Hira Moti

Diunggah oleh

Prakhar RatheeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Hira Moti

Diunggah oleh

Prakhar RatheeHak Cipta:

Format Tersedia

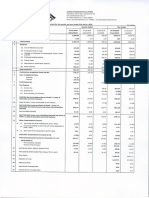

The Marginal Income Report prepared by consultant highlights some of the following features of Moti and Heera (P)

Limited: Mumbai

Income Variable Cost Contribution to Mumbai Fixed OH Sunk Cost Escapable Fixed Cost Total Fixed Cost Contributin to Local Company OH Mumbai OH Contribution to Company OH and Profits Poster EX 3 3,55,231 1,07,621 2,47,610 96,155 89,651 1,85,806 61,804 Paint EX 4 2,06,261 72,305 1,33,956 32,344 51,502 83,846 50,110 2,300 2,300 24,344 Commercial EX 5 81,363 54,719 26,644 Location Total Company TOTAL

6,42,855 2,34,645 4,08,210 1,28,499 1,43,453 2,71,952 1,36,258 89,482 46,776

Fixed Cost to Sales Break Even Income Location Cont./ Sales Ratio Cont to Sales (P/v Ratio)

0.52 1,85,806 0.17 0.70

0.41 83,846 0.24 0.65

0.03 2,300 0.30 0.33

0.42 2,71,952 0.21 0.63

Delhi

Income Variable Cost Contribution to Delhi Fixed OH Sunk Cost Escapable Fixed Cost

Poster EX 6 99,899 40,619 59,280 13,608 15,938

Paint EX 7 23,318 3,867 19,451 4,068 5,518

Commercial EX 8 14,516 9,884 4,632 1,37,733 54,370 83,363 (28,993) 592 1,12,356 7,80,588 2,89,015 4,91,573 99,506 2,55,809

Total Fixed Cost Contributin to Local Company OH Delhi OH Contribution to Company OH and Profits Company OH Company Profit/Loss

29,546 29,734

9,586 9,865 4,040

592

83,363 43,639 31,011 12,628 1,79,897 1,20,493 59,404 1,00,061 (40,657)

Fixed Cost to Sales Break Even Income Location Cont./ Sales Ratio Cont to Sales (P/v Ratio)

0.30 29,546 0.30 0.59

0.41 9,586 0.42 0.83

0.04 592 0.28 0.32

0.61 83,363 0.32 0.61

0.58

In addition to the accounts classification, breakeven information is also given at the end of the table, which has been extracted from the case details.

Questions:

1. What is the purpose of separating sunk fixed costs and escapable fixed costs? What is the meaning of these terms? How is this breakdown relevant? Ans: Both sunk costs and escapable fixed costs are constituent of total specific fixed cost allocated to any particular department of any location. Sunk cost is that component of fixed cost that is bound to occur even if the production of that particular department is halted immediately, while escapable fixed cost is that component of fixed cost which is incurred as long as the production is carried. For the purpose of drawing break even charts, both types of fixed costs are taken together. But the consultants report is prepared for taking a business decision i.e. shutting down a part of business completely. In order to get such insights from the report it is beneficial to separate the two costs. Loss (if plant is operational): Total Cost Total Revenues = Sunk Costs + Esc. F.C +Variable Costs Total Revenues = Sunk Costs + Esc. F.C Total Contribution And, Loss (if plant is shutdown): Sunk Cost So, its better to operate the plant if: Loss (if plant is shutdown) > Loss (if plant is operational)

i.e. Sunk Cost > Sunk Cost + Esc. F.C Total Contribution or, Total Contribution > Esc. F.C Thus the plant can be operated below B.E.P also if the above derived condition is fulfilled. 2. What is the meaning of specific fixed costs as used in the consultants report? Ans: The consultant divided the total overhead/fixed costs of company as follows: a) Company-wide overhead b) Local overhead c) Specific fixed costs The company-wide overhead is that part of total overhead which cannot be linked to any particular location. Location overheads are those overheads which can be associated with a particular location but cannot be associated with a particular product at that location. While Specific Fixed Costs are those overhead which can be clearly attributed to a particular product in a particular location. In Break-even charts, it is this Specific Fixed Costs that is used. Since each individual product break-even chart shows profit, this implies that the contributions are sufficient to cover the Specific Fixed Costs but are not able to cover the total overheads of th company (as the company is overall making losses). This Specific Fixed Costs is further divided into two parts, and thus can also be represented as: Specific Fixed Costs = Sunk Costs + Esc. F.C

