Buy Unitech - Target 51

Diunggah oleh

Sovid GuptaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Buy Unitech - Target 51

Diunggah oleh

Sovid GuptaHak Cipta:

Format Tersedia

th

25 March, 2009

India

Unitech Ltd.

Construction CMP: Rs. 33.90 Target: Rs. 51

We initiate a buy on Unitech, with a target of Rs. 51. Yesterday share closed up by 16% to

close at 33.90. Unitech touched its peak of Rs. 546.80 in Jan’08 and since then Unitech

stock has fallen and is currently trading at discount of 94% to that price. One year of global

Sovid Gupta +911243024840 turmoil has taken maximum toll on leveraged companies. Unitech has a debt of ~ Rs.

10,000 crore and Debt to Equity Ratio of 2.4 (TTM)

Equity Analyst: Fairwealth Securities Company had to pay 2500 crore of debt by March’09, global credit crisis squeezed liquidity

Private. Ltd. out of the system, have made it difficult for Unitech to pay its short term and long term debt.

However company has made huge efforts to solve the current liquidity crisis.

Highlights:

Company has achieved major break through in terms of handling its liquidity:

Priced on March’25, 2009

1) Rolled of 75% of Rs. 2500 crores due by March’09.

±% potential 50%

2) Company has raised Rs.1000 crores long term debt with maturity of 3-5 years, to

Target set on 25th March replace short term debt.

3) Closed Telenor deal and expecting first payment within this week. Company has

declared that this money would be used to to pay off debts taken by Unitech for

Unitech wireless.

4) Sold off Hotel property in Gurgaon at around Rs. 250 crore and is in advanced

Market Data talks for to sell office property in Saket at around Rs. 500 crore.

Beta 1.53

12M hi/lo 338/21.9 Future Estimates:

Market cap, INR Crores 45374 Income Statement (Standalone Rs. Crore)

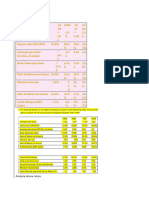

Shares in issue (mn.) FY09E FY08 FY07

Reuters UNTE.BO Net Sales 3300 4115 3290

Bloomberg UT.IN Stock Adjustment Na -13 -13

Total 3300 4101 3276

Operating Profit 1815 2240 1866

Interest 550 317 165

Gross Profit 1265 1923 1799

Share Holding Pattern (%) Depreciation 20 21 7

Promoters 67.5% Profit Before Tax before OI 1245 1903 1792

FII 6.3% Other Income 80 165 98

Domestic Inst. & Corp Bod. 13.5%

PBT 1325 2068 1890

Public & Others 13%

Tax 265 399 486

Net Profit 1060 1669 1306

EO Items & Min. Interest 8 44 22

Adj Net profit 1052 1581 1261

EPS 6.8 10.2 8.0

Source: Fairwealth Securities Research Estimates, Company data

Fairwealth Securities Page 1

Unitech- Buy

Quarterly Result Round up:

Q3FY’09 Q3FY’08 VAR % Q2FY’09 VAR %

Net Sales 489 1142 -57% 983 -50%

Other Income 18 25 -27% 18 -1%

Total Income 508 1167 -57% 1001 -49%

Interests costs have seen Total Expenditure 245 408 -40% 374 -34%

sharp rise as company raised

PBIDT 262 759 -65% 627 -58%

a lot of short term debt at

higherest rates(19%) to PBIDT(before OI) 244 734 -67% 609

handle the acute liquidity

crises. Interest 97 98 -1% 134 -28%

PBDT 166 661 -75% 493 -66%

Margins have dipped by 1400

bps from 64% in Q3 FY’08 to Depreciation 5 5 -4% 4 37%

50% in Q3 Fy’09. Operating

margins will fall further in Tax 21 131 -84% 130 -84%

coming quarters and will Reported Profit After Tax 139 525 -74% 359 -61%

settle at around 40%

Minority Interest After NP 3 -1 1

Interests’ costs stand at

around 14%. Net Profit after Minority

136 526 -74% 359 -62%

As interests are linked to Interest

individual projects, decreased Extra-ordinary Items 2 0 0 0

sales will impact profitability

Adjusted Profit After Extra-

134 526 -74% 359 -63%

ordinary item

Margins

Interest/Sales(%age) 20% 9% (+1300bps) 14% (-600bps)

