Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)

Diunggah oleh

Bhoj SinghJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)

Diunggah oleh

Bhoj SinghHak Cipta:

Format Tersedia

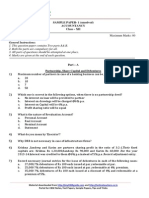

General Instructions: 1. This question paper contains three parts A, B and C 2. Part A is compulsory for all candidates 3.

Candidates can attempt only one part of the remaining parts B and C 4. All parts of a question should be attempted at one place. ACCOUNTANCY (Delhi) (Delhi) PART - A (ACCOUNTANCY) Q1. Define partnership. 2

Q2. P Ltd. purchased assets worth Rs. 1, 80,000 from S Ltd. The payment was made by issuing equity shares of the face value of Rs. 100 each at a premium of Rs. 20 per share. Pass necessary journal entries. 2

Q3. JCM Ltd invited applications for issuing 20,000 equity shares of Rs. 20 each at a discount of 10%. The whole amount was payable on application. The issue was fully subscribed. Pass necessary Journal entries 2

Q4. . On 31.1.2005 Janta Ltd. converted Its Rs. 88,00,000, 6% debentures into equitysharesofRs.20 each at a premium of Rs. 2 per share. Pass necessary journal entries in the books of the company for redemption of debentures. 2

Q5. . Pappu and Munna are partners In a firm sharing profits in the ratio of 3 : 2. The partnership deed provided that Pappu was to be paid salary of Rs. 2,500 per month and Munna was to get a commission of Rs. 10,000 per year. Interest on capital was to be allowed @ 5% per annum and interest on drawings was to be charged @ 6% per annum. Interest on Pappus drawing was Rs. 1,250 and on Munnas drawings Rs. 425. Capital of the partners were Rs. 2.00.000 and respectively, and were fixed. The firm earned a profit of Rs. 90,575 for the year ended 31.3.2004. Prepare Profit and Loss Appropriation Account of the firm. 3

Q6. . What is meant by issue of debentures as Collateral Security?

Q7. . What is meant by reconstitution of a partnership firm? Explain briefly any two occasions on which a partnership firm can be reconstituted. 4

Q8. . State the purposes for which securities premium amount can be used by a company. .4 Q9. . A, B and C were the partners in a firm, sharing profits in the ratio of 4: 3: 3. The firm was dissolved on 28-2-2005. After transfer of assets and external liabilities to Realization Account the following transactions took place: 4

Q10. . On 1.1.2000, X Ltd. issued 5, 00,000 8% debentures of Rs. 100 each, redeemable after l0 years. Debenture-holders were given the option to get their debentures redeemed at any time after 3 years at Re. 105 per debenture. At the end of four years, debenture-holders holding 40,000 debentures exercised their option and got their debentures redeemed. Record necessary journal entries for issue and redemption of debentures in the books of the company. 4 Q11. . On 1.1.2005, Fast Computers Ltd. issued 20,00,0 6% debentures of Rs. 100 each at a discount of 4% redeemable at a premium of 5% after three years. The amount was payable as follows: On application Rs. 50 per debenture. Balance on allotment. Record the necessary Journal entries for issue of debentures. 4

Q12. . Ram and Mohan were partners in a firm sharing profits in the ratio of 4: 1. On 01.03.2005, they admitted Sohan as a new partner for 1/3rd share in the profit of the firm. They fixed the new profit sharing ratio as 4: 2: 3.On the date of Sohans admission, the firm had a JLP for Rs, 60,000 (surrender value Rs. 20,000) The P & LA/c on the date of admission showed a Balance of Rs. 32,000 (DR). The firm also had a reserve of Rs 1, 00,000.Sohan is to bring Rs. 60,000 as premium for his hare of good will showing your calculations a clearly, pass necessary Journal entries to record the above transactions. Q13. . Following is the Balance Sheet of Ramesh and Suresh as on 28.2.2005. 6

Liabilities Sundry Creditors Bills Payable Capital Accounts: Ramesh Suresh 30,000 30,000

Amount Rs.

