Accounts 1

Diunggah oleh

Piyush PatelHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounts 1

Diunggah oleh

Piyush PatelHak Cipta:

Format Tersedia

2011

ACCOUNTS

DELTA 1/1/2011

INTRODUCTION Accounting is perhaps one of the oldest, structured management information system. The accounting system is a means to provide relevant and reliable financial information to all the interest. BOOK-KEEPING Book-keeping is defined as the science and art of recording business transactions in a systematic manner in a certain set of books known as books of accounts. ACCOUNTING It is termed as language of business which records all events and transactions that are of monetary value and facilitates communication among individuals in a society. ACCOUNTANCY It refers to a systematic knowledge of accounting. It explains why to do and how to do of various aspects of accounting. It tells us why and how to prepare the books of accounts and how to summarize

the accounting information and communicate it to the interested parties.

ACCOUNTING PROCESS

It is the process of identifying the transactions and events, measuring the transactions and events in terms of money, recording them in a systematic manner in the books of accounts.

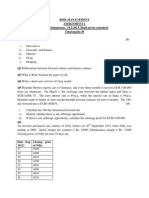

Accounting Encompasses 1. Identification 2. Measuring 3. Recording 4. Classifying 5. Summarising 6. Analysing 7. Interpreting 8. Communicating

1.

Identification This is the first step of accounting process. It defines the transaction of financial character that is required to be recorded in the books of accounts. Events of non financial character cannot be recorded even through such events may have an impact on the operational results of the firm.

2. Measuring This denotes expressing the value of business transactions and events in terms of money.

3. Recording o It deals with recording of identifiable and measurable transactions and events in a systematic manner in the books of original entry that are in accordance with the principles of accountancy.

4. Classifying It deals with periodic groping of transactions of similar nature that appear in the books of original entry into appropriate heads by posting or transfer entries.

5. Summarizing It deals with summarizing or condensing transactions in a manner useful to the users.

6. Analyzing It deals with establishment of relationship between the various items or group of items taken from income statement or balance sheet or both.

7. Interpreting It deals with explaining the significance of those data in a manner that the end users of the financial statement can make a meaningful judgment about the profitability and financial position of the business.

8. Communicating It deals with communicating the analyzed and interpreted data in the form of financial reports or statements to the users of financial information. Ex :: Balance sheet

Accounting information system:

Accounting involves following functions & objective: Accounting helps in systematic recording of all business events or transactions. Written records are more preferable to memorizing because the latter may fade away with time. Also systematic records can be used by different persons for different decision making process. Accounting measure the financial performance of the enterprise. The results of operations are ascertained by preparing profit & loss account, balance sheet and cash flow statements. This will enable the business person to ascertain what the business owes to others. Accounting facilitates the result to both internal & external users. The management requires information for internal purpose at various levels of operations. They need to prepare various reports as production report, idle time report, cash budget report, receivable report, accounts payable, project appraisal report, capital budgeting report etc. The management report s the financial performance of the firm to external users such as shareholders, creditors,

bankers, investors, stock brokers, stock exchanges, employees, government etc. Accounting is requires to fulfill the statutory requirements of various regulatory bodies such as Registrar of Companies, SEBI ( Securities Exchange Board of India) income tax authorities and the government. Accounting helps in internal control by holding the concerned persons responsible for any errors, lapses or under performance. Equally it helps to identify the strong/ weak areas of each unit or department. Current years financial performance becomes the basis for future predictions and estimations. Preparation of budgets, cost analysis, tax planning, auditing are some of the functions of accounting. Accountants: Accountancy is the profession and the practitioners of accountancy are called accountants. Book keeping is recording of business transactions. Accounting is analyzing and reporting of financial data Distinction between Book-keeping & Accounting Book keeping It is a process of identifying, measuring, recording and analyzing the transactions in books of accounts Adopt principles of accounting for recording Book keeping is the first stage of accounting process The objective is to prepare final accounts and balance sheet in a systematic manner at the end of Accounting It involves summarizing the classified transaction, interpreting the analyzed results and communicating the information to the users of financial statement Analyzing and interpreting requires skill, knowledge and experience Accounting follows book keeping. It is the secondary stage The objective is to ascertain net results of financial operations and communicate the results to all

