Rinl

Diunggah oleh

Ravi ChandDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Rinl

Diunggah oleh

Ravi ChandHak Cipta:

Format Tersedia

www.vizagsteel.

com

5.4 Rashtriya Ispat Nigam Ltd.

Rashtriya Ispat Nigam Ltd. (RINL)/ Visakhapatnam Steel Plant (VSP) was incorporated on 18.2.1982 under the Companies Act, 1956. RINL/VSP is a schedule- A Navratna company in Steel sector, under the administrative control of Ministry of Steel with 100% shareholding by the Government of India. Its Registered and Corporate office is at Visakhapatnam, Andhra Pradesh. The Vision of the Company is to be a continuously growing world class company Its endeavor is to harness its growth potential and sustain profitable growth; deliver high quality and cost competitive products and be the first choice of customers; create an inspiring work environment to unleash the creative energy of people; achieve excellence in enterprise management; be a respected corporate citizen; ensure clean and green environment and to develop vibrant communities. The Mission of the Company is to attain 16 Mt liquid steel capacity through technological up-gradation, operational efficiency and expansion; augmentation of assured supply of raw materials; to produce steel at international Standards of Cost & Quality; and to meet the aspirations of stakeholders. RINL/VSP is involved in production and marketing of steel products in the long product category and basic grade pig iron through its operating unit at Visakhapatnam, Andhra Pradesh. The principal products of VSP include Pig Iron, rounds, structurals, reinforcement bars, wire rods, blooms, billets and squares. The iron & steel products, which account for 98% of total sales, are used in construction, wire drawing industry, forging industry, and foundry and re rolling industry. The physical performance of the company for last three years are given below:

Main Product Unit Performance During (% capacity utilisation) 2010-11 Bar Products Wire rods MMSM Products Pig Iron Mt Mt Mt Mt 0.868 (122%) 1.016 (120%) 1.044 (123%) 0.318 (57%) 2009-10 0.870 (123%) 1.016 (120%) 1.073 (126%) 0.408 (73%) 2008-09 0.825 (116%) 0.972 (114%) 0.748 (88%) 0.322 (58%)

MOU signed for installation of Uttarbanga RINL Rail Kharkhana to produce Axels for Railways at New Jalpaiguri, West Bengal. The operational performance of the company along with performance indicators and selected financial ratios during the period 2008-09 to 2010-11 can be seen on the opposite page. The Company registered an increase of ` 1377.73 crore in total income during 2010-11 which went up to ` 11529.06 crore in 2010-11 from ` 10151.33crore during 2009-10. The net profit of the company however reduced to ` 658.49 crore, a reduction of ` 138.18 crore over the previous years profit of ` 796.67 crore due to increase in Raw Material Consumption Expenditure as a result of increase in raw material prices over last year. The year 2010-11 witnessed considerable growth of Indian economy and steel industry has also shown growth rates of 8.9% and 10.6% with respect to production and apparent consumption of finished steel respectively. RINL has been surpassing rated capacities of its production units since 2001 and continued the same trend for the year 201011. RINL/VSP registered capacity utilization of 113%, 114% & 116% in Hot Metal, Liquid Steel and Saleable Steel productions respectively. 24.23 lakh tons of value added steel products were produced during 2010-11which is about 79% of saleable steel, is the best since inception.

Performance Highlights

Vision/Mission

Industrial / Business Operations

Human Resource Management

The company employed 17829 regular employees as on 31.3.2011. The retirement age in the company is 60 years. It is following IDA 2007 pattern of remuneration. Details of employment in last 3 years are given below:

Particulars Executives including NonUnionised Supervisors Non-Executives # Total Employees 2010-11 5207 12622 17829 2009-10 5263 12567 17830 2008-09 5184 11988 17172

# Detail break-up of Non-Executive employees is at Statement no. 25 of volume-I of PE Survey.

Technology Up-gradation, Research & Development

BIRD Group of Companies (BGC) have formally been made subsidiaries of RINL, with acquisition of 51% stake in EIL, the holding company of BGC. RINL has long term directional plans to expand the capacity of liquid steel to 20 million tonnes in phases by the year 2020 to maintain its important position in the Indian steel market. RINL is currently doubling its capacity to 6.3 Mtpa of liquid steel which is scheduled to be completed by 2011-12 progressively. In addition to expansion, RINL is also in the process of adding capacities through revamping / up gradation of existing units like Blast Furnaces, Converters, Sinter Plant and other associated facilities with which capacity will go up to 7.3 mtpa of Liquid steel by 2013. RINL has taken number of initiatives for growth of business of the company in addition to its expansion plan, which includes formation of Joint Ventures, acquisition of mineral assets for raw material security, mergers etc.

