What Is Insurance and How Insurance Work

Diunggah oleh

Avinash ThakurDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

What Is Insurance and How Insurance Work

Diunggah oleh

Avinash ThakurHak Cipta:

Format Tersedia

Macro-Analysis of INDIAN INSURANCE SECTOR

Business Environment Assignment No.2

Submitted to: Dr. S.K. Chadha UBS, Chandigarh

Arundeep, Arjun, Avinash, Bharat, Deepak, Eashani MBA Gen. IInd Semester , Section B, UBS

Macro-Analysis of INDIAN INSURANCE SECTOR

Table of Contents:

S. No.

1 2 3 4 5 6 7 8 9 10 11

Contents

What is Insurance and How does Insurance Work? Historical Perspective Need for Life Insurance Benefits from Life Insurance EMERGENCE OF IRDA INSURANCE SECTOR REFORMS PRESENT SCENARIO MAJOR PLAYERS IN INSURANCE SECTOR Growth and Competition PEST ANALYSIS ECONOMICAL FACTORS AFFECTING INSURANCE INDUSTRY

Page No.

2 3 5 6 7 8 10 13 14 21 23

12

SOCIO-CULTURAL FACTORS AFFECTING LIFEINSURANCE INDUSTRY

26

13

TECNOLOGICAL FACTORS AFFECTING LIFEINSURANCE INDUSTRY

28

14 15 16

Opportunities & Threats Analysis FUTURE POSSIBILITIES References

31 34 37

Macro-Analysis of INDIAN INSURANCE SECTOR

What is Insurance and How does Insurance Work? According to the U.S. Life Office Management Association Inc. (LOMA), life insurance is defined as follows: Life insurance provides a some of money if the person who is insured Dies whilst the policy is in effect. Anybody who has knowledge about life insurance will be tempted to say yes.BUT In other words, surly this is far too brief an explanation for a financial service that provides a very sophisticated range of savings and investment products, as well as mere compensation for death. Classification of Insurance: Insurance business can be divided into two broad categories: i. ii. Life Non-life

Life insurance is concerned with making provision for a specific event happening to the individual, such as death where as non life (or general insurance) is more commonly concerned with the provision for a specific event, which affects a property, such as fire, flood, theft etc. With largest number of life insurance policies in force in the world, Insurance happens to be a mega opportunity in India. It's a business growing at the rate of 15-20 per cent annually and presently is of the order of Rs 450 billion. Together with banking services, it adds about 7 per cent to the country's GDP. Gross premium collection is nearly 2 per cent of GDP and funds available with LIC for investments are 8 per cent of GDP. Yet, nearly 80 per cent of Indian population is without life insurance cover while health insurance and non-life insurance continues to be below international standards. And this part of the population is also subject to weak social security and pension systems with hardly any old age income security. This it is an indicator that growth potential for the insurance sector is immense. A well-developed and evolved insurance sector is needed for economic development as it provides long term funds for infrastructure development and at the same time strengthens the risk taking ability. It is estimated that over the next ten years India would require investments of the

2

Macro-Analysis of INDIAN INSURANCE SECTOR

order of one trillion US dollar. The Insurance sector, to some extent, can enable investments in infrastructure development to sustain economic growth of the country. Insurance is a federal subject in India. There are two legislations that govern the sector- The Insurance Act- 1938 and the IRDA Act- 1999. In India, insurance is generally considered as a tax-saving device instead of its other implied long term financial benefits. Indian people are prone to investing in properties and gold followed by bank deposits. They selectively invest in shares also but the percentage is very small. Even to this day, Life Insurance Corporation of India dominates Indian insurance sector. With the entry of private sector players backed by foreign expertise, Indian insurance market has become more vibrant. Historical Perspective The history of life insurance in India dates back to 1818 when it was conceived as a means to provide for English Widows. Interestingly in those days a higher premium was charged for Indian lives than the non-Indian lives as Indian lives were considered more riskier for coverage. The Bombay Mutual Life Insurance Society started its business in 1870. It was the first company to charge same premium for both Indian and non-Indian lives. The Oriental Assurance Company was established in 1880. The General insurance business in India, on the other hand, can trace its roots to the Triton (Tital) Insurance Company Limited, the first general insurance company established in the year 1850 in Calcutta by the British. Till the end of nineteenth century insurance business was almost entirely in the hands of overseas companies. Insurance regulation formally began in India with the passing of the Life Insurance Companies Act of 1912 and the provident fund Act of 1912. Several frauds during 20's and 30's sullied insurance business in India. By 1938 there were 176 insurance companies. The first comprehensive legislation was introduced with the Insurance Act of 1938 that provided strict State Control over insurance business. The insurance business grew at a faster pace after independence. Indian companies strengthened their hold on this business but despite the growth that was witnessed, insurance remained an urban phenomenon.

Macro-Analysis of INDIAN INSURANCE SECTOR

The Government of India in 1956, brought together over 240 private life insurers and provident societies under one nationalized monopoly corporation and Life Insurance Corporation (LIC) was born. Nationalization was justified on the grounds that it would create much needed funds for rapid industrialization. This was in conformity with the Government's chosen path of State lead planning and development. The (non-life) insurance business continued to thrive with the private sector till 1972. Their operations were restricted to organized trade and industry in large cities. The general insurance industry was nationalized in 1972. With this, nearly 107 insurers were amalgamated and grouped into four companies- National Insurance Company, New India Assurance Company, Oriental Insurance Company and United India Insurance Company. These were subsidiaries of the General Insurance Company (GIC). Indian federal government considers insurance as one of major sources of funds for infrastructure development. The government has identified the following as major thrust areas: * Timely and reliable statistical data and information about policies and markets to instill a degree of credibility; * A code of good practices based on international best practices to raise the standard of Indian insurance sector; * Strengthening of supervision and regulation; * Market participation in decision-making; * High solvency standard' and Developing alternative channels. Till end of 1999-2000 fiscal years, two state-run insurance companies, namely, Life Insurance Corporation (LIC) and General Insurance Corporation (GIC) were the monopoly insurance (both life and non-life) providers in India. Under GIC there were four subsidiaries-- National Insurance Company Ltd, Oriental Insurance Company Ltd, New India Assurance Company Ltd, and United India Assurance Company Ltd. In fiscal 2000-01, the Indian federal government lifted all entry restrictions for private sector investors. Foreign investment insurance market was also allowed with 26 percent cap. GIC was converted into India's national reinsure from December, 2000 and all the subsidiaries working under the GIC umbrella were restructured as independent insurance companies.