accounting period Accounts executives who perform this function may not require higher level of knowledge The nature of job is routine and clerical Users of Accounting Information:

stakeholders in a manner they understand. Accountants who perform this function need higher analytical skills to interpret the data and to take appropriate decisions. The nature of job is non routine but analytical

Investors: It may be broadly classified as retail investors, high net worth individuals, institutional investors both domestic & foreign. They are keen to know both the return from their investments & the associated risk. Lenders: Banks, financial institutes & debenture holders are the main lenders & they need information about the financial stability of the borrower enterprise. Regulators, Rating agencies & security analyst: investors & creditors seek the assistance of information specialist in assessing prospective returns. Equity analyst, bond analyst & credit rating agencies offer a wide range of information in the form of answering queries. Security analyst obtain valuable information including insider information by means of face-to-face meetings with the company officials, visit their premises & make constant enquiry using e-mails, teleconference & video conference. Firms build a good rapport with such type of information seekers to gain visibility in the market. Management: management needs information to review the firms short term solvency & long term solvency. It has to ensure effective utilization of its resources, profitability in terms of turnover & investment. Employees, trade union & tax authorities: Employees are keen to know about the general health of the organization in terms of stability & profitability. Trade unions use financial reports for negotiating wage package, declaration of bonus & other benefits. Tax authorities need information to assess the tax liability of the firm. Customers: customers have an interest in the accounting information about the continuation of the company especially when they have established a long term involvement with or are dependent on the company. Eg. Car owners

Government & regulatory agencies: government & the regulatory agencies require information to obtain timely & correct information, to regulate the activities of the enterprise if any. The public: every firm has a social responsibility. Firms depend on local economy to meet their varied needs. Prosperity of the enterprise may lead to prosperity of the economy both directly & indirectly. Limitation: Though accounting system is the only source for extracting financial information of the firm, it grossly lacks qualitative elements. (eg: best products, brand image etc.) The accountants have some leeway or freedom on the methods of depreciation charged, inventory valuation etc. though the convention says consistency has to be maintained on the policies adopted, there is considerable room for bias, favourism and personal judgment. Accounting reveals the estimated position and not the real position of the firm. Financial statements are prepared on separate entity concept, conservation concept etc. which are based on the estimates that may lead to over valuation or under valuation of assets and liabilities. Accounting ignores the price level changes when financial statements are prepared on historical cost. Fixed assets are shown in the balance sheet at historical cost less accumulated depreciation and not at their replacement value. The danger of window dressing arises when the management decides to incorporate wrong figures to artificially inflate revenue or deflate losses or when there is a threat of hostile takeover. In such a situation the management fails to provide true and fair view of the financial position to the various users of the financial statement. Basic Terminologies: Transaction: Transfer of money or goods or services from one person/account to another person/account Example: Paid cash for goods purchased; Rent received for letting out services

etc., Capital: Funds brought in to start business to earn profits. Types: Fixed Capital: capital use to purchase fixed assets is called fixed capital Working Capital: The capital use for day to day affairs of business is known as working capital. Capital is a liability for the business. Share: a share in a company is one of the units into which the total capital of the company is divided. Assets: An asset is a resources legally owned by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise. Fixed asset: those which are held for use in the production or supply of goods & services. Current asset: those which are held or receivable within a year or within the operating cycle of the business. Liquid asset: those which can be easily converted into cash. Fictitious asset: they are in the form of such expenses which could not be written off during the period of their incidence. Liability: it is a financial obligation of an enterprise arising from past event the settlement of which is expected to result in an outflow of resources embodying economic benefit. Current liability: it is that obligation which has to be satisfied within a year. Equity: it is the residual interest in the asset of the enterprise after deducting all its liabilities. Entity: it is an economic unit that performs economic activities. Sole Trader: A single individual owning and carrying on business with or without the help of his/her kith and kin. Partnership: it is a relationship between partners to contribute capital to start business, agree to distribute profits and losses in an agreed proportion and the

