Deloitte GCC PPT Fact Sheet

Diunggah oleh

Rakawy Bin RakJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Deloitte GCC PPT Fact Sheet

Diunggah oleh

Rakawy Bin RakHak Cipta:

Format Tersedia

GCC powers of construction GCC countries fact sheet

Eighty five years in the Middle East

Contents

5

GCC countries

Overview

6

U.A.E

macroeconomic data SWOT analysis Global competitiveness

9

K.S.A.

macroeconomic data SWOT analysis Global competitiveness

12

Qatar

macroeconomic data SWOT analysis Global competitiveness

15

Kuwait

macroeconomic data SWOT analysis global competitiveness

18

Bahrain

macroeconomic data SWOT analysis global competitiveness

21

Oman

macroeconomic data SWOT analysis gobal competitiveness

GCC countries fact sheet | 3

GCC construction sector

Overview

Key characteristics Country Overview UAE

Capital Abu Dhabi

Area (sq km) 83,600

Currency UAE Dirham Pegged to US$= 3.675 dirham

The UAE is a federation of seven emirates, of which Abu Dhabi is the largest. After gaining FDI to exploit oil and gas, the UAE has diversified into a prosperous economy.

Saudi Arabia

KSA is one the largest economies in the world, accounting for c.55% of total GCC GDP. Oil accounts for c.90% of exports and 75% of government revenue, which is being used to facilitate an infrastructure boom.

Riyadh

2,240,000

Saudi Riyal Pegged to US$= 3.75 riyal

Qatar

Qatar has one of the highest levels of GDP per capita in the world, driven by oil revenue Oxford Business Group reports that the current Emir is initiating liberalizing changes to steer the economy towards diversification.

Doha

11,437

Qatari Riyal Pegged to US$= 3.64 riyal

Bahrain

Bahrain is an island country in the Persian Gulf and is relatively highly diversified away from oil. There is a major infrastructure overhaul in progress, aiming to cement Bahrains place as the gateway to the Northern Gulf.

Manama

716

Bahraini Dinar Pegged to US$= 0.376 dinar

Kuwait

Kuwait is slowly beginning to diversify its economy, with the hope of reducing dependency on oil revenue. However, it remains relatively closed-minded towards new inward investment.

Kuwait City

17,818

Kuwaiti Dinar Abandoned $ peg in 2007 = 0.404 dinar

Oman

Oman is regarded as one of the more conservative and traditional GCC states, where the local citizens are still a majority. The construction industry is beginning to see returns from the diversification policies instigated under the Vision 2020 plan.

Muscat

309,500

Omani Rial Pegged to US$= 0.3850 rial

GCC countries fact sheet | 4

U.A.E.

Macroeconomic data

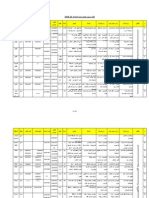

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin of GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Government revenue Goverment expenditure Goverment balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 After contracting by an estimated 2.7% in 2009, the economy is expected to recover from 2010 with real GDP growth averaging 4.6% in 2010-14. 2 Although oil will remain a core driver of growth, non-oil re-exports will play an increasingly prominent role in total exports. 3 Inflation is expected to pick up gradually until 2012 but is expected to fall after that, as prices of commodities such as iron ore and steel fall. 4 However, it is not expected to reach the heights of previous years as slower population growth and increased housing supply will eradicate previous bottlenecks, bringing down rental costs. 5 A stronger dollar would also help to contain imported inflation. 6 The current account is expected to register a surplus through to 2014 as oil prices will remain at comfortable levels. 7 The fiscal account is expected to remain in surplus up to 2013 but a fall in oil prices in 2014 will lead to a small fiscal deficit.

137,993 13.1

175,222 13.0

206,406 62

254,394 7.4

248,925a (2.7)

273,573 2.6

311,714 3.5

(12.9) 18.4 8.0

(4.8) 17.3 7.9

(0.8) 6.0 6.9

0.2 8.1 6.7

2.0 (5.6) 1.7

2.0 3.2 1.8

2.0 4.0 3.0

4.7 27,440

5.3 28,715

5.9 27,862

6.8 26,814

6.5 27,369

6.7 27,446

7.0 27,694

28.4 20.6 7.8 32.3

31.2 19.9 11.3 37.2

30.2 21.1 9.1 41.2

33.2 19.0 14.2 39.4

24.6 22.0 2.6 48.9

24.4 21.9 2.4 44.2

22.2 21.1 1.0 38.4

12.5 7.2

13.5 7.9

11.1 8.0

12.3 7.8

1.6 5.9

2.2 5.2

3.2 5.5

Source | Economist Intelligence Unit

GCC countries fact sheet | 5

U.A.E.

SWOT analysis

Strengths

The UAE is a member of the GCC which is targeting a common currency by 2012 (although the UAE looks, at present, unlikely to participate). The UAE has one of the most liberal trade regimes in the GCC and attracts strong capital flows from across the region. In common with most Gulf states, there are a high number of expatriate workers at all levels of the economy, making up for the otherwise small workforce. The UAE is progressively diversifying its economy, minimizing vulnerability to oil price movements.

