State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents Required

Diunggah oleh

Mojahed AhmarDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents Required

Diunggah oleh

Mojahed AhmarHak Cipta:

Format Tersedia

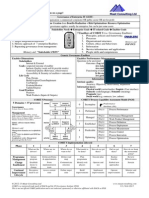

State Bank of India (SBI) Personal Loan

State Bank of India Personal Loan rates are competitive in market but not lowest as per popular belief. Before taking any loans compare Personal Loan Rates of all banks and then take a decision. Enjoy the SBI Advantage : Low Personal Loan Interest Rates. Further, charge interest on a daily reducing balance!! Minimum processing charges; only 1%-2% of loan amount. No hidden costs or administrative charges. No security required.... which means minimal documentationsomething that you had always wanted. No prepayment penalties. Reduce your interest burden and optimally utilize your surplus funds by prepaying the loan (1% of the loan amount will be charged if you repay the loan before 6 months) Long repayment period of up to 48 months.

Salaried (At present, only salaried individuals are covered under the scheme).

Eligibility Criteria

Resident Indian National

Loan Amount

2.50 lakhs in Non Metros 5 lakhs in Metros Upto 10 lakhs where salaried account or current account is with Sbi It is determined by your repayment capacity. Minimum Income: Rs.24,000/in metro and urban centres Rs.10,000/- in rural/semi-urban centres Maximum Loan Amount: 12 times Net Monthly Income for salaried individuals and pensioners subject to a ceiling of Rs.10 lacs in all centres

Documents Required

1). Passport size photograph 2). Proof of official address for self employed individuals and professionals. This can include shop and establishment certificate/Lease deed/Telephone Bill 3). Latest Salary clip and Form 16, in the case of salaried persons.

Max Tenor : 48 months Processing fee : 1% No prepayment charges Personal loan amount can be increased by making your spouse as co borrower.

Interest Rates

Full Name

Select City Ahmedabad Bangalore

Personal Loans Scheme (SBI Saral) SBI Loan to Pensioners

16.75% p.a. 12.25% p.a.

Loans to Employee to Subscribe to 14.00% p.a. ESOPs State bank of India also provides beneficial services in Home Loan, Car Loan, Credit Card, Educational loans, festival loan and Loan Against Property. Other Products from SBI SBI Home Loan SBI Home Finance SBI Personal Loan SBI Card

State Bank Head State Bank State Bank Bhawna, Madame Cama Mumbai-400021 Telephone No. 22029456 or 22029451, Fax no. 22885369. of of 8th IndiaOffice: India, Floor, Road,

SUGGESTION

The most important threat which appears in S.B.I banks are the

competitors in which the major competitor is HDFC bank, having many branches in jaipur itself and thats why it is more convenient for the people to approach that bank. Thus S.B.I bank should expand the number of branches.

In terms of charges also, majority of customers are in favour of SBI. Thus HDFC bank should adopt flexible approach in charges and the charges should be charged according to the customers income, competition and other factors so that they do not loose any genuine customer due to these unfair charges. According to my analysis, majority of customers said that they use S.B.I

BANKS ATM the most for cash withdrawal because its location covers almost all the areas of the city. Thus, S.B.I bank can use this feature as a major tool for advertising and promotion purposes.

Providing best customer service is also one of the advantages for the bank which can be used for promotion purposes so that more and more people attracts towards the bank.

Anda mungkin juga menyukai

- All You Need to Know About Payday LoansDari EverandAll You Need to Know About Payday LoansPenilaian: 5 dari 5 bintang5/5 (1)

- Chapter1 - Fundamental Principles of ValuationDokumen21 halamanChapter1 - Fundamental Principles of ValuationだみBelum ada peringkat

- Corpo Bar QsDokumen37 halamanCorpo Bar QsDee LM100% (1)

- SAP PM Fiori AppsDokumen16 halamanSAP PM Fiori AppsVijayaw Vijji100% (1)

- Car Loan Interest RateDokumen9 halamanCar Loan Interest RateOnkar ChavanBelum ada peringkat

- Umjetnost PDFDokumen92 halamanUmjetnost PDFJuanRodriguezBelum ada peringkat

- COBIT 5 Foundation Exam Revision On A PageDokumen1 halamanCOBIT 5 Foundation Exam Revision On A PageSergiö Montoya100% (1)