Strategic Issues

RINL-VSP through in-house R&D, has taken up various projects towards in-plant process improvements, development of new products, cost reduction, waste & environment management, improvement in yield & efficiency etc. Projects are also taken up in collaboration with different research institutes like Council of Scientific & Industrial Research (CSIR), premier educational institutions viz. IITs, IISc-Bangalore, Jadavpur University, Andhra University etc. Keeping in view the market demand and to cater to specific customer requirement, 25 new products were developed during 2010-11. These new products are used in manufacturing products / applications.

96

Steel

Vishkahapatnam Steel Plant, Administrative Building., Vishakhapatnam, Andhra Pradesh

Rashtriya Ispat Nigam Ltd.

Balance Sheet Particulars Authorised Capital (1) Sources Of Fund (1.1) Shareholders Funds (A) Paid-Up Capital Central Govt Others (B) Share Application Money (C) Reserves & Surplus Total (A) + (B) + (C) (1.2) Loan Funds (A) Secured Loans (B) Unsecured Loans Total (A) + (B) (1.3) Deferred Tax Liability Total (1.1) + (1.2) + (1.3) (2) Application Of Funds (2.1) Fixed Assets (A) Gross Block (B) Less Depreciation (C) Net Block (A-B) (D) Capital Work In Progress Total (C) + (D) (2.2) Investment (2.3) Current Assets, Loan & Advances (A) Inventories (B) Sundry Debtors (C) Cash & Bank Balances (D) Other Current Assets (E) Loan & Advances Total (A)+ (B)+ (C)+ (D)+ (E) (2.4) Less:current Liabilities & Provisions (A) Current Liabilities (B) Provisions Total (A+B) (2.5) Net Current Assets (2.3-2.4) (2.6) Deferred Revenue / Pre. Expenditure (2.7) Deferred Tax Asset (2.8) Profit & Loss Account(Dr) Total (2.1+2.2+2.5+2.6+2.7+2.8) 327143 133606 460749 301772 0 0 0 1444595 287195 143589 430784 524282 0 0 0 1421537 325471 33061 199889 7596 196504 762521 245152 18118 541554 13740 136502 955066 979463 826471 152992 953671 1106663 36160 947395 800855 146540 750690 897230 25 27489 86187 113676 7997 1444595 40728 82527 123255 9782 1421537 488985 293747 0 540190 1322922 782732 0 0 505768 1288500 2010-11 800000 2009-10 800000

(` in Lakhs) 2008-09 800000

Profit & Loss Account Particulars (1) Income (A) Sales/Operating Income (B) Excise Duty 1151699 104581 1047118 52556 53232 1152906 1063463 82548 980915 75753 -41535 1015133 2010-11 2009-10

(` in Lakhs) 2008-09

1041063 128225 912838 97633 91665 1102136

782732 0 0 459259 1241991 90772 10004 100776 12449 1355216

(C) Net Sales (A-B) (D) Other Income/Receipts (E) Accretion/Depletion in Stocks (I)Total Income (C+D+E) (2) Expenditure (A) Purchase of Finished Goods/ Consumption Of Raw Materials (B) Stores & Spares (C) Power & Fuel (D) Manufacturing / Direct / Operating Expenses (E) Salary, Wages & Benefits / Employee Exp. (F) Other Expenses

713926 47122 42503 14581 127295 68776 984 1015187 137719 26594 0 111125

553511 46648 40827 48582 139974 25159 919 855620 159513 27717 0 131796

589625 50123 34031 57333 115668 19268 1008 867056 235080 24046 20 211014

900604 774974 125630 461781 587411 5

(G) Provisions (II)Total Expenditure (A to G) (3) Profit Before Dep, Int, Taxes & EP (PBDITEP) (I-II) (4) Depreciation (5) Dre/Prel Exp Written Off (6) Profit Before Int., Taxes & Ep (Pbitep) (3-4-5)

