Liquidity Coverage Ratio

Diunggah oleh

ama2amalDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Liquidity Coverage Ratio

Diunggah oleh

ama2amalHak Cipta:

Format Tersedia

LIQUIDITY COVERAGE RATIO

I. We understand that the definition of liquid assets for the calculation of the liquidity ratio should be more in line with the criteria established by the European Central Bank in the operation of monetary policy. Liquid assets should consider those securities which, although not included in the policy, are immediately eligible for open market operations or for marginal credit facilities in the Bank of Spain or other central banks to which the institution has access: a) Debt issued by credit institutions. Reconsider the treatment of securities issued by credit institutions. Include senior debt in the definition of liquid assets applying, where necessary, more restrictive haircuts that include the hypothetical liquidity premium to which the assets would be subject in a critical scenario. The maturity period should be another factor to consider when assessing the liquidity of this type of security. For example, considering those securities maturing in less than one year, a period which does not need to be covered with long-term funds according to the requirements for a stable financing ratio. b) Securitisation bonds. As in the previous case, certain criteria need to be established when estimating the liquidity of these types of assets, which should not be entirely excluded. The criteria established in the document for the characteristics required of an asset with a good level of liquidity are in many cases difficult to measure and, in operational terms, would complicate and slow down the decision-making process. Adapting reporting processes would be costly. Consequently, it would be important to set criteria that are easy to observe and measure in the market. We therefore suggest that the current definition of liquid assets be revised to consider the requirements imposed by respective central banks.

II. Taking into consideration the implications of the stability of deposits for the calculation of cash outflows and the traditional activity of transformation of banking maturities, establishing clear and objective variables for all institutions is essential. Particular attention is required for the criteria for differentiating between stable retail deposits (7.5%) and less stable deposits (15%), as the definition in the document is somewhat ambiguous. The same percentage (run-off) should not be applied to demand deposits and term deposits, particularly to the less stable balances and even more so in the case of wholesale customers.

III. Setting a loss of three notches in the institutions credit rating as the stress scenario is excessive considering that the period observed is 30 days. Such a drop in credit rating is not a realistic estimate and completely arbitrary.

IV. Establish a differentiation for deposits from wholesale customers to which a factor of 100% is applied. This category would include deposits from investment funds and securitisation funds. In the last instance, the institution would be required to pass on the cost of the penalty calculated in the liquidity ratio to customers. The proposed factor should be revised distinguishing, at least, between the source of funds or activity, as in this case, the custodianship which forms part of a vital and not speculative activity. In the case of securitisation funds, the treatment of the reserve fund, for example, would have to be considered. V. The difference between liquidity and credit facilities is not clear.

VI. Discrepancies in the treatment of interbank lines of credit. A factor of 100% is applied to the balance available for financial institutions but inflows for lines of credit which the institution could have with other banks are not considered.

NET STABLE FUNDING RATIO I. Stable financing does not include the institutions capacity for long-term issues. The liquidity ratio requires institutions to maintain long-term funds to cover assets maturing in over one year, even when they have high credit ratings that enable them to issue mortgage bonds, for example. In this case, two options could be considered: adding the capacity for issue of those eligible assets in the portfolio to long-term financing or applying larger cuts for those assets with a long maturity based on their eligibility when calculating financing requirements.

II. We do not understand the need for long-term financing requirements for loans and receivables maturing in less than one year and, in any case, why such a high percentage (85%), as it is scarcely any different to that for assets with longer maturities.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Mid Term Exam 1 - Fall 2018-799Dokumen3 halamanMid Term Exam 1 - Fall 2018-799abdirahmanBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Ratio AnalysisDokumen11 halamanRatio Analysiskarthik.s88% (24)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Factory Audit ReportDokumen33 halamanFactory Audit ReportMudit Kothari100% (1)

- Midsemester Practice QuestionsDokumen6 halamanMidsemester Practice Questionsoshane126Belum ada peringkat

