Let's Go For Derivative 29 April 2013 by Mansukh Investment and Trading Solution

Diunggah oleh

Mansukh Investment & Trading SolutionsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Let's Go For Derivative 29 April 2013 by Mansukh Investment and Trading Solution

Diunggah oleh

Mansukh Investment & Trading SolutionsHak Cipta:

Format Tersedia

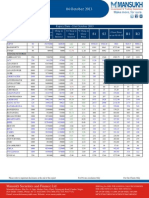

Daily Derivative Report

NIFTY FUTURE : 5,889.00 -32.80 -0.55%

29 April 2013

Nifty Sentiment Indicators

Put Call Ratio-Index Options Put Call Ratio-Stock Options 1.15 0.59

F & O HIGHLIGHTS

Nifty May 2013 futures closed at 5887.75 on Friday at a premium of 16.30 points over spot closing of 5,871.45, while Nifty June 2013 futures ended at 5897.50, at a discount of 26.05 points over spot closing. Nifty May futures saw an addition of 0.79 million (mn) units taking the total outstanding open interest (OI) to 15.81 mn units. The near month May 2013 derivatives contract will expire on May 30, 2013. From the most active contracts, R Com May 2013 futures were trading flat at 93.65 compared with spot closing of 93.65. The number of contracts traded was 11,279.DLF May 2013 futures were trading at a discount of 0.65 points at 237.85 compared with spot closing of 238.50. The number of contracts traded was 14,937. LIC Housing Finance May 2013 futures were trading at a discount of 1.91 points at 248.9 compared with spot closing of 250.00. The number of contracts traded was 18,074. Reliance Industries May 2013 futures were at a discount of 3.70 points at 790 compared with spot closing of 793.70. The number of contracts traded was 20,057. United Spirits May 2013 futures were at a premium of 14.15 points at 2061.8 compared with spot closing of 2,047.65. The number of contracts traded was 13,701.

Increase in Open Interest with Decrease in price Symbol Last price Chg (%) Open Interest Increase (%)

Product

Index Futures Stock Futures Index Options Stock Options Total F&O

25.04.13 771462

1,332,241 8038164 470209 10612076

Volume 26.04.13 246231

548,234 1694921 288011 2777397

% Chg

-68.08% -58.85% -78.91% -38.75% -73.83%

Index

NIFTY BANK NIFTY CNXIT

Spot

5,871.45 12,533.15 5,972.70

Future

5,889.00

Basis

18 (29) (11)

12,504.00

5,961.50

Increase in Open Interest with Increase in price Symbol MARUTI EXIDEIND GAIL IGL HDFC Last price 1682.75 139.85 351.75 307.05 878.65 Chg (%) 5.24% 1.01% 2.00% 2.25% 1.40% Open Interest 2,685,000 2,284,000 1,787,000 1,265,000 4,021,750 21.69% 14.31% 14.11% 11.95% 11.24% Increase (%)

SIEMENS HCLTECH TCS JINDALSTEL ICICIBANK

504.55 688.8 1366.9 317.2 1132.75

-3.96% -4.66% -2.71% -3.82% -3.16%

883,000 2,939,000 4,207,250 7,164,000 5,637,000

44.87% 31.06% 27.75% 20.20% 18.11%

t s e r e t n i n e p o

6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0

CP

call put

Nifty Option Open Interest Distribution Nifty May 5900 call added 4.22 lakh shares in OI and 6000 call added 5.22 lakh shares in OI. On the put side nifty May 5800 put added 2.41 lakh shares in OI and 5700 put added 3.14 lakh in OI. The put-call ratio of index option decreased from 1.21 to 1.15 while put-call ratio of stock option increased from 0.58 to 0.59. On the whole the put call ratio was at 1.05.

strike price

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Daily Derivative Report

NIFTY OUTLOOK :

The nifty future is likely to trade in the range of 5610 - 6148 level in short term as the OI is added. The trading strategy would be create long positions if the nifty takes support around 5800 levels for the target of 5850 and 5900 . On the other hand, one can also create short positions if the nifty future resist around 5980 levels.

MOST ACTIVE CALLS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY BANKNIFTY NIFTY NIFTY Expiry Date Strike Price 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 6,000 5,900 6,100 6,200 6,300 5,800 13,000 6,600 5,700 Contracts Traded 1,91,048 1,86,509 1,18,423 80979 48583 44,129 9,422 8,180 7,677 Open Interest 39,11,400 45,89,400 31,56,950 20,93,800 14,38,550 35,07,100 89275 32950 27,07,600

Symbol MOST ACTIVE PUTS Expiry Date Strike Price Contracts Traded Open Interest

NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY

30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13 30-May-13

5,800 5,900 5,700 5,600 5,500 5,400 6,000 5,300

2,07,336 1,97,263 1,27,437 84183 62304 54,397 31,998 19,509

51,07,800 32,66,650 48,79,700 34,57,250 41,76,900 41,99,800 10,51,950 13,13,850

For any information or suggestion, please send your query at research@moneysukh.com

For Private circulation Only For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Daily Derivative Report

STRATEGY TRACKER DATE OF STRATEGY UNDERLYING ASSET STRATEGY IN/OUT FLOW NET PROFIT/ LOSS AS ON 22/04/2013 REMARK

9/4/2013

NIFTY

BUY NIFTY APRIL FUTURE @5550 BUY NIFTY APRIL 5500 PUT@ 50 BUY NIFTY APRIL FUTURE @5700 BUY NIFTY APRIL 5700 PUT@ 70 SELL NIFTY MARCH 6000 CALL@23 SELL NIFTY MARCH 5800 PUT@ 29 SELL NIFTY JAN 6000 CALL@ 49 BUY TWO NIFTY JAN 6100 CALL@ 18 SELL NIFTY MARCH 5900 CALL@22 SELL NIFTY MARCH 5600 PUT@ 37

