80219a 05

Diunggah oleh

Indaia RufinoDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

80219a 05

Diunggah oleh

Indaia RufinoHak Cipta:

Format Tersedia

Chapter 5: Sales Tax Setup

CHAPTER 5: SALES TAX SETUP

Objectives

The objectives are: Provide an overview on sales tax. Create Ledger Posting Groups. Create Sales Tax Authorities. Create Sales Tax Settlement Periods. Create Sales Tax Codes. Create Sales Tax Codes Intervals. Create Sales Tax Groups. Create Item Sales Tax Groups. Set up Sales Tax Jurisdictions. Create Sales Tax Transactions. Create Sales Tax Exempt Data. Calculate and Post Withholding Sales Tax.

Introduction

The requirements for tax calculation and tax reporting differ significantly for different countries. Therefore, the tax module of a true international Enterprise Resource Planning (ERP) system must be comprehensive. In Microsoft Dynamics AX, the tax module offers many different options for: Tax calculation Posting Reporting

This content explores the extensive functionality for sales tax handling. NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

5-1

Financials I in Microsoft Dynamics AX 2012

Sales Tax Overview

All businesses must collect and pay taxes to various tax authorities. Different countries have different rules and rates. In some countries, the rules differ between states or counties. This topic provides a general overview on taxes, with the focus on sales taxes, although the tax system in Microsoft Dynamics AX can process many kinds of taxes and duties. The sales tax system within Microsoft Dynamics AX functions as follows: The user specifies where to post sales taxes by entering a ledger account in the Ledger posting groups. The user specifies the sales tax authorities by using the Sales tax authorities form. The user specifies when and how frequently to settle under sales tax settlement periods. The user defines how much to collect or pay as a certain amount or percentage. The user sets this up under the Sales tax codes. The system determines whether a sales tax should be imposed on a sale or purchase order through a combination of the Sales tax group and the Item sales tax group.

5-2

Chapter 5: Sales Tax Setup

Sales Tax Overview - Suggested Steps

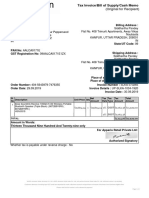

The image illustrates the steps for setting up tax information. If you follow the steps in this order, you can avoid going back and forth between dialog boxes in Microsoft Dynamics AX.

FIGURE 5.1 SALES TAX SETUP IMAGE

When you buy an item from a vendor or sell an item to a customer, the system must calculate all the applicable sales taxes. The calculated sales tax in Microsoft Dynamics AX is based on the sales tax codes included in both of the tax groups that are attached to the customer or vendor and the item.

5-3

Financials I in Microsoft Dynamics AX 2012

Sales Tax Overview- Example

The following table shows the: Sales tax setup for a customer and an item Attached tax groups and the associated tax codes

If you sell the item P Lamp to customer TTL Tire, the system calculates the sales taxes based on tax codes CA and Fed because those codes exist in both groups.

FIGURE 5.2 AFFECT OF SALES TAX CODES ON SALES TAX CALCULATION

When you attach settlement period and posting group to the tax codes, you specify how to post and pay the taxes. Finally, you can set up the tax reporting on the sales tax code.

Ledger Posting Groups

The ledger posting groups control the automatic posting of sales taxes in Microsoft Dynamics AX. You must create the accounts that General Ledger uses in the Chart of Accounts before using them to set up the ledger posting groups. The following characteristics apply to ledger posting groups: A ledger account is updated automatically when the system calculates taxes and updates invoice posting. The system attaches the ledger accounts that the taxes are posted in to the sales tax code. Because each ledger account can use several tax codes, a ledger posting group determines posting.

5-4

Chapter 5: Sales Tax Setup

Each ledger posting group can contain several ledger accounts. The help text indicates the purpose of each account and how it is used. You can set up ledger accounts that have the posting type Sales tax to select the accounts in the Account group form. Changes that you make to the ledger account numbers in Ledger posting groups only affect transactions that have not yet posted.

Ledger Posting Groups - Types of Accounts

The number of accounts you must set up depends on the use of the group and national law. For example, you can set up accounts for the following: Sales-tax payable Use-tax payable Settlement account Sales-tax receivable

Procedure: Create Ledger Posting Groups

Perform the following steps to create ledger posting groups: Go to General ledger, click Setup, click Sales Tax, then click Ledger posting groups. 1. Click the New button to create a new record. 2. Enter a unique name for the ledger posting group in the Ledger posting group field. 3. Enter a meaningful name to describe the ledger posting group in the Description field. The description appears on reports and other areas throughout Microsoft Dynamics AX. HINT: Describe the groups so that you can recognize them. This description appears with the code of the ledger posting group.

5-5

Financials I in Microsoft Dynamics AX 2012

4. Select the ledger account in the Sales tax payable list, where you must post the outgoing sales tax as part of the company's revenue. The system debits the outgoing tax in the customer account and then credits this account. Debits are automatically recorded in the account and settled upon payment of the taxes. The ledger accounts available in the Sales tax payable list are the posting type of sales tax in the Chart of accounts.

FIGURE 5.3 ACCOUNT GROUP- LEDGER POSTING GROUPS FORM

Create Ledger Posting Groups - Posting Example

The following is a brief example about posting sales taxes. These sales taxes are collected by the company on behalf of the tax authority when you sell taxable goods and services. The amount you receive includes the sales tax. For example, if a customer makes a purchase of 95.00 USD and the tax amount is 5.00 USD, the ledger transactions are as follows: Ledger account Customer account (Accounts Receivable) Sales tax payable* Sales account (domestic) Debit (USD) 100 5 95 Credit (USD)

* The sales tax payable line represents the ledger account specified in the Sales tax payable field on the Ledger posting group form. The system credits this account for sales tax amounts received from customers and debits the appropriate customer accounts.

5-6

Chapter 5: Sales Tax Setup

Procedure: Create Ledger Posting Groups - Sales Tax Receivable

Perform the following steps to create sales tax receivable ledger posting groups: 1. Select the ledger account for incoming taxes (receivable from the tax authority) in the Sales tax receivables field. Vendors collect these taxes on behalf of the tax authority when the company purchases taxable goods and services, and the amount paid to the vendor includes taxes. For example, if a vendor sends an invoice of 100.00 USD, of which 5.00 USD is value-added tax, the ledger transactions are as follows: Ledger account Vendor account (Accounts payable) VAT paid (Sales tax receivable)** Inventory account (Expense account) 5 95 Debit ($) Credit ($) 100

** This account represents the ledger account specified in this field. The system debits to this account the sales tax amounts that you pay vendors and credits the appropriate vendor accounts. 2. Enter the ledger account for posting deductible incoming taxes that vendors do not claim or report to the tax authority in the Use-tax expense list. NOTE: If the Apply US sales tax and use tax rules check box is selected on the General Ledger Parameters form on the Sales tax tab, the Sales tax payable field is unavailable. Instead, the system debits sales taxes paid to vendors as expenditures (costs) to the same accounts as the purchases.

5-7

Financials I in Microsoft Dynamics AX 2012

Procedure: Create Ledger Posting Groups - Use Tax Payable

Perform the following steps to create use tax payable ledger posting groups: Enter the ledger account that offsets the use tax expense for taxes that vendors do not claim in the Use tax payable list. The way you use this account depends on the type of tax system your company chooses. 1. Non-U.S. taxes - You must indicate a use tax expense account for the Ledger posting group. For any sales tax groups that contribute amounts to this ledger account, you must select the Use Tax field on the Setup tab on the Sales tax group form, found at General Ledger, Setup, Sales tax. 2. U.S. taxes - The amount in this account offsets the taxes posted as expenses if the Apply US sales tax and use tax rules check box is selected on the Parameters form. The vendor is not required to collect the tax. However, the company may still owe taxes to a sales tax authority and must track such taxes.

Create Ledger Posting Groups- Use Tax Payable Example

The following is an example of the use tax payable concept. A company buys office supplies on the Internet from an out-of-state vendor. The vendor charges 100.00 USD for the supplies and no tax. The company may still owe use taxes to the sales tax authority in its own state. The ledger transactions are as follows: Ledger account Vendor account (Accounts Payable) Use tax payable*** Office supplies (Expense account) 105 Debit (USD) Credit (USD) 100 5

***This account represents the ledger account specified in this field. NOTE: This field is visible only when the Apply U.S. sales tax and use tax rules check box is selected in the General ledger parameters form on the Sales tax tab.

