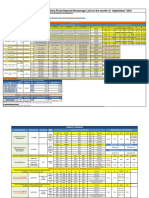

15% Increment: Lgcap/Gwt Smlcap/Gwt Smlcap/Val Govt Long

Diunggah oleh

Gallo SolarisJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

15% Increment: Lgcap/Gwt Smlcap/Gwt Smlcap/Val Govt Long

Diunggah oleh

Gallo SolarisHak Cipta:

Format Tersedia

Select four numbers: 1 to 10

Selected Assets =

Selected Allocations

Number of Years: from

Inflation =

Withdrawal Rate =

Monte Carlo Iterations =

Years

Survival Rates

SmlCap/Gwt

SmlCap/Val

50.0%

20.0%

15.0%

20

3.0%

5.00%

5000

Increment

Govt Long

15%

increasing with inflation

20

90.7%

25

86.0%

30

81.6%

35

79.4%

40

76.7%

9%

14%

18%

21%

23%

30%

Dead Portfolios

95%

LgCap/Gwt

50% LgCap/Gwt+20% SmlCap/Gwt+15% SmlCap/Val+15% Govt Long

90%

25%

Survival Rates

20%

85%

15%

80%

10%

75%

5%

0%

70%

20

25

30

35

40

45

50

55

60

65

Fill in the data inside a red box

70

20

then click on Calculate Survival Ra

See: http://www.gummy-stuff.org/risk1.htm

Note:

LgCap/Gwt SmlCap/Gwt SmlCap/Val

Returns are selected at random

from annual returns for each

asset, from year 1928 to year 2000.

