National Budget Vis-A-Vis Local Budget

Diunggah oleh

Mohammad Shahjahan SiddiquiHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

National Budget Vis-A-Vis Local Budget

Diunggah oleh

Mohammad Shahjahan SiddiquiHak Cipta:

Format Tersedia

VOL 20 NO 157 REGD NO DA 1589 | Dhaka, Tuesday, May 21 2013

FE_Search

Google_Search

http://www.thefinancialexpress-bd.com/index.php?ref=MjBfMDVfMjFfMTNfMV8yN18xNzAwMTY=

National budget vis-a-vis local budget

An effective budget system of local government is important for both political and economic reasons. It shares power and promotes the accountability of local public services. It also helps to fit those services to local needs and preferences, writes M S Siddiqui A national budget is a statement of allocation of scarce resources to achieve national objectives for a specific time period of one year. Budgeting balances the resources drawn from the public against the demand for services. The services pave the way of economic, social, political and other developments for optimum benefit of its community in order to realise pre-determined goals and objectives. Budget is a financial plan embodying the revenue and expenditures for one fiscal year. It sets goals and formulates a plan to achieve them and determines the level of taxes necessary to finance the plan. The two major components of a budget are revenues that are raised through various means and expenditures for spending on specific projects. A budget is used to set standards for controlling costs. It allows regular comparisons of estimated costs to actual costs during a given financial period. There will probably be several statements of goals of various sectors. Generally, each department should develop a fairly firm and complete idea of what the government intends to accomplish. These individual objectives are then integrated and reconciled by the Finance Ministry and the fiscal body into a single, cohesive policy. The result is a comprehensive statement of governmental goals and decisions as to priority and practicality. The government is responsible for the preparation and approval of the national revenue and expenditure budget and approves the budget for Ministries, Departments and agencies. The Bangladesh government may have sectoral budgets at the national level for certain programmes. But it still performs many functions that should be moved to the local-level government elected by citizens. Some of the units of the Bangladesh government cover activities of a commercial nature, such as

the Bangladesh Railway and the Bangladesh Telegraph and Telephone Board (BTTB), some sector corporations. Some general government activities carried out by autonomous and semiautonomous bodies (such as universities) are shown in the budget only to the extent of the budget subsidies provided. One of the major objectives of a budget is development of every region and all sectors in the country. This necessitates fiscal decentralisation throughout the regions from local governments to the grassroots level. In many countries, district-level local government is responsible for the overall development of the district and it ensures preparation and submission of the budget to the national government. The budget prepared by local level synthesises and harmonises all revenue and expenditure estimates of the plans and programmes of all decentralised departments and agencies under the local government administration. This decentralisation is a transfer of authority for decision-making, finances and management from central to local governments. Local councils set the direction of economic and social development, and coordinate development efforts within their respective territorial jurisdictions. Such fiscal decentralisation entails entrusting local government units with the authority and capacity to generate, allocate and utilise financial resources to promote socio-economic development. In most countries, local government is responsible for what are often called community services like health care, waste disposal, local roads and lighting, water supply and sanitation, parks and sports facilities, graveyards and housing. What varies greatly is the extent of local responsibility for the social sector, chiefly education, health and social assistance. In some cases, the whole service is funded by the state budget; costs are split between levels of government. Some local budgets meet all costs except for central supervision. The government in Bangladesh consists of the central government and local governments. There are more than 50 ministry and divisional budget heads. Activities are carried out by departments and directorates. There were about 200 departments. Administratively, Bangladesh is divided into eight divisions plus four metropolitan areas. Each division is subdivided into districts, which are in turn divided into upazilas in rural areas and pourashavas in urban areas. Upazilas are divided into unions, and each union into villages. As an extension of central administration, officials are appointed to district councils/Zila Parishads and Upazila Parishads although the Constitution provides for representative local government bodies at every administrative level and local representative government at all tiers of local government. Local-level budgets: But, the national government of Bangladesh retains responsibility for preparation and implementation of local-level budgets. This restricts local government from need assessment and resource allocation and utilisation at the grassroots level. The local government in Bangladesh has no role in the budget planning process although upazila

