Acqusation

Diunggah oleh

Goutham NaiduDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Acqusation

Diunggah oleh

Goutham NaiduHak Cipta:

Format Tersedia

What Does Acquisition Mean?

Acquisition means the act of acquiring or gaining possession. It is commonly used in the phrase Mergers and Acquisitions. It generally indicates the feature of business finance strategy and administrational dealing with the amalgamation and acquiring of various companies. Mergers generally are a tool used by corporate for the reason of increasing their operations and with that their profits.

Benefits of Mergers and Acquisitions are manifold. Mergers and Acquisitions can generate cost efficiency through economies of scale, can enhance the revenue through gain in market share and can even generate tax gains.

The principal benefits from mergers and acquisitions can be listed as increased value generation, increase in cost efficiency and increase in market share.

Benefits of Mergers and Acquisitions are the main reasons for which the companies enter into these deals. Mergers and Acquisitions may generate tax gains, can increase revenue and can reduce the cost of capital. The main benefits of Mergers and Acquisitions are the following:

Greater Value Generation Mergers and acquisitions often lead to an increased value generation for the company. It is expected that the shareholder value of a firm after mergers or acquisitions would be greater than the sum of the shareholder values of the parent companies. Mergers and acquisitions generally succeed in generating cost efficiency through the implementation of economies of scale.

Merger & Acquisitionalso leads to tax gains and can even lead to a revenue enhancement through market share gain. Companies go for Mergers and Acquisition from the idea that, the joint company will be able to generate more value than the separate firms. When a company buys out another, it expects that the newly generated shareholder value will be higher than the value of the sum of the shares of the two separate companies.

Mergers and Acquisitionscan prove to be really beneficial to the companies when they are weathering through the tough times. If the company which is suffering from various problems in the market and is not able to overcome the difficulties, it can go for an acquisition deal. If a company, which has a strong market presence, buys out the weak firm, then a more competitive and cost efficient company can be generated. Here, the target company benefits as it gets out of the difficult situation and after being acquired by the large firm, the joint company accumulates larger market share. This is because of these benefits that the small and less powerful firms agree to be acquired by the large firms.

Gaining Cost Efficiency When two companies come together by merger or acquisition, the joint company benefits in terms of cost efficiency. A merger or acquisition is able to create economies of scale which in turn generates cost efficiency. As the two firms form a new and bigger company, the production is done on a much larger scale and when the output production increases, there are strong chances that the cost of production per unit of output gets reduced.

An increase in cost efficiency is affected through the procedure of mergers and acquisitions. This is because mergers and acquisitions lead to economies of scale. This in turn promotes cost efficiency. As the parent firms amalgamate to form a bigger new firm the scale of operations of the new firm increases. As output production rises there are chances that the cost per unit of production will come down

Mergers and Acquisitions are also beneficial

When a firm wants to enter a new market When a firm wants to introduce new products through research and development When a forms wants achieve administrative benefits To increased market share To lower cost of operation and/or production To gain higher competitiveness For industry know how and positioning For Financial leveraging

To improve profitability and EPS

An increase in market share is one of the plausible benefits of mergers and acquisitions. In case a financially strong company acquires a relatively distressed one, the resultant organization can experience a substantial increase in market share. The new firm is usually more cost-efficient and competitive as compared to its financially weak parent organization.

It can be noted that mergers and acquisitions prove to be useful in the following situations: Firstly, when a business firm wishes to make its presence felt in a new market. Secondly, when a business organization wants to avail some administrative benefits. Thirdly, when a business firm is in the process of introduction of new products. New products are developed by the R&D wing of a company.

Employee Benefits under Mergers and Acquisitions in US The 'Employee Retirement Income Security Act' was enacted in 1974. It is also known as ERISA. Since then programs for employee benefit have been a major component of the balance and income statements of US business organizations. Current law promulgations have attached supreme importance to the presence of post retirement pension schemes and welfare benefit schemes as a part of corporate obligation. As a result employee benefit programs are affecting the viability of mergers and acquisitions in the USA.

