Marriot Corporation

Diunggah oleh

Eddie KruleHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Marriot Corporation

Diunggah oleh

Eddie KruleHak Cipta:

Format Tersedia

Q#1 Marriotts CFO proposed this project because: (1) Marriott wanted to separate its management operations from

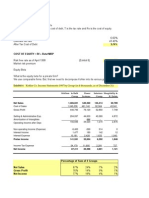

property ownership. In this way, Marriott could get rid of its real estate investment business in trouble and related debt; meanwhile the hotel management business could be unburdened and have the ability to raise additional capital to finance growth. With 10.4x interest coverage after spin-off, MII could easily get A or even AA credit rating for additional debt. This is the main reason for the spinoff. (2) The two separate businesses could have more clear business models and get higher valuation respectively. (3) More career opportunities would be offered to Marriotts management team. This spinoff is necessary for survival. With 1.5x interest coverage and 59% debt-to-capital ratio, Marriott would easily be downgraded to BB or even B level. This would make Marriott even more difficult to raise additional capital and become a vicious circle. Moreover, Marriott had unconsolidated affiliates, which had $3.1 bn long-term debt but negative equity on their balance sheet. If we consolidate proportionately these balance sheets into Marriotts, its balance sheet would be even worse. The crucial issue here is whether this spin-off is fraudulent conveyance and whether the board of directors has fiduciary duties to bondholders when Marriott is approaching insolvency. Value generated in this spin-off came mainly at the expense of bondholders; a small fraction might come from better analyst coverage and higher valuation. Q#2 Managements responsibilities should be enhancing firm value and maximizing shareholders returns. With the spin-off, management is clearly doing their job to maximize the shareholders value. There is no conflict of interest between management and shareholders in this case, given that Marriott family still owns 25.75% stake in Marriott and the Marriott brothers are still managing Marriott. However, there is conflict of interest between management/shareholders and bondholders. The spin-off is done at the expense of bondholders. Most of bondholders are put in HMC, which has significant lower interest coverage and higher debt-to-equity ratio. Q#3 There are several reasons for Marriott to disregard other forms of restructuring and focus on a spinoff. A carve-out would imply that the parent would sell part of the shares to outside investors. This poses two issues: first, the ownership structure of the carved-out unit would most likely change, which could challenge how the Marriott family has been running the business; second, HMC doesnt look anywhere close to having a high sell price or being attractive to outside investors. Again, a split-off would imply a clear ownership break-up between MII and HMC, shareholders having to decide in which corporation they would have ownership (not likely to have any of them eager to own HMC alone). Finally, other forms of pure divestiture would be appropriate if the businesses were somehow unrelated; on the contrary, Mr. Marriott wants to avoid the distress sale of its overgrown hotel real estate. The spin-off fits like a glove the purpose of financial engineering without changing control. The fact that more than 80% of the new corporations would have the same ownership structure also qualifies for tax free reorganization while giving MII a clean balance sheet ready to raise some debt. Since MC wasnt performing so well, the spin-off also detracts potential acquirers from considering an offer, since a change of control would trigger a taxable event. This ties in to the requirements for Section 368(a): First, the new corporation needs to qualify for continuity of business purpose and continuity of interest, keeping current owners from cashing out of the business for free; second, there has to be a clear business purpose beyond financial engineering. While the purpose for MII is pretty clear, the objectives become grey when focusing on HMC. In other words, Section 368(a) is very important as means to make it more difficult for a company to get rid of a portion of its business that will eventually go bankrupt and getting away with it for free. Hence, Marriott will have to prepare a comprehensive explanation on how the spin-off is better for both services and real estate businesses. Q#4 The Spin-off makes sense when: PV(MC Consolidated) < PV(MCs service) + PV(MCs properties holding). Before looking into the actual numbers we can argue that the capitalization of the services business will definitely increase as result of the reorganization, i.e. the market will price in the managements access to financing to expand operations and focus on a better performing business. On the other hand, the real estate business will most probably get hurt in terms of market price and the market value of debt will likely decrease with the higher bankruptcy probability of the underperforming/overlevered company. Overall, this means shareholders are benefitted (wouldnt be the case in a split-off, 1 Corporate Restructuring: Jos Liberti