321528 19127 662417 25891 156969 1185932

(7) Interest (A) On Central Government Loans (B) On Foreign Loans (C) Others (D) Less Interest Capitalised (E) Charged to P & L Account (A+B+C-D) (8) Profit Before Tax & EP(PBTEP) (6-7E) (9) Tax Provisions (10) Net Profit / Loss Before EP (8-9) (11) Net Extra-Ord. Items (12) Net Profit / Loss(-) (10-11) (13) Dividend Declared (14) Dividend Tax (15) Retained Profit (12-13-14) 0 0 16455 0 16455 94670 32317 62353 -3496 65849 27147 4404 34298 0 0 7755 0 7755 124041 45098 78943 -724 79667 28529 4738 46400 0 0 8814 0 8814 202200 69102 133098 -459 133557 33918 5764 93875

256079 162053 418132 767800 0 0 0 1355216

Important Indicators (i) Investment (ii) Capital Employed (iii) Net Worth (iv) Cost of Production (v) Cost of Sales (vi) Gross Value Added (At Market Price) (vii) Total Employees (Other Than Casuals) (Nos.) (viii) Avg. Monthly Emoluments Per Employee (Rs.)

2010-11 782732 454764 1322922 1058236 1005004

2009-10 788524 670822 1288500 891092 932627

2008-09 782732 893430 1241991 899936 808271

Financial Ratios (i) Sales : Capital Employed (ii) Cost of Sales : Sales (iii) Salary / Wages : Sales (iv) Net Profit : Net Worth (v) Debt : Equity (vi) Current Ratio (vii) Sundry Debtors : Sales (No. of Days) (viii) Total Inventory : Sales

2010-11 230.26 95.98 12.16 4.98 0.09 1.65 11.52 113.45

2009-10 146.23 95.08 14.27 6.18 0.1 2.22 6.74 91.22

2008-09 102.17 88.54 12.67 10.75 0.08 2.84 7.65 128.56

17829 59498

17830 65421

17172 56132

Public Enterprises Survey 2010-2011: Vol-II

97

Anda mungkin juga menyukai

- Fauji Cement Company Limited Annual-Report-2012Dokumen63 halamanFauji Cement Company Limited Annual-Report-2012Saleem Khan0% (1)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportDari EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportBelum ada peringkat

- 12.4 Hindustan Newsprint LTD.: Human Resource ManagementDokumen2 halaman12.4 Hindustan Newsprint LTD.: Human Resource ManagementBinoj V JanardhananBelum ada peringkat

- PDF 718201235101PMKBLAnnualReport 18.07.2012Dokumen120 halamanPDF 718201235101PMKBLAnnualReport 18.07.2012Keshav KalaniBelum ada peringkat

- NFL Annual Report 2011-2012Dokumen108 halamanNFL Annual Report 2011-2012prabhjotbhangalBelum ada peringkat

- Equity Asset Valuation Mughal SteelsDokumen11 halamanEquity Asset Valuation Mughal SteelsHabiba PashaBelum ada peringkat

- Visaka Industries FY13 PDFDokumen85 halamanVisaka Industries FY13 PDFrajan10_kumar_8050530% (1)

- Campus PPT - jspl2Dokumen53 halamanCampus PPT - jspl2deepesh3191Belum ada peringkat

- FAM Project Report of ACC CementDokumen16 halamanFAM Project Report of ACC CementRajiv PaniBelum ada peringkat

- BSE Company Research Report - Saurashtra Cement LTDDokumen5 halamanBSE Company Research Report - Saurashtra Cement LTDdidwaniasBelum ada peringkat

- Fluidomat BSE CAREDokumen5 halamanFluidomat BSE CAREayushidgr8Belum ada peringkat

- Corp LTD: (GMDV)Dokumen5 halamanCorp LTD: (GMDV)api-234474152Belum ada peringkat

- SintexInd Sunidhi 211014Dokumen7 halamanSintexInd Sunidhi 211014MLastTryBelum ada peringkat

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaDokumen126 halamanStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaBelum ada peringkat

- SIIL - Annual Report 2010-11Dokumen188 halamanSIIL - Annual Report 2010-11SwamiBelum ada peringkat

- L&T Press Release: Performance For The Quarter Ended March 31, 2012Dokumen6 halamanL&T Press Release: Performance For The Quarter Ended March 31, 2012blazegloryBelum ada peringkat

- Tata Steel Balance Sheet 2005-06Dokumen172 halamanTata Steel Balance Sheet 2005-06karthikrmBelum ada peringkat

- Omax Annual ReprtDokumen78 halamanOmax Annual ReprtSalini RajamohanBelum ada peringkat

- Hindustan Construction Company Financial Analysis 2010-2014Dokumen21 halamanHindustan Construction Company Financial Analysis 2010-2014Harsh MohapatraBelum ada peringkat

