P 17-1 Cash Distribution Plan and Entries - Installment: Required

Diunggah oleh

Ghitha Afifah HurinDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

P 17-1 Cash Distribution Plan and Entries - Installment: Required

Diunggah oleh

Ghitha Afifah HurinHak Cipta:

Format Tersedia

P 17-1 Cash distribution plan and entriesInstallment

Barney, Betty, and Rubble are partners in a business that is in the process of liquidation. On January 1, 2011, the ledger accounts show the balances indicated:

Cash $25,000 Barney capital $72,000 Inventory 72,000 Betty capital 28,000 Supplies 18,000 Rubble capital 15,000

The cash is distributed to partners on January 1, 2011. Inventory and supplies are sold for a lumpsum price of $81,000 on February 9, 2011, and on February 10, 2011, cash on hand is distributed to the partners in final liquidation of the business. REQUIRED

1. Prepare the journal entry to distribute available cash on January 1, 2011. Include a safe payments schedule as proper explanation of who should receive cash. 2. Prepare journal entries necessary on February 9, 2011, to record the sale of assets and distribution of the gain or loss to the partners capital accounts. 3. Prepare the

P 17-4 Installment liquidation

The partnership of Gary, Henry, Ian, and Joseph is preparing to liquidate. Profit and loss sharing ratios are shown in the summarized balance sheet at December 31, 2011, as follows:

Cash $200,000 Other liabilities $100,000 Inventories 200,000 Gary capital (40%) 300,000 Loan to Henry 20,000 Henry capital (30%) 320,000 Other assets 510,000 Ian capital (20%) 100,000 Joseph capital (10%) 110,000 $930,000 $930,000

REQUIRED

1. The partners anticipate an installment liquidation. Prepare a cash distribution plan as of January 1, 2012, that includes a $50,000 contingency fund to help the partners predict when they will be included in cash distributions. 2. During January 2012, the inventories are sold for $100,000, the other liabilities are paid, and $50,000 is set aside for contingencies. The partners agree that loan balances should be closed to capital accounts and that remaining cash (less the contingency fund) should be distributed to partners. How much cash should each partner receive?

P 17-6 Installment liquidation

Jones, Smith, and Tandy are partners in a furniture store that began liquidation on January 1, 2011, when the ledger contained the following account balances:

Debit Credit

Cash $ Accounts receivable Inventories Land Buildings Accumulated depreciationbuildings Furniture and fi xtures Accumulated depreciationfurniture and fi xtures Accounts payable Jones capital (20%) Smith capital (30%) Tandy capital (50%)

15,000 20,000 65,000 50,000 100,000 40,000 50,000

300,000

30,000 80,000 40,000 60,000 50,000 300,000

The following transactions and events occurred during the liquidation process: January Inventories were sold for $20,000 cash, collections on account totaled

$14,000, and half of the amount due to creditors was paid. February Land costing $40,000 was sold for $60,000, the remaining land and buildings were sold for $40,000, half of the remaining receivables were collected, and the remainder were uncollectible. March The remaining liabilities were paid, and available cash was distributed to the partners in fi nal liquidation. REQUIRED: Prepare a statement of liquidation for the Jones, Smith, and Tandy partnership

P 17-7 Installment liquidation

The after-closing trial balance of the Lin, Mary, and Nell partnership at December 31, 2011, was as follows:

Debit Credit

Cash $ Receivablesnet Inventories Plant assetsnet Accounts payable $ Lin capital (50%) Mary capital (30%) Nell capital (20%) Total $

47,000 25,000 20,000 50,000 55,000 55,000 12,000 20,000 142,000 $142,000

ADDITIONAL INFORMATION

1. The partnership is to be liquidated as soon as the assets can be converted into cash. Cash realized on conversion of assets is to be distributed as it becomes available, except that $10,000 is to be held to provide for contingencies during the liquidation period. 2. Profits and losses on liquidation are to be divided in the percentages indicated in the trial balance.

REQUIRED

1. Prepare a cash distribution plan for the Lin, Mary, and Nell partnership. 2. If $25,000 cash is realized from the receivables and inventories during January 2012, how should the cash be distributed at the end of January? (Assume that this is the first distribution of cash during the liquidation period.).