business being carried on by all or, any one acting for all. Joint Stock Company: Association of persons, collecting capital by issue of shares. Compulsorily registered under Companies Act, 1956. A company enjoys perpetual existence and an independent entity Goods: Commodities or articles purchased in a business for sale or resale Purchases: Indicate buying of goods in which the trader deals in. Sales: Transfer of ownership in goods from seller to buyer is called sale. Purchase return or return outward: goods returned by the business to its suppliers out of the purchase already made from them. Sales return or return inward: goods returned to a business by its customers out of the sales already made to them Opening stock: unsold goods lying in a business at the beginning of a year. Closing stock: unsold goods lying in a business at the end of a year. Inventory: it refers to goods held by a business for sale in the ordinary course of business or for consumption in the production of the goods or services for sale. Drawings: it refers to cash, goods or any other asset withdrawn by the proprietor from his business for his personal or domestic use. Debtor: a debtor is a person who owes money to the business. Trade debtor: it is a person who owes money to the business for the goods supplied to him on credit. A loan debtor: it is a person who owes money to the business for the loan advanced to him. Debtor for asset sold: it is a debtor who owes money to the business for any asset sold to him on credit. A debtor for service rendered: it is a debtor who owes money to the business for the service rendered to him on credit. Debt: the amount due from a debtor to the business. Good Debt: fully recoverable debt Bad Debt : irrecoverable

Doubtful debt : recovery is doubtful Creditor: a creditor is a person to whom the business owes money Trade creditor: it is a person to whom the business owes money for goods purchased from him on credit Loan credit: it is a person to whom the business owes money for the loan borrowed from him. Creditor for asset purchased: it is a person to whom the business owes money for any asset purchased from him on credit. Expenses creditor: it is a person to whom the business owes money for any service received from him on credit. Loss: it refers to money or moneys worth given up without any benefit in return. Profit: it is a situation where the revenue of a business exceeds its expenses. Journal: it is a daily record of business transaction Ledger: it is an account book in which all the accounts are maintained. Entry: it is the record of a transaction made in any book of account. Narration: it is a brief explanation to a journal entry, given below the journal entry, with in brackets. Posting: it is the process of entering in the ledger the information already recorded in the journal or in any of the subsidiary books. Voucher: it refers to any written document in support of a financial transaction. Trial balance: a worksheet listing of all the accounts appearing in the general ledger with the dollar amount of the debit or credit balance of each, used to make sure the books are in balance total debits and credits are equal. Balance sheet: it is the financial statement , which shows the amount and nature of the business assets, liabilities and owners equity as of a specific point in time. Carried forward: it is used at the foot of a page to indicate that the total amount at the foot of that page has been c/f to the head of the next page. Brought forward: it is used at the head of the page to indicate that the total amount at the head of that page has been b/f from the foot of the previous page.

Carried down: it is written in a ledger account at the time of its closing to indicate that the balance in that account has been carried down to next page. Brought down: it is written in a ledger account at the time of its opening to indicate that the opening balance in that account has been brought down from the previous period. Bill of Exchange : Documentary evidence in writing containing an unconditional order signed by th maker, directing a certain person to pay a certain sum of money only to, or to the order of , a certain person or the bearer of the instrument Bill payment / Bill receivable: B/P : In case of purchase of raw materials on credit the supplier or the creditor draws bill of exchange . When entity accepts it becomes B/P . B/R : On sale of goods on credit the entity draws a bill of exchange on the customer. When customer accept it becomes B/R.