Weaknesses

The UAE's currency is pegged to the dollar, giving it minimal control over monetary policy and reducing its ability to tackle inflationary pressure. The UAEs location in a volatile region means that its risk profile is, to some extent, affected by events elsewhere. US concerns about regional militant groups and Iranian nuclear programs could affect investor perceptions.

Opportunities

Oil prices are expected to stay high (by historical standards). Economic diversification into gas, tourism, financial services and high-tech industries offers some protection against volatile oil prices. Despite the impact of the 2009 downturn, the tourism and financial sectors still have good growth prospects, driven by domestic and foreign investment.

Threats

Heavy subsidies on utilities and agriculture, and an outdated tax system, have contributed to persistent fiscal deficits in the past, although rising oil revenues have masked the problem in recent years. Several high-profile construction projects have been delayed and the property market crash could threaten future development.

Source | Business Monitor International

GCC countries fact sheet | 6

UAE Global competitiveness

Tax rates Crime and theft Corruption Goverment instability/coups Foreign currency regulations Poor public health Inadequate supply of infrastructure Poor work ethic in national labor force Policy instability Inefcient govermment bureaucracy Ination Restrictive labor regulations In Inadequately educated workforce Access to nancing

Source | The Global Competitiveness Report 2010-2011

This chart summarizes those factors seen by business executives as the most problematic for doing business in their economy. The information is drawn from the 2010 edition of the World Economic Forums Executive Opinion Survey. From a list of 15 factors, respondents were asked to select the five most problematic and to rank those from 1 (most problematic) to 5. The results were then tabulated and weighted according to the ranking assigned by respondents.

10

15

20

25

30 % responses

GCC countries fact sheet | 7

K.S.A.

Macroeconomic data

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin of GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Goverment revenue Goverment expenditure Goverment balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 EIU forecast that real GDP will grow by an annual average of 3.8% in 2010-14, up from 3% in 2005-09. 2 The average is dragged down by a contraction in 2009, but this largely reflects temporary cuts in oil output, aimed at shoring up prices, rather than structural problems. 3 The government will play a leading role in driving growth in 2010-11 as private financing will remain limited, but the non-oil private sector should expand further in the medium term. 4 Both private and public investments is expected to focus on natural gas and refined oil, infrastructure, and energy-intensive industries such as petrochemicals, metals, fertilisers, plastics and packaging. 5 Oil will continue to account for the bulk of export earnings and of government revenue, leaving the economy vulnerable to external shocks from the world oil market. 6 Based on EIU oil price assumptions, however, the current account should stay in surplus.

Source | Economist Intelligence Unit

315,600 5.6

356,600 3.2

384,900 2

476,300 4.2

375,800 0.6

451,700 3.4

480,800 3.7

1.2 6.4 5

1.1 2 4.4

1.9 -0.2 4.2

0.7 4.4 4.3

0.6 -2.8 4

0.6 3.1 4

0 3.6 4.1

23.2 21,127

24 21,817

24.7 22,195

25.5 22,906

26.3 22,606

27.1 22,906

27.9 23,468

47.7 29.3 18.4 44

50.4 29.4 21 31

44.6 32.3 12.2 24.8

61.6 29.1 32.5 18.8

35.8 42.3 -6.5 22.6

41.4 38.8 2.6 16.6

39.2 37.8 1.3 15.7

0.6 3.8

2.3 5

4.1 4.8

9.9 2.9

5.1 0.6

5.7 0.5

6 0.9

GCC countries fact sheet | 8

K.S.A.

SWOT analysis

Strengths

As the main OPEC swing producer, the KSA is in a strong position within the association. The recent oil price boom has boosted growth in the non-oil sector, and infrastructure is now much improved. A large and growing local population means solid domestic demand for goods, services and infrastructure in spite of the global macroeconomic crisis.

Weaknesses

Dependence on oil means growth, exports and government revenue remain highly vulnerable to shifts in world oil prices. The private sector is dependent on expatriate labor, reflecting a shortage of marketable skills among nationals and a high unemployment rate among Saudi citizens.

Opportunities

A competitive business environment is expected to make Saudi Arabia appealing to investors once risk appetite returns to global markets. Slower growth and lower liquidity should bring inflation down domestically, cushioning the impact of the consumer slowdown.

Threats

Any attacks on oil facilities could lead to a disruption of output, which would be extremely detrimental to the overall economy given the reliance on this sector. Perceptions of high security risk deter some investors as well as adding to the costs of insurance.

Source | Business Monitor International

GCC countries fact sheet | 9

K.S.A.

Global competitiveness

Government instability/coups Poor public health Crime and theft Policy instability Ination Corruption Tax regulations Foreign currency regulations Tax rates Poor work ethic in national labor force Inadequate supply of infrastructure Inefcient government bureaucracy Inadequately educated workforce Access to nancing Restrictive labor regulations

Source | The Global Competitiveness Report 2010-2011

This chart summarizes those factors seen by business executives as the most problematic for doing business in their economy. The information is drawn from the 2010 edition of the World Economic Forums Executive Opinion Survey. From a list of 15 factors, respondents were asked to select the five most problematic and to rank those from 1 (most problematic) to 5. The results were then tabulated and weighted according to the ranking assigned by respondents.

