2 halamanSyed Hamid Kazmi - CVHamid KazmiBelum ada peringkat

- Quality in CRDokumen10 halamanQuality in CRkaushikcrBelum ada peringkat

- CPE Cisco LTE Datasheet - c78-732744Dokumen17 halamanCPE Cisco LTE Datasheet - c78-732744abds7Belum ada peringkat

- Portfolio Report Zarin Tasnim Tazin 1920143 8Dokumen6 halamanPortfolio Report Zarin Tasnim Tazin 1920143 8Fahad AlfiBelum ada peringkat

- 133 The Science and Understanding of TheDokumen14 halaman133 The Science and Understanding of TheCarlos RieraBelum ada peringkat

- CT018 3 1itcpDokumen31 halamanCT018 3 1itcpraghav rajBelum ada peringkat

- ABB Price Book 524Dokumen1 halamanABB Price Book 524EliasBelum ada peringkat

- Belimo Fire & Smoke Damper ActuatorsDokumen16 halamanBelimo Fire & Smoke Damper ActuatorsSrikanth TagoreBelum ada peringkat

- KV Tripple Eccentric Butterfly Valve-LinDokumen12 halamanKV Tripple Eccentric Butterfly Valve-LinWelma JohnsonBelum ada peringkat