NCP 2B

Diunggah oleh

Mahendra HemkarDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NCP 2B

Diunggah oleh

Mahendra HemkarHak Cipta:

Format Tersedia

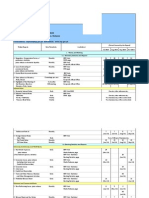

Banking Management- NCP -2 Name of the Student: Enrolment No: SN 1 Question Under priority sector advances, domestic banks

are required to provide ______ percent of Adjusted Net Bank Credit to agriculture? 2 As per Basel-2 norms, commercial banks are required to maintain 8 % of CRAR. But, what is the minimum CRAR that is required to be maintained by all 9 percent scheduled commercial banks in India? 3 If a bank gives a loan to a borrower at a fixed rate of interest for one or two years, after which the interest rate would become floating or linked to bank lending rate, Dual Interest Rate/Teasing Rates such interest structure is called____ 4 If any bank continues to fail in maintaining 70 per cent of the total CRR requirement on the next succeeding day/s, penal interest will be recovered from 5 per cent above bank rate that bank at the rate ________ % per annum 5 A small (service) enterprise is an enterprise where the investment in equipment is more than Rs. 10 lakh but does not exceed Rs. _______ 6 The Return Guarantee Corporation approached seven banks and availed a loan of Rs. 300 crores from six different banks on common documentation. Such loan is Consortium Loan called_______ 7 As per second method of Tandon Committee to arrive at MPBF, borrower or promoter is required to bring 25 per cent of __________as margin 8 If a foreign bank fails to reach its priority sector target in a particular year, the shortfall amount has to be deposited with_______ 9 _______is a type of corporate loan arranged by a bank in consultation with other interested banks in the project without informing the borrower of whether the loan is solely financed by the bank or funded with other banks. 10 Total working capital (TWC) requirement = 6000x0.25% =1500; Finance ratio = 4:1; 20% of PAT As per the Nayak Committee, bank can finance 20 % of projected annual turnover (or 80% of TWC) = 1200; of the borrower. Projected annual turnover (PAT) is Rs. 6000. Existing Borrower would bring either 5% of PAT or ENWC whichever is networking capital (ENWC) is Rs. 250. What is the amount the bank can finance? higher as margin; 5% of PAT=300, which is higher than ENWC. Thus, MPBF = 1500-300=1200; The answer is 1200. 11 As per RBIs draft guidelines for licensing of new banks, the banks are re quired to 25 percent open at least _____ % of its branches in unbanked rural areas. 12 What was the previous Name of Axis Bank? UTI Bank Undisclosed/Closed Syndication Current Assets Small Industrial Development Fund (SIDF) - SIDBI Rs. 2 crore 18 percent Answer Section:

13 The Bold Bank issued a Bank Guarantee in favour of The Chief Engineer, Public No Works Department. The Chief Engineer was transferred later. The said guarantee

was invoked by Executive Engineer of the same department. Whether the bank should honour the BG? (Yes and No). 14 As per the Indian Contract act, the claim period for Bank Guarantees issued to other than Govt. Departments is_______ 15 If a Letter of Credit (LC) contains a clause to provide finance to the exporter to purchase the raw material, process it, manufacture the finished goods, pack it and store it , such a L.C is called_______ 16 In the case of borrowers belonging to a group, the credit exposure ceiling limits (including additional exposure) would be not more than ________ per cent of 50 percent capital (Tier 1 plus Tier 2 capital). 17 The acronym 'SWIFT' stands for_________ Society for Worldwide Interbank Financial Telecommunications No. But, only outward remittances to Nepal under the Indo-Nepal Remittance Facility Scheme Yes Safety, Liquidity, Profitability, Purpose, Diversification of Risks, and Security General Crossing Red clause L.C 3 years

18

Can remittances be sent abroad using NEFT?

19 Can ECS be used to transfer funds to Non Resident External (NRE) and Non Resident Ordinary (NRO) accounts? 20 What are the cardinal principles of lending?

21 Two parallel transverse lines are compulsory for_______type of crossing of cheque 22 Any shortfall in priority sector lending target has to be deposited with NABARD/SIDBI. If the shortfall lies between 5 and 9 percentage points, the Bank Rate minus 4 percentage points deposit amount will earn at the rate of ______ per annum 23 What is the time taken for effecting funds transfer from one account to another under RTGS? 24 Under ________ facility banks may borrow overnight up to one per cent of their respective NDTL outstanding at the end of the second proceeding fortnight. 25 What are the components of base rate________ 26 Collecting a cheque for a party other than the true owner is called _______ 27 What is the rate of interest under Marginal Standing Facility as on today? 28 ______ is a document given by a transporter of goods and issued to the exporter of goods that evidences the receipt of goods for shipment to a specified person or Bill of Lading importer. 29 NEFT operates in hourly batches. There are _____settlements on week days and ________ on Saturdays 30 Who is the Governor of Reserve Bank of India_____ 11 and 5 Dr. Duvvuri Subba Rao Marginal Standing Facility a. Cost of Deposits b. Negative Carry on CRR & SLR c. Unallocable overhead cost d. Average return on net worth Conversion 9 percent Normally in real time. Bank has to credit the beneficiary's account within 2 hours of receiving the funds transfer message

