Tax Review

Diunggah oleh

Aibo GacuLaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tax Review

Diunggah oleh

Aibo GacuLaHak Cipta:

Format Tersedia

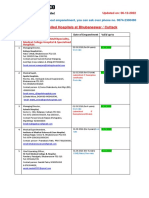

Assessment 1. When does an assessment of internal revenue tax liability become final and unappealable? a.

When the taxpayer fails to file an administrative protest with the CIR within 30 days from receipt of the assessment. b. Failure of the taxpayer to appeal the decision of the CIR re protest against assessment to the CTA within 30 days from receipt of the decision. c. When the protest is not acted upon within 180 days from submission of documents and the taxpayer failed to appeal with the CTA within 30 days from the lapse of the 180-day period. 2. When is pre-assessment notice not necessary? General Rule is that PAN is necessary before the CIR or his duly authorized representative can assess proper taxes. The exceptions are as follows: a. When the deficiency tax arise from a mathematical error in the computation of tax (appearing on the face of the return); b. When there is deficiency between the tax withheld and the amount actually remitted; c. When the taxpayer who opted to claim refund or tax credit of excess creditable taxable quarters of the succeeding taxable year; d. When the excise tax due on the excisable articles has not been paid; e. When an article locally purchased by an exempt person has been sold, traded or transferred to non-exempt persons. 3. In what instances may the Court of Tax Appeals enjoin the collection of taxes? Injunction may be issued by the CTA in aid of its appellate jurisdiction under RA 1125 (as amended by RA 9282) on the condition that the same may jeopardize the interest of the government and/or the taxpayer. In this instance, the court may require the taxpayer either to deposit the amount claimed or file a surety bond for not more than double the amount with the court. 4. Distinguish the BIR Rulings from Revenue Regulations. BIR Rulings are official position of the Bureau to queries raised by taxpayers and other stakeholders relative to clarification and interpretation of tax laws whereas Revenue Regulations (RRs) are issuances signed by the Secretary of Finance, upon recommendation of the Commissioner of Internal Revenue that specify, prescribe or define rules and regulations for the effective enforcement of the provisions of the National Internal Revenue Code (NIRC) and related statutes. 5. Distinguish Tax Verification Notice from Letter of Authority and from Assessment Notice. Letter of Authority is an official document that empowers a Revenue Officer to examine and scrutinize a taxpayers book of accounts and other accounting records in order to deter mine the taxpayers correct internal revenue tax liabilities. Notice of Assessment or Formal Letter of Demand is a declaration of deficiency taxes issued to a taxpayer who fails to respond to a Pre-Assessment Notice within the prescribed period of time or whose reply to the PAN was found to be without merit. 6. X, a taxpayer, wanted to have a particular provision of the NIRC and other tax laws be interpreted. To whom or to what office should he file his petition or letter-request for the interpretation of the said provisions? The power to interpret the provisions of the NIRC and other tax laws shall be under the exclusive and original jurisdiction of the (BIR) Commissioner, subject to review by the Secretary of Finance (Section 4, RA 8424) 7. When can rules and regulations or any rulings or circulars promulgated by the CIR be given retroactive application? The general rule is that it cannot be given retroactive application except in the following cases: (1) where the taxpayer deliberately misstates or omits material facts from his return or any document required of him by the BIR; (2) where the facts subsequently gathered by the BIR are materially different from the facts on which the ruling is based; and (3) where the taxpayer acted in bad faith. (Reference: Section 246, RA 8424) 8. What is jeopardy assessment? It is a tax assessment made by an authorized Revenue Officer without the benefit of a complete or partial audit who has reason to believe that the assessment and collection of a deficiency tax will be