5-8

Chapter 5: Sales Tax Setup

Procedure: Create Ledger Posting Groups Settlement

Perform the following steps to create settlement accounts for ledger posting groups: 1. Select the ledger account that the system debits when you pay taxes in the Settlement account field. To ease use, group the account with other ledger accounts in the Chart of accounts that contain posted taxes. The sum of these accounts is the total balance of taxes due. 2. Perform the following in the Ledger posting groups form: o Enter the ledger account for the posting of vendor cash discounts that include a sales tax amount. If you use this field, you must also select the Reverse sales tax on cash discount and Cash discount is calculated on amount incl. sales tax check boxes in the Parameters form. o Select the account for posting loss on cash discounts in the Customer cash discount list. You can use this account to view a more accurate audit trail on the transaction. The ledger posting groups have the following characteristics: They can be attached to individual sales tax codes They determine the ledger accounts to which the sales taxes calculated for the sales tax code are posted

5-9

Financials I in Microsoft Dynamics AX 2012

Lab 5.1 - Create a Ledger Posting Group

During this lab, you will set up ledger accounts and a ledger posting group for use in posting sales tax transactions. Scenario Phyllis is the Accounting Manager for Contoso. Contoso has a new customer in Alabama. A ledger account must be set up to record the sales tax liability and payments made (settlements) to the taxing authority in Alabama automatically. Phyllis asks you to perform these tasks for her. NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!

1. Create an account to record the sales tax payable and the sales tax settlements for the Alabama customer. 2. Set up a new ledger posting group to assign to the Alabama customer to automate postings of sales tax transactions.

Need a Little Help?

1. When you create a new account for the sales tax liability for the Alabama customer, use account number 220105. 2. Create a new ledger posting group for the Alabama customer in the Ledger posting form that uses the Ledger posting group ALST (Alabama State Tax).

Step by Step

Set up the ledger account: 1. On the Navigation Pane, click General ledger, click Common, then click Main accounts. 2. Click the Main account button to add a line. 3. In the Main account field, enter 220105. 4. In the Name field, enter Alabama state sales tax payable. 5. In the Select the level of main account to display field, select Chart of accounts. 6. In the Main account type field, click the arrow to select Balance sheet. 7. Click the Setup FastTab. 8. In the Posting type field, click the arrow to select Sales tax. 9. Close the Main Accounts - Chart of accounts form.

5-10

Chapter 5: Sales Tax Setup

Set up the ledger posting group: 1. Click General ledger, then click Setup, then click Sales Tax, and then click Ledger posting groups. 2. Click the New button to add a line. 3. In the Ledger posting group field, enter ALST. 4. In the Description field, enter Alabama State Tax. 5. In the Sales tax payable field, click the arrow to select account 220105. 6. In the Settlement account field, click the arrow to select account 220105. 7. Close the Ledger posting groups form.

5-11

Financials I in Microsoft Dynamics AX 2012

Sales Tax Authorities

Companies pay and report taxes to authorities. The authorities determine when and where the company pays its taxes. Tax authorities can be countries, states, regions, and cities. You can pay sales tax through a vendor or to the sales tax authority directly. To pay sales tax through a vendor, specify the vendor's account number together with the correct sales tax authority. Sales tax payments are transferred by the system to the vendor making the payment. To make payments to the sales tax authority, enter the sales tax authority's address information.

Procedure: Create a Sales Tax Authority

Perform the following steps to create a sales tax authority: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax authorities. 2. Click the New button. 3. Enter a unique code for the authorities that you send tax declarations and payments in the Authority field. Microsoft Dynamics AX uses this code throughout the system to refer to a particular authority. 4. Enter the name of the tax authority in the Name field. It displays on reports and in other areas throughout the system. NOTE: Give the tax authority a name that is easy to identify. The name displays together with the tax authority code.

5. Select the vendor to make tax payments to the appropriate authorities in the Vendor account list. The sales tax payments are then posted automatically to the settlement account specified in the Ledger posting group. If you leave the field blank, you must pay the tax authorities directly.

5-12

Chapter 5: Sales Tax Setup

6. Select the report layout to print for the tax authority in the Report layout list.

FIGURE 5.4 AUTHORITY FORM

Procedure: Create a Sales Tax Authority - General

Perform the following steps to create a sales tax authority, for fields on the General FastTab: 1. Select the vendor to make tax payments to the appropriate authorities in the Vendor account list. The sales tax payments are then posted automatically to the settlement account specified in the Ledger posting group. When you select a vendor, the vendor's address is entered automatically. If you leave the field blank, you must pay the tax authorities directly. 2. Select the report layout to print for the tax authority in the Report layout list. 3. Select the rounding form to use for rounding the sales tax amount in the Rounding form list. o Normal - round up numbers five and higher and round down numbers lower than five to the right of the specified unit. o Downward - round down any number to the right of the specified unit. o Rounding-up - round up any number adjacent to the specified unit. o Own advantage - round any number to the company's advantage. When the system settles sales tax, the total sales tax amount rounds automatically according to the setup on the sales tax authority. 4. Specify the general unit for rounding sales tax amounts in the Round-off field, according to the chosen rounding form.

5-13

Financials I in Microsoft Dynamics AX 2012

EXAMPLE: If you select Own advantage, with a Round-off of 0.10, the system rounds a figure of 10.16 to 10.10 and -10.16 to -10.20. This ensures that the rounding is always to the advantage of the company.

Procedure: Create a Sales Tax Authority- Address and Contact

Perform the following steps to create a sales tax authority, for fields on the Address and Contact information FastTabs: 1. On the Address FastTab, enter the address of the Sales tax authority. 2. Enter the remaining contact information on the Contact Information FastTab of the Sales tax authority. Create as many sales tax authorities as needed, each with specific address and contact information and report layout. The company can pay sales taxes to the authority directly or through a vendor account created for the sales tax authority. NOTE: If you have not set up the tax authority as a vendor, prepare a manual payment to the tax authority on the appropriate due date.

5-14

Chapter 5: Sales Tax Setup

Lab 5.2 - Create a Sales Tax Authority

During this lab you will demonstrate how to create a sales tax authority in Microsoft Dynamics AX. Scenario Phyllis, the Accounting Manager for Contoso, has asked for your assistance in setting up a sales tax authority. Contoso recently started conducting business with a customer in Alabama. A new sales tax authority must be set up to use to report sales taxes to the Alabama authorities. NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!

Set up the Alabama sales tax authority. Use ALA for the authority name.

Need a Little Help?

1. Click General ledger, then click Setup, then click Sales tax, and then click Sales tax authorities. 2. Create a new sales tax authority. Contoso uses the field value "Normal" for the rounding method and it rounds to the nearest penny.

Step by Step

1. On the Navigation Pane, click General ledger, then click Setup, then click Sales tax, and then click Sales tax authorities. 2. Click the New button to add a new line. 3. In the Authority field, enter ALA. 4. In the Name field, enter Alabama Authorities. 5. Expand the General FastTab 6. In the Report layout field, click the arrow to select U.S. report layout. 7. In the Rounding form field, click the arrow to select Normal. 8. In the Round-off field, enter .01. 9. Close the Sales tax authorities form.

5-15

Financials I in Microsoft Dynamics AX 2012

Lab 5.3 - Create and Assign a Vendor to the Sales Tax Authority

To make paying the sales tax authorities more efficient, you can assign a vendor to the authority. During this lab you will assign a vendor. Scenario Phyllis, the Accounting Manager for Contoso, has discovered that assigning a vendor to a sales tax authority has the following advantages: She can make payments as a part of the typical payment routines. When she runs the Sales tax payment periodic job, the amount the company owes the sales tax authority transfers to the sales tax authority's vendor account. During the company's usual payment routine, the payment to the sales tax authority is created automatically with payments to other vendors.

To automate payments to the Alabama sales tax authority, Phyllis has asked you to set the Alabama sales tax authority up as a vendor. Use the following information for the vendor. Field Name Search name Group Terms of payment Method of payment Value State of Alabama AL tax 10 M15-Month end + 15 days USAUSD_CHK

NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!