- How To Calculate An Annual Compounded Growth RateDokumen1 halamanHow To Calculate An Annual Compounded Growth Rateama2amalBelum ada peringkat

- Insurance Regulatory and Development Authority - Insurance Brokers ..Dokumen6 halamanInsurance Regulatory and Development Authority - Insurance Brokers ..ama2amalBelum ada peringkat

- Rate of Return On Owners Equity1Dokumen18 halamanRate of Return On Owners Equity1ama2amalBelum ada peringkat

- InfltnDokumen3 halamanInfltnnsadnanBelum ada peringkat

- Updated List of Eas 23112012Dokumen29 halamanUpdated List of Eas 23112012Neerav Indrajit GadhviBelum ada peringkat

- Return R Change in Asset Value + Income Initial Value: - R Is Ex Post - R Is Typically AnnualizedDokumen41 halamanReturn R Change in Asset Value + Income Initial Value: - R Is Ex Post - R Is Typically AnnualizedrameshmbaBelum ada peringkat

- Updated List of Eas 23112012Dokumen29 halamanUpdated List of Eas 23112012Neerav Indrajit GadhviBelum ada peringkat

- How To Calculate An Annual Compounded Growth RateDokumen1 halamanHow To Calculate An Annual Compounded Growth Rateama2amalBelum ada peringkat

- Liquidity Coverage RatioDokumen2 halamanLiquidity Coverage Ratioama2amalBelum ada peringkat

- Online Shopping - Its Past - Present - and FutureDokumen1 halamanOnline Shopping - Its Past - Present - and Futureama2amalBelum ada peringkat

- Easy-Health Premium PWDokumen13 halamanEasy-Health Premium PWama2amalBelum ada peringkat

- Online Shopping - Its Past - Present - and FutureDokumen1 halamanOnline Shopping - Its Past - Present - and Futureama2amalBelum ada peringkat

- SBI Bank PO Sam3343Dokumen7 halamanSBI Bank PO Sam3343ama2amalBelum ada peringkat

- Sbi Bank PoDokumen6 halamanSbi Bank Poama2amalBelum ada peringkat

- CAPM Capital Asset Pricing ModelDokumen16 halamanCAPM Capital Asset Pricing Modelama2amalBelum ada peringkat

- CAPM Capital Asset Pricing ModelDokumen16 halamanCAPM Capital Asset Pricing Modelama2amalBelum ada peringkat

- SBI Bank PO Sam3343Dokumen7 halamanSBI Bank PO Sam3343ama2amalBelum ada peringkat

- CapmDokumen6 halamanCapmama2amalBelum ada peringkat

- CAPMDokumen10 halamanCAPMama2amalBelum ada peringkat

- Previous Year SBI Bank PO Papers 1Dokumen17 halamanPrevious Year SBI Bank PO Papers 1Milind KasiBelum ada peringkat

- SBI Bank PO 2010 Question PaperDokumen26 halamanSBI Bank PO 2010 Question PaperPankaj BhargavaBelum ada peringkat

- SBI Bank PO Sam3343Dokumen7 halamanSBI Bank PO Sam3343ama2amalBelum ada peringkat

- Previous Year SBI Bank PO Papers 1Dokumen17 halamanPrevious Year SBI Bank PO Papers 1Milind KasiBelum ada peringkat

- Sbi Bank PoDokumen6 halamanSbi Bank Poama2amalBelum ada peringkat

- Form 3: Motor Licencing Officer East Zone, Mayur Vihar PH - 1 Zonal OfficeDokumen1 halamanForm 3: Motor Licencing Officer East Zone, Mayur Vihar PH - 1 Zonal Officeama2amalBelum ada peringkat

- HandbookpensionarybenefitsPBOR Oct11Dokumen258 halamanHandbookpensionarybenefitsPBOR Oct11ama2amalBelum ada peringkat

- Previous Year SBI Bank PO Papers 1Dokumen17 halamanPrevious Year SBI Bank PO Papers 1Milind KasiBelum ada peringkat

