Agent Appointment Form

Diunggah oleh

Satyen ChikhliaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Agent Appointment Form

Diunggah oleh

Satyen ChikhliaHak Cipta:

Format Tersedia

Authorising your agent

Please read the notes on the back before completing this authority. This authority allows us to exchange and disclose information about you with your agent and to deal with them on matters within the responsibility of HM Revenue & Customs (HMRC), as specified on this form. This overrides any earlier authority given to HMRC. We will hold this authority until you tell us that the details have changed.

I, (print your name) Unique Taxpayer Reference (if applicable) of (name of your business, company or trust if applicable)

If UTR not yet issued tick here

Please tick the box(es) and provide the reference(s) requested only for those matters for which you want HMRC to deal with your agent. Individual*/Partnership*/Trust* Tax Affairs *delete as appropriate (including National Insurance).

Your National Insurance number (individuals only)

If you are self employed tick here

authorise HMRC to disclose information to (agents business name)

If you are a Self Assessment taxpayer, we will send your Statement of Account to you, but if you would like us to send it to your agent instead, please tick here

who is acting on my/our behalf. This authorisation is limited to the matters shown on the right-hand side of this form. Signature see note 1 before signing

Tax Credits

Your National Insurance number (only if not entered above)

Date

If you have a joint Tax Credit claim and the other claimant wants HMRC to deal with this agent, they should sign here Name

Signature Give your personal details or Company registered office here

Address

Joint claimants National Insurance number

Postcode Telephone number

Corporation Tax

Company Registration number

Give your agents details here

Address

Companys Unique Taxpayer Reference

Postcode Telephone number Agent codes (SA/CT/PAYE)

Employer PAYE Scheme

Employer PAYE reference

Accounts Office reference

Client reference

For official use only

SA NIRS COP NTC / / / / / / / / COTAX EBS VAT COP link / / / / / / / /

VAT

(see notes 2 and 5 overleaf) If not yet registered tick here HMRC 07/06

VAT registration number

64-8

1 Who should sign the form

If the authority is for Who signs the form

You

You. We need the name of the business in all cases unless this form is for your personal tax affairs The partner responsible for the partnership's tax affairs. It applies only to the partnership. Individual partners need to sign a separate authority for their own affairs One or more of the trustees The secretary or other responsible officer of the company

Partnership

Trust Company

2 What this authority means

For matters other than VAT or Tax Credits We will start sending letters and forms to your agent and give them access to your account information online. Sometimes we need to correspond with you as well as, or instead of, your agent. For example, the latest information on what SA forms we send automatically can be found on our website, go to www.hmrc.gov.uk/sa/agentlist.htm or phone the SA Helpdesk on 0845 9 000 444. You will not receive your Self Assessment Statements of Account if you authorise your agent to receive them instead, but paying any amount due is your responsibility. We do not send National Insurance statements and requests for payment to your agent unless you have asked us if you can defer payment. Companies do not receive Statements of Account. For VAT and Tax Credits We will continue to send correspondence to you rather than to your agent but we can deal with your agent in writing or by phone on specific matters. If your agent is able to submit VAT returns online on your behalf, you will need to authorise them to do so through our website. For joint Tax Credit claims, we need both claimants to sign this authority to enable HM Revenue & Customs to deal with your agent.

3 How we use your information

HM Revenue & Customs is a Data Controller under the Data Protection Act 1998. We hold information for the purposes specified in our notification to the Information Commissioner, including the assessment and collection of tax and duties, the payment of benefits and the prevention and detection of crime, and may use this information for any of them. We may get information about you from others, or we may give information to them. If we do, it will only be as the law permits. We may check information we receive about you with what is already in our records. This can include information provided by you, as well as by others, such as other government departments or agencies and overseas tax and customs authorities. We will not give information to anyone outside HM Revenue & Customs unless the law permits us to do so. This authority does not allow your agent to request personal information held about you under the subject access provisions of the Data Protection Act 1998. Further information can be found on our website, www.hmrc.gov.uk

4 Multiple agents

If you have more than one agent (for example, one acting for the PAYE scheme and another for Corporation Tax), please sign one of these forms for each.