1. Create a vendor for Alabama sales tax. 2. Assign the vendor to the sales tax authority for Alabama.

5-16

Chapter 5: Sales Tax Setup

Need a Little Help?

1. When you add a vendor, Microsoft Dynamics AX can assign the vendor number because of the Accounts Payable setup in Contoso. Ensure that this setup is correct. 2. Assign the new vendor to the sales tax authority for the State of Alabama.

Step by Step

Set up the vendor: 3. On the Navigation Pane, click Accounts payable, click Common, click Vendors, then click All Vendors. 4. Click the New - Vendor button to add a record. In Contoso, because of accounts payable setup, the next available vendor number is assigned automatically. 5. In the Name field, enter State of Alabama. 6. In the Search name field, enter AL tax. 7. In the Group field, click the arrow to select 70- Tax Authorities. 8. Click the Payment FastTab. 9. In the Term of payment field, use the arrow to select M15. 10. In the Method of payment field, use the arrow to select USAUSD_CHK. 11. Close the Vendor form. Assign the vendor to the authority: 1. On the Navigation Pane, click General ledger, then click Setup, then click Sales tax, and then click Sales tax authorities. 2. Locate the line for Alabama Authorities. 3. In the Vendor account field, click the arrow to select State of Alabama. 4. Close the Sales tax authorities form.

5-17

Financials I in Microsoft Dynamics AX 2012

Sales Tax Settlement Periods

Sales tax settlement periods specify the intervals when the company reports and pays taxes. The company then can determine which sales tax settlement period to report to the authorities. The system automatically marks the posted tax transaction with the settlement period when it must report the transaction. NOTE: If the Include corrections field on the Sales tax tab page in the General ledger parameters form is selected, Microsoft Dynamics AX includes corrections from previous periods into the tax report for the actual period. Otherwise it is possible to manually select what information is included before running the report. Reporting periods depend on the size of the company, laws, and the authorities. Typical periods could be: Monthly Quarterly Yearly

Procedure: Create Sales Tax Settlement Period

Perform the following steps to create sales tax settlement periods. Click General ledger, click Setup, click Sales tax, then click Sales tax settlement periods. 1. Click the New button. 2. Enter a code in the Settlement period field that the system will use in the other forms to refer to the settlement period. For example, sales tax codes associate with a settlement period through the Settlement period field in the Sales tax codes form.

5-18

Chapter 5: Sales Tax Setup

3. Enter the name of the settlement period that appears on reports and in other areas throughout the system in the Description field.

FIGURE 5.5 SALES TAX SETTLEMENT PERIODS FORM

Procedure: Add Terms of Payment

Perform the following steps to set up terms of payments: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax settlement periods. 2. Select a record. 3. Select the terms of payment for the sales tax settlement in the Terms of payment list. Create and manage terms of payment in the Terms of payment form in Accounts Receivable or Accounts Payable. 4. Select the tax authority that you report and pay taxes to for each settlement period in the Authority list. NOTE: The Terms of payment field, which is attached to the settlement period, only applies if a vendor account is set up on the sales tax authority. In this case, this payment term overrules any terms of payment set on the vendor in the Accounts Payable module. Also note that the Due date calculates based on the date set when you run Sales tax payment from General ledger > Periodic > Sales tax payment.

5-19

Financials I in Microsoft Dynamics AX 2012

Procedure: Specify Period length

Perform the following steps to set up period intervals for the sales tax settlement periods: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax settlement periods. 2. Select a record. 3. Select the reporting interval in days, months, or years, in the Period interval list, on the General FastTab. 4. Enter the length of the settlement period in the Number of units field. Based on how you define the Period interval, the settlement period displays in days, months, or years. EXAMPLE: If the Period interval is set to Month(s) and the Number of units is set to 1, a new period automatically is one month. However, if the Period interval is set to Month(s) and the Number of units is set to 12, the length of one period is one year or 12 months. You can create new periods automatically by clicking New periods.

Procedure: Specify the Actual Periods

Perform the following steps to set up new Sales Tax Settlement periods for a already created Settlement Period record: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax settlement periods. 2. Select a record. 3. To create a new period, click on the Periods FastTab, and then click the Add button. 4. Enter the first day and last day of a period interval in the From date and To date fields. You cannot change an updated period interval. This means that you cannot remove tax transactions from the original period interval. You can correct errors with an offset transaction that is identical to the original transaction, but with the opposite mathematical sign. 5. Add additional periods by clicking the New Period action.

Example: Create Sales Tax Settlement Periods

In the year 2011, Contoso settles its sales taxes every quarter. To create the first period, enter January 1, 2011 in the From date field and March 31, 2011 in the To date field. To create the other quarters of the year, click the Add button three additional times.

5-20

Chapter 5: Sales Tax Setup

CAUTION: The sum of period intervals must cover whole periods so that no tax transactions fall outside the calculation periods. Period intervals may not overlap.

Inquire about Sales Tax Settlement Periods

When you set up the sales tax settlement periods, you can inquire, report and pay sales tax for specific settlement periods. The Sales Tax Settlement Periods form contains several methods to inquire on Sales tax transactions: View the sales tax payments for a specific sales tax settlement period by selecting a sales tax settlement period and clicking Sales tax payments. Additionally, view sales tax payments for a specific period by selecting an interval on the Periods tab and clicking Interval sales tax settlements.

HINT: Click General ledger > Reports > External > Sales tax payments to print a report about all settled sales taxes. View posted sales tax transactions for a specific sales tax settlement period by selecting a sales tax settlement period and clicking Posted sales tax. This provides an overview of each sales tax transaction, which is posted in Microsoft Dynamics AX with a sales tax code. Alternatively, click Sales tax per interval to view posted sales tax transactions for a specific interval.

Use settlement periods to create and manage the periods the company uses to report sales tax.

5-21

Financials I in Microsoft Dynamics AX 2012

Lab 5.4 - Setup of Sales Tax Settlement Periods

During this lab you set up a sales tax settlement period. Scenario Ken, the Controller for Contoso, wants April, the accounts payable coordinator, to pay Contoso's Alabama sales tax liability quarterly. The sales tax authorities expect settlement 15 days after the close of the quarter. The sales tax settlement period and deadlines are laid out in the following table: Settlement period January 1 - March 31 April 1 - June 30 July 01 - September 30 October 1 - December 31 Deadline for reporting April 15 July 15 October 15 January 15, the following year

April has asked for your assistance in completing the setup for the Alabama sales tax settlement so that April can generate the tax payments automatically. NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!

Set up the required sales tax settlement for Alabama.

Need a Little Help?

1. 2. 3. 4. Create the Sales tax settlement period. Attach the Terms of payment to the settlement period. Set up the Period length. Create the individual Settlement periods.

Step by Step

Set up the Tax Settlement: 5. On the Navigation Pane, click General ledger, click Setup, click Sales tax, and then click Sales tax settlement periods. 6. Click the New button to insert a line. 7. In the Settlement period field, enter AL. 8. In the Description field, enter Alabama Quarterly. 9. Expand the General FastTab.

5-22

Chapter 5: Sales Tax Setup

10. In the Authority field, click the arrow to select ALA-Alabama Authorities. 11. In the Terms of payment field, use the arrow to select N015. 12. In the Period interval field, use the arrow to select Months. 13. In the Number of units field, enter 3. Set up the Periods tab: Click the Periods tab. Press Add button to add a line, if needed. In the From date field, enter 01/01/2011. In the To date field, enter 03/31/2011. Click the New Period action three additional times to create the remaining quarters. 6. Close the Sales tax settlement periods form. 1. 2. 3. 4. 5.

5-23

Financials I in Microsoft Dynamics AX 2012

Sales Tax Codes

The Sales tax code is a central part of the setup. It specifies the following: How taxes are calculated The value that is used for tax calculation

The sales tax value is very important because no tax is calculated without it. A sales tax code includes information about the following: How the tax is calculated, posted and reported When the payments are made To whom the payments are made

You can define the sales tax rate for the following: Various intervals and periods in Values Limits on sales tax amounts in Limits

Sales Tax Codes - When to Create

Create sales tax codes when you initially set up the system. Update the sales tax codes when you need to make changes to existing taxes or when you add new taxes. Because taxes frequently depend on geographic location, changes to the company's market can result in the need for new sales tax codes. NOTE: If a company operates in the United States, it is highly recommended that you set up sales tax jurisdictions, as well as sales tax codes. You must attach sales tax jurisdictions to sales tax groups. You can attach sales tax codes to the sales tax group through the sales tax jurisdictions.