Solution P17-1 1 Entries on trustees books:

March 1, 2008 Cash Accounts receivable net Inventories Land Buildings net Intangible assets Accounts payable Note payable unsecured Revenue received in advance Wages payable Mortgage payable Estate equity To record custody of Scott Corporation in liquidation. March 2008 Cash Estate equity Accounts receivable net To record collection of receivables and recognize loss. Cash Estate equity Inventories To record sale of inventories at a loss. Cash Estate equity Land Buildings net To record sale of land and buildings at a loss. Estate equity Intangible assets To write off intangible assets at a loss. Estate equity Administrative expenses payable new To accrue trustee expenses.

$ 4,000 8,000 36,000 20,000 100,000 26,000 $50,000 40,000 1,000 3,000 80,000 20,000

$ 7,200 800 $ 8,000

$ 19,400 16,600 $36,000

$ 90,000 30,000 $ 20,000 100,000

$ 26,000 $ 26,000

$ 8,200 $ 8,200

Scott Corporation in Trusteeship Balance Sheet at March 31, 2008 Assets Cash Liabilities And Deficit Accounts payable Note payable unsecured Revenue received in advance Wages payable Mortgage payable Administrative expenses payable new Total liabilities Less: Estate deficit Total liabilities less deficit Statement of Cash Receipts and Disbursements from March 1 to March 31, 2008 Cash balance, March 1, 2008 Add: Cash receipts Collections of receivables Sale of inventories Sale of land and buildings Less: Cash disbursements (none) Cash balance, March 31, 2008 Statement of Changes in Estate Equity from March 1 to March 31, 2008 Estate equity, March 1, 2008 Less: Loss on uncollectible receivables Loss on sale of inventories Loss on sale of land and buildings Loss on write-off of intangibles Administrative expenses Estate deficit, March 31, 2008 $ 800 16,600 30,000 26,000 8,200 $20,000 $ 4,000

$120,600

$ 50,000 40,000 1,000 3,000 80,000 8,200 182,200 (61,600) $120,600

$ 7,200 19,400 90,000

116,600 120,600 0 $120,600

81,600 $61,600

Entries on trustees books:

April 2008 Mortgage payable $80,000 Cash $80,000 To record payment of secured creditors from proceeds from sale of land and buildings. Administrative expenses payable new Revenue received in advance Wages payable Cash To record payment of priority liabilities. $ 8,200 1,000 3,000 $12,200

Accounts payable $15,800 Note payable unsecured 12,600 Cash $28,400 To record payment of $.32 per dollar to unsecured creditors (available cash of $28,400 divided by unsecured claims of $90,000). Accounts payable Note payable unsecured Estate equity To write off remaining liabilities and close trustees records. $34,200 27,400 $61,600

Anda mungkin juga menyukai

- Cold ShadowsDokumen130 halamanCold ShadowsDrraagh100% (4)

- Wonka ScriptDokumen9 halamanWonka ScriptCarlos Henrique Pinheiro33% (3)

- Control Accounts Practice QuestionsDokumen5 halamanControl Accounts Practice Questionsmairaj0897% (36)

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsDari EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsBelum ada peringkat

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsDari EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDari EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideBelum ada peringkat

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsDari EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsBelum ada peringkat

- 5.AUDITING ProblemDokumen111 halaman5.AUDITING ProblemAngelu Amper68% (22)

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityDari EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityBelum ada peringkat

- Invoice FANDokumen1 halamanInvoice FANVarsha A Kankanala0% (1)

- Basics of AccountingDokumen38 halamanBasics of AccountingAathirai AsokanBelum ada peringkat

- 25 Useful Brainstorming Techniques Personal Excellence EbookDokumen8 halaman25 Useful Brainstorming Techniques Personal Excellence EbookFikri HafiyaBelum ada peringkat

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersDari EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersBelum ada peringkat

- Pilot Exam FormDokumen2 halamanPilot Exam Formtiger402092900% (1)

- Accounting for Goodwill and Other Intangible AssetsDari EverandAccounting for Goodwill and Other Intangible AssetsPenilaian: 4 dari 5 bintang4/5 (1)

- Fa2 Specimen j14Dokumen16 halamanFa2 Specimen j14Shohin100% (1)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnDari EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- Doctrines On Persons and Family RelationsDokumen69 halamanDoctrines On Persons and Family RelationsCarla VirtucioBelum ada peringkat

- (Cooperative) BOD and Secretary CertificateDokumen3 halaman(Cooperative) BOD and Secretary Certificateresh lee100% (1)