parishad and municipality have an administrative set-up to plan and implement any programme due to long experience in local administration. At present, bureaucrats working in different Ministries undertake the responsibilities for formulating the non- development budget and to frame the development budget. The Finance Division of the Ministry of Finance (MoF) is responsible for formulating the non-development budget centrally while the Planning Commission is entrusted with the formulation of the Annual Development Programme (ADP) or development budget. The External Relations Division (ERD) of the Ministry of Finance is responsible for monitoring resource flows for externally financed development projects and for external debt management. The Implementation, Monitoring, and Evaluation Division (IMED) of the Ministry of Planning monitors project implementation on the basis of financial and physical data from project directors. The concerned Ministries are given a single expenditure ceiling and accordingly the Ministry prepares non-development and development budget within the given ceiling. Line ministries prepare detailed budgets covering activities within their responsibilities, and these budgets are further broken down by individual agencies within each ministry. The Annual Development Programme (ADP) spending includes public enterprises as well as general government investment spending in the annual budget. Moreover, many fiscal activities are carried out by other parts of the public sector, as discussed below. The budget is usually deficit budget and reliant on additional fund from loans from internal and external sources. The ERD compiles and disseminates comprehensive annual data on external government debt, but data for domestic debt are produced by the MoF for internal government use only. Data on government domestic borrowing and debt are available with the central bank. The government has the right of interventions on planning and budgeting, procurement, internal and external audit, payroll, accounting, financial reporting and monitoring and evaluation of finances and programmes. The process of control over general government finances is complicated in part by the exclusion of local government data from the fiscal management system, and weak administrative capacity at the local levels. Moreover, the structure of inter-governmental fiscal relations in Bangladesh has served to discourage local governments from raising their own revenues. The government pursues a range of social and economic objectives through various forms of direct and indirect subsidies. These interventions have complex interactions, and the policy objectives are generally not explicitly stated in the budget documents. The budget impact is both

substantial and, to a large extent, unpredictable, and the extent to which (implicit) policy objectives have been achieved is not monitored or reviewed. The government remains heavily involved in commercial and financial sectors of the economy. It also very often supports the enterprise sector through a complex nexus of direct subsidies to manufacturing and service sectors. These activities lack clarity in reporting either direct or indirect support to enterprises. In addition to lack of transparency in reporting, the lack of clarity of managerial roles between commercial activity and provision of subsidised services or goods to the public is a major factor contributing to widely acknowledged failures of management, corruption, and poor industrial relations in these sectors. The nation pays for inefficiency and corruption of the responsible government officials. It has an impact on income and expenditures of the nation. There are some direct budget subsidies that are provided to farmers for, among other things, fertilisers, seeds, purchase and open market sales of foodstuffs and food subsidies to police and defense personnel and subsidies to export industries, mostly jute products. Other direct subsidies include subsidies to the Rural Electrification Board and for internal water transport. The budget documents show aggregate spending on subsidies and transfers, but there is no summary of subsidies by purpose nor is there any discussion of subsidy policy. There are some individual annual budgets for municipality, district council, upazila parishad and union parishad allocated by the central government but there is no mechanism and authority at any local government level for participating in and compiling these budgets. The government has a 'plan' to involve the field-level officials in preparation of the budget. It will start with district budget. Under the proposed system, budget allocation for the operational units of the departments/organisations of the Ministries (e.g. head offices, district offices, upazila offices) may be exhibited at the beginning, which will be followed by allocations for development projects of the respective department. As per standard rule, the elected representatives of local government should be entrusted with responsibilities to administer most of the government offices/ departments except a few. Unfortunately, some of those authorities are vested with the Deputy Commissioners in the districts. The Local Government Act 1990 reformed the government structure by devolving expenditure responsibilities in the areas of law and order, infrastructure development and maintenance, health and education to local governments. Local governments (LG) are, however, heavily dependent on revenues from the central

government in the form of grants and transfers, which have not been based on a clearly defined set of principles. The LG should have authority with the responsibility of collecting revenues from local tax and where possible central tax as commission agent, formulation of expenditure budget and disbursement of fund. The national level budgets allocate a consolidated fund and the LG should have authority of district budget. Local government may have the authority to receive loans for development activities. An effective budget system of local government is important for both political and economic reasons. It shares power and promotes the accountability of local public services. It also helps to fit those services to local needs and preferences. The budget planner at the local level requires a degree of discretionary authority to plan, mobilise and utilise resources to promote development. Finally, we may consider the extent to which a new constitutional settlement for local government could create and maintain a new, more appropriate, balance of power through amendment of Local Government Act and rule for preparation of budget etc. e-mail: shah@banglachemical.com

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Bangladesh's Cross Border Transaction in Chinese RMBDokumen3 halamanBangladesh's Cross Border Transaction in Chinese RMBMohammad Shahjahan SiddiquiBelum ada peringkat

- How To Upgrade Bangladesh's Banking AlmanacDokumen4 halamanHow To Upgrade Bangladesh's Banking AlmanacMohammad Shahjahan SiddiquiBelum ada peringkat

- IMF and Reforms in BangladeshDokumen4 halamanIMF and Reforms in BangladeshMohammad Shahjahan SiddiquiBelum ada peringkat

- How Insiders Are Manipulating Dollar RatesDokumen4 halamanHow Insiders Are Manipulating Dollar RatesMohammad Shahjahan SiddiquiBelum ada peringkat

- FTAs Instrumental To Sustained GrowthDokumen4 halamanFTAs Instrumental To Sustained GrowthMohammad Shahjahan SiddiquiBelum ada peringkat

