Comprehensive Problem 2

Diunggah oleh

Manal ElkhoshkhanyHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Comprehensive Problem 2

Diunggah oleh

Manal ElkhoshkhanyHak Cipta:

Format Tersedia

Comprehensive Problem More Co. is a merchandising business. The account balances for More Co.

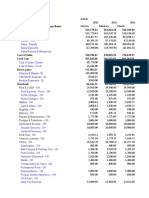

as of November 30, 2012 (unless otherwise indicated), are as follows: 110 112 115 116 117 123 124 210 211 218 220 310 311 312 410 411 412 510 520 521 522 523 529 530 531 532 539 550 Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Store Supplies Store Equipment Accumulated Depreciation-Store Equipment Accounts Payable Salaries Payable Interest Payable Note Payable (Due 2017) P. Williams, Capital (January 1, 2012) P. Williams, Drawing Income Summary Sales Sales Returns and Allowances Sales Discounts Cost of Merchandise Sold Sales Salaries Expense Advertising Expense Depreciation Expense Store Supplies Expense Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Miscellaneous Administrative Expense Interest Expense $ 13,920 34,220 133,900 3,750 2,550 114,300 12,600 21,450 0 0 10,000 103,280 10,000 0 715,800 20,600 13,200 360,500 74,400 18,000 0 0 2,800 40,500 18,600 0 1,650 240

More Co. uses the perpetual inventory system and the last-in, first-out costing method. Transportation-in and purchase discounts should be added to the Inventory Control Sheet, but since this will complicate the computation of the Last-in, first-out costing method, please ignore this step in the process. More Co. sells four types of television entertainment units. The sales price of each are: TV A: $3,500 TV B: $5,250 TV C: $6,125 PS D: $9,000

During December, the last month of the accounting year, the following transactions were completed: Dec. 1. Issued check number 2632 for the December rent, $1,600. 3. Purchased four TV C units on account from Prince Co., terms 2/10, n/30, FOB shipping point, $14,800. 4. Issued check number 2633 to pay the transportation changes on purchase of December 3, $400. (NOTE: Do not include shipping and purchase discounts to the Inventory Control sheet for this project.) 6. Sold four TV A and 4 TV B on account to Albert Co., invoice 891, terms 2/10, n/30, FOB shipping point. 7. Received $7,500 cash from Marie Co. on account, no discount. 10. Sold two project systems for cash. 11. Purchased store supplies on account from Matt Co., terms 1/10, n/30, $620. 13. Issued check number 2634 for merchandise purchased on December 3, less discount. 14. Issued credit memo for one TV A unit returned on sale of December 6. 15. Issued check number 2635 for advertising expense for last half of December, $1,500. 16. Received cash from sale of December 6, less return of December 14 and discount. 19. Issued check number 2636 for two TV C units, $7,600. 19. Issued check number 2637 for $6,100 to Joseph Co. on account. 20. Sold three TV C units on account to Cameron Co., invoice number 892, terms 1/10, n/30, FOB shipping point. 20. For the convenience of the customer, issued check number 2638 for shipping charges on sale of December 20, $600. 21. Received $11,750 cash from McKenzie Co. on account, no discount. 21. Purchased three projector systems on account from Elisha Co., terms 1/10, n/30, FOB destination, $15,600. 24. Issued a debit memo for return of $5,200 because of a damaged projection system purchased on December 21, receiving credit from the seller. 26. Issued check number 2639 for refund of cash on sales made for cash, $1,000. (Customer was going to return goods until partial refund was arranged.) 27. Issued check number 2640 for sales salaries of $1,750 and office salaries of $950. 28. Purchased store equipment on account from Matt Co., terms 2/10, n/30, FOB destination, $800. 29. Issued check number 2641 for store supplies, $550. 30. Sold four TV C units on account to Randall Co., invoice number 893, terms 2/10, n/30, FOB shipping point. 30. Received cash from sale of December 20, less discount, plus transportation paid on December 20. 30. Issued check number 2642 for purchase of December 21, less return of December 24 and discount. 30. Issued a debit memo for $200 of the purchase returned from December 28.

