Solution Advance Taxation Planning and Fiscal Policy Nov 2007

Diunggah oleh

Samuel DwumfourHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Solution Advance Taxation Planning and Fiscal Policy Nov 2007

Diunggah oleh

Samuel DwumfourHak Cipta:

Format Tersedia

SOLUTION: ADVANCE TAXATION PLANNING AND FISCAL POLICY, NOV 2007 QUESTION 1 CAPITAL ALLOWANCES 2003 1/10/02 30/9/03

3 Residue b/d Additions Total C.A. Residue c/f 2004 1/10/03 - 30/9/04 Residue b/d C.A. Residue c/f 2005 1/10/04 - 30/9/05 Residue b/d C.A. Class 2 (30%) 250,000,000 350,000,000 600,000,000 180,000,000 420,000,000 Class 4 (20%) Total 15,000,000 50,000,000 65,000,000 13,000,000 193,000,000 52,000,000

420,000,000 126,000,000 294,000,000

52,000,000 10,400,000 41,600,000

136,400,000

294,000,000 88,200,000 205,800,000 ASSESSMENTS

41,600,000 8,320,000 33,280,000

96,520,000

2003 1/10/02 - 30/9/03 Income Less CA CI Each Partners Share 2004 1/10/03 - 30/9/04 Income Less CA CI Each Partners Share 2005 1/10/04 - 30/9/05 Income Less CA CI Each Partners Share = = = = = = = = = = = =

393,000,000 193,000,000 200,000,000 100,000,000 GH10,000 436,400,000 136,400,000 300,000,000 150,000,000 GH15,000 896,520,000 96,520,000 800,000,000 400,000,000 GH40,000 1

QUESTION 2 1. 2. 3. The building was inherited under a Will. There is therefore no Gift Tax applicable. The rent of 120,000,000 a year is subject to rent tax for the three years at the rate of 10% a year. The sale of the building will result in Capital Gains Tax as follows: Realised sun Cost Base Capital Gain Tax @ 10% 4. 5. = = = = 500,000,000 Nil 500,000,000 50,000,000

Sale of shares on Ghana Stock Exchange is exempt from Capital Gains Tax for the time being. The disbursement of the profit of 100,000,000 will result in Gift Tax in some cases. (a) (b) (c) (d) (e) (f) G.N.T.F Tithe to church Gift to wife Gift to mother Gift to friend, Joe Gift to driver = = = = = = No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt)

6.

Win on Last Chance Raffle is not taxable. It is a game of change.

QUESTION 3 1. Tax Planning The main essence of tax planning is to take advantage of all available tax incentives to pay just the minimum amount of tax due. As the name implies it should be a well thought out plan giving due consideration to the whole spectrum of the tax laws and the economy generally. It should start from the point of selecting the type of business to be undertaken. It should be noted that nothing illegal or nothing that does not make business sense is included in the plan. Some considerations to be made are:i. ii. iii. iv. how much capital is available? what type of venture is to be undertaken? what are the tax incentives, reliefs, exemptions etc available? is it going to be a sole-proprietorship, partnership or limited liability company?

When the business is finally selected and established, there will be need for:i. ii. iii. iv. good record keeping, a thorough grasp or knowledge of the tax laws so as to be able to take full advantage of tax incentives available for the business, a sound commercial judgement is also necessary in decision making submission of returns and tax payments on due dates will obviate the imposition of penalties. Tax planning is therefore essential in putting the business on a sound footing right from commencement and keeping it on track whilst taking advantage of all reliefs and incentives to pay just the right amount due. 2. Tax Avoidance Tax avoidance is synonymous to tax planning in the sense that it also takes advantage of the provisions of the tax laws to pay the minimum of tax. Secondly, it does not involve itself in any thing illegal. Tax avoidance schemes operate by finding loopholes in the tax laws and using them to pay the minimum of tax or not paying anything at all. It therefore requires a comprehensive knowledge of the tax laws to determine what exemptions, reliefs and other incentives are avoidable to take advantage of them.

3.