Anda mungkin juga menyukai

- Chapter 1: Introduction To AccountingDokumen17 halamanChapter 1: Introduction To AccountingPALADUGU MOUNIKABelum ada peringkat

- Accounting and Finance For Managers - Course Material PDFDokumen94 halamanAccounting and Finance For Managers - Course Material PDFbil gossayw100% (1)

- Introduction to Accounting LectureDokumen15 halamanIntroduction to Accounting LectureMary FolawumiBelum ada peringkat

- Financial Accounting 123Dokumen46 halamanFinancial Accounting 123shekhar87100% (1)

- Financial Accounting NotesDokumen44 halamanFinancial Accounting NotesVansh TayalBelum ada peringkat

- Unit 1. Introduction To Accounting and Business 1.1Dokumen25 halamanUnit 1. Introduction To Accounting and Business 1.1Qabsoo FiniinsaaBelum ada peringkat

- Chap 1-4Dokumen20 halamanChap 1-4Rose Ann Robante TubioBelum ada peringkat

- BBA 1st Sem. FULL SYLLABUS Basic AccountingDokumen115 halamanBBA 1st Sem. FULL SYLLABUS Basic AccountingYash KhattriBelum ada peringkat

- Concepts, Principles and Convensions - AnoverviewDokumen6 halamanConcepts, Principles and Convensions - AnoverviewA KA SH TickuBelum ada peringkat

- Accounting ConceptsDokumen16 halamanAccounting ConceptsEverjoice ChatoraBelum ada peringkat

- Accounts-Cls Notes 1Dokumen8 halamanAccounts-Cls Notes 1AmritMohantyBelum ada peringkat

- Unit I MaterialDokumen40 halamanUnit I Materialarun kumarBelum ada peringkat

- Intro to Accounting FundamentalsDokumen14 halamanIntro to Accounting FundamentalssimmysinghBelum ada peringkat

- Introduction To Financial AccountingDokumen19 halamanIntroduction To Financial AccountingJashan100% (1)

- Limitations of Financial AccountingDokumen6 halamanLimitations of Financial Accountingchitra_shresthaBelum ada peringkat

- Module 2 - Financial Accounting PrinciplesDokumen13 halamanModule 2 - Financial Accounting PrinciplesVimbai MusangeyaBelum ada peringkat

- Notes of Basic AccountingDokumen9 halamanNotes of Basic AccountingAshit BaidBelum ada peringkat

- CMBE 2 - Lesson 1 ModuleDokumen11 halamanCMBE 2 - Lesson 1 ModuleEunice AmbrocioBelum ada peringkat

- The Accounting Cycle: 9-Step Accounting Process InshareDokumen3 halamanThe Accounting Cycle: 9-Step Accounting Process InshareBTS ARMYBelum ada peringkat

- Accounting Principle From 1 To 10Dokumen10 halamanAccounting Principle From 1 To 10trishqBelum ada peringkat

- Module 1 - AccountsDokumen22 halamanModule 1 - AccountsPrince BharvadBelum ada peringkat

- Basic Accounting Concepts and ConventionDokumen12 halamanBasic Accounting Concepts and ConventionParul TandanBelum ada peringkat

- Lesson-2 Generally Accepted Accounting Principles and Accounting StandardsDokumen10 halamanLesson-2 Generally Accepted Accounting Principles and Accounting StandardsKarthigeyan Balasubramaniam100% (1)

- What Are Financial StatementsDokumen4 halamanWhat Are Financial StatementsJustin Era ApeloBelum ada peringkat

- Ch. 1-Fundamentals of Accounting IDokumen20 halamanCh. 1-Fundamentals of Accounting IDèřæ Ô MáBelum ada peringkat

- Accounting ConceptsDokumen13 halamanAccounting ConceptsdeepshrmBelum ada peringkat

- Review of The Accounting ProcessDokumen10 halamanReview of The Accounting ProcessFranz TagubaBelum ada peringkat