Instructions: 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account (General Ledger). Write Balance in the item section, and place a check mark () in the Post Reference column. 2. Journalize the transactions in a sales journal, purchases journal, cash receipts journal, cash payments journal, or general journal as illustrated in chapter 7. Also post to the Accounts Receivable and Accounts Payable Subsidiary ledgers. 3. Total each column on the special journals and prove the journal. 4. Post the totals of the account columns and individually post the other columns as well as the general journal. 5. Prepare the Schedule of Accounts Receivable and the Schedule of Accounts Payable (their total amount must equal the amount in their controlling general ledger account). 6. Prepare the unadjusted trial balance on the worksheet. 7. Complete the worksheet for the year ended December 31, 2012, using the following adjustment data: a. Merchandise inventory on December 31 $111,040 b. Insurance expired during the year 1,250 c. Store supplies on hand on December 31 975 d. Depreciation for the current year needs to be calculated. More Co. uses the Straight-line method, the store equipment has a useful life of 10 years with no salvage value. (NOTE: the purchase and return will not be included as the dates of the transactions were after the 15th of the month). e. Accrued salaries on December 31: Sales salaries $350 Office salaries 180 530 f. The note payable terms are at 8%, payment is not being made until Jan. 3, 2013. Interest must be recognized for one month (round answer to the nearest dollar amount). 8. Prepare a multiple-step income statement, a statement of owners equity, and a classified balance sheet in good form. 9. Journalize and post the adjusting entries. 10. Journalize and post the closing entries. Indicate closed accounts by inserting a line in both balance columns opposite the closing entry. 11. Prepare a post-closing trial balance.

Anda mungkin juga menyukai

- Question Complete Donna's EnterpriseDokumen4 halamanQuestion Complete Donna's Enterprise786ss100% (1)

- Comp Problem 3Dokumen3 halamanComp Problem 3cjnegrette80% (5)

- 1P91+F2012+Midterm Final+Draft+SolutionsDokumen10 halaman1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyBelum ada peringkat

- ACCT 2001 Exam 2 Review ProblemsDokumen11 halamanACCT 2001 Exam 2 Review Problemsdpa7020Belum ada peringkat

- Chapter 4 5 6Dokumen4 halamanChapter 4 5 6nguyen2190Belum ada peringkat

- CH 05Dokumen4 halamanCH 05vivienBelum ada peringkat

- SummerAssignmentClass11th (2014 15)Dokumen18 halamanSummerAssignmentClass11th (2014 15)Niti AroraBelum ada peringkat

- Module 05-06-07 ProblemsDokumen14 halamanModule 05-06-07 ProblemsmaxzBelum ada peringkat

- ACT 501 - AssignmentDokumen6 halamanACT 501 - AssignmentShariful Islam ShaheenBelum ada peringkat

- FDNACCT Quiz-2 Answer-Key Set-ADokumen4 halamanFDNACCT Quiz-2 Answer-Key Set-APia DigaBelum ada peringkat

- 01 Company Final Accounts QuestionsDokumen10 halaman01 Company Final Accounts QuestionsMd. Iqbal Hasan0% (1)

- Week 3Dokumen14 halamanWeek 3John PerkinsBelum ada peringkat

- ICMA Questions Aug 2011Dokumen57 halamanICMA Questions Aug 2011Asadul Hoque100% (1)

- Accounts Assignment 2Dokumen12 halamanAccounts Assignment 2shoaiba167% (3)

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Dokumen7 halamanDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointBelum ada peringkat

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDokumen12 halamanLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- 7 Adjustments To Final AccountsDokumen11 halaman7 Adjustments To Final AccountsBhavneet SachdevaBelum ada peringkat

- ACC121 FinalExamDokumen13 halamanACC121 FinalExamTia1977Belum ada peringkat

- The Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkDokumen4 halamanThe Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkRadithBelum ada peringkat

- Exercises/Assignments Answer The Following ProblemsDokumen22 halamanExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanBelum ada peringkat

- Comprehensive Problems Solution Answer Key Mid TermDokumen5 halamanComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneBelum ada peringkat

- FDNACCT LE2 ReviewerDokumen5 halamanFDNACCT LE2 Reviewerclassic swagBelum ada peringkat

- FA Mod1 2013Dokumen551 halamanFA Mod1 2013Anoop Singh100% (2)

- Homework QuestionsDokumen17 halamanHomework QuestionsABelum ada peringkat

- (C) San Antonio Home Furnishings CompanyDokumen3 halaman(C) San Antonio Home Furnishings Companyjojo0% (2)

- Department of Business Administration Group Assignment On Fundamental of Accounting IDokumen5 halamanDepartment of Business Administration Group Assignment On Fundamental of Accounting IMohammed HassenBelum ada peringkat

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Dokumen7 halamanDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartBelum ada peringkat

- Econ 3a Midterm 1 WorksheetDokumen21 halamanEcon 3a Midterm 1 WorksheetZyania LizarragaBelum ada peringkat

- OddFalls Practice SetDokumen28 halamanOddFalls Practice SetAntonio Jerome GageBelum ada peringkat

- KTTC1Dokumen22 halamanKTTC1Trần Khánh VyBelum ada peringkat

- 1Dokumen13 halaman1DesireeBelum ada peringkat

- Acct 220 Final Exam UmucDokumen10 halamanAcct 220 Final Exam UmucOmarNiemczyk0% (2)