10

15

20

25

30 % responses

GCC countries fact sheet | 10

Qatar

Macroeconomic data

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin of GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Goverment revenue Goverment expenditure Goverment balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 Real GDP growth in Qatar is expected to remain strong, averaging 9.5% in 2010-14, but will grow at a slower pace than the previous five years, as the LNG expansion program tails off. 2 One implication of the recent fall in property and energy prices is that inflation, which had become a significant problem, is now not expected to be substantial, averaging 4% in 2010-14, after a brief period of deflation in 2009, owing largely to a fall in property prices and associated rents. 3 However, there is a risk that if construction of residential property stalls more than expected, the ongoing influx of foreign workers could push inflation slightly higher than forecast. 4 Meanwhile, the coming on stream of the last two LNG trains and rising oil output should keep both the fiscal and the current accounts comfortably in surplus, allowing Qatar to add to its already considerable foreign assets.

43,040 6.1

60,497 12.2

80,751 17.3

100,407 11.7

96,805 9.5

128,214 19.4

159,649 15.9

0 5.2 8.1

0 7.2 23

0 18.7 15

2.5 10 15.4

1.9 14.9 3

1.7 27.1 6.1

1.5 19.4 5.4

1 59,179

1.1 58,367

1.3 59,729

1.6 58,673

1.6 61,920

1.7 70,479

1.8 78,184

39.1 30.2 8.9 19.1

40.4 31.5 8.9 11.8

40.6 29.3 11.4 7.6

40.4 26.9 13.5 5.1

34.5 27 7.5 14

33.3 21.8 11.5 10.2

31.8 18.6 13.2 8.1

12.6 6.7

11.3 7.2

13.7 7.4

13.2 6.8

-1.9 7

2.7 5.7

4.7 6.2

Source | Economist Intelligence Unit

GCC countries fact sheet | 11

Qatar

SWOT analysis

Strengths

A massive endowment of natural gas as well as sizeable oil reserves. A small population means per capita GDP is very high. Good credit ratings have allowed the country to borrow internationally at low rates.

Weaknesses

Dependence on oil and gas leaves growth, exports and government revenue vulnerable to shifts in world prices. Dependence on immigrant labor means outflows of remittances are high, though the current account remains firmly in surplus.

Opportunities

Development of natural gas reserves and distribution deals, especially in the liquefied natural gas (LNG) industry. Development of the non-hydrocarbons sector, principally financial institutions. Investments in education are improving the skills base. Qatar is a member of the GCC regional trading bloc and is negotiating a free trade agreement (FTA) with the US.

Threats

Oil-fueled asset price booms pose an upside risk to inflation. Tight credit markets could make financing for large-scale projects hard to come by, or prohibitively expensive.

Source | Business Monitor International

GCC countries fact sheet | 12

Qatar

Global competitiveness

Corruption Crime and theft Tax rates Government instability/coups Tax regulations Poor work ethic in national labor force Policy instability Poor public health Inefcient government bureaucracy Ination Foreign currency regulations Inadequate supply of infrastructure Inadequately educated workforce Acess to nancing Restrictive labor regulations

Source | The Global Competitiveness Report 2010-2011

This chart summarizes those factors seen by business executives as the most problematic for doing business in their economy. The information is drawn from the 2010 edition of the World Economic Forums Executive Opinion Survey. From a list of 15 factors, respondents were asked to select the five most problematic and to rank those from 1 (most problematic) to 5. The results were then tabulated and weighted according to the ranking assigned by respondents.

10

15

20

25

30 % responses

GCC countries fact sheet | 13

Kuwait

Macroeconomic data

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin od GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Goverment revenue Goverment expenditure Goverment balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 Economic activity will remain overwhelmingly dependent on the oil sector. 2 Real GDP growth is expected to average over 5% a year in 2011-14, supported by government capital spending and a gradual recovery in oil production. 3 Inflationary pressures are expected to remain under control as tighter regulation of the financial services sector will constrain liquidity in the economy and the government's extensive system of subsidies will cushion the population against volatile movements in international commodity prices. 4 The current exchange-rate regime of managing the dinar against a basket of currencies (dominated by the US dollar) is expected to remain in place. 5 The current and fiscal accounts is expected to stay firmly in surplus, but both will fall as a proportion of GDP.

80,799 10.6

101,550 5.2

114,627 4.4

148,013 8.5

109,481 -4.6

128,253 3.2

136,483 4.7

(3.0) 11.5 9.6

(2.0) 3.1 7.9

(8.8) (1.3) 11.2

1.0 8.2 8.8

(9.1) -

1.0 2.1 4.2

2.0 5.0 4.5

3.0 36,952

3.2 37,729

3.4 37,922

3.4 41,511

3.5 39,684

3.6 40,161

3.7 40,880

58.1 21.9 36.2 12.1

52.5 28 24.4 10.1

58.1 23 35.1 11.8

52.9 37.8 15.1 9.7

56.9 31 25.9 13.1

52.9 29.7 23.2 12.3

51.8 30.5 21.3 12.2

4.5 7.5

3.6 8.6

7.5 8.5

9.0 7.6

2.1 6.0

3.7 5.2

3.4 5.3

Source | Economist Intelligence Unit

GCC countries fact sheet | 14

Kuwait

SWOT analysis

Strengths

Kuwait is the only GCC state with an independent monetary policy. Oil wealth typically enables the state to run a fiscal surplus and this should resume from 2010although the large size of the public sector hampers the development of the non-oil private sector.

