Partnerships

Diunggah oleh

Luana BonniciHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Partnerships

Diunggah oleh

Luana BonniciHak Cipta:

Format Tersedia

GCSE (The Legal Organisation of Business)

BUSINESS FORMS Learning Objectives:1. To define what is meant by a business partnership 2. To understand who owns, manages and shares the profits in a business partnership 3. To determine the liability of the partners with regards to the businesses debts 4. To list the advantages and dis-advantages of being in a partnership

What is a partnership?

A partnership is an agreement between two or more people to take joint responsibility for the running of a business, to share in the profits and to share the risks. A partnership means:Shared ownership A shared workload Share profit

Shared decision making

Shared liability for debts

How do you go about setting up in partnership?

A partnership is almost as easy as a sole trader. If no formal agreement is drawn up then the rules of the partnership are as laid down in the 1890 Partnership Act. The Act states that everything including decision making, responsibility and profit is split equally between the partners. If two or more people are running a business together then they are a partnership and it is wise for the partners to draw up a special document known as a deed of partnership which outlines in detail

GCSE (The Legal Organisation of Business)

How profits and losses are to be shared, especially if this is not to be equal. How much money each partner is expected to put into the business How much money and what share of the profit each partner may take out of the business

The working arrangements of the partnership e.g. who has responsibility for which part of the business

Arrangements for removing a partner or adding a partner to a business. Arrangements for ending the partnership and the distribution of assets once the partnership is dissolved.

What are the main aims of a partnership?

Partnerships are common among professional people such as architects, solicitors, accountants and doctors. The aims of a partnership are usually similar to a sole trader i.e. profit, survival, stability and people may enter into a partnership for a number of reasons. The main reason is usually to expand the business by an increase in capital or to gain specialist skills that are required for the business to develop

Who owns a partnership?

The business is owned by the partners equally e.g. if there are 3 partners then they will each own a third of the business, this is the case unless stated otherwise in the deed of partnership. There has to be a minimum of two partners in a business and a maximum of 20.

Who manages the business?

The partners share the control of the business equally unless the partnership agreement states otherwise. In many partnerships certain responsibilities are delegated to certain partners e.g. in a law firm one partner may be responsible for criminal law as this is their area of expertise whereas another may be responsible for land law and conveyancing.

GCSE (The Legal Organisation of Business)

How are the profits shared?

Again as with the ownership and management, the profits are shared equally as stated in the 1890 Partnership Act or altered in the partnership agreement. Each partner is classed as self employed (the same as a sole trader) and therefore each partner is responsible for ensuring that he or she pays their income tax an NI contributions from the relevant Profit & Loss and Balance Sheets.

How is the liability for the businesses debts distributed?

As sole traders the partners liability to meet the firms debts is unlimited. Each partner is responsible for the entire debt of the partnership, so if one partner makes a bad decision which is financially very costly then the burden has to be met by all of the partners.

How is a partnership financed?

Again this is very similar to a sole trader, however one of the main advantages of a partnership is that is pools the partners resources including personal saving, loans from friends and families and when applying for a bank loan then there is more security available.

What are the advantages of a partnership?

Easy to set up and future disagreements can be resolved at the start in the form of a partnership agreement Business can gain professional help through taking on a qualified partner. Extra partners bring extra capital Responsibility for running the business (both decision making and workload) is shared Finances are kept private Division of labour leads to greater expertise.

GCSE (The Legal Organisation of Business)

What are the dis-advantages of a partnership?

Unlimited liability means that all the partners could face financial ruin for one partners mistake Lack of continuity the loss of one partner would dissolve the partnership and a new one would have to be formed

Partners can make decisions without consulting the other parties

Although more capital available than for a sole trader, finance is still limited

Disagreements between partners could make decision making difficult.

EXERCISES 1. Write the definition, advantages and dis-advantages onto your table. 2. Refer to the case study (a) Explain the meaning of the words and phrases in italics

Redundant no work available for that person to complete so they are released from employment Partnership A partnership is an agreement between two or more people to take joint responsibility for the running of a business, to share in the profits and to share the risks. National Lottery an organisation that collects money in return for the chance of winning a cash prize. Money is gained to fund worthwhile projects.

GCSE (The Legal Organisation of Business)

(b)

Why do you think it was a mistake for John and Dave not to put anything in writing before setting up their partnership?

The liability to meet the firms debts is shared therefore John is responsible for Daves debts. If the partnership had been agreed in writing then certain limitations might have been placed on both partners e.g. joint signatures on cheques over 500 (c) What agreements could they have come to which might have avoided some of the later problems?

The duties of each partner How profits are to be shared Who organises the workload The wages of each partner Leaving the partnership Financial details including who will take care of the accounts and how often the finances are discussed and reviewed

GCSE (The Legal Organisation of Business)

John and Dave who had both been at school together in Liverpool, both became architects. John worked for a large private firm while Dave got a job with the local council. They had been working three years when, first John and then Dave were made redundant. Neither of them could obtain a job, so they decided to set up in partnership together.