- Access To Finance For The Informal SectorDokumen5 halamanAccess To Finance For The Informal SectorMohammad Shahjahan SiddiquiBelum ada peringkat

- Evaluation of Import Policy Order 2021-2024Dokumen6 halamanEvaluation of Import Policy Order 2021-2024Mohammad Shahjahan SiddiquiBelum ada peringkat

- Ongoing War On SemiconductorsDokumen3 halamanOngoing War On SemiconductorsMohammad Shahjahan SiddiquiBelum ada peringkat

- Evaluation of Bangladesh's Data Protection BillDokumen4 halamanEvaluation of Bangladesh's Data Protection BillMohammad Shahjahan SiddiquiBelum ada peringkat

- Chinese Dual Circulation Economic PolicyDokumen4 halamanChinese Dual Circulation Economic PolicyMohammad Shahjahan SiddiquiBelum ada peringkat

- About Doing Business' ReportDokumen4 halamanAbout Doing Business' ReportMohammad Shahjahan SiddiquiBelum ada peringkat

- Bangladesh Needs Rules On Odourised LPGDokumen2 halamanBangladesh Needs Rules On Odourised LPGMohammad Shahjahan SiddiquiBelum ada peringkat

- Some Thoughts On Pension SchemeDokumen4 halamanSome Thoughts On Pension SchemeMohammad Shahjahan SiddiquiBelum ada peringkat

- Bangladesh Bank's Rules of Export Documents Require An AmendmentDokumen3 halamanBangladesh Bank's Rules of Export Documents Require An AmendmentMohammad Shahjahan SiddiquiBelum ada peringkat

- Ad Free Channel Ends Unfair Privileges To Overseas ManufacturersDokumen4 halamanAd Free Channel Ends Unfair Privileges To Overseas ManufacturersMohammad Shahjahan SiddiquiBelum ada peringkat

- Pandemic Recession and Employment CrisisDokumen4 halamanPandemic Recession and Employment CrisisMohammad Shahjahan SiddiquiBelum ada peringkat

- Bangladesh - Last Option of Relocation of Chinese FactoryDokumen4 halamanBangladesh - Last Option of Relocation of Chinese FactoryMohammad Shahjahan SiddiquiBelum ada peringkat

- HSIA Needs Off-Doc WarehouseDokumen4 halamanHSIA Needs Off-Doc WarehouseMohammad Shahjahan SiddiquiBelum ada peringkat

- The Legal Impacts of The Coronavirus On RMG ContractsDokumen4 halamanThe Legal Impacts of The Coronavirus On RMG ContractsMohammad Shahjahan SiddiquiBelum ada peringkat

- Spillover of Technology and CompetitivenessDokumen4 halamanSpillover of Technology and CompetitivenessMohammad Shahjahan SiddiquiBelum ada peringkat

- Need For A Payment System ActDokumen4 halamanNeed For A Payment System ActMohammad Shahjahan SiddiquiBelum ada peringkat

- Post Clearance Customs AuditDokumen3 halamanPost Clearance Customs AuditMohammad Shahjahan SiddiquiBelum ada peringkat

- The Inflow and Outflow of CapitalDokumen4 halamanThe Inflow and Outflow of CapitalMohammad Shahjahan SiddiquiBelum ada peringkat

- Onions, Syndicates and PricesDokumen3 halamanOnions, Syndicates and PricesMohammad Shahjahan SiddiquiBelum ada peringkat

- Transfer of Ownership of Export BillDokumen3 halamanTransfer of Ownership of Export BillMohammad Shahjahan SiddiquiBelum ada peringkat

- Import Tax On Onion Is The Best SolutionDokumen4 halamanImport Tax On Onion Is The Best SolutionMohammad Shahjahan SiddiquiBelum ada peringkat

- Weaknesses in SME Financing PolicyDokumen4 halamanWeaknesses in SME Financing PolicyMohammad Shahjahan SiddiquiBelum ada peringkat

- Education To Develop Creativity and Analysing AbilityDokumen4 halamanEducation To Develop Creativity and Analysing AbilityMohammad Shahjahan SiddiquiBelum ada peringkat

- Negative List For FDI in China and BangladeshDokumen4 halamanNegative List For FDI in China and BangladeshMohammad Shahjahan SiddiquiBelum ada peringkat

- Bangladesh Media Busy With India's Decision About RCEPDokumen3 halamanBangladesh Media Busy With India's Decision About RCEPMohammad Shahjahan SiddiquiBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Tambasen Vs PeopleDokumen3 halamanTambasen Vs PeopleKier ArqueBelum ada peringkat

- Constitutional Adjudication - Pasquale PasquinoDokumen13 halamanConstitutional Adjudication - Pasquale PasquinocrisforoniBelum ada peringkat