Weaknesses

Oil accounts for almost 50% of GDP, more than 80% of government revenues and over 90% of total export earnings, with the non-oil economy still relatively underdeveloped. This makes Kuwait highly vulnerable to exogenous shocks, especially in relation to world oil prices. Attempts to 'Kuwaitize' private sector employment have met with limited success.

Opportunities

Although security risks across the border have so far minimized the potential for investors in Kuwait to benefit from reconstruction work in its neighbor, the situation is now improving and Kuwait remains an attractive staging point for companies and businessmen with dealings in Iraq. Inflation has come down, mitigating the risks to consumer spending. The government has ample assets in sovereign wealth and reserve funds to keep the economy afloat in spite of lower oil prices.

Threats

Continuing political disagreement with Iraq and other neighbors may threaten regional stability. Continued lack of private investment may result in a period of extended stagnation as investors look elsewhere for returns.

Source | Business Monitor International

GCC countries fact sheet | 15

Kuwait

Global competitiveness

Tax rates Tax regulations Crime and theft Poor public health Foreign currency regulations Ination Government instability/coups Policy instability Poor work ethic in national labor force Corruption Inadequate supply of infrastructure Inadequately educated workforce Restrictive labor regulations Acess to nancing Inefcient government bureaucracy

Source | The Global Competitiveness Report 2010-2011

This chart summarizes those factors seen by business executives as the most problematic for doing business in their economy. The information is drawn from the 2010 edition of the World Economic Forums Executive Opinion Survey. From a list of 15 factors, respondents were asked to select the five most problematic and to rank those from 1 (most problematic) to 5. The results were then tabulated and weighted according to the ranking assigned by respondents.

10

15

20

25

30 % responses

GCC countries fact sheet | 16

Bahrain

Macroeconomic data

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin of GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Goverment revenue Goverment expenditure Goverment balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 Bahrain's real GDP is forecast to grow by an average of 4.7% a year in 2010-14, compared with an annual average of 6.5% in 2005-09 and a forecast annual average of 4.6% for the region as a whole. 2 The pace of Bahrain's economic recovery will depend on global demand for hydrocarbons and regional demand for Bahrain's export of services, particularly financial services. 3 Consumer price inflation is forecast to average 3.2% in 2010-14, compared with 2.8% in 2005-09. 4 With oil projected to average US$78.9/barrel in 2010-14, the current account should record surpluses in most years, but the budget is expected to only record small surpluses in 2010-12 before moving into deficit. 5 The Central Bank of Bahrain is expected to maintain the currency peg to the US dollar but will begin to prepare for monetary union with Saudi Arabia, Kuwait and Qatar.

13,459 7.9

15,852 6.7

18,472 8.4

22,157 6.3

19,319 3.1

21,355 3.9

22,622 44

8.4 1.8 20

-10.1 6.4 7.1

27.6 6.1 10.9

2.9 4.5 8.3

4.6 -3.3 9.9

1.2 1.5 6.1

1.1 2 6.5

0.9 22,9.5

1.0 23,344

1.0 24,051

1.1 24,528

1.1 25,588

1.2 25,821

1.2 26,043

33 25.5 7.5 79.9

30.9 26.1 4.7 32.9

29.3 26.2 3.1 28.4

32.1 25.6 6.6 26.3

23.5 29.7 -6.1 40.6

28.4 27.8 0.6 41.7

26.7 26.4 0.3 39.2

1.8 7.9

2.7 1.8

3.4 8.4

3.2 8.3

3.1 8.1

3.3 8.1

3.2 8.4

Source | Economist Intelligence Unit

GCC countries fact sheet | 17

Bahrain

SWOT analysis

Strengths

Despite recent strong growth, the domestic market remains relatively small, with a population of just over 1m. Although the banking sector is well developed, the local stock market is relatively small and illiquid. Fiscal policy has historically been prudent, with the government usually spending below its targets.

Weaknesses

Oil price movements remain a source of risk, as exports and services are highly vulnerable to changes in demand in the extremely oildependent country. Public finances are only partially transparent, due to the persistence of opaque 'extra budgetary transactions.

Opportunities

Bahrain is a leading force in the development of Islamic finance. A package of labor market reforms backed by the Economic Development Board should improve productivity and so boost growth.

Threats

As the dinar is pegged to the US dollar, dollar weakness is leading to imported inflation. Proposals to limit the duration of expatriate work permits could lead to labor shortages in the construction industry, which is reliant on workers from South Asia. Despite renewed exploration efforts, oil reserves are dwindling and output is expected to fall by the end of the decade.