- Visaka Industries Annual Report FY12Dokumen37 halamanVisaka Industries Annual Report FY12rajan10_kumar_805053Belum ada peringkat

- Corp LTD: (GMDV)Dokumen5 halamanCorp LTD: (GMDV)api-234474152Belum ada peringkat

- NCL Industries (NCLIND: Poised For GrowthDokumen5 halamanNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyBelum ada peringkat

- Financial Reporting Statement Analysis Project Report: Name of The Company: Tata SteelDokumen35 halamanFinancial Reporting Statement Analysis Project Report: Name of The Company: Tata SteelRagava KarthiBelum ada peringkat

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Dokumen1 halamanStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaBelum ada peringkat

- Dialog2011 MainDokumen73 halamanDialog2011 MainSopsky SalatBelum ada peringkat

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Dokumen9 halamanTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaBelum ada peringkat

- Project Report On: Larsen & Toubro Limited (L&T)Dokumen31 halamanProject Report On: Larsen & Toubro Limited (L&T)rohitghulepatilBelum ada peringkat

- Blue Dart Express LTD: Key Financial IndicatorsDokumen4 halamanBlue Dart Express LTD: Key Financial IndicatorsSagar DholeBelum ada peringkat

- India Cements: Performance HighlightsDokumen12 halamanIndia Cements: Performance HighlightsAngel BrokingBelum ada peringkat

- "Working Capital": A Project Report On GNFCDokumen13 halaman"Working Capital": A Project Report On GNFCEr Priti SinhaBelum ada peringkat

- Project Report On Working Capital Management at Tata Steel Ltd.Dokumen8 halamanProject Report On Working Capital Management at Tata Steel Ltd.Ankit Agrawal50% (4)

- Hindustan Copper: Stretched ValuationsDokumen7 halamanHindustan Copper: Stretched ValuationsAngel BrokingBelum ada peringkat

- F S A JSW - Ispat: Prof. Padmini SrinivasanDokumen18 halamanF S A JSW - Ispat: Prof. Padmini Srinivasantanmay1984Belum ada peringkat

- Everest Industries Limited: Investor Presentation 29 April 2011Dokumen12 halamanEverest Industries Limited: Investor Presentation 29 April 2011vejendla_vinod351Belum ada peringkat

- Rio Tinto Chartbook 2012Dokumen49 halamanRio Tinto Chartbook 2012chasstyBelum ada peringkat

- Market Outlook 18th January 2012Dokumen7 halamanMarket Outlook 18th January 2012Angel BrokingBelum ada peringkat

- Hindalco Industries Hindalco Industries - An Integrated NtegratedDokumen12 halamanHindalco Industries Hindalco Industries - An Integrated Ntegratedvibhach1Belum ada peringkat

- 2010 Annual ReportDokumen84 halaman2010 Annual ReportnaveenBelum ada peringkat

- Vedanta GrowthDokumen38 halamanVedanta Growthsudeep khandelwalBelum ada peringkat

- Market Outlook Market Outlook: Dealer's DiaryDokumen15 halamanMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- 20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsDokumen2 halaman20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsskjamuiBelum ada peringkat

- 2013 Daewoo InternationalDokumen35 halaman2013 Daewoo InternationalJohnathan WoodBelum ada peringkat

- BUY BUY BUY BUY: Exide Industries LTDDokumen13 halamanBUY BUY BUY BUY: Exide Industries LTDcksharma68Belum ada peringkat

- Reasons For The Selection If Stocks For Trading: 1) Man IndustriesDokumen6 halamanReasons For The Selection If Stocks For Trading: 1) Man IndustriesSreekumar ThottapillilBelum ada peringkat

- Innoventive Industries LTD: Innovative Product LineDokumen8 halamanInnoventive Industries LTD: Innovative Product Linenitinahir20105726Belum ada peringkat

- Annual Report - Italian Thailand Development - E2010Dokumen108 halamanAnnual Report - Italian Thailand Development - E2010institutesezBelum ada peringkat

- Chartbook PDFDokumen49 halamanChartbook PDFdidwaniasBelum ada peringkat

- AR Rites 2015 EnglishDokumen152 halamanAR Rites 2015 EnglishGanesh BabuBelum ada peringkat

- JSW Steel Full 2010Dokumen106 halamanJSW Steel Full 2010Nishant SharmaBelum ada peringkat