jeopardized by delay because of the taxpayers failure to comply with audit and investigation requirements to present his books of accounts and/or pertinent records or to substantiate all or any of the deductions, exemptions or credits claimed in the return. (Reference: Philippine Journal Taxpayers Rights and Obligations by Eufrocina M. Sacdalan-Casasola) 9. False Return (surcharge is not imposed) -there is deviation from truth which may not be always intentional -it may result from mistake, error or negligence of the taxpayer Fraudulent Return (surcharged is imposed) -there is intent to defraud the government to evade taxes 10. When shall the liability for violation of the Tax Code prescribe? (Section 281 of RA 8424) All violations of any provision of this Code shall prescribe after Five (5) years. Prescription shall begin to run from the day of the commission of the violation of the law and if the same be not known at the time, from the discovery thereof and the institution of judicial proceedings for its investigation and punishment. The prescription shall be interrupted when proceedings are instituted against the guilty persons and shall begin to run again if the proceedings are dismissed for reasons not constituting jeopardy. 11. What is the period of limitation upon Assessment and Collection under RA 8424? (Section 203 RA 8424) Internal revenue taxes shall be assessed within three (3) years after the last day prescribed by law for the filing of the return, and no proceeding in court without assessment for the collection of such taxes shall begin after the expiration of such period. Provided, That in a case where a return is filed beyond the period prescribed by law, the three (3)-year period shall be counted from the day the return was filed. For purposes of this section, a return filed before the last day prescribed by law for the filing thereof shall be considered filed on such last day. 12. What are the exceptions as to the period of limitation for assessment and collection of taxes under RA 8424? (Section 222 RA 8424) (a) In the case of a false or fraudulent return with intent to evade tax or of failure to file a return, the tax may be assessed, or a proceeding in court for the collection of such tax may be filed without assessment, at any time within ten (10) years after the discovery of the falsity, fraud or omission. (b) If before the expiration of the time prescribed in Section 203 for the assessment of the tax, both the Commissioner and the taxpayer have agreed in writing to its assessment after such time, the tax may be assessed within the period agreed upon. (c) Any internal revenue tax which has been assessed within the period of limitation as prescribed in paragraph (a) hereof may be collected by distraint or levy or by a proceeding in court within five (5) years following the assessment of the tax. (d) Any internal revenue tax, which has been assessed within the period agreed upon as provided in paragraph (b) hereinabove, may be collected by distraint or levy or by a proceeding in court within the period agreed upon in writing before the expiration of the five (5)-year period.

Tax Remedies

1. Distinguish the remedy protest under RA 8424 and the Tariff and Customs Code. Payment under protest is not required in protesting tax assessments made by the CIR or his authorized representatives within 30 days from receipt of the assessment notice while payment under protest is required in protesting the assessment issued by the collector of customs within 15 days from receipt of assessment notice.

2. On January 1, 2004, T filed his Annual Income Tax Return for his 2003 income. On April 14, 2007, the BIR issued a Notice Assessment. T was assessed to pay additional taxes amounting to Php 500,000.00 from his 2003 income. T did not file any protest believing that the right of the government to make assessment on his 2003 income has already prescribed. On May 13, 2012, the BIR now filed a case to collect additional assessment made on April 14, 2007. T, this time interposed the defense that the government cannot anymore collect from him the sum of Php 500,000.00 because at the time he was issues a Notice of Assessment and at the time the case for collection was filed, in both, the right of the government has already prescribed. Is the contention of T tenable? Explain. The contentions of T are tenable. The assessment was made within the prescriptive period of 3-years. The 3-year period should be counted from April 15, 2004 and not on January 1, 2004 since the former period is the later date. (Section 203 of RA 8424). Likewise, the collection suit was filed within the prescriptive period of 5-years. Any internal revenue tax which has been assessed within the period of limitation may be collected by distraint or levy or by a proceeding in court within 5 years following the assessment of the tax. (Section 222, RA 8424) 3. On January 1, 2004, T filed his Annual Income Tax Return for his 2003 income. On April 14, 2007, the Revenue Regional Director (RRD) issued a Notice of Assessment. T filed his protest on April 30, 2007. The RRD denied the protest of T. T filed an appeal to the Commissioner of BIR (CIR) on May 10, 2007. The CIR issued its decision on December 10, 2007. On December 15, 2007, T filed his appeal to the Court of Tax Appeals. Will the appeal prosper? Yes. It is timely filed. Under the law, the taxpayer should file an appeal to the CTA within 30 days from receipt of the decision. T has until January 9, 2007 to file his appeal to CTA. Failing to perfect an appeal on January 9, 2007, the assessment had become final and executor already. Hence, the appeal is timely filed on December 15, 2007. (Reference: Section 228, RA 8424) Supposed T submitted his supporting documents in May 10, 2007. No. It is not timely filed. Under the law the taxpayer should file an appeal to the CTA within 30 days from lapse of the 180-day period from the filing of the supporting documents; otherwise the assessment will become final and executor. The 180th day from the filing of the supporting documents fell on November 5, 2007 and so T has until December 4, 2007 to file his appeal to the CTA. Failing to perfect an appeal on December 4, 2007, the assessment had become final and executor already. Hence, the appeal is not timely filed on December 15, 2007. (Reference: Section 228, RA 8424) 4. X on April 15, 2004, filed a fraudulent Income Tax Return covering his 2003 income. X was thereafter issued a notice of assessment on August 10, 2004. He was assessed to pay Php 500,000.00, X on August 16, 2004 filed a protest (motion for reinvestigation) in proper form. On August 17, 2004, while the protest is still pending, the CIR filed a collection case and a criminal case against X before the regular courts. X filed a motion to dismiss/quash on both cases arguing that filing of the cases is premature in as much as his protest is still pending. Is the contention of X tenable? (Sec 203, 222 of RA 8424 and the Ungab vs. Cusi Jr., 97 SCRA 877) In the case of a false or fraudulent return with intent to evade tax or of failure to file a return, the tax may be assessed, or a proceeding in court for the collection of such tax may be filed without assessment at any time within ten (10) years after the discovery of the falsity, fraud or omission. Further, jurisprudence provides that criminal action may be filed during the pendency of an administrative protest in the BIR. It is not a requirement for the filing thereof that there be aprecise computation and assessment of the tax since what is involved in the criminal action is not the collection of tax but a criminal prosecution for the violation of the NIRC. Provided however, that there is a prima facie showing of a willfull attempt to evade taxes or failure to file the required return. 5. When may the CIR compromise any internal revenue tax? (Section 204 RA 8424) (1) When a reasonable doubt as to the validity of the claim against the taxpayer exists; (2) When the financial position of the taxpayer demonstrates a clear inability to pay the assessed tax.

