Bulgaria

Diunggah oleh

Vasislava Slavova0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

39 tayangan15 halamangklgl

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inigklgl

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

39 tayangan15 halamanBulgaria

Diunggah oleh

Vasislava Slavovagklgl

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 15

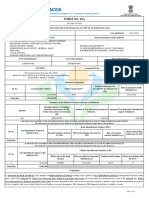

ING International Trade Study

Developments in global trade: from 1995 to 2017

Bulgaria

Executive summary

About the International Trade Study by ING

The ING International Trade Study aims to help INGs (inter)national clients develop their knowledge and capabilities for doing

business across borders, and to contribute to the public debate on internationalization. We do this by generating valuable insights

on the current and future economic trends and international trade developments worldwide.

This report is part of a series of ING 2012 International Trade Study reports, which includes forecasts for 60 different country and

13 product group reports. These reports document trade developments over the past years and the ING forecasts (2012-2017) for

future international trade patterns and business opportunities, by partner country and export product. These forecasts are derived

from a model specifically developed by the ING Economics Bureau (see also Methodology), and complemented with the in-depth

knowledge of ING economists in our offices around the world.

Bulgaria is expected to grow on average 1.3% in the coming years. This is relatively low compared to the average of other

Central and Eastern European countries and also relatively low compared to the global average of 3.7%. Because of its own

economic growth and that of its main trading partners, Bulgaria's exports are expected to grow 12% annually to US$ 56 bn in

2017, making Bulgaria the 51st largest exporter worldwide. Similarly, import demand will grow with an average of 10% per year

to US$ 57 bn in 2017, meaning that Bulgaria will take the 52nd position on the global list of largest importers. By 2017, Bulgaria

will mainly import fuels, office telecom & electrical equipment and ores & metals, which together account for 38% of total imports

of Bulgaria. Similarly, Bulgaria's exports will mainly consist of ores & metals, basic food and textiles (including fibers, yarn and

products). Together these products will represent 51% of total exports in 2017. By 2017, Bulgaria will mainly import products

from Russia, Germany and Turkey, which together account for 38% of total imports of Bulgaria. Bulgaria's main export markets

will be Germany, Italy and Turkey. Together these countries will account for 51% of total exports in 2017.

8

2012F 2013F 2014F

GDP growth (real): 0.6% 1.2% 2.1%

GDP nominal (bn): 51 $ 51 $ 58 $

Exchange rate* EUR/BGN 1.96 1.96 1.96

Inflation: 2.9% 3.1% 3.3%

GDP composition by sector 2010

Agriculture: 5.4%

Industry: 31.4%

Services: 63.3%

2011 2030

Population (mln): 7.5 6.5

GDP per capita: 6,948 $

Unemployment rate (avg.): 12.5%

2011 2012 2013

Competitiveness rank WEF 74 62

Ease of doing business rank: 57 59 66

Credit rating :

S&P BBB

Moodys Baa2

Fitch: BBB-

*end period

Economy

Population

Other indicators

International

Trade

Trade by products (bn)