- Accounting Concepts and ConventionsDokumen18 halamanAccounting Concepts and ConventionsDr. Avijit RoychoudhuryBelum ada peringkat

- 1 - Understanding AccountingDokumen12 halaman1 - Understanding AccountingNicole DuranteBelum ada peringkat

- Accounting Concepts, Conventions & PrinciplesDokumen34 halamanAccounting Concepts, Conventions & PrincipleskaleabBelum ada peringkat

- Nderstand The Difference Between Accounting and BookkeepingDokumen2 halamanNderstand The Difference Between Accounting and BookkeepingManju GuptaBelum ada peringkat

- Session - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFDokumen27 halamanSession - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFShashank Pandey100% (1)

- Financial Acctg Reporting 1 Chapter 1Dokumen26 halamanFinancial Acctg Reporting 1 Chapter 1Charise Jane ZullaBelum ada peringkat

- Chapter 5 Principls and ConceptsDokumen10 halamanChapter 5 Principls and ConceptsawlachewBelum ada peringkat

- FINANCIAL ACCOUNTING PART 1: DEFINING, HISTORY & USERSDokumen22 halamanFINANCIAL ACCOUNTING PART 1: DEFINING, HISTORY & USERSJan Paulene RiosaBelum ada peringkat

- Lesson 3 AccountingDokumen12 halamanLesson 3 AccountingDrin BaliteBelum ada peringkat

- ACT103 - Module 1Dokumen13 halamanACT103 - Module 1Le MinouBelum ada peringkat

- 413 Block1Dokumen208 halaman413 Block1Subramanyam Devarakonda100% (1)

- NAMI Accounting Principles ExplainedDokumen9 halamanNAMI Accounting Principles ExplainedNishan magarBelum ada peringkat

- Role of Accounting in SocietyDokumen9 halamanRole of Accounting in SocietyAbdul GafoorBelum ada peringkat

- Introduction To AccountingDokumen9 halamanIntroduction To AccountingJessicaBelum ada peringkat

- #02 Conceptual FrameworkDokumen5 halaman#02 Conceptual FrameworkZaaavnn VannnnnBelum ada peringkat

- BCOM 1 Financial Accounting 1Dokumen63 halamanBCOM 1 Financial Accounting 1karthikeyan01Belum ada peringkat

- Modules 1Dokumen4 halamanModules 1JT GalBelum ada peringkat

- Introduction To Accounting: StructureDokumen418 halamanIntroduction To Accounting: StructureRashadBelum ada peringkat

- Accounting Process CycleDokumen12 halamanAccounting Process Cyclechandra sekhar Tippreddy100% (1)

- Accountancy ManualDokumen61 halamanAccountancy ManualAhmad Fauzi MehatBelum ada peringkat

- Bcfa 1: Fundamentals of Accounting 1Dokumen14 halamanBcfa 1: Fundamentals of Accounting 1Arlene PerlasBelum ada peringkat

- Chapter 2: Accounting Equation and The Double-Entry SystemDokumen15 halamanChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilBelum ada peringkat

- CMBE 2 - Lesson 3 ModuleDokumen12 halamanCMBE 2 - Lesson 3 ModuleEunice AmbrocioBelum ada peringkat

- Lesson 1Dokumen9 halamanLesson 1Bervette HansBelum ada peringkat

- Fundamentals of ABMDokumen161 halamanFundamentals of ABMPavi Antoni Villaceran100% (1)

- Accounting and FinanceDokumen301 halamanAccounting and FinanceLuvnica Verma100% (2)

- Smu Account Assignment SolvedDokumen323 halamanSmu Account Assignment SolvedAnupam Rana100% (1)

- AccountingDokumen57 halamanAccountingReynaldo Jose Alvarado RamosBelum ada peringkat

- Accounting Theory Handout 1Dokumen43 halamanAccounting Theory Handout 1Ockouri Barnes100% (3)