Operating Profits/Sales(%) 50% 64% (-1400bps) 62% (-1200bps)

NPM/Sales (%) 26% 45% (-1900bps) 36% (-1000bps)

Source: Company Data, Capital Line

Company Description:

Unitech is one of India’s largest real estate companies with over 3 decades experience in real estate

development. India’s second largest real estate company by market cap, with land bank of 14000

acres spread across 15 cities in India. The company, which used to be an NCR developer a few years

ago, with over 84% of its land bank in non-NCR regions at present. Unitech is planning to develop its

land bank through a mix of 51 projects in the residential, commercial, retail and hotel segments

The Company has diversified into residential, commercial, retail, entertainment and hospitality

projects.

Fairwealth Securities Page 2

Unitech- Buy

Valuations:

Company has a debt of around Rs. 8000 crores with interest cost of around 14%, however most of the

interest payment has been capitalized and the interest will be paid when the asset for which the loan was

taken is sold. Thus, Unitech Ltd. paid interest of only Rs 97 crore during the quarter.

With delay in projects across the industry at lower expected Operating margins of around 40%. Interest

costs will effect NPM which we expect to go down sharply down in FY10E.

Considering all the mentioned factors we still believe that company’s ability to execute projects remain

strong and with huge land bank of 14000 acres we woud value the share price of the company at Rs. 50

per share, even if property value further moves goes down.

Key to valuations at this point in time is not the profitability or debt, but how fast the company is able to

reschedule its debt, able to get enough funds to restart stalled projects by injecting liquidity and how

quickly it will sell completed units even if at lower profitability.

At the CMP of Rs 34, Unitech is trading at 3.3x FY08 EPS of 10.2 and 5x FY09E EPS of Rs 6.8.

We believe most of the concerns are already priced in, and recommend a BUY with a target price of

Rs.51, a 50% upside from here. At the target price the stock would be valued at 7.3x FY09E EPS of Rs

6.8, implying an upside potential of 50%.

Unitech Wireless-Telenor Telecom Deal

Unitech has a pan-India GSM license and has already got the crucial spectrum for 22 circles. It had paid

Rs 1,650 crore as license fee for the pan-Indian license, for which Unitech Wireless had received a

valuation of more than Rs 11,000 crore. Unitech has so far invested Rs 138 crore as equity in the

telecom venture. Addition Unitech Telecom has also borrowed around Rs 2,000 crore from the holding

company. Unitech needed a partner for its telecom venture which finally ended with Telenor coming in for

67% stake in the venture by paying Rs 6,120 crore.

As part of the deal: Company has given following details with respect to the Unitech wireless -Telenor

Qtr. ended March Qtr. Ended June 30, Qtr. Ended September 30,

31, 2009* 2009 2009

Telenor Cash 3) Rs.15.0 billion

1) Rs.12.5 billion 2) Rs.15.0 billion

injections 4) Rs. 11.2 billion

Cumulative Cash

Rs.12.5 billion Rs. 27.5 billion Rs. 53.7 billion

injection

Telenor Ownership 33.33 50 67%

Note: Changed according to latest announcement of increased dilution from 60% to 67%.

According to the deal Telenor will inject Rs. 5370 crore of new Equity in 4 tranches for 67% partnership.

Telenor will maintain ownership share when Unitech limited converts Rs. 500 crore of share holder to

equity. Telenor will put additional funds of Rs. 750 crore in Unitech wireless, taking its total investment to

Rs. 6120 crore in 2009.

Additionally Unitech Wireless will use Rs. 400 crore of cash received to payoff debt to Unitech Ltd.

Debt and Guarantees totalling Rs. 2100 crore will be transferred to Unitech Wireless.

Fairwealth Securities Page 3

Unitech- Buy

Key Risks:

According to our estimates Unitech will see an immediate jump in share prices as soon as it is

out of troubled waters or in other words as soon as it gets enough financing to pay off short term

debts and enough capital to fund its expansion over next 4-6 months. Another major risk to

company’s growth is slow down in Real Estate markets led by Flattish to negative growth in IT

sector. Company has huge capacities coming up in both residential and real Estate segment,

however Company is even struggling to sell current capacities.

We believe following risks are already hurting the company’s financials and will continue to do so

in coming 2-3 quarters.