- 2 People v. MontejoDokumen8 halaman2 People v. Montejojuan dela cruzBelum ada peringkat

- Repeal Laws.: Legislative Department Legislative PowerDokumen2 halamanRepeal Laws.: Legislative Department Legislative PowerM A J esty FalconBelum ada peringkat

- Carpio vs. Executive SecretaryDokumen2 halamanCarpio vs. Executive Secretarymichael jan de celisBelum ada peringkat

- Berdin V MascarinasDokumen1 halamanBerdin V MascarinasCecille MangaserBelum ada peringkat

- Elements of War Crimes Under The Rome Statute of The International Criminal Court - Sources and Commentary PDFDokumen586 halamanElements of War Crimes Under The Rome Statute of The International Criminal Court - Sources and Commentary PDFFransisca Fitriana Riani Candra100% (1)

- IRACDokumen11 halamanIRACShikhar RawatBelum ada peringkat

- Fundamental Powers of the State: Police, Eminent Domain, TaxationDokumen2 halamanFundamental Powers of the State: Police, Eminent Domain, TaxationÄnne Ü Kimberlie81% (74)

- Petitioners,: People of The Philippines and Vilma Campos, G.R. No. 158157Dokumen17 halamanPetitioners,: People of The Philippines and Vilma Campos, G.R. No. 158157Ton Ton CananeaBelum ada peringkat

- People vs. BillaberDokumen2 halamanPeople vs. BillaberSalie VillafloresBelum ada peringkat

- Law of Void JudgmentsDokumen2 halamanLaw of Void JudgmentsTreAnne Iam MyAncestors100% (1)

- Racism & Capitalism. Chapter 1: Racism Today - Iggy KimDokumen5 halamanRacism & Capitalism. Chapter 1: Racism Today - Iggy KimIggy KimBelum ada peringkat

- A Legal Analysis of The Role of Bar Associations Towards Access To Justice For The Poor: A Case Study of CameroonDokumen10 halamanA Legal Analysis of The Role of Bar Associations Towards Access To Justice For The Poor: A Case Study of CameroonEditor IJTSRDBelum ada peringkat

- Digest - G.R. No. L-38025 Casibang V Aquino, Yu (Doctrine of Separation of Powers)Dokumen3 halamanDigest - G.R. No. L-38025 Casibang V Aquino, Yu (Doctrine of Separation of Powers)Mark0% (1)

- The Facebook, Inc. v. Connectu, LLC Et Al - Document No. 53Dokumen3 halamanThe Facebook, Inc. v. Connectu, LLC Et Al - Document No. 53Justia.comBelum ada peringkat

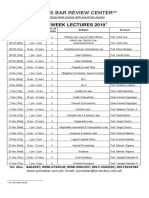

- 2019 Schedule of Preweek LecturesDokumen1 halaman2019 Schedule of Preweek LecturesVioletBelum ada peringkat

- Nancy Fraser and The Feminist Contribution To Habermas's Critical TheoryDokumen1 halamanNancy Fraser and The Feminist Contribution To Habermas's Critical TheoryLaiz FragaBelum ada peringkat

- CBI ASP Haridath's Suicide JudgmentDokumen14 halamanCBI ASP Haridath's Suicide JudgmentLive LawBelum ada peringkat

- People Vs Perfecto 43 Phil 887Dokumen5 halamanPeople Vs Perfecto 43 Phil 887filamiecacdacBelum ada peringkat

- Disiplina MunaDokumen5 halamanDisiplina MunaRolly Balazon100% (1)

- Tinker V Des Moines Points To PonderDokumen2 halamanTinker V Des Moines Points To Ponderapi-362440038Belum ada peringkat

- INFO5MoralDimensionsDokumen1 halamanINFO5MoralDimensionskhanrorgsp123100% (2)

- Study GuideDokumen372 halamanStudy GuideJean Guo100% (2)

- Trinidad Et Al Vs Atty Angelito Villarin Lawyer and The ClientDokumen1 halamanTrinidad Et Al Vs Atty Angelito Villarin Lawyer and The ClientCassandra LaysonBelum ada peringkat

- Cencership 170403053312Dokumen19 halamanCencership 170403053312bhanwatiBelum ada peringkat

- Senior Citizens Financial LiteracyDokumen30 halamanSenior Citizens Financial LiteracyJohn MaduraBelum ada peringkat

- Detailed Teaching Syllabus (DTS) and Instructors Guide (Ig'S)Dokumen13 halamanDetailed Teaching Syllabus (DTS) and Instructors Guide (Ig'S)raul gironellaBelum ada peringkat

- Santosh Korgaonkar 3 AugDokumen5 halamanSantosh Korgaonkar 3 AugptrBelum ada peringkat

- Ching vs. NicdaoDokumen2 halamanChing vs. NicdaoJessica BernardoBelum ada peringkat