4

Macro-Analysis of INDIAN INSURANCE SECTOR

Indian Parliament has cleared a Bill on July 30, 2002 de-linking the four subsidiaries from GIC. A separate Bill has been approved by Parliament to allow brokers, cooperatives and intermediaries in the sector. Currently insurance companies- both private and public-- have to cede 20 percent of its reinsurance with GIC. GIC is planning to increase re-insurance premium by 20 percent which works out at Rs 3000 cr. GIC is actively considering entry into overseas markets including West Asia, South-east Asia and SAARC region. Need for Life Insurance: The above definition captures the original, basic, and intention of life insurance: i.e. to provide for ones family and perhaps others in the event of death, especially premature death. Originally, policies were to provide for short periods of time, covering temporary risk situations, such as sea voyages. As life insurance 10 becomes more established, it was realized what a useful tool it was for a number of situation including: Temporary needs/ threats: The original purpose of life insurance remains an important element, namely providing for replacement of income on death etc. Regular Savings: Providing for ones family and oneself, as a medium to long-term exercise (through a series of regular payment of premiums). This has become more relevant in recent times as people seek financial independence from their family. Investment: Put simply, the building up of savings while safeguarding it from the ravages of inflation. Unlike regular saving products, investment products are traditionally lump sum investments, where the individual makes a one-time payment. Retirement: Provision for ones own later years become increasing necessary, especially in a changing culture and social environment. One can buy a suitable insurance policy, which will provide periodical payments in ones old age. This simple example illustrates the impact premature death can have on a family, where the main earner has no life cover. A simple life insurance policy (term assurance) could have provided Mr. Atols family with a lump sum that could have been invested to provide an income equal to all or part of his income. We will discuss how to analyze the need for life cover and the value of life later in the course.

5

Macro-Analysis of INDIAN INSURANCE SECTOR

Benefits from Life Insurance: i. It is superior to a traditional saving vehicle: As well as providing a secure vehicle to build up saving s etc, it provides peace of mind to the policyholder. In the event of untimely death, of say the main earner in the family, the policy will pay out of the guaranteed sum assured, which is likely to be significant more than the total premiums paid. With more traditional savings vehicles, such as fixed deposits, the only return would be the amount invested plus any interest accrued. ii. It encourages saving and forces thrift: Once an insurance contract has been entered into, the insured has an obligation to continue paying premiums, until the end of the term of the policy, otherwise the policy will lapse. In other words, it becomes compulsory for the insured to save regularly and spend wisely. In contrast savings held in a deposit account can be accessed or stopped easily. iii. It provides easy settlement and protection against creditors: Once a person is appointed for receiving the benefits (nomination) or a transfer of rights is made (assignment), a claim under the life insurance contract can be settled easily. In addition, creditors have no rights to any monies paid out by the insurer, where the policy is written under trust. Under the Married Womens Property Act (M.W.Act), the money available from the policy forms a kind of trust, which creditors cannot claim on. iv. It helps to achieve the purpose of the Life Assured: If someone receives a large sum of money, it is possible that they may spend the money unwisely or in a speculative way. To overcome this, the person taking the policy can instruct the insurer that the claim amount is given in installments. For example, if the total amount to be received by the dependents is Rs. 2,00,000 say Rs.50, 000 can be taken out as a lump sum and the balance paid out in smaller installments, say Rs. 5,000 per month. v. It can be enchased and facilitates borrowing: Some contracts may allow the policy can be surrendered for a cash amount, if a policyholder is not in a position to pay the premium. A loan, against certain policies, can be taken for a temporary period to tide over the difficulty; some lending institutions will accept a life insurance policy as collateral for a personal or commercial loan.

Macro-Analysis of INDIAN INSURANCE SECTOR

Tax Relief: The policyholders obtain Income Tax rebates by paying the insurance premium. The specified forms of saving which enjoy a tax rebate, under section 88 of the Income Tax Act, include Life Insurance Premiums and contributions to a recognized Provident Fund etc. EMERGENCE OF IRDA Insurance Regulatory and Development Authority (IRDA): Reforms in the Insurance sector were initiated with the passage of the IRDA Bill in Parliament in December 1999. The IRDA since its incorporation as a statutory body in April 2000 has fastidiously stuck to its schedule of framing regulations and registering the private sector insurance companies. The other decisions taken simultaneously to provide the supporting systems to the insurance sector and in particular the life insurance companies were the launch of the IRDAs online service for issue and renewal of licenses to agents. The approval of institutions for imparting training to agents has also ensured that the insurance companies would have a trained workforce of insurance agents in place to sell their products, which are expected to be introduced by early next year. Since being set up as an independent statutory body the IRDA has put in a framework of globally compatible regulations. In the private sector 12 life insurance and 6 general insurance companies have been registered.

Duties, Power and Functions of IRDA: Section 14 of IRDA Act, 1999 lays down the duties, powers and functions of IRDA.1. Subject to the provisions of this Act and any other law for the time being in force, the Authority shall have the duty to regulate, promote and ensure orderly growth of the insurance business and reinsurance business.2. Without prejudice to the generality of the provisions contained in subsection. The powers and functions of the Authority shall include Issue to the applicant a certificate of registration, renew, modify, withdraw, suspend or cancel such registration. Protection of the interests of the policy holders in matters concerning assigning of policy, nomination by policy holders, insurable interest, settlement of insurance claim, surrender value of policy and other terms and conditions of contracts of insurance. Specifying requisite qualifications, code of conduct and practical training for intermediary or insurance intermediaries and agents.

7

Macro-Analysis of INDIAN INSURANCE SECTOR

Specifying the code of conduct for surveyors and loss assessors. Promoting efficiency in the conduct of insurance business. Promoting and regulating professional organizations connected with the insurance and re-insurance business. Levying fees and other charges for carrying out the purposes of this Act. Calling for information from, undertaking inspection of, conducting enquiries and investigations including audit of the insurers, intermediaries, insurance intermediaries and other organizations connected with the insurance business.

Control and regulation of the rates, advantages, terms and conditions that may be offered by insurers in respect of general insurance business not so controlled and regulated by the Tariff Advisory Committee under section 64U of the Insurance Act, 1938 (4 of 1938); j. Specifying the form and manner in which books of account shall be maintained and statement of accounts shall be rendered by insurers and other insurance intermediaries.

Regulating investment of funds by insurance companies Adjudication of disputes between insurers and intermediaries or insurance intermediaries. Supervising the functioning of the Tariff Advisory Committee. Specifying the percentage of premium income of the insurer to finance schemes for promoting and regulating professional organizations referred to in clause (f). Specifying the percentage of life insurance business and general insurance business to be undertaken by the insurer in the rural or social sector; and p. Exercising such other powers as may be prescribed.

INSURANCE SECTOR REFORMS In 1993, Malhotra Committee- headed by former Finance Secretary and RBI Governor R.N. Malhotra- was formed to evaluate the Indian insurance industry and recommend its future direction. The Malhotra committee was set up with the objective of complementing the reforms initiated in the financial sector. The reforms were aimed at creating a more efficient and competitive financial system suitable for the requirements of the economy keeping in mind the

8

Macro-Analysis of INDIAN INSURANCE SECTOR

structural changes currently underway and recognizing that insurance is an important part of the overall financial system where it was necessary to address the need for similar reforms. In 1994, the committee submitted the report and some of the key recommendations included: i) Structure Government should take over the holdings of GIC and its subsidiaries so that these subsidiaries can act as independent corporations. All the insurance companies should be given greater freedom to operate. ii) Competition Private Companies with a minimum paid up capital of Rs.1bn should be allowed to enter the sector. No Company should deal in both Life and General Insurance through a single entity. Foreign companies may be allowed to enter the industry in collaboration with the domestic companies. Postal Life Insurance should be allowed to operate in the rural market. Only one State Level Life Insurance Company should be allowed to operate in each state. iii) Regulatory Body The Insurance Act should be changed. An Insurance Regulatory body should be set up. Controller of Insurance- a part of the Finance Ministry- should be made independent iv) Investments Mandatory Investments of LIC Life Fund in government securities to be reduced from 75% to 50%. GIC and its subsidiaries are not to hold more than 5% in any company (there current holdings to be brought down to this level over a period of time) v) Customer Service LIC should pay interest on delays in payments beyond 30 days. Insurance companies must be encouraged to set up unit linked pension plans. Computerization of operations and updating of technology to be carried out in the insurance industry.

