Unified Chart of Accounts Guide for Nonprofits

Diunggah oleh

mcmonizDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Unified Chart of Accounts Guide for Nonprofits

Diunggah oleh

mcmonizHak Cipta:

Format Tersedia

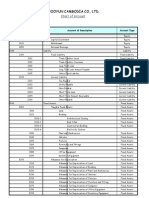

CHART OF ACCOUNTS

This is important link for Unified Chart of Accounts that is opensource for Nonprofit organizations and coincides with changes in the 990s.

UNIFIED CHART OF ACCOUNTS (UCOA)

The National Center for Charitable Statistics (NCCS) in conjunction with the Support Center of Washington, the California Association of Nonprofits (CAN), CompassPoint Nonprofit Services and the California Society of CPAs have developed a Unified Chart of Accounts (UCOA) for nonprofits. The UCOA is designed so that nonprofits can easily translate their financial reports into the categories required on IRS Form 990. The following link allows you to view the accounts and keywords, as well as freely download the UCOA in either a MS Excel spreadsheet or MS Access database.

http://www.mncn.org/info/template_fin.htm

Each accounting system has both a numbered and a label for each account that you establish. It is important to set up your accounts so that they match your budget in order to compare your budget projections with actual expenses. In QuickBooks for Non-Profits there are accounts and classes. Think of the difference between rows and columns in a spreadsheet. Rows are your accounts and classes are your columns. A program based budget will use columns for each program and it is useful to use classes within your accounting system so your financial system can provide you management information. Accounts are the line items for your revenue and expenses. Subaccounts can be set up to track smaller expenses such as plane fare, food, and parking within an account called Travel. Another example would be an account for Insurance with subaccounts for Directors and Officers, General Liability and Auto Insurance. Classes and subclasses are for your programs. All nonprofits must track Administration and Fundraising so these would each be a class. Other programs and not projects would be your major services organized or clustered into two to five categories. Subclasses are projects or funded activities that you want to account for separately. So a program might be Family Services and a subclass might be the Fathering project. The following page contains a sample list for a chart of accounts. If you are using an accounting software this should be easy to set up.

Sample Chart of Accounts for Nonprofit Statement of Financial Position Assets Financial Statement Titles Account Titles Cash and Cash Equivalents Operating checking Savings/Money Market Savings: Restricted grants Receivables Program svc fees receivable: clients/tenants/etc Program svc fees receivable: government contracts Payroll advances Grants receivable Allowance for uncollectible receivables Prepaid Expenses Prepaid insurance Investments Mutual fund #1 Common stock Property, Furniture & Equipment Land Buildings Building improvements Furniture Equipment Software Accumulated depreciation Notes Receivable Note receivable #1 Note receivable #2 Note receivable #3 Other Assets Rent deposit Liabilities Accounts Payable Accounts payable Payroll, Payroll Taxes 2000 Account Numbers 1000 1010 1020 1100 1110 1120 1130 1190 1200 1300 1310

1300 1310 1320 1330 1340 1350 1390 1410 1420 1430 1900

Payroll payable & Withholding FICA & Hosp. payable Fed. W/H payable State W/H payable Accrued fees Accrued interest Accrued vacation Deferred revenue Current portion of long-term debt Refundable advances Long-Term Liabilities Notes payable Capital lease Mortgage payable Net Assets Unrestricted net assets Temporarily restricted net assets Permanently restricted net assets Statement of Unrestricted Activities Revenue & Support Contributions Contributions individuals Contributions foundations Contributions corporations Grants government Transfers to/from temp. restricted fund In-kind contributions

2100 2110 2120 2130 2200 2210 2300 2310 2320 2330 2400 2410 2420 3000 3100 3200

Accrued Expenses Other Current Liabilities

4000 4100 4200 4300 4400

In-kind contributions goods 4500 In-kind contributions 4600 services Program service fees Program service fees Special events Special event #1 net Special event #2 net Investment income Dividends and interest 5600 5400 5410 4700