Assets

Amount Rs. 40,000 28,000 20,000 10,000 12,000 10,000 1,20,000

20,000 Land and Building 40,000 Furniture and Fittings Truck Stock 60,000 Debtors ______ Cash 1,20,000

On the above date, Ramesh and Suresh decided to dissolve the firm. Ramesh took over the creditors and Suresh took over the bills payables. Assets realized as follows: Debtors Rs. 9,000; Furniture Rs. 21,000; Stock Rs. 6,000; Truck Rs. 32,000 and Land and Buildings Rs. 60,000. Expenses of realization paid by Ramesh were Rs. 1,200. Prepare Realization Account, Cash Account and Capital Accounts of the partners to close the books of the firm. Or Pass necessary journal entries to record the following at the time of dissolution of a partnership firm assuming that the Assets and third party liabilities have already been transferred to Realization A/c: a) An unrecorded asset of Rs. 300 was taken over by A, one of the partners. b) Creditors were paid Rs. 14,000 In full settlement of their claims for Rs. 15,000 c) Sundry assets realized Rs. 1, 95,000. d) B (another partner) was to bear the expenses on dissolution, which amounted to Rs.1, 500. e) Value of Sundry liabilities including creditors at the time of dissolution was Rs. 1, 90,000. f) A takes over the loan payable to Mrs. A Rs. 15,000. 6 6

Q14. . Z Ltd. invited applications for Issuing 40,000 equity shares of Rs. 10 each at a premium of Rs. 2 per share. The amount was payable as follows: On Application Ra. 6 (including premium) and balance on Allotment. Applications for 50,000 shares were received Pro-rata allotment was made to all applicants Excess money received on application was adjusted towards sums due on allotment. A shareholder to whom 8,000 shares

were allotted failed to pay the allotment money and therefore, his share was forfeited. Later on the forfeited shares were re-issued for Rs. 70,000 as fully paid up. Pass necessary journal entries hi the books of Z Ltd. ` 6

Q15. . M and N were partners in a firm sharing profits in the ratio of 3: 1. Their Balance Sheet as on 31.3.2004 was as follows: Liabilities Creditors Bills Payable Outstanding Salary Capital Accounts: M N 2,00,000 1,30,000 3,30,000 4,40,000 Amount Rs. 28,000 Cash 40,000 Debtors 2,000 Stock Plant Land and Building Assets Amount Rs. 50,000 60,000 40,000 1,00,000 1,50,000 _________ 4,00,000

On the above date O was admitted as a partner for 1/4th share in profits on the following terms: a) O will bring Rs. 1, 50,000 as his capital and Rs. 90,000 as his share of premium for goodwill for his share of profits. b) Plant is to be appreciated to Rs. 1, 30,000 and the value of land and building is to be appreciated by 5%. c) Stock is overvalued by Rs. 6,000. d) A provision for bad and doubtful debts is to be created at 5% on debtors. e) There were unrecorded creditors Is. 4,500. Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet Of the new firm. Or P, Q and R were partners in a firm sharing profits in the ratio of 2 : 3 : 5. On 31.3.2004 their balance Sheet was as follows: 8

Liabilities Creditors Capital Accounts: P Q R 80,000 70,000 60,000

Amount Rs. 70,000 Bank Debtors 40,000

Assets

Amount Rs. 45,000

Less: provision for 2,10,000 5,000 ________ Stock 2,80,000 Building Profit & loss A/c doubts debts

35,000 50,000 1,40,000 10,000 2,80,000

On the above date R retired firm due to his Illness on the following terms: a) Building was to be depreciated by Rs. 40,000. b) Provision for doubtful debts was to be maintained at 20% on debtors. c) Salary outstanding Rs. 5,000 was to be recorded and creditors Re. 4,000 will not be claimed. d) Goodwill of the firm was valued at Rs. 72,000 and the same was to be treated without opening goodwill account. e) R was to be paid Rs. 15,000 In cash, through bank and the balance was to be transferred to his loan account Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of P and Q after Rs retirement PART - B (ANALYSIS OF FINANCIAL STATEMENTS) Q16. . What is meant by a Cash Flow Statement? 2 8

Q17. . State whether the following transactions will result into inflow, outflow or no flow of funds a) Purchased machinery for cash Rs. 80,000. b) Paid to creditors Rs. 40,000.

c) Converted Rs. 10,000 equity shares into 9% debentures. d) Issued equity shares Rs. 10, 00,000 for cash. Q18. . Briefly explain the limitations of analysis of financial statements. 2 3

Q19. . The current liabilities of a company are Rs. 3,50,000. Its current ratio is 3.00 and liquid ratio is 1.75. Calculate the amount of current assets, liquid assets and inventory. 3

Q20. . On the basis of Information given below, calculate any two of the following ratios: 4 a) Gross Profit Ratio; b) Debt Ratio and c) Working Capital Turnover Ratio. Information: Rs. Rs. Net Sales 3,75,000 Current assets 4,25,000 Cost of goods sold 2,50,000 Equality share Capital 1,90,000 Current liabilities 1,20,000 Debentures 75,000 Loan 60,000 Q21. . Following are the Balance Sheets of XY Ltd. As on 31st March, 2003 and 2004: 2003 Rs. Rs. 1,20,000 8.000 7,200 11,200 14,000 14,400 _________ 1,74,800 2004 Rs. 2003 Rs. Rs. 20,000 76,000 4,000 30,000 34,000 6,800 __4,000 2004 Rs. 16,000 96,400 14,000 43,200 31,200 11,200 __2,800