- ReceivablesDokumen36 halamanReceivablesElla MalitBelum ada peringkat

- As Practice Paper 4Dokumen9 halamanAs Practice Paper 4FarrukhsgBelum ada peringkat

- 2012 Final Exam SolutionDokumen14 halaman2012 Final Exam SolutionOmar Ahmed ElkhalilBelum ada peringkat

- A 17 QuizDokumen5 halamanA 17 QuizLei0% (1)

- Fa Mod1 Ont 0910Dokumen511 halamanFa Mod1 Ont 0910subash1111@gmail.comBelum ada peringkat

- Unit 2 TestDokumen7 halamanUnit 2 TestThetMon HanBelum ada peringkat

- Lecture Notes Chapters 1-4Dokumen32 halamanLecture Notes Chapters 1-4BlueFireOblivionBelum ada peringkat

- Accounts TestDokumen6 halamanAccounts Testwaqas malikBelum ada peringkat

- Aud Prob Module 2 - Accounts ReceivableDokumen19 halamanAud Prob Module 2 - Accounts ReceivableErika PanganBelum ada peringkat

- Accounting Sample QuestionsDokumen6 halamanAccounting Sample QuestionsScholarsjunction.comBelum ada peringkat

- CPAR - Auditing ProblemDokumen12 halamanCPAR - Auditing ProblemAlbert Macapagal83% (6)

- Assignment 1Dokumen11 halamanAssignment 1Muhammad ImranBelum ada peringkat

- FA3PDokumen4 halamanFA3PdainokaiBelum ada peringkat

- Modul Latihan Ii Pengantar Akuntansi I: Dosen: Okky Rizkia Yustian, S.E., M.MDokumen19 halamanModul Latihan Ii Pengantar Akuntansi I: Dosen: Okky Rizkia Yustian, S.E., M.MTito MangestoniBelum ada peringkat

- Accounting Chapter 5Dokumen42 halamanAccounting Chapter 5Joy PacotBelum ada peringkat

- Pracsetandformsv 2Dokumen28 halamanPracsetandformsv 2Ismaeel Gani DalidigBelum ada peringkat

- AdvanceDokumen32 halamanAdvancemuse tamiruBelum ada peringkat

- ACC101 Chapter2newDokumen19 halamanACC101 Chapter2newRahasia RommelBelum ada peringkat

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDari EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionBelum ada peringkat

- 21St Century Computer Solutions: A Manual Accounting SimulationDari Everand21St Century Computer Solutions: A Manual Accounting SimulationBelum ada peringkat

- Summary of Tycho Press's Accounting for Small Business OwnersDari EverandSummary of Tycho Press's Accounting for Small Business OwnersBelum ada peringkat

- Egypt Revolution Inc.Dokumen4 halamanEgypt Revolution Inc.Manal ElkhoshkhanyBelum ada peringkat

- Auditing SP 2008 CH 5 SolutionsDokumen13 halamanAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyBelum ada peringkat

- Auditing SP 2008 CH 6 SolutionsDokumen19 halamanAuditing SP 2008 CH 6 SolutionsManal ElkhoshkhanyBelum ada peringkat

- Chapters 11 & 12Dokumen4 halamanChapters 11 & 12Manal ElkhoshkhanyBelum ada peringkat

- Hightower ServiceDokumen3 halamanHightower ServiceManal Elkhoshkhany100% (2)

- Omaha 1Dokumen7 halamanOmaha 1Manal ElkhoshkhanyBelum ada peringkat

- Omaha 1Dokumen7 halamanOmaha 1Manal ElkhoshkhanyBelum ada peringkat

- Financial AccountingDokumen3 halamanFinancial AccountingManal Elkhoshkhany100% (1)

- Accounting For Managers FinalDokumen4 halamanAccounting For Managers FinalManal ElkhoshkhanyBelum ada peringkat

- Managerial AccountingDokumen5 halamanManagerial AccountingManal ElkhoshkhanyBelum ada peringkat

- Project A Project B Probability Net Cash Flow Probability Net Cash FlowDokumen1 halamanProject A Project B Probability Net Cash Flow Probability Net Cash FlowManal ElkhoshkhanyBelum ada peringkat

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokumen23 halamanParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyBelum ada peringkat

- 50 Multiple Choice, T/F, & Essay QuestionsDokumen24 halaman50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- Summertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Dokumen2 halamanSummertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Manal ElkhoshkhanyBelum ada peringkat

- Nov Dec Jan Feb Mar Apr May June July AugustDokumen9 halamanNov Dec Jan Feb Mar Apr May June July AugustManal ElkhoshkhanyBelum ada peringkat

- Reed Clothier Income StatementDokumen4 halamanReed Clothier Income StatementManal ElkhoshkhanyBelum ada peringkat

