Ifp 30 Taxable Income

Diunggah oleh

sachin_chawlaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ifp 30 Taxable Income

Diunggah oleh

sachin_chawlaHak Cipta:

Format Tersedia

Chapter 30

202

Financial Planning Handbook

PDP

Taxable Income

nder the Income tax act, the Total Income is the taxable income because the tax is payable on the total income.

What is income?

Income connotes a periodical monetary return coming in with some sort of regularity, or expected regularity from definite sources. The source is not necessarily one which is expected to be continuously productive, but it must be one whose object is the production of a definite return, excluding anything in the nature of a mere windfall. Following principles are important to understand the concept of Income: Income has a regular and definite source Income may be in cash or in kind. Tainted or illegal receipt is also income. Reimbursement of expenses is not an income. Capital receipt is not an income. Revenue receipt is an income. Income can arise on both receipt and accrual basis. Personal gifts received are not income. But it is covered under the extended definition of income. Income must be real and not fictional. A person cannot earn an income by trading with himself or by transferring funds from one pocket to another. Income does not arise in a transaction between head office and branch office. Windfall or receipt due to pure chance is not an income. However, in the extended definition some types of wind fall or casual receipt has been included as income. Compensation for death on account of fatal accident is not an income. Subsidies and grants-in-aid. This will also depend on the purpose of receipt. If it is intended to supplement or augment the trading receipt of the recipient it is income. For example subsidy to sugar factories for early crushing of sugarcane. But subsidy for starting a new factory in a backward area is a capital receipt and not an income. What constitute Total Income? First of all we should calculate what is normally considered as income and what is covered under the extended definition of income. From this we need to exclude what is exempted income under section 10 to 13A. What ever is left will have to be divided into various heads of income as shown below: Income Heads Income from Salary Income from House Property Profits and gains from Business and profession Income from Capital gain, and

PDP

Financial Planning Handbook

203

Income from other sources. It is important to classify the income into various heads as each head of income has different rules for allowing deduction of expenses and exemptions. Once we have identified income to correct heads, the expenses and exemptions as prescribed under those heads are allowed to be deducted to arrive at income under each head. Total of all these five heads of income is Gross Total Income (GTI). From GTI we need to allow deduction under Chapter VIA of the Income Tax Act, which is in the form of investment in various schemes (section 80C), investment in Pension Fund (80CCC), investment in pension scheme of GOI ( section 80CCD), medical insurance premium ( 80D), medical treatment of handicapped dependent ( 80DD), medical treatment for specified disease (80DDB), interest on loan for higher education (80E), donation (80G), donation for scientific research or rural development (80GGA), contribution to political parties (80GGB and 80GGC), Industrial undertaking engaged in infrastructure development ( 80IA), Industrial undertaking located in industrial backward state or district (section 80IB), undertakings or enterprises located in notified area in North Eastern State, State of Sikkim, Himachal Pradesh, Uttranchal (section 80IC), business of collecting and processing of bio-degradable waste 80JJA), employment of new workmen (80JJAA), Offshore banking unit and International Financial Services Centre in SEZ (80LA), Primary agricultural Credit Society (80P), Royalty from books (80QQB), Royalty on patents (80RRB), handicapped person (80U).The sum of deduction under chapter VI A of the Income Tax Act can not be more than Gross Total Income. What is left after deducting these deductions from Gross Total Income is the Total Income chargeable to tax under the Income-tax Act. On this, income tax is calculated in accordance with the rates prescribed in Finance Act. There is separate rate for capital gain tax. For resident, long term capital gain on shares where security transaction tax is paid is nil. Short term capital gain where security transaction tax is paid is 10%. In all other cases of residents, long term capital gain tax is calculated at the rate of 20% on indexed cost of acquisition subject to maximum 10% on non indexed cost. Short term capital gain, in other cases of resident, is taxed as normal income. Once we have calculated tax on total income, we need to allow some rebate or relief from this tax. What is left after applying the rebate and relief is the tax payable by the assessee. On this he will get credit for tax deducted at source or advance or self assessment tax paid by him. If this is more than the tax payable, the tax payer will be entitled to refund.

Chapter Review

204

Financial Planning Handbook

PDP

Anda mungkin juga menyukai

- NEED FOR PROJECT APPRAISAL - October 15th, 2010Dokumen1 halamanNEED FOR PROJECT APPRAISAL - October 15th, 2010sachin_chawlaBelum ada peringkat

- Depository Bank Shares AccountDokumen1 halamanDepository Bank Shares Accountsachin_chawlaBelum ada peringkat

- Ifp 21 Understanding Investment RiskDokumen9 halamanIfp 21 Understanding Investment Risksachin_chawlaBelum ada peringkat

- Ifp 20 Fundamentals of Investment PlanningDokumen4 halamanIfp 20 Fundamentals of Investment Planningsachin_chawlaBelum ada peringkat

- 10 December: Negativity Necessary For Constructive WorkDokumen3 halaman10 December: Negativity Necessary For Constructive Worksachin_chawlaBelum ada peringkat

