Tax Calculator 2012-13

Diunggah oleh

arijit_ghosh_18Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tax Calculator 2012-13

Diunggah oleh

arijit_ghosh_18Hak Cipta:

Format Tersedia

tax clculator

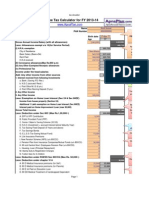

Income Tax Calculator for FY 2012-13

www.ApnaPlan.com

Birth date

Age 7-Oct-81 31

Gross Annual Income/Salary (with all allowances) Less: Allowances exempt u/s 10(for Service Period)

(I) H.R.A. exemption City of Residence Basic Salary (Basic+DA) Rent Paid H.R.A received (II) Conveyance allowances(Max Rs.800/-p.m) (iii) Any Other Exempted Receipts/ allowances (iv) Professional Tax

1,272,972 191,862

M

383,724 231,000 191,862 0 0 0

191,862 192,628 191,862 0 0 0 0

Income under the head salaries Add: Any other income from other sources

1. Interest received from following Investments a. Bank ( Saving /FD /Rec ) b. N.S.C.(accrued/ Recd ) c. Post Ofice M.I.S (6 yrs.) d. Post Office Recring Deposit (5 yrs.) e. Term Deposit (1 to 5 yrs.) f. Saving Bonds (6yrs.) g. Kishan Vikas patra 2. Any Other Income 3. Any Other Income

Income from house property

Less: Interest paid on housing loan(max150,000)

0 0 0 0 0 0 0 0 0 0 148,993 100,000 41,861 20,379 0 0 61,336 0 0 0 0 0 0 0

Gross Total Income Less: Deduction under Sec 80C (Max Rs.1,00,000/-)

a. PF&VPF Contribution b. Life Insurance premiums c. PPF a/c Contribution d. N.S.C (Investment +accrued Int first five year) e. Housing. Loan (Principal Repayment ) f. Tuition fees for 2 children g. E.L.S.S(Mutual Fund) h. Tax Savings Bonds I. FD (5 Years and above) j. 80 ccc Pension Plan

Less: Deduction under chapter VI A

b. 80 D Medical Insurance premiums (for Self ) Page 1

tax clculator C. 80 D Medical Insurance premiums (for Parents) d. 80 E Int Paid on Education Loan e. 80G Donation to approved fund f. Any other

0 18,000 0 0

Total Income

Total Tax Payable Add; Edn Cess @ 3%

Net Tax Payable

Tax to Total Income Ratio

Page 2

tax clculator

1,272,972 -191,862

1,081,110 0

-148,993 932,117 -100,000

-18,000

Page 3

tax clculator

814,117 92,823 2,785

95,608

8%

Page 4

Top 10 Tax-saving Instruments for Investors! Let me share with you a small personal tryst with investment in Equity-linked Savings Scheme (ELSS) for tax-saving purposes. towards direct equity investments rather than going through the mutual

However, in order to stifle my taxable income, I had to invest Rs. 30,000 in an ELSS scheme way back in Feb-2008. The Ind Sensex hovering around 16000 levels.

The time ticked by and it was Feb-2009 on the calendar. It was time to invest another Rs. 30,000 to save on taxes. The Sensex the trough of the bear market. Needless to say, there was panic written all o

Top 10 Tax saving Instruments for Investors!

Fortunately, for me, this period turned out to be a golden opportunity to average my previous lump-sump investment which we 60,000 investments now stood correlated with Sensex 12000 lev

But, you might not be lucky enough to get such averaging opportunities just around the end of every financial year. Your lumpyour investments are made arbitrarily during the year-end. They need to be planned well in LESSONS:

Plan your tax-saving instruments dont leave it for the last ho Even tax-saving investments can be routed through systematic Most of the tax-saving investments are for minimum of 3 yea Determine which investment option to save taxes suits you the Investments with mere intention of saving taxes might backfire o

ents for Investors! for tax-saving purposes. Since I track stock markets closely, my preference is usually tilted going through the mutual fund route.

ack in Feb-2008. The Indian markets were in the midst of a severe bear phase then, with 16000 levels.

ve on taxes. The Sensex was quoting at paltry 8000 levels on hindsight, it turned out to be re was panic written all over the screen.

ents for Investors!

mp investment which went in at higher levels of market. The average value of my total Rs. ed with Sensex 12000 levels.

inancial year. Your lump-sump investments may not necessarily stand you in sweet spot if eed to be planned well in advance through out the year.

ont leave it for the last hour. uted through systematic plans. are for minimum of 3 years. save taxes suits you the best. ng taxes might backfire on you.