50% LgCap/Gwt+20% SmlCap/Gwt+15% SmlCap/Val+15% Govt Long

45

75.6%

50

72.8%

55

71.8%

60

72.1%

65

71.6%

70

72.4%

24%

27%

28%

28%

28%

28%

Dead Portfolios

20

25

30

35

40

45

then click on Calculate Survival Rates

50

55

60

65

70

45.9%

31.2%

39.8%

-20.1%

-46.0%

-37.4%

-25.5%

-35.2%

-47.1%

-35.8%

-41.6%

-52.2%

-7.2%

-1.9%

-1.2%

44.4%

158.1%

118.1%

10.4%

33.3%

8.2%

41.8%

42.7%

51.2%

25.4%

33.1%

74.3%

-33.2%

-46.3%

-50.3%

32.6%

41.9%

26.3%

8.0%

10.9%

-2.4%

-9.2%

-0.8%

-9.4%

-12.3%

-17.1%

-4.1%

13.2%

17.6%

35.3%

21.4%

45.6%

92.0%

16.0%

39.9%

49.1%

30.8%

62.4%

75.6%

-6.7%

-12.7%

-6.9%

3.3%

-8.3%

5.5%

3.5%

-7.6%

-2.9%

22.7%

23.2%

21.6%

24.2%

30.8%

51.9%

19.7%

16.6%

11.7%

13.1%

5.6%

8.3%

2.2%

0.6%

-6.7%

50.2%

42.7%

64.2%

30.1%

17.8%

23.9%

6.7%

5.9%

7.5%

-8.9%

-14.4%

-15.4%

40.8%

76.9%

68.2%

13.2%

19.9%

18.6%

-2.7%

-1.0%

-5.8%

26.0%

21.2%

31.1%

-10.5%

-20.9%

-8.8%

21.1%

8.2%

27.2%

15.0%

10.9%

22.7%

13.6%

35.1%

41.5%

-10.9%

-5.6%

-7.6%

29.9%

79.4%

65.7%

4.1%

29.5%

45.2%

3.0%

-24.5%

-25.8%

-5.5%

-21.0%

6.3%

23.0%

22.0%

15.7%

21.9%

-0.7%

8.1%

-21.1%

-42.8%

-25.8%

-29.7%

-32.6%

-17.4%

33.8%

58.8%

57.4%

17.5%

36.9%

57.8%

-9.4%

19.2%

24.2%

7.3%

16.8%

21.8%

18.2%

50.1%

38.2%

32.7%

52.9%

22.4%

-7.6%

-12.0%

17.8%

19.9%

19.9%

40.8%

15.2%

21.3%

48.0%

-0.6%

-14.4%

7.7%

33.5%

28.4%

30.3%

14.0%

1.5%

13.3%

7.6%

-13.1%

-6.2%

11.8%

13.8%

29.6%

36.9%

18.7%

15.4%

0.6%

-18.7%

-23.6%

43.2%

53.7%

40.8%

6.8%

4.7%

35.5%

2.5%

12.4%

28.2%

2.0%

-3.9%

2.8%

37.3%

35.6%

28.7%

20.8%

13.2%

21.5%

31.7%

15.3%

38.9%

34.9%

1.3%

-8.6%

29.3%

50.4%

3.9%

-13.2%

-21.2%

-3.2%

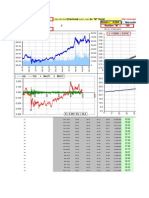

Portfolio

Calculation of

Govt Long Term Bond

Year

Returns

Max Withdrawal Rate

0.1%

35.2%

76.2%

55.6%

LgCap/Gwt

45.9%

LgCap/Val SmlCap/Gwt

23.6%

-20.1%

-4.7%

3.4%

-24.3%

1

103.7%

30.8%

20%

50% LgCap/Gwt+20% SmlCap/Gwt+15% SmlCap/Val+15% Govt Long

-25.5%

-43.7%

4.7%

-26.1%

2

144.7%

18.1%

18%

- 2000

-35.8%

-58.7%

-5.3%

-34.8%

3

228.6% 1928

12.6%

4

SmlCap/Val

5

T-bills

6

5 yr Treasury

31.2%

39.8%

3.2%

0.9%

-46.0%

-37.4%

4.7%

6.0%

-35.2%

-47.1%

2.4%

6.7%

-41.6%

-52.2%

1.1%

-2.3%

16.8%

16%

-1.6%

239.4%

10.7%

-7.2%

-7.4%

-1.9%

-1.2%

1.0%

8.8%

-0.1%

14%

10.0%

12%

5.0%

71.5%

143.7%

9.4%

44.4%

115.5%

158.1%

118.1%

0.3%

1.8%

14.6%

129.2%

8.6%

10.4%

-19.8%

33.3%

8.2%

0.2%

9.0%

37.9%

48.8%

42.7%

51.2%

0.1%

7.0%

31.6%

49.6%

33.1%

74.3%

0.2%

3.0%

10%

7.5%

41.8%

96.5%

8.1%

Maximum Withdrawal Rate

25.4%

75.5%

7.4%

0.0%

6.2%

11

6.7%

89.7%

6.1%

8.0%

-12.6%

10.9%

-2.4%

0.0%

4.5%

4%

6.1%

12

-5.3%

97.5%

5.7%

-9.2%

-1.8%

-0.8%

-9.4%

0.0%

3.0%

0.9%

2%

3.2%

0%

2.1%

13

-10.0%

111.7%

5.4%

-12.3%

-1.2%

-17.1%

-4.1%

0.0%

0.5%

14

15.9%

99.2%

5.2%

13.2%

33.6%

17.6%

35.3%

0.3%

1.9%

15

34.0%

76.3%

5.0%

21.4%

42.2%

45.6%

92.0%

0.4%

2.8%

70

26.3%

65