Liabilities Share capital General reserve Profit & loss A/c Proposed Dividend Bills payable Outstanding Expenses

Assets

1,40,000 Good will 12,000 Building 6,200 Investments 20,200 Debtors 21,200 Stock 15,200 Cash ________ Preliminary Expenses 2,14,800

1,74,800 2,14,800

You are required to: a) Prepare schedule of changes in working DIPRIL: b) Calculate funds from operations, and c) Prepare a Funds Flow Statement. Or The following balances appeared in Plant Account and Accumulated Depreciation Account In the books of Bharat Ltd: Balances as a Plant Accumulated Depreciation Addition Information: Plant costing Rs. 1,45000; accumulated depreciation thereon Rs. 70,000, was sold for Rs. 35,000. You are required to: a) Compute the amount of Plant purchased, depreciation charged for the year and loss on sale of plant. b) Show how each of the Items related to the plant will be shown in the cash flow statement. 31.3.2003 Rs. 7,50,000 1,80,000 31.3.2004 Rs. 9,70,000 2,40,000 6

Anda mungkin juga menyukai

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokumen34 halamanClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsBelum ada peringkat

- XII - Accy. QP - Revision-15.2.14Dokumen6 halamanXII - Accy. QP - Revision-15.2.14devipreethiBelum ada peringkat

- Accountancy For Class XII Full Question PaperDokumen35 halamanAccountancy For Class XII Full Question PaperSubhasis Kumar DasBelum ada peringkat

- XII AccountancyDokumen4 halamanXII AccountancyAahna AcharyaBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokumen7 halamanCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsBelum ada peringkat

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokumen50 halamanAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataBelum ada peringkat

- Accountancy exam questions on partnership, companies, debenturesDokumen8 halamanAccountancy exam questions on partnership, companies, debenturesVijayBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Dokumen17 halamanCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsBelum ada peringkat

- 12th Marking AccountancyDokumen52 halaman12th Marking AccountancyManoj GiriBelum ada peringkat

- 12 2006 Accountancy 4Dokumen5 halaman12 2006 Accountancy 4Akash TamuliBelum ada peringkat

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokumen5 halamanSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokumen20 halamanCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperBelum ada peringkat

- Class 12th Accountancy Set BDokumen6 halamanClass 12th Accountancy Set BjashanjeetBelum ada peringkat

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokumen20 halamanClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatBelum ada peringkat

- Accountancy Model QuestionsDokumen19 halamanAccountancy Model QuestionsSunil Kumar AgarwalaBelum ada peringkat

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Dokumen5 halamanSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaBelum ada peringkat

- ACCOUNTANCY EXAM PAPERDokumen58 halamanACCOUNTANCY EXAM PAPER9chand3Belum ada peringkat

- Accounting For Partnership Firms: Short Answer Type QuestionsDokumen8 halamanAccounting For Partnership Firms: Short Answer Type QuestionssalumBelum ada peringkat

- 03 - Accounts - Prelims 1Dokumen7 halaman03 - Accounts - Prelims 1Pawan TalrejaBelum ada peringkat

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokumen37 halamanClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsBelum ada peringkat

- Sample Paper 4Dokumen6 halamanSample Paper 4Ashish BatraBelum ada peringkat

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDokumen8 halamanSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3Belum ada peringkat

- XII Acct Sample Paper SolvedDokumen5 halamanXII Acct Sample Paper SolvedDeepakPhalkeBelum ada peringkat

- Module-2 Sample Question PaperDokumen18 halamanModule-2 Sample Question PaperRay Ch100% (1)

- Corporate Accounting QUESTIONSDokumen4 halamanCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Ad Account Question PaperDokumen3 halamanAd Account Question PaperAbdul Lathif0% (1)

- D.A.V. Public School Practice Test 5 Accountancy 12th Commerce QuestionsDokumen2 halamanD.A.V. Public School Practice Test 5 Accountancy 12th Commerce QuestionsshubhamsundraniBelum ada peringkat

- Financial Accounting I SemesterDokumen25 halamanFinancial Accounting I SemesterBhaskar KrishnappaBelum ada peringkat