6. Can a taxpayer file a mandamus case against the CIR to compel him to exercise his power to compromise? Explain. (PP vs. Desiderio, L-20805, 11/29/65) No. Even the court cannot compel the CIR to exercise this discretionary power. The reason is to assure that no improper compromise is made to the prejudice of the government. 7. Will the subsequent satisfaction of an internal revenue tax liability operate to extinguish the criminal liability for violation of the Tax Code? Explain. No. The subsequent satisfaction of tax liability by payment or prescription does not extinguish the taxpayers criminal liability. 8. Will the forfeiture or seizure of the property of a taxpayer bar the filing of a criminal case for violation of the Tax Code against him? Expalin. (Garcia vs. Collector, 66 Phil 441) Jurisprudence provides that the taxpayer in forfeiture or seizure cases to enforce tax lien may still be the subject to criminal action even if his property has been forfeited. 9. Distinguish a forfeiture proceeding from a seizure proceeding under RA 842. (Bank of PI vs. Trinidad, 42 Phil 220) In forfeiture, all the proceeds of the sale will go to the coffers of the government whereas in seizure, the residue, after deducting the tax liability and expenses, will go to the taxpayer. 10. Can the government file civil or criminal action for recovery of taxes or enforcement of fine, penalty, etc. without the approval of the Commissioner of BIR? No. The institution of civil or criminal action for tax collection filed with the regular courts cannot be instituted without approval of the CIR. 11. T was assessed by the CIR for back taxes in the amount of 2M. T immediately offered to compromise the payment of the assessment. After some negotiations, the Commissioner of the BIR, solely, approved the offer of compromise and allowed T to pay only 1.5M. Is the compromise agreement valid? Explain. The Commissioner is allowed to enter into a compromise only if the basic tax involved does not exceed one million pesos (Php 1,000,000.00) and the settlement offered is not less than the prescribed percentages. Further, the law provides that where the basic tax involved exceeds One Million Pesos or where the settlement offered is less than the prescribed minimum rates, the compromise shall be subject to the approval of the Evaluation Board which shall be composed of the Commissioner and the four (4) Deputy Commissioners. (Sec. 204 (A)) 12. In 2002, X, a taxpayer, indicated in his income tax return that his tax liability is Php 80,000.00. In 2003 the Commissioner of BIR launched the program Tax Mapping. An audit investigation was made on the business of X and it was found out that his correct tax liability is Php 120,000.00. The BIR is now pursuing him to pay the difference of Php 140,000.00. X, through his counsel, filed a Petition for injunction before the Regional Trial Court. If you were the judge, what would you do? Explain. I will dismiss the Petition. No court shall have the authority to grant an injunction to restrain the collection of any internal revenue tax, fee or charge imposed by NIRC code. Also, it was said that under the lifeblood doctrine, taxes are the lifeblood of the nation so that its prompt and certain availability is an imperious need. Finally, the collection of taxes cannot be unduly hampered. 13. When to file a claim for refund? When should the appeal be made? File the claim for refund within two years from the date of payment. The appeal should also be made within the said two-year period. 14. X filed a fraudulent Income Tax Return on February 24, 2004 covering his 2003 income. The Commissioner of the BIR, aftr thorough audit conducted buy its subordinates, amended, in his own initiative the income tax return of X for his 2003 income. In such amended return, X was made to