3. Would an overall breakeven chart for the company serve the purpose just as well as the individual P/V charts? Ans: No. The individual P/V charts gives us various insights that the overall breakeven chart cannot give. P/V charts give us information about which product of a particular location is contributing more to the companys income. The P/V ratios available from individual charts indicate which product will result in maximum increase in income on unit increment in sales and thus indicate the direction in which the future investments are to be made. The overall breakeven chart, however show the overall income of the company which these individual charts do not show directly, but it make more sense to draw these overall breakeven charts if we are sure that all the fixed costs are associated with the production of either of these products which is not the case here since there are certain fixed overhead costs under company and location overhead which cannot be associated with the production of any of these items.

4. What is the meaning and significance of the breakeven points shown on the P\V charts? Ans: The P/V charts are the graphical representation of how the companys profits\contributions vary with the sales. These have been drawn by first plotting the specific fixed costs (both sunk and escapable), which is a horizontal line, of a particular department of a particular location. Then, the P/V line is plotted, which is nothing but the incremental income (additional income minus added variable costs) at increasing sales volumes sales pertaining to that department of that particular location. Simply put, this line has the slope, which equals the fraction of incremental income over sales of the specified location. The intersection of the P/V and the fixed costs line is the breakeven point. At this breakeven point, the specific fixed costs (income minus variable costs) are covered by the amount of sales generated. Whatever excess income is garnered beyond this point will cover the local and company overheads or simply will add to the profits. 5. Three types of contributions are shown in the exhibit (or the table above). What is the significance of each? Ans: The three levels of contributions are: a. Total contribution to Specific Fixed Costs The sum of the - income minus variable costs, of the local department at the given region. b. Total contribution to Local company overheads Contribution from the given region (ex: Bombay and Delhi). c. Contribution to Company overheads and profit Total contribution of the company. The clear picture of the contributions of each department in each location will give the managers good clarity in deciding the most profitable\useful department in the company. 6. What purposes could be served by this type of analysis? Ans: Marginal accounting or cost volume profit analysis (CVP) simplifies computation of the break even points in breakeven analysis and allows simple computation of target income sales. It simplifies analysis of short run tradeoffs in operational decisions. Accountants often perform CVP analysis to plan future levels of operating activity and provide information about: y y Potential products or services to emphasize Break out of different products and their individual contribution

y y y

The amount of revenue needed to avoid losses and to break even etc Profitability of different departments Volume of sales needed to achieve the targeted profits

7. What are the limitations of this type of analysis? Ans: The main limitation of this type of analysis is that it makes some key assumption, as under: y Cost function is linear o Fixed costs remain constant o Variable costs per unit remains constant y Revenue function is linear o Sales mix remains constant o Prices remain constant CVP analysis is difficult in cases where separation of fixed and variable costs is difficult. Also, future volumes, revenues and costs are unknown, so the above CVP assumptions might not hold. Because of this, factors such as the quality of data used, suitability of CVP analysis and the sensitivity of CVP results to changes in input data must also be taken into consideration, before making any decisions based on this analysis.

Anda mungkin juga menyukai

- 09b Valuation2Dokumen8 halaman09b Valuation2david AbotsitseBelum ada peringkat

- Analyzing cash flows and profitability of Ceres Gardening CompanyDokumen5 halamanAnalyzing cash flows and profitability of Ceres Gardening CompanyShubham MishraBelum ada peringkat

- Enel Snapshot Analysis - Manfredi SopraniDokumen9 halamanEnel Snapshot Analysis - Manfredi SopraniManfredi SopraniBelum ada peringkat

- Moti and HeeraDokumen4 halamanMoti and HeeraAnupam BanerjeeBelum ada peringkat

- NBA ADVANCED - Happy Hour Co - DCF COMPLETEDDokumen10 halamanNBA ADVANCED - Happy Hour Co - DCF COMPLETEDViinnii Kumar100% (1)