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- FSS Presentation - 16122019 - BanksDokumen20 halamanFSS Presentation - 16122019 - BankspriyaBelum ada peringkat

- Home at Last! - Downloadable FileDokumen114 halamanHome at Last! - Downloadable Filejopaypagas100% (2)

- Def in at IonsDokumen1 halamanDef in at IonsMahendra HemkarBelum ada peringkat

- Boosting Sales 1Dokumen2 halamanBoosting Sales 1Mahendra HemkarBelum ada peringkat

- Boosting Sales 1Dokumen2 halamanBoosting Sales 1Mahendra HemkarBelum ada peringkat

- Basel IiiDokumen12 halamanBasel Iiimounis22Belum ada peringkat

- 515 First Source Solutions - Campus PPT - Nov 11 - SIMSDokumen18 halaman515 First Source Solutions - Campus PPT - Nov 11 - SIMSd420_warriorBelum ada peringkat

- The Time Value of Money: SolutionDokumen6 halamanThe Time Value of Money: Solutionabdullah noorBelum ada peringkat

- VouchingDokumen8 halamanVouchingAnanth RohithBelum ada peringkat

- 基金认购意向书 英文版Dokumen3 halaman基金认购意向书 英文版Anonymous rGBeIwYccTBelum ada peringkat

- Js BankDokumen10 halamanJs BanknimraBelum ada peringkat

- 3001 A 184552264 00 B00 PyDokumen2 halaman3001 A 184552264 00 B00 PyRaghu DsBelum ada peringkat

- Idbi DwnloadDokumen12 halamanIdbi Dwnloadharry0023Belum ada peringkat

- Iaccess FAQs 02.10.2023Dokumen17 halamanIaccess FAQs 02.10.2023pink jennieBelum ada peringkat

- ABL Asset-Based Lending Guide April 2015Dokumen20 halamanABL Asset-Based Lending Guide April 2015Venp PeBelum ada peringkat

- Comments On The COIN ETF (SR-BatsBZX-2016-30)Dokumen34 halamanComments On The COIN ETF (SR-BatsBZX-2016-30)randombitcoin2Belum ada peringkat

- Appendix 11ABDokumen4 halamanAppendix 11ABJohn PickleBelum ada peringkat

- Amp Paper - Final Part 1+2Dokumen44 halamanAmp Paper - Final Part 1+2Abd RahimBelum ada peringkat

- Welcome To HDFC Bank NetBanking PDFDokumen2 halamanWelcome To HDFC Bank NetBanking PDFHarvinder SinghBelum ada peringkat

- BSP Calendar ReleasesDokumen6 halamanBSP Calendar ReleasesSarah WilliamsBelum ada peringkat

- Manual de AlgDokumen23 halamanManual de AlgAdancuellar TellezBelum ada peringkat

- Allied Bank ReportDokumen53 halamanAllied Bank ReportAli HassanBelum ada peringkat

- Audited Financial StatementDokumen17 halamanAudited Financial StatementVictor BiacoloBelum ada peringkat

- LoansDokumen4 halamanLoanssandhya.iyyanar1992Belum ada peringkat

- Micro Finance RoleDokumen35 halamanMicro Finance Roleanon_583145487100% (1)

- ApaDokumen2 halamanApaPaula Villarubia100% (1)

- HHH1Dokumen24 halamanHHH1Sitan Kumar SahooBelum ada peringkat

- Big Data Over in Debt Final 1Dokumen3 halamanBig Data Over in Debt Final 1Anonymous FnM14a0Belum ada peringkat

- Postal Accounts Volume - 2Dokumen324 halamanPostal Accounts Volume - 2K V Sridharan General Secretary P3 NFPE100% (1)

- Turtle SecretsDokumen16 halamanTurtle Secretsapi-3764182100% (2)

- Principles of AuditingDokumen81 halamanPrinciples of AuditingSahana Sameer KulkarniBelum ada peringkat

- CDokumen16 halamanC7610216922Belum ada peringkat

- Sa2 Pu 14 PDFDokumen150 halamanSa2 Pu 14 PDFPolelarBelum ada peringkat

- Assignment 2 Critical Reading PDFDokumen4 halamanAssignment 2 Critical Reading PDFAmelia Ramadhani0% (1)