Realized gain/loss on sale Other revenue & support Miscellaneous revenue Miscellaneous support Expenses Salaries & wages Salaries & wages Payroll taxes FICA & Medicare State unemployment Benefits Health insurance Dental insurance Workers compensation insurance Retirement contribution Accounting/bookkeeping Auditing Bank fees Books & publications Depreciation Dues & subscriptions Equipment lease In-kind expense goods In-kind expense services Insurance Interest IT support Legal fees Licenses and fees Miscellaneous Office supplies Postage Printing Rent Repair & maintenance Staff training Telephone Travel & mileage Utilities

5610 5900 5910

6000 6100 6110 6120 6130 6140 6150 7000 7010 7020 7030 7040 7050 7060 7070 7080 7090 7100 7110 7120 7130 7140 7150 7160 7170 7180 7190 7200 7210 7220 7230

Accounting/bookkeeping Auditing Miscellaneous Books & publications Depreciation Dues & subscriptions Equipment lease Donated goods Donated services Insurance Interest IT support Legal fees Licenses and fees Miscellaneous Office supplies Postage Printing Rent Repair & maintenance Staff training Telephone Travel & mileage Utilities

Model Accounting and Financial Policies and Procedures Handbook For Not-for-Profit Organizations by Edward Mc Millan ASAE Financial Management Series

Anda mungkin juga menyukai

- Hot Shot Trucking Business PlanDokumen39 halamanHot Shot Trucking Business PlanJoseph QuillBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementDharmaMaya ChandrahasBelum ada peringkat

- Worksheet in Chart AccountDokumen3 halamanWorksheet in Chart AccountthorseiratyBelum ada peringkat

- Team Fundraising HandbookDokumen10 halamanTeam Fundraising HandbookOum OumBelum ada peringkat

- Printable Flash CardsDokumen96 halamanPrintable Flash CardsSnehil SinghBelum ada peringkat

- How To Write A Winning Grant ProposalDokumen12 halamanHow To Write A Winning Grant Proposalqueztlurv100% (1)

- Nonprofit PDFDokumen3 halamanNonprofit PDFrengkujeffry5323Belum ada peringkat

- TaskForce FinalReport 1-8-24Dokumen22 halamanTaskForce FinalReport 1-8-24Robert GarciaBelum ada peringkat

- Excel VBA CodeDokumen6 halamanExcel VBA CodemcmonizBelum ada peringkat

- Veterans Resource CatalogDokumen139 halamanVeterans Resource Catalogthedoefund100% (1)

- Nonprofit AccountingDokumen10 halamanNonprofit AccountingRoschelle MiguelBelum ada peringkat

- Grantsat: Grant Proposal Self Assessment ToolDokumen19 halamanGrantsat: Grant Proposal Self Assessment ToolElmina MušinovićBelum ada peringkat

- Laura Bush Foundation Grant Application Part I: Contact Information & AgreementsDokumen9 halamanLaura Bush Foundation Grant Application Part I: Contact Information & AgreementsKelly TaylorBelum ada peringkat

- Harm Reduction Grant AnnouncementDokumen11 halamanHarm Reduction Grant AnnouncementLeslie RubinBelum ada peringkat

- Cycle 27 Application EditableDokumen9 halamanCycle 27 Application EditableMarcus AttheCenter FlenaughBelum ada peringkat

- Home Budget Worksheet by Vertex42Dokumen3 halamanHome Budget Worksheet by Vertex42davidjc77Belum ada peringkat

- Example - Letter of Inquiry (Paper)Dokumen2 halamanExample - Letter of Inquiry (Paper)Sandie Barrie100% (2)

- Doc-Balance Sheet Cheat Sheet PDFDokumen2 halamanDoc-Balance Sheet Cheat Sheet PDFConnor McloudBelum ada peringkat

- Revenue Cycle Management Comprehensive Solutions - 0Dokumen4 halamanRevenue Cycle Management Comprehensive Solutions - 0avinashn1984Belum ada peringkat

- Ey Certificate in Financial Modelling and ValuationDokumen8 halamanEy Certificate in Financial Modelling and ValuationThanh Nguyen100% (1)