6.5%

41.9%

60

92.9%

26.0%

55

10

32.6%

50

1.6%

29.4%

45

0.3%

40

-50.3%

35

-46.3%

30

-39.6%

25

-33.2%

20

6.9%

15

116.8%

10

-33.4%

0.2%

8%

5.5%

6%

6.0%

2.8%

16

23.7%

63.5%

4.9%

16.0%

42.0%

39.9%

49.1%

0.3%

1.8%

10.7%

17

40.9%

46.4%

4.8%

30.8%

48.3%

62.4%

75.6%

0.3%

2.2%

-0.1%

18

-6.9%

51.4%

4.7%

-6.7%

-7.5%

-12.7%

-6.9%

0.4%

1.0%

-2.6%

19

0.4%

52.7%

4.6%

3.3%

8.4%

-8.3%

5.5%

0.5%

0.9%

3.4%

20

0.3%

54.2%

4.5%

3.5%

5.1%

-7.6%

-2.9%

0.8%

1.9%

6.4%

21

20.2%

46.4%

4.4%

22.7%

18.5%

23.2%

21.6%

1.1%

2.3%

0.1%

22

26.1%

37.9%

4.3%

24.2%

55.4%

30.8%

51.9%

1.2%

0.7%

-3.9%

23

14.3%

34.2%

4.3%

19.7%

13.8%

16.6%

11.7%

1.5%

0.4%

1.2%

24

9.1%

32.3%

4.2%

13.1%

20.2%

5.6%

8.3%

1.7%

1.6%

3.6%

25

0.8%

-7.7%

0.6%

-6.7%

1.8%

3.2%

26

44.3%

4.2%

4.1%

2.2%

7.2%

33.0%

23.5%

50.2%

77.3%

42.7%

64.2%

0.9%

2.7%

-1.3%

27

22.0%

19.9%

4.1%

30.1%

29.9%

17.8%

23.9%

1.6%

-0.7%

-5.6%

28

4.8%

19.5%

4.1%

6.7%

4.8%

5.9%

7.5%

2.5%

-0.4%

7.5%

29

-8.5%

22.0%

4.0%

-8.9%

-22.8%

-14.4%

-15.4%

3.2%

7.8%

-6.1%

30

45.1%

15.6%

4.0%

40.8%

74.6%

76.9%

68.2%

1.5%

-1.3%

-2.3%

31

13.0%

14.2%

4.0%

13.2%

14.8%

19.9%

18.6%

3.0%

-0.4%

13.8%

32

-0.3%

14.7%

4.0%

-2.7%

-7.0%

-1.0%

-5.8%

2.7%

11.8%

1.0%

33

22.0%

12.4%

4.0%

26.0%

25.3%

21.2%

31.1%

2.1%

1.9%

6.9%

34

-9.7%

14.2%

3.9%

-10.5%

-1.5%

-20.9%

-8.8%

2.7%

5.6%

1.2%

35

16.4%

12.5%

3.9%

21.1%

35.0%

8.2%

27.2%

3.1%

1.6%

3.5%

36

13.6%

11.4%

3.9%

15.0%

19.8%

10.9%

22.7%

3.5%

4.0%

0.7%

37

20.1%

9.7%

3.9%

13.6%

25.3%

35.1%

41.5%

3.9%

1.0%

3.7%

38

-7.2%

10.8%

3.9%

-10.9%

-9.0%

-5.6%

-7.6%

4.8%

4.7%

-9.2%

39

39.3%

8.0%

3.9%

29.9%

31.4%

79.4%

65.7%

4.2%

1.0%

-0.3%

40

14.7%

7.2%

3.9%

4.1%

23.6%

29.5%

45.2%

5.2%

4.5%

-5.1%

41

-8.0%

8.0%

3.8%

3.0%

-16.7%

-24.5%

-25.8%

6.6%

-0.7%

12.1%

42

-4.2%

8.6%

3.8%

-5.5%

11.2%

-21.0%

6.3%

6.5%

16.9%

13.2%

43

20.2%

7.4%

3.8%

23.0%

12.4%

22.0%

15.7%

4.4%

8.7%

5.7%

44

12.9%

6.8%

3.8%

21.9%

18.1%

-0.7%

8.1%

3.8%

5.2%

-1.1%

45

-23.1%

9.0%

3.8%

-21.1%

-0.2%

-42.8%

-25.8%

6.9%

4.6%

4.4%

46

-23.3%

12.2%

3.8%

-29.7%

-25.5%

-32.6%

-17.4%

8.0%

5.7%

9.2%

47

38.7%

9.0%

3.8%

33.8%

50.8%

58.8%

57.4%

5.8%

7.8%

16.8%

48

27.3%

7.3%

3.8%

17.5%

46.5%

36.9%

57.8%

5.1%

12.9%

-0.7%

49

2.7%

7.3%

3.7%

-9.4%

1.3%

19.2%

24.2%

5.1%

1.4%

-1.2%

50

10.1%

6.9%

3.7%

7.3%

3.6%

16.8%

21.8%

7.2%

3.5%

-1.2%

51

24.6%

5.7%

3.7%

18.2%

22.1%

50.1%

38.2%

10.4%

4.1%

-4.0%

52

29.7%

4.5%

3.7%

32.7%

15.2%

52.9%

22.4%

11.3%

1.9%

53

-3.2%

4.8%

3.7%

-7.6%

14.4%

-12.0%

17.8%

14.7%

9.4%

40.4%

54

26.1%

3.9%

3.7%

19.9%

27.4%

19.9%

40.8%

10.5%

29.1%

3.9%

0.7%

55

19.2%

3.4%

3.7%

15.2%

27.5%

21.3%

48.0%

8.8%

7.4%

15.5%

56

0.3%

3.5%

3.7%

-0.6%

17.7%

-14.4%

7.7%

9.8%

14.0%

31.0%

57

31.6%

2.7%

3.7%

33.5%

33.2%

28.4%

30.3%

7.7%

20.3%

24.5%

58

12.9%