5 Where to send this form

When you have completed this form please send it to: HM Revenue & Customs, CAA Team, Longbenton, Newcastle upon Tyne, NE98 1ZZ. There are some exceptions to this to help speed the handling of your details in certain circumstances. If this form: accompanies other correspondence, send it to the appropriate HM Revenue & Customs (HMRC) office is solely for Corporation Tax affairs, send it to the HMRC office that deals with the company is for a Complex Personal Return or Expatriate customer, send it to the appropriate CPR team or Expat team accompanies a VAT Registration application, send it to the appropriate VAT Registration Unit has been specifically requested by an HMRC office, send it back to that office.

Anda mungkin juga menyukai

- 64-8 Form (Másolat)Dokumen2 halaman64-8 Form (Másolat)Molnar FerencneBelum ada peringkat

- Nat 2938Dokumen22 halamanNat 2938fred fluchterBelum ada peringkat

- Tax Credit Claim Form 2018: For Donation Claims OnlyDokumen2 halamanTax Credit Claim Form 2018: For Donation Claims OnlyasdfBelum ada peringkat

- Bill To:: 13 Cook Street Cork City,, Ireland WWW - Ielectron.ie Phone: 0212397669 VAT Reg No: IE9815703IDokumen2 halamanBill To:: 13 Cook Street Cork City,, Ireland WWW - Ielectron.ie Phone: 0212397669 VAT Reg No: IE9815703IDenny Ramirez PedrerosBelum ada peringkat

- NinoDokumen1 halamanNinoSavage GuyBelum ada peringkat

- Chapter 1 Introduction To Uk Tax SystemDokumen3 halamanChapter 1 Introduction To Uk Tax Systemtans1100% (1)

- P 50Dokumen2 halamanP 50Emily DeerBelum ada peringkat

- customs: CorporationDokumen2 halamancustoms: Corporationbilal sarfrazBelum ada peringkat

- Protect DocumentsDokumen8 halamanProtect DocumentsStephen KhiBelum ada peringkat

- Your Universal Credit Claim: We Need To Find Out More About Your Health ConditionDokumen4 halamanYour Universal Credit Claim: We Need To Find Out More About Your Health ConditionNasir KarwanBelum ada peringkat

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDokumen4 halamanClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshBelum ada peringkat

- R43 2019 PDFDokumen4 halamanR43 2019 PDFDavid Mark AldridgeBelum ada peringkat

- Leaving The UK - Getting Your Tax Right: About This FormDokumen4 halamanLeaving The UK - Getting Your Tax Right: About This Form_Cristi_Belum ada peringkat

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDokumen7 halamanA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaBelum ada peringkat

- Mongolia Energy Corporation MEC Electricity Utility BillDokumen1 halamanMongolia Energy Corporation MEC Electricity Utility Billmike fastBelum ada peringkat

- Statement of Benefits 30 04 2020Dokumen10 halamanStatement of Benefits 30 04 2020Chris MillsBelum ada peringkat

- Your Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowDokumen2 halamanYour Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowPaula UrhieBelum ada peringkat

- DD Form - Watford Council TaxDokumen1 halamanDD Form - Watford Council TaxAfzal ShaikhBelum ada peringkat

- Itemized FINV02553268-2006A 14591571 20200704 2320771 PDFDokumen1 halamanItemized FINV02553268-2006A 14591571 20200704 2320771 PDFAkshay AKBelum ada peringkat

- Preview 26Dokumen15 halamanPreview 26kakabadzebaiaBelum ada peringkat

- NewPolicyDocuments 2Dokumen8 halamanNewPolicyDocuments 2S BarkerBelum ada peringkat

- E0800J3WXBDokumen2 halamanE0800J3WXBAhmed Al AdawiBelum ada peringkat

- 604673792 (1)Dokumen22 halaman604673792 (1)shakeyjakeycoppin93Belum ada peringkat

- DCONSCDokumen5 halamanDCONSCAnonymous Ih1EEEBelum ada peringkat

- Dent Eimear LindaDokumen4 halamanDent Eimear LindaITBelum ada peringkat

- Completion LetterDokumen2 halamanCompletion LetterCharles WheadonBelum ada peringkat

- Goods Documents Required Customs Prescriptions Remarks: IrelandDokumen4 halamanGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameBelum ada peringkat

- Costel Mitrofan, SA Tax Return 1Dokumen2 halamanCostel Mitrofan, SA Tax Return 1Flutur GavrilBelum ada peringkat

- Eonnext - 3rd of Jun - 25th of Jun 2023Dokumen5 halamanEonnext - 3rd of Jun - 25th of Jun 2023qzvg5csbmnBelum ada peringkat