- Year SBI Bank PO Papers 3Dokumen13 halamanYear SBI Bank PO Papers 3ama2amalBelum ada peringkat

- (70448314976) 08112022Dokumen2 halaman(70448314976) 08112022DICH THUAT LONDON 0979521738Belum ada peringkat

- Workplace Housekeeping: Training Slides OnDokumen42 halamanWorkplace Housekeeping: Training Slides Onamit yadavBelum ada peringkat

- Introduction To Operation ManagementDokumen78 halamanIntroduction To Operation ManagementNico Pascual IIIBelum ada peringkat

- BXL22 23437Dokumen1 halamanBXL22 23437zilaniBelum ada peringkat

- IP-A1 SiddharthAgrawal 19A2HP405Dokumen2 halamanIP-A1 SiddharthAgrawal 19A2HP405Debanjan MukherjeeBelum ada peringkat

- Project Appraisal FinanceDokumen20 halamanProject Appraisal Financecpsandeepgowda6828Belum ada peringkat

- Comparative Matrix Phil USDokumen27 halamanComparative Matrix Phil USDenzel Edward CariagaBelum ada peringkat

- What Is Commerce?: Comprehensive DefinitionDokumen31 halamanWhat Is Commerce?: Comprehensive Definitionmuhammad riazBelum ada peringkat

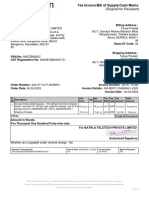

- InvoiceDokumen1 halamanInvoicetanya.prasadBelum ada peringkat

- MBA Result 2014 16Dokumen7 halamanMBA Result 2014 16SanaBelum ada peringkat

- ICI Vol 43 29-11-16Dokumen32 halamanICI Vol 43 29-11-16PIG MITCONBelum ada peringkat

- Training Levies: Rationale and Evidence From EvaluationsDokumen17 halamanTraining Levies: Rationale and Evidence From EvaluationsGakuya KamboBelum ada peringkat

- Ibs Bukit Pasir, BP 1 31/03/22Dokumen5 halamanIbs Bukit Pasir, BP 1 31/03/22Design ZeroBelum ada peringkat

- Godown Creation in Tally 9 Tutorial Youtube PDFDokumen3 halamanGodown Creation in Tally 9 Tutorial Youtube PDFKristinBelum ada peringkat

- Introduction of Icici BankDokumen6 halamanIntroduction of Icici BankAyush JainBelum ada peringkat

- F3 - Consolidation, RatiosDokumen11 halamanF3 - Consolidation, RatiosArslan AlviBelum ada peringkat

- Employee Motivation and Retention ProgrammeDokumen2 halamanEmployee Motivation and Retention ProgrammeHarish Kumar100% (1)

- CommoditiesDokumen122 halamanCommoditiesAnil TiwariBelum ada peringkat

- Letter of Intent To Buy: Insert Company Letter HeadDokumen3 halamanLetter of Intent To Buy: Insert Company Letter HeadVelasco JerwenBelum ada peringkat

- INTERN 1 DefinitionsDokumen2 halamanINTERN 1 DefinitionsJovis MalasanBelum ada peringkat

- Strategy Implementation - ClassDokumen56 halamanStrategy Implementation - ClassM ManjunathBelum ada peringkat

- MGMT 324 Midterm Study Guide Summer 2018Dokumen12 halamanMGMT 324 Midterm Study Guide Summer 2018أبومراد أبويوسفBelum ada peringkat

- Merchandise Assortment PlanningDokumen9 halamanMerchandise Assortment PlanningJyotika ThakurBelum ada peringkat

- Problems DatabaseDokumen200 halamanProblems DatabasesharadkulloliBelum ada peringkat

- DP World Internship ReportDokumen40 halamanDP World Internship ReportSaurabh100% (1)

- Poliform Kitchens Aust (855KB) PDFDokumen12 halamanPoliform Kitchens Aust (855KB) PDFsage_9290% (1)

- Lesson 5Dokumen31 halamanLesson 5Glenda DestrizaBelum ada peringkat