- Steel Authority of India Result UpdatedDokumen13 halamanSteel Authority of India Result UpdatedAngel BrokingBelum ada peringkat

- Honeywell Automation 2009 ReportDokumen4 halamanHoneywell Automation 2009 ReportmworahBelum ada peringkat

- SIP RINL Final1Dokumen88 halamanSIP RINL Final1jyotiBelum ada peringkat

- Accounts AssignmentDokumen15 halamanAccounts AssignmentGagandeep SinghBelum ada peringkat

- Tata SteelDokumen28 halamanTata SteelmuzammilBelum ada peringkat

- Fie M Industries LimitedDokumen4 halamanFie M Industries LimitedDavuluri OmprakashBelum ada peringkat

- 4 May Opening BellDokumen8 halaman4 May Opening BelldineshganBelum ada peringkat

- Analysis & Financial Performnce of AccDokumen25 halamanAnalysis & Financial Performnce of Accneeks818100% (1)

- Market Outlook 22-04-2016Dokumen5 halamanMarket Outlook 22-04-2016xytiseBelum ada peringkat

- NSSMC en Ar 2013 All V Nippon SteelDokumen56 halamanNSSMC en Ar 2013 All V Nippon SteelJatin KaushikBelum ada peringkat

- 12 LogisticsDokumen15 halaman12 LogisticsWhitney BrownBelum ada peringkat

- Evolution of Stragic ManagementDokumen24 halamanEvolution of Stragic ManagementRavi ChandBelum ada peringkat

- Logistics in The Humanitarian FieldDokumen17 halamanLogistics in The Humanitarian FieldCarlos TembaBelum ada peringkat

- Trade Theory and Trade Facts : Raphael BergoeingDokumen45 halamanTrade Theory and Trade Facts : Raphael BergoeingRavi ChandBelum ada peringkat

- WIRELESSDokumen57 halamanWIRELESSRavi ChandBelum ada peringkat

- Wireless NetworksDokumen42 halamanWireless NetworksRavi ChandBelum ada peringkat

- BankersChoice: Current Affairs February 2014Dokumen19 halamanBankersChoice: Current Affairs February 2014TalentSprintBelum ada peringkat

- Biomedical-Instrumentation NotesDokumen283 halamanBiomedical-Instrumentation NotesNikhil CherianBelum ada peringkat

- 5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsDokumen2 halaman5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsRavi ChandBelum ada peringkat

- 5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsDokumen2 halaman5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsRavi ChandBelum ada peringkat

- Biomedical-Instrumentation NotesDokumen283 halamanBiomedical-Instrumentation NotesNikhil CherianBelum ada peringkat

- World Steel Review 04 13Dokumen3 halamanWorld Steel Review 04 13Ravi ChandBelum ada peringkat

- World Steel Review 04 13Dokumen3 halamanWorld Steel Review 04 13Ravi ChandBelum ada peringkat

- World Steel Review 04 13Dokumen3 halamanWorld Steel Review 04 13Ravi ChandBelum ada peringkat

- Mba Project TitlesDokumen3 halamanMba Project TitlesRavi ChandBelum ada peringkat

- PresentationonE 3Dokumen29 halamanPresentationonE 3Ravi ChandBelum ada peringkat

- Employee WelfareDokumen91 halamanEmployee Welfarevaishalisonwane77Belum ada peringkat

- Organazatation Chart of Ministry SteelDokumen2 halamanOrganazatation Chart of Ministry SteelRavi ChandBelum ada peringkat

- World Steel Review 04 13Dokumen3 halamanWorld Steel Review 04 13Ravi ChandBelum ada peringkat

- GSM Based Home AutomationDokumen16 halamanGSM Based Home AutomationNimal_V_Anil_2526100% (5)

- Inventory IllustrationDokumen6 halamanInventory IllustrationVatchdemonBelum ada peringkat

- Further Changes in Literature ReviewDokumen18 halamanFurther Changes in Literature ReviewMY SolutionsBelum ada peringkat

- The Economist - 1012Dokumen96 halamanThe Economist - 101220203ad063Belum ada peringkat

- Cost Accounting A Managerial Emphasis Canadian 7th Edition Horngren Solutions Manual 1Dokumen36 halamanCost Accounting A Managerial Emphasis Canadian 7th Edition Horngren Solutions Manual 1maryreynoldsxdbtqcfaje100% (23)

- Reliance Jio: Revolutionizing Indian TelecomDokumen4 halamanReliance Jio: Revolutionizing Indian TelecomNIVAS PANDIAN GUNASEKHARANBelum ada peringkat