Source | Business Monitor International

GCC countries fact sheet | 18

Bahrain

Global competitiveness

Tax rates Government instability/coups Crime and theft Tax regulations Poor public health Foreign currency regulations Corruption Policy instability Ination Inadequate supply of infrastructure Acess to nancing Inefcient government bureaucracy Inadequately educated workforce Poor work ethic in national labor force Restrictive labor regulations

Source | The Global Competitiveness Report 2010-2011

This chart summarizes those factors seen by business executives as the most problematic for doing business in their economy. The information is drawn from the 2010 edition of the World Economic Forums Executive Opinion Survey. From a list of 15 factors, respondents were asked to select the five most problematic and to rank those from 1 (most problematic) to 5. The results were then tabulated and weighted according to the ranking assigned by respondents.

10

15

20

25

30 % responses

GCC countries fact sheet | 19

Oman

Macroeconomic data

2005 Actual GDP Normal GPD (USDm) Real GDP growth (%) Origin of GDP (%real change) Agriculture Industry Services Population and income Population GDP per head (USD at PPP) Fiscal indicators (%of GDP) Government revenue Government expenditure Government balance Netpublic debt Prices and financial indicators Consumer prices (av,%) Lending interest rate (av,%) 2006 Actual 2007 Actual 2008 Actual 2009 Estimate 2010 Forecast 2011 Forecast 1 Data released by the Central Bank put nominal GDP in 2009 at OR17.7bn, a decline of 23.5% year on year, owing to a sharp drop in oil prices coupled with a fall in oil and non-oil exports. 2 In spite of the fall in nominal GDP, EIU still estimates that real GDP growth was positive, at 2%, as oil output rose by 7.4% year on year to 813,000 barrels/day (b/d). 3 The share of hydrocarbons in overall GDP declined substantially in 2009 - oil and gas accounted for just over 40% of GDP in 2009 (compared with just over 50% in 2008). 4 Nevertheless, the Omani economy will remain vulnerable to any downturn in domestic oil production and to fluctuations in oil and gas export prices. 5 Consumer price inflation declined to an annual average of 3.5% in 2009, owing to a fall in oil and non-oil commodity prices and is forecast to increase to an average of 4% in 2010 and 4.5% in 2011, as prices of basic food items and industrial raw materials increase.

30,9.5 4.0

36,804 5.5

41,9.8 6.8

60,299 12.8

46,115 2.0

56,251 3.6

61,840 3.8

-2.9 5.6 6.7

-4.6 -1.7 12.2

4.6 3.6 9.5

0.5 11.9 13

1.5 0.3 1.2

1.6 3.8 3.4

1.6 3.9 3.7

2.5 20,396

2.6 21,639

2.7 22,360

2.9 24,629

3.2 22,960

3.3 23,151

3.4 23,440

38.0 35.4 2.5 4.9

35.2 34.9 0.3 3.8

36.7 36.5 0.2 3.1

32.9 32.6 0.4 2.5

38.1 41.9 (3.8) 5.5

36.3 37.1 (0.8) 4.5

34.0 35.0 (1.0) 4.1

n/a 7.1

n/a 7.4

n/a 7.3

n/a 7.1

n/a 7.4

n/a 6.8

n/a 6.9

Source | Economist Intelligence Unit

GCC countries fact sheet | 20

Oman

SWOT analysis

Strengths

As a minnow among Gulf oil producers, Oman has had to diversify its economy earlier than most. A wealth of historical sitesin contrast to some Gulf neighborsprovides a good basis for tourism expansion. Prudent fiscal policy.

Weaknesses

At current output levels, known oil reserves will be exhausted within 20 years. Hydrocarbons dependence leaves the economy vulnerable to world price shocks.

Opportunities

Investments in advanced oil recovery technology could potentially boost reserves. Construction is booming around the industrial port of Sohar, though most services depend on a healthy oil economy. Major tourism investments aim to attract visits from the rising numbers of tourists traveling to and within the GCC.

Threats

Widening price differential between Oman's sour-grade crude oil and OPEC producers' grades. Oman is not a member of OPEC. Lower oil prices will result in less room to maneuver for the government, and will have negative repercussions for consumer spending and investment.

Source | Business Monitor International

GCC countries fact sheet | 21

Oman

Global competitiveness

Tax rates Poor public health Tax regulations Government instability/coups Crime and theft Corruption Policy instability Ination Inefcient government bureaucracy Foreign currency regulations Inadequate supply of infrastructure Poor work ethic in national labor force Acess to nancing Inadequately educated workforce Restrictive labor regulations