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Dokumen686 halamanXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiBelum ada peringkat

- Types of Charitable OrganizationsDokumen6 halamanTypes of Charitable OrganizationsБегимай Нурланбекова МНКОBelum ada peringkat

- ANANDA Grant ProposalDokumen6 halamanANANDA Grant Proposal9578326917 9578326917Belum ada peringkat

- Myob - Chart of AccountsDokumen4 halamanMyob - Chart of AccountsAr RaziBelum ada peringkat

- Franklin (MA) Food Pantry ApplicationDokumen4 halamanFranklin (MA) Food Pantry ApplicationFranklinFoodPantryBelum ada peringkat

- Risk ManagementDokumen15 halamanRisk ManagementanupkallatBelum ada peringkat

- Chart of AccountsDokumen6 halamanChart of Accountssundar kaveetaBelum ada peringkat

- Real Time Strategic Planning Compiled DocumentDokumen17 halamanReal Time Strategic Planning Compiled DocumentSunita Bhanu PrakashBelum ada peringkat

- Event Budget For (Event Name) : EstimatedDokumen3 halamanEvent Budget For (Event Name) : Estimatedhellfire8Belum ada peringkat

- Executive Director Operations Administrations in Portland OR Resume Christina TubbDokumen3 halamanExecutive Director Operations Administrations in Portland OR Resume Christina TubbChristina Tubb100% (1)

- Mrs Terri Williams TynerDokumen3 halamanMrs Terri Williams Tynerapi-255253557Belum ada peringkat

- Barber Shop Business PlanDokumen34 halamanBarber Shop Business PlanccptripoliBelum ada peringkat

- Balance Sheet & Income StatementDokumen12 halamanBalance Sheet & Income StatementPahile Bajirao PeshaveBelum ada peringkat

- Financial Accounting11Dokumen14 halamanFinancial Accounting11AleciafyBelum ada peringkat

- Developing A Childcare Center Business Plan: 1. Cover Sheet - SummaryDokumen3 halamanDeveloping A Childcare Center Business Plan: 1. Cover Sheet - SummaryPrincess Marshalee Foster100% (1)

- Case 9 The Body Shop International PLC 2001 An Introduction To Financial ModelingDokumen10 halamanCase 9 The Body Shop International PLC 2001 An Introduction To Financial ModelingSajjad Ahmad0% (1)

- 1 Statement of Financial PositionDokumen46 halaman1 Statement of Financial Positionapi-267023512100% (1)

- Controller Finance Director Accounting in San Francisco Bay CA Resume Edwin LewisDokumen2 halamanController Finance Director Accounting in San Francisco Bay CA Resume Edwin LewisEdwinLewisBelum ada peringkat

- Office Scope of WorksDokumen2 halamanOffice Scope of WorksmcmonizBelum ada peringkat

- Drill 2 - Working Capital & Current Liabilities - ANSWERSDokumen7 halamanDrill 2 - Working Capital & Current Liabilities - ANSWERSStanly ChanBelum ada peringkat

- Military and Veterans' Benefits Observations On The Concurrent Receipt of Military Retirement and VA Disability CompensationDokumen15 halamanMilitary and Veterans' Benefits Observations On The Concurrent Receipt of Military Retirement and VA Disability CompensationpolitixBelum ada peringkat

- Introduction to Nonprofit BookkeepingDokumen47 halamanIntroduction to Nonprofit BookkeepingEdemson NavalesBelum ada peringkat

- Paralegal or Compliance or Contract Specialist or Legal AssistanDokumen2 halamanParalegal or Compliance or Contract Specialist or Legal Assistanapi-77677733Belum ada peringkat

- Grant Writing Proposal ChecklistDokumen1 halamanGrant Writing Proposal ChecklistLeslie AtkinsonBelum ada peringkat

- Accounting Basics 1Dokumen75 halamanAccounting Basics 1allangreslyBelum ada peringkat

- Nonprofit Business Plan (Revised For Conciseness)Dokumen1 halamanNonprofit Business Plan (Revised For Conciseness)Kim Sydow CampbellBelum ada peringkat