- Whitepaper - State of Construction TechnologyDokumen16 halamanWhitepaper - State of Construction TechnologyRicardo FigueiraBelum ada peringkat

- Lesson 6 EntrepreneurshipDokumen13 halamanLesson 6 EntrepreneurshipRomeo BalingaoBelum ada peringkat

- Janalakshmi Financial ServicesDokumen26 halamanJanalakshmi Financial ServicesHarish Jakkannavar100% (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesDari EverandA Haven on Earth: Singapore Economy Without Duties and TaxesBelum ada peringkat

- Project Report on"CASA" in HDFCDokumen42 halamanProject Report on"CASA" in HDFCRoshan Friendsforever100% (5)

- Axis Bank-Vehicle LoanDokumen45 halamanAxis Bank-Vehicle LoansonamBelum ada peringkat

- State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredDokumen1 halamanState Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredMojahed AhmarBelum ada peringkat

- SXXDokumen3 halamanSXXMojahed AhmarBelum ada peringkat

- Personal Loan FAQsDokumen16 halamanPersonal Loan FAQsAlokThakur143Belum ada peringkat

- Mrutyunjaya Sangresakoppa - MB207683Dokumen21 halamanMrutyunjaya Sangresakoppa - MB207683Prashanth Y GBelum ada peringkat

- Libin Lalu 12102948 CA1Dokumen11 halamanLibin Lalu 12102948 CA1Libin laluBelum ada peringkat

- About Oriental Bank of CommerceDokumen10 halamanAbout Oriental Bank of CommerceMandeep BatraBelum ada peringkat

- Comparative Study of Bank's Retail Loan Product (Home LoanDokumen27 halamanComparative Study of Bank's Retail Loan Product (Home LoanDevo Pam NagBelum ada peringkat

- Fsa Isa-3 (Group-3)Dokumen12 halamanFsa Isa-3 (Group-3)AlonnyBelum ada peringkat

- Advance Product of SbiDokumen20 halamanAdvance Product of SbiSeKha RudiThongerBelum ada peringkat

- Sbi Saral Personal LoanDokumen2 halamanSbi Saral Personal LoanMukesh BohraBelum ada peringkat

- Comparative Study of Financial Products (Casa) in Banking IndustryDokumen17 halamanComparative Study of Financial Products (Casa) in Banking Industrypolakisagar0% (1)

- Cash Credit System of HDFC BankDokumen38 halamanCash Credit System of HDFC Bankloveleen_mangatBelum ada peringkat

- Ritesh HDFCDokumen51 halamanRitesh HDFCRitesh VarmaBelum ada peringkat

- Rbi DiscussionDokumen3 halamanRbi DiscussionSanjeev KhanBelum ada peringkat

- Summer Training ReportDokumen25 halamanSummer Training ReportAjay SharmaBelum ada peringkat

- Assignment 1 - Banking OperationDokumen72 halamanAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreBelum ada peringkat

- MBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science ProjectsDokumen11 halamanMBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science Projectspeacock1983Belum ada peringkat

- A Personal Loan Is A Credit Instrument That Helps A Borrower To Get Quick Financing For Any Kind Personal RequirementDokumen17 halamanA Personal Loan Is A Credit Instrument That Helps A Borrower To Get Quick Financing For Any Kind Personal RequirementneelamBelum ada peringkat

- Payment Bank - A Need of Digital India: Abhinav National Monthly Refereed Journal of Research inDokumen5 halamanPayment Bank - A Need of Digital India: Abhinav National Monthly Refereed Journal of Research inmonica niroliaBelum ada peringkat

- Greater Bombay Bank CO OPERATIVESDokumen62 halamanGreater Bombay Bank CO OPERATIVESsnehalgaikwadBelum ada peringkat

- Service Marketing AssignmentDokumen8 halamanService Marketing AssignmentSourav MishraBelum ada peringkat

- 2010 Live Project at Imantec: C A B, M P A MNC& N B IDokumen15 halaman2010 Live Project at Imantec: C A B, M P A MNC& N B Irakesh_raj68Belum ada peringkat

- 7p of SbiDokumen9 halaman7p of SbiMilan PatelBelum ada peringkat

- L1 BankingDokumen38 halamanL1 BankingdjroytatanBelum ada peringkat

- Why customers do term depositsDokumen22 halamanWhy customers do term depositsPriyneet PriyneetBelum ada peringkat