Anda mungkin juga menyukai

- BSA1-5 PascualRaymond FinalExDokumen5 halamanBSA1-5 PascualRaymond FinalExRaymond Pascual100% (1)

- Project Report On Direct Tax (5 Heads of Income Tax)Dokumen42 halamanProject Report On Direct Tax (5 Heads of Income Tax)Sagar Zine67% (39)

- ACCT550 Exercises Week 1Dokumen6 halamanACCT550 Exercises Week 1Natasha DeclanBelum ada peringkat

- Gen. Math. Periodical Exam. 2nd QuarterDokumen4 halamanGen. Math. Periodical Exam. 2nd Quarterhogmc media100% (1)

- Whistleblower's Open Letter To CanadiansDokumen2 halamanWhistleblower's Open Letter To CanadiansAndrew Frank90% (10)

- Are Your Savings Flying Away?Dokumen20 halamanAre Your Savings Flying Away?livin2dieBelum ada peringkat

- Income Tax Calculator FY 2012 13Dokumen4 halamanIncome Tax Calculator FY 2012 13raattaiBelum ada peringkat

- Income Tax Calculator FY 2013 14Dokumen4 halamanIncome Tax Calculator FY 2013 14faiza17Belum ada peringkat

- Tax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeDokumen14 halamanTax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeRohitBelum ada peringkat

- Dsop Fund-Post Budget Analysis - 21 Feb 2021Dokumen4 halamanDsop Fund-Post Budget Analysis - 21 Feb 2021Sandeep SinghBelum ada peringkat

- 10 Things To Do Before March 31..... !!!Dokumen3 halaman10 Things To Do Before March 31..... !!!naveen1yanamBelum ada peringkat

- Some Terms in Income Tax ClarifiedDokumen9 halamanSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9Belum ada peringkat

- Individual Taxation (Ay 2019-20)Dokumen29 halamanIndividual Taxation (Ay 2019-20)Mudit SinghBelum ada peringkat

- Know How Your Spending Are Traced by Income Tax DeptDokumen2 halamanKnow How Your Spending Are Traced by Income Tax DeptAlagar Samy ABelum ada peringkat

- Individual Txation FY 203 24Dokumen44 halamanIndividual Txation FY 203 24Smarty ShivamBelum ada peringkat

- Income Tax Consultants in HyderabadDokumen51 halamanIncome Tax Consultants in Hyderabadav consaltansBelum ada peringkat

- Self Employed: TRN Requirements For Sole ProprietorsDokumen14 halamanSelf Employed: TRN Requirements For Sole ProprietorsAnonymous imWQ1y63Belum ada peringkat

- The Payments That You Make To Your PF Are Counted Towards Sec 80CDokumen4 halamanThe Payments That You Make To Your PF Are Counted Towards Sec 80CManu VermaBelum ada peringkat

- Presentation On: Important Tools of Investments and Operations of Share MarketDokumen36 halamanPresentation On: Important Tools of Investments and Operations of Share MarketSheetal Kumar VermaBelum ada peringkat

- Make Investments: Save On Income TaxDokumen30 halamanMake Investments: Save On Income TaxMelinda BartleyBelum ada peringkat

- Saving Income Tax - Understanding Section 80C DeductionsDokumen6 halamanSaving Income Tax - Understanding Section 80C DeductionsAbhishek JainBelum ada peringkat

- Tax Planning For Year 2010Dokumen24 halamanTax Planning For Year 2010Mehak BhargavaBelum ada peringkat

- Individual Txation FY 2019 20 With Demo of Return FilingDokumen73 halamanIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PBelum ada peringkat