2.5%

3.7%

14.0%

21.7%

1.5%

13.3%

6.2%

15.1%

-2.7%

59

-0.1%

2.6%

3.7%

7.6%

-2.3%

-13.1%

-6.2%

5.5%

2.9%

9.7%

60

14.6%

2.3%

3.7%

11.8%

25.1%

13.8%

29.6%

6.4%

6.1%

18.1%

61

27.2%

1.9%

3.7%

36.9%

31.2%

18.7%

15.4%

8.4%

13.3%

6.2%

62

-6.0%

2.0%

3.7%

0.6%

-13.5%

-18.7%

-23.6%

7.8%

9.7%

19.3%

63

41.3%

1.5%

3.7%

43.2%

26.8%

53.7%

40.8%

5.6%

15.3%

9.4%

64

11.1%

1.4%

3.7%

6.8%

22.1%

4.7%

35.5%

3.5%

7.2%

18.2%

65

10.7%

1.3%

3.7%

2.5%

19.7%

12.4%

28.2%

2.9%

11.2%

-7.8%

66

-0.5%

1.3%

3.7%

2.0%

-5.9%

-3.9%

2.8%

3.9%

-5.1%

31.7%

67

34.8%

1.0%

3.7%

37.3%

37.6%

35.6%

28.7%

5.6%

16.1%

-0.9%

68

16.1%

0.9%

3.7%

20.8%

13.4%

13.2%

21.5%

5.2%

2.1%

15.9%

69

27.1%

0.7%

3.7%

31.7%

31.0%

15.3%

38.9%

5.3%

8.4%

13.1%

70

18.4%

0.6%

3.7%

34.9%

18.2%

1.3%

-8.6%

4.9%

10.2%

-9.0%

71

24.0%

0.5%

3.7%

29.3%

5.4%

50.4%

3.9%

4.7%

-1.8%

21.5%

72

-8.1%

0.6%

3.7%

-13.2%

0.6%

-21.2%

-3.2%

5.9%

12.6%

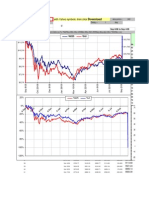

Govt Long Term Bond

S&P 500

9

TSM

10

TSE 300

0.1%

43.6%

38.7%

38.9%

3.4%

-8.4%

-14.5%

-24.9%

4.7%

-24.9%

-28.3%

-31.3%

-5.3%

-43.4%

-43.9%

-39.4%

16.8%

-8.2%

-9.8%

-18.4%

-0.1%

54.0%

57.6%

54.3%

10.0%

-1.4%

4.3%

-6.7%

5.0%

47.7%

44.0%

28.2%

7.5%

33.9%

32.3%

22.9%

0.2%

-35.0%

-34.6%

-27.5%

5.5%

31.1%

28.2%

-3.1%

6.0%

-0.4%

2.8%

2.3%

6.1%

-9.8%

-7.2%

-20.1%

0.9%

-11.6%

-9.9%

-7.5%

3.2%

20.3%

15.9%

17.7%

2.1%

25.9%

28.4%

12.1%

2.8%

19.7%

21.3%

12.0%

10.7%

36.4%

38.0%

44.5%

-0.1%

-8.1%

-5.9%

-6.1%

-2.6%

5.7%

3.6%

-6.4%

3.4%

5.5%

2.2%

5.9%

6.4%

18.8%

20.3%

15.7%

57.8%

0.1%

31.7%

29.4%

-3.9%

24.0%

20.8%

4.8%

1.2%

18.4%

13.5%

-4.1%

3.6%

-1.0%

0.6%

-7.4%

7.2%

52.6%

50.1%

38.3%

-1.3%

31.5%

25.2%

19.1%

-5.6%

6.6%

8.3%

11.7%

7.5%

-10.8%

-10.3%

-17.9%

-6.1%

43.4%

45.0%

29.6%

-2.3%

12.0%

13.1%

-2.8%

13.8%

0.5%

0.8%

12.6%

1.0%

26.9%

27.4%

22.4%

6.9%

-8.7%

-10.2%

0.1%

1.2%

22.8%

21.0%

13.1%

3.5%

16.5%

16.2%

29.0%

0.7%

12.5%

14.4%

5.2%

3.7%

-10.1%

-8.7%

-4.6%

-9.2%

24.0%

28.7%

7.4%

-0.3%

11.1%

14.2%

29.2%

-7.0%

-5.1%

-8.5%

-10.9%

12.1%

4.0%

0.1%

3.3%

13.2%

14.3%

16.1%

14.2%

19.1%

5.7%

19.0%

16.9%

-1.1%

-14.7%

-18.2%

0.8%

4.4%

-26.5%

-27.2%

-15.8%

9.2%

37.2%

38.7%

11.4%

16.8%

23.9%

26.7%

0.6%

-0.7%

-7.2%

-4.2%

5.2%

-1.2%

6.6%

7.5%

42.5%

-1.2%

18.4%

23.0%

56.4%

-4.0%

32.4%

32.7%

14.2%

1.9%

-4.9%

-3.7%

-16.3%

40.4%

21.4%

20.9%

19.7%

0.7%

22.5%

22.0%

26.3%

15.5%

6.3%

4.5%

9.1%

31.0%

32.2%

32.2%

13.4%

24.5%

18.5%

16.2%

21.4%

-2.7%

5.2%

1.7%

-6.2%

9.7%

16.8%

18.0%

22.6%

18.1%

31.5%

29.0%

6.1%

6.2%

-3.2%

-6.0%

-8.2%

19.3%

30.6%

34.7%

14.1%

9.4%

7.7%

9.8%

-5.1%

18.2%

10.0%

11.1%

41.6%

-7.8%

1.3%

-0.1%

-9.7%

31.7%

37.4%

36.8%

26.6%

-0.9%

23.1%

21.4%

25.5%

15.9%

33.4%

31.3%

11.6%

13.1%

28.6%

24.4%

2.1%

-9.0%

21.0%

25.5%

28.0%

21.5%

-9.1%

-11.1%

11.2%

0.993

0.994

0.996

0.998