Expenses accruing due to employee benefit programs may not be fully reflected in a company's balance sheet. Some employee benefit obligations may arise out of a change in the corporate structure of a firm. Retirement income schemes and benefit plans may vary from company to company. Companies going for mergers and acquisitions strive to iron out the internal differences to maintain a specified level of employee satisfaction.

Mergers and Acquisitions (Information) Merger and Acquisition Process

The Deal of Merger or Acquisition Failure of Mergers and Acquisitions Important Terms Relating to Mergers and Acquisitions Impact of Mergers and Acquisitions Benefits of Mergers and Acquisitions Difference Between Merger and Acquisition Costs of Mergers and Acquisitions Mergers and Acquisitions Law Merger and Acquisition Accounting Mergers and Acquisitions History De-Mergers Reasons Behind Mergers Merger and Acquisition Statistics Valuation Related to M and A Hostile Takeover and Friendly Takeover Merger and Acquisition Strategies Merger and Acquisition Trends Corporate Mergers and Acquisitions Insurance Mergers and Acquisitions Airline Mergers and Acquisitions International Mergers and Acquisitions Mergers and Acquisitions 2005 Mergers and Acquisitions 2006 US Mergers and Acquisitions Mergers and Acquisitions in China

Mergers and Acquisitions in India Mergers and Acquisitions in Indian Telecommunication Industry Merger and Acquisition in Mortguage Industry Failed Mergers and Acquisitions in India

Relevant Related Links:Benefits of M&A Impact of M&A M&A in India Process of M&A M&A Accounting M&A Strategies Airline M&A Failure of M&A International M&A Corporate M&A Reasons behind Mergers

Know about your Stock MarketCapital Market Mutual Fund Stock Trading

IPO

Advertise With Us | Bulletin Board | Terms & Copyright | Disclaimer

Anda mungkin juga menyukai

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Dari EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Penilaian: 4.5 dari 5 bintang4.5/5 (25)

- Mergers and Acquisitions Notes MBADokumen24 halamanMergers and Acquisitions Notes MBAMandip Luitel100% (1)

- Seminar Presentation ON Mergers & Acquisitions: Issues and ChallengesDokumen13 halamanSeminar Presentation ON Mergers & Acquisitions: Issues and ChallengesSubrata kumar sahooBelum ada peringkat

- Rationale For Mergers and AcquisitionsDokumen5 halamanRationale For Mergers and AcquisitionsMinu HarlalkaBelum ada peringkat

- MergerDokumen41 halamanMergerarulselvi_a9100% (1)

- Introductio1 AmitDokumen11 halamanIntroductio1 AmitKaranPatilBelum ada peringkat

- Mergers and AcquisitionsDokumen6 halamanMergers and AcquisitionsVishnu RajeshBelum ada peringkat

- M&a 1Dokumen34 halamanM&a 1shirkeoviBelum ada peringkat

- Corporate RestructuringDokumen13 halamanCorporate RestructuringSubrahmanya SringeriBelum ada peringkat

- Theories of MergersDokumen17 halamanTheories of MergersDamini ManiktalaBelum ada peringkat

- M&ADokumen166 halamanM&AVishakha PawarBelum ada peringkat

- Definition - What Does Operating Synergy Mean?Dokumen3 halamanDefinition - What Does Operating Synergy Mean?sonika7Belum ada peringkat

- Mergers and AcquisitionDokumen14 halamanMergers and Acquisitionmanita_usmsBelum ada peringkat

- Strategic Financial ManagementDokumen14 halamanStrategic Financial ManagementDeepak ParidaBelum ada peringkat

- Event Study: Financial and Valuation Impact of M&a DealDokumen21 halamanEvent Study: Financial and Valuation Impact of M&a DealRAVI KUMARBelum ada peringkat

- Cost Reduction Through Mergers and AcquisitionDokumen16 halamanCost Reduction Through Mergers and AcquisitionKHATAULIBelum ada peringkat