Macro-Analysis of INDIAN INSURANCE SECTOR

The committee emphasized that in order to improve the customer services and increase the coverage of insurance policies, industry should be opened up to competition. But at the same time, the committee felt the need to exercise caution as any failure on the part of new players could ruin the public confidence in the industry. The committee felt the need to provide greater autonomy to insurance companies in order to improve their performance and enable them to act as independent companies with economic motives. For this purpose, it had proposed setting up an independent regulatory body- The Insurance Regulatory and Development Authority. Reforms in the Insurance sector were initiated with the passage of the IRDA Bill in Parliament in December 1999. The IRDA since its incorporation as a statutory body in April 2000 has fastidiously stuck to its schedule of framing regulations and registering the private sector insurance companies. Since being set up as an independent statutory body the IRDA has put in a framework of globally compatible regulations. The other decision taken simultaneously to provide the supporting systems to the insurance sector and in particular the life insurance companies was the launch of the IRDA online service for issue and renewal of licenses to agents. The approval of institutions for imparting training to agents has also ensured that the insurance companies would have a trained workforce of insurance agents in place to sell their products. PRESENT SCENARIO The Government of India liberalized the insurance sector in March 2000 with the passage of the Insurance Regulatory and Development Authority (IRDA) Bill, lifting all entry restrictions for private players and allowing foreign players to enter the market with some limits on direct foreign ownership. Under the current guidelines, there is a 26 percent equity cap for foreign partners in an insurance company. There is a proposal to increase this limit to 49 percent. The opening up of the sector is likely to lead to greater spread and deepening of insurance in India and this may also include restructuring and revitalizing of the public sector companies. In the private sector 12 life insurance and 8 general insurance companies have been registered. A host of private Insurance companies operating in both life and non-life segments have started selling their insurance policies since 2001.

10

Macro-Analysis of INDIAN INSURANCE SECTOR

Today hardly 20 per cent of the population in India is insured and insurance premium (life as well as non-life) account for just 2 per cent of GDP as against the G-7 average of 9.2 per cent. Consequently, the fear that new companies will displace public companies is misplaced. There is room for more for not only the existing companies but also for any number of competitors. In China, insurance premium accounted for just over 1 per cent of China's GDP in 1995 but in the four years since the market has been liberalized (albeit partially),spending on insurance has grown at a compound annual rate of 33 per cent. It is not just foreign companies alone that have grown but also the national PICC as well. The story is no different in S Korea. There, the opening of the sector saw the Big Six domestic players, who initially controlled the entire market, increase their business from 7 to 37 trillion won by 1997. Meanwhile foreign companies were not able to capture more than a miniscule 0.7 per cent of the market. The liberalization of life insurance will benefit the industry in the following ways: It helps transfer of technology in the field of life insurance. New techniques and methods can be used for assessment of risk, fixation of reasonable premium and provide new investment opportunities. This will help in expansion and development of business.

It helps in adopting a flexible price policy on new life insurance policies developed and introduce now onward. It will make available in all countries of the world the service of efficient management and financial experts. It can help in development of knowledge of insurance business. Many educational and training institution stand fast functioning this lead to availability of professional managers. It will enlarge the scope of insurance. It will help spread it in rural and small villages also. The life insurance market will become global. The productivity as well as the efficiency also increases. The international competition in the field itself will play an important roll in this direction. Competing ability will increase due to liberalization. All categories of employees serving in life insurance sector will get more satisfaction through good opportunity for training, higher opening in jobs and higher income.

The general public will also be benefited from liberalization of life insurance sector:

They can get better choice of selection of policy and insurer.

11

Macro-Analysis of INDIAN INSURANCE SECTOR

When there is large number of insurer, the insurer is able to select such an insurer whose premium rate is reasonable. The insurers play more attention to the interest of insured. This way interest of the insured is well protected. There will be number of policies based on social security brought out by different insurers. Such schemes include plan like pension scheme, gratuity scheme, medical claim etc.

Good employment opportunity in the life insurance sector when a number of new institutions are established in these fields.

The employee will also benefit from liberalization life insurance sector: Better opportunity for training and development. Knowledge can be gain about new method of functioning through education and training. The employee gets opportunity for job promotion and other financial non-financial benefits. The productivity of employees shall develop due to education and training facility. Working with professional manager benefit the employee in learning the new methods and technique in work situation. The employee will get motivation and their moral will be higher. Negative implication:Cut throat competition liberalization will create acute competition in the insurance market, which is not in the interest of the industry, customers or the country. This type of acute competition may sometime leads to insolvency of insurance companies and thereby the policy holders may face serious consequences. This seems far from truth, as the experience shows that nowhere the competition has threatened anybody. The experience of banking sector in our own country testifies to this effect that despite presence of 42 foreign banks, the balance is not distributed. Total investment assets of the foreign banks are about10 %. But the impact of the competition has increased the size of the market. End of government monopoly: This liberalization of life insurance sector brings an end to the government monopoly in life insurance sector and private companies may exercise their domination.

12

Macro-Analysis of INDIAN INSURANCE SECTOR

Dominance of outside companies: foreign companies capture the life insurance sectors as a whole under their dominance, because they possess more efficient insurance techniques, knowledge. As such Indian companies cannot survive before these foreign companies.

Shortage of funds for social cause: It is estimated that at present the LIC and GIC invest a total of Rs 90,000 crores to the public/ social sector. This amount is early 70-80 % of their total fund available. Although the government is making rules for the private sector companies to invest certain percentages of their premium income in the social sector, the availability of such huge fund is doubtful.

Policies of heavy amount the insurance companies issues policies of heavy amount when at present a policy is available for an insured sum even below Rs.1,00,007/- where the sum assured against a policy becomes very heavy, economically backward people cannot benefit of insurance.

More attention towards profitable policies:- the private sector life insurance companies develop and introduce only those policies that involve the minimum risk burden and more profitable of them. They overlook the interest of the common people. They want taken any special attention to insured the lives of woman, physically handicapped etc. which involve more risk.

Neglect the rural lives: The people who are against the concept of liberalization of insurance sector believe that the domestic as well as foreign private companies neglect the rural areas, by giving more attention in getting people insured from urban areas. This because of the average cost incurred on policies is less in urban areas.

Problem of exercising control over insurance companies: it becomes very difficult to control Indian and foreign private insurance companies by the government.

MAJOR PLAYERS IN INSURANCE SECTOR About the various player of life insurance sector: Since being set up as an independent statutory body the IRDA has put in a framework of globally compatible regulations. In the private sector 12 life insurance and 6 general insurance companies have been registered than after remaining companies are registered. Here we have described the private life insurance companies registered in which year wise.