0.994

0.999

Anda mungkin juga menyukai

- Dahlia Simmons Analyzes Solar Battery ProjectDokumen227 halamanDahlia Simmons Analyzes Solar Battery ProjectParth Dhingra0% (3)

- Example Loan PricingDokumen4 halamanExample Loan PricingNino NatradzeBelum ada peringkat

- Month Average Market Month: BOG TBC BOGDokumen4 halamanMonth Average Market Month: BOG TBC BOGNino NatradzeBelum ada peringkat

- Calculadora de Valor de Capitalización (Valor Futuro) de Un Flujo de Efectivo ActualDokumen33 halamanCalculadora de Valor de Capitalización (Valor Futuro) de Un Flujo de Efectivo ActualKerry WestBelum ada peringkat

- Statistics OverviewDokumen12 halamanStatistics OverviewAryan DuttaBelum ada peringkat

- The 15 Percent Delusion by Carol LoomisDokumen20 halamanThe 15 Percent Delusion by Carol LoomistakmayoBelum ada peringkat

- Frequencies: StatisticsDokumen9 halamanFrequencies: StatisticsOlahdata SpssBelum ada peringkat

- Tablas de frecuencia de datosDokumen4 halamanTablas de frecuencia de datosStephania MendozaBelum ada peringkat

- RatioDokumen3 halamanRatioumeshBelum ada peringkat

- Valuation - FCFF and FCFEDokumen9 halamanValuation - FCFF and FCFESiraj ShaikhBelum ada peringkat

- Coca Cola: The Operating Margin EffectDokumen2 halamanCoca Cola: The Operating Margin EffectmilliekittyBelum ada peringkat

- PE Ratios PDFDokumen40 halamanPE Ratios PDFRoyLadiasanBelum ada peringkat

- Ratio Analysis-Overview Ratios:: CaveatsDokumen18 halamanRatio Analysis-Overview Ratios:: CaveatsabguyBelum ada peringkat

- Risk and Rates of ReturnDokumen45 halamanRisk and Rates of ReturnRizwanahParwinBelum ada peringkat

- MODULE 2.2 Affordability Analysis & Affordable OptionsDokumen56 halamanMODULE 2.2 Affordability Analysis & Affordable Optionsbanate LGUBelum ada peringkat

- Midterm 3 SolutionsDokumen4 halamanMidterm 3 SolutionsIMAN MOHAMED MOHAMMEDBelum ada peringkat

- Ethiopia Case Companion SpreadsheetDokumen1 halamanEthiopia Case Companion SpreadsheetKwaku DanielBelum ada peringkat

- Chapter 4. Model For Analyzing The Financial Environment: The Determinants of Interest RatesDokumen11 halamanChapter 4. Model For Analyzing The Financial Environment: The Determinants of Interest RatesJavier Diaz ZumaetaBelum ada peringkat

- FLT Business Growth Drivers AnalysisDokumen12 halamanFLT Business Growth Drivers AnalysisShweta SawaneeBelum ada peringkat

- IIFL Associate FD List September'2021Dokumen4 halamanIIFL Associate FD List September'2021BHARAT SBelum ada peringkat

- SharedResourceModel - System DynamicsDokumen42 halamanSharedResourceModel - System DynamicsKeren ThomasBelum ada peringkat

- The Revenue WreckDokumen12 halamanThe Revenue WreckZerohedgeBelum ada peringkat

- Presentation of 4Q11 ResultsDokumen20 halamanPresentation of 4Q11 ResultsMillsRIBelum ada peringkat

- Statistical Arbitrage How To Diversify To Generate AlphaDokumen21 halamanStatistical Arbitrage How To Diversify To Generate Alphaeng1858260Belum ada peringkat

- %age Increase / (Decrease) Over Last Year Yr-1 Yr-2 Yr-3 Yr-4 Yr-5Dokumen6 halaman%age Increase / (Decrease) Over Last Year Yr-1 Yr-2 Yr-3 Yr-4 Yr-5Muhammad BilalBelum ada peringkat