pay Php 100,000.00 more than the return he originally filed. X then filed a Petition for Certiorari under Rule 65 of the Rules of Court alleging therein that the Commissioner gravely abused its discretion when it amended motu propio the 2003 Income Tax Return. Resolve the issues raised by X in his Petition. (Sec 6 of RA 8424) In case a person fails to file a required return or other document at the time prescribed by law, or willfully or otherwise files a fraudulent return or other document the Commissioner shall make or amend the return from his own knowledge and from such information as he can obtain through testimony or otherwise, which shall be prima facie correct and sufficient for all legal purposes. 15. Enumerate 5 situations or matters involving an income tax which cannot be the proper subject of a compromise between the CIR and the taxpayer. 1. Withholding tax cases 2. Criminal tax fraud cases 3. Criminal violations already filed in courts 4. Delinquent accounts of duly approved schedule of installment payments 5. Cases where final reports for reinvestigation or reconsideration have been issued resulting to reduction in the original assessment and the taxpayer is agreeable to such decision. 16. When can the taxpayers property may be placed under constructive distraint? (Sec 206 RA 8424) To safeguard the interest of the Government, the Commissioner may place under constructive distraint the property of a delinquent taxpayer or any taxpayer who, in his opinion, is retiring from any business subject to tax or is intending to leave the Philippines or to remove his property therefrom or to hide or conceal his property or to perform any act tending to obstruct the proceedings for collecting the tax due or which may be due from him. 17. What are the requisites before the remedy of distraint under RA 8424 be validly exercised? a. Taxpayer is delinquent in payment of tax; b. There must be subsequent demand to pay; c. Taxpayer failed to pay delinquent tax on time; d. Period within which to assess and collect the tax due has not yet prescribed. 18. When can the Commissioner of the BIR validly abate or cancel the taxpayers liability? (Sec 204 B RA 8424) (1) When the tax or any portion thereof appears to be unjustly or excessively assessed; (2) When the administration and collection costs involved do not justify the collection of the amount due. 19. What are the grounds for filing a claim for tax refund or tax credit? Distinguish tax refund from tax credit. When there is erroneously or illegally assessed or collected internal revenue taxes, penalties impose without authority and any sum alleged to have been excessively or wrongfully collected. Tax refund is the actual reimbursement of tax while in tax credit, the reimbursable amount is applied against the sum due or collectible from the taxpayer. In tax refund, there is actual restitution of money, whereas in tax credit, there is no actual restitution of money. 20. X filed his annual income tax covering his 2001 income on February 1, 2002. The total tax liability that he paid on said date amounted to Php 500,000.00. On February 1, 203, X filed his annual income tax return covering his 2002 income. The total liability that he paid amounted to Php 400,000.00. On June 1, 2004 the Bureau of Internal Revenue (BIR) issued a Notice of Assessment against X demanding him to pay additional Php 100,000.00 tax deficiency on the ground that he understated his income for the year 2002. X admitted such underpayment but he interposed the defense that he overpaid his tax liability for his income in the year 2001 by Php 100,000.00 also. The BIR after an examination agreed that X had actually overpaid his tax liability for his income in the year 2001 by Php 100,000.00. With such facts, answer the following questions:

