Supliment Engleza Capitol 3

Diunggah oleh

Mihaela Constantina Stroe RăducuHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Supliment Engleza Capitol 3

Diunggah oleh

Mihaela Constantina Stroe RăducuHak Cipta:

Format Tersedia

Structuring Macroeconomic Data for Business Decisions Before deciding for going international, business professionals need a lot

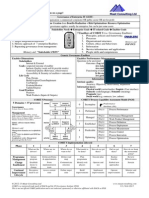

of quantitative and qualitative information on the partners home country economy. These data are usually presented in form of two different studies: 1. A Country Report; 2. A Market Survey. The country report contains data and arguments related to political, social, legal system, macroeconomic and information risks. Only when the country report is positive, a market survey will come in discussion. The political risk is related to the change of the governing body as a result of regular or early election. The social risk refers to strikes and other conflicts or tensions between employers and employees that might jeopardize a business or a transaction. Legal system risk means frequent change in legal regulations referring to businesses (legislative volatility) and/or weak implementation of legal provisions in real business life. Information risk is generated by fake information or by manipulated data by certain individuals or groups of interest in order to induce a wrong attitude or decision. Only data from guaranteed official sources should be considered by business professionals. Macroeconomic risks are referring to unexpected and strong changes in the economic trends of a country, changes that determine absolute or relative losses for a business. Businessmen and managers use a whole range of indicators aiming at sensing the different risks mentioned before. A grouping of these data in five categories (also known as a magic pentagon might be an appropriate structuring of the available information: 1. Economic growth indicators: - real growth rate of GDP in the previous 1-3 years; - gross fixed capital formation as % of GDP or investment ratio. 2. Price stability indicators: - consumer price index during the last 1-3 years or (by subtracting 100 from the CPI) the (annual) inflation rate in consumer price terms; - more rarely, the implicit GDP deflator is also showing up in this group of indicators. 3. Use of human resources indicators: - quota of active or occupied population in the total number of inhabitants; - number of unemployed persons and unemployment rate. 4. Social stability (harmony) indicators: - poverty ratio - number of work conflicts and/or average duration of strikes per 1,000 employees; - the spread between the highest and the lowest wages in a specific industry. 5. External sector equilibrium indicators: - current account imbalance as % of GDP;

- commercial account imbalance as % of GDP; - external debt as % of GDP or external debt per capita; - external debt service as % of exports income. Table No. 3.1 shows the main macroeconomic indicators for Romania. To the five groups of data, in specific transactions a businessman could be interested to learn also about the share of the public sector in a transition economy, the level and increase ratio of the postponed payments between economic actors, the increase ratio of the inventories (non marketed final products), the internal indebtness of the government, the % value of the public deficit as compared to the GDP or the grey economy estimation. A business professional might not have always the time to have a self-made pentagon of macroeconomic indicators. Sometimes he is referring only to one or two sensors of the economic cycle in order to estimate risks and opportunities for his business. Examples: - Interesting sensors during economic growth phases and boom periods of an economy: - number of new enterprises created in the economy or in a specific industry; - number of new work-places; - decrease of the unemployment rate; - increase of loans granted to private enterprises and entrepreneurs; - increase of the consumption and/or increase of investments in building projects; - increase of the consumer sentiment index, etc. - Sensors to be used to observe decrease or crisis periods in an economy: - number of businesses closed down; - number of new unemployed persons; - increase of the unemployment rate; - increase of the inventories of un-marketed goods, etc. It is important to note that different industries and activities within a national economy are usually in various stages of the economic cycle. See also Figure No. 3.2. Alternative instruments for sensing macroeconomic environment in a country The Index of Economic Freedom. The idea of producing a user-friendly instrument for policy-makers in order to quickly sense the economic freedom in a business environment was born at The Heritage Foundation in 1989. The purpose is to develop an index that measures the extent of economic freedom in countries around the world. To this end, a set of ten objective economic criteria has been established to grade and rank countries. While there are many theories referring to the origins and causes of economic development, it seems to be obvious that countries with the most economic freedom show higher rates of growth (a more consistent growth) and better living standards than those with less economic freedom. The Index of Economic Freedom is based on grades given by independent experts on a scale from 1 to 5 for the ten factors listed below. The higher the grade, the more government interference in the economy (hence the less economic freedom) there is. After grading each of the criteria, a simple arithmetical average of the ten grades gives the general score of a country. Facts and figures about the researched economies are