Source | The Global Competitiveness Report 2010-2011

10

15

20

25

30 % responses

www.deloitte.com About Deloitte: Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.com/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its member firms. Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries. With a globally connected network of member firms in more than 140 countries, Deloitte brings world-class capabilities and deep local expertise to help clients succeed wherever they operate. Deloitte's approximately 170,000 professionals are committed to becoming the standard of excellence. Deloitte's professionals are unified by a collaborative culture that fosters integrity, outstanding value to markets and clients, commitment to each other, and strength from cultural diversity. They enjoy an environment of continuous learning, challenging experiences, and enriching career opportunities. Deloitte's professionals are dedicated to strengthening corporate responsibility, building public trust, and making a positive impact in their communities. About Deloitte & Touche (M.E.): Deloitte & Touche (M.E.) is a member firm of Deloitte Touche Tohmatsu Limited (DTTL) and is the first Arab professional services firm established in the Middle East region with uninterrupted presence for over 85 years. Deloitte & Touche (M.E.) is among the regions leading professional services firms, providing audit, tax, consulting, and financial advisory services through 26 offices in 15 countries with over 2,400 partners, directors and staff. Deloitte & Touche (M.E.) is a 2009 Hewitt Best Employer in the Middle East and was recognized as the 2010 Best Consulting Firm of the Year in the First Complinet GCC Compliance Awards. Deloitte is a Tier 1 advisor in the GCC region (International Tax Review World Tax 2010 Rankings).

Deloitte & Touche (M.E.). All rights reserved.

Member of Deloitte Touche Tohmatsu Limited

Anda mungkin juga menyukai

- KSA Market CredentialsDokumen24 halamanKSA Market CredentialsTeodoraBelum ada peringkat

- ITTI Corporate Presentation - 04th March 2021Dokumen11 halamanITTI Corporate Presentation - 04th March 2021Rejin SurendranBelum ada peringkat

- Singapore Pharma Industry 2020Dokumen3 halamanSingapore Pharma Industry 2020mngb6499100% (1)

- Connected Manufacturing ReportDokumen36 halamanConnected Manufacturing ReportNgọc Khánh TrươngBelum ada peringkat

- Top 50 EMS 2012Dokumen1 halamanTop 50 EMS 2012Lina GanBelum ada peringkat

- Prequalification PDFDokumen225 halamanPrequalification PDFNandanaBelum ada peringkat

- Digital Door Lock System MarketDokumen11 halamanDigital Door Lock System MarketNamrataBelum ada peringkat

- State of The UAE Retail Economy - Q1 - 2021 - FINALDokumen32 halamanState of The UAE Retail Economy - Q1 - 2021 - FINALFarhaan MutturBelum ada peringkat

- Excel Dashboard Templates 29Dokumen2 halamanExcel Dashboard Templates 29Foxuae Abu DahbiBelum ada peringkat

- ? WhatsApp Emoji Meanings - Emojis For WhatsApp On Iphone, Android and WebDokumen32 halaman? WhatsApp Emoji Meanings - Emojis For WhatsApp On Iphone, Android and WebAlaris65Belum ada peringkat

- 17july2013 TMO CyprusDokumen21 halaman17july2013 TMO CyprusAccess Info Europe100% (1)

- What You Need To Know Before Doing Business in DubaiDokumen15 halamanWhat You Need To Know Before Doing Business in Dubaiapi-621658511Belum ada peringkat

- Production Networks in Asia: A Case Study From The Hard Disk Drive IndustryDokumen23 halamanProduction Networks in Asia: A Case Study From The Hard Disk Drive IndustryADBI PublicationsBelum ada peringkat

- E50 PDFDokumen296 halamanE50 PDFEdward KokBelum ada peringkat

- Enterprise Singapore GCP GrantDokumen4 halamanEnterprise Singapore GCP GrantGavinsiauBelum ada peringkat

- IMOA AnnualReview 2022 2023Dokumen28 halamanIMOA AnnualReview 2022 2023PUTODIXONVOL2Belum ada peringkat

- Installation Recommendations NSXDokumen11 halamanInstallation Recommendations NSXNemanjaGlisicBelum ada peringkat

- Malaysia Steel Works (KL) BHD and The Malaysia Smelting Corporation Berhad.Dokumen5 halamanMalaysia Steel Works (KL) BHD and The Malaysia Smelting Corporation Berhad.Wasim SabriBelum ada peringkat

- SIRI Manufacturing Transformation Insights Report 2019Dokumen40 halamanSIRI Manufacturing Transformation Insights Report 2019Tedy IskandarBelum ada peringkat

- RFID ProposalDokumen2 halamanRFID ProposalMarlon Benson QuintoBelum ada peringkat

- QatarDokumen3 halamanQatarAbhishek kumarBelum ada peringkat

- Oracle Golden GateDokumen5 halamanOracle Golden GateThota Mahesh DbaBelum ada peringkat

- GCC Markets Monthly Report - June-2023Dokumen10 halamanGCC Markets Monthly Report - June-2023Nirmal MenonBelum ada peringkat

- SR Annual Report 2022 Digital enDokumen83 halamanSR Annual Report 2022 Digital enAlaa Mohamed100% (1)

- ICT Investments Report GCCDokumen31 halamanICT Investments Report GCCMohammed Jabir AhmedBelum ada peringkat

- Artifical Intelligence InvestmentOpportunityBriefDokumen17 halamanArtifical Intelligence InvestmentOpportunityBriefRoseller Sumonod100% (1)

- 2014-01-14-Industrie 4.0-Smart Manufacturing For The Future German Trade InvestDokumen21 halaman2014-01-14-Industrie 4.0-Smart Manufacturing For The Future German Trade InvestTrumpf FanBelum ada peringkat