- Income Tax in IndiaDokumen19 halamanIncome Tax in IndiaConcepts TreeBelum ada peringkat

- TDS (Tax Deducted at Source) : ST STDokumen6 halamanTDS (Tax Deducted at Source) : ST STRuchiRangariBelum ada peringkat

- Income Tax Deductions From SalaryDokumen34 halamanIncome Tax Deductions From SalaryPaymaster Services100% (2)

- How To Calculate Income TaxDokumen4 halamanHow To Calculate Income TaxreemaBelum ada peringkat

- Taxation Flow PresentationDokumen73 halamanTaxation Flow PresentationMohan ChoudharyBelum ada peringkat

- 10 Easy Steps To Tax FilingDokumen8 halaman10 Easy Steps To Tax FilingChandan VirmaniBelum ada peringkat

- Pay Less Tax,: Ways To LegallyDokumen1 halamanPay Less Tax,: Ways To LegallyGauravBelum ada peringkat

- Income From Other SourcesDokumen6 halamanIncome From Other Sourcesanusaya1988Belum ada peringkat

- Taxation ProjectDokumen83 halamanTaxation ProjectManish JaiswalBelum ada peringkat

- Tax Saving StepsDokumen10 halamanTax Saving StepsDheeraj SethBelum ada peringkat

- Avoidance & EvasionDokumen34 halamanAvoidance & EvasionHarshita RanjanBelum ada peringkat

- Exercise Adjusting The AccountDokumen4 halamanExercise Adjusting The Accountukandi rukmanaBelum ada peringkat

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Dokumen5 halamanTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaBelum ada peringkat

- Quiz 2Dokumen24 halamanQuiz 2Lee TeukBelum ada peringkat

- Case 7-1 Lands' End: Muhamad Fitri Bin Shahiran 826315 FRSA (A201) Dr. Syed Mohd Na'ImDokumen6 halamanCase 7-1 Lands' End: Muhamad Fitri Bin Shahiran 826315 FRSA (A201) Dr. Syed Mohd Na'ImfitriBelum ada peringkat

- Auto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesDokumen6 halamanAuto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesashutoshbinduBelum ada peringkat

- Investment Declaration Form F.Y. 2016-17Dokumen2 halamanInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Investments For Section 80CDokumen17 halamanInvestments For Section 80CAsħîŞĥLøÝåBelum ada peringkat

- Tax PlanningDokumen7 halamanTax PlanningJyoti SinghBelum ada peringkat

- 5.income Tax On Salaries-Ppt5Dokumen9 halaman5.income Tax On Salaries-Ppt5Priyaprasad PandaBelum ada peringkat

- Presumptive Taxation For Business and ProfessionDokumen17 halamanPresumptive Taxation For Business and ProfessionRupeshBelum ada peringkat

- Saving Income Tax - Understanding Section 80C DeductionsDokumen4 halamanSaving Income Tax - Understanding Section 80C DeductionsArun SinghBelum ada peringkat

- Tax Planning and ManagementDokumen4 halamanTax Planning and ManagementPravina SantoshBelum ada peringkat

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Dokumen28 halamanModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyBelum ada peringkat

- ELSS - Ways To Efficient Tax SavingsDokumen4 halamanELSS - Ways To Efficient Tax SavingsDhiraj KhatriBelum ada peringkat

- Assessment 1 - Written or Oral QuestionsDokumen7 halamanAssessment 1 - Written or Oral Questionswilson garzonBelum ada peringkat

- The Financial Kaleidoscope - Feb 2021 (Eng)Dokumen9 halamanThe Financial Kaleidoscope - Feb 2021 (Eng)MdBelum ada peringkat

- Deepanshu FileDokumen54 halamanDeepanshu FileMayankRohillaBelum ada peringkat

- 8 SMART Ways To Lower Your Tax LiabilityDokumen6 halaman8 SMART Ways To Lower Your Tax LiabilityansplanetBelum ada peringkat

- Comprehensive Guide For Income Tax Returns FY 20-21Dokumen34 halamanComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Choice of Accounting SystemDokumen4 halamanChoice of Accounting SystemAnkush At Shiv ShaktiBelum ada peringkat