- Internship Report on Ratio Analysis of Jamuna BankDokumen5 halamanInternship Report on Ratio Analysis of Jamuna BanksahhhhhhhBelum ada peringkat

- Sigachi Quaterly and Annual ResultsDokumen18 halamanSigachi Quaterly and Annual Resultsknowme73Belum ada peringkat

- Group 2 employee detailsDokumen20 halamanGroup 2 employee detailsReeja Mariam MathewBelum ada peringkat

- C Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23Dokumen325 halamanC Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23yash rajBelum ada peringkat

- How to achieve success through performance highlightsDokumen4 halamanHow to achieve success through performance highlightsShubham GoelBelum ada peringkat

- Financial HighlightsDokumen4 halamanFinancial HighlightsmomBelum ada peringkat

- Case 1Dokumen3 halamanCase 1Naveen AttigeriBelum ada peringkat

- Revenues & Earnings: All Figures in US$ MillionDokumen4 halamanRevenues & Earnings: All Figures in US$ MillionenzoBelum ada peringkat

- Pakistan State Oil Company Limited (Pso)Dokumen6 halamanPakistan State Oil Company Limited (Pso)Maaz HanifBelum ada peringkat

- Financial Analysis of Boohoo plc Reveals Rapid GrowthDokumen47 halamanFinancial Analysis of Boohoo plc Reveals Rapid Growthameet100% (1)

- NIKE 10-Year Financial History SummaryDokumen3 halamanNIKE 10-Year Financial History Summarylrsrz8Belum ada peringkat

- Key Performance Indicators (Kpis) : FormulaeDokumen4 halamanKey Performance Indicators (Kpis) : FormulaeAfshan AhmedBelum ada peringkat

- Featherstone Dry Mix Pvt. Ltd. Serial Particulars Units: Sales 848.25 1050.53Dokumen39 halamanFeatherstone Dry Mix Pvt. Ltd. Serial Particulars Units: Sales 848.25 1050.53saubhik goswamiBelum ada peringkat

- Tata Global Beverages Ltd. Capital Structure and Ratio AnalysisDokumen3 halamanTata Global Beverages Ltd. Capital Structure and Ratio AnalysisKapil Singh RautelaBelum ada peringkat

- Financial Performance and Ratio Trends Over 4 YearsDokumen2 halamanFinancial Performance and Ratio Trends Over 4 YearsASHOK JAINBelum ada peringkat

- Project ChimniDokumen12 halamanProject ChimniManjari AgrawalBelum ada peringkat

- Finance Seminar 4Dokumen2 halamanFinance Seminar 4phoebe8sohBelum ada peringkat

- Projections of Performance, Profitability and RepaymentDokumen5 halamanProjections of Performance, Profitability and Repaymentmanohar michaelBelum ada peringkat

- MTP 2 SolDokumen12 halamanMTP 2 SolItikaa TiwariBelum ada peringkat

- Unitech LimitedDokumen25 halamanUnitech LimitedVikas SharmaBelum ada peringkat

- Pidilite Industries Income StatementDokumen4 halamanPidilite Industries Income StatementRehan TyagiBelum ada peringkat

- MBMR 2ndQtr2020 - 19 Aug 2020Dokumen15 halamanMBMR 2ndQtr2020 - 19 Aug 2020Gan ZhiHanBelum ada peringkat

- PNX Income Statement AnalysisDokumen12 halamanPNX Income Statement AnalysisDave Emmanuel SadunanBelum ada peringkat

- Fundcard: SBI Consumption Opportunities FundDokumen4 halamanFundcard: SBI Consumption Opportunities FundNikit ShahBelum ada peringkat

- Cma-Data RajeshwarDokumen16 halamanCma-Data RajeshwarVIRAT SAXENABelum ada peringkat

- Asian Paints (Autosaved) 2Dokumen32.767 halamanAsian Paints (Autosaved) 2niteshjaiswal8240Belum ada peringkat

- Massage Oil Production Income ScenariosDokumen3 halamanMassage Oil Production Income Scenarios'Mariciela LendioBelum ada peringkat