Slowdown in IT hiring will continue to hurt residential demand.

Job losses/ pay cuts across sectors is putting off investors, also buyers are waiting for

developers to cut prices further, although demand has started picking up investors are awaiting

a momentum in Indian Real Estate Sector.

Companies have stalled expansion process, industry confidence suggests demand is picking

up however if that doesn’t happen it could delay commercial lease agreements and put

additional pressure on company’s commercial sales.

Unitech similar to other players in the segment was building capacities for the SEC A segment,

which has higher margins. However real demand lay in the growing Indian middle class. Going

forward as company’s build apartments with lower built up area and lower persq. Ft. area

margins will most definitely fall in future.

Higher raw material prices will put pressure on margins.

Share prices of Unitech have dropped by

around 90% over last year while other players in

the sector have fallen between 70% and 80%.

Source: Capital Line

Fairwealth Securities Page 4

Unitech- Buy

Investment Rational

Unitech has a market Cap of around Rs. 5500

crores. Company has total available land At the beginning of 2008 when all analysts rated Unitech as buy at CMP of Rs. 600 they

bank at around14000 acres. Company’s MD mentioned following downside risks.

Mr. Sanjay Chandra recently said in a press

interview that land cost for the company Tightening of Interests rate

remains at around Rs. 100-120 per sq. ft. and Restricted Overseas borrowning and change in FDI regulations,

available land bank enough to last 15 years. Rise in steel and cement prices

Delay in completion of planned projects and

Overall decline in Indian Econmics

.

All the downside risks along with massive unexpected slump in Real Estate markets and

Company also has plans to raise USD 500

tight credit markets got realized as a result of which we saw deep and long correction in Real

million through PE’s at project as well as

Estate markets pushing Unitech stock prices down by 95%.

company level.

We believe that Real Estate markets in India are yet to bottom out, however we also believe

that share markets either discounts or overprice the reality and in this case all bad news has

been discounted. The fact is that company holds 14000 acres of land. Millions of square feet

of developement in various stages, and ownership in a telecom company valued at over Rs.

3000 crores

We do not believe Unitech is out of blues as yet, however most of the above factors have

revised themselves, which should reflect in stock prices of Unitech.

Interest rates on Home Mortgage are below 2007 rates.

Government is considering change in current FDI rules to allow Unitech with

Overseas borrowing.

Government has been quick to boost Indian Economy through its Fiscal stimulus.

Raw material prices have dropped by more than 50% giving some respite to

developers.

Real Estate markets have started looking up with prices settling at 20% discount to

Jan’ 2008 prices

TECHNICAL OUTLOOK: Unitech

UNITECH has given a good

breakout above 28 levels. The

stock has seen a good support

around levels 25-28 .One could

buy the stock on very declines for

Target of 50.

Fairwealth Securities Page 5

Unitech- Buy

Annexure:

1. Income Statement: Fund Flow Statement:

200803 200703 200603

Income Statement (Standalone Rs. Crore)

SOURCES OF FUNDS :

2008(12) 2007(12) 2006 (12) Share Capital 325 162 12

Reserves Total 3276 1832 247

INCOME

Total Shareholders Funds 3600 1994 260

Net Sales 4115 3290 926

Minority Interest 116 1 24

Stock Adjustment -13 -13 291 Secured Loans 6231 3896 956

Total 4101 3276 1218 Unsecured Loans 4235 1722 195

Expenditure : Total Debt 10466 5618 1150

Total Liabilities 14182 7614 1434

Raw Materials 78 118 146

APPLICATION OF FUNDS :