carve-out or other restructuring form resulting in separate ownership) and debt holders get hurt but we will deal with this issue later on. For now, assuming MII keeps the same P/E ratio as MC, the market value of debt equals book and the market capitalization of HMC is not higher than its BV we obtain the results in Exhibit A. As expected, unlocking the services business from a sick real estate will be the source of value to the entire firm. As a robustness check, the MVD would have to drop more than 60% for the spin-off to break even with the consolidated company in terms of EV. This scenario is somehow unlikely even in a fire sale of HMC assets. Q#5 According to the case, the one we prefer is the corporate conception. This is because the company is essentially responsible for all the stakeholders which include both debt and equity holders, among others. This is important because shareholder conception and corporate conception could have led the company to pursue different actions and to represent the interest of different group of people. Had the company favored shareholder conception, the company would do everything in the best interest of shareholders and maybe even at the expense of other stakeholders in the firm. On the contrary, had the company favored corporate conception, the company would be more holistically consider all actions based on interest of all stakeholders. These conflicts of interests often lead to agency costs and the discrepancies between ownership and control, as well as between debt and equity holders. The role of fraudulent conveyance in this case is to protect all stakeholders in the company. This is because fraudulent conveyance protected creditors from debtors who tried to shelter their wealth or avoid their debts by conveying their property to others. Similar to the case, MC is looking to spin-off the company and let one entity with troubled business/assets to assume majority of the debt. This action may be in the best interest of equity holders but not debt holders. Debt holders would be put in an inferior position than before since they would have fewer assets to claim to when things go wrong with MCs businesses. In addition, there is less room for errors in HMCs property holding business especially when the real estate market crash. Therefore, debt holders might try to block this spin-off by requesting the Federal Bankruptcy Code, the Uniform Fraudulent Conveyance Act, or the Uniform Fraudulent Transfer Act to test if the spin-off would trigger the constructive fraud. Q#6 For the purpose of this analysis lets consider that we have a fair estimate of the market value of assets for each of the corporations MC, MII and HMC. Additionally, we can consider that equity holders have a call option on these assets for which the exercise price is the total value to debt. To get the total value of debt we need to make the proportionate consolidation of unconsolidated investment affiliates to uncover true long-term liabilities. We can do this by adding $349 m total commitments to debt holders of the unconsolidated affiliates to the total long-term debt. Using a set of simplifying assumptions, we can now compare the total market value of debt before and after the spin-off to measure how much bondholders get hurt (Exhibit B) using the Black-Scholes pricing model. The results come with no surprise as all the debt is transferred to HMC while all the ability to pay it down stays on MII. Marriott basically engineers to skip returning bondholders $1.3bn. An even easier way to look at this would be to compare the present value of debt for MC at the current interest rates and compare that to the PV debt of HCM after an inevitable downgrade (from Appendix A) and of MII after a possible upgrade. Note that the values obtained for MVD post spin-off still make previous assertions about value creation hold true. Q#7 Mr. Marriott, who has two hats to play (as the top management and as a shareholder), would have to weigh the side he would like to base his actions on. As a top management, he has a responsibility to protect all the stakeholders, therefore pursuing a spin-off might only benefit shareholders but would potentially hurt the debt holders. As a shareholder, Mr. Marriott clearly has a hidden incentive to push for the spin-off proposal and protect his and other shareholders interest. Therefore, it depends on the sides he is more inclined to. However, had he played the shareholders role and pursued spin-off strategy, debt holders would be put in a disadvantage position as they would only have HMC and its property-holding businesses/assets to rely on. Since the real estate market crash, HMCs ability to pay back debt is doubtful and the company has less room for errors. Mr. Marriott should be worried about the debt holders and HMCs capacity to service debt. If HMC cannot do so, it might potentially lead to the bankruptcy of this entity, thereby affecting Marriotts credibility and reputation ultimately. Besides, spin-off strategy clearly demonstrates agency costs between debt and equity holders as the two parties have conflict of interests. In 2 Corporate Restructuring: Jos Liberti