- Mergers and Acquisition ProjectDokumen21 halamanMergers and Acquisition ProjectNivedita Kotian100% (1)

- Introduction To Mergers and AcquisitionDokumen35 halamanIntroduction To Mergers and AcquisitionkairavizanvarBelum ada peringkat

- Merger & AcquisitionDokumen43 halamanMerger & AcquisitionVinod100% (1)

- Chapter 8 of BBS 3rd YearDokumen26 halamanChapter 8 of BBS 3rd YearAmar Singh SaudBelum ada peringkat

- 11.top 5 Recent Mergers and AquisitionsDokumen5 halaman11.top 5 Recent Mergers and AquisitionsmercatuzBelum ada peringkat

- Merger TheoriesDokumen18 halamanMerger TheoriesKrishna MishraBelum ada peringkat

- Corporate RestructuringDokumen9 halamanCorporate Restructuringsurajverma76766Belum ada peringkat

- Business Policy and Strategy PDFDokumen13 halamanBusiness Policy and Strategy PDFAnmol GuptaBelum ada peringkat

- Mergers and Acquisitions, Answer Sheet MF0011Dokumen5 halamanMergers and Acquisitions, Answer Sheet MF0011Ganesh ShindeBelum ada peringkat

- 8 Specific Motives For Mergers and Acquisitions: In,, On atDokumen2 halaman8 Specific Motives For Mergers and Acquisitions: In,, On atMahesh HadapadBelum ada peringkat

- MergerDokumen11 halamanMergerSachi LunechiyaBelum ada peringkat

- SFMDokumen10 halamanSFMSoorajKrishnanBelum ada peringkat

- Chapter 5 FM NotesDokumen14 halamanChapter 5 FM NotesVina DoraiBelum ada peringkat

- MACR Assignment 1Dokumen5 halamanMACR Assignment 1Srinidhi RangarajanBelum ada peringkat

- Merger and AcquisitionsDokumen16 halamanMerger and Acquisitionsanuja kharelBelum ada peringkat

- Merger and AcquisitionDokumen4 halamanMerger and AcquisitionluBelum ada peringkat

- 6th LessonDokumen8 halaman6th LessonThùy Dương VõBelum ada peringkat

- MGT425 SEC-01 INDIVIDUAL-ASSIGNMENT - EditedDokumen11 halamanMGT425 SEC-01 INDIVIDUAL-ASSIGNMENT - Editedsama116676Belum ada peringkat

- Merger and AcquisitionDokumen8 halamanMerger and AcquisitionAnil Kumar KashyapBelum ada peringkat

- Failures of International Mergers and AcquisitionsDokumen20 halamanFailures of International Mergers and AcquisitionsTojobdBelum ada peringkat

- Process of Merger and AcquisitionDokumen5 halamanProcess of Merger and AcquisitionAnupam MishraBelum ada peringkat

- Notes On MergersDokumen4 halamanNotes On MergersYaaseen InderBelum ada peringkat

- Horizontal Merger: Reason For MergersDokumen5 halamanHorizontal Merger: Reason For MergershiteshBelum ada peringkat

- Mergers & Acquisitions: Some Key Issues: Prof. Ajit Kumar BansalDokumen9 halamanMergers & Acquisitions: Some Key Issues: Prof. Ajit Kumar Bansalkomal_preetBelum ada peringkat

- Mergers and AcquisitionDokumen56 halamanMergers and AcquisitionRakhwinderSinghBelum ada peringkat

- Assignment - 5 (Strategic Management and Business Policy)Dokumen6 halamanAssignment - 5 (Strategic Management and Business Policy)ankurBelum ada peringkat

- Mergers and Acquisitions: Global PhenomenonDokumen3 halamanMergers and Acquisitions: Global PhenomenonSyeda SaniBelum ada peringkat

- Chapters of Merger and AqusitionDokumen62 halamanChapters of Merger and AqusitionRicha SaraswatBelum ada peringkat