Power & Fuel Cost 54 4 32

Net Block 1159 712 444

Employee Cost 96 64 42 Capital Work in Progress 2098 215 127

Other Manuf. Expenses 1505 1156 759 Investments 1416 455 14

S&A Expenses 103 57 50 Current Assets, Loans &

Miscellaneous Expenses 24 25 33 Advances

Total Expenditure 1861 1410 1043 Inventories 13608 8700 3087

Operating Profit 2240 1866 175 Sundry Debtors 746 146 103

Interest Cash and Bank 1408 1023 390

317 165 52

Loans and Advances 2944 1840 286

Gross Profit 1923 1799 150

Total Current Assets 18706 11708 3866

Depreciation 21 7 11

Less : Current Liabilities

Profit Before Tax before OI 1903 1792 139 and Provisions

Other Income 165 98 28 Current Liabilities 8256 4898 2916

PBT 2068 1890 167 Provisions 935 578 87

Tax 399 486 52 Total Current Liabilities 9191 5476 3003

Net Profit 1669 1306 87 Net Current Assets 9515 6232 863

EO Items & Min. Interest 44 22 -1 Net Deferred Tax -6 0 -15.08

Adj Net profit 1581 1261 88 Total Assets 14182 7614 1434

Source: Company Report, Capital Line Contingent Liabilities 1599 2144 838

Source: Company Report, Capital Line

2. Cash Flow Statement:

200803 200703 200603

Cash Flow Summary

Cash and Cash Equivalents at Beginning of the

year 1022.73 389.94 271.76

Net Cash from Operating Activities -975.03 2074.49 -224.67

Net Cash Used in Investing Activities 3187.44 -725.46 -308.28

Net Cash Used in Financing Activities 4548.01 3432.74 651.13

Net Inc/(Dec) in Cash and Cash Equivalent

385.54 632.79 118.18

Cash and Cash Equivalents at End of the year

1408.27 1022.73 389.94

Source: Company Report, Capital Line

Fairwealth Securities Page 6

Unitech- Buy

Disclaimer

This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. While

the information contained therein has been obtained from sources believed to be reliable; investors are advised to satisfy themselves before making

any investments. Fairwealth Securities Pvt Ltd does not bear any responsibility for the authentication of the information contained in

the reports and consequently, is not liable for any decisions taken based on the same. Further, Fairwealth Research Reports only provide information

updates and analysis. All opinion for buying and selling are available to investors when they are registered clients of Fairwealth Investment Advisory

Services. As a matter of practice, Fairwealth refrains from publishing any individual names with its reports. As per SEBI requirements it is stated that,

Fairwealth Sec Pvt Ltd., and/or individuals thereof may have positions in securities referred herein and may make purchases or sale while this report is

in circulation.

Fairwealth Securities Page 7

Anda mungkin juga menyukai

- Accumulate Unitech LimitedDokumen8 halamanAccumulate Unitech LimitedSovid GuptaBelum ada peringkat

- Balkrishna Industries LTD: Investor Presentation February 2020Dokumen30 halamanBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCEBelum ada peringkat

- Buy Mayur Uniquoters - Aug'18Dokumen6 halamanBuy Mayur Uniquoters - Aug'18Deepak GBelum ada peringkat

- Peninsula+Land 10-6-08 PLDokumen3 halamanPeninsula+Land 10-6-08 PLapi-3862995Belum ada peringkat

- Mock Test - 2023Dokumen3 halamanMock Test - 2023Phuoc TruongBelum ada peringkat

- Q2-FY19 Result Update: CMP: 125 Target: 263Dokumen7 halamanQ2-FY19 Result Update: CMP: 125 Target: 263Ashutosh GuptaBelum ada peringkat

- Business Finance Quiz NAME: - DATE: - Make An Analysis For The Following Situations. Show Your Solutions. Statements of Financial PositionDokumen1 halamanBusiness Finance Quiz NAME: - DATE: - Make An Analysis For The Following Situations. Show Your Solutions. Statements of Financial Positionerica_paraiso100% (1)

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDokumen4 halamanMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniBelum ada peringkat

- Case StudyDokumen3 halamanCase StudyJamshidbek OdiljonovBelum ada peringkat

- Glenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateDokumen9 halamanGlenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateAkatsuki DBelum ada peringkat

- NMDC Results Update: Maintain Hold With Target Price Of ₹115Dokumen10 halamanNMDC Results Update: Maintain Hold With Target Price Of ₹115Mani SeshadrinathanBelum ada peringkat

- Amtek Auto LTD: 3Q FY10 ResultsDokumen5 halamanAmtek Auto LTD: 3Q FY10 Resultsgaurav.m09Belum ada peringkat

- KFin Technologies - Flash Note - 12 Dec 23Dokumen6 halamanKFin Technologies - Flash Note - 12 Dec 23palakBelum ada peringkat

- Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedDokumen5 halamanTata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedAnkita ChauhanBelum ada peringkat