- FAQ S On Income Tax 2022-23Dokumen4 halamanFAQ S On Income Tax 2022-23Ranjan SatapathyBelum ada peringkat

- Analysis of Tax05Dokumen19 halamanAnalysis of Tax05kharemixBelum ada peringkat

- How Is TDS Calculated?: Section 80C Section 80D of The Income Tax Act, 1961Dokumen1 halamanHow Is TDS Calculated?: Section 80C Section 80D of The Income Tax Act, 1961Ganesh YadavBelum ada peringkat

- Rizza-Acsat Income TaxationDokumen6 halamanRizza-Acsat Income TaxationRizza CasipongBelum ada peringkat

- 7th Term - Legal Frameworks of ConstructionDokumen79 halaman7th Term - Legal Frameworks of ConstructionShreedharBelum ada peringkat

- HDFC TaxSaver Leaflet Aug 2014Dokumen2 halamanHDFC TaxSaver Leaflet Aug 2014bollasudarshanBelum ada peringkat

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2Dari EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2Belum ada peringkat

- Program Layout - CMI2021Dokumen10 halamanProgram Layout - CMI2021arijit_ghosh_18Belum ada peringkat

- MAKALDokumen2 halamanMAKALarijit_ghosh_18Belum ada peringkat

- IntroductionToPLC DCS ApplicationIIIBrochureDokumen2 halamanIntroductionToPLC DCS ApplicationIIIBrochurearijit_ghosh_18Belum ada peringkat

- Vladimir Cherkassky IJCNN05Dokumen40 halamanVladimir Cherkassky IJCNN05arijit_ghosh_18Belum ada peringkat

- A Survey On Optical Character Recognition For Bangla and Devanagari ScriptsDokumen36 halamanA Survey On Optical Character Recognition For Bangla and Devanagari Scriptsarijit_ghosh_18Belum ada peringkat

- IntroductionToPLC DCS ApplicationIIIBrochureDokumen2 halamanIntroductionToPLC DCS ApplicationIIIBrochurearijit_ghosh_18Belum ada peringkat

- Particle Swarm OptimizationDokumen54 halamanParticle Swarm Optimizationarijit_ghosh_18Belum ada peringkat

- TCS34725 Color Sensor User ManualDokumen16 halamanTCS34725 Color Sensor User Manualarijit_ghosh_18Belum ada peringkat

- Geffcm Gefem: Approximate Clustering in Very Large Object DataDokumen32 halamanGeffcm Gefem: Approximate Clustering in Very Large Object Dataarijit_ghosh_18Belum ada peringkat

- Rohm ML8511 00FCZ05B Datasheet PDFDokumen8 halamanRohm ML8511 00FCZ05B Datasheet PDFarijit_ghosh_18Belum ada peringkat

- Adafruit TCS34725 Library Documentation: Release 1.0Dokumen23 halamanAdafruit TCS34725 Library Documentation: Release 1.0arijit_ghosh_18Belum ada peringkat

- Wireless Sensor Networks:: Network Architectures, Protocols and ApplicationsDokumen2 halamanWireless Sensor Networks:: Network Architectures, Protocols and Applicationsarijit_ghosh_18Belum ada peringkat

- Coral Reef Packages - LakshadweepDokumen31 halamanCoral Reef Packages - Lakshadweeparijit_ghosh_18Belum ada peringkat

- Application For Package Tour To Lakshadweep: Please Submit in Word FormatDokumen2 halamanApplication For Package Tour To Lakshadweep: Please Submit in Word Formatarijit_ghosh_18Belum ada peringkat

- Fuzz IeeeDokumen47 halamanFuzz Ieeearijit_ghosh_18Belum ada peringkat

- MOODLE Workshop AssignmentDokumen2 halamanMOODLE Workshop Assignmentarijit_ghosh_18Belum ada peringkat

- Military Subjects/Knowledge 11 General OrdersDokumen2 halamanMilitary Subjects/Knowledge 11 General Ordersnicole3esmendaBelum ada peringkat