- Inventory Valuation (Ias 2)Dokumen30 halamanInventory Valuation (Ias 2)Patric CletusBelum ada peringkat

- Microsoft PowerPoint - Introduction To Consumer Behavior Students 6092198429188766Dokumen8 halamanMicrosoft PowerPoint - Introduction To Consumer Behavior Students 6092198429188766ninaBelum ada peringkat

- Chu de 3 Nhom 6 Hay PDFDokumen10 halamanChu de 3 Nhom 6 Hay PDFNhư NhưBelum ada peringkat

- AT&T INC., DIRECTV GROUP HOLDINGS, LLC, and TIME WARNER INC.Dokumen237 halamanAT&T INC., DIRECTV GROUP HOLDINGS, LLC, and TIME WARNER INC.Camila SansonBelum ada peringkat

- Wharton - AMP - India - Brochure - 20 - 02 - 2020 Executive EducationDokumen18 halamanWharton - AMP - India - Brochure - 20 - 02 - 2020 Executive Educationsantosh kumarBelum ada peringkat

- EconomicsDokumen12 halamanEconomicsRithesh KBelum ada peringkat

- © The Institute of Chartered Accountants of IndiaDokumen40 halaman© The Institute of Chartered Accountants of Indiaकनक नामदेवBelum ada peringkat

- NetSuite Administrator Sample TestDokumen20 halamanNetSuite Administrator Sample TestadhiBelum ada peringkat

- MP Plan 1001458764 2022082Dokumen3 halamanMP Plan 1001458764 2022082Satyanarayana NerugondaBelum ada peringkat

- Homework 7 - Leases (Lessor - S Books)Dokumen1 halamanHomework 7 - Leases (Lessor - S Books)alvarezxpatriciaBelum ada peringkat

- ACYAVA1 Comprehensive Examination Quiz Instructions: Started: Jun 4 at 13:00Dokumen37 halamanACYAVA1 Comprehensive Examination Quiz Instructions: Started: Jun 4 at 13:00Joel Kennedy BalanayBelum ada peringkat

- Tax 302 Business and Transfer Tax Finals Answer PDFDokumen29 halamanTax 302 Business and Transfer Tax Finals Answer PDFsunthatburns00Belum ada peringkat

- Week 3 HandoutDokumen22 halamanWeek 3 HandoutMj Ong Pierson GarboBelum ada peringkat

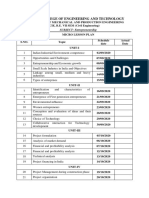

- MICRO LESSON PLAN (Entrepreneurship)Dokumen2 halamanMICRO LESSON PLAN (Entrepreneurship)musthakmechBelum ada peringkat

- CFA Level 1 Derivatives - Our Cheat Sheet - 300hoursDokumen11 halamanCFA Level 1 Derivatives - Our Cheat Sheet - 300hoursMichBelum ada peringkat

- 259 5 Super Special Ultimate Fun BingoDokumen12 halaman259 5 Super Special Ultimate Fun BingoSosa Gremory (PanditaSosa)Belum ada peringkat

- Resume Templates IIDokumen13 halamanResume Templates IIzay yan htetBelum ada peringkat

- Program of WorksDokumen3 halamanProgram of WorksElizabethBelum ada peringkat

- Minutes For 1st Meeting Dec3Dokumen3 halamanMinutes For 1st Meeting Dec3Re Yah AnoosBelum ada peringkat

- On The Sum of Orders of Elements in Finite GroupsDokumen7 halamanOn The Sum of Orders of Elements in Finite GroupsmathsdepartmentbitsBelum ada peringkat

- Ultimo User GuideDokumen136 halamanUltimo User Guidejeremy_emilBelum ada peringkat

- How To Use The Flash Tool For Xperia PDFDokumen12 halamanHow To Use The Flash Tool For Xperia PDFjefferstevenBelum ada peringkat

- 6.14, Vishal Yadav PDFDokumen19 halaman6.14, Vishal Yadav PDFSujit K ChauhanBelum ada peringkat

- Business Studies P1 May-June 2021 MG EngDokumen25 halamanBusiness Studies P1 May-June 2021 MG Engcardo neethlingBelum ada peringkat

- Interfacing Cloud Base Data Into Your Reliability Program PDFDokumen22 halamanInterfacing Cloud Base Data Into Your Reliability Program PDFMuhammad HaroonBelum ada peringkat