- FATCA CRS Curing DeclarationDokumen1 halamanFATCA CRS Curing DeclarationramdpcBelum ada peringkat

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Dokumen2 halamanNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977Belum ada peringkat

- Filling in Your VAT ReturnDokumen28 halamanFilling in Your VAT ReturnkbassignmentBelum ada peringkat

- Certificate of LLC CompanyDokumen2 halamanCertificate of LLC CompanybettyBelum ada peringkat

- Governing Body: International Labour OfficeDokumen33 halamanGoverning Body: International Labour OfficeMu Eh HserBelum ada peringkat

- Avis 2018 Revenus 2017Dokumen15 halamanAvis 2018 Revenus 2017Arnaud CalisteBelum ada peringkat

- Xapo Bank Statement - 2022-01-01-To-2022-12-31Dokumen1 halamanXapo Bank Statement - 2022-01-01-To-2022-12-31Raja Hermansyah0% (1)

- Extct Bill 905431x 677697Dokumen2 halamanExtct Bill 905431x 677697clinica.sante.resultsBelum ada peringkat

- P45 Part 1A Details of Employee Leaving WorkDokumen6 halamanP45 Part 1A Details of Employee Leaving WorkCatalin FandaracBelum ada peringkat

- HMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYADokumen4 halamanHMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYAAbhay PatodiBelum ada peringkat

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDokumen6 halamanICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanBelum ada peringkat

- YourBTbill 21032024Dokumen3 halamanYourBTbill 21032024faninhalemes25Belum ada peringkat

- Maury UtilityDokumen4 halamanMaury Utilityyusufosoba51Belum ada peringkat

- Preview PDFDokumen7 halamanPreview PDF13KARATBelum ada peringkat

- Royal Mail Label WP 1806 9869 290 3Dokumen1 halamanRoyal Mail Label WP 1806 9869 290 3Toni MirosanuBelum ada peringkat

- 6.110907 29424343Dokumen10 halaman6.110907 29424343Christy JosephBelum ada peringkat

- Transaction Receipt-230623019384124991Dokumen1 halamanTransaction Receipt-230623019384124991Victor EmmanuelBelum ada peringkat

- PreviewDokumen5 halamanPreviewFaz AliBelum ada peringkat

- Member Statement 68600048552Dokumen3 halamanMember Statement 68600048552Johnny Warhawk ONeillBelum ada peringkat

- RMCL Certioficate of IncorporationDokumen3 halamanRMCL Certioficate of IncorporationDr M R aggarwaalBelum ada peringkat

- StatusOutcome 04 February 2020Dokumen6 halamanStatusOutcome 04 February 2020Takacs Marcel100% (1)

- Monzo Bank Statement 2024 01 01 2024 03 31 40 1Dokumen10 halamanMonzo Bank Statement 2024 01 01 2024 03 31 40 1tsundereadamsBelum ada peringkat

- invoice (с)Dokumen1 halamaninvoice (с)OlgaBelum ada peringkat

- Attachment PDFDokumen1 halamanAttachment PDFmuhammad arhum aishBelum ada peringkat

- First Page: Metered Bill - EnglandDokumen8 halamanFirst Page: Metered Bill - Englandagnes LopesBelum ada peringkat

- Hi Andini, Here's Your Bill: Page 1 of 3Dokumen3 halamanHi Andini, Here's Your Bill: Page 1 of 3Sonya DindaBelum ada peringkat

- Your Estimated Gas Bill: MR Madhava Avvula Flat 184, City View Centreway Apartments, Axon Place Ilford Essex Ig1 1NlDokumen4 halamanYour Estimated Gas Bill: MR Madhava Avvula Flat 184, City View Centreway Apartments, Axon Place Ilford Essex Ig1 1NlMadhava Reddy AvvulaBelum ada peringkat

- DefaultDokumen1 halamanDefaultSahar SosoBelum ada peringkat

- Preview 28Dokumen22 halamanPreview 28kakabadzebaiaBelum ada peringkat

- Authorising Your AgentDokumen2 halamanAuthorising Your AgentpronoybaruaBelum ada peringkat

- P 68Dokumen1 halamanP 68Phan Anh HaoBelum ada peringkat

- 2015 Lanzar Web Optimized PDFDokumen58 halaman2015 Lanzar Web Optimized PDFrecursowebBelum ada peringkat