- SBI: India's largest bank with over 21,500 branchesDokumen18 halamanSBI: India's largest bank with over 21,500 branchesBala SubramanianBelum ada peringkat

- SBI Business LoanDokumen12 halamanSBI Business LoanAjit SamalBelum ada peringkat

- Jyoti Pathak 11910540 OPR511Dokumen10 halamanJyoti Pathak 11910540 OPR511Jyoti Pathak FnEqfAISerBelum ada peringkat

- Icici and YahooDokumen12 halamanIcici and YahooPavan AhujaBelum ada peringkat

- Mudra YojanaDokumen26 halamanMudra YojanaKirti ChotwaniBelum ada peringkat

- HDFC Bank Personal Loan StudyDokumen26 halamanHDFC Bank Personal Loan StudyTaniya Dutta100% (4)

- MBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit SchemesDokumen68 halamanMBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit Schemeszargar100% (1)

- Competitive Analysis of Retail Banking, Market PenetrationDokumen13 halamanCompetitive Analysis of Retail Banking, Market PenetrationProjjal DasBelum ada peringkat

- RESEARCH METHODOLOGYDokumen10 halamanRESEARCH METHODOLOGYDostar ChuBelum ada peringkat

- SBI Commercial and International BankDokumen14 halamanSBI Commercial and International BankSefy BastianBelum ada peringkat

- Axis BankDokumen7 halamanAxis BankKaranPatilBelum ada peringkat

- Stringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic TimesDokumen2 halamanStringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic Timesanupbhansali2004Belum ada peringkat

- Prepared by PC15MBA-034: Basanti BagDokumen23 halamanPrepared by PC15MBA-034: Basanti BagSusilPandaBelum ada peringkat

- Customer survey on relationship marketing strategiesDokumen13 halamanCustomer survey on relationship marketing strategiesAbhishek PathakBelum ada peringkat

- Name: Darshan Shrikant Dhoot Roll No: 721013 Guided By: Prof - Prasad SahasrabuddhiDokumen8 halamanName: Darshan Shrikant Dhoot Roll No: 721013 Guided By: Prof - Prasad Sahasrabuddhidarshan dhootBelum ada peringkat

- Assignment CB_C64Dokumen19 halamanAssignment CB_C64S H RE EBelum ada peringkat

- Raj Bank PPT 2003Dokumen32 halamanRaj Bank PPT 2003Sunny Bhatt100% (1)

- Psubank 170716083448 1Dokumen12 halamanPsubank 170716083448 1Kool KingBelum ada peringkat

- Customer perceptions of HDFC Bank products & servicesDokumen97 halamanCustomer perceptions of HDFC Bank products & servicessaifasainudeenBelum ada peringkat

- Meta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeDokumen4 halamanMeta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeParag ShrivastavaBelum ada peringkat

- Financial Institutions and Markets: Case Study: Banking ProductsDokumen10 halamanFinancial Institutions and Markets: Case Study: Banking ProductsSai Dinesh BilleBelum ada peringkat

- Know The Charges, Limits in SBI Cash Deposit Machine - The Financial ExpressDokumen2 halamanKnow The Charges, Limits in SBI Cash Deposit Machine - The Financial ExpressA.YOGAGURUBelum ada peringkat

- 7ps of ShivaniDokumen9 halaman7ps of ShivaniPranay JuwatkarBelum ada peringkat

- Sme Project ReportDokumen7 halamanSme Project ReportHuzefa BadriBelum ada peringkat

- Sources of CapitalDokumen6 halamanSources of CapitalarshadBelum ada peringkat

- Grace Report CompensationDokumen13 halamanGrace Report CompensationDarkindi GreceyBelum ada peringkat

- Procedures and comparison of banking productsDokumen44 halamanProcedures and comparison of banking productsBhurabhai MaliBelum ada peringkat

- Rwanda Settlements Nov 01Dokumen78 halamanRwanda Settlements Nov 01Mojahed AhmarBelum ada peringkat

- Curriculum Vitae: C/O Anand Singh, House No 45 Rajpur Khurd, Chattarpur, New Delhi 110068Dokumen3 halamanCurriculum Vitae: C/O Anand Singh, House No 45 Rajpur Khurd, Chattarpur, New Delhi 110068Mojahed AhmarBelum ada peringkat