- Hydrogen Economist MENA2022Dokumen15 halamanHydrogen Economist MENA2022DanihBelum ada peringkat

- Standard On AuditDokumen70 halamanStandard On AuditDeepak WadhwaBelum ada peringkat

- KIZAD: Khalifa Industrial Zone Abu DhabiDokumen24 halamanKIZAD: Khalifa Industrial Zone Abu DhabiOscar WangBelum ada peringkat

- Mep CompanyDokumen2 halamanMep CompanyHarish MenonBelum ada peringkat

- Rapid 7 Competitive AnalysisDokumen2 halamanRapid 7 Competitive AnalysisBharti SangwanBelum ada peringkat

- THG Annual ReportDokumen46 halamanTHG Annual ReportHardik ThackerBelum ada peringkat

- Sadat City Factories List 2010 To Web - 2Dokumen41 halamanSadat City Factories List 2010 To Web - 2Bossa Babosa75% (4)

- Chart of Accounts Format - OdsDokumen5 halamanChart of Accounts Format - OdsAnonymous PKLGaHnx100% (1)

- Housing Investor Presentation May 18Dokumen55 halamanHousing Investor Presentation May 18Data CentrumBelum ada peringkat

- Euro Wire - Jan 2019Dokumen80 halamanEuro Wire - Jan 2019Varun KumarBelum ada peringkat

- Etisilat and Du Eco ProjectDokumen22 halamanEtisilat and Du Eco ProjectSiddharth ShahBelum ada peringkat

- Product Catalogue 2019: Ruijie NetworksDokumen36 halamanProduct Catalogue 2019: Ruijie Networkskzarne735Belum ada peringkat

- IRRDigital Transformation Navigating The Way To Success Executive SummaryDokumen9 halamanIRRDigital Transformation Navigating The Way To Success Executive SummaryRahul WargadBelum ada peringkat

- Civmec Limited Annual Report 2013Dokumen136 halamanCivmec Limited Annual Report 2013WeR1 Consultants Pte LtdBelum ada peringkat

- Masdar City Free Zone - Schedule of Charges 202287Dokumen13 halamanMasdar City Free Zone - Schedule of Charges 202287Liau Cheong ZerBelum ada peringkat

- Intracom Telecom Company - ProfileDokumen8 halamanIntracom Telecom Company - ProfileSameh AbdelazizBelum ada peringkat

- Ruijie Enterprise CatalogDokumen32 halamanRuijie Enterprise Catalogjhon tanaka100% (1)

- PMI Toolkit - Overview and ApproachDokumen18 halamanPMI Toolkit - Overview and ApproachMmamel ChinenyeBelum ada peringkat

- AFMCO Project (Telco Part)Dokumen59 halamanAFMCO Project (Telco Part)Faraz Faizi0% (1)

- Digital Transformation in Energy: Achieving Escape VelocityDokumen12 halamanDigital Transformation in Energy: Achieving Escape VelocityManuel Otero Alza100% (1)

- Inkjet Vs Laser PrinterDokumen4 halamanInkjet Vs Laser PrinteriamvishalBelum ada peringkat

- Singapore Tradenet: A Tale of One City Group 14Dokumen17 halamanSingapore Tradenet: A Tale of One City Group 14msadique1Belum ada peringkat

- KSA Country Report-Oct (1) .07Dokumen22 halamanKSA Country Report-Oct (1) .07Bash KhanBelum ada peringkat

- MENA Economic 2008Dokumen98 halamanMENA Economic 2008Mahmoud FawzyBelum ada peringkat

- Chart BookDokumen74 halamanChart BookMuthirevula SiddarthaBelum ada peringkat

- Economic Outlook For 2009/10Dokumen83 halamanEconomic Outlook For 2009/10vishwanathBelum ada peringkat

- 2Q2010 SaudiequityfundreportDokumen2 halaman2Q2010 SaudiequityfundreportShunmasBelum ada peringkat

- Highlights: Economic Advisory Council To The PM Economic Outlook 2012/13Dokumen6 halamanHighlights: Economic Advisory Council To The PM Economic Outlook 2012/13mustaneer2211Belum ada peringkat

- Egypt Country Report-18May08Dokumen36 halamanEgypt Country Report-18May08mbasearch2012Belum ada peringkat

- Abraaj Emerging With Confidencev2Dokumen34 halamanAbraaj Emerging With Confidencev2ajudehBelum ada peringkat

- Economicoutlook 201314 HighlightsDokumen5 halamanEconomicoutlook 201314 Highlightsrohit_pathak_8Belum ada peringkat

- Cement Manufacturing Sector ReportDokumen19 halamanCement Manufacturing Sector ReportAbbasHassanBelum ada peringkat

- EAC Highlights 2011 12Dokumen5 halamanEAC Highlights 2011 12Ishaan GoelBelum ada peringkat

- Managerial Economics-Project Report On KONE ElevatorsDokumen19 halamanManagerial Economics-Project Report On KONE ElevatorsHarsh KhemkaBelum ada peringkat