Procedure: Create a Sales Tax Code - Overview

Perform the following steps to create a sales tax code: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax codes 2. Click the New button to create a line for the new sales tax code. 3. Enter a unique identifier for the sales tax code in the Sales tax code field. This is the basis for calculation of tax, purchase duty, and packing duty throughout the system. 4. Enter a meaningful name for the new sales tax code in the Name field. This describes the function of the code and appears on reports and throughout the system.

5-24

Chapter 5: Sales Tax Setup

NOTE: If a company operates in the United States, set up sales tax jurisdictions in the Sales tax jurisdiction list.

FIGURE 5.6 SALES TAX CODES FORM

Procedure: Create a Sales Tax Code - General

Perform the following steps to enter general information when creating a sales tax code: 1. Click the General tab. Select the currency in which tax must be calculated and paid in the Sales tax code form on the General tab in the Currency list. If the original transaction is in another currency, the tax converts automatically 2. Select the period and the sales tax authority used to calculate the sales tax code in the Settlement period list. 3. Select the ledger posting group for a sales tax code in the Ledger posting group list. The posting group contains information about which accounts to use when the sales tax amounts are automatically posted in the General Ledger. You can create the posting groups in the Ledger posting groups form. 4. Select whether a user-defined code or the sales tax rate should print with the sales tax specifications in invoice documents by making a selection in the Print field on the General tab. 5. Define an identifier that specifies the sales tax code on printed invoices in the Print code field, but only if Print code is selected in the Print list. The sales tax code identifier is an alphanumeric string that may include special characters. 6. Enter a Packing duty Sort code to help identify the packing duty.

5-25

Financials I in Microsoft Dynamics AX 2012

7. Select the Negative sales tax percentage check box to allow a negative tax percentage for the sales tax code. This feature, can be used when a legal entity must retain tax (for example IRPF Impuesto sobre la Renta de las Personas Fsicaspersonal income in Spain) from vendors, and pay this amount to the sales tax authorities. 8. In the Payment sales tax code field, select a sales tax code to which sales taxes are posted when invoices are settled with payments. This setting is used for unrealized sales tax when a sales tax is calculated at time of invoicing but will be due (realized) for payment to the tax authorities only at the time when the invoice has been paid. The sales tax rate must be the same sales tax rate that you entered in the Sales tax code field. NOTE: For the transfer to occur, set up the general ledger to allow the posting of conditional sales taxes. In the General ledger parameters form, select the Conditional sales tax check box.

Procedure: Create a Sales Tax Code - Calculation

Perform the following steps to enter calculation information when creating a sales tax code: 1. Click General ledger, click Setup, click Sales tax, click Sales tax codes, then click the Calculation FastTab. 2. Select from the following options in the Origin list: o Percentage of net amount - percentage of purchase or sale, excluding any other taxes. o Percentage of gross amount - percentage of purchase or sale, including any other taxes. Sales tax calculates as a percentage of the purchase or sale amount. This includes all other taxes or duties. o Percentage of sales tax - percentage of another tax. The tax code that this calculation is based on must exist in the system. On the Calculation tab, set up the specific sales tax code that you based the current sales tax code on, in the Sales on sales tax field. o Amount per unit - indicate the unit on which the sales tax will be calculated in the Unit field. If the transaction is in another unit, it converts automatically based on Unit conversion in Inventory. o Calculated percentage - of the net amount -the calculated percentage of net amount calculation method can be used to calculate input tax deduction for per diem expenses (as used for example in Germany).

5-26

Chapter 5: Sales Tax Setup

3. On the Calculation tab in the Unit list, select the unit to use when taxes are calculated. If the transaction is expressed in another unit, it converts automatically according to the Unit conversion. NOTE: If the basis for tax is the number of units, this Unit field is mandatory.

FIGURE 5.7 SALES TAX CODE CALCULATIONS

Procedure: Create a Sales Tax Code - Calculation Rounding Options

Perform the following steps to set up rounding when you create a sales tax code: 1. Click General ledger, click Setup, click Sales tax, click Sales tax codes, then click the Calculation tab. 2. Enter the lowest absolute value of a calculated tax on the Calculation tab in the Round-off field. For example, if taxes should round off to a unit that is 1/100 of the currency of the tax, enter the value as a decimal (0.01). The Rounding form field indicates the kind of rounding to use. Refer to the following table for rounding on the amount 98,765.435 USD with different rounding values set up. Round-off = 0.01 98,765.43 Round-off = 0.10 98,765.40 Round-off = 1.00 98,765.00 Round-off = 100.00 98,800.00

NOTE: There is no requirement that the value be less than 1. If the value must round to the nearest 10, enter 10.00 in the field.

5-27

Financials I in Microsoft Dynamics AX 2012

Procedure: Create a Sales Tax Code - Calculation Packing Duty

Select the Packing duty check box to specify that the sales tax code is a packing duty. You can only select this check box when the Amount per unit option is selected in the Origin field. When you convert a unit of measure, the unit that it is converted to depends on whether or not this field is selected. If this check box is selected, the unit of measure is converted to the unit of measure of the product as shown in the Unit field in the Product per company details form. If this check box is clear, the unit of measure is converted to the unit of measure displayed in the Unit field in the Sales tax codes form.

Select the Calculate before sales tax check box to calculate and add a duty or tax to the net amount before sales tax is calculated. For example, you could calculate a duty and a sales tax on the same transaction, and add the duty amount to the net amount before the sales tax is calculated. Example: In the Origin field, Percentage of net amount is selected. The net amount is 100.00. The purchase duty is 10.00. The sales tax is 25 percent. The Calculate before sales tax check box is selected. The sales tax is calculated as (100 + 10) x 25% = 27.50. The total amount is 127.50.

5-28

Chapter 5: Sales Tax Setup

Procedure: Create a Sales Tax Code - Additional Calculation Options

Perform the following steps to set up additional calculation options when you create a sales tax code: 1. Click General ledger, click Setup, click Sales tax, then click Sales tax codes 2. Click the Values button on the action bar. Enter the Percentage/Amount in the Values form. Enter Values to set up the sales tax rate. Also refer to the procedure on how to create sales tax codes intervals. Close the Values form.

Procedure: Create a Sales Tax Code- Report Setup

Perform the following steps to create sales tax codes: 1. Click General ledger, click Setup, click Sales tax, click Sales tax codes, then click the Reports Setup FastTab or click the Report setup- credit note FastTab. 2. Insert the Reporting code numbers to facilitate reporting on the Report setup and Report setup - credit note tab pages. Frequently the tax authorities have special forms with numbered cells for reporting of taxes. For example, in the Taxable sales list, you can select the number of the field in the tax report that contains taxable sales. A series of forms exists within Microsoft Dynamics AX, which contains numbered cells that you can report to various authorities. The sales tax code is included in these reports in the cell indicated in this field.

FIGURE 5.8 SALES TAX CODE REPORT SETUP

5-29

Financials I in Microsoft Dynamics AX 2012

Rounding and Report Setup Notes

NOTE: Click General ledger > Reports > Base data > Sales tax codes to print a report listing all the sales tax codes. NOTE: In the Parameters form (click General ledger, click Setup, click General ledger parameters, then click the Sales tax link in the navigation pane), select the Calculation date type to determine the date that sales tax calculates. In the Method of calculation list, select whether the sales tax should calculate for each line or the total amount.