Tax Evasion Tax evasion, unlike tax planning and tax avoidance is illegal. It involves a deliberate act of: i. ii. iii. iv. Failure to declare and under declarations; Submitting false statements and returns; Keeping one set of books containing false entries for the revenue authorities and another with the actual business operations for himself; and Any other fraudulent act or means of deliberately dodging or minimizing payment of tax on ones income.

It is a crime against the state and therefore any person who aids or abets is also guilty and punishable under the tax laws.

QUESTION 4

a)

Employment arises when there is a contract of service. In other words when a master servant relationship has been established between two parties. The employer engages the services of the employee for an agreed amount under certain conditions. The employer can dismiss the employee when he does not meet the terms of the contract; alternatively, the employee can sue the employer if he also fails to meet his part of the bargain. The employer provides the tools for the work and in some cases, but not always, directs the employee as to how the work should be done. At the end of the day, the employer reaps all profits or bears all losses. The employee is just entitled to his wages.

b)

Benefits attached to the office of employment are called perquisites. If they form part of the conditions of service, they are taxable. Sometimes, they are not specifically spelt out but over the years have become customary or traditional; such benefits are taxable.

Some examples are the following i. Imprests: Some grades of officers are given some allowances for the entertainment of guest or clients. If such amounts are accountable then they are tax exempt; otherwise they are taxable. Some companies give their products for free or at reduced price to their employees. Such packages are benefits in kind and must be assessed at the market value; that is what the receiver will get on selling the item. In some cases employees negotiate for tax-free salaries. In which case the employer bears the tax element. This is not accepted for tax purposes, and the Tax Authorities have a mechanism to work out the gross amount and levy the appropriate tax. Other benefits such as payment of school fees or other liabilities of the employee are assessed by the employee. If there is a scholarship for children of the employee which is available to all on competitive bases, then such benefits are not assessable to tax. v. Quite often employees are given loans for various purposes. Strictly speaking such loans should attract interest at the prevailing bank rate as it is a benefit and must be assessed to tax. This also applies to company shares which are sold to employees at reduced rates. Lamp sum payment Certain lump sums are exempt from tax e.g. pension, severance pay, gratuities under Act 592. Normally the conditions of service will provide a clue as to whether the lump sum is taxable or not. If the payment can be as a result of services rendered (except those exempt) then it is taxable. Compensation in lieu of notice is taxable, whereas compensation paid for loss of office is not taxable. Long service awards, generally are taxable because it is as a result of services rendered. However if it is for exceptional performance or a testimonial which is out of the blues, then it is tax exempt.

ii.

iii.

iv.

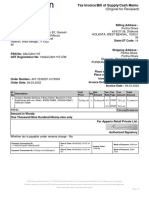

QUESTION 5 YEAR OF ASSESSMENT - 2003 Net profit as per a/cs Less: Rent receivable Dividends Add Back Depreciation Repairs and Maintenance Subs. and Donations Legal Expenses Travelling and Transport Less: Loss B/f Adjusted Profit Less: Capital Allowance B/f Capital (Current) Chargeable Income (Mining) Add Rent Income Gross 30% std. Allowance Total Chargeable Income 80,000 24,000 56,000 1,916,000 40,000 278,928 318,928 1,860,000 124,000 30,800 3,500 1,100 13,800 173,200 2,388,928 210,000 2,178,928 80,000 44,000 124,000 2,215,728 2,339,728

Anda mungkin juga menyukai

- Ifp 29 Tax PlanningDokumen5 halamanIfp 29 Tax Planningsachin_chawlaBelum ada peringkat

- Tax PlanningDokumen26 halamanTax Planningpuneeta chughBelum ada peringkat

- Corporatetaxplanning2003 120515115836 Phpapp01Dokumen26 halamanCorporatetaxplanning2003 120515115836 Phpapp01thiruvenkatrajBelum ada peringkat

- A Quick Revision For NET/GSET Examination Prepared By-Anuj Bhatia Assistant Professor, Anand Institute of Business Studies ContactDokumen26 halamanA Quick Revision For NET/GSET Examination Prepared By-Anuj Bhatia Assistant Professor, Anand Institute of Business Studies ContactPankaj KhindriaBelum ada peringkat