North

America

South America

Africa

EU

Asia

Bulgaria 2011

Food & live animals

Crude materials,

inedible, except fuels

Machinery & Transport

equipment

Beverage & Tobacco

Manufactured goods

Mineral fuels Chemicals

Animal and vegetable

oils

Miscellaneous

manufactured articles

Oceania

CIS

3.3%

1%

16%

0.2%

2%

5%

62%

Exports (bn) $28 Imports (bn) $32 Trade balance (bn) -$4.33 Exports % of GDP 53%

Exports $2.55

Imports $2.46

Exports $0.56

Imports $0.43

Exports $2.82

Imports $3.73

Exports $3.83

Imports $6.42

Exports $0.21

Imports $0.15

Exports $2.08

Imports $3.72

Exports $6.92

Imports $5.52

Exports $4.60

Imports $7.26

Exports $3.86

Imports $2.10

Exports by region

MENA

Developing Asia

South America

United States

Central and Eastern Europe

Commonwealth of

Independent States

2.0 2.6 3.2

2012 2013 2014

6.7 7.2 7.5

2012 2013 2014

3.2 3.9 4.1

2012 2013 2014

4.0 4.1 4.2

2012 2013 2014

5.3 3.6 3.8

2012 2013 2014

2.1 1.8 2.1

2012 2013 2014

-0.2

0.5 1.5

2012 2013 2014

0.6 1.2 2.1

2012 2013 2014

GDP growth

Global economic growth forecast: Bulgaria

European Union

Bulgaria

Economic growth in the coming years will remains sluggish in developed markets. Especially the Eurozone will only experience

limited growth as the region continues to struggle with the Eurocrisis. World output growth is strongly driven by emerging

markets, in particular China and other developing Asian countries.

GDP growth of Bulgaria is predicted to be lower than the growth of Central Eastern Europe, with 1.2% in 2013 and 2,1% in 2014.

Trade forecast

Bulgaria 1995 2011 2017

World ranking 50 51 51

CAGR 2012-2017 12.0%

Bulgaria 1995 2011 2017

World ranking 52 53 52

CAGR 2012-2017 10.0%

0

10

20

30

40

50

60

70

Total exports

bn $

2011 2017

0

10

20

30

40

50

60

70

Total imports

bn $

2011 2017

In the coming years, exports (in current dollar terms) are expected to increase with 12% annually. The rank of Bulgaria in

the list of largest exporters worldwide will remain the same at 51.

Demand for foreign products (imports) is also expected to increase in the next five years, with 10% annually. The rank of

Bulgaria in the list of largest importers worldwide will increase to 52.

Worldwide, the top three export and import countries in 2017 will be China, United States and Germany. The countries that

show the greatest increase in demand for imports of foreign products are Vietnam, Indonesia and Taiwan.

Today (2012) Tomorrow (2017)

The size of the bubble represents the size of imports

Bulgarian import demand

Bulgarian import origins

2017

2012

Demand for products: origins of imports

Main origins of imports, 2011 and 2017

*

Bulgaria

Import product Origin mln $

Fuels Russia |||||||||||||||||||| 21% ||||||||||||||||||||||||||||| 2935

Ores and metals Spain ||||||||||||| 14% |||||| 670

Industrial machinery Germany ||||||| 8% ||||| 595

Office, telecom and electrical equipment Germany |||||||| 8% ||||| 517

Ores and metals Ukraine ||||||||||||||||| 18% |||| 480

Textiles Italy |||||||||| 10% |||| 473

Basic food and food products Romania 0% |||| 458

Ores and metals Romania 0% |||| 444

Fuels Romania 0% |||| 423

Textiles Turkey ||||||||||||||| 15% ||| 385

CAGR 2012-2017 Value 2011

0

1

2

3

4

5

6

0

1

2

3

4

5

6

bn $

2011 2017

Top 10 largest import flows by product and country of origin

*

By 2017, Bulgaria will mainly

import products from Russia,

Germany and Turkey, which

together account for 38% of

total imports of Bulgaria. In

volumes, the most important

trade flows to Bulgaria currently

include fuels from Russia, ores

and metals from Spain, and

industrial machinery from

Germany. In the coming years,

these flows are expected to

change with 21%, 14% and 8%

per year, respectively.

*within the 60 countries and product flows

included in the study

Demand for products: imports by product group

0 1 2 3 4 5 6

0 1 2 3 4 5 6

Basic food and food products

Beverages and tobacco

Agricult. raw materials

Textiles

Ores and metals

Fuels

Chemicals

Pharmaceuticals

Industrial machinery

Office, telecom and electrical equipment

Road vehicles & transport equipment

Other manufactures

Other products

bn $

2017

2011

2007

By 2017, Bulgaria will mainly import fuels, office telecom & electrical equipment and ores & metals,

which together account for 38% of total imports of Bulgaria.