13

Macro-Analysis of INDIAN INSURANCE SECTOR

Private Player in Life Insurance industry: HDFC Standard Life Insurance Company Ltd. Max New York Life Insurance Co. Ltd. ICICI Prudential Life Insurance Company Ltd. OM Kotak Mahindra Life Insurance Co. Ltd. Birla Sun Life Insurance Company Ltd. Tata AIG Life Insurance Company Ltd. SBI Life Insurance Company Limited. ING Vysya Life Insurance Company Private Limited. Allianz Bajaj Life Insurance Company Ltd. MetLife India Insurance Company Pvt. Ltd. AMP SANMAR Assurance Company Ltd. Aviva Life Insurance Co. India Pvt. Ltd. Sahara India Insurance Company Ltd.

Growth and Competition

The size of the insurance business has been increasing. The life insurance segment witnessed an average annual growth of 43.8 per cent in first-year premium between 2000-01 and 2007-08 and general insurance witnessed an average annual growth rate of 17 per cent during the same period. While the growth in both private and public sectors is comparable in the life sector, the general insurance sector saw a higher growth in the private sector. There has also been an increase in insurance penetration. Underwritten premium in a given year to GDP ratio has increased, from 2.3 per cent in 2000 to 4.7 per cent in 2007. This compares favourably with some of the emerging economies in Asia, i.e., Malaysia, Thailand and China with ratios of 4.9, 3.5 and 2.7 per cent respectively. Insurance density, which is defined as the ratio of premium underwritten in a given year to total population (per capita premium underwritten), has increased significantly from Rs.465 (US $ 9.9)70 to Rs.2190 (US $ 46.6) between 2001 and 2007. This is still lower than in other Asian emerging market economies; the comparable figures for Malaysia, Thailand and China are US $

14

Macro-Analysis of INDIAN INSURANCE SECTOR

292.2, 110.1 and 53.5, respectively. Premia as a per cent of GDP, however, compared well in respect of life, though it lagged behind in non-life Table 3.28: Premia as a Per Cent of GDP Country Life insurance premia 2005 India Malaysia Thailand China 2.11 2.96 1.83 1.34 2008 4.00* 3.68 1.83 1.77 Non-life insurance premia 2005 0.55 1.75 0.90 1.07 2008 0.60* 1.86 0.92 1.61

*pertains to 2008 Source: IRDA

The Herfindahl Index for concentration for the life insurance industry is very high due to the dominance of the Life Insurance Corporation of India (LIC). Growing competition in the sector is, however, evident from the decline in the index over the years. Life insurance sectors financial soundness The life insurance segment is dominated by the public sector Life Insurance Corporation (LIC), and there is significant variance between the

15

Macro-Analysis of INDIAN INSURANCE SECTOR

business models of LIC and private sector participants. Accordingly, the financial soundness indicators are analyzed separately for these two categories to better understand the underlying difference between the two segments.

Solvency and Capital Adequacy

The weighted solvency ratio for the life insurance sector shows an increasing trend and has increased from 134.1 per cent to 159.5 per cent, indicating a increase in the available solvency margin relative to the required. LICs solvency ratio, which increased to 152 per cent b y 2008 from 130 per cent in 2006, still remains relatively low compared to other players in the life insurance segment.

The stipulated solvency requirement as per regulation is based on a formula approach. Solvency ratio and entry level capital requirement are the tools used with regard to capital adequacy requirement for the insurance sector. Capital adequacy for the purpose of the analysis, which is measured by the ratio of capital + reserves and surplus to total mathematical reserves71, is low. This is mainly due to the low capital base of LIC, the dominant component of the life insurance industry. The solvency ratio, though consistently higher than the stipulated solvency requirement, had shown a decline till 2006-07 before exhibiting an increase in 2007-08 for private sector companies.

16

Macro-Analysis of INDIAN INSURANCE SECTOR

Asset Quality The asset quality of the insurance sector is measured in terms of the potential volatility of its investment portfolio, and is looked at from the ratio of its equity investment to non-linked/linked investment. There has been some increase in these ratios, though they are well within the regulatory stipulations Mathematical reserve is the amount that a life insurance company must set aside and capitalize in order to meet its future obligations.

Reinsurance and Actuarial Issues The ratio of net to gross premium remains stable at nearly 100 per cent. The ratio reflects the risk retention policy of the insurer.

17

Macro-Analysis of INDIAN INSURANCE SECTOR

Earnings and Profitability

While operating expenses to gross premium after showing a decline has shown an increasing trend, the wide difference in the quantum of total expenses to net premium between the private insurers and LIC is an indication of the maturity structure of the business portfolio of LIC.

Liquidity

The cash and bank balances of life insurers are sufficient to meet immediate liability towards claims towards payments but not paid. It also covers the incurred, but not reported, portion of the claims liabilities.

Non-Life Solvency The weighted solvency ratio of the non-life sector was significantly above the stipulated 150 per cent. The lower and declining capital base relative to the net premium of the private sector non-life companies is evident from their increasing net premium to capital ratio. The asset risk of these

18

Macro-Analysis of INDIAN INSURANCE SECTOR

companies also shows a slight increasing trend, as evidenced from their marginally declining capital to assets ratio between 2005-06 and 2007-08.

Reinsurance and Actuarial Issues The propensity to reinsure is much higher in the non-life sector than in the life insurance segment. In the case of non-life insurers, the private sector

is more inclined to reinsure risk. There is a slight decline in the ratio of net technical reserves to average of net claims.

19

Macro-Analysis of INDIAN INSURANCE SECTOR

Earnings and Profitability

Operating expenses to gross premium has shown a general decline in recent years. However, the high ratio of net claims to net premiums particularly in public sector companies raises concerns. This calls for better quality control in underwriting new business, better risk management and appropriate utilization of reinsurance. The adequacy of premium, particularly in respect of public sector companies, needs to be looked into. The combined ratio, which takes into account both loss ratio and expenses incurred, is more than 100 per cent, which indicates potential vulnerability. The ratio of investment income to net premium shows that the public sector companies have larger investment assets than their private sector counterparts. Liquidity

The liquidity position, as indicated by the ratio of current assets to current liabilities, at around 60 per cent indicates its inadequacy, as current assets are not sufficient to cover all current liabilities.

20

Macro-Analysis of INDIAN INSURANCE SECTOR

PEST ANALYSIS

POLITICAL FACTORS AFFECTING INSURANCEINDUSTRY: Within India political ambitions and rise of communalism, fissiparous tendencies are on the rise and may well continue for quite some time to time. Therefore, it expected that the insurance companies might consider offering political risk coverage also. The only area where Indian insurers consider giving cover is with regard to customs duty change under certain conditions. Certain type of political risk at the international level has serious implications for exporters. The term political risk has a wider connotation than commonly understood or assumed. It covers events arising not just from politics, but risks in the course of international transactions. In this connection, it may be noted that export credit insurance has evolved out of uncertainties relating to international trade, particularly due to problems arising out of foreign legal jurisdiction, political changes and currency exchange difficulties faced by many developing countries. Prohibition for Investment: The funds of policyholders are prohibited from being directly / indirectly invested outside India as per section 27 C. Manner and conditions of investment Subject to the above provisions contained in Section 27 -/ 27- A / 27 B, the IRDA may, In the interest of the policyholders, specify the time, manner and other conditions of investment by insurer. Give specific directions applicable to all insurers for the time, manner and other conditions subject to which the policyholders funds should be invested in the infrastructure and social sectors. After taking into account the nature of business and to protect the interest of the policyholders, issue directions to insurers relating to time, manner and other conditions of the investments provided the latter are given a reasonable opportunity of being heard. Insurance business in rural / social sector: All insurers are required to undertake such percentage of their insurance business, including insurance for crops, in the rural social sector as specified by the IRDA. They should discharge their obligations to providing life insurance policies to persons residing