- GroupX Firm PerformanceDokumen12 halamanGroupX Firm PerformanceAimen KhatanaBelum ada peringkat

- 16 Financial HighlightsDokumen2 halaman16 Financial HighlightswasiumBelum ada peringkat

- PLFM D22 Student Mark Plan PDFDokumen12 halamanPLFM D22 Student Mark Plan PDFscottBelum ada peringkat

- Aditya Birla Fashion and Retail - 3QFY24 Result Update - 15 Feb 24Dokumen8 halamanAditya Birla Fashion and Retail - 3QFY24 Result Update - 15 Feb 24krishna_buntyBelum ada peringkat

- Sanitärtechnik Eisenberg GMBH - FinancialsDokumen2 halamanSanitärtechnik Eisenberg GMBH - Financialsin_daHouseBelum ada peringkat

- R D Offlc Mbic Oad, Va o A 3 003: of MaDokumen10 halamanR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalBelum ada peringkat

- Nba Advanced - Happy Hour Co - DCF Model v2Dokumen10 halamanNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SBelum ada peringkat

- SLDokumen10 halamanSLNadya Indah DewantiBelum ada peringkat

- Bajaj - Hero Honda ComparisonDokumen11 halamanBajaj - Hero Honda ComparisonPunit SardaBelum ada peringkat

- Exxon Mobil PDFDokumen65 halamanExxon Mobil PDFivan.maldonadoBelum ada peringkat

- Lloyds Banking Group PLC Q1 2019 Interim Management StatementDokumen5 halamanLloyds Banking Group PLC Q1 2019 Interim Management StatementsaxobobBelum ada peringkat

- Introduction To Business Finance Chemical Industry: Submitted To: Ma'Am Shakira FareedDokumen69 halamanIntroduction To Business Finance Chemical Industry: Submitted To: Ma'Am Shakira Fareedmohtashim khalidBelum ada peringkat

- Equity ValuationDokumen26 halamanEquity ValuationAashish mishraBelum ada peringkat

- Nike Inc - Cost of Capital - Syndicate 10Dokumen16 halamanNike Inc - Cost of Capital - Syndicate 10Anthony KwoBelum ada peringkat

- Financial PlanDokumen8 halamanFinancial PlanwajeehaBelum ada peringkat

- 2 - BK City Union Bank - 3QFY20Dokumen8 halaman2 - BK City Union Bank - 3QFY20Girish Raj SankunnyBelum ada peringkat

- Kurva S Pembangunan Rumah Di Jl. Balai Pustaka Baru No. 1 RawamangunDokumen2 halamanKurva S Pembangunan Rumah Di Jl. Balai Pustaka Baru No. 1 RawamangunFarhan LangenBelum ada peringkat

- Financials SaharaDokumen19 halamanFinancials SaharaJitendra NikhareBelum ada peringkat

- Principles of FinanceDokumen9 halamanPrinciples of FinanceEdmond YapBelum ada peringkat

- Payback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsDokumen2 halamanPayback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsIzhiel Mai PadillaBelum ada peringkat

- ANEXDokumen2 halamanANEXIzhiel Mai PadillaBelum ada peringkat

- Task 3 - DCF ModelDokumen10 halamanTask 3 - DCF Modeldavin nathanBelum ada peringkat

- Airan PL YearlyDokumen2 halamanAiran PL YearlymilanBelum ada peringkat

- Mahindra Ratio Analysis InsightsDokumen25 halamanMahindra Ratio Analysis Insightssovinahalli 1234Belum ada peringkat

- Jamna Auto Industries LimitedDokumen1 halamanJamna Auto Industries LimitedpoloBelum ada peringkat

- Cummins India Financial ModelDokumen52 halamanCummins India Financial ModelJitendra YadavBelum ada peringkat

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesDari EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesPenilaian: 5 dari 5 bintang5/5 (3)

- The Vanca CaseDokumen17 halamanThe Vanca CasePhilip Sembiring100% (3)

- Logistik 1Dokumen49 halamanLogistik 1endangBelum ada peringkat

- Short Guide To IFRSDokumen35 halamanShort Guide To IFRSAdekanye Adetayo100% (1)