Today (2012) Tomorrow (2017)

The size of the bubble represents the size of exports

Where do Bulgarian products go to?

Bulgarian export markets

Exports: key destination markets

Key destination markets of exports, 2011 and 2017

*

Top 10 largest export flows by product and destination country

*

0

1

2

3

4

5

6

0

1

2

3

4

5

6

bn $

2011 2017

Bulgaria

Export product Export partner mln $

Ores and metals Belgium |||||||||||| 12% ||||||||| 932

Ores and metals Turkey ||||||||||||| 14% ||||||||| 909

Ores and metals Germany ||||||||||| 11% ||||||| 739

Basic food and food products Romania 0% ||||||| 734

Ores and metals Italy ||||||||||||||||||||||||| 25% |||||| 642

Textiles Italy |||||||||||||||||||||||| 24% ||||| 586

Textiles Germany |||||||||||||||||||| 21% ||||| 573

Fuels Turkey |||||||| 8% ||||| 531

Ores and metals Romania 0% |||| 444

Other products Italy ||||||||||||||||||||||||| 26% |||| 411

CAGR 2012-2017 Value 2011

Bulgaria's main export markets

will be Germany, Italy and

Turkey. Together these

countries will account for 51%

of total exports in 2017. In

volumes, the most important

export flows from Bulgaria

currently consist of ores and

metals to Belgium, ores and

metals to Turkey, and ores and

metals to Germany. In the

coming years, these flows are

expected to change with 12%,

14% and 11% per year,

respectively.

*within the 60 countries and product flows

included in the study

Exports: key product groups

0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

Basic food and food products

Beverages and tobacco

Agricult. raw materials

Textiles

Ores and metals

Fuels

Chemicals

Pharmaceuticals

Industrial machinery

Office, telecom and electrical equipment

Road vehicles & transport equipment

Other manufactures

Other products

bn $

2017

2011

2007

By 2017, Bulgaria's exports will mainly consist of ores & metals, basic food and textiles (including

fibers, yarn and products). Together these products will represent 51% of total exports in 2017.

Methodology and data considerations

Our forecasts are derived from an econometric model of international trade in goods among 60 countries.

Trade among these countries represents 87% of world trade in goods classified by SITC excluding SITC 9.

Data (1990-2011) for exports from and among 60 countries (forming 3600 country pairs) at the SITC(rev.3)

2-digit product classification were obtained from UNCTAD International Trade Statistics.

These were combined with several macroeconomic variables, including GDP, GDP growth, and unit labour

costs (GDP/capita) (for both the origin and destination country; source: IMF), as well as geographical

distance and cultural distance between the two countries in each country pair (source: CEPII; Hofstede).

Forecasts for macroeconomic variables (GDP, GDP growth and ULC) for the 2012-2017 period were based

on our own ING forecasts.

The trade forecasts were derived from a single equation ADL, explaining 90% of the variance in the

dependent variable, specified as follows:

where LogExports

ijkt

represents the logarithmic value of exports of country i to country j of product k at time t;

j

the set of partner fixed effects,

d

the set of product group fixed effects, LogExports x d the set of interactions

between LogExports and the product group binary variables d, and X

the set of independent variables with their

vector of coefficients ; and

ijkt

the residual.

The set of independent variables (X) includes (the log of) GDP; GDP growth and ULC for the reporter (i) and partner

countries (j) and the geographical and cultural distance between them.