- Syndicate 3 - Analisa Ratio IndustriDokumen5 halamanSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Presentation of 1Q12 ResultsDokumen20 halamanPresentation of 1Q12 ResultsMillsRIBelum ada peringkat

- CH 06 - Risk, Return, and The Capital Asset Pricing ModelDokumen60 halamanCH 06 - Risk, Return, and The Capital Asset Pricing ModelSyed Mohib HassanBelum ada peringkat

- Portfolio Diversification Lowers Risk - InternationalDokumen7 halamanPortfolio Diversification Lowers Risk - InternationalJohn simpsonBelum ada peringkat

- FFMFM - Akash Singhal - 2020PGP001Dokumen8 halamanFFMFM - Akash Singhal - 2020PGP001Akash SinghalBelum ada peringkat

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokumen1 halaman3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234Belum ada peringkat

- Pigeon Express investment analysis and dividend growthDokumen15 halamanPigeon Express investment analysis and dividend growthspectrum_48Belum ada peringkat

- Marcospelaez PracproblemsDokumen23 halamanMarcospelaez Pracproblemsapi-270738615Belum ada peringkat

- Paginas Amarelas Case Week 8 ID 23025255Dokumen4 halamanPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- FCFF2 21HS10002Dokumen21 halamanFCFF2 21HS10002aayush.5.parasharBelum ada peringkat

- Trade History News High Impact MomentsDokumen8 halamanTrade History News High Impact MomentsElev Septivianto Limantokoh and Les privat QprojectBelum ada peringkat

- Bond valuation and yield relationshipDokumen9 halamanBond valuation and yield relationshipVishnu GaurBelum ada peringkat

- GSS Sheet SAMPLEDokumen9 halamanGSS Sheet SAMPLERakesh BehuriaBelum ada peringkat

- Whitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Dokumen2 halamanWhitehall: Monitoring The Markets Vol. 5 Iss. 22 (June 24, 2015)Whitehall & CompanyBelum ada peringkat

- FS Analysis 1Dokumen37 halamanFS Analysis 1Roselyn AcbangBelum ada peringkat

- Hedge Vol Columbia 0999Dokumen40 halamanHedge Vol Columbia 0999prashyraoBelum ada peringkat

- CWSG Capital Markets Update - 10.24.11Dokumen1 halamanCWSG Capital Markets Update - 10.24.11jddishotskyBelum ada peringkat

- Year Interest Rate Death Rate Surrender Rate Death Claim ExpenseDokumen4 halamanYear Interest Rate Death Rate Surrender Rate Death Claim ExpenseJohnBelum ada peringkat

- BetasDokumen9 halamanBetasMiguelÁngelNúñezBelum ada peringkat

- May 24Th 2015 Kick Off Day!Dokumen6 halamanMay 24Th 2015 Kick Off Day!srstomBelum ada peringkat

- Case Ascend The Finnacle FinalRound 2ADokumen3 halamanCase Ascend The Finnacle FinalRound 2ASAHIL BERDEBelum ada peringkat

- With Insurance: Make Smart Moves To Grow Your WealthDokumen16 halamanWith Insurance: Make Smart Moves To Grow Your Wealthchethanhg526Belum ada peringkat

- Report WritingDokumen14 halamanReport Writingzala ujjwalBelum ada peringkat

- Gss Sheet SampleDokumen9 halamanGss Sheet Sampledr.kabirdevBelum ada peringkat

- Atlu Thyu CheDokumen13 halamanAtlu Thyu Chezala ujjwalBelum ada peringkat

- Atlu Thyu CheDokumen13 halamanAtlu Thyu Chezala ujjwalBelum ada peringkat

- DCF Valuation Financial ModelingDokumen10 halamanDCF Valuation Financial ModelingHilal MilmoBelum ada peringkat

- National 2013 Work Zone SurveyDokumen4 halamanNational 2013 Work Zone SurveyFranklin OpinionBelum ada peringkat

- Colgate, 4th February, 2013Dokumen10 halamanColgate, 4th February, 2013Angel BrokingBelum ada peringkat

- VEBITDA Multiples and Tax RatesDokumen5 halamanVEBITDA Multiples and Tax Ratesminhthuc203Belum ada peringkat

- Mora PerformanceTask2Dokumen2 halamanMora PerformanceTask2Jean Jean MoraBelum ada peringkat

- Mills' Results: Ebitda Financial Indicators Per DivisionDokumen30 halamanMills' Results: Ebitda Financial Indicators Per DivisionMillsRIBelum ada peringkat

