Authority For Advance Ruling-An Overview

Diunggah oleh

9999391451Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Authority For Advance Ruling-An Overview

Diunggah oleh

9999391451Hak Cipta:

Format Tersedia

AAR 1.

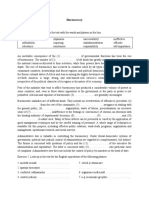

India has emerged as a potential investment location in the world today on the back of large market size and high customer potential. At the same time, it is perceived as a risky place to make investments in the light of expensive and long drawn taxation litigation. To comfort the position of investors, scheme of Advance Ruling was introduced by Finance Act, 1993 by inserting Chapter XIXB consisting of sections 245N to 245V in the Income Tax Act, 1956 with effect from 1st June, 1993. It seeks to provide greater clarity to investors, primarily non-residents and specified categories of residents on their tax liability in India and enables them to plan their taxation affairs to avoid any litigation. 2. Under the scheme, Authority for Advance Ruling (AAR) has been set up to pronounce advance rulings. It is an independent body comprising of a chairman, who is a retired judge of the Supreme Court and two members of the rank of additional secretary to the Government of India, one each from Indian revenue services and Indian legal Services. 3. Section 245N reads as defines Advance ruling and applicant as follows: Advance ruling" means (i) A determination by the Authority in relation to a transaction which has been undertaken or is proposed to be undertaken by a non-resident applicant; or (ii) a determination by the Authority in relation to the tax liability of a non-resident arising out of a transaction which has been undertaken or is proposed to be undertaken by a resident applicant with such non-resident, and such determination shall include the determination of any question of law or of fact specified in the application; (iii) a determination or decision by the Authority in respect of an issue relating to computation of total income which is pending before any income-tax authority or the Appellate Tribunal and such determination or decision shall include the determination or decision of any question of law or of fact relating to such computation of total income specified in the application : [Provided that where an advance ruling has been pronounced, before the date on which the Finance Act, 2003 receives the assent of the President, by the Authority in respect of an application by a resident applicant referred to in sub-clause (ii) of this clause as it stood immediately before such date, such ruling shall be binding on the persons specified in section 245S;]

"Applicant" means any person who (i) (ii) (iii) is a non-resident referred to in sub-clause (i) of clause (a); or is a resident referred to in sub-clause (ii) of clause (a); or is a resident falling within any such class or category of persons as the Central Government may, by notification in the Official Gazette42, specify in this behalf;

In simple words, Section 245N states that a ruling may be obtained by an applicant who may be a non resident or a resident having a transaction with a non resident or a specified categories of

resident ( at present Public sector companies, as defined in sec 2(36A) of the Income tax act, 1956. The applicant may raise any question of law or fact to ascertain the tax liability of a nonresident arising out of a transaction undertaken or proposed to be undertaken. Sec 245U provides that 1.7 1.8

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Osmena V OrbosDokumen1 halamanOsmena V OrbosMichelle DecedaBelum ada peringkat

- Equal Opportunites FormDokumen3 halamanEqual Opportunites FormCatchy DealzBelum ada peringkat

- Islamic Economics and The Relevance of Al-Qawā Id Al-FiqhiyyahDokumen11 halamanIslamic Economics and The Relevance of Al-Qawā Id Al-Fiqhiyyahaim_nainaBelum ada peringkat

- Ramos, Michael Candidate Statement DA-Australia March2017Dokumen1 halamanRamos, Michael Candidate Statement DA-Australia March2017Todd St VrainBelum ada peringkat

- District Wise General Posts of Compliance MonitorsDokumen3 halamanDistrict Wise General Posts of Compliance MonitorsFayaz Ali DayoBelum ada peringkat

- Reading in Phillipine History PDFDokumen12 halamanReading in Phillipine History PDFjohn alester cuetoBelum ada peringkat

- IPRA PresentationDokumen15 halamanIPRA PresentationMae Niagara100% (1)

- Race, Gender and MediaDokumen6 halamanRace, Gender and Mediaallure_ch0% (2)

- 2011 Buckingham JF PHDDokumen397 halaman2011 Buckingham JF PHDMidnight_12Belum ada peringkat

- O P Jindal School - Raigarh (C.G) : Question Bank Set 1Dokumen35 halamanO P Jindal School - Raigarh (C.G) : Question Bank Set 1Horror TalesBelum ada peringkat

- Final Amc IndigenousnationmovementDokumen1 halamanFinal Amc IndigenousnationmovementDoug ThomasBelum ada peringkat

- The Loeb Classical Library. Aristotle. Politics. 1932 (Reprint 1959)Dokumen728 halamanThe Loeb Classical Library. Aristotle. Politics. 1932 (Reprint 1959)MJohn JSmith100% (1)

- Looming TowerDokumen8 halamanLooming TowerJared1015Belum ada peringkat

- ENGLEZA - Bureaucracy and MaladministrationDokumen3 halamanENGLEZA - Bureaucracy and MaladministrationCristian VoicuBelum ada peringkat

- Types of RightsDokumen2 halamanTypes of RightsArbab AlamBelum ada peringkat

- Sta. Rosa Development Vs CA and Juan Amante DigestDokumen1 halamanSta. Rosa Development Vs CA and Juan Amante DigestMirzi Olga Breech Silang100% (1)

- Garcia Vs DrilonDokumen2 halamanGarcia Vs DrilonAndrea Rio100% (1)

- General StudiesDokumen34 halamanGeneral StudiesMurali Krishna VelavetiBelum ada peringkat

- New CouncillorsDokumen7 halamanNew Councillorslavilovely545Belum ada peringkat

- Colombia-Canonoy and NaviaDokumen4 halamanColombia-Canonoy and NaviaLeila CanonoyBelum ada peringkat

- Our Common Agenda Policy Brief Youth Engagement enDokumen24 halamanOur Common Agenda Policy Brief Youth Engagement enGiang VuBelum ada peringkat

- Belgica Et Al Vs Exec Sec PDAF Case DigestDokumen9 halamanBelgica Et Al Vs Exec Sec PDAF Case DigestLudica OjaBelum ada peringkat

- Philippines Halal Certification Bodies (HCB)Dokumen2 halamanPhilippines Halal Certification Bodies (HCB)Marshae Chaclag PasongBelum ada peringkat

- The Most Outstanding Propagandist Was Jose RizalDokumen5 halamanThe Most Outstanding Propagandist Was Jose RizalAnonymous G7AdqnemziBelum ada peringkat

- Calalang V WilliamsDokumen1 halamanCalalang V WilliamsDarlene GanubBelum ada peringkat

- Why I Killed The Mahatma Under - Elst DR Koenraad PDFDokumen251 halamanWhy I Killed The Mahatma Under - Elst DR Koenraad PDFdarshanBelum ada peringkat

- ICAI Amends CPE Hours Requirements From 01st January 2023Dokumen2 halamanICAI Amends CPE Hours Requirements From 01st January 2023visshelpBelum ada peringkat

- A.C. No. 1699Dokumen2 halamanA.C. No. 1699w jdwjkndkjBelum ada peringkat

- 2.why They Don't Want You To Know What Types of Books The Nazis Burned - DailyVeracityDokumen1 halaman2.why They Don't Want You To Know What Types of Books The Nazis Burned - DailyVeracitym5wtpjnfh7Belum ada peringkat

- Anti-Loitering OrdinanceDokumen2 halamanAnti-Loitering OrdinanceJose AvenidoBelum ada peringkat