21

Macro-Analysis of INDIAN INSURANCE SECTOR

in the rural sector, workers in the unorganized sector or to economically vulnerable classes of society and other categories of persons as specified by the IRDA. Capital requirement: The paid up equity of an insurance company applying for registration to carryon life insurance business should be Rs 100 Crores. Renewal of registration: An insurer, who has been granted a certificate of registration, should have the registration renewed annually with each year ending on March 31 after the commencement of the IRDA Act. The application for renewal should be accompanied by a fee as determined by IRDA regulations, not exceeding one forth of one percent of the total gross premium income in India in the preceding year or Rs 5 Crores or whichever is less, but not less than Rs 50000 for each class of business as per Section3-A. Requirements as to Capital: The minimum paid up equity capital, excluding required deposits with the RBI and any preliminary expenses in the formation of the country, requirement of an insurer would be Rs. 100 crore to carry on life insurance business and Rs 200 crore to exclusively do reinsurance business as per Section 6 Role of the government: As insurance is an important service sector, hence it is highly regulated by government. Since 1956 insurance sector was highly regulated by government of India. On March 16, 1999, the Indian cabinet approved on Insurance Regulatory Authority Bills that was designed to liberalize the insurance sector. Two governments in India have fallen over the issue of liberalization of the insurance sector (which was nationalized in 1971). But the government of A.B.Vajpayee as gone ahead to announce the liberalization of this sector announcement was made in November 1998. Governments objectives for liberalization of insurance: The main objective of opening of insurance sector to the private insurers is asunder: 1. To provide better coverage to the Indian citizens. 2. To augment the flow of long-term financial resources to finance the growth of infrastructure.

22

Macro-Analysis of INDIAN INSURANCE SECTOR

BODIES THAT REGULATE THE SECTOR: For better regulation purpose of the insurance sector the government has established following bodies; 1. IRA: Insurance Regulatory Authority. 2. IRDA: Insurance Regulatory and Developmental Authority. 3. TAC: Tariff Advisory Committee.

ECONOMICAL FACTORS AFFECTING INSURANCE INDUSTRY Interest rate at bank and interest rate of P.F variation very much affect to insurance industry, because people always attract by higher return. Therefore, they do not prefer lower return policy. Unemployment also affects insurance industry, because the unemployment people will not have earning, so saving also affect to life insurance sector Life insurance industry will directly affected by Earthquake, Monsoon, and Natural calamity. Because of these events turns into lots of death, so the insurance companies have to pay claim against policy. Infant mortality rate and maternity mortality rate are also affecting to life insurance. Typical Indian want luxurious product against low income, so that they prefer installment or annuity (EMI), so that they may not have extra saving to invest in insurance. Adequacy of capital: Capital adequacy is a matter of attention in view of the nature of the life insurance business, where in the case a contingency arises, the insurers should be in a position to meet its long-term contractual obligations and pay up the dues or claims. In that sense, life insurance is a capitalintensive business and must be backed by an adequate capital base on the part of the owners and the companies should not be running their business purely on other peoples money. So minimum start up amounts and long running capital adequacy norms are absolutely essential, in consideration of this, the Malhotra committee suggested and subsequently the IRDA stipulated a minimum capital base of Rs 1 bn for any entity wanting to enter the life insurance business. Increased Economical Activity: Although economic activity has slowed down since 1996, sooner or later there will bean upswing. The increase in the growth rate in various sectors accompanied by the growth in trade in the context of fulfilling of commitments to the WTO will signal a growth in the demand for insurance covers of new types. For example, aviation insurance cover will be on an increasing

23

Macro-Analysis of INDIAN INSURANCE SECTOR

scale in view of the need for more frequent travel for men and for transporting materials. This would necessitate substantial property, liability and personal insurance. As far as cover against business interruption is concerned, the pace of business and of change today is so fast that even the most careful assessment of exposure time, and the most liberal coverage cannot protect the insured adequate in the event of a loss be on the increase and insurance companies cannot afford to ignore the vast potential in this business. Interest Rates: During the last years the government has rationalized interest rate creates better business opportunities for the life insurance sector because the substitute products are graded lower by the customers. On the other hand the value of the holdings of the insurance companies will increase. Rationalized of the interest rates is still expected, and it is an opportunity for the company. Low interested rates mean low investment return for reinsures causing negative impact on their overall net profitability as pricing is to a certain extent sensitive to interest rate fluctuations. The negative impact therefore, lead to higher pricing level for reinsures in order to sustain their profitability. But, in reinsurance market, which is characterized by over capitalization a resulting intense competition. The opportunity for such rate increases practically remains very slim and even non-existent. As a result, reinsures are under tremendous pressure to cut their operational cost to safeguard profitability. Furthermore, low interest rates discourage and even prevent any outflow of capital from reinsurance business to capital markets, causing current over capitalization in reinsurance market to continue. A positive outcome is that low inflation rates, if sustained for a considerable period, usually bring some relief to reinsures from the resulting lower than forecast claims payment. Also, this can lead stability to reinsures administrative cost. As interest rates fall, bond value rise, and insurers feel richer. On the liability side, reserves are not explicitly discounted so lower interest rates do not increase reserves, lower inflation means lower expected future claims payments which lowers required reserves. This in turn increases surplus, again allowing insurers to feel richer. Therefore, low interest rates and low inflation result in higher assets, lower liabilities, hence greater surplus and greater risk capacity resulting in less demand for, and greater surplus of reinsurance. Low interest rates and low inflation reduce the ability of reinsures to off set technical losses by using financial products and should, as a consequences, force market competition downloads. However, this will also serve to weaken the balance sheets of insurers and create an increase in the demand for balance sheet protections

24

Macro-Analysis of INDIAN INSURANCE SECTOR

.Lastly, these conditions move risk from the liability side of the balance sheet to the asset side while actually generating new needs for cover. Inflation rate: Inflation can also be one of the causes to change the scenario of the insurance

sector. High inflation for instance, would tend to reduce the insurance business, particularly life, because the real value of the money paid back to the policyholder on maturity of the policy would go down and would, therefore, lose its attraction for the investor. At the most, the insuring public may prefer pure risk plans (terms insurance), which have a low premium outlay. The response to an inflationary situation will depend on what benefit the insured is looking for. In a situation of high inflation, clients would prefer policies where the savings portion is periodically returned while the risk portion is maintain for the duration of the contract. Those who prefer risk protection are likely to opt for long term policies, which may also be preferred because they are likely to be low premium policies. A flexible system, under which the sum insured, is increased from time to time so that the real value of the cover is maintained, and could give a boost to the market under conditions of high inflation. Fortunately, the rate of inflation in India has been contained to less than 5 percent for a fairly long time and unless it goes out of hand, it is not likely to dampen the market. Market related factors: These are the factors, which governs the entire life insurance sector. This includes internal as well as the external factors. We have seen the various factors like technological, economical and will see the political and government factors , environmental factors and competitive analysis of insurance sector in the next session. These all factors have changed the trend of life insurance sector, which is shown in the following figure:

25

Macro-Analysis of INDIAN INSURANCE SECTOR

Customer satisfaction: Since the customer is the focus of any service industry, every such industry continuously strives for greater variety and better quality of products, improvement in its delivery system, cost effectiveness, easy access, and quick response to perceived needs in short qualitatively superior service. Indian life insurance companies already have a sizable line up of the products. The difference between them and the foreign operators perhaps lies in the service provided, because there is still not enough concern on the part of the Indian companies, with customer satisfaction, on time renewals, claims settlements, etc. if high standards have been achieved else where, it is not impossible to attain the same in India too. The concept of sales is now redefined as a long standing relationship. The relationship does not end with the conclusion of the transaction, but has to be durable and of a long term nature. Hence, improved in performance of the company will not be synonymous with only basic cost reduction or larger business, but the new measure of performance will be set in terms of service to the customer. One can anticipate greater insistence from pressure groups like customer forums to keep customer satisfaction at the top of the list of priorities of the insurers.

SOCIO-CULTURAL FACTORS AFFECTING LIFEINSURANCE INDUSTRY: The basic social factors that affect the life insurance sector are as under: Population Life style Educational level Level of earning Societal benefits

These are the major social factors, which affect the life insurance sector. We will discuss all of them in brief Population: Growth in the population is a major factor pushing up the demand. It is also going to exert a special influence on the life insurance market in other ways. Apart from exerting pressure on demand for goods and services, and through that, ill effects of uncontrolled growth of population also could spur the growth of demand. For example, overcrowding in public places of entertainment, public support, or too many vehicles on the road can result in hazards like

26

Macro-Analysis of INDIAN INSURANCE SECTOR

stampedes and pollution, which require covers and still are not sold on a large scale today. Thus the positive as well as the negative aspects of population growth are going to spur demand. Life Style: The peculiar lifestyle of a country or an age also affects the insurance business. Change therein produces different demands for life insurance. For e.g. Allover the world, family size is shrinking and the fact that in decades to come, both presents are more frequently likely to work outside the home will mean that there could be a greater possibility of property loss. Similarly, a larger number of vehicles on the roads for people commuting to their jobs or business would mean larger incidence of accidents. This will increase the demand for life insurance products. Of course, there is also the other possibility that wherever it is possible, some people will try to spend a part of their time working at home either because they would like to be with their families or because they find it more convenient. Activities like life insurance and financial services are particularly well suited for such arrangements. With time becoming scarcer for most people who pack in a full day, there is a higher demand for convenience and service. Companies will respond by trying to shorten the transaction time for the delivery of products and services and creating distribution systems that can reach clients wherever they are and whenever they want to use them, so as to ensure convenient access to service providers .In recent times, there has been a surge in the high end business of the LIC. For instance, as against 90 policies each worth more than Rs 10 million in 1999-2000, the number was as high as 900 policies in the next year. Or again, the number of jeevanshri policies jumped from 88,000 to a total of 2,33,000 policies in the same period. However, consumers behavior cannot be adequately and accurately predicted. The younger generation is overwhelmingly influenced by consumerism. If this trend continues or increases with increasing income, there will be fewer propensities to save or insure, as a result of which the increasing purchasing poser may not be reflected in the life insurance market. Crumbling social values, the deteriorating law and order situation, the growing incidence of crime, extortion, abduction, etc., are posing a new category of risks which need to be covered through suitably designed policies. Thus these are how changing life style of the citizens is affecting the life insurance industry.

27

Macro-Analysis of INDIAN INSURANCE SECTOR

Level of education: India is one of the developing countries: the level of education is very low here. The literacy rate is very poor. More than 50% of the population is still uneducated or more or less not educated. Thus the people are not able to understand the concept of the life insurance. Among the educated people the quality of the education is still a big question mark. Thus the awareness is not created and it has become a big challenge for the industry. Thus one of the factors, which affect the life insurance sector, is low level of education. Level of earning: Another factor, which affects the life insurance sector, is the level of earning. In India the rule of 80-20 is working. The 80% of the total population is having the 20%of the wealth and the 20% of the total population is having 80% of total wealth. Thus the richer are richer and poorer are poorer. Due to this the life insurance sector is affected very much. Societal benefits: In view of the fact that large sections of India have inadequate life insurance cover, an important social responsibility of the government relates to spreading it far and wide. In addition, the government attempts to extent life insurance with certain social obligations in view in both urban and the rural areas through such means special schemes for the weaker sections, and by tilting of the life insurance companies investments in favor of social developments. The social changes emerging in the country provide opportunities for insurers to sell financial services products such as family health care programmed, retirement plans disability insurance, long-term care for senior citizens and different employee benefit plans. It is not the total population but the insurable population which is material for the conclusion of potential. Apart from the usual demographic and other well known factors such as age group, income level, sex-wise distribution, and literacy level, a realistic assessment of this potential has to be based on several other relevant factors. Many invisible factors like religious faiths and social values too need to be considered. As such, there is considerable difficulty in accurately estimating the potential and crude estimates can be misleading. The estimate will also vary according to the criteria used to measure it. TECNOLOGICAL FACTORS AFFECTING LIFEINSURANCE INDUSTRY: Internet as an intermediary in the current Indian market customer is not aware about the intrinsic value of insurance. He thinks of insurance only in the mount of March as a tax saving measure.

28

Macro-Analysis of INDIAN INSURANCE SECTOR

The security provide by an insurance cover is rarely thought about. In such a scenario Internet can be an effective medium for educating the consumers about insurance. It serves as a single window for disseminating product, process and procedural information to the consumers. Product development and target marketing through the Internet: with increase in the number of insurance companies there will be a need for market segmentation and subsequently product designed for each of them. In such a scenario Internet can be a effective channel for pushing product specific information to a particular market segment. Consumer feedback about a particular product as well as suggestions for different types or covers can also be generated through the Internet. Retail marketing is a commonly expected concept and the providers of the retail products and service will try out for larger market and market share. There would be cut through competition and the real benefit would be to the customers in terms of better products, distribution, pricing, post transaction service and technology. Technology will perhaps be the single largest driver of the retail thrust. The entire strategy will evolve around the absolute ability of the organization. The customer will demand for greater convenience of excess to the product/ service and all at low cost of delivery. There fore the use of technology and specifically the Internet with realigned strategies would be one of the key factors to success. Constraints of locations, timing and accessibility would not be a hurdle for either customers or businesses. Maintaining the database The most important facto that is affecting the insurance industry is the marinating the database of the customers. The insurance industry having a huge list of the customers. In order to maintain it in manual format it is really the work of stupidity. With the change in time the computers has taken the work of this things. Thus with the development of the technology it has becoming possible to maintain such huge database very easily. A person can switch over to the computer and get the details of the customer very easily. Thus maintaining the database has really become easy due to the development in technology. E-business insurance in India: The Internet has played a vital role in transforming the business of the 21st century. Computers are now being used extensively for creating a storing data, information with the help of complex and sophisticated technological tools in every kind of business. This change having been widely accepted, the advantages are numerous such as fast processing improved. Efficiency, cost reduction among several other benefits. However, with every positive change, there is an evil