produced by American businessmen and officials and transmitted on a regular basis to the State Department of Trade. The criteria (factors) are: 1. Trade Policy 2. Taxation Policy 3. Government consumption as % of GDP 4. Monetary policy 5. Capital Flows across Borders and Foreign Investment 6. Banking Policy 7. Wage and Price Controls 8. Property Rights Preservation 9. Level of Regulations 10. Black Market Romania was enlisted the first time in 1995. It currently scores 3.70 and rank on position 131 out of 156 researched countries. Another very fashionable instrument sensing the business environment in a country is the Perceived Corruption Index estimated by The Transparency International organization. This is why it is also known as the Transparency Index. Experts of the organization estimate this index for each country by making use of the outcomes of a number of independent opinion surveys in the respective country. There are three target groups surveyed: businessmen, risk experts and citizens of the country. On this basis experts are grading on a scale from 1 to 10 the responses of each target group and establish an average grade and a standard deviation between the different dominant opinions expressed in the surveys. The lower the perceived bureaucracy and corruption in a country, the higher grade is granted. In 2003, Romania showed a score of 2.8 and ranked 83 among 133 countries. A way to easily sense the business environment in a country might be represented by the Business Barometers regularly published by various institutions in each country. They are based on monthly inquiries of managers aiming at scoring their expectations in the field of their business. The most important advantages of this instrument are two: - it shows not only the general perception of industrials, bankers and other categories of business professionals but also short term expectations of the managers differentiated by industries: - it is a user-friendly source of systematic information for every one. Country Risk Ratings are also a good source of information for business orientation. Ratings are the result of a systematic appraisal of the relative risks between countries from a financial and political viewpoint. They try to identify explicitly and, as far as possible, to quantify the international macroeconomic risks that concern a financial institution, whether investing, lending money or financing trade. Rating agencies are using different scaling systems and final score presentations. Finally, Stock Market Indices might be also used by business professionals to sense the immediate situation and the very short term outlook of the business environment in a country. Nevertheless, these index numbers have to be considered only as an indirect source of information for a correct and complete diagnosis of the business opportunities and risks existing in a given country.

Anda mungkin juga menyukai

- Unit 3 International Business Environment: StructureDokumen23 halamanUnit 3 International Business Environment: StructurerajatBelum ada peringkat

- PRS Methodology: About "PRS" and The Coplin-O'Leary System™Dokumen17 halamanPRS Methodology: About "PRS" and The Coplin-O'Leary System™Fania Anindita RizkaBelum ada peringkat

- Mduszynski-18112022135942-Topic3-2 - Environment - AnalysisDokumen22 halamanMduszynski-18112022135942-Topic3-2 - Environment - AnalysisSviatoslav DzhumanBelum ada peringkat

- Fundamental Analysis Macroeconomic FactorsDokumen12 halamanFundamental Analysis Macroeconomic FactorsluvnehaBelum ada peringkat

- Economic ForecastingDokumen4 halamanEconomic ForecastingAssignmentLab.comBelum ada peringkat

- Role of An EconomistDokumen2 halamanRole of An Economiststephbatac241Belum ada peringkat

- Political RiskDokumen5 halamanPolitical Riskashu khetanBelum ada peringkat

- Sapm (MT)Dokumen12 halamanSapm (MT)Joy NathBelum ada peringkat

- 11-Economic Analysis - IDokumen5 halaman11-Economic Analysis - Iking410Belum ada peringkat