- Liquid Penetrant Test Procedure: Document No.: SP-1.5 Rev. 1.2Dokumen12 halamanLiquid Penetrant Test Procedure: Document No.: SP-1.5 Rev. 1.2Anas PratamaBelum ada peringkat

- Alcoa Lock Bolt PDFDokumen8 halamanAlcoa Lock Bolt PDFMurugan PalanisamyBelum ada peringkat

- NCHRP Report 507Dokumen87 halamanNCHRP Report 507Yoshua YangBelum ada peringkat

- 2016 Smart City PresentationDokumen22 halaman2016 Smart City PresentationDeshGujarat80% (5)

- Method Statement of Refrigran Pipe Insulation and Cladding InstallationDokumen16 halamanMethod Statement of Refrigran Pipe Insulation and Cladding InstallationOdot Al GivaryBelum ada peringkat

- List of Algorithms Interview QuestionsDokumen9 halamanList of Algorithms Interview QuestionsSivaselvi RBelum ada peringkat

- How To Export Resource Assignment Data To Excel From P6Dokumen9 halamanHow To Export Resource Assignment Data To Excel From P6artletBelum ada peringkat

- PLAN UPDATE 2020 r1Dokumen101 halamanPLAN UPDATE 2020 r1David SusantoBelum ada peringkat

- Modern Love - The New York TimesDokumen23 halamanModern Love - The New York TimesPearl Sky100% (1)

- CRD MethodDokumen12 halamanCRD MethodSudharsananPRSBelum ada peringkat

- Logic SelectivityDokumen6 halamanLogic SelectivitymoosuhaibBelum ada peringkat

- MapObjects inVBNET PDFDokumen34 halamanMapObjects inVBNET PDFWanly PereiraBelum ada peringkat

- West Point Partners Project - OverviewDokumen11 halamanWest Point Partners Project - OverviewhudsonvalleyreporterBelum ada peringkat

- Bio GasDokumen4 halamanBio GasRajko DakicBelum ada peringkat

- SAFMC 2023 CAT B Challenge Booklet - V14novDokumen20 halamanSAFMC 2023 CAT B Challenge Booklet - V14novJarrett LokeBelum ada peringkat

- 50 58 Eng Concrete TestingDokumen92 halaman50 58 Eng Concrete TestingJimmy LopezBelum ada peringkat

- Unit 1 Module 2 Air Data InstrumentsDokumen37 halamanUnit 1 Module 2 Air Data Instrumentsveenadivyakish100% (1)

- Installation Manual For PV PanelDokumen23 halamanInstallation Manual For PV PanelVăn ST QuangBelum ada peringkat

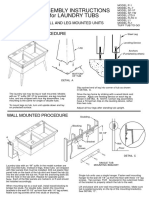

- American Standard fl7tg Installation SheetDokumen2 halamanAmerican Standard fl7tg Installation SheetJonn Denver NuggetsBelum ada peringkat

- Fiber Bragg Grating SensingDokumen36 halamanFiber Bragg Grating SensingAgung Podo MoroBelum ada peringkat

- Fdocuments - in Companies List With Contact DetailsDokumen80 halamanFdocuments - in Companies List With Contact DetailsNaren RawatBelum ada peringkat

- Proco Rat Distortion DIY SchemDokumen1 halamanProco Rat Distortion DIY SchemFer VazquezBelum ada peringkat

- Computer Organization and Assembly Language: Lecture 1 - Basic ConceptsDokumen13 halamanComputer Organization and Assembly Language: Lecture 1 - Basic ConceptsNosreffejDelRosarioBelum ada peringkat

- Utilisation of Electrical Energy May 2008Dokumen8 halamanUtilisation of Electrical Energy May 2008rajaniramBelum ada peringkat

- PresPrescient3 Extinguishing Control Panelcient 3 SLDokumen4 halamanPresPrescient3 Extinguishing Control Panelcient 3 SLIgor NedeljkovicBelum ada peringkat

- Convention On Cybercrime BudafestDokumen26 halamanConvention On Cybercrime BudafestWinardiBelum ada peringkat

- Building A Custom Rifle StockDokumen38 halamanBuilding A Custom Rifle Stock24HR Airgunner Channel100% (1)

- CATIA Cloud of PointsDokumen141 halamanCATIA Cloud of Points4953049530100% (1)

- Classification Essay On FriendsDokumen8 halamanClassification Essay On Friendstycheknbf100% (2)