- Peer Company COmparision For StartupsDokumen2 halamanPeer Company COmparision For StartupsBiki BhaiBelum ada peringkat

- Short Term Trading - ASX Power SetupsDokumen5 halamanShort Term Trading - ASX Power SetupsNick Radge0% (1)

- Stochastic Portfolio Theory - A Survey - SlidesDokumen27 halamanStochastic Portfolio Theory - A Survey - SlidesTraderCat SolarisBelum ada peringkat

- The Bible of The Good & Moral AtheistDokumen109 halamanThe Bible of The Good & Moral Atheistnitagrl74100% (14)

- The Impact of Computational Error On The Volatility Smile - Chance and Hanson Et Al - 2013 - SlidesDokumen19 halamanThe Impact of Computational Error On The Volatility Smile - Chance and Hanson Et Al - 2013 - SlidesGallo SolarisBelum ada peringkat

- Time Varying Higher Moments and The Cost of GARCH - Ghalanos - 2013 - SlidesDokumen19 halamanTime Varying Higher Moments and The Cost of GARCH - Ghalanos - 2013 - SlidesGallo SolarisBelum ada peringkat

- Community Futures Strathcona Loan Application PDFDokumen4 halamanCommunity Futures Strathcona Loan Application PDFGallo SolarisBelum ada peringkat

- Deeper Kernels - Taylor - 2013 - Slides PDFDokumen70 halamanDeeper Kernels - Taylor - 2013 - Slides PDFGallo SolarisBelum ada peringkat

- R-QuantLib Integration Spanderen 2013 SlidesDokumen20 halamanR-QuantLib Integration Spanderen 2013 SlidesGallo SolarisBelum ada peringkat

- Business Name Request Form PDFDokumen2 halamanBusiness Name Request Form PDFGallo SolarisBelum ada peringkat

- How To Choose The Right Business StructureDokumen4 halamanHow To Choose The Right Business StructureAnu AnushaBelum ada peringkat

- Estimating High Dimensional Covariance Matrices Using A Factor Model - Sun - 2013 - SlidesDokumen12 halamanEstimating High Dimensional Covariance Matrices Using A Factor Model - Sun - 2013 - SlidesGallo SolarisBelum ada peringkat

- The Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesDokumen25 halamanThe Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesGallo SolarisBelum ada peringkat

- 30 Stock KurtosisDokumen60 halaman30 Stock KurtosisGallo SolarisBelum ada peringkat

- Using Markov Models in R To Understand The Lifecycle of Exchange-Traded Derivatives - Cavanaugh - 2013 - SlidesDokumen37 halamanUsing Markov Models in R To Understand The Lifecycle of Exchange-Traded Derivatives - Cavanaugh - 2013 - SlidesGallo SolarisBelum ada peringkat

- The Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesDokumen25 halamanThe Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesGallo SolarisBelum ada peringkat

- Ito PredictDokumen79 halamanIto PredictGallo SolarisBelum ada peringkat

- Understanding Moving Averages Strategies With The Help of Toy Models Using R - Silva - 2013 - SlidesDokumen9 halamanUnderstanding Moving Averages Strategies With The Help of Toy Models Using R - Silva - 2013 - SlidesGallo SolarisBelum ada peringkat

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDokumen78 halamanUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- 5 Year AnalysisDokumen100 halaman5 Year AnalysisGallo SolarisBelum ada peringkat

- California tenants guide rights responsibilitiesDokumen122 halamanCalifornia tenants guide rights responsibilitieskingsaratBelum ada peringkat

- 4 Stock RegressionsDokumen16 halaman4 Stock RegressionsGallo SolarisBelum ada peringkat

- OneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesDokumen8 halamanOneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesGallo SolarisBelum ada peringkat

- 4 Stock RegressionsDokumen16 halaman4 Stock RegressionsGallo SolarisBelum ada peringkat

- Download: Fill in The Then Click The ButtonDokumen101 halamanDownload: Fill in The Then Click The ButtonGallo SolarisBelum ada peringkat

- 3 Stock Correlations2Dokumen162 halaman3 Stock Correlations2Gallo SolarisBelum ada peringkat

- Hurst ExponentDokumen148 halamanHurst ExponentGallo SolarisBelum ada peringkat

- 2 Stock CorrelationDokumen118 halaman2 Stock CorrelationGallo SolarisBelum ada peringkat

- Golden RatiosDokumen7 halamanGolden RatiosGallo SolarisBelum ada peringkat

- Ito OptionsDokumen5 halamanIto OptionsGallo SolarisBelum ada peringkat

- GARCHDokumen125 halamanGARCHGallo SolarisBelum ada peringkat

- AngloAmerican 2012 - SocioEconomic Assessment Toolbox PDFDokumen297 halamanAngloAmerican 2012 - SocioEconomic Assessment Toolbox PDFSnertBelum ada peringkat