-50

270.00

BOOK FULL PROFIT AS ON 23.04.2013 BOOK PARTIAL PROFIT AS ON 03.04.2013

2/4/2013

NIFTY

-70

47.00

18/3/2013

NIFTY

52

(57.00)

CLOSED

11/3/2013

NIFTY

13

7.00

BOOK PARTIAL PROFIT AS ON 14.03.2013 BOOK PARTIAL PROFIT AS ON 05.03.2013

4/3/2013

NIFTY

59

11.45

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Results Tracker 09.11.2013Dokumen3 halamanResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Results Tracker 08.11.2013Dokumen3 halamanResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Results Tracker 07.11.2013Dokumen3 halamanResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Ifs Tybms Sem Vi Mcqs FinalDokumen12 halamanIfs Tybms Sem Vi Mcqs FinalSudhakar Guntuka0% (1)

- Topic 1.1 Common-Size Financial Statement Analysis: Page 1 of 54Dokumen54 halamanTopic 1.1 Common-Size Financial Statement Analysis: Page 1 of 54Galeli PascualBelum ada peringkat

- SCDL Solved Papers & Assignments - Security Analysis and Portfolio Management - Set 3Dokumen13 halamanSCDL Solved Papers & Assignments - Security Analysis and Portfolio Management - Set 3Om PrakashBelum ada peringkat

- Understanding Bank Financial StatementsDokumen49 halamanUnderstanding Bank Financial StatementsRajat MehtaBelum ada peringkat

- Research Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Dokumen18 halamanResearch Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Ajinkya YadavBelum ada peringkat

- Suttmeier Weekly Market BriefingDokumen3 halamanSuttmeier Weekly Market BriefingRichard SuttmeierBelum ada peringkat

- Working Capital Management BhelDokumen82 halamanWorking Capital Management Bhelarunravi24120% (1)

- Axis Top Picks - Apr 2024 - Final - 01-04-2024 - 16Dokumen82 halamanAxis Top Picks - Apr 2024 - Final - 01-04-2024 - 16RASHMIN GADHIYABelum ada peringkat

- Aswath Damodaran Tesla ValuationDokumen57 halamanAswath Damodaran Tesla ValuationArup DeyBelum ada peringkat

- Sources of Finance DefinitionDokumen6 halamanSources of Finance Definitionpallavi4846100% (1)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Venezuelan Enterprise Current Situation Challenges and OpportunitiesDokumen74 halamanThe Venezuelan Enterprise Current Situation Challenges and OpportunitiesRuben Gonzalez CortesBelum ada peringkat

- Ratio Analysis of Suzlon EnergyDokumen3 halamanRatio Analysis of Suzlon EnergyBharat RajputBelum ada peringkat

- CH 15Dokumen72 halamanCH 15Debora Silvyana ManaluBelum ada peringkat

- Final Defense ScriptDokumen4 halamanFinal Defense Scriptandeng100% (1)

- Day Trading Rules That Makes Successful Trader ADokumen6 halamanDay Trading Rules That Makes Successful Trader Aसन्तोष सिंह जादौनBelum ada peringkat

- Financial AnalysisDokumen22 halamanFinancial Analysisnomaan khanBelum ada peringkat

- 3.2 Mat112 Markup and Markdown Answer SchemeDokumen5 halaman3.2 Mat112 Markup and Markdown Answer SchemeNisha CDBelum ada peringkat

- Contemporary Labor Economics 11th Edition McConnell Test Bank 1Dokumen19 halamanContemporary Labor Economics 11th Edition McConnell Test Bank 1patricia100% (22)

- Startup India Standup IndiaDokumen24 halamanStartup India Standup IndiaYash SoniBelum ada peringkat

- Economic Value AddedDokumen17 halamanEconomic Value Addedapi-26923473100% (1)

- Summer Internship Project: "Online Trading Mechanism at Sharekhan"Dokumen49 halamanSummer Internship Project: "Online Trading Mechanism at Sharekhan"Manish KumarBelum ada peringkat

- Phoenix Light SF Limited Vs Morgan StanleyDokumen311 halamanPhoenix Light SF Limited Vs Morgan StanleyRazmik BoghossianBelum ada peringkat

- Entrepreneur First Grapples With Staff Exits, Seed Funding Gap in SEADokumen4 halamanEntrepreneur First Grapples With Staff Exits, Seed Funding Gap in SEAbonobomonkeyBelum ada peringkat

- Airtel Africa PLC - Results For Half Year Ended 30 September 2023Dokumen56 halamanAirtel Africa PLC - Results For Half Year Ended 30 September 2023Anonymous FnM14a0Belum ada peringkat

- 05 Wms Green Fields RenaissanceDokumen5 halaman05 Wms Green Fields RenaissanceAllan DouglasBelum ada peringkat

- Corporate Reputation: Image and IdentityDokumen15 halamanCorporate Reputation: Image and IdentityInês PereiraBelum ada peringkat

- General Accounting 1 - Indianola Pharmaceutical CompanyDokumen7 halamanGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesBelum ada peringkat

- JSC Bank For Investment and Development of Vietnam (HOSE: BID)Dokumen7 halamanJSC Bank For Investment and Development of Vietnam (HOSE: BID)Thu Huong PhamBelum ada peringkat

- Cyber ScamDokumen11 halamanCyber ScamGinger KalaivaniBelum ada peringkat

- PCEF Part 2 - Optional Units ELECTRONIC 2020 15102020Dokumen17 halamanPCEF Part 2 - Optional Units ELECTRONIC 2020 15102020D.WorkuBelum ada peringkat