- Chapter 1: Session 1 Introduction To Financial AccountingDokumen161 halamanChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- Importance of Accounting for Business DecisionsDokumen4 halamanImportance of Accounting for Business DecisionsRechie Gimang AlferezBelum ada peringkat

- Financial Accounting FrameworkDokumen45 halamanFinancial Accounting Frameworkajit_satapathy1988Belum ada peringkat

- RM Assignmemt I-19!2!2013Dokumen2 halamanRM Assignmemt I-19!2!2013Piyush PatelBelum ada peringkat

- Banking TermsDokumen11 halamanBanking TermsPiyush PatelBelum ada peringkat

- 2013 New World Day ListDokumen6 halaman2013 New World Day ListPiyush PatelBelum ada peringkat

- Organisational Behaviour Leadership Theory: Vanaja Madam Ajudiya Mayur CDokumen8 halamanOrganisational Behaviour Leadership Theory: Vanaja Madam Ajudiya Mayur CPiyush PatelBelum ada peringkat

- Acconuting ConceptsDokumen35 halamanAcconuting ConceptsPiyush PatelBelum ada peringkat

- EconomicDokumen17 halamanEconomicPiyush PatelBelum ada peringkat

- Lec 11Dokumen23 halamanLec 11Piyush PatelBelum ada peringkat

- MinisteryDokumen2 halamanMinisteryPiyush PatelBelum ada peringkat

- Chepter 1Dokumen44 halamanChepter 1Piyush PatelBelum ada peringkat

- Submitted From, G.Hemanth Kumar: Submittedto, Vanaja MamDokumen7 halamanSubmitted From, G.Hemanth Kumar: Submittedto, Vanaja MamPiyush PatelBelum ada peringkat

- List of Case Studies-2010Dokumen23 halamanList of Case Studies-2010Piyush PatelBelum ada peringkat

- List of Case Studies-2009Dokumen17 halamanList of Case Studies-2009Piyush PatelBelum ada peringkat

- Organizational Psychology: Theme: Effective Management of PeopleDokumen47 halamanOrganizational Psychology: Theme: Effective Management of PeoplePiyush PatelBelum ada peringkat

- Amul DerryDokumen58 halamanAmul DerryPiyush PatelBelum ada peringkat

- List of Case Studies-2010Dokumen23 halamanList of Case Studies-2010Piyush PatelBelum ada peringkat

- Innovation in Retail BankingDokumen47 halamanInnovation in Retail BankingPiyush PatelBelum ada peringkat

- Broking - Depository - Distribution - Financial Advisory: For Any EnquiryDokumen13 halamanBroking - Depository - Distribution - Financial Advisory: For Any EnquiryAbhishek ShankarBelum ada peringkat

- Cash Flow StatementDokumen9 halamanCash Flow StatementPiyush PatelBelum ada peringkat

- Banking in IndiaDokumen57 halamanBanking in IndiaPiyush PatelBelum ada peringkat

- SFMDokumen18 halamanSFMPiyush PatelBelum ada peringkat

- SFMDokumen18 halamanSFMPiyush PatelBelum ada peringkat

- Chepter 1Dokumen44 halamanChepter 1Piyush PatelBelum ada peringkat

- AlukDokumen7 halamanAlukPiyush PatelBelum ada peringkat

- Assel LiabilityDokumen74 halamanAssel LiabilityVinay KumarBelum ada peringkat

- Marketing GlossaryDokumen14 halamanMarketing GlossaryKARISHMAATBelum ada peringkat

- Sick CompanyDokumen9 halamanSick CompanyPiyush PatelBelum ada peringkat

- The Satyam Scandal: Group Member: Nadeem Ahmad Kehkasha Hitesh JainDokumen41 halamanThe Satyam Scandal: Group Member: Nadeem Ahmad Kehkasha Hitesh JainNadeem AhmadBelum ada peringkat

- Treasury management functions and departmentsDokumen4 halamanTreasury management functions and departmentsnarmada88Belum ada peringkat