29

Macro-Analysis of INDIAN INSURANCE SECTOR

attached and technology is no exception. In technical is an evil attached and technology is no exception. In technical terms, increased sophistications of technology brings with it, an increased factor of risk involved. The risk can be of various attributes, for example, the risk of data being lost due to a virus attack, the theft of important and confidential information and so on, which ultimately results in losses for the business entity. With this change in the business process, insurers have to devise new methods for assessing, underwriting and servicing claims for the socalled e-business insurance. Insurers face challenges to ascertain risks, in order to quantify them because such risks dont have any past data, which makes it all the more difficult for actuaries. Moreover, what financial impact a particular risk can have is very difficult to be determined. For example, if some hackers obtain credit card information of few customers, its a loss for banks, their credibility, customers and also their brand. Will an insurance policy cover all of this is million dollar question hence; the difficulty is to design a cover first of all, which really answers the needs of customers. But even after designing and pricing such products with difficulty, the challenge to underwrite and handle claims for such policies remains existent. Impact on distribution channels: Distribution channels are the most important part of the insurance industry. The scenario is continuously changing in this industry. In future the customers are expected to be more technology oriented, better informed, more knowledgeable and more demanding. The insurers will have to offer all types of channel to customer and it is the customer who will have the right to choose the channel suiting him/ her. Dualin come families with young children, singles with long working days and flexi-timers all demand high level of sophistication and ease when it comes to service. Hence the companies have to be very careful and cautious in catering to the needs of these customers who provides a good amount of business to the insurers. Thanks to the technological advancement and increased de regulation and sophistication, the carriers and producers can now reach the customers in different ways as has been proved in the US market and other developed nations the web is extensively used for the access of information but when it comes to the purchase of policy, the offline mode is preferred. The private players in India seems to have identified this and have put substantial information on there websites regarding policies, quotes and contact information among other routine stuff.

30

Macro-Analysis of INDIAN INSURANCE SECTOR

OT ANALYSIS( Opportunities & Threats Analysis)

OT- analysis of the industry shows opportunity and threat the industry is likely to face. OT analysis of Indian life insurance industry shows the comparative strengths and weakness of Indian life insurance industry with rest of the world and also major opportunities and threats the Indian life insurance industry is facing. Opportunities: Todays human life becomes full uncertain, so they prefer protection against the risk. Therefore they prefer life insurance. This is the opportunity for the life insurance sector. Easy accesses to development in the more advance market provide further opportunity to upgrade their working. Technological, financial or

specific area based avenues of absorbing improved system are also now more easily available. So, that insurance companies working efficiently and fast service. Increased economic activities: increase in the economic activity has become the opportunity for the life insurance sector. The activity such as development in the automobile industry, development in the shipping industry. The growth in the GDP shows the opportunity for this industry. The growth rate expected this year 7-7.5%. So this is also one of the opportunities for the life insurance sector. Uncovered market: The Indian insurance market is the one of the least markets in the world. India has a population 1044.15 million out of which only 77.7 million have a life insurance policy. Almost 300 million people in the country can afford to buy life insurance but of this only 20 % have an insurance cover. Thus there lies a big opportunity for the insurance industry. No doubt lots of marketing and promotional efforts have to be done for trapping the uncovered portion of the huge market. Indias insurance has long way to catch up with the rest of the world. According to the institute of charted financial analyst of India. India is the 23rd largest insurance market in the world. India accounts for just 0.4% of the global insurance market which is very low. The ratios of premium to GDP for India stands at only 3% against 5.2% in US ,6.5%in UK. To enter into rural market where customer awareness about insurance is low by effective and efficient marketing strategies.

31

Macro-Analysis of INDIAN INSURANCE SECTOR

To sell insurance products through electronic Medias. Natural calamities: natural calamities taking place now days have created a concern for life insurance among the public. Because of natural calamities like earthquake, flood, and cyclone people have become conscious about benefits and need of insurance. Thus through a calamity it has become a considerably big opportunity for the industry.

Growing population: the growth in the population (approximately 1.7%) is very high. It is said that one Australia is added in our country every year. Thus potential customers for the life insurance industry. It has become an opportunity for the life insurance industry.

The lack of comprehensive social security system combined with a willingness to save means that Indian people demand for pension products will be large. Thus, it has become an opportunity for the life insurance industry.

India has traditionally been a highly savings oriented country. Needless to say, if the insurance market is properly tapped, it is possible to raise life insurance premium as a percentage of GDP from its existing level. Thus, it has become an opportunity for the life insurance industry.

To use Internet and e-commerce technologies to dramatically cut the costs and/or to pursue new sales-growth opportunities. With the help of technology it has become easy for the companies to reach the customer quickly, easily, efficiently and in a better way. Also the companies can cut down the cost of operation up to considerable level. Thus technology has thrown lots of opportunity for the company.

Liberalized government policy toward insurance sector: the government has liberalized the government policy in the life insurance sector. Now a day role of government has changed. Due to liberalized policy of government the country is benefited in earning foreign inflows: the domestic company can also collaborate with foreign country and can create synergy. Thus there is great opportunity for those who can trap it. Exist the option of joint venture& alliance etc. for companies to create Synergy, value as well as competitive capabilities for the firms.

Threats: Private entrants are naturally targeting the profitable and more lucrative segments, by providing better service, new products and flexibility. They are targeting the bigger corporate the other

32

Macro-Analysis of INDIAN INSURANCE SECTOR

clients in the well established metropolitan center. These new entrants succeeded in eating share of the existing entities. This creates threat among rival firms itself. Decreased in bank rate: the decreased bank rate is the biggest threat for the insurance sector. Fluctuation in the bank rate makes big difference for the insurance industry. It has become threats for the life insurance industry. Interest rate of P.F and bank saving create threat to insurance sector. All other saving is obviously the threat for life insurance sector. Increasing intensity of competition among industry rivals-may cause squeeze(fall) on profit margins. Consumers education- consumers are more and more confused because the market players are offering large number of product range. As at present the awareness level is not much, it is only because the education level is only 62 %( in which only 10% are well educated). Fraud in insurance sector: the major problem fraud, which affects the insurance sector. The flight of talent to new entrants is already in evidence, and could be on the rise for some time to come. Retaining qualified and competent executives will be considerable challenges for existing companies. One very serious danger that the government on units is likely to face is that even if at some point of time, the government does decide to disinvest a portion of its equity; they may not be fully free from government interference. They could face a peculiar problem that although paper and in terms of legal definition they would not be public sector units. In effects, their working could be no different from what it was before their ownership pattern change. This could be genuine threats since they would be competing with units which are free from such artificial and unnecessary restrictions. The new units, equipped with state of arts equipment and innovative procedure would have an in-built edge over the erstwhile public sector units, which until recently had no such opportunity and incentives. Due to possible negative impact on employment, there were no serious efforts at updating technology and equipment. The resultant inadequate investment in infrastructure could lead to their lagging behind in the race.