- Macroeconomics & Economic StatisticsDokumen56 halamanMacroeconomics & Economic Statisticsamankamat2002Belum ada peringkat

- Strategic Manageemnt CHAPTER-threeDokumen13 halamanStrategic Manageemnt CHAPTER-threewubeBelum ada peringkat

- Sapm Unit 3Dokumen22 halamanSapm Unit 3VelumoniBelum ada peringkat

- 1.4 Macroeconomics and Business EnvironmentDokumen3 halaman1.4 Macroeconomics and Business EnvironmentShishirKharelBelum ada peringkat

- Group 1 Equity Research ReportDokumen45 halamanGroup 1 Equity Research ReportKuldip DixitBelum ada peringkat

- Risk Management Framework for Assessing Risks in South AfricaDokumen18 halamanRisk Management Framework for Assessing Risks in South AfricaLalitha PramaswaranBelum ada peringkat

- What Is 'Microeconomics': Microeconomics Is The Study of The Behaviour of The Individual Units (Like AnDokumen5 halamanWhat Is 'Microeconomics': Microeconomics Is The Study of The Behaviour of The Individual Units (Like AnMae Jane AguilarBelum ada peringkat

- Investement Analysis and Portfolio Management Chapter 5Dokumen15 halamanInvestement Analysis and Portfolio Management Chapter 5Oumer ShaffiBelum ada peringkat

- ICRG MethodologyDokumen20 halamanICRG MethodologyAvijit Bhowmick AviBelum ada peringkat

- Economic Analysis: Gross Domestic Product (GDP)Dokumen4 halamanEconomic Analysis: Gross Domestic Product (GDP)Madhuri BhamreBelum ada peringkat

- ICRG MethodologyDokumen20 halamanICRG MethodologyMahmud HasanBelum ada peringkat

- EOP Mid ProjectDokumen9 halamanEOP Mid ProjectHamza ShafiqBelum ada peringkat

- Lecture 13 Fundamental Analysis of Foreign Exchange MarketDokumen8 halamanLecture 13 Fundamental Analysis of Foreign Exchange MarketHilmi AbdullahBelum ada peringkat

- Economic Indicators: Fixed IncomeDokumen3 halamanEconomic Indicators: Fixed IncomepedroBelum ada peringkat

- Appendix 3Dokumen16 halamanAppendix 3hcu805Belum ada peringkat

- 1 Environmental ScanningDokumen11 halaman1 Environmental ScanningClare FernandesBelum ada peringkat

- What Is EconomicsDokumen13 halamanWhat Is Economicsandreilouis.castillanoBelum ada peringkat

- I CRG MethodologyDokumen17 halamanI CRG Methodologynafis022Belum ada peringkat

- Corporate Governance Presentation (CHV)Dokumen10 halamanCorporate Governance Presentation (CHV)SidhooBelum ada peringkat

- Chapter 6 Security AnalysisDokumen13 halamanChapter 6 Security Analysistame kibruBelum ada peringkat

- Why environmental analysis is crucial for businessesDokumen24 halamanWhy environmental analysis is crucial for businessesSmriti PathakBelum ada peringkat

- Top-Down Valuation (EIC Analysis) : EconomyDokumen5 halamanTop-Down Valuation (EIC Analysis) : EconomyManas MohapatraBelum ada peringkat

- Ibt 7Dokumen5 halamanIbt 7tenyente gimoBelum ada peringkat

- Analysis of Variable Income SecuritiesDokumen11 halamanAnalysis of Variable Income SecuritiesManjula100% (3)

- United States Global Competitiveness Index Ranking Over TimeDokumen12 halamanUnited States Global Competitiveness Index Ranking Over TimeAjit Singh AjimalBelum ada peringkat

- WEALTH MANAGEMENT PROJECTDokumen24 halamanWEALTH MANAGEMENT PROJECTshrishtiBelum ada peringkat

- Fundamental Factors That Impact Currency ValuesDokumen3 halamanFundamental Factors That Impact Currency ValuesVishvesh SinghBelum ada peringkat