- IHub's Memorandum in Opposition To COR's Motion To Compel ProductionDokumen73 halamanIHub's Memorandum in Opposition To COR's Motion To Compel ProductionjaniceshellBelum ada peringkat

- SGArrivalCard 110820231101Dokumen12 halamanSGArrivalCard 110820231101GPDI OIKUMENE MANADOBelum ada peringkat

- Chironji Guthli E-Tender Condition 2015 & 2016 - 20161025 - 044915Dokumen36 halamanChironji Guthli E-Tender Condition 2015 & 2016 - 20161025 - 044915Lucky ChopraBelum ada peringkat

- CarlDokumen20 halamanCarlAnton NaingBelum ada peringkat

- Letter Request To Conduct Survey-JanuaryDokumen2 halamanLetter Request To Conduct Survey-JanuaryJohnNicoRamosLuceroBelum ada peringkat

- Illustration 1: Trial Balance As On 31' March 2015 Rs. Credit RsDokumen3 halamanIllustration 1: Trial Balance As On 31' March 2015 Rs. Credit RsDrpranav SaraswatBelum ada peringkat

- 03 10-3 Acquiring New LandsDokumen11 halaman03 10-3 Acquiring New Landsapi-203319377Belum ada peringkat

- KeyLessons From BibleDokumen345 halamanKeyLessons From BibleEmmanuel KaluriBelum ada peringkat

- OMKAR OPTICALS (ZEISS) - 1346-12 Dec 23Dokumen1 halamanOMKAR OPTICALS (ZEISS) - 1346-12 Dec 23akansha16.kumariBelum ada peringkat

- Saraswat Co-Oprative Bank FINALDokumen45 halamanSaraswat Co-Oprative Bank FINALVivek Rabadia100% (1)

- Shweta Tech RecruiterDokumen2 halamanShweta Tech RecruiterGuar GumBelum ada peringkat

- Police Patrol Is One of The Most Important Tasks eDokumen4 halamanPolice Patrol Is One of The Most Important Tasks emary magadiaBelum ada peringkat

- Hebrews: Josh JamesDokumen19 halamanHebrews: Josh Jamesjosh3929Belum ada peringkat

- 1629 Criminal LawDokumen22 halaman1629 Criminal LawprdyumnBelum ada peringkat

- Usage of Word SalafDokumen33 halamanUsage of Word Salafnone0099Belum ada peringkat

- Assign Law of MotionDokumen2 halamanAssign Law of MotionRodesa Delos SantosBelum ada peringkat

- Freest Patricks Day Literacy and Math Prin TablesDokumen14 halamanFreest Patricks Day Literacy and Math Prin Tablesبوابة اقرأBelum ada peringkat

- Jref - Mastertile 333Dokumen2 halamanJref - Mastertile 333Manal AlhuniediBelum ada peringkat

- Catholicism and The Ten CommandmentsDokumen3 halamanCatholicism and The Ten Commandmentsjoshua piolino100% (1)

- APO Country Paper - S Ky - FinalDokumen17 halamanAPO Country Paper - S Ky - FinalS Ky NBCBelum ada peringkat

- Ughurs in ChinaDokumen8 halamanUghurs in ChinaLeland MurtiffBelum ada peringkat

- Case Facts Ratio and Doctrine: Expert EvidenceDokumen7 halamanCase Facts Ratio and Doctrine: Expert EvidencePao InfanteBelum ada peringkat

- MH CET Law 3 Year LLB Previous Year Question PaperDokumen22 halamanMH CET Law 3 Year LLB Previous Year Question PaperAniket Nsc0025Belum ada peringkat

- Bid Opening and EvaluationDokumen64 halamanBid Opening and EvaluationDavid Sabai100% (3)

- Chapter 2a-Water and The Aqueous EnvironmentDokumen42 halamanChapter 2a-Water and The Aqueous EnvironmentAra Jean AgapitoBelum ada peringkat

- 2021 Fourth Quarter Non-Life Industry ReportDokumen62 halaman2021 Fourth Quarter Non-Life Industry ReportPropensity MuyamboBelum ada peringkat