good times where the debt holders can easily get paid and equity holders enjoy the upside returns, the conflict seemed to be unseen. In bad times where the future of the company is uncertain, equity holders would find ways to stop the bleed even if it comes at an expense of debt holders. Hence, the conflict of interests and ability of equity holders to effect the change and act in their best interest are the primary reasons for these costs to exist. To make matter worse, by doing spin-off, Mr. Marriott might have expected HMC to be fallen into the zone of insolvency or even bankruptcy, so that he could lead the negotiation with creditors to ask for discount debt payments or even get away without paying back debt. As a result, spin-off the businesses now would lead the way for him to get away with his desirable businesses/assets, segregating from the troubled businesses that have large amount of debt. However, should we operate in an M&M world, where the assumptions are no bankruptcy cost, everything is correctly priced, and capital structure is irrelevant, among others, we would not be facing this type of problem. Debt and equity holders would have no conflict as the enterprise value of the two entities (from the spin-off) and enterprise value of MC would be the same. Additionally, the debt holders would have gotten paid back, given no bankruptcy and perfect information in the market. Therefore, whether or not MC decided to spin-off or operate under one entity, it does not matter in an M&M world. Q#8 We conducted a series of event studies by using three event windows: 1) one day before and after announcement (Window 1), 2) 3 days before and after announcement (Window 2), 3) 20 days before and after announcement (Window 3) (Exhibit C). We found that CARs during WINDW 1 and WINDOW 2 are significantly positive, 8.42% and 15.61% respectively. As a result $133 million $215 million value was created during this period. However, if we look at WINDOW 3, the CAR is only 1.03% and not significant, which means the announcement did not make a significant impact on the stock price of Marriott (Exhibit D). The bond price moves to opposite direction. The price went down by around 25% 4 days after announcement. Assuming the price of all $3billion debt of Marriot declined 25%, the impact is worth -750 million. However, if in the long term, the bond price also was going back to the original price range. What is behind the movements of the stock price and bond price? We assume that the market first believed that the deal might be done and the value would be transferring from bond holder to Q#9 As we described in Q8, the market was more inclined to the expectation that the deal would NOT happen, which means the stock price would go down to the intrinsic price. Risk arbitrageurs with that expectation would short the stock and buyback and return when the price goes down (Sell high and Buy low). Q#10 Both Penzoil and Texaco management have a fiduciary duty to their respective shareholders. Having already been awarded $10.3B in appeals court, Hugh Liedtke, believed he would be able to obtain significantly more than the $2B settlement being offered by Texaco, and would be violating his duty if he does accept less than that amount. Penzoil may believe that they will have been able to recover more than the $2B even if Texaco follows through on its threat of bankruptcy. Texaco on the other hand, feels that if they were to pay the amount demanded by Penzoil they too would be violating fiduciary duty. A big part of what is preventing a mutually beneficial agreement is ego on behalf of the CEOs. Penzoil feels wronged by Texaco stealing Getty away from them and Texaco feels that the judgment is tremendously outsized. Both are willing to go to extremes to defend their position, Penzoil by filing liens on Texacoss assets and Texaco by filing bankruptcy. In a Modigliani-Miller world there are no bankruptcy costs. If Texaco suffered no bankruptcy costs, its strategy would have been much more effective in reducing the final settlement amount, as could have remained in bankruptcy indefinitely without incurring any negative effects on its operations or share value. As bankruptcy law blocks Pennzoil from grabbing Texaco's assets, Penzoil cant force Texaco into quickly settling on Pennzoil's terms. This would have worked in Texacos favor and would have provided them an opportunity to negotiate the settlement down significantly.

Corporate Restructuring: Jos Liberti

Anda mungkin juga menyukai

- Mariott Hotel Case SolutionsDokumen2 halamanMariott Hotel Case SolutionsACF201450% (2)

- RestructuringDokumen6 halamanRestructuringswati_0211Belum ada peringkat

- Marriott CorporationDokumen8 halamanMarriott CorporationtarunBelum ada peringkat

- Marriott Restructuring Case AnalysisDokumen6 halamanMarriott Restructuring Case AnalysisjaribamBelum ada peringkat