- Fashion ShoeDokumen5 halamanFashion ShoeManal ElkhoshkhanyBelum ada peringkat

- Gray HouseDokumen2 halamanGray HouseManal ElkhoshkhanyBelum ada peringkat

- Finance QuizDokumen2 halamanFinance QuizManal ElkhoshkhanyBelum ada peringkat

- StatsDokumen1 halamanStatsManal ElkhoshkhanyBelum ada peringkat

- JanDokumen1 halamanJanManal ElkhoshkhanyBelum ada peringkat

- Finance QuizDokumen3 halamanFinance QuizManal ElkhoshkhanyBelum ada peringkat

- Lasserre (2012) Chapter 1 - GlobalizationDokumen25 halamanLasserre (2012) Chapter 1 - GlobalizationTom BurgessBelum ada peringkat

- Business Plan Strategic Plan 2022 Template2Dokumen44 halamanBusiness Plan Strategic Plan 2022 Template2scorpionrockBelum ada peringkat

- Buffer Profile and Buffer Level Determination For Demand Driven MRPDokumen3 halamanBuffer Profile and Buffer Level Determination For Demand Driven MRPPrerak GargBelum ada peringkat

- HDFCDokumen4 halamanHDFCTrue ChallengerBelum ada peringkat

- Terms ReferenceDokumen4 halamanTerms ReferenceEmmanuel Mends FynnBelum ada peringkat

- Marketing Final ProjectDokumen10 halamanMarketing Final ProjectVictor OlariuBelum ada peringkat

- CapabilitiesDokumen4 halamanCapabilitiesAnmol NadkarniBelum ada peringkat

- Business Ethics of Nepalese FirmsDokumen15 halamanBusiness Ethics of Nepalese FirmssauravBelum ada peringkat

- Parker Economic Regulation Preliminary Literature ReviewDokumen37 halamanParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuBelum ada peringkat

- IBIG 06 01 Three Statements 30 Minutes CompleteDokumen12 halamanIBIG 06 01 Three Statements 30 Minutes CompletedarylchanBelum ada peringkat

- RHED Financing Application Form 1Dokumen2 halamanRHED Financing Application Form 1Kenneth InuiBelum ada peringkat

- Strategic Management (MGMT 2301) : The Cost Leadership StrategyDokumen8 halamanStrategic Management (MGMT 2301) : The Cost Leadership StrategyDusmahomedBelum ada peringkat

- Vodacom Sa Bee Certificate FinalDokumen2 halamanVodacom Sa Bee Certificate FinalAlex MathonsiBelum ada peringkat

- 0001 UCPL - SAP - FICO - S4 - HANA - SyllabusDokumen14 halaman0001 UCPL - SAP - FICO - S4 - HANA - SyllabusRajesh Kumar100% (1)

- Case Study Project Income Statement BudgetingDokumen186 halamanCase Study Project Income Statement BudgetingKate ChuaBelum ada peringkat

- Larsen & ToubroDokumen15 halamanLarsen & ToubroAngel BrokingBelum ada peringkat

- Seller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceDokumen1 halamanSeller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceNitinKumarBelum ada peringkat

- Income From Business and Profession HandoutDokumen29 halamanIncome From Business and Profession HandoutAnantha Krishna BhatBelum ada peringkat

- JOHANSSON - ChapDokumen38 halamanJOHANSSON - Chaplow profileBelum ada peringkat

- McLeod CH08Dokumen46 halamanMcLeod CH08RichaMaehapsari CahKeraton100% (1)

- Profit. Planning and ControlDokumen16 halamanProfit. Planning and ControlNischal LawojuBelum ada peringkat

- Business PlanDokumen6 halamanBusiness PlanAshley Joy Delos ReyesBelum ada peringkat

- PRM in Sports StadiumsDokumen6 halamanPRM in Sports Stadiumskeyurpatel1993Belum ada peringkat

- Excel Solutions To CasesDokumen32 halamanExcel Solutions To Cases박지훈Belum ada peringkat

- Millward Brown Methodology - For WebDokumen5 halamanMillward Brown Methodology - For WebAnkit VermaBelum ada peringkat

- 1.5-Case StudyDokumen11 halaman1.5-Case StudyPradeep Raj100% (1)

- Stakeholder MapDokumen6 halamanStakeholder Mapabirami manoj100% (1)

- A Great CEODokumen2 halamanA Great CEOnochip10100% (1)

- Managerial Economics Group Assignment For MBA 2014Dokumen2 halamanManagerial Economics Group Assignment For MBA 2014EmuyeBelum ada peringkat

- Pan African Resources: Exceeding Expectations (As Usual)Dokumen11 halamanPan African Resources: Exceeding Expectations (As Usual)Owm Close CorporationBelum ada peringkat