Example Setup: Calculation Methods for Sales Tax Codes

The following is an example showing a sample setup for sales tax codes: Scenario: Phyllis is the Accounting Manager at Contoso. Contoso's customer base includes many international customers. To increase the understanding of sales tax, Phyllis is asking your assistance in reviewing the calculation of sales tax by using various options available in Microsoft Dynamics AX. The following table shows Phyllis's review of setups in Contoso: Setup 1 - Use percentage of amount Duty 1 Duty 2 Percentage of net amount Percentage of net amount Percentage of gross amount Setup 2 - Use percentage of sales tax Percentage of net amount Percentage of sales tax (Duty 1 in the sales tax on sales tax list) Percentage of gross amount Rate

10% 20%

Sales Tax Calculation

25%

Example Setup: Calculation Methods for Sales Tax Codes- Incomplete Table

How would you apply the information in the table above to determine the effect of each setup on an invoice for 10.00 USD by completing the following table with the provided information? Setup 1 Rate Duty 1 Duty 2 10% 20% Formula Calculation Setup 2 Formula Calculation

5-30

Chapter 5: Sales Tax Setup

Setup 1 Gross Amount Sales Tax Calculation Duty + Sales Tax Total Sale The completed table is shown in the next lesson section. 25% Setup 2

Example Setup: Calculation Methods for Sales Tax Codes- Completed Table

The completed table is as follows: Setup 1 Rate Duty 1 Duty 2 Gross Amount Sales Tax Calculation Duty + Sales Tax Total Sale 25% 10% 20% Formula $10 * 10% $10 * 20% $10+1+2 $13 * 25% $1+2+3.25 $10 + 6.25 Calculation $1.00 $2.00 $13.00 $ 3.25 $ 6.25 $16.25 Setup 2 Formula $10 * 10% ($10+1)* 20% $10+1+2 .20 $13.20 * 25% $1+2.20 +3.30 $10 + 6.50 Calculation $1.00 $2.20 $13.20 $ 3.30 $ 6.50 $16.50

5-31

Financials I in Microsoft Dynamics AX 2012

Sales Tax Codes Intervals

Use Microsoft Dynamics AX to specify the following: The sales tax rates to use in different intervals A lower and upper amount limit for sales tax calculations

Sales taxes lower than the minimum limit amount are not recorded, and sales taxes over the upper limit amount are set to the upper limit amount automatically. You can attach the limits to specific dates. The sales tax code defines the limits. Changes to minimum and upper limits do not affect sales tax that is already updated and posted.

Procedure: Create Sales Tax Codes Intervals - Effective Dates

Perform the following steps to set up the From date and To date field in sales tax code intervals, both Limits and Values: Click General ledger, click Setup, click Sales tax, click Sales tax codes, then click the Limits OR click General ledger, then click Setup, then click Sales tax, then click Sales tax codes, then click the Values button. 1. Enter the first date the tax limits apply in the From date field. NOTE: The previous limits are visible because they are not overwritten when users make changes. 2. Enter the last date the tax limits apply in the To date field. 3. With From date and To date fields, indicate a period that the calculated tax applies to. The posting date determines when the tax falls outside the given period.

5-32

Chapter 5: Sales Tax Setup

If you have made changes to the limits, close the old period to indicate an ending date in the To date field and create a period with a new starting date in the From date field. Extend the old period by changing the date in the To date field. You can change the limits taking effect at a later date.

FIGURE 5.9 SALES TAX LIMITS

Procedure: Create Sales Tax Codes Intervals - Minimums and Maximums

Perform the following steps to set up the minimums and maximums in sales tax code intervals in the Limits form: 1. Enter the lower sales tax limit in the Minimum sales tax field. If the tax is lower than this minimum amount, it is reduced to zero automatically. The amount in this field must be the same currency as the currency specified in the sales tax code. 2. Enter the upper sales tax limit in the Maximum sales tax field. If the tax is more than the amount indicated, it is adjusted automatically to match this amount. The amount in this field must be the same currency as the currency specified in the sales tax code.

5-33

Financials I in Microsoft Dynamics AX 2012

Perform the following steps to set up the field in the Values form: 1. In the Values form, specify a sales tax rate for the different intervals. 2. In the Value field, define the tax percentage, or amount for each unit. If the basis for the calculation of tax is an amount, the entry in the Value field on the Overview tab of the Values form is the percentage value used in the calculation. 3. If the basis is several units, such as Purchase duty or Packing duty, the entry in the Value field on the Overview tab of the Values form is the amount for each unit used in the calculation. You can define units by using the Unit field found on the Calculation tab on the Sales tax codes form.

Sales Tax Code Intervals- Values Versus Limits

For a sales tax code, Values define the tax to calculate, on either a percentage or amount per unit, based upon the effective interval dates and the minimum and upper limits. These minimum and upper limits are the minimum and upper sales amount to which the amount entered in the Value field applies. For a sales tax code, Limits define the tax to calculate, based upon the effective interval dates and the minimum and maximum sales tax. These minimum and maximum sales tax limits are the minimum and maximum sales tax that will be calculated on the sale, after all tax calculations are performed.

Procedure: Create Sales Tax Codes Intervals - Marginal Base Options

Perform the following steps to set up the marginal base options in sales tax code intervals: 1. In the Sales tax code form on the Calculation FastTab, select the origin for the sales tax limits in the Marginal base list. 2. Select from the following options: o Net amount per line - value of the line, excluding any other taxes. o Net amount per unit - value of the unit, excluding any other taxes. This can involve the unit price specified by using a unit in the Unit field. o Net amount of invoice balance - the total value for the invoice, excluding any other taxes. o Gross amount per line - value of the line. This includes any other taxes. You can include only one tax code with this or the next property in the individual calculation.

5-34

Chapter 5: Sales Tax Setup

o Gross amount per unit - value of the unit. This includes any other taxes. You can include only one tax code with this or the previous property in the individual calculation. Invoice total incl. other sales tax amounts - The total value for the invoice. This includes any other taxes. You can include only one tax code with this property in the individual calculation.

Procedure: Create Sales Tax Codes Intervals - Method of Calculation

Perform the following steps to set up the method of calculation in sales tax code intervals: 1. Select the origin for the sales tax limits in the Method of calculation, in the Sales tax code form on the Calculation tab. 2. Select from the following options: o Whole amount - the sales tax calculates for the whole amount, which the tax rate for the interval that includes the transaction determines. Interval - the base is divided into intervals. The part within a given interval is calculated automatically based on the tax rate for that interval.

NOTE: Click the Inquiries button > Included in sales tax groups or Included in item sales tax groups to view or attach sales tax codes to sales tax groups or item sales tax groups. Click the Inquiries button > Posted sales tax to display posted sales tax transactions for a sales tax code and an itemization of each tax. Use this function for inquiries and error detection. In the Sales tax transactions form, click Voucher to view related ledger transactions. Click the Recalculate tax button to recalculate taxes on unposted transactions if the settings of a sales tax code have been modified.

5-35

Financials I in Microsoft Dynamics AX 2012

Lab 5.5 - Set Up Sales Tax Codes Intervals

During this lab you get to practice setting up sales tax code intervals. Scenario Ken, the Controller for Contoso, has received a notification from the State of Florida that as of 07/01/2011, a tiered tax is due on video recorder sales. Ken asks for your assistance in setting up tax codes that comply with the new structure. The notice specifies the following rates: Minimum limit 0.00 50.001 100.001 Maximum limit 50.00 100.00 Tax rate 10% 9% 8%

NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!

1. Use sales tax code intervals to structure the AV_FLST tax rate in Microsoft Dynamics AX for the new rates. 2. Microsoft Dynamics AX will require an 'ending' date for the tax. Plan to enter an artificial date of 12/31/2020.

Need a Little Help?

1. Before you add a new line to the Values form, you must enter dates on the existing line. Suggested dates are 1/01/2006 - 6/30/2011. 2. Add the lines to the Values form. All of them will be assigned the same date range assigned.

Step by Step

Edit the State of Florida Tax code record: 1. On the Navigation Pane, click General ledger, then click Setup, then click Sales tax, and then click Sales tax codes. 2. Locate the line for AV_FLST. 3. Click the Values button.

5-36

Chapter 5: Sales Tax Setup

Edit the existing line by adding dates: 1. 2. 3. 4. 5. 6. 7. 8. In the From date field, enter 01/01/2006. In the To date field, enter 06/30/2011. Click the New button to add a line. In the From date field, enter 07/01/2011. In the To date field, enter 12/31/2020. In the Minimum limit field, enter 0.00. In the Upper limit field, enter 50.00. In the Value field, enter 10.00.