- The Banker-Customer RelationshipDokumen31 halamanThe Banker-Customer RelationshipStefan Adrian VanceaBelum ada peringkat

- Pricol Limited - Broker Research - 2017 PDFDokumen25 halamanPricol Limited - Broker Research - 2017 PDFnishthaBelum ada peringkat

- Use of Information Technology in Income Tax DepartmentDokumen12 halamanUse of Information Technology in Income Tax DepartmentVaibhav RakhejaBelum ada peringkat

- Risk Management: Sitara Chemical Industries LimitedDokumen11 halamanRisk Management: Sitara Chemical Industries LimitedNuman RoxBelum ada peringkat

- Accounting in Action: Assignment Classification TableDokumen50 halamanAccounting in Action: Assignment Classification TableChi IuvianamoBelum ada peringkat

- Financial StatementDokumen16 halamanFinancial StatementCuracho100% (1)

- The Global Economic Environment: Powerpoint by Kristopher Blanchard North Central UniversityDokumen35 halamanThe Global Economic Environment: Powerpoint by Kristopher Blanchard North Central Universitys.vijayaraniBelum ada peringkat

- Sample Document - For Information Only: Name, Address and Telephone Number of Person Without AttorneyDokumen9 halamanSample Document - For Information Only: Name, Address and Telephone Number of Person Without AttorneyRyan SteburgBelum ada peringkat

- Ngo Small Grants Program: Application FormDokumen9 halamanNgo Small Grants Program: Application FormNzugu HoffmanBelum ada peringkat

- Business Plan For Dairy Farm 30 Animals Final11Dokumen17 halamanBusiness Plan For Dairy Farm 30 Animals Final11dauda kizitoBelum ada peringkat

- Accounting Unit 3 Notes - ATARNotesDokumen22 halamanAccounting Unit 3 Notes - ATARNotesAnonymous rP0DTw58XBelum ada peringkat

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Dokumen15 halamanEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytBelum ada peringkat

- Week 1 Topic Tutorial Solutions CB2100 - 1920ADokumen6 halamanWeek 1 Topic Tutorial Solutions CB2100 - 1920ALily TsengBelum ada peringkat

- Kwame Nkrumah University Mechanical Engineering QuizDokumen9 halamanKwame Nkrumah University Mechanical Engineering QuizMohammed Abdul-MananBelum ada peringkat

- Financial Management PDFDokumen397 halamanFinancial Management PDFArly Kurt TorresBelum ada peringkat

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Dokumen4 halaman) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikBelum ada peringkat

- Corporate Finance Assignment 3Dokumen5 halamanCorporate Finance Assignment 3Hardeep KaurBelum ada peringkat

- Dwnload Full Systems of Psychotherapy A Transtheoretical Analysis 8th Edition Prochaska Test Bank PDFDokumen36 halamanDwnload Full Systems of Psychotherapy A Transtheoretical Analysis 8th Edition Prochaska Test Bank PDFsurfaceaunterbdkid92% (12)

- Travel Expenses Report: Date Description of Expenses AmountDokumen3 halamanTravel Expenses Report: Date Description of Expenses AmountDenBelum ada peringkat

- PWC PreSIP Diptimaya SarangiDokumen15 halamanPWC PreSIP Diptimaya SarangiChandan KumarBelum ada peringkat

- Accounting Standards Full INCLUSING ANSWERSDokumen235 halamanAccounting Standards Full INCLUSING ANSWERSAnsari Salman100% (1)

- SFM Notes Units 1 - 3Dokumen89 halamanSFM Notes Units 1 - 3Dhruvi AgarwalBelum ada peringkat

- Non-Current Assets Held For Sale Discontinued OperationsDokumen32 halamanNon-Current Assets Held For Sale Discontinued Operationsnot funny didn't laughBelum ada peringkat

- Slide 1Dokumen1 halamanSlide 1Hazel CorralBelum ada peringkat

- Ahold Financial Report 2010Dokumen137 halamanAhold Financial Report 2010George Traian VoloacăBelum ada peringkat

- Millares vs NLRC ruling on separation pay allowancesDokumen6 halamanMillares vs NLRC ruling on separation pay allowancesDanica Irish RevillaBelum ada peringkat

- Article On CompensationDokumen9 halamanArticle On CompensationAhmadBelum ada peringkat

- Internship Report On Janata BAnkDokumen51 halamanInternship Report On Janata BAnkkhansha Computers100% (4)

- Accounting Principles ExplainedDokumen4 halamanAccounting Principles ExplainedKeyah NkonghoBelum ada peringkat