( )

ijkt ijkt ijkt d ijkt ijkt d j ijkt

X d LogExports LogExports LogExports LogExports c | | | o o + + + + + + =

1 3

2

1 2 1 1

Disclaimer

The views expressed in this report reflect the personal views of the analyst(s) on the subject on this report. No

part of the compensation(s) of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of

specific views in this report. This report was prepared on behalf of ING Bank N.V. (ING), solely for the

information of its clients. This report is not, nor should it be construed as, an investment advice or an offer or

solicitation for the purchase or sale of any financial instrument or product. While reasonable care has been taken

to ensure that the information contained herein is not untrue or misleading at the time of publication, ING makes

no representation that it is accurate or complete in all respects. The information contained herein is subject to

change without notice. Neither ING nor any of its officers or employees accept any liability for any direct or

consequential loss or damage arising from any use of this report or its contents. Copyright and database rights

protection exists with respect to (the contents of) this report. Therefore, nothing contained in this report may be

reproduced, distributed or published by any person for any purpose without the prior written consent of ING. All

rights are reserved. Investors should make their own investment decisions without relying on this report. Only

investors with sufficient knowledge and experience in financial matters to evaluate the merits and risks should

consider an investment in any issuer or market discussed herein and other persons should not take any action on

the basis of this report. ING Bank N.V. is a legal entity under Dutch Law and is a registered credit institution

supervised by the Dutch Central Bank (De Nederlandsche Bank N.V.) and the Netherlands Authority for the

Financial Markets (Stichting Autoriteit Financile Markten). ING Bank N.V., London branch is regulated for the

conduct of investment business in the UK by the Financial Services Authority. ING Bank N.V., London branch is

registered in the UK (number BR000341) at 60 London Wall, London EC2M 5TQ. ING Financial Markets LLC,

which is a member of the NYSE, NASD and SIPC and part of ING, has accepted responsibility for the distribution

of this report in the United States under applicable requirements.

The final text was completed on 1 November

Disclaimer

The views expressed in this report reflect the personal views of the analyst(s) on the subject on this report. No

part of the compensation(s) of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of

specific views in this report. This report was prepared on behalf of ING Bank N.V. (ING), solely for the

information of its clients. This report is not, nor should it be construed as, an investment advice or an offer or

solicitation for the purchase or sale of any financial instrument or product. While reasonable care has been taken

to ensure that the information contained herein is not untrue or misleading at the time of publication, ING makes

no representation that it is accurate or complete in all respects. The information contained herein is subject to

change without notice. Neither ING nor any of its officers or employees accept any liability for any direct or

consequential loss or damage arising from any use of this report or its contents. Copyright and database rights

protection exists with respect to (the contents of) this report. Therefore, nothing contained in this report may be

reproduced, distributed or published by any person for any purpose without the prior written consent of ING. All

rights are reserved. Investors should make their own investment decisions without relying on this report. Only

investors with sufficient knowledge and experience in financial matters to evaluate the merits and risks should

consider an investment in any issuer or market discussed herein and other persons should not take any action on

the basis of this report. ING Bank N.V. is a legal entity under Dutch Law and is a registered credit institution

supervised by the Dutch Central Bank (De Nederlandsche Bank N.V.) and the Netherlands Authority for the

Financial Markets (Stichting Autoriteit Financile Markten). ING Bank N.V., London branch is regulated for the

conduct of investment business in the UK by the Financial Services Authority. ING Bank N.V., London branch is

registered in the UK (number BR000341) at 60 London Wall, London EC2M 5TQ. ING Financial Markets LLC,

which is a member of the NYSE, NASD and SIPC and part of ING, has accepted responsibility for the distribution

of this report in the United States under applicable requirements.

The final text was completed on 1 November

To find out more, visit INGTradeStudy.com or contact:

Name (function) Telephone Email

dr. Fabienne Fortanier

Senior Economist and Manager International Trade Study

+ 31 20 576 9450 Fabienne.Fortanier@ing.nl

Mohammed Nassiri

Research Assistant International Trade Study

+ 31 20 563 4444 Mohammed.Nassiri@ing.nl

Elena Ganeva

Economist Bulgaria, Croatia, Serbia

+359 2 9176720 Elena.Ganeva@ingbank.com

Robert Gunther

Senior Communications & PR Manager

+31 6 5025 7879 Robert.Gunther@ing.nl

Arjen Boukema

Senior Communications & PR Manager

+31 6 3064 8709 Arjen.Boukema@ing.nl

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- JPMorgan M&a BibleDokumen146 halamanJPMorgan M&a Biblewallstreetprep100% (21)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Establishing A Business Plan For An Agricultural EnterpriseDokumen19 halamanEstablishing A Business Plan For An Agricultural EnterpriseClyde Beth Bumatay CaraangBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Starting a Chocolate Company Business PlanDokumen26 halamanStarting a Chocolate Company Business PlanYummy Choc83% (6)