- Budget Template and Samples GuideDokumen5 halamanBudget Template and Samples GuidebelijobBelum ada peringkat

- Emergency Solutions Grant Programs ApplicationDokumen127 halamanEmergency Solutions Grant Programs ApplicationThe Anniston StarBelum ada peringkat

- Nonprofit Bugetting Final PaperDokumen12 halamanNonprofit Bugetting Final Paperapi-539553357Belum ada peringkat

- 06 Crafting A Winning Business PlanDokumen17 halaman06 Crafting A Winning Business PlanKIM ROFFELLYN EXCONDEBelum ada peringkat

- California Notary All Purpose Acknowledgment 2015Dokumen1 halamanCalifornia Notary All Purpose Acknowledgment 2015sergio musettiBelum ada peringkat

- Global Taxation Accounting Service Incrmdeh PDFDokumen7 halamanGlobal Taxation Accounting Service Incrmdeh PDFbutterfoot87Belum ada peringkat

- Sr. Corporate ParalegalDokumen3 halamanSr. Corporate Paralegalapi-77866848Belum ada peringkat

- Ngo IncomeDokumen11 halamanNgo IncomeBhuwanPandeBelum ada peringkat

- Corporate Paralegal Governance Compliance in San Francisco Bay CA Resume Susan Chow-MalgioglioDokumen3 halamanCorporate Paralegal Governance Compliance in San Francisco Bay CA Resume Susan Chow-MalgioglioSusanChowMalgioglioBelum ada peringkat

- Q111VC Fundraising Release FINAL-RevDokumen3 halamanQ111VC Fundraising Release FINAL-RevbmyeungBelum ada peringkat

- Starting A Halfway House or Transitional Housing FacilityDokumen1 halamanStarting A Halfway House or Transitional Housing FacilityJoe DBelum ada peringkat

- 04/26/2013: Meeting of The Directors of The New York State Urban Development Corporation D/b/a Empire State Development (New York, NY) 9:30 A.M.Dokumen188 halaman04/26/2013: Meeting of The Directors of The New York State Urban Development Corporation D/b/a Empire State Development (New York, NY) 9:30 A.M.Empire State DevelopmentBelum ada peringkat

- Accounting Exam 2 Study GuideDokumen1 halamanAccounting Exam 2 Study GuideIvan LauBelum ada peringkat

- Federal Lawsuit Against HinsdaleDokumen15 halamanFederal Lawsuit Against HinsdaleDavid GiulianiBelum ada peringkat

- Global Client SolutionsDokumen3 halamanGlobal Client SolutionsGlobal Client SolutionsBelum ada peringkat

- Executive Assistant in Raleigh NC Resume Sandra KorbelDokumen2 halamanExecutive Assistant in Raleigh NC Resume Sandra KorbelSandraKorbelBelum ada peringkat

- Justice Management Institute ReportDokumen149 halamanJustice Management Institute ReportPublic OpinionBelum ada peringkat

- A Generic Nonprofit Articles of Incorporation Tax Exempt LanguageDokumen3 halamanA Generic Nonprofit Articles of Incorporation Tax Exempt LanguageDave McGee100% (1)

- Entrepreneurship Workbook (2 Ed) - LeggeDokumen78 halamanEntrepreneurship Workbook (2 Ed) - LeggeTroy M. FowlerBelum ada peringkat

- Letter To Notify The IRS of A Fraudulent Tax FilingDokumen1 halamanLetter To Notify The IRS of A Fraudulent Tax FilingRocketLawyerBelum ada peringkat

- Meeting Minutes BasicDokumen1 halamanMeeting Minutes Basicfaraeiin57Belum ada peringkat

- OneDrive for Business A Complete Guide - 2019 EditionDari EverandOneDrive for Business A Complete Guide - 2019 EditionBelum ada peringkat

- Independent Contractors A Complete Guide - 2020 EditionDari EverandIndependent Contractors A Complete Guide - 2020 EditionBelum ada peringkat