- Economics Answers 2Dokumen14 halamanEconomics Answers 2Rakawy Bin RakBelum ada peringkat

- Answers To End of Chapter 1 QuestionsDokumen2 halamanAnswers To End of Chapter 1 QuestionsRakawy Bin RakBelum ada peringkat

- Annual Review of HSE PerformanceDokumen20 halamanAnnual Review of HSE PerformanceRakawy Bin RakBelum ada peringkat

- KOC Gathering Centre 35 Kuwait - Profile - 070222Dokumen4 halamanKOC Gathering Centre 35 Kuwait - Profile - 070222salman Khan100% (1)

- Arab Times - Lu 15 May 2017Dokumen44 halamanArab Times - Lu 15 May 2017Anonymous AE1w0EaPBelum ada peringkat

- Projects in Kuwait DetailsDokumen3 halamanProjects in Kuwait DetailsFaisal MohammedBelum ada peringkat

- Transportation of Oil and GasDokumen6 halamanTransportation of Oil and GasMichael WainainaBelum ada peringkat

- More Than 11,000 Overseas Vacancies: UAE Passport Ranks Among 15 Most Powerful in The WorldDokumen6 halamanMore Than 11,000 Overseas Vacancies: UAE Passport Ranks Among 15 Most Powerful in The WorldShaheryar KhanBelum ada peringkat

- 30 of World's 50 Wealthiest Arabs Are SaudisDokumen2 halaman30 of World's 50 Wealthiest Arabs Are SaudisRafay MoizBelum ada peringkat

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDokumen28 halamanIELTS Writing Task 1 Sample - Bar Chart - ZIMĐộp LemBelum ada peringkat

- VAT Introduction Kuwait Qatar DelayDokumen3 halamanVAT Introduction Kuwait Qatar DelaypoBelum ada peringkat

- Operation Supercharge II Giovanni MesseDokumen56 halamanOperation Supercharge II Giovanni MesseKyal Sinn MinBelum ada peringkat

- Arabnet - KFAS - Hospitality Publication - ENDokumen27 halamanArabnet - KFAS - Hospitality Publication - ENEdmond DsilvaBelum ada peringkat

- PHL-Kuwait MOUDokumen8 halamanPHL-Kuwait MOUgmanewsBelum ada peringkat

- Conflict & Cooperation ReadingsDokumen2 halamanConflict & Cooperation Readingsapi-261009456Belum ada peringkat

- Labasbas, Roderick M. - LP3Dokumen6 halamanLabasbas, Roderick M. - LP3Roderick Labasbas100% (1)

- KuwaitDokumen358 halamanKuwaitJonathan ElíasBelum ada peringkat

- NBK - Annual Report Management Eng 14062017-6-WebDokumen157 halamanNBK - Annual Report Management Eng 14062017-6-WebsumitBelum ada peringkat

- Rules For Import of Personal Property in KuwaitDokumen3 halamanRules For Import of Personal Property in KuwaitSeaworks CompanyBelum ada peringkat

- The Gulf WarDokumen3 halamanThe Gulf WarShiino FillionBelum ada peringkat

- Resumen Diario India NewsDokumen16 halamanResumen Diario India NewsMilis MilletBelum ada peringkat

- CV Draftsman Sagar CVDokumen6 halamanCV Draftsman Sagar CVZiad EzzeddineBelum ada peringkat

- Chalhoub Group White Paper 2013 EnglishDokumen9 halamanChalhoub Group White Paper 2013 EnglishFahad Al MuttairiBelum ada peringkat

- Oil and Development in GCCDokumen43 halamanOil and Development in GCCHeena SrivastavaBelum ada peringkat

- Shops KuwaitDokumen51 halamanShops KuwaitAhmad AhmadBelum ada peringkat

- Major Road and Housing Projects in KuwaitDokumen5 halamanMajor Road and Housing Projects in KuwaitMichael FarinBelum ada peringkat

- Law 37 of 1964 Regarding Public TendersDokumen14 halamanLaw 37 of 1964 Regarding Public TendersDurban Chamber of Commerce and IndustryBelum ada peringkat

- Folder of Middle East EditedDokumen213 halamanFolder of Middle East EditedSaffiBelum ada peringkat

- Moneygram DetailsDokumen4 halamanMoneygram DetailsMarc VillamorBelum ada peringkat

- Amir Urges Iran To Respond To International Demands: Act Now To Stop KillingDokumen56 halamanAmir Urges Iran To Respond To International Demands: Act Now To Stop KillingImran AslamBelum ada peringkat

- Screenshot 2022-01-08 at 11.21.05 AMDokumen6 halamanScreenshot 2022-01-08 at 11.21.05 AMUbed KudachiBelum ada peringkat

- University of Oslo Library: Short Bibliography of Modern Arab ArtDokumen23 halamanUniversity of Oslo Library: Short Bibliography of Modern Arab ArtsveinosloBelum ada peringkat

- Sulayman S. Al-Qudsi: Curriculum VitaeDokumen23 halamanSulayman S. Al-Qudsi: Curriculum VitaeComputer GuruBelum ada peringkat