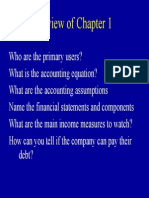

- Review of Ch 1 & 2 Key ConceptsDokumen46 halamanReview of Ch 1 & 2 Key ConceptsBookAddict721Belum ada peringkat

- Causation in CrimeDokumen15 halamanCausation in CrimeMuhammad Dilshad Ahmed Ansari0% (1)

- Accounting - ProblemsDokumen11 halamanAccounting - ProblemsAzfar JavaidBelum ada peringkat

- Summary of Richard A. Lambert's Financial Literacy for ManagersDari EverandSummary of Richard A. Lambert's Financial Literacy for ManagersBelum ada peringkat

- Assemblage Theory, Complexity and Contentious Politics - The Political Ontology of Gilles DeleuzeDokumen130 halamanAssemblage Theory, Complexity and Contentious Politics - The Political Ontology of Gilles DeleuzeGiorgio Bertini75% (4)

- Advanced Accounting ProblemsDokumen4 halamanAdvanced Accounting ProblemsAjay Sharma0% (1)

- Be16 P16 2aDokumen7 halamanBe16 P16 2aLisa Hammerle ClarkBelum ada peringkat

- Exercise Advanced Accounting SolutionsDokumen14 halamanExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- Advanced Accounting Chapter 16Dokumen3 halamanAdvanced Accounting Chapter 16sutan fanandiBelum ada peringkat

- Caribbean Examinations CouncilDokumen4 halamanCaribbean Examinations CouncilAneilRandyRamdialBelum ada peringkat

- CXC Principles of Accounts Past Paper Jan 2009Dokumen8 halamanCXC Principles of Accounts Past Paper Jan 2009lordBelum ada peringkat

- BU8101 Sem3 - Group 11Dokumen63 halamanBU8101 Sem3 - Group 11Shweta SridharBelum ada peringkat

- Quiz Chapter 11 Advance AccountingDokumen5 halamanQuiz Chapter 11 Advance Accounting20174112008 HERI AHMAD FAUZIBelum ada peringkat

- SOAL LATIHAN MK - AKL - FC TransactionsDokumen4 halamanSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- CP 7 TemplatesDokumen13 halamanCP 7 Templatessunnitd10Belum ada peringkat

- ACC 215 Homework 1Dokumen8 halamanACC 215 Homework 1abiroeskeBelum ada peringkat

- Caribbean Examinations Council: (16 Marks)Dokumen4 halamanCaribbean Examinations Council: (16 Marks)AneilRandyRamdialBelum ada peringkat

- ACCT5101Pretest PDFDokumen18 halamanACCT5101Pretest PDFArah OpalecBelum ada peringkat

- AaaDokumen43 halamanAaaMazhar ArshadBelum ada peringkat

- Bba1093 - Business Accounting - AssignmentDokumen3 halamanBba1093 - Business Accounting - AssignmentHuy NguyễnBelum ada peringkat

- Week 4Dokumen5 halamanWeek 4Erryn M. ParamythaBelum ada peringkat

- On January 1 The Partners of Van Bakel and Cox: Unlock Answers Here Solutiondone - OnlineDokumen1 halamanOn January 1 The Partners of Van Bakel and Cox: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghBelum ada peringkat

- Financial Accounting Basics Part FiveDokumen15 halamanFinancial Accounting Basics Part FiveSai KrishnaBelum ada peringkat

- Fa2 (Mba)Dokumen53 halamanFa2 (Mba)Muhbat Ali JunejoBelum ada peringkat

- Accounting II Chapters 12, 13, 14 ReviewDokumen10 halamanAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889Belum ada peringkat

- UntitledDokumen12 halamanUntitledMaykel BolañosBelum ada peringkat

- ACCT 2001 Exam 2 Review ProblemsDokumen11 halamanACCT 2001 Exam 2 Review Problemsdpa7020Belum ada peringkat

- WK 3 Textbook AssignmentDokumen4 halamanWK 3 Textbook AssignmentTressa audellBelum ada peringkat

- Que 01 12Dokumen13 halamanQue 01 12Cosovliu RamonaBelum ada peringkat

- Worksheet PartnershipDokumen6 halamanWorksheet PartnershipyoseBelum ada peringkat

- Ac550 FinalDokumen4 halamanAc550 FinalGil SuarezBelum ada peringkat

- CH 14Dokumen2 halamanCH 14vivienBelum ada peringkat

- Recording Business TransactionsDokumen48 halamanRecording Business TransactionsShahzeb RaheelBelum ada peringkat