- Project ChariotDokumen6 halamanProject ChariotRavina PuniaBelum ada peringkat

- Marriott Corporation (Project Chariot) : Case AnalysisDokumen5 halamanMarriott Corporation (Project Chariot) : Case AnalysisChe hareBelum ada peringkat

- "Marriott Corporation" Case Analysis: (Submitted by Group H)Dokumen6 halaman"Marriott Corporation" Case Analysis: (Submitted by Group H)Chahat ShahBelum ada peringkat

- EPGP-11 Sec B - LCA - Marriott - EPGP-11-153Dokumen8 halamanEPGP-11 Sec B - LCA - Marriott - EPGP-11-153Chaitanya RavankarBelum ada peringkat

- Marriott Case Study Solution - Antesh Kumar - EPGP-13A-021Dokumen3 halamanMarriott Case Study Solution - Antesh Kumar - EPGP-13A-021Antesh SinghBelum ada peringkat

- Project Chariot IpDokumen7 halamanProject Chariot Ipapi-544118373Belum ada peringkat

- Marriott Case AnalysisDokumen3 halamanMarriott Case Analysissplinterion0% (1)

- Marriott Corporation (Project Chariot) : Case AnalysisDokumen5 halamanMarriott Corporation (Project Chariot) : Case AnalysisStefan RadisavljevicBelum ada peringkat

- Marriott Corporation (A)Dokumen4 halamanMarriott Corporation (A)Ilya KBelum ada peringkat

- Case Analysis - Mariott CorpDokumen8 halamanCase Analysis - Mariott CorpratishmayankBelum ada peringkat

- BRL Hardy: Globalizing An Australian Wine Company: International BusinessDokumen5 halamanBRL Hardy: Globalizing An Australian Wine Company: International BusinessMegha SinhaBelum ada peringkat

- Kohler Group 5Dokumen6 halamanKohler Group 5Prateek PatraBelum ada peringkat

- Marriott Corporation (A) : Case Study and AnalysisDokumen6 halamanMarriott Corporation (A) : Case Study and AnalysisChe hareBelum ada peringkat

- BRLHARDY Case PresentationDokumen25 halamanBRLHARDY Case PresentationVigneshwari KrishnamoorthyBelum ada peringkat

- Marriott Corporation Case SolutionDokumen4 halamanMarriott Corporation Case SolutionccfieldBelum ada peringkat

- HertzDokumen6 halamanHertzArpit KhuranaBelum ada peringkat

- Introduction To Affinity Diagrams and Pareto ChartsDokumen20 halamanIntroduction To Affinity Diagrams and Pareto ChartsAmit SenBelum ada peringkat

- Carter LBODokumen1 halamanCarter LBOEddie KruleBelum ada peringkat

- MarriottDokumen7 halamanMarriottHaritha PanyaramBelum ada peringkat

- CitiesService Takeover CaseDokumen20 halamanCitiesService Takeover CasesushilkhannaBelum ada peringkat

- Oracle'S Hostile Takeover Peoplesoft Fends Off: Case QuestionsDokumen5 halamanOracle'S Hostile Takeover Peoplesoft Fends Off: Case Questionssurya rajanBelum ada peringkat

- LedgerDokumen1 halamanLedgervinay jaiswalBelum ada peringkat

- Marriot Corp. Finance Case StudyDokumen5 halamanMarriot Corp. Finance Case StudyJuanBelum ada peringkat

- Marriott CaseDokumen1 halamanMarriott CasejenniferBelum ada peringkat

- BigbasketDokumen1 halamanBigbasketKritikaBelum ada peringkat

- BRL HardyDokumen8 halamanBRL HardyParimal Shivendu100% (5)

- Strategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersDokumen13 halamanStrategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersPrashant JhakarwarBelum ada peringkat

- BRL Hardy CaseDokumen27 halamanBRL Hardy CaseHendry LukitoBelum ada peringkat

- Warren Buffett Case AnswerDokumen5 halamanWarren Buffett Case Answeryunn lopBelum ada peringkat

- Business Policy Mba-Ii: Beech-Nut Nutrition CorporationDokumen3 halamanBusiness Policy Mba-Ii: Beech-Nut Nutrition CorporationmsaadnaeemBelum ada peringkat