Create the rest of the lines: 1. Click the New button to add a line. 2. Repeat steps 1 through 8 to add the remaining tax intervals to the form. 3. Close the Values form. 4. Close the Sales tax codes form.

5-37

Financials I in Microsoft Dynamics AX 2012

Sales Tax Groups

A sales tax group includes all sales tax codes that apply when you trade goods or services with customers and vendors. In most countries, different tax rules apply when you trade with domestic and foreign customers. The tax rules for foreign trade frequently are split up based on bilateral and multilateral trade agreements. Therefore, you must create tax groups depending on the taxes that may apply for a certain group of customers or vendors. A careful analysis of the different types of customers and vendors that the company trades with is a good starting point for determining the types of Sales tax groups needed, and the setup of those Sales tax groups.

Sales Tax Groups - Example Comparison

If your company needs the following tax codes, here is an example of how to apply sales tax codes to a sales tax group: VAT (only applies for domestic customers) Export Tax (only applies for foreign customers) Environmental duty (applies to all customers)

In a table, the tax codes appear as follows: Domestic customers VAT Export Tax Environmental Duty Yes No Yes Foreign customers No Yes Yes

The two groups of customers (domestic and foreign) do not have identical tax needs. Therefore, you must create two different sales tax groups that reflect the differences: Foreign customers: this group would contain the Export Tax and Environmental Duty tax codes Domestic customers: this group would contain the VAT and Environmental Duty tax codes

After you create the sales tax groups, attach the appropriate sales tax group to: Customers Vendors Ledger accounts

5-38

Chapter 5: Sales Tax Setup

Procedure: Create a Sales Tax Group

Because the geographic location of the customer or the supplier determines taxes, you usually assign the same Sales tax group to similar trading partners in the system. The correct tax codes used by the system are attached to this Sales tax group. The Sales tax group then associates with customer information specified in the Sales tax group field found on the Setup tab in the Customers form. Perform the following steps to create a sales tax group: 1. Click General ledger, click Setup, click Sales tax, click Sales tax groups, then click the New button. 2. Enter a unique name for the sales tax group in the Sales tax group field. 3. Enter a name that identifies the sales tax group in the Description field.

FIGURE 5.10 SALES TAX GROUP FORM

Procedure: Create a Sales Tax Group - General Information

Perform the following steps to set up additional fields in Sales tax groups: 1. Click General ledger, click Setup, click Sales tax, click Sales tax groups, then click the General FastTab. 2. Enter a form of identification to identify a sales tax group based on specific criteria, such as country, state, or county, in the Country/State and County/Purpose fields. This provides another method to identify the group.

5-39

Financials I in Microsoft Dynamics AX 2012

3. Select the Reverse sales tax on cash discount check box to reverse sales tax on a cash discount. States in the United States have different requirements, so you must set up this information on the sales tax group. When you create a sales tax group, the selection in the Reverse sales tax on cash discount field in General ledger parameters defaults to the field. 4. Select Sales tax setup section, select a code in the Sales tax group setup list. If the company is located in a country with sales tax jurisdiction, select the Sales tax jurisdictions value. NOTE: If the Sales tax jurisdictions value is selected in the Sales tax group setup list, a new tab called Jurisdictions setup appears and you cannot add sales tax codes to the Sales tax group.

Rounding By- Additional Information

The following is additional information on the General FastTab in the Sales tax group form. The Rounding by field controls the rounding principle that applies to the taxes of the sales tax group. This field is available if your company configuration includes sales tax jurisdictions. The two kinds of rounding that you can select that apply to the sales tax group are: Sales tax codes rounding is according to the sales tax code roundoff. You can see the value in the Round-off field on the Calculation tab of the Sales tax codes form. Sales tax code combinations - rounding is according to the sales tax code combination that is attached to each invoice line.

Printing Taxes on Invoices

Select the way you want the sales taxes to appear on the printed invoice by selecting one of the following in the Invoicing - Print field. Sales tax codes the sales taxes are shown by sales tax code. Sales tax groups the sales taxes are shown by sales tax group. No details no sales tax details are shown on the invoice. This option is a logical selection for sales tax groups that are based on sales tax jurisdictions for which you have selected the Exempt check box on the Jurisdiction setup tab.

5-40

Chapter 5: Sales Tax Setup

Recalculating Taxes on Unposted Transactions

After changing the settings of a Sales tax group you can click Recalculate taxes on all transactions with the modified Sales tax group or all unposted transactions.

Procedure: Create a Sales Tax Group - Setup

Perform the following steps to set up additional tax codes with this Tax Group: 1. Click the Add button to create a new tax code line. 2. Select one or more sales tax codes to use with the sales tax group. The fields on the Setup tab automatically fill in with values from the Sales tax codes form. 3. Select the Use-tax check box to indicate whether the company is responsible for calculating and paying use-tax on the purchase. If the company is not responsible, the vendor calculates and pays the tax. If the vendor did not charge tax, the system credits the tax to the account shown in the Use-tax payable field in Ledger posting groups. How the tax is debited depends on how you set the Apply U.S taxation rules parameter in the General Ledger parameters. If the Apply U.S. taxation rules parameter option is selected in General ledger parameters , the tax posts to the same account as the expense. If the option is not selected, the tax posts to the account specified in the Use-tax expense field in Ledger posting groups, there are no deductions for taxes on purchases and the tax posts together with the expense. The value is entered automatically from the Use-tax field in Sales tax groups, but you can change it if necessary.

Procedure: Create a Sales Tax Group - Attach to Customer or Vendor

Attach a sales tax group to a customer or vendor on the Setup area of the Customers form or Vendors form. This is the default sales tax group for transactions that involve the customer. As with all defaults, you can change the sales tax group on individual transactions, if necessary. Additionally, you can attach a default sales tax group to each ledger account for purchases or sales excluding a customer or vendor are posted, for example, the ledger account for office equipment. The default sales tax group appears automatically on transactions for the customer or vendor; however, you can change the sales tax group on individual transactions before you post transactions. It is also possible to specify a default sales tax group on Customer and Vendor groups which will then be defaulted to customers and vendors for the group.

5-41

Financials I in Microsoft Dynamics AX 2012

Amount Includes Sales Tax- Additional Information

You can indicate if the amounts entered in journals include sales tax or do not include sales tax. You can specify this information in three different forms: General ledger, Parameters form specify the default setting of lowest priority regarding the inclusion of sales tax in journal amounts. This is the setting that will apply to amounts on journals if no other information is supplied through a default setting of higher priority or through a manual setting in a line. General ledger, Journal names form specify a default setting that overrides the default setting on the Parameters form. Lines in journals that are patterned on a specific journal template automatically receive the journal template default setting regarding the inclusion of sales tax in journal amounts, unless you have entered a setting on the journal itself. Individual Journal forms specify a default setting on an individual journal to override the default settings of the Journal names and Parameters forms. The highest priority setting is entered automatically on journal templates, journals, and journal lines as they are created, but you can select or clear the Amount incl. sales tax field at any time. If you select the Amount incl. sales tax field, you must enter gross amounts in journals. Sales taxes are calculated on the basis of the gross amount and posted to the sales tax account. The net amount is posted to the ledger account entered in the journal. If you do not select the Amount incl. sales tax field, you must enter net amounts in journals. The net amount is posted to the ledger account entered in the journal. The sales taxes are calculated on the basis of the net amount and are posted automatically.

5-42

Chapter 5: Sales Tax Setup

Item Sales Tax Groups

Because items generally determine taxes, you must indicate how taxes are calculated for each item. The Item sales tax group includes all the sales tax codes that apply when you sell that item. The Item sales tax group also may include most of the sales tax codes in the system. When you create the Item sales tax groups, attach the group to Items. NOTE: This information is in Item sales tax group. The association between sales tax codes and the item sales tax group is in the Item sales tax group form, on the Setup tab.