- NUS ACC1002X Lecture 2 Accounting Cycle (I) - RecordingDokumen29 halamanNUS ACC1002X Lecture 2 Accounting Cycle (I) - Recordingchestervale1Belum ada peringkat

- IF2 - Project 1 PDFDokumen6 halamanIF2 - Project 1 PDFBillBelum ada peringkat

- Accounting entries transactions debit creditDokumen4 halamanAccounting entries transactions debit creditaigerimBelum ada peringkat

- Case. 1: Cash 15.000 $ Other Assets 185.000 $Dokumen2 halamanCase. 1: Cash 15.000 $ Other Assets 185.000 $RAJA JEFRY ERWIN YOSHUA S.Belum ada peringkat

- ACC300 Principles of AccountingDokumen11 halamanACC300 Principles of AccountingG JhaBelum ada peringkat

- An Introduction To Accounting Module F1Dokumen30 halamanAn Introduction To Accounting Module F1Jason Fry100% (1)

- Cat/fia (Fa2)Dokumen14 halamanCat/fia (Fa2)theizzatirosliBelum ada peringkat

- F3 MOCK 4: KEY ACCOUNTING CONCEPTSDokumen14 halamanF3 MOCK 4: KEY ACCOUNTING CONCEPTSMan Ish K DasBelum ada peringkat

- Why This AccountingDokumen8 halamanWhy This Accountingspectrum_48Belum ada peringkat

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDari EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetBelum ada peringkat

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransDari EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransBelum ada peringkat

- Summary of Tycho Press's Accounting for Small Business OwnersDari EverandSummary of Tycho Press's Accounting for Small Business OwnersBelum ada peringkat

- Bernardo Motion For ReconsiderationDokumen8 halamanBernardo Motion For ReconsiderationFelice Juleanne Lador-EscalanteBelum ada peringkat

- Marketing, Advertising and Product SafetyDokumen15 halamanMarketing, Advertising and Product SafetySmriti MehtaBelum ada peringkat

- Sabbia Food MenuDokumen2 halamanSabbia Food MenuNell CaseyBelum ada peringkat

- Addressing Menstrual Health and Gender EquityDokumen52 halamanAddressing Menstrual Health and Gender EquityShelly BhattacharyaBelum ada peringkat

- TallerDokumen102 halamanTallerMarie RodriguezBelum ada peringkat

- Social media types for media literacyDokumen28 halamanSocial media types for media literacyMa. Shantel CamposanoBelum ada peringkat

- Student-Led School Hazard MappingDokumen35 halamanStudent-Led School Hazard MappingjuliamarkBelum ada peringkat

- Music Business PlanDokumen51 halamanMusic Business PlandrkayalabBelum ada peringkat

- ERP in Apparel IndustryDokumen17 halamanERP in Apparel IndustrySuman KumarBelum ada peringkat

- Surface Chemistry Literature List: Literature On The SubjectDokumen5 halamanSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaBelum ada peringkat

- Can You Dribble The Ball Like A ProDokumen4 halamanCan You Dribble The Ball Like A ProMaradona MatiusBelum ada peringkat

- Data Mahasiswa Teknik Mesin 2020Dokumen88 halamanData Mahasiswa Teknik Mesin 2020Husnatul AlifahBelum ada peringkat

- CH 07Dokumen40 halamanCH 07Bobby513Belum ada peringkat

- Table of ProphetsDokumen5 halamanTable of ProphetsNajib AmrullahBelum ada peringkat

- International HR Management at Buro HappoldDokumen10 halamanInternational HR Management at Buro HappoldNishan ShettyBelum ada peringkat

- High-Performance Work Practices: Labor UnionDokumen2 halamanHigh-Performance Work Practices: Labor UnionGabriella LomanorekBelum ada peringkat

- MGT420Dokumen3 halamanMGT420Ummu Sarafilza ZamriBelum ada peringkat

- Chapter 2 Islamic Civilization4Dokumen104 halamanChapter 2 Islamic Civilization4Anas ShamsudinBelum ada peringkat

- New Wordpad DocumentDokumen2 halamanNew Wordpad DocumentJia JehangirBelum ada peringkat

- Subject and Object Questions WorksheetDokumen3 halamanSubject and Object Questions WorksheetLucas jofreBelum ada peringkat

- GLORIADokumen97 halamanGLORIAGovel EzraBelum ada peringkat