As they were friends for so long, they did not bother to put anything down in writing. John put 4,000 into the business and Dave put in 2,500. The rest of their start up costs came from a bank loan. Dave had good contacts with the local Health Service Trust and they received a commission to design a small out patient clinic

They also obtained a few private commissions. They were scarcely making enough to make ends meet, when they had a stroke of luck, the partnership won a competition to design a 4 million arts complex in the south east. The project was to be financed by the National Lottery. They had never had such an important commission before!

Dave was greatly encourages by this success and started to look for other commissions of a similar kind. It was not long before he managed to win a competition for another Lottery financed project in the Southeast. As a true northerner, Dave thought he would never want to live in the Southeast but as he came to know it better he found the life style more appealing

Dave wanted to move the partnership to London, however John had no desire to move from the north. They had talked about dissolving the partnership however they agreed that Dave should rent a small office in London as that was where they were making the most money. Dave thought that he should have most of the profit but John thought that this was unfair. Their partnership started to go wrong after this. Dave bought 6 started drinking heavily himself a Mercedes and

Not long afterwards, Dave was driving home late one night after he had been drinking. He crashed into a tree and was killed. Later John found that Dave had been running up partnership debts totalling thousands of pounds. As the surviving partner, John was legally responsible for all the debts except for Daves outstanding income tax.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Super Injunction BookDokumen3 halamanSuper Injunction BookReckless Kobold0% (1)

- Fundraising Blueprint Plan TemplateDokumen3 halamanFundraising Blueprint Plan Templateoxade21Belum ada peringkat

- Spisak Parfema NEWDokumen1 halamanSpisak Parfema NEWDouglas CoxBelum ada peringkat

- Chief Executive Officer CPG in West Palm Beach FL Resume James MercerDokumen2 halamanChief Executive Officer CPG in West Palm Beach FL Resume James MercerJames MercerBelum ada peringkat

- Sap MM Standard Business ProcessesDokumen65 halamanSap MM Standard Business ProcessesDipak BanerjeeBelum ada peringkat

- Gat PreparationDokumen21 halamanGat PreparationHAFIZ IMRAN AKHTERBelum ada peringkat

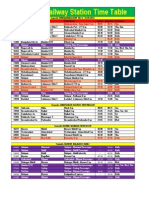

- Solapur Railway Station Time TableDokumen2 halamanSolapur Railway Station Time TableAndrea Lopez33% (3)

- PricelistDokumen3 halamanPricelist4 fruit companyBelum ada peringkat

- Ticket PDFDokumen1 halamanTicket PDFVenkatesh VakamulluBelum ada peringkat

- Tourism PolicyDokumen6 halamanTourism Policylanoox0% (1)

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDokumen24 halamanPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidBelum ada peringkat

- Supervisory Development Final ProjectDokumen12 halamanSupervisory Development Final ProjectCarolinaBelum ada peringkat

- Corporate FinanceDokumen11 halamanCorporate Financemishu082002100% (2)

- Agriculture Subsidies and DevelopmentDokumen2 halamanAgriculture Subsidies and Developmentbluerockwalla100% (2)

- 5-Minute Chocolate Balls PDFDokumen10 halaman5-Minute Chocolate Balls PDFDiana ArunBelum ada peringkat

- Key Points in Creation of Huf and Format of Deed For Creation of HufDokumen5 halamanKey Points in Creation of Huf and Format of Deed For Creation of HufGopalakrishna SrinivasanBelum ada peringkat

- Influence of Celebrity Endoresement On Consumer Prefeference For Glo NigeriaDokumen8 halamanInfluence of Celebrity Endoresement On Consumer Prefeference For Glo NigeriaBraym Mate'sunBelum ada peringkat

- Donner Company 2Dokumen6 halamanDonner Company 2Nuno Saraiva0% (1)

- Question Bank Volume 2 QDokumen231 halamanQuestion Bank Volume 2 QCecilia Mfene Sekubuwane100% (1)

- Apartment Community BrochureDokumen7 halamanApartment Community Brochureapi-327678777Belum ada peringkat

- Akuntansi Keuangan Lanjutan 2Dokumen6 halamanAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiBelum ada peringkat

- Tennis Ball Activity - Diminishing Returns - Notes - 3Dokumen1 halamanTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaBelum ada peringkat

- 1) History: Evolution of Indian Banking SectorDokumen8 halaman1) History: Evolution of Indian Banking SectorPuneet SharmaBelum ada peringkat

- StartUp India - Case AnalysisDokumen3 halamanStartUp India - Case AnalysisIrshad AzeezBelum ada peringkat

- Business Level StrategyDokumen28 halamanBusiness Level StrategyMohammad Raihanul HasanBelum ada peringkat

- Putting English Unit14Dokumen13 halamanPutting English Unit14Dung LeBelum ada peringkat

- Introduction To Business - 5Dokumen11 halamanIntroduction To Business - 5Md. Rayhanul IslamBelum ada peringkat

- Scarcity and ChoiceDokumen4 halamanScarcity and ChoicearuprofBelum ada peringkat

- Walt Disney Company PDFDokumen20 halamanWalt Disney Company PDFGabriella VenturinaBelum ada peringkat

- Accounting For NotesDokumen3 halamanAccounting For NotesRaffay MaqboolBelum ada peringkat