- Working capital managementDokumen9 halamanWorking capital managementAbegail Ara Loren33% (3)

- PDFDokumen12 halamanPDFnnBelum ada peringkat

- Kingsbridge Armory Request For Proposals 2011 FF 1 11 12Dokumen54 halamanKingsbridge Armory Request For Proposals 2011 FF 1 11 12xoneill7715Belum ada peringkat

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDokumen9 halamanSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesBelum ada peringkat

- Credit Card ETB Customer - Mar29 - 06 04Dokumen4 halamanCredit Card ETB Customer - Mar29 - 06 04tanvir019Belum ada peringkat

- Fort Lauderdale Police and Fire Pension Board Investment Workshop 2009Dokumen209 halamanFort Lauderdale Police and Fire Pension Board Investment Workshop 2009Ken RudominerBelum ada peringkat

- Hamada 1972Dokumen18 halamanHamada 1972Ivon SilvianaBelum ada peringkat

- Residentail LeaseDokumen17 halamanResidentail LeaseMuzammil ZargarBelum ada peringkat

- Instructions for Excel templatesDokumen4 halamanInstructions for Excel templatespcsriBelum ada peringkat

- Comparative Analysis of Indian and Global Stock MarketsDokumen35 halamanComparative Analysis of Indian and Global Stock MarketsAmol Dahiphale0% (1)

- Primary MarketDokumen39 halamanPrimary Market微微Belum ada peringkat

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokumen79 halamanIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAulia Eka PutriBelum ada peringkat

- Impact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaDokumen10 halamanImpact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaBrijbhushan ChavanBelum ada peringkat

- Invitation To Bid: General GuidelinesDokumen24 halamanInvitation To Bid: General GuidelinesGregoria ReyesBelum ada peringkat

- CSEC POA January 2010 P032Dokumen4 halamanCSEC POA January 2010 P032Jael BernardBelum ada peringkat

- DBH 1st Mutual FundDokumen34 halamanDBH 1st Mutual Fundrishav_agarwal_1Belum ada peringkat

- Form 16A TDS CertificateDokumen2 halamanForm 16A TDS CertificateRichardNoelFernandesBelum ada peringkat

- Chapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationDokumen12 halamanChapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationkimkimBelum ada peringkat

- Atoorva MamDokumen31 halamanAtoorva Maminspection wing SDBelum ada peringkat

- Leo 2Dokumen44 halamanLeo 2cadeau01Belum ada peringkat

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Dokumen7 halamanCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010pushpraj rastogiBelum ada peringkat

- Chapter 3 - Investment Appraisal - DCFDokumen37 halamanChapter 3 - Investment Appraisal - DCFInga ȚîgaiBelum ada peringkat

- Director Finance Operations in New York City Resume Elliot GoldsteinDokumen2 halamanDirector Finance Operations in New York City Resume Elliot GoldsteinElliotGoldsteinBelum ada peringkat

- Financial Planning and Analysis: The Master BudgetDokumen37 halamanFinancial Planning and Analysis: The Master BudgetWailBelum ada peringkat

- Group 2 Ancom BerhadDokumen21 halamanGroup 2 Ancom Berhad杰小Belum ada peringkat

- BISI - Equity Research - FikryDokumen12 halamanBISI - Equity Research - Fikryaly_rowiBelum ada peringkat

- Business OrganizationDokumen26 halamanBusiness OrganizationChandura PriyankBelum ada peringkat