- Ifp 36 Environment of A Financial PlannerDokumen8 halamanIfp 36 Environment of A Financial Plannersachin_chawlaBelum ada peringkat

- Overall Role PurposeDokumen2 halamanOverall Role Purposesachin_chawlaBelum ada peringkat

- Faridabad Telecom District: Account SummaryDokumen1 halamanFaridabad Telecom District: Account Summarysachin_chawlaBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Claim For Refund and Request For AbatementDokumen1 halamanClaim For Refund and Request For AbatementIRSBelum ada peringkat

- Toshiba Information v. CIR G.R. No. 157594 March 9, 2010Dokumen6 halamanToshiba Information v. CIR G.R. No. 157594 March 9, 2010Emrico CabahugBelum ada peringkat

- IRS Issues Guidance On State Tax Payments To Help TaxpayersDokumen2 halamanIRS Issues Guidance On State Tax Payments To Help TaxpayersMeaghan BellavanceBelum ada peringkat

- Fernando Vazquez567935467Dokumen21 halamanFernando Vazquez567935467Richivee100% (2)

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDokumen2 halamanSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarBelum ada peringkat

- Fundamentals of Taxation 2019 Edition 12th Edition Cruz Solutions ManualDokumen48 halamanFundamentals of Taxation 2019 Edition 12th Edition Cruz Solutions ManualGregWilsonarsdn100% (15)

- Pay Slip 37000140 - Apr - 2020 PDFDokumen1 halamanPay Slip 37000140 - Apr - 2020 PDFSumantrra ChattopadhyayBelum ada peringkat

- Taxation: Home Case Digest Notes and Legal Forms Commentary GuestbookDokumen157 halamanTaxation: Home Case Digest Notes and Legal Forms Commentary GuestbookDyëng RäccâBelum ada peringkat

- Coi Ay 22-23Dokumen2 halamanCoi Ay 22-23vikash pandeyBelum ada peringkat

- Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsDokumen61 halamanCommissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896. February 17, 1988 FactsShall PMBelum ada peringkat

- BAYER FinalDokumen17 halamanBAYER Finalravina bhuvadBelum ada peringkat

- 2019 07 23 09 00 40 881 - 452619484 - PDFDokumen6 halaman2019 07 23 09 00 40 881 - 452619484 - PDFSadhana TiwariBelum ada peringkat

- Tax Practice MCQDokumen16 halamanTax Practice MCQZenedel De JesusBelum ada peringkat

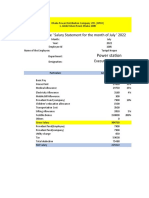

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Dokumen6 halamanTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenBelum ada peringkat

- Petitioner Respondent: Second DivisionDokumen19 halamanPetitioner Respondent: Second DivisionJeffrey JosolBelum ada peringkat

- CA Inter N22 - Tax Model QPDokumen14 halamanCA Inter N22 - Tax Model QPNAVEEN SURYA MBelum ada peringkat

- Return of Income: Basic InformationDokumen8 halamanReturn of Income: Basic InformationSudmanBelum ada peringkat

- Court Oft Ax Appeal: DecisionDokumen18 halamanCourt Oft Ax Appeal: Decisionjsus22Belum ada peringkat

- COMMISSIONER OF INTERNAL REVENUE Vs CommonwealthDokumen52 halamanCOMMISSIONER OF INTERNAL REVENUE Vs CommonwealthM Azeneth JJBelum ada peringkat

- BPI vs. CA, GR#122480, April 12, 2000Dokumen7 halamanBPI vs. CA, GR#122480, April 12, 2000Khenlie VillaceranBelum ada peringkat

- Goods and Services Tax Refund Tutorial PDFDokumen27 halamanGoods and Services Tax Refund Tutorial PDFMOHANBelum ada peringkat

- NTA Annual ReportDokumen293 halamanNTA Annual ReportAustin DeneanBelum ada peringkat

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDokumen8 halamanThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariBelum ada peringkat

- Star Novel Coronavirus (Ncov) (Covid-19) Insurance Policy (Pilot Product)Dokumen2 halamanStar Novel Coronavirus (Ncov) (Covid-19) Insurance Policy (Pilot Product)Me SutradharBelum ada peringkat

- Chapter 06 - Share of Profit From Association of PersonsDokumen6 halamanChapter 06 - Share of Profit From Association of PersonsSuniel JamilBelum ada peringkat

- Tax Remedies DigestsDokumen50 halamanTax Remedies DigestsybunBelum ada peringkat

- Rapid Meal Marketing PlanDokumen26 halamanRapid Meal Marketing PlanAng JamesBelum ada peringkat

- FTFCS 2023-04-14 1681510273125 PDFDokumen17 halamanFTFCS 2023-04-14 1681510273125 PDFIvel RhaenBelum ada peringkat

- Taxation Law (2007-2013)Dokumen125 halamanTaxation Law (2007-2013)Axel FontanillaBelum ada peringkat

- CIR vs. PL Management Intl Phils. Inc. GR No. 160949Dokumen4 halamanCIR vs. PL Management Intl Phils. Inc. GR No. 160949ZeusKimBelum ada peringkat