a. Can X claim for the refund of the Php 100,000.00 which he overpaid on February 1, 2002? Explain. No, under the law the following requisites must concur in case of tax refund: a. Claim must be in writing; b. It must be filed with the Commissioner within two (2) years after the payment of the tax or penalty; c. Show proof of payment. In the instant case, the foregoing requisites are not complied with. Hence, X cannot claim for the refund. b. Can X set off the amount of Php 100,000.00 which he overpaid in February 1, 2001 from his tax liability of Php 100,000.00 due to underpayment of his 2002 Tax liability? Explain. No. As a rule, taxes cannot be the subject of compensation or set-off because the government and the taxpayer are not creditors and debtors of each other. Besides, the debts are not due, demandable and fully liquidated. Though the Doctrine of Equitable Recoupment states that a claim for refund barred by prescription may be allowed to offset unsettled tax liabilities arising from the same transaction, this doctrine has been rejected by the Supreme Court since it may worsen to tempt both parties to delay and neglect their respective pursuits of legal action within the period set by law. 21. T filed his 2005 Annual Income Tax Return on April 15, 2006. The CIR issued a corresponding Notice of Assessment on January 1, 2007 requiring him to pay Php 400,000.00 delinquency tax. T filed his protest and simultaneously submitted his supporting documents on January 10, 2007. In January 13, 2007, the CIR: a. issued a Warrant of Distraint. If you are the counsel for T, what should you do? Explain. b. issued a final demand letter for the payment of the assessed tax. c. referred Ts case to the Solicitor General for the filing of appropriate case in court. If you are the counsel for T, what should you do? Explain. I will file an appeal by way of a Petitionfor Review under Rule 42 of the Revised Rules of Court to the Court of Tax Appeals within 30 days from receipt of the: (1) warrant of distraint; (2) final demand letter. 22. X Corporation has been issued a Tax Credit Certificate (TCC) entitling it to apply against its internal revenue tax liability to the extent of 2M. The said corporation has been found out to have un-remitted withholding tax liability of Php 100,000.00 representing the withholding taxes of the salaries of its employees. Can X Corporation apply its TCC against the said withholding tax liability? Explain. No. A Tax Credit Certificate validly issued under the provisions of NIR Code may be applied against any internal revenue tax EXCLUDING withholding taxes. (Section 204, 2nd par. RA 8424) 23. Suspension of Running of Statute of Limitations The running of the Statute of Limitations provided in Sections 203 and 222 on the making of assessment and the beginning of distraint or levy a proceeding in court for collection, in respect of any deficiency, shall be suspended for the period during which the Commissioner is prohibited from making the assessment or beginning distraint or levy or a proceeding in court and for sixty (60) days thereafter; a. when the taxpayer requests for a reinvestigation which is granted by the Commissioner; b. when the taxpayer cannot be located in the address given by him in the return filed upon which a tax is being assessed or collected: Provided, that, if the taxpayer informs the Commissioner of any change in address, the running of the Statute of Limitations will not be suspended; c. when the warrant of distraint or levy is duly served upon the taxpayer, his authorized representative, or a member of his household with sufficient discretion, and no property could be located; and d. when the taxpayer is out of the Philippines. 24. Protesting Assessment

The taxpayers shall be informed in writing of the law and the facts upon which the assessment is made; otherwise, the assessment shall be void. Within a period to be prescribed by implementing rules and regulations, the taxpayer shall be required to respond to said notice. If the taxpayer fails to respond, the Commissioner or his duly authorized representative shall issue an assessment based on his findings. Such assessment may be protested administratively by filing a request for reconsideration or reinvestigation within thirty (30) days from receipt of the assessment in such form and manner as may be prescribed by implementing rules and regulations. Within sixty (60) days from filing of the protest, all relevant supporting documents shall have been submitted; otherwise, the assessment shall become final. If the protest is denied in whole or in part, or is not acted upon within one hundred eighty (180) days from submission of documents, the taxpayer adversely affected by the decision or inaction may appeal to the Court of Tax Appeals within thirty (30) days from receipt of the said decision, or from the lapse of one hundred eighty (180) day period; otherwise, the decision shall become final and executor and demandable.

Court of Tax Appeal

1. What matters fall under the jurisdiction of the Court of Tax Appeals? 2. What is the mode of appeal to the CTA? Decisions rendered by the RTC and CBAA in the exercise of their appellate jurisdiction shall be by petition for review under Rule 43. All others shall be by petition for review under Rule 42. Those appealed under Rule 43 shall be decided by CTA en banc while those appealed by way of Rule 42 shall be first decided by CTA in division.

Local Taxation

1. What are the basic principles in local taxations? a. Taxation shall be uniform in each local sub-unit; b. Taxes, fees, charges and other impositions shall be equitable and based as much as possible on the tax payers ability to pay; c. They shall be levied and collected for public purposes; d. They shall not be unjust, excessive, oppressive or confiscatory; e. They shall not be contrary to law, public policy, national economic policy or in restraint of trade; f. The collection of local taxes, fees, charges and other impositions shall in no case be left to a private person. g. The revenues collected under the Code shall inure solely to the benefit of and subject to disposition by the LGU levying the tax of fee or charge or other imposition unless otherwise specifically provided therein; and h. Each LGU shall as far as practicable, evolve a progressive system of taxation. 2. Give several kinds of taxes or fees under the Local Government Code that the: a. Barangay can impose 1. Taxes on stores or retailers with fixed business establishments with gross sales or receipts of the preceding calendar year of Php 50,000.00 or less; 2. Service fees or charges collect reasonable fees or charges for services rendered in connection with the regulation or the use of barangay owned properties or service facilities such as palay, copra or tobacco dryers; 3. Barangay clearance; 4. Fees and charges on commercial breeding of fighting cocks, cockfighting and cockpits; 5. On billboards, signboards, neon signs and outdoor advertisements