- Name: Class: Semester: Roll No.: Enrollment No.: Subject:: Vartika Srivastava Mba (HR)Dokumen13 halamanName: Class: Semester: Roll No.: Enrollment No.: Subject:: Vartika Srivastava Mba (HR)Ceegi Singh SrivastavaBelum ada peringkat

- DissertationDokumen25 halamanDissertationKanak Rai0% (1)

- Topic 2 - The FirmDokumen6 halamanTopic 2 - The Firmsherryl caoBelum ada peringkat

- The Merger and Acquisition MotivesDokumen15 halamanThe Merger and Acquisition MotivesHubert HoBelum ada peringkat

- Corporate Restructuring (Hons 2) 3Dokumen230 halamanCorporate Restructuring (Hons 2) 3Yash VermaBelum ada peringkat

- UU AFA II Note Unit 1 Business Combination - PDF - ProtectedDokumen18 halamanUU AFA II Note Unit 1 Business Combination - PDF - Protectednatnaelsleshi3Belum ada peringkat

- Merger & AcquisitionDokumen7 halamanMerger & AcquisitionAranya KarraBelum ada peringkat

- CIMA F3 - FS - Chapter - 9Dokumen52 halamanCIMA F3 - FS - Chapter - 9MichelaRosignoliBelum ada peringkat

- Ethics in Merger & AcquistiionDokumen44 halamanEthics in Merger & AcquistiionJitin BhutaniBelum ada peringkat

- Mergers & Acquisition On Performance of CompanyDokumen31 halamanMergers & Acquisition On Performance of CompanyAkanksha UpadhyayBelum ada peringkat

- Mergers and AcquisitionsDokumen79 halamanMergers and Acquisitions匿匿100% (1)

- Research PaperDokumen8 halamanResearch Paperrachna yadavBelum ada peringkat

- Chapter Outline 28Dokumen16 halamanChapter Outline 28Yajie ZouBelum ada peringkat

- The Key to Higher Profits: Pricing PowerDari EverandThe Key to Higher Profits: Pricing PowerPenilaian: 5 dari 5 bintang5/5 (1)

- Business Opportunity Thinking: Building a Sustainable, Diversified BusinessDari EverandBusiness Opportunity Thinking: Building a Sustainable, Diversified BusinessBelum ada peringkat

- Vodafone Payment ReceiptDokumen1 halamanVodafone Payment ReceiptGoutham NaiduBelum ada peringkat

- Casestudytridentgroup 130311072223 Phpapp02 PDFDokumen11 halamanCasestudytridentgroup 130311072223 Phpapp02 PDFGoutham NaiduBelum ada peringkat

- ApqcDokumen23 halamanApqcGoutham NaiduBelum ada peringkat

- Tourism 1Dokumen34 halamanTourism 1Goutham NaiduBelum ada peringkat

- 8 Monkeys MGT TheoryDokumen1 halaman8 Monkeys MGT TheoryGoutham NaiduBelum ada peringkat

- Storelayout 110201062846 Phpapp01Dokumen22 halamanStorelayout 110201062846 Phpapp01istrucklBelum ada peringkat

- Fault Tree Analysis TQMDokumen20 halamanFault Tree Analysis TQMGoutham NaiduBelum ada peringkat

- Rahul Mishra - 0901201780Dokumen13 halamanRahul Mishra - 0901201780Goutham NaiduBelum ada peringkat

- Core Competencies: A Mahesh SharmaDokumen14 halamanCore Competencies: A Mahesh SharmaGoutham NaiduBelum ada peringkat

- List of Mutual Fund CoDokumen2 halamanList of Mutual Fund CoGoutham NaiduBelum ada peringkat

- Session On PEST Analysis: Presenter: Prof. K. T. Rengamani VIT Business SchoolDokumen15 halamanSession On PEST Analysis: Presenter: Prof. K. T. Rengamani VIT Business SchoolGoutham NaiduBelum ada peringkat

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Dokumen7 halamanExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghBelum ada peringkat

- Rofi Operation and Maintenance ManualDokumen3 halamanRofi Operation and Maintenance ManualSteve NewmanBelum ada peringkat