- Segment AnalysisDokumen53 halamanSegment AnalysisamanBelum ada peringkat

- CBL AssignmentDokumen25 halamanCBL Assignmentkokila amarasingheBelum ada peringkat

- Pathways To Entrepreneurial GrowthDokumen11 halamanPathways To Entrepreneurial GrowthHòa Âu DươngBelum ada peringkat

- Good Formatted Accounting Finance For Bankers AFB 1 1Dokumen32 halamanGood Formatted Accounting Finance For Bankers AFB 1 1Aditya MishraBelum ada peringkat

- Marketing Plan for Adidas Analyzes Segmentation, 4Ps, and Relationship StrategiesDokumen13 halamanMarketing Plan for Adidas Analyzes Segmentation, 4Ps, and Relationship StrategiesDenis DobreBelum ada peringkat

- Lecture 10 - Industrial ManagementDokumen91 halamanLecture 10 - Industrial ManagementSadaf MustafaBelum ada peringkat

- Offensive Pricing Strategies For Online PlatformsDokumen18 halamanOffensive Pricing Strategies For Online PlatformsYolita Satya Gitya UtamiBelum ada peringkat

- Jurnal Ud BuanaDokumen9 halamanJurnal Ud BuanaLutfiyah Alkaff100% (1)

- Galley+Final AmelyaDokumen7 halamanGalley+Final AmelyaDinaa KiraniiBelum ada peringkat

- Chapter 1 Fundamental Principles of ValuationDokumen22 halamanChapter 1 Fundamental Principles of ValuationEmilyn MagoltaBelum ada peringkat

- Assessment 2 (Case Study)Dokumen6 halamanAssessment 2 (Case Study)Rishabh KulshreshthaBelum ada peringkat

- The Fashion Channel: Harvard Business Publishing Case Study by Wendy StahlDokumen9 halamanThe Fashion Channel: Harvard Business Publishing Case Study by Wendy Stahlyukio1989100% (4)

- Holy Angel University School of Business and Accountancy Management and Human Behavior in OrganizationsDokumen3 halamanHoly Angel University School of Business and Accountancy Management and Human Behavior in OrganizationsIrish Chrysel TorresBelum ada peringkat

- Corpo Questions 1Dokumen10 halamanCorpo Questions 1Kyle SantosBelum ada peringkat

- Welsh Hotel Cost-Volume-Profit Analysis and UncertaintyDokumen6 halamanWelsh Hotel Cost-Volume-Profit Analysis and UncertaintyramondBelum ada peringkat

- Từ điển kiểm toánDokumen51 halamanTừ điển kiểm toánElena Happy-today100% (13)

- Jindi ShikhaDokumen11 halamanJindi ShikhaShikha TickooBelum ada peringkat

- Kerin3Ce AppendixDokumen14 halamanKerin3Ce AppendixKalia HayesBelum ada peringkat

- Cfas 1-4 First QuizDokumen165 halamanCfas 1-4 First QuizDona Kris GumbanBelum ada peringkat

- How to Write a Business Plan in 40 StepsDokumen14 halamanHow to Write a Business Plan in 40 StepsThirdaine Medz GañaBelum ada peringkat

- Ratio Analysis (1) .Doc 1Dokumen24 halamanRatio Analysis (1) .Doc 1Priya SinghBelum ada peringkat

- Optimize HP Inkjet Supply ChainDokumen10 halamanOptimize HP Inkjet Supply Chainmatt_dellinger12Belum ada peringkat

- Don Honorio Ventura State University College of Business StudiesDokumen12 halamanDon Honorio Ventura State University College of Business StudiesMariz TrajanoBelum ada peringkat

- Do It Yourself - AnswersDokumen60 halamanDo It Yourself - AnswersSafaetplayzBelum ada peringkat

- Apayao Glassworks BusinessDokumen4 halamanApayao Glassworks BusinessvicentaBelum ada peringkat

- Digital Marketing Boosts Small Business ProfitsDokumen13 halamanDigital Marketing Boosts Small Business ProfitsMJ Gomba AdriaticoBelum ada peringkat

- Multi Sport Complex Business PlanDokumen35 halamanMulti Sport Complex Business Plantirthank628296Belum ada peringkat