- Notes On External Strategic Management AuditDokumen7 halamanNotes On External Strategic Management AuditGabrielle TabarBelum ada peringkat

- Investment PortfolioDokumen1 halamanInvestment PortfolioMAYANK YADAV 22GSOB2010351Belum ada peringkat

- Chapter - 1Dokumen111 halamanChapter - 1Niranjan Phuyal100% (1)

- Ivan Valeriu Cluj en v1Dokumen7 halamanIvan Valeriu Cluj en v1Valeriu IvanBelum ada peringkat

- Sweden: Country Risk TierDokumen4 halamanSweden: Country Risk Tierarunbose576Belum ada peringkat

- Economic Theory Paper Assignment FinalDokumen22 halamanEconomic Theory Paper Assignment Finalolawuyi adedayoBelum ada peringkat

- FUNDAMENTAL ANALYSIS or EIC AnalysisDokumen8 halamanFUNDAMENTAL ANALYSIS or EIC AnalysisMidhun Thomas100% (2)

- Answer/Solution Case: The BRICs: Vanguard of The RevolutionDokumen3 halamanAnswer/Solution Case: The BRICs: Vanguard of The RevolutionEvan Octviamen67% (6)

- Wa0004.Dokumen12 halamanWa0004.Sunny RajputBelum ada peringkat

- Template Mkt5000 Marketing AuditDokumen8 halamanTemplate Mkt5000 Marketing AuditterrancekuBelum ada peringkat

- Macroeconomics: Macroeconomic Variables: Aggregate Output or Income, The Unemployment Rate, The Inflation RateDokumen4 halamanMacroeconomics: Macroeconomic Variables: Aggregate Output or Income, The Unemployment Rate, The Inflation RateNivedhitha SubramaniamBelum ada peringkat

- What Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current PriceDokumen9 halamanWhat Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current Pricedhwani100% (1)

- Statistical Survey, A Method For Collecting Quantitative Information About Items in A PopulationDokumen1 halamanStatistical Survey, A Method For Collecting Quantitative Information About Items in A PopulationNancy NamacpacanBelum ada peringkat

- Session 2 - The Equity Risk PremiumDokumen37 halamanSession 2 - The Equity Risk PremiumDanny GuevaraBelum ada peringkat

- 17091AA043 BES Assignment - LLDokumen14 halaman17091AA043 BES Assignment - LLBharani MadamanchiBelum ada peringkat

- Undamental Nalysis: Gayatri Mohanty Asst. Professor, Parul Institute of Management & ResearchDokumen32 halamanUndamental Nalysis: Gayatri Mohanty Asst. Professor, Parul Institute of Management & Researchkunalacharya5Belum ada peringkat

- Book Issue Part 1Dokumen25 halamanBook Issue Part 1amanBelum ada peringkat

- Ultra Iyi BS ÖzetiDokumen9 halamanUltra Iyi BS ÖzetikeremBelum ada peringkat

- Macroeconomic Analysis ReportDokumen2 halamanMacroeconomic Analysis ReportGasimovskyBelum ada peringkat

- Lecture_7-8Dokumen5 halamanLecture_7-8shadowlord468Belum ada peringkat

- Fundamental Analysis: 1. OverviewDokumen20 halamanFundamental Analysis: 1. OverviewRahul PujariBelum ada peringkat

- EY M&A MaturityDokumen16 halamanEY M&A MaturityppiravomBelum ada peringkat

- Fundamental Analysis of IT Sector on BSEDokumen12 halamanFundamental Analysis of IT Sector on BSEManasi Kalgutkar100% (2)

- Bills of ExchangeDokumen31 halamanBills of ExchangeViransh Coaching ClassesBelum ada peringkat

- BUS835M Group 5 Apple Inc.Dokumen17 halamanBUS835M Group 5 Apple Inc.Chamuel Michael Joseph SantiagoBelum ada peringkat