- Moshi Co-Operative University (Mocu)Dokumen19 halamanMoshi Co-Operative University (Mocu)duncanBelum ada peringkat

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Dari EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Belum ada peringkat

- Tax Avoidance and Tax EvasionDokumen11 halamanTax Avoidance and Tax EvasionYashVardhan100% (1)

- Tax Planning, Evasion, AvoidanceDokumen16 halamanTax Planning, Evasion, AvoidanceDr. Nathan WafBelum ada peringkat

- AX Lanning: by Anup K SuchakDokumen27 halamanAX Lanning: by Anup K SuchakanupsuchakBelum ada peringkat

- Cost AccountingDokumen21 halamanCost AccountingXandarnova corpsBelum ada peringkat

- Master of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)Dokumen10 halamanMaster of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)balakalasBelum ada peringkat

- Short Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Dokumen22 halamanShort Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Satvik MishraBelum ada peringkat

- St. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Dokumen22 halamanSt. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Barkha LohaniBelum ada peringkat

- SHORT ANSWERS ChaurasiaDokumen22 halamanSHORT ANSWERS ChaurasiaSatvik MishraBelum ada peringkat

- Tax PlanningDokumen21 halamanTax Planningpriyani0% (1)

- Solution Review QuestionsDokumen41 halamanSolution Review Questionsying huiBelum ada peringkat

- Summary of Thailand-Tax-Guide and LawsDokumen34 halamanSummary of Thailand-Tax-Guide and LawsPranav BhatBelum ada peringkat

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Dokumen150 halamanICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- AC405 Lecture 4Dokumen26 halamanAC405 Lecture 4ernest libertyBelum ada peringkat

- QekZVqmARlmpGVapgIZZmQ Module 5 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsDokumen66 halamanQekZVqmARlmpGVapgIZZmQ Module 5 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsAbhey GoyalBelum ada peringkat

- Advanced Taxation & Fiscal Policy Nov 2011Dokumen7 halamanAdvanced Taxation & Fiscal Policy Nov 2011Samuel DwumfourBelum ada peringkat

- Introduction To Indian Tax StructureDokumen45 halamanIntroduction To Indian Tax StructureSadir AlamBelum ada peringkat

- ACC212 Student Notes 2019Dokumen62 halamanACC212 Student Notes 2019preciousgomorBelum ada peringkat

- Chapter 14Dokumen40 halamanChapter 14Ivo_NichtBelum ada peringkat

- Student Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesDokumen25 halamanStudent Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesPriyanka AggarwalBelum ada peringkat

- Chapter Five 5. Investment IncentivesDokumen12 halamanChapter Five 5. Investment IncentivesSeid KassawBelum ada peringkat

- Personal Tax PlanningDokumen9 halamanPersonal Tax PlanningGayathri SudheerBelum ada peringkat

- Lecture 1 - Introduction To Income TaxDokumen27 halamanLecture 1 - Introduction To Income TaxMimi kupiBelum ada peringkat

- M6 - Deductions P1 Students'Dokumen36 halamanM6 - Deductions P1 Students'micaella pasionBelum ada peringkat

- 2009 R-3 Class Notes PDFDokumen5 halaman2009 R-3 Class Notes PDFAgayatak Sa ManenBelum ada peringkat

- F1 Sept 2011 AnswersDokumen10 halamanF1 Sept 2011 AnswersmavkaziBelum ada peringkat

- 8TH Sem Tax Paper PDFDokumen25 halaman8TH Sem Tax Paper PDFAnamika VatsaBelum ada peringkat

- Taxation Management AssignmentDokumen11 halamanTaxation Management AssignmentniraliBelum ada peringkat

- Mahusay Acc227 Module 2Dokumen9 halamanMahusay Acc227 Module 2Jeth MahusayBelum ada peringkat

- Tax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'Dokumen4 halamanTax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'mba departmentBelum ada peringkat

- Module 13 Regular Deductions 3Dokumen16 halamanModule 13 Regular Deductions 3Donna Mae FernandezBelum ada peringkat

- Chapter 13 ADokumen22 halamanChapter 13 AAdmBelum ada peringkat

- Sttart Up Company 2012 ArticleDokumen5 halamanSttart Up Company 2012 ArticleResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Belum ada peringkat