Procedure: Create Item Sales Tax Groups

Perform the following steps to create item sales tax groups: 1. Click General ledger, click Setup, click Sales tax, then click Item sales tax groups. 2. Enter a unique name for the item sales tax group in the Item sales tax group field, and a description in the Description field. This information appears on reports and in other areas throughout Microsoft Dynamics. 3. Select the sales tax code for an item sales tax group on the Setup tab. For a sales tax code to be valid, you must select it for the sales tax group and the item sales tax group. The sales tax codes calculated are determined automatically when you post. 4. Select where the item sales tax line amount will be included on the EU sales list in the Reporting Type field: o Blank the sales tax line amount is included in the Not assigned value column. o Item the sales tax line amount is included in the Items value column. o Service the sales tax line amount is included in the Services value column. o Investment the sales tax line amount is included in the Investment value column. This column is relevant only for Belgium.

Procedure: Set Up a Default Item Sales Tax Group for an Item

To ensure sales tax calculates on all transactions for a specific item group, set up a default item sales tax group. Perform the following steps to set up the default: 1. Click Inventory and warehouse management, click Inventory and then Item groups. 2. Select an item group and then click the Setup FastTab.

5-43

Financials I in Microsoft Dynamics AX 2012

3. Select a value in the Item sales tax group lookup field in the Purchase tax section. This value is the default item sales tax group for the selected item group when you enter it on a purchase order line. 4. Select a value in the Item sales tax group lookup field in the Sales tax section. This value is the default item sales tax group for the selected item group when you enter it on a sales purchase line.

Set Up a Default Item Sales Tax Group for a Ledger Account

To ensure sales tax calculates on all journal transactions that you post to ledger accounts: Set up a default item sales tax group for all ledger accounts Set up default item sales tax groups for particular ledger accounts, if necessary

You can change any default item sales tax group that appears automatically on a journal line as necessary before the transaction posts. NOTE: In sales journals, purchase journals, and other journals where you enter an item number, the item sales tax group attached to the item automatically is entered on the journal lines.

Procedure: Set Up a Default Item Sales Tax Group for a Ledger Account

Perform the following steps to select a default item sales tax group for all ledger accounts: 1. Click General ledger, click Setup, click General ledger parameters. 2. Click the Sales tax link on the navigation pane and then select the default item sales tax group in the Item sales tax group list on the General FastTab. The item sales tax group in this field is entered automatically on journal lines as you create them, unless a specific item sales tax group is attached to the ledger account that you enter in the line. Follow these steps to set up a default item sales tax group for a particular ledger account: 1. Click General ledger, click Chart of accounts and select the ledger account. 2. Select the default item sales tax group in the Item sales tax group list on the Setup tab.

5-44

Chapter 5: Sales Tax Setup

Sales Tax Jurisdictions

Use Sales Tax Jurisdiction functionality to create the sales tax jurisdictions for which the company must collect sales tax. The sales tax jurisdiction functionality is designed for companies that operate in the United States, but is not a legal requirement. The form is available if an administrator enables the Sales tax jurisdictions configuration key. A sales tax jurisdiction is a grouping of sales tax codes for a particular settlement period (including the sales tax authority). Each jurisdiction is assigned one or more sales tax codes and has only one tax authority. Additionally, transactions that are posted for the sales tax jurisdiction are posted to the accounts of the Sales tax ledger posting group which is assigned to the tax account group that is selected in this form. Some state tax authorities collect taxes for all the jurisdictions within the state. If a state has many jurisdictions and a complex tax code structure, using jurisdictions makes it easier for a company to pay correct tax amounts to the authority. NOTE: A sales tax jurisdiction is not a geographical area. A geographical area can be covered by several jurisdictions, for example a district, town, country or state.

Procedure: Set Up Sales Tax Jurisdictions

Perform the following steps to set up sales tax jurisdictions: 1. Make sure that the configuration key is turned on for sales tax jurisdictions (see Licensing configuration help) 2. Click General ledger, click Setup, click Sales tax, then click Sales tax jurisdictions. 3. Click New button on the toolbar to create a new sales tax jurisdiction record. 4. In the Sales tax jurisdiction code text box, enter a unique identifier for a sales tax jurisdiction. 5. In the Name text box, enter the name of the jurisdiction. 6. In the Settlement period and the Ledger posting group lookup fields, select values. 7. In the Currency lookup field, select the currency of the sales tax jurisdiction. 8. Click Sales tax codes. In the Sales tax codes form, create sales tax codes for the sales taxes that the sales tax authority collects in the sales tax jurisdiction.

5-45

Financials I in Microsoft Dynamics AX 2012

NOTE: Click General ledger > Reports > Base data > Sales tax codes. In the line for the sales tax code, in the Sales tax jurisdiction code lookup field, select a jurisdiction.

Procedure: Set Up Sales Tax Groups for Jurisdictions

Perform the following steps to set up sales tax groups for jurisdictions: 1. Click General ledger, click Setup, click Sales tax, and click Sales tax groups. 2. In the Sales tax group setup drop-down list, select Sales tax jurisdictions. 3. In the Rounding by drop-down list, select the rounding convention for the sales tax group. 4. On the Jurisdiction setup tab, add the sales tax jurisdictions that apply to the sales tax group, and enter information about tax exempt status and use tax if applicable. The sales tax codes that are attached to a selected sales tax jurisdiction appear automatically on the Setup tab. 5. If necessary, you can change the sales tax codes of the jurisdiction in the Sales tax jurisdictions form. 6. In the Print drop-down list, select the way you want sales taxes printed on the invoice. 7. Close the Sales tax groups form. When a journal line or purchase or sales order line is created, the sales tax codes on the sales tax jurisdictions that are attached to sales tax groups are matched to the sales tax codes on the item sales tax groups, and sales taxes are calculated for the transaction.

5-46

Chapter 5: Sales Tax Setup

Lab 5.6 - Comprehensive Setup of Sales Tax

During this lab you gain comprehensive practice in setting up sales tax information in Microsoft Dynamics AX. Scenario Ken, the Controller for Contoso, has decided to do business with a new vendor, Blue Yonder Airlines, located in Little Rock, Arkansas where business has not previously been conducted. April, the accounts payable coordinator, receives an invoice for 50,000 USD from Blue Yonder Airlines, and comes to you for help because the necessary setups are to post this invoice are not in Microsoft Dynamics AX. You determine to do the following: Set up Blue Yonder Airlines as a vendor Set up the Arkansas Department of Revenue as a vendor Set up two accounts in the Chart of Accounts: one for the Arkansas state sales tax payable (account 220107) and one for the Little Rock city sales tax payable (account 220245) Set up both ledger posting groups Set up a sales tax authority Set up sales tax settlement periods Set up sales tax codes Set up sales tax code intervals Set up sales tax groups Set up item sales tax groups

The vendor's information is in the following table: Field Name City State ZIP Code/Postal Code Group Currency Terms of Payment Value Blue Yonder Airlines Little Rock AR 72205 10 USD N030

5-47

Financials I in Microsoft Dynamics AX 2012

NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Comprehensive Setup of Sales Tax - Additional Lab Data

The information for Arkansas is in the following table: Field Name Search Name Group Terms of Payment Method of Payment Value The Arkansas Department of Revenue AR tax 70 M15 USAUSD_CHK

You can set up the sales tax authority by using the U.S. Report layout. Plan to round taxes in a typical manner to the nearest penny. Any gain or loss that occurs when you round will post to account 618160. The tax breakdown for city and state taxes is as follows: City of Little Rock: three percent, the maximum tax limit that can be paid is 1000 USD in sales tax State of Arkansas: two percent

Challenge Yourself!

1. Setup two ledger posting groups, by using ARST for Arkansas and LRAST for Little Rock. 2. Setup a sales tax group by using ARLRA as the group name. 3. Setup a sales tax authority by using ARA as the authority name. 4. Enter a sales tax settlement period (AR) to use for each code. The term of payment is 15 days. The settlement period is an interval of one month. Then set up three new periods starting with the beginning of the current month. 5. Plan to set up two sales tax codes, one for each authority, by using the codes ALL_LRCITY and ALL_ARST. Use the standard ledger posting group for each tax code.

5-48

Chapter 5: Sales Tax Setup

7. Add the two new sales tax codes to the ALL item tax group. 8. After you complete the sales tax setup, record the invoice in an accounts payable Invoice journal. Make sure when creating the journal that you have deselected the Amount incl. sales tax field found on the Setup tab of the journal. Set your session date to 6/30/2011. 9. Review the tax calculation in the journal.