- Balkrishna Industries LTD: Investor Presentation - May 2021Dokumen31 halamanBalkrishna Industries LTD: Investor Presentation - May 2021Kpvs NikhilBelum ada peringkat

- Fixed Line Telecom: Wateen Telecom Limited - Going For The ListingDokumen4 halamanFixed Line Telecom: Wateen Telecom Limited - Going For The ListingjawadataBelum ada peringkat

- BKT PDFDokumen28 halamanBKT PDFnikhilBelum ada peringkat

- Security Analysis - Infosys Life CycleDokumen3 halamanSecurity Analysis - Infosys Life Cyclesmr.aroraBelum ada peringkat

- Numericals _IAPMDokumen25 halamanNumericals _IAPMfhq54148Belum ada peringkat

- Directors' Report: Financial ResultsDokumen63 halamanDirectors' Report: Financial Resultsmrindia2kBelum ada peringkat

- B20F Exam Scenario and RequiredDokumen13 halamanB20F Exam Scenario and RequiredNicolasBelum ada peringkat

- CSIQ 3Q21 Investor Presentation - 2021.12.6Dokumen45 halamanCSIQ 3Q21 Investor Presentation - 2021.12.6Vitor MouraBelum ada peringkat

- Gone Rural Historical Financials Reveal Growth Over TimeDokumen31 halamanGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeBelum ada peringkat

- Buy Tata ChemicalsDokumen9 halamanBuy Tata ChemicalsSovid GuptaBelum ada peringkat

- Ar Engro2009Dokumen554 halamanAr Engro2009Faryal ArifBelum ada peringkat

- Question 62: Advanced ConsolidationDokumen7 halamanQuestion 62: Advanced ConsolidationSaifurrehman MalikBelum ada peringkat

- Investment Appraisal AssignmentDokumen15 halamanInvestment Appraisal AssignmentPranesh KhaleBelum ada peringkat

- CECDokumen4 halamanCECJyoti Berwal0% (3)

- Ratio - Tesco AssignmentDokumen11 halamanRatio - Tesco AssignmentaXnIkaran100% (1)

- Yes Bank - IDFC SSKI - 22 01 09Dokumen6 halamanYes Bank - IDFC SSKI - 22 01 09api-19728845Belum ada peringkat

- Ultratech Cement: 30 AugustDokumen7 halamanUltratech Cement: 30 AugustmanavBelum ada peringkat

- Balkrishna Industries Investor PresentationDokumen34 halamanBalkrishna Industries Investor PresentationAnand SBelum ada peringkat

- Resource Sharing For An Intelligent Future: Annual Report 2020Dokumen176 halamanResource Sharing For An Intelligent Future: Annual Report 2020mailimailiBelum ada peringkat

- Interim Management StatementDokumen16 halamanInterim Management StatementsaxobobBelum ada peringkat

- M&A Problms - ClassDokumen14 halamanM&A Problms - ClassSeemaBelum ada peringkat

- Lloyds Banking Group PLC 2017 Q1 RESULTSDokumen33 halamanLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobBelum ada peringkat

- Q4 FY 10 Investor UpdateDokumen5 halamanQ4 FY 10 Investor UpdateshahvinBelum ada peringkat

- Valuations Remvest - ScenarioDokumen6 halamanValuations Remvest - ScenarioMoses Nhlanhla MasekoBelum ada peringkat

- Vodafone Bid HBS Case - ExhibitsDokumen13 halamanVodafone Bid HBS Case - ExhibitsNaman PorwalBelum ada peringkat

- Cyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsDokumen6 halamanCyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsADBelum ada peringkat

- c3 Mergers and Acquisitions Review QuestionsDokumen7 halamanc3 Mergers and Acquisitions Review Questionscharlesmicky82Belum ada peringkat

- DCFValuation JKTyre1Dokumen195 halamanDCFValuation JKTyre1Chulbul PandeyBelum ada peringkat

- CHB Mar19 PDFDokumen14 halamanCHB Mar19 PDFSajeetha MadhavanBelum ada peringkat

- Interim Management StatementDokumen10 halamanInterim Management StatementsaxobobBelum ada peringkat

- 2019 LBG q1 Ims CombinedDokumen19 halaman2019 LBG q1 Ims CombinedsaxobobBelum ada peringkat

- MM Forgings MM Forgings: Auto AutoDokumen22 halamanMM Forgings MM Forgings: Auto Autorchawdhry123Belum ada peringkat