- 2 Tax GropDokumen3 halaman2 Tax GropPeter MBelum ada peringkat

- Unit 5 Profits and Gains of Business or Profession StructureDokumen31 halamanUnit 5 Profits and Gains of Business or Profession StructuredeepaksinghalBelum ada peringkat

- Module VIII Tax Evasion, Tax Avoidance and Tax PlanningDokumen7 halamanModule VIII Tax Evasion, Tax Avoidance and Tax PlanningrahulBelum ada peringkat

- Assignment of Income DoctrineDokumen20 halamanAssignment of Income DoctrinewxwgmumpdBelum ada peringkat

- Tax Seatwork #3Dokumen5 halamanTax Seatwork #3irish7erialcBelum ada peringkat

- DeductionsDokumen7 halamanDeductionsConcerned CitizenBelum ada peringkat

- Chapter Seven Tax Planning BackgroundDokumen9 halamanChapter Seven Tax Planning BackgroundTriila manillaBelum ada peringkat

- CTP 22 QuestionsDokumen31 halamanCTP 22 QuestionsNitin MalikBelum ada peringkat

- Corporate Tax Planning & ManagemenDokumen94 halamanCorporate Tax Planning & ManagemenArshit PatelBelum ada peringkat

- Business Income, Deductions, and Accounting MethodsDokumen37 halamanBusiness Income, Deductions, and Accounting MethodsMo ZhuBelum ada peringkat

- CBTPDokumen33 halamanCBTPMader Adem100% (1)

- Tax Planning and ManagementDokumen23 halamanTax Planning and Managementarchana_anuragi100% (1)

- Corporate Tax PlanningDokumen7 halamanCorporate Tax PlanningimamBelum ada peringkat

- Tax Seatwork #4Dokumen4 halamanTax Seatwork #4irish7erialcBelum ada peringkat

- Taxation Management AssignmentDokumen12 halamanTaxation Management AssignmentJaspreetBajajBelum ada peringkat

- Af308 WK 07 Text 2020Dokumen29 halamanAf308 WK 07 Text 2020Prisha NarayanBelum ada peringkat

- Withholding Taxes in ZimbabweDokumen61 halamanWithholding Taxes in ZimbabweJeremiah NcubeBelum ada peringkat

- Tax Evasion, Tax Avoidance and Tax PlanningDokumen20 halamanTax Evasion, Tax Avoidance and Tax PlanningGeetanjali KashyapBelum ada peringkat

- Dfi 201 Lec Three Managing Taxes Teaching NotesDokumen14 halamanDfi 201 Lec Three Managing Taxes Teaching Notesraina mattBelum ada peringkat

- Corporate TaxDokumen29 halamanCorporate Taxsu_pathriaBelum ada peringkat

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFDokumen30 halamanSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFmary.graf929100% (11)

- Section 7 RespiratoryDokumen26 halamanSection 7 RespiratorySamuel DwumfourBelum ada peringkat

- Section 2 SKINDokumen48 halamanSection 2 SKINSamuel DwumfourBelum ada peringkat

- Audit ReportsDokumen5 halamanAudit ReportsSamuel DwumfourBelum ada peringkat

- Chapter 16 Financial Assets and Liabilities: Answer 1Dokumen3 halamanChapter 16 Financial Assets and Liabilities: Answer 1Samuel DwumfourBelum ada peringkat

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDokumen3 halamanChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourBelum ada peringkat

- Section A: Answer Any Two (2) of The 3 Questions Based On The ScenarioDokumen5 halamanSection A: Answer Any Two (2) of The 3 Questions Based On The ScenarioSamuel DwumfourBelum ada peringkat

- Chapter 21 Associates: Answer 1Dokumen6 halamanChapter 21 Associates: Answer 1Samuel DwumfourBelum ada peringkat

- Solution Assurance and Audit Practice May 2008Dokumen7 halamanSolution Assurance and Audit Practice May 2008Samuel DwumfourBelum ada peringkat