- Manage Greenbelt Condo UnitDokumen2 halamanManage Greenbelt Condo UnitHarlyne CasimiroBelum ada peringkat

- Employee Training at Hyundai Motor IndiaDokumen105 halamanEmployee Training at Hyundai Motor IndiaRajesh Kumar J50% (12)

- Supply Chain Management Course Syllabus for Integrated MBADokumen4 halamanSupply Chain Management Course Syllabus for Integrated MBAJay PatelBelum ada peringkat

- Non Disclosure AgreementDokumen2 halamanNon Disclosure AgreementReginaldo BucuBelum ada peringkat

- Compare Q1 and Q2 productivity using partial factor productivity analysisDokumen3 halamanCompare Q1 and Q2 productivity using partial factor productivity analysisDima AbdulhayBelum ada peringkat

- AM.012 - Manual - UFCD - 0402Dokumen23 halamanAM.012 - Manual - UFCD - 0402Luciana Pinto86% (7)

- MOTIVATION - Strategy For UPSC Mains and Tips For Answer Writing - Kumar Ashirwad, Rank 35 CSE - 2015 - InSIGHTSDokumen28 halamanMOTIVATION - Strategy For UPSC Mains and Tips For Answer Writing - Kumar Ashirwad, Rank 35 CSE - 2015 - InSIGHTSDhiraj Kumar PalBelum ada peringkat

- OutSystems CertificationDokumen7 halamanOutSystems CertificationPaulo Fernandes100% (1)

- Gestion de La Calidad HoqDokumen8 halamanGestion de La Calidad HoqLuisa AngelBelum ada peringkat

- Money ClaimDokumen1 halamanMoney Claimalexander ongkiatcoBelum ada peringkat

- Notary CodeDokumen36 halamanNotary CodeBonnieClark100% (2)

- Understanding consumer perception, brand loyalty & promotionDokumen8 halamanUnderstanding consumer perception, brand loyalty & promotionSaranya SaranBelum ada peringkat

- Hotel PlanDokumen19 halamanHotel Planlucky zee100% (2)

- Consumer Buying Behaviour - FEVICOLDokumen10 halamanConsumer Buying Behaviour - FEVICOLShashank Joshi100% (1)

- SS ISO 9004-2018 - PreviewDokumen12 halamanSS ISO 9004-2018 - PreviewKit ChanBelum ada peringkat

- Cabanlit - Module 2 SPDokumen2 halamanCabanlit - Module 2 SPJovie CabanlitBelum ada peringkat

- 1 Deed of Absolute Sale Saldua - ComvalDokumen3 halaman1 Deed of Absolute Sale Saldua - ComvalAgsa ForceBelum ada peringkat

- Balance ScorecardDokumen11 halamanBalance ScorecardParandeep ChawlaBelum ada peringkat

- PsychographicsDokumen12 halamanPsychographicsirenek100% (2)

- Jesd 48 BDokumen10 halamanJesd 48 BLina GanBelum ada peringkat

- COBIT 5 Foundation Exam Revision On A PageDokumen1 halamanCOBIT 5 Foundation Exam Revision On A PageSergiö Montoya100% (1)

- 5 Why AnalysisDokumen2 halaman5 Why Analysislnicolae100% (2)

- Paper 5 PDFDokumen529 halamanPaper 5 PDFTeddy BearBelum ada peringkat

- Internship PresentationDokumen3 halamanInternship Presentationapi-242871239Belum ada peringkat

- Pest Analysis of Soccer Football Manufacturing CompanyDokumen6 halamanPest Analysis of Soccer Football Manufacturing CompanyHusnainShahid100% (1)

- Ctpat Prog Benefits GuideDokumen4 halamanCtpat Prog Benefits Guidenilantha_bBelum ada peringkat

- IQA QuestionsDokumen8 halamanIQA QuestionsProf C.S.PurushothamanBelum ada peringkat

- Pakistan Is Not A Poor Country But in FactDokumen5 halamanPakistan Is Not A Poor Country But in Factfsci35Belum ada peringkat