- BSc (Hons) Financial Services (General) Exam QuestionsDokumen8 halamanBSc (Hons) Financial Services (General) Exam Questionspriyadarshini212007Belum ada peringkat

- GMR Infra: Robust Traffic GrowthDokumen4 halamanGMR Infra: Robust Traffic GrowthRaunak MukherjeeBelum ada peringkat

- POSCO Reports Record Revenue and Profits in 1Q 2021Dokumen13 halamanPOSCO Reports Record Revenue and Profits in 1Q 2021Eric ChiangBelum ada peringkat

- ADRO FY22 Press ReleaseDokumen7 halamanADRO FY22 Press ReleaseChuslul BadarBelum ada peringkat

- Interim Management StatementDokumen7 halamanInterim Management StatementsaxobobBelum ada peringkat

- Lloyds Banking Group Q1 2018 Interim Management StatementDokumen8 halamanLloyds Banking Group Q1 2018 Interim Management StatementsaxobobBelum ada peringkat

- BKT InvestorPresentation March2020Dokumen34 halamanBKT InvestorPresentation March2020Rina JageBelum ada peringkat

- Q2FY19 Investor Update - PGCILDokumen19 halamanQ2FY19 Investor Update - PGCILHemant SharmaBelum ada peringkat

- Voltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Dokumen5 halamanVoltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Darwish MammiBelum ada peringkat

- Amara Raja Batteries LTD: 1Q FY11 ResultsDokumen5 halamanAmara Raja Batteries LTD: 1Q FY11 ResultsveguruprasadBelum ada peringkat

- Financial Reporting Paper 2.1 Dec 2023Dokumen28 halamanFinancial Reporting Paper 2.1 Dec 2023Oni SegunBelum ada peringkat

- LUCK Q3FY20 profit in line with expectationsDokumen2 halamanLUCK Q3FY20 profit in line with expectationsUmer AftabBelum ada peringkat

- Investors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02Dokumen19 halamanInvestors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02miteshpathBelum ada peringkat

- Equity Valuation: Models from Leading Investment BanksDari EverandEquity Valuation: Models from Leading Investment BanksJan ViebigBelum ada peringkat

- Decoupling A Fresh PerspectiveDokumen3 halamanDecoupling A Fresh PerspectiveSovid GuptaBelum ada peringkat

- Special Report1Dokumen5 halamanSpecial Report1Sovid Gupta100% (2)

- PVRDokumen9 halamanPVRSovid GuptaBelum ada peringkat

- Buy Moser Baer Target 160Dokumen7 halamanBuy Moser Baer Target 160Sovid GuptaBelum ada peringkat

- Accumulate Sintex Industries Target 200-240Dokumen7 halamanAccumulate Sintex Industries Target 200-240Sovid GuptaBelum ada peringkat

- Buy Tata ChemicalsDokumen9 halamanBuy Tata ChemicalsSovid GuptaBelum ada peringkat

- Educomp Solutions Reiterate: Buy: Industry PotentialDokumen9 halamanEducomp Solutions Reiterate: Buy: Industry PotentialSovid GuptaBelum ada peringkat

- Mah and Mah Target450 - M&M-12th March CMP 345Dokumen9 halamanMah and Mah Target450 - M&M-12th March CMP 345Sovid GuptaBelum ada peringkat

- Financial Technologies Target 850Dokumen9 halamanFinancial Technologies Target 850Sovid GuptaBelum ada peringkat

- Punj Lloyd Target 120Dokumen7 halamanPunj Lloyd Target 120Sovid GuptaBelum ada peringkat

- Tata Steel Target 250Dokumen11 halamanTata Steel Target 250Sovid GuptaBelum ada peringkat

- Havells India Jan 09 Fairwealth Securities Initiate-Buy Target280Dokumen9 halamanHavells India Jan 09 Fairwealth Securities Initiate-Buy Target280Sovid Gupta100% (1)

- Educomp Solutions Equity Research Report Buy Call Jan'09 - Fairwealth Securities Private LimitedDokumen8 halamanEducomp Solutions Equity Research Report Buy Call Jan'09 - Fairwealth Securities Private LimitedSovid GuptaBelum ada peringkat