b. Municipality can impose 1. Fees for sealing and licensing of weights and measures; 2. Fishery rentals, fees and charges; 3. Reasonable fees and charges on business and occupation except as reserved to the province, and 4. Business taxes; c. City can impose 1. May levy taxes, fees and charges which the province or municipality may impose; The rates of taxes that the city may levy may exceed the maximum rates allowed for the province or municipality by not more than fifty percent (50%) except the rates of professional and amusement taxes. d. Province can impose 1. Tax on transfer of real property ownership; 2. Tax on business of printing and publication; 3. franchise tax; 4. Professional tax; 5. Tax on sand, gravel and other quarry resources 3. Can an LGU impose tax on income tax? Gift tax? No. It cannot. These are among the common limitations of the power to tax by the LGUs. 4. X is a businessman. The municipality of Q passed a local tax ordinance. If X wants to question the legality of such tax ordinance, what should he do? He should question the legality and constitutionality of the said local tax ordinance within 30 days from its effectivity to the Office of the Secretary of Justice. 5. Can a municipality impose franchise tax? No. Only province can validly do so, (Article 137 LGC-IRR) 6. Congressman X has a personal grudge with the Mayor of Aringay. Congressman X then filed in the House of Representatives a bill deleting the power to tax by the Municipality of Aringay. The bill was passed by the Congressman and approved by the President of the Philippines. Is the law constitutional? Explain. The law is unconstitutional for it violates the constitutional mandate that each local government unit shall have the power to create their own sources of revenue and to levy taxes, fees and charges subject to such guidelines and limitations as the Congress may provide consistent to the basic policy of local autonomy.

Real property Taxation

1. X Corporation is engaged in the distribution of water supply The Treasurer of the Municipality of Aringay issued a Notice of Assessment to X Corporation, demanding the latter to pay real property tax (RPT) on its land and machineries. X argued that under the Local Government Code, it is exempt from the payment of RPT. Is the contention of X Corp. tenable? X Corp., a GOCC engaged in the distribution of water is exempt from payment of Real Property Tax insofar as its machineries and equipment are concerned but with respect to its land, it is liable to pay RPT. (Reference: RA 7160) 2. State the procedures governing the protest and appeal of contested assessment of Real Property Tax under the Local Government Code of 1991. Administrative Protest - filed within 30 days from payment of the tax with the provincial, city or municipal treasurer who shall decide within 60 days from receipt Appeal to the Local Board of Assessment Appeals - any owner or person having legal interest in the property who is not satisfied with the action of the provincial, city or municipal assessor in the assessment of his property may, within 60 days from date of receipt of written notice of assessment, appeal to the Local Board of Assessment Appeals.