Need a Little Help?

For a visual representation of the sales tax setup process, refer to the lesson titled Sales Tax Overview- Suggested steps. Note that Sales tax jurisdictions will not be used in this lab. Review the tax calculation by clicking Inquiry and then clicking Sales tax totals. It is not necessary to post the invoice.

Step by Step

Set up Blue Yonder Airlines as a vendor: 1. On the Navigation Pane, click Accounts payable, click Vendors, then click All vendors. 2. Click the New - Vendor button on the action pane. In CEU, the next available vendor number is assigned automatically based on setups in the sample data. 3. In the Name field, enter Blue Yonder Airlines. 4. In the Search name field, enter Blue Yonder. 5. In the Group field, click the arrow to select 10. 6. Click the Address FastTab, and click the Add button to create a new address. 7. In the Name and description field enter Primary. 8. In the Country/region field select USA from the drop down list. 9. In the Zip code field, enter 72205. 10. Verify that the tab entries are correct. These values were populated automatically based on setups in the sample data. Click the OK button and close the window. 11. Click the Payment FastTab. 12. In the Terms of payment field, use the arrow to select N030. 13. In the Method of payment field, use the arrow to select USAUSD_CHK. 14. Close the window.

5-49

Financials I in Microsoft Dynamics AX 2012

Set up the Arkansas Department of Revenue as a vendor: 1. On the Navigation Pane, click Accounts payable, click Vendors, then click All vendors. 2. Click the New - Vendor button on the action pane. In CEU, the next available vendor number is assigned automatically based on setups in the sample data 3. In the Name field, enter The Arkansas Department of Revenue. 4. In the Search name field, enter AR tax. 5. In the Group field, click the arrow to select 70. 6. Click the Payment FastTab. 7. In the Terms of payment field, use the arrow to select M15. 8. In the Method of payment field, use the arrow to select USAUSD_CHK. 9. Close the Vendor form. Set up accounts in the Chart of accounts account for sales tax payable: 1. On the Navigation Pane, click General ledger, click Common, then click Main accounts. 2. Click the New - Main account button on the Action Pane. 3. In the Main account field, enter 220107. 4. In the Name field, enter Arkansas state sales tax payable. 5. In the Main account type field, click the arrow to select Balance sheet. 6. Click the Setup FastTab. 7. In the Posting type field, click the arrow to select Sales tax. 8. Repeat steps 2 through 8, adding an account 220245 for Little Rock city sales tax payable. 9. Close the Main accounts form. Set up ledger posting groups: 1. On the Navigation Pane, click General ledger, click Setup, click Sales tax, then click Ledger posting groups. 2. Click the New button to add a line. 3. In the Ledger posting group field, enter ARST. 4. In the Description field, enter Arkansas State Tax. 5. In the Sales tax payable field, click the arrow to select account 220107. 6. In the Settlement account field, click the arrow to select account 220107. 7. Repeat steps 2 through 6, adding a ledger posting group for Little Rock. 8. Close the Account group form.

5-50

Chapter 5: Sales Tax Setup

Set up a sales tax authority for Arkansas: 1. On the Navigation Pane, click General ledger, click Setup, click Sales tax, then click Sales tax authorities. 2. Click the New button to add a new line. 3. In the Authority field, enter ARA. 4. In the Name field, enter Arkansas Authorities. 5. In the Vendor account field, click the arrow to select The Arkansas Department of Revenue. 6. In the Report layout field, click the arrow to select U.S. report layout. 7. In the Rounding form field, click the arrow to select Normal. 8. In the Round-off field, enter .01. 9. Close the Authority form. Set up a sales tax settlement periods: 1. On the Navigation Pane, click General ledger, click Setup, click Sales tax, then click Sales tax settlement periods. 2. Click the New button to insert a line. 3. In the Settlement period field, enter AR. 4. In the Description field, enter Arkansas Monthly. 5. In the Authority field, click the arrow to select ARA-Arkansas Authority. 6. In the Terms of payment field, use the arrow to select M15. 7. In the Period interval field, use the arrow to select Months. 8. In the Number of units field, enter 1. 9. Click the Periods FastTab. 10. If a new line is not available, press the Add button to add a line. 11. In the From date field, enter 06/01/2011. 12. In the To date field, enter 06/30/2011. 13. Click the Add button two more times to create two additional months. 14. Close the Sales tax settlement periods form. Set up sales tax codes and sales tax code intervals for Arkansas and Little Rock: 1. On the Navigation Pane, click General ledger, click Setup, click Sales tax, then click Sales tax codes. 2. Click the New button to add a line. 3. In the Sales tax code field, enter ALL_ARST. 4. In the Name field, enter Arkansas State - All. 5. In the Settlement period field, click the arrow to select AR. 6. In the Ledger posting group field, click the arrow to select ARST. 7. Click the Values button on the menu bar.

5-51

Financials I in Microsoft Dynamics AX 2012

8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. In the Minimum limit field, enter 0.00. In the Upper limit field, enter 0.00. In the Value field, enter 2.00 for the percentage. Close the Values form. Repeat steps 2 through 6 for Little Rock and enter ALL_LRCITY. Click the Values button. In the Minimum limit field, enter 0.00. In the Upper limit field, enter 0.00. In the Value field, enter 3.00 for the percentage. Close the Values form. Click the Limits button. In the Minimum sales tax field, enter 0.00 In the Maximum sales tax field, enter 1000.00 Close the Limits form. Close the Sales tax codes form.

Set up a sales tax group: 1. On the Navigation Pane, click General ledger, click Setup, click Sales tax, then click Sales tax groups. 2. Click the New button to add a line. 3. In the Sales tax group field, enter ARLRA. 4. In the Description field, enter Arkansas and Little Rock. 5. In the Sales tax group setup field, select Sales tax codes. 6. In the Rounding by field, select Sales tax codes. 7. Click the Setup FastTab and click the Add button. 8. In the Sales tax code field, select ALL_ARST. 9. Click the Add button to add a line. 10. In the Sales tax code field, select ALL_LRCITY. 11. Close the Sales tax group form. 12. On the Navigation Pane, click General ledger, click Setup, click Sales tax, and then click Item sales tax groups. 13. In the left hand Navigation pane, click the ALL line. 14. Click the Setup FastTab. 15. Click the Add button to add a line. 16. In the Sales tax code field, use the arrow to select ALL_ARST. 17. Click the Add button to add a line. 18. In the Sales tax code field, use the arrow to select ALL_LRCITY. 19. Close the form.

5-52

Chapter 5: Sales Tax Setup

Record the invoice in an accounts payable invoice journal: 1. Click Accounts payable from the Navigation pane, click Journals, click Invoices, and click Invoice journal. 2. Click the New button to add a line. 3. Select the APInv in the Name field. 4. Click the Setup tab, and make sure that the Amount include sales tax check box is not selected. 5. Click the Lines button. 6. Enter 06/30/2011 in the Date field. Accept the Voucher number and Vendor Account type. 7. Select Blue Yonder Airlines in the Account field. 8. In the Invoice field, enter COMPLAB. 9. Enter 50,000 in the Credit field. 10. Enter 618900 in the Offset account field. 11. In the Sales tax group field, select ARLRA. 12. In the Item sales tax group field, select ALL. 13. Click the Inquiries button, then click Sales tax totals. Verify the correct calculation of sales tax: a. For Arkansas, two percent of 50,000 is 1,000. b. For Little Rock, three percent of 50,000 is 1,500; however, the maximum tax should be 1,000. c. Total tax should be 2,000. 14. Close all forms.

5-53

Financials I in Microsoft Dynamics AX 2012

Lab 5.7 - Including Sales Tax in Journal Amounts

During this lab you will set up sales tax in journal amounts. Scenario Ken is the Controller for Contoso. He wants to include sales taxes in journal amounts to make it easier to create journal entries. Ken requests your assistance. For example, suppose the sales tax is ten percent and the total invoice amount is 110.00 USD. If it is specified that the journal amount includes sales tax, the net amount is 100.00 USD (110.00/1.10), and the sales tax amount is 10.00 USD. NOTE: The labs in this chapter must be completed in order as they are dependent on the previous lab.

Challenge Yourself!