- Buy Lupin Limited March '09 Target 780Dokumen9 halamanBuy Lupin Limited March '09 Target 780Sovid Gupta100% (1)

- Buy-Jaiprakash Associates Target 110 Research Report Feb 2009Dokumen12 halamanBuy-Jaiprakash Associates Target 110 Research Report Feb 2009Sovid Gupta100% (1)

- Global Professional Accountant ACCA BrochureDokumen12 halamanGlobal Professional Accountant ACCA BrochureRishikaBelum ada peringkat

- Reyes Vs Tuparan DigestDokumen2 halamanReyes Vs Tuparan DigestDarlene Anne100% (1)

- Mr. Daniel Lott 29 Friesland Street Belvenie Estate 7490Dokumen1 halamanMr. Daniel Lott 29 Friesland Street Belvenie Estate 7490Claudia LottBelum ada peringkat

- RMIT FR Week 3 Solutions PDFDokumen115 halamanRMIT FR Week 3 Solutions PDFKiabu ParindaliBelum ada peringkat

- Augat v. AegisDokumen7 halamanAugat v. AegisRobert Sunho LeeBelum ada peringkat

- Presentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitDokumen14 halamanPresentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitPreetaman SinghBelum ada peringkat

- Distinction Between General and Limited PartnershipDokumen1 halamanDistinction Between General and Limited PartnershipMhali100% (1)

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dokumen12 halamanNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaBelum ada peringkat

- Barangay ClearanceDokumen2 halamanBarangay Clearancegingen100% (1)

- Agency Theory AssignmentDokumen6 halamanAgency Theory AssignmentProcurement PractitionersBelum ada peringkat

- Module-1.1 PUBLIC FINANCEDokumen5 halamanModule-1.1 PUBLIC FINANCEPauline Joy Lumibao100% (2)

- Aof Dsa Odmfs05837 30112023Dokumen8 halamanAof Dsa Odmfs05837 30112023kbank0510Belum ada peringkat

- INVESTMENT THEORY AND DETERMINANTSDokumen7 halamanINVESTMENT THEORY AND DETERMINANTSJoshua KirbyBelum ada peringkat

- Small BusinessDokumen11 halamanSmall BusinessSaahil LedwaniBelum ada peringkat

- Beauty SalonDokumen6 halamanBeauty SalonsharatchandBelum ada peringkat

- PAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsDokumen15 halamanPAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsSandeep ModhBelum ada peringkat

- ERRORS - Accounting ErrorsDokumen15 halamanERRORS - Accounting Errorsdeklerkkimberey45Belum ada peringkat

- General Principles of TaxationDokumen25 halamanGeneral Principles of TaxationJephraimBaguyo100% (1)

- February 6, 2013Dokumen12 halamanFebruary 6, 2013The Delphos HeraldBelum ada peringkat

- Woolworths+Trolley+Trends+2013+28 8 13Dokumen20 halamanWoolworths+Trolley+Trends+2013+28 8 13pnrahmanBelum ada peringkat

- Sales CasesDokumen18 halamanSales CasesConnieAllanaMacapagaoBelum ada peringkat

- Specialized Industry Finals - With AnswerDokumen16 halamanSpecialized Industry Finals - With AnswerXXXXXXXXXXXXXXXXXXBelum ada peringkat

- Sales Report: Sweet Bliss CompanyDokumen6 halamanSales Report: Sweet Bliss CompanyDonna Julian ReyesBelum ada peringkat

- Partnership Deed FormatDokumen3 halamanPartnership Deed FormatMan SinghBelum ada peringkat

- Joint and Solidary ObligationsDokumen13 halamanJoint and Solidary ObligationsNimfa Sabanal100% (2)

- Financial Study of Iti LTD MankapurDokumen22 halamanFinancial Study of Iti LTD MankapurAshwani SinghBelum ada peringkat

- 5 Steps To Negotiating PaymentDokumen39 halaman5 Steps To Negotiating PaymentThanh Loan100% (1)

- Introduction To MacroeconomicsDokumen38 halamanIntroduction To MacroeconomicsadrianrivalBelum ada peringkat

- Company Law 2Dokumen12 halamanCompany Law 2PRABHAT SINGHBelum ada peringkat

- Uniform Commercial Code - Discharge and PaymentDokumen43 halamanUniform Commercial Code - Discharge and Paymentmo100% (1)