- Web DSS Chapter 01Dokumen12 halamanWeb DSS Chapter 01mcmonizBelum ada peringkat

- Application Procedure Mof Revised 80213Dokumen1 halamanApplication Procedure Mof Revised 80213mcmonizBelum ada peringkat

- Numbers To Words in Ms-ExcelDokumen3 halamanNumbers To Words in Ms-ExcelmcmonizBelum ada peringkat

- Anggaran Dasar BankmandiriDokumen62 halamanAnggaran Dasar BankmandirimcmonizBelum ada peringkat

- Answers To The Overall Questions of Chapter SevenDokumen3 halamanAnswers To The Overall Questions of Chapter SevenHamza MahmoudBelum ada peringkat

- ENT300 Fin Plan SpreadsheetDokumen40 halamanENT300 Fin Plan SpreadsheetSyafawani SyazyraBelum ada peringkat

- Balance Sheet PosterDokumen2 halamanBalance Sheet PosterVeronika RaichevaBelum ada peringkat

- HRM 808 Human Resource Accounting ExaminationDokumen6 halamanHRM 808 Human Resource Accounting ExaminationharshadampgdmBelum ada peringkat

- Balance Sheet of Urmul Dairy BikanerDokumen7 halamanBalance Sheet of Urmul Dairy Bikanersaragupta456Belum ada peringkat

- Depreciation and DepletionDokumen5 halamanDepreciation and DepletionMohammad Salim HossainBelum ada peringkat

- PS2 - Financial Analysis (Answers) VfinalDokumen41 halamanPS2 - Financial Analysis (Answers) VfinalAdrian MontoyaBelum ada peringkat

- IAS 16 SummaryDokumen7 halamanIAS 16 SummaryCharmaine LogaBelum ada peringkat

- LAB 5 - Materi (Consolidation Techniques - Procedures)Dokumen6 halamanLAB 5 - Materi (Consolidation Techniques - Procedures)Alvira FajriBelum ada peringkat

- FinEssence Finance PrimerDokumen16 halamanFinEssence Finance Primerdarbha91Belum ada peringkat

- Final RFP UpssclDokumen58 halamanFinal RFP Upssclbikashsingh01Belum ada peringkat

- Quiz On LeasesDokumen1 halamanQuiz On LeasesBambi 1234Belum ada peringkat

- 06 Equity InvestmentsDokumen8 halaman06 Equity InvestmentsAllegria AlamoBelum ada peringkat

- Accounting Concepts MCQsDokumen1 halamanAccounting Concepts MCQsAdil IqbalBelum ada peringkat

- Networth Statement of GuarantorDokumen2 halamanNetworth Statement of GuarantorSharif MahmudBelum ada peringkat

- Assertion Reasoning Questions: Chapter 2 - Accounting For Partnership: FundamentalsDokumen71 halamanAssertion Reasoning Questions: Chapter 2 - Accounting For Partnership: Fundamentalsabhi yadavBelum ada peringkat

- APC 403 PFRS For SMEsDokumen10 halamanAPC 403 PFRS For SMEsHazel Seguerra BicadaBelum ada peringkat

- Government Sector PolicyDokumen39 halamanGovernment Sector Policyrak999Belum ada peringkat

- Corporate Finance Assignment SolutionsDokumen6 halamanCorporate Finance Assignment SolutionsHaroon Z. ChoudhryBelum ada peringkat

- Eraa LK TW Iii 2021Dokumen172 halamanEraa LK TW Iii 2021Jhon Sudiarman SilalahiBelum ada peringkat

- Financial Statement Analysis of Dell IncDokumen62 halamanFinancial Statement Analysis of Dell IncclassicsabirBelum ada peringkat

- Accounting in Business: © 2019 Mcgraw-Hill EducationDokumen81 halamanAccounting in Business: © 2019 Mcgraw-Hill Educationkikad10038Belum ada peringkat

- Post Fin301 - Fin 301 Unit 7 QuizDokumen2 halamanPost Fin301 - Fin 301 Unit 7 Quizteacher.theacestudBelum ada peringkat