- Fundamentals of Accounting, Business and Management 2Dokumen86 halamanFundamentals of Accounting, Business and Management 2Derek Jason DomanilloBelum ada peringkat

- Tech Mahindra (TECMAH) : LacklustreDokumen11 halamanTech Mahindra (TECMAH) : Lacklustrejitendrasutar1975Belum ada peringkat

- Director Report - Series - 83Dokumen15 halamanDirector Report - Series - 83Divesh GoyalBelum ada peringkat

- Valuation Methods for Startups Under 40 CharactersDokumen16 halamanValuation Methods for Startups Under 40 CharactersVaidehi sonawani50% (2)

- Insurance vOCABULARYDokumen2 halamanInsurance vOCABULARYteacherAmparoBelum ada peringkat

- 8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionDokumen29 halaman8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionParamithaBelum ada peringkat

- Module 4 Financial Projections and BudgetsDokumen11 halamanModule 4 Financial Projections and BudgetsJanin Aizel GallanaBelum ada peringkat

- Trading Setup EbookDokumen34 halamanTrading Setup EbookJohn JosephBelum ada peringkat

- CPA Firm Involved AdelphiaDokumen2 halamanCPA Firm Involved AdelphiaHenny FaustaBelum ada peringkat

- Lecture On Fundamental Analysis - Dr. NiveditaDokumen32 halamanLecture On Fundamental Analysis - Dr. NiveditaSanjanaBelum ada peringkat

- Customer Perceptions of Mutual Funds During CovidDokumen66 halamanCustomer Perceptions of Mutual Funds During CovidAmar Nath BabarBelum ada peringkat

- Financial Derivatives 260214Dokumen347 halamanFinancial Derivatives 260214Kavya M Bhat33% (3)

- Structured Products Nov 2019 EIBSDokumen38 halamanStructured Products Nov 2019 EIBSAli AkberBelum ada peringkat

- WWW - Centralbankofindia.co - In: Central OfficeDokumen28 halamanWWW - Centralbankofindia.co - In: Central Officesriram TPBelum ada peringkat

- Equity Valuation Report - EDPDokumen2 halamanEquity Valuation Report - EDPFEPFinanceClubBelum ada peringkat

- United States Court of Appeals, Eleventh CircuitDokumen30 halamanUnited States Court of Appeals, Eleventh CircuitScribd Government DocsBelum ada peringkat

- GIS June 11 2020 Annual Stockholders MeetingDokumen10 halamanGIS June 11 2020 Annual Stockholders MeetingammendBelum ada peringkat

- 01 General Excellence PDFDokumen151 halaman01 General Excellence PDFSteve TaylorBelum ada peringkat

- G.R. No. 137321Dokumen6 halamanG.R. No. 137321Weddanever CornelBelum ada peringkat

- Case Digest: Pimentel Vs AguirreDokumen1 halamanCase Digest: Pimentel Vs AguirreMaria Anna M Legaspi80% (5)

- Chinatrust Bank Application FormDokumen2 halamanChinatrust Bank Application FormJoel VerbBelum ada peringkat

- Solved Examples - Balance SheetDokumen5 halamanSolved Examples - Balance SheetShruti ShivhareBelum ada peringkat

- 526 TableDokumen11 halaman526 TableAllysson Mae LicayanBelum ada peringkat

- Tax CasesDokumen50 halamanTax CasesBasri JayBelum ada peringkat

- Technical Analysis GuideDokumen57 halamanTechnical Analysis GuideThiru Shankar100% (5)

- Corporate ValuationDokumen16 halamanCorporate ValuationJuBeeBelum ada peringkat

- 2022-02-14 Market - Mantra - 140222Dokumen9 halaman2022-02-14 Market - Mantra - 140222vikalp123123Belum ada peringkat

- Form 1455Dokumen6 halamanForm 1455Shevis Singleton Sr.100% (17)