How? By filing a petition under oath, together with copies of tax declarations and such affidavits and documents submitted in support of appeal. 3. X is the owner of a real property. X failed to pay his real property tax (RPT) for the year 1995 to 2002. In 2003, X sold his property to B. The municipal treasurer in 2003 issued a notice of delinquency to X. X contested the notice by contending that he is not anymore the owner of the property and that the liability for unpaid real property attaches to the property. Decide. The contention of X is untenable. The owner of the property at the time of the obligation to pay RPT becomes due is the one liable to pay the same. In the case of Manila Electric Co. vs. Barlis, it was held that, the fact that NAPOCOR is the present owner of the Sucat Power Plant Machineries and Equipment does not constitute a legal barrier to the collection of delinquent taxes from the former owner (MERALCO) who has defaulted its payment. 4. What are the properties/entities exempt from the payment of Real Property Tax under RA7160? 1. Real property owned by the Republic or any of its political subdivisions except the beneficial use thereof has been granted for consideration. 2. Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, nonprofit cemeteries and all lands and buildings and improvements actually, directly and exclusively used for religious, educational and charitable purposes. 3. All machineries and equipment that are actually, directly and exclusively used by local water utilities and GOCCs engaged in the supply and distribution of water and/or generation and transmission of electric power. 4. All real property owned by duly registered cooperatives 5. Machinery and equipment used for pollution control and environment. 5. Is there an instance when the liability for Real Property Tax be condoned? State the requisites/requirements. SEC. 276. Condonation or Reduction of Real Property Tax and Interest. In case of a general failure of crops or substantial decrease in the price of agricultural or agribased products, or calamity in any province, city, or municipality, the sanggunian concerned, by ordinance passed prior to the first (1 st) day of January of any year and upon recommendation of the Local Disaster Coordinating Council, may condone or reduce, wholly or partially, the taxes and interest thereon for the succeeding year or years in the city or municipality affected by the calamity. SEC. 277. Condonation or Reduction of Tax by the President of the Philippines The President of the Philippines may, when public interest so requires, condone or reduce the real property tax and interest for any year in any province or city or a municipality within the Metropolitan Manila Area. 6. What are the components of the extent of the power to levy Real Property Tax by the appropriate Local Government Unit? 7. What are the essential information(s) that should be stated in the Notice of Assessment for real property tax assessments? (1) Value of the specific property; (2) the discovery; (3) listing; (4) classification and (5) the appraisal of the property (Reference: Manila Electric Company vs. Barlis) 8. What are the fundamental principles that shall govern the exercise of the taxing and other revenue-raising powers of local government units: The appraisal, assessment, levy and collection of real property tax shall be guided by the following fundamental principles: (a) Real property shall be appraised at its current and fair market value; (b) Real property shall be classified for assessment purposes on the basis of its actual use; (c) Real property shall be assessed on the basis of a uniform classification within each local government unit; (d) The appraisal, assessment, levy and collection of real property tax shall not be let to any private person; and

(e) The appraisal and assessment of real property shall be equitable. Minimum Compromise Rates (MCR) of any tax liability 1. In case of financial incapacity MCR- 10% of the basic assessed tax 2. Other cases MCR= 40% of the basic assessed tax Approval of the Compromise by the Evaluation Board is required when: a. the basic tax involved exceeds Php 1,000,000.00 b. the settlement offered is less than the MCR Compromise involves reduction of the taxpayers liability while abatement means that the entire tax liability of the taxpayer is cancelled Indirect Denial Protes 1. Commissioner did not rule on the taxpayers motion for reconsideration of the assessment 2. Referral by the Commissioner of request for reinvestigation to the Solicitor General 3. Reiterating the demand for immediate payment of the deficiency tax due to taxpayers continued refusal to execute waiver 4. preliminary collection letter may serve an assessment notice Acts of the BIR Commissioner considered as denial of protest which serve as a basis for APPEAL TO THE CTA 1. filed by the BIR of a civil suit for collection of the deficiency tax 2. indication to the taxpayer by the Commissioner in clear and unequivocal language of his final demand 3. BIR demand letter reiterating his previous demand to pay, sent to the taxpayer after his protest of the assessment 4. the actual issuance of a warrant of distraint and levy in certain cases cannot be considered a final decision on a disputed settlement Warrant of distraint - summary procedure forcing the taxpayer to pay - receipt of it may or may not partake the character of final decision - if it is an indication of a final decision, the taxpayer may appeal to the CTA within 30 days from service of the warrant AMENDMENT OF RETURN - Within 3 years from the date of such filing, the same may be modified, changed or amended provided that no notice for audit or investigation of such return, statement or declaration has in the meantime been actually served upon the taxpayer. 1. What are the pro-poor provisions of your new VAT Law? 2. Facilitator Food Processing Phils. Inc., is engaged in the business of meat processing. The meat being processed is imported from the USA. Processes include thawing, cutting, boiling, packing and freezing. Is the importation exempt from VAT? Explain. (Source: BIR Ruling 022-99) VAT; Processing of Meat Facilitator Foods Processing Philippines, Inc. which is engaged in the processing of meat imported from the U.S.A. and other countries, is exempt from VAT pursuant to Sec. 109 (c) of the Tax Code of 1997. (BIR Ruling No. 022-99 dated February 25, 1999) 3. X, is a VAT registered entity. During the audit investigation conducted by the BIR agents, it was discovered that X is not issuing any official receipt to its customers which fact was admitted by X.