- Company ProfileDokumen7 halamanCompany ProfileMojahed AhmarBelum ada peringkat

- Other CompanyDokumen8 halamanOther CompanyMojahed AhmarBelum ada peringkat

- Curriculum Vitae: MD - Mojahed Ul Ahmar Cell No:-+91-8745872036Dokumen3 halamanCurriculum Vitae: MD - Mojahed Ul Ahmar Cell No:-+91-8745872036Mojahed AhmarBelum ada peringkat

- Company ProfileDokumen7 halamanCompany ProfileMojahed AhmarBelum ada peringkat

- AaaaDokumen6 halamanAaaaMojahed AhmarBelum ada peringkat

- Trainig ResumeDokumen8 halamanTrainig ResumeMojahed AhmarBelum ada peringkat

- Star LoanDokumen1 halamanStar LoanMojahed AhmarBelum ada peringkat

- Mojahed Research ObjectivesDokumen6 halamanMojahed Research ObjectivesMojahed AhmarBelum ada peringkat

- 2000 Chrisman McmullanDokumen17 halaman2000 Chrisman McmullanjstanfordstanBelum ada peringkat

- 1 MDL299356Dokumen4 halaman1 MDL299356Humayun NawazBelum ada peringkat

- TVSM 2004 2005 1ST InterimDokumen232 halamanTVSM 2004 2005 1ST InterimMITCONBelum ada peringkat

- Visa InterviewDokumen1 halamanVisa InterviewVivek ThoratBelum ada peringkat

- Managing Capability Nandos Executive Summary Marketing EssayDokumen7 halamanManaging Capability Nandos Executive Summary Marketing Essaypitoro2006Belum ada peringkat

- B&O Annual Report 2015-16Dokumen136 halamanB&O Annual Report 2015-16anon_595151453Belum ada peringkat

- Living To Work: What Do You Really Like? What Do You Want?"Dokumen1 halamanLiving To Work: What Do You Really Like? What Do You Want?"John FoxBelum ada peringkat

- Theory of Value - A Study of Pre-Classical, Classical andDokumen11 halamanTheory of Value - A Study of Pre-Classical, Classical andARKA DATTABelum ada peringkat

- Non Disclosure AgreementDokumen2 halamanNon Disclosure AgreementReginaldo BucuBelum ada peringkat

- Service Supreme: A Born BusinessmanDokumen112 halamanService Supreme: A Born BusinessmanPumper MagazineBelum ada peringkat

- The Builder's Project Manager - Eli Jairus Madrid PDFDokumen20 halamanThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridBelum ada peringkat

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDokumen2 halamanGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezBelum ada peringkat

- Bms Index Numbers GROUP 1Dokumen69 halamanBms Index Numbers GROUP 1SIRISHA N 2010285Belum ada peringkat

- BudgetingS15 FinalExam 150304 2Dokumen9 halamanBudgetingS15 FinalExam 150304 2FrOzen HeArtBelum ada peringkat

- Model LOC Model LOC: CeltronDokumen3 halamanModel LOC Model LOC: CeltronmhemaraBelum ada peringkat

- Balance ScorecardDokumen11 halamanBalance ScorecardParandeep ChawlaBelum ada peringkat

- Lemon MaltDokumen33 halamanLemon MaltUmar AsifBelum ada peringkat

- American Medical Assn. v. United States, 317 U.S. 519 (1943)Dokumen9 halamanAmerican Medical Assn. v. United States, 317 U.S. 519 (1943)Scribd Government DocsBelum ada peringkat

- Customer Satisfaction Report on Peaks AutomobilesDokumen72 halamanCustomer Satisfaction Report on Peaks AutomobilesHarmeet SinghBelum ada peringkat

- Importance of Entrepreneurship EducationDokumen8 halamanImportance of Entrepreneurship EducationRansel Burgos100% (1)

- Bid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalDokumen374 halamanBid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalmatshonaBelum ada peringkat

- Role of Market ResearchDokumen2 halamanRole of Market ResearchGaurav AgarwalBelum ada peringkat

- Kotler & Keller (Pp. 325-349)Dokumen3 halamanKotler & Keller (Pp. 325-349)Lucía ZanabriaBelum ada peringkat