- Cs8792 Cns Unit 1Dokumen35 halamanCs8792 Cns Unit 1Manikandan JBelum ada peringkat

- 4th Sem Electrical AliiedDokumen1 halaman4th Sem Electrical AliiedSam ChavanBelum ada peringkat

- Catalog Celule Siemens 8DJHDokumen80 halamanCatalog Celule Siemens 8DJHAlexandru HalauBelum ada peringkat

- Configuring Master Data Governance For Customer - SAP DocumentationDokumen17 halamanConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoBelum ada peringkat

- Income Statement, Its Elements, Usefulness and LimitationsDokumen5 halamanIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamBelum ada peringkat

- CLAT 2014 Previous Year Question Paper Answer KeyDokumen41 halamanCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuBelum ada peringkat

- Hotel Reservation SystemDokumen36 halamanHotel Reservation SystemSowmi DaaluBelum ada peringkat

- Building Program Template AY02Dokumen14 halamanBuilding Program Template AY02Amy JaneBelum ada peringkat

- Difference Between Mountain Bike and BMXDokumen3 halamanDifference Between Mountain Bike and BMXShakirBelum ada peringkat

- TAB Procedures From An Engineering FirmDokumen18 halamanTAB Procedures From An Engineering Firmtestuser180Belum ada peringkat

- 23 Things You Should Know About Excel Pivot Tables - Exceljet PDFDokumen21 halaman23 Things You Should Know About Excel Pivot Tables - Exceljet PDFRishavKrishna0% (1)

- Reflections On Free MarketDokumen394 halamanReflections On Free MarketGRK MurtyBelum ada peringkat

- Peoria County Jail Booking Sheet For Oct. 7, 2016Dokumen6 halamanPeoria County Jail Booking Sheet For Oct. 7, 2016Journal Star police documents50% (2)

- BMA Recital Hall Booking FormDokumen2 halamanBMA Recital Hall Booking FormPaul Michael BakerBelum ada peringkat

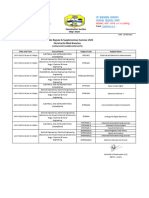

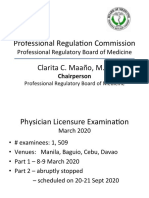

- Professional Regula/on Commission: Clarita C. Maaño, M.DDokumen31 halamanProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartBelum ada peringkat

- Shubham RBSEDokumen13 halamanShubham RBSEShubham Singh RathoreBelum ada peringkat

- Use of EnglishDokumen4 halamanUse of EnglishBelén SalituriBelum ada peringkat

- 2016 066 RC - LuelcoDokumen11 halaman2016 066 RC - LuelcoJoshua GatumbatoBelum ada peringkat

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Dokumen4 halamanRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanBelum ada peringkat

- Ss 7 Unit 2 and 3 French and British in North AmericaDokumen147 halamanSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Belum ada peringkat

- L1 L2 Highway and Railroad EngineeringDokumen7 halamanL1 L2 Highway and Railroad Engineeringeutikol69Belum ada peringkat

- 004-PA-16 Technosheet ICP2 LRDokumen2 halaman004-PA-16 Technosheet ICP2 LRHossam Mostafa100% (1)

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésDokumen298 halamanAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouBelum ada peringkat

- Lockbox Br100 v1.22Dokumen36 halamanLockbox Br100 v1.22Manoj BhogaleBelum ada peringkat

- PLT Lecture NotesDokumen5 halamanPLT Lecture NotesRamzi AbdochBelum ada peringkat

- MDOF (Multi Degre of FreedomDokumen173 halamanMDOF (Multi Degre of FreedomRicky Ariyanto100% (1)

- Tanzania Finance Act 2008Dokumen25 halamanTanzania Finance Act 2008Andrey PavlovskiyBelum ada peringkat

- Everlube 620 CTDSDokumen2 halamanEverlube 620 CTDSchristianBelum ada peringkat