- ACCOUNTANCY-Practice QuestionsDokumen6 halamanACCOUNTANCY-Practice QuestionsMary JaineBelum ada peringkat

- BK Paper 45 MarksR3 PrelimDokumen5 halamanBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Class XII Commerce (1) GGBDokumen10 halamanClass XII Commerce (1) GGBAditya KocharBelum ada peringkat

- 12 Accountancy Sample Paper 2014 04Dokumen6 halaman12 Accountancy Sample Paper 2014 04artisingh3412Belum ada peringkat

- AccountancyDokumen18 halamanAccountancyMeena DhimanBelum ada peringkat

- TH TH STDokumen3 halamanTH TH STsharathk916Belum ada peringkat

- class 12th Accountancy Set ADokumen6 halamanclass 12th Accountancy Set AjashanjeetBelum ada peringkat

- NPO, Partnership & Co Acc A/c CalculationsDokumen6 halamanNPO, Partnership & Co Acc A/c CalculationsMaulik ThakkarBelum ada peringkat

- XII ACCOUNTANCY PRACTICE PAPER PART A AND BDokumen4 halamanXII ACCOUNTANCY PRACTICE PAPER PART A AND BTûshar ThakúrBelum ada peringkat

- Accountancy QP Set-2Dokumen15 halamanAccountancy QP Set-2ABDUL RAHMAN 11BBelum ada peringkat

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDokumen3 halamanGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Belum ada peringkat

- Class 12 CBSE ISC Accountancy Assignment 10Dokumen15 halamanClass 12 CBSE ISC Accountancy Assignment 10studentBelum ada peringkat

- Sample Paper Accountancy Class XIIDokumen6 halamanSample Paper Accountancy Class XIIAcHu TanBelum ada peringkat

- 29Dokumen3 halaman29sharathk916Belum ada peringkat

- Accounts Holiday HW 1Dokumen4 halamanAccounts Holiday HW 1AlishbaBelum ada peringkat

- 12th Accounts Partnership Test 15 Sept.Dokumen6 halaman12th Accounts Partnership Test 15 Sept.SGEVirtualBelum ada peringkat

- Mock Test Class 12 Accountancy Questions and SolutionsDokumen11 halamanMock Test Class 12 Accountancy Questions and SolutionsNaman ChotiaBelum ada peringkat

- Acc Ws Dissolution of Part - FirmDokumen12 halamanAcc Ws Dissolution of Part - FirmDhivegaBelum ada peringkat

- ACCOUNTANCY TEST-40 MARKDokumen2 halamanACCOUNTANCY TEST-40 MARKCharming CuteBelum ada peringkat

- 3hr Paper 4feb 2010Dokumen3 halaman3hr Paper 4feb 2010Bhawna BhardwajBelum ada peringkat

- Worksheet Accounts Ut 1 RefrenceDokumen10 halamanWorksheet Accounts Ut 1 Refrencemayankkochar216Belum ada peringkat

- Asm1 25560Dokumen12 halamanAsm1 25560shivanshu11o3o6Belum ada peringkat

- AccountancyDokumen0 halamanAccountancyJaimangal RajaBelum ada peringkat

- 9 Partnership Question 21Dokumen11 halaman9 Partnership Question 21kautiBelum ada peringkat

- 9 Partnership Question 4Dokumen7 halaman9 Partnership Question 4kautiBelum ada peringkat

- Worksheet - Retirement & DissolutionDokumen4 halamanWorksheet - Retirement & DissolutionYogesh AdhikariBelum ada peringkat

- Prati AccountancyDokumen2 halamanPrati AccountancyMohan NjBelum ada peringkat

- Accountancy Sample Question PaperDokumen20 halamanAccountancy Sample Question PaperrahulBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- Summary of Richard A. Lambert's Financial Literacy for ManagersDari EverandSummary of Richard A. Lambert's Financial Literacy for ManagersBelum ada peringkat

- 12 2008 Accountancy 3 MsDokumen23 halaman12 2008 Accountancy 3 MsBhoj SinghBelum ada peringkat

- Study TYBCom Accountancy Auditing-IIDokumen396 halamanStudy TYBCom Accountancy Auditing-IIRani Naik Dhuri100% (2)

- BRS Bank Reconcilation StatementDokumen15 halamanBRS Bank Reconcilation Statementbabluon22Belum ada peringkat

- Financial Market FinalDokumen327 halamanFinancial Market Finalvarshadumbre100% (3)

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Dokumen7 halamanAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghBelum ada peringkat

- 12 2006 Accountancy 3Dokumen5 halaman12 2006 Accountancy 3Bhoj SinghBelum ada peringkat