- Solution Principles and Practice of Taxation May 2010Dokumen4 halamanSolution Principles and Practice of Taxation May 2010Samuel DwumfourBelum ada peringkat

- Shipping IncentivesDokumen4 halamanShipping IncentivesGonçalo CruzeiroBelum ada peringkat

- PST 110 Production Machinery Equipment Exemption PDFDokumen40 halamanPST 110 Production Machinery Equipment Exemption PDFABAYNEGETAHUN getahunBelum ada peringkat

- Vat Rates en 2013Dokumen28 halamanVat Rates en 2013Alessandro MascelloniBelum ada peringkat

- Solved Minden Corporation Wants To Open A Branch Operation in EasternDokumen1 halamanSolved Minden Corporation Wants To Open A Branch Operation in EasternAnbu jaromiaBelum ada peringkat

- 9708 s02 Er 1+2+3+4Dokumen14 halaman9708 s02 Er 1+2+3+4Hana DanBelum ada peringkat

- Everytown Gun Safety Action Fund - 990 Tax FormDokumen118 halamanEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comBelum ada peringkat

- Modified Purchase Manual: 1.0 IntroductoryDokumen40 halamanModified Purchase Manual: 1.0 IntroductoryAbdul Rashid QureshiBelum ada peringkat

- Afar Consignment RaDokumen1 halamanAfar Consignment RaRose Anne BalanaBelum ada peringkat

- SBM Self-Test Questions With Immediate AnswersDokumen180 halamanSBM Self-Test Questions With Immediate Answersahme farBelum ada peringkat

- New Microsoft PowerPoint Presentation TAXDokumen10 halamanNew Microsoft PowerPoint Presentation TAXramesh BBelum ada peringkat

- Mrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintDokumen2 halamanMrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintAkash Singh Chauhan0% (2)

- 2022 PTD 1889Dokumen4 halaman2022 PTD 1889Your AdvocateBelum ada peringkat

- Format For Goods 1Dokumen1 halamanFormat For Goods 1Sanket PatelBelum ada peringkat

- Land Law ProjectDokumen15 halamanLand Law ProjectShubhankar ThakurBelum ada peringkat

- State Bank of India34 PDFDokumen2 halamanState Bank of India34 PDFKhushboo PatidarBelum ada peringkat

- Case 3 - Andy 2015Dokumen14 halamanCase 3 - Andy 2015api-306226330Belum ada peringkat

- Profits and Types of IncomeDokumen2 halamanProfits and Types of IncomeVera KramarovaBelum ada peringkat

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Dokumen201 halamanAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Income Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDokumen5 halamanIncome Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDaniel SohBelum ada peringkat

- Botswana-Training For Inspectors On Iso-Iec 17020Dokumen30 halamanBotswana-Training For Inspectors On Iso-Iec 17020SankaranarayananBelum ada peringkat

- InvoiceDokumen1 halamanInvoicePartha DharaBelum ada peringkat

- Finland Tax SystemDokumen4 halamanFinland Tax SystemHitesh ChintuBelum ada peringkat

- Important Questions - Income Tax PDFDokumen6 halamanImportant Questions - Income Tax PDFShourya RajputBelum ada peringkat

- KPMG Wells Fargo Lies and FraudDokumen10 halamanKPMG Wells Fargo Lies and Fraudkpmgtaxshelter_kpmg tax shelter-kpmg tax shelterBelum ada peringkat

- The Instruments of Trade PolicyDokumen55 halamanThe Instruments of Trade PolicyMadalina RaceaBelum ada peringkat

- Full Download Gerontologic Nursing 4th Edition Meiner Test BankDokumen35 halamanFull Download Gerontologic Nursing 4th Edition Meiner Test Bankkodakusant.q1b3ef100% (37)

- United States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Dokumen16 halamanUnited States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Scribd Government DocsBelum ada peringkat

- YTD & FYFCST Budget Control M11Dokumen11 halamanYTD & FYFCST Budget Control M11rominasavioBelum ada peringkat

- Causes of InflationDokumen15 halamanCauses of Inflationkhalia mowattBelum ada peringkat

- Annual Report 2016Dokumen49 halamanAnnual Report 2016Muhammad haseebBelum ada peringkat