- Case Study 2: Sustainability of Ikea GroupDokumen3 halamanCase Study 2: Sustainability of Ikea Groupneha reddyBelum ada peringkat

- Corp Fin Case 1 NextelDokumen5 halamanCorp Fin Case 1 NextelPedro José ZapataBelum ada peringkat

- Mariott Valuation in Corporate FinanceDokumen5 halamanMariott Valuation in Corporate FinanceRasheeq RayhanBelum ada peringkat

- Marriot CaseDokumen15 halamanMarriot CaseArsh00100% (7)

- Marriott Corporation Case SolutionDokumen4 halamanMarriott Corporation Case SolutionAsif RahmanBelum ada peringkat

- Marriott Corporation Case SolutionDokumen6 halamanMarriott Corporation Case Solutionanon_671448363Belum ada peringkat

- Overview : 1. Compared With Illegal, Free Platforms, What Are The Advantages That Prompt InternetDokumen2 halamanOverview : 1. Compared With Illegal, Free Platforms, What Are The Advantages That Prompt InternetMaya YammineBelum ada peringkat

- Bbva CRMDokumen8 halamanBbva CRMSavitha Bhaskaran0% (2)

- BRL Hardy-Sec F-Group 1 (Dokumen4 halamanBRL Hardy-Sec F-Group 1 (Jack WelchBelum ada peringkat

- L&T DemergerDokumen28 halamanL&T DemergerabcdeffabcdefBelum ada peringkat

- Goldman Sachs IPODokumen5 halamanGoldman Sachs IPOBhanu MallikBelum ada peringkat

- Kohler DCF Control Prem and DiscDokumen6 halamanKohler DCF Control Prem and Discapi-239586293Belum ada peringkat

- ZipcarDokumen7 halamanZipcarFandy Mahatma Jaya100% (1)

- The Goldman Sachs IPO (A) - ATSCDokumen9 halamanThe Goldman Sachs IPO (A) - ATSCANKIT PUNIABelum ada peringkat

- Iridium WriteupDokumen5 halamanIridium WriteupDaniel Medeiros100% (1)

- Case Study Hertz CorporationDokumen27 halamanCase Study Hertz CorporationprajeshguptaBelum ada peringkat

- KohlerDokumen10 halamanKohleragarhemant100% (1)

- HardyDokumen69 halamanHardyKily Gonzalez100% (1)

- Hampton Machine Tool CompanyDokumen5 halamanHampton Machine Tool Companydownloadsking100% (1)

- Beach Nut Nutrition Corporation (A1)Dokumen3 halamanBeach Nut Nutrition Corporation (A1)Nav EedBelum ada peringkat

- 551 KohlerDokumen3 halaman551 KohlerwesiytgiuweBelum ada peringkat

- PV Technologies Case - Krishnaprasad C - EPGCMM-13-010Dokumen2 halamanPV Technologies Case - Krishnaprasad C - EPGCMM-13-010Krishnaprasad ChenniyangirinathanBelum ada peringkat

- Case Analysis ReportDokumen9 halamanCase Analysis Reportchirag shahBelum ada peringkat

- Harvard Case - The Parable of Sadhu With QuestionsDokumen6 halamanHarvard Case - The Parable of Sadhu With QuestionsKunal SthaBelum ada peringkat

- This Study Resource Was: Relationship With Richard PatricofDokumen1 halamanThis Study Resource Was: Relationship With Richard PatricofCourse HeroBelum ada peringkat

- MarriottDokumen3 halamanMarriottluizBelum ada peringkat

- Carter LBODokumen1 halamanCarter LBOEddie KruleBelum ada peringkat

- Chiarella v. United StatesDokumen4 halamanChiarella v. United StatesEddie KruleBelum ada peringkat

- Eddie Krule Take-Home Final Exam Ekrule@kellogg - Northwestern.eduDokumen6 halamanEddie Krule Take-Home Final Exam Ekrule@kellogg - Northwestern.eduEddie KruleBelum ada peringkat

- Eddie Krule Take-Home Final Exam Ekrule@kellogg - Northwestern.eduDokumen6 halamanEddie Krule Take-Home Final Exam Ekrule@kellogg - Northwestern.eduEddie KruleBelum ada peringkat