33

Macro-Analysis of INDIAN INSURANCE SECTOR

FUTURE POSSIBILITIES (NEXT 5-10 YEARS) Job opportunities are likely to increase manifold. The number of people working in the insurance sector in India is roughly the same as in the UK with a population that is 1/7 India's; the US with a population 1/4 the size of India has nearly 4 times the number. In the emerging markets, the picture is no less encouraging. In S Korea, the no of full time employees more than doubled over a ten-year period. Thailand added 50 per cent more jobs in four years. The liberalization of the insurance sector promises several new jobs opportunities for those employed in the finance sector that are equipped with degrees in finance. Finance professionals who had witnessed a slump in the job market would be a much-relieved lot to hear about the privatization of the insurance sector. Let us look into the type of jobs that will be created once the private players come on the scene. Certainly, it won't be far different from the traditional streams in any other industry. There will be demand for marketing specialists, finance experts, human resource professionals, engineers from diverse streams like the petrochemical and power sectors, systems professionals, statisticians and even medical professionals. Apart from this, there will be high demand for professionals in the streams like Underwriting and claims management and actuarial sciences. There could be a huge inflow of funds into the country. Given the industry's huge requirement of start-up capital, the initial years after opening up are bound to see a strong inflow of foreign capital. Moreover, given that the break-even, typically, comes much later than in the case of other sectors, odds are that the first remittance of dividend will not happen before a good 10-15 years. In the areas of reinsurance, huge capacity is likely to be created with players like Swiss Re and Munich Re keenly observing the unfolding saga of liberalization of insurance industry in India. Not only the outward reinsurance will reduce, it is bound to attract inward reinsurance from the neighboring countries and regions. If the regulator is forward looking and legislature is supportive, this trend may well lead to the creation of a Lloyds like market for the direct as well as reinsurance businesses. However, increased competition is very likely to result in rate reductions incertain classes of business, but in those areas that have so far been cross-subsidized an increase in rates may be

34

Macro-Analysis of INDIAN INSURANCE SECTOR

possible. Overall, the rate reductions may outweigh the increases, thus bringing down the reinsurance premium volume available. Apart from pure re-insurance activities, which is providing insurance protection, a revolution will come in service related fields like training, seminars, workshops, knowhow transfer regarding risk assessment and rating, risk inspections, risk management and devising new policy covers, etc. Also, with more players in the market, there will be significant increase in advertising, brand building, and keen pricing not ridiculous pricing and this will benefit whole lot of ancillary industries. Another effect of de-regulation will be that, projects, especially mega-projects where one needs the capacities of the international re-insurance market, will get exposed to international trends to an even greater extent than is the case today. This will affect rates too. Areas like the personal lines segment, where we also expect to see substantial growth as also new types of covers, would usually not be affected by international trends in the same way as, there is much less need for global re-insurance support. Substantial shift in the distribution of LIFE insurance in India is likely to take place. Many of these changes will echo international trends. Worldwide, insurance products move along a continuum from pure service products to pure commodity products. Initially, insurance is seen as a complex product with a high advice and service component. Buyers prefer a face-to-face interaction and place a high premium on brand names and reliability. As products become simpler and awareness increases, they become off-the-shelf, commodity products. Sellers move to remote channels such as the telephone or direct mail. Various intermediaries, not necessarily insurance companies, sell insurance. In the UK for example, retailer Marks & Spencer now sells insurance products. In some countries like Netherlands and Japan, insurance is marketed using post office's distribution channels. At this point, buyers look for low price. Brand loyalty could shift from the insurer to the seller. In other markets, notably Europe, this has resulted in bancassurance: banks entering the insurance business. The Netherlands led with financial services firms providing an entire range of products including bank accounts, motor, home and life insurance, and pensions. Other European markets have followed suit. In France over half of all life insurance sales

35

Macro-Analysis of INDIAN INSURANCE SECTOR

are made through banks. In the UK, almost 95% of banks and building societies are distributing insurance products today. In India too, banks hope to maximize expensive existing networks by selling a range of products. Various seminars and conferences on banc assurance are taking place and many bankers have clearly shown their inclination to enter insurance market by leveraging their strengths in the areas of brand image, distribution network, and face to face contact with the clients and telemarketing coupled with advanced information technology systems. The mergers of Citibank with Travelers in USA and of Winterthur, the largest Swiss Co. with Credit Suisse are recent examples of the phenomenon likely to sweep India too. Insurers in India should also explore distribution through non-financial organizations. For example, insurance for consumer items such as refrigerators can be offered at the point of sale. This piggybacks on an existing distribution channel and increases the likelihood of insurance sales. Alliances with manufacturers or retailers of consumer goods will be possible. With increasing competition, they are wooing customers with various incentives, of which insurance can be one. Another potential channel that reduces the need for an owned distribution network is worksite marketing. Insurers will be able to market pensions, health insurance and even other general covers through employers to their employees. These products may be purchased by the employer or simply marketed at the workplace with the employers cooperation. Worldwide interest in E-commerce and India's predominant position in information technology and software development is also likely to be a major factor in the marketing of insurance products in the immediate future. The Internet account is increasing in arithmetic progression and the trend has already been set by some of the leading insurers and insurance brokers worldwide.

36

Macro-Analysis of INDIAN INSURANCE SECTOR

References:

E&Y Indian Insurance Sector Report 2010 available at http://www.bellamyassocies.com/Insurance_Report.pdf

http://www.acadjournal.com/2008/v22/part7/p2/

http://www.economywatch.com/indianeconomy/india-insurance-sector.html

http://www.ey.com/IN/en/Industries/Financial-Services/Insurance/Indian-insurance-sector

http://www.ibef.org/industry/insurance_industry.aspx

37

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Karnataka ANNUAL REPORT English - 2016-17Dokumen82 halamanKarnataka ANNUAL REPORT English - 2016-17K Srinivasa MurthyBelum ada peringkat

- Balance Per Books, End. XX XX: Add: Credit Memos (CM)Dokumen7 halamanBalance Per Books, End. XX XX: Add: Credit Memos (CM)Misiah Paradillo JangaoBelum ada peringkat

- Org Study Canara Bank 150904183048 Lva1 App6892Dokumen81 halamanOrg Study Canara Bank 150904183048 Lva1 App6892shivaraj p yBelum ada peringkat

- 3 Slide Đầu RevisionDokumen5 halaman3 Slide Đầu RevisionLương Mỹ DungBelum ada peringkat

- Case Stdy AntDokumen5 halamanCase Stdy AntGayathiri Dorai SingamBelum ada peringkat

- ODTÜkayıt BilgileriDokumen25 halamanODTÜkayıt BilgileriNofal GadimliBelum ada peringkat

- Publice Notice Merger Notification Arise B.V and NMB 20170629Dokumen2 halamanPublice Notice Merger Notification Arise B.V and NMB 20170629Anonymous iFZbkNw100% (2)

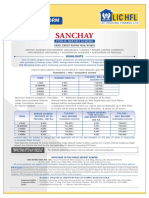

- LIC Housing Finance LTD FDDokumen6 halamanLIC Housing Finance LTD FDBiswa Jyoti GuptaBelum ada peringkat

- FY19 Global MNC Plan FinalDokumen21 halamanFY19 Global MNC Plan FinalMARTHA HDEZBelum ada peringkat

- DSRD Ar05Dokumen132 halamanDSRD Ar05djon888Belum ada peringkat