- Top Glove CorporationDokumen13 halamanTop Glove CorporationVivek BanerjeeBelum ada peringkat

- Strategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.Dokumen4 halamanStrategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.DivyaDesai100% (1)

- Assignment On HyfluxDokumen11 halamanAssignment On HyfluxJosephiney92Belum ada peringkat

- Certificate in Advanced Business Calculations Level 3/series 3-2009Dokumen18 halamanCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- RES Essay Competition 2014 Judges Report & Winning EssaysDokumen38 halamanRES Essay Competition 2014 Judges Report & Winning EssaysAxelBelum ada peringkat

- Fpu Lesson 01Dokumen9 halamanFpu Lesson 01edwardoughBelum ada peringkat

- International Management Journal Jan Jun.2019Dokumen145 halamanInternational Management Journal Jan Jun.2019fabio_rogerio_sjBelum ada peringkat

- Dominic Zappa ResumeDokumen2 halamanDominic Zappa Resumeapi-509333516Belum ada peringkat

- BP Annual Report and Form 20F 2014 PDFDokumen263 halamanBP Annual Report and Form 20F 2014 PDFBo BéoBelum ada peringkat

- CMEC enDokumen533 halamanCMEC enAndres PaezBelum ada peringkat

- Corporate Banking Assign 4Dokumen26 halamanCorporate Banking Assign 4Akshay RathiBelum ada peringkat

- LyndonBasc 0894220504221237Dokumen7 halamanLyndonBasc 0894220504221237LyndonBelum ada peringkat

- Returns To Alternative Savings VehiclesDokumen18 halamanReturns To Alternative Savings VehiclesDownloadBelum ada peringkat

- InterCompany Matching Application in BPCDokumen36 halamanInterCompany Matching Application in BPCsapd65Belum ada peringkat

- FI/CO Frequently Used Transactions: General LedgerDokumen7 halamanFI/CO Frequently Used Transactions: General LedgerShijo PrakashBelum ada peringkat

- PWC Vietnam Ifrs Vas PDFDokumen99 halamanPWC Vietnam Ifrs Vas PDFminhBelum ada peringkat

- The History of SukukDokumen4 halamanThe History of SukukNahidul Islam IUBelum ada peringkat

- 1 Mark QuestionsDokumen8 halaman1 Mark QuestionsPhani Chintu100% (2)

- Chapter 31 - AnswerDokumen15 halamanChapter 31 - AnswerEunice LigutanBelum ada peringkat

- Beams10e Ch16Dokumen32 halamanBeams10e Ch16Mikha ReytaBelum ada peringkat

- Jeurissen, Roland - A Hybrid Genetic Algorithm To Track The Dutch AEX-Index (2005)Dokumen36 halamanJeurissen, Roland - A Hybrid Genetic Algorithm To Track The Dutch AEX-Index (2005)Edwin HauwertBelum ada peringkat

- Mega Walk-In Drive For Financial Analyst: Job DescriptionDokumen3 halamanMega Walk-In Drive For Financial Analyst: Job DescriptionRaj JoshiBelum ada peringkat

- Lenskart - Marketing ProjectDokumen27 halamanLenskart - Marketing Projectaditya bandil0% (2)

- Lacerta Abs Cdo 2006 1 LTD ProspectusDokumen215 halamanLacerta Abs Cdo 2006 1 LTD ProspectusDuff ChampBelum ada peringkat

- HSBCDokumen20 halamanHSBCAl Rezwan Bin ParvezBelum ada peringkat

- ch01 The Role of Financial ManagementDokumen25 halamanch01 The Role of Financial ManagementBagusranu Wahyudi PutraBelum ada peringkat

- BP Amoco Pre Zen Tare PPT ModificatDokumen37 halamanBP Amoco Pre Zen Tare PPT ModificatSergiu DraganBelum ada peringkat

- 3850 Salomon Discussion PuigDokumen7 halaman3850 Salomon Discussion PuigAnkkit PandeyBelum ada peringkat

- YTL Corporation Berhad - Annual Report 2013Dokumen239 halamanYTL Corporation Berhad - Annual Report 2013ETDWBelum ada peringkat