The Commissioner of the BIR then issued a 5-day temporary closure order to the establishment of X. The following day, X filed a petition for certiorari with prayer for injunction before the Regional Trial Court. X contended that the Commissioner has no authority and jurisdiction to order the closure of the business establishment of X because it is equivalent to depriving him of his property rights without due process. Is X correct? Explain. The Commissioner or his authorized representative is hereby empowered to suspend the business operations and temporarily close the business establishment of any person for any of the following violations: (a) In the case of a VAT-registered Person. (1) Failure to issue receipts or invoices; (2) Failure to file a value-added tax return as required under Section 114; or (3) Understatement of taxable sales or receipts for the taxable quarter (b) Failure of any Person to Register as Required under Section 236. The temporary closure of the establishment shall be for the duration of not less than five (5) days and shall be lifted only upon compliance with whatever requirements prescribed by the Commissioner in the closure order. 4. Who are large taxpayers? LARGE TAX PAYER means a taxpayer who satisfies any of the following criteria: (1) Value-Added Tax (VAT) Business establishment with VAT paid or payable of at least One hundred thousand pesos (p100,000) for any quarter of the preceding taxable year; (2) Excise Tax Business establishment with excise tax paid or payable of at least One million pesos (P1,000,000) for the preceeding year; (3) Corporate Income Tax Business establishment with annual income tax paid or payable of at least One million pesos (P1,000,000) for the preceding taxable year; and (4) Withholding tax Business establishment with withholding tax payment or remittance of at least One million pesos (P1,000,000) for the preceding taxable year. 5. Best Telephone Directories, Inc., (BTDI), a corporation duly organized and existing under Philippine laws was awarded the exclusive contract to publish the Bayantel and Globe Telecom Telephone Directories, to solicit advertisements therefor, and to include and print such advertisements in the yellow pages of the directories. Is BTDI engaged in the sale of service subject to 10% VAT on gross receipts? Explain. (BIR Ruling 099-98) VAT; sale of Services Best Telephone Directories, Inc. (BTDI) which is engaged in the sale of services, was awarded the exclusive contract to publish the Bayantel and the Globe Telecom Telephone Directories to solicit advertisements and to include and print such advertisements in the yellow pages of the Directories. Payment terms for the foreign advertisers differ in that Best Telephone Directories entered into a Sales Ageny Agreement with Bizlink Communications Pte., Singapore, pursuant to which BTDI received the 50% initial payment from the Singaproe advertiser in 1998. Thus, BTDI is engaged in the sale of services and therefore subject to 10% VAT and is required t file VAT return covering the fees received from the advertisers. 6. What is gift splitting? It is a tax avoidance scheme done by splitting ones donation to a member of the family across many years rather than giving it in one huge gift in one taxable year. 7. If a real property classified as capital asset is sold for a price lower than its actual fair market value, will the insufficiency in the consideration be subject to donors tax, estate tax or capital gains tax? Explain. Transfer for Less Than Adequate and Full Consideration, - Where property, other than real property referred to in Section 24(D), is transferred for less than an adequate and full consideration in money or moneys worth, then the amount by which the fair market value of the property exceeded the value of the consideration shall, for the purpose of the tax imposed by this Chapter, be deemed a gift, and shall be included in computing the amount of gifts made during the calendar year.

8. A died in January 2009. One of the properties he left is a car which he received by way of a donation from his friend F during his lifetime. a. For purposes of computing the estate tax, what is the basis of valuation for the said car? Explain. The actual fair market value of the car at the time of death of A. b. Assuming A sold the car before his death, what is the basis of valuation for purposes of determining the cost of said car to A. Explain. The amount of the car if it was in the hand of the donor F. 9. X, a Filipino citizen died on March 12, 2004. He left properties worth Php 10,000,000.00. His estate incurred actual funeral expenses of Php 10,000,000.00. His estate incurred actual funeral expenses of Php 300,000.00. How much funeral expenses should be allowed to be deducted in the gross estate of X for purposes of computing the estate tax liability? Explain. Php 200,000.00 because the allowable funeral expense is the actual funeral expense incurred or 5% of the gross estate but in no case be more than Php 200,000.00. 10. Proceeds of cash surrender value of Xs life insurance policy Not taxable. It is an exclusion from the gross income since it represents an amount received by insured as a return of premium. 11. X Corporation secured a life insurance policy insuring the life of P, its president. X Corporation paid the premiums falling due on said policy. X Corporation deduct from its gross income the amount of Php 200,000.00 representing the premiums it paid under the above mentioned policy as an expense? Explain. No. It is non-deductible item since it is a premium paid on life insurance policy covering the life of any officer, or employee or of any person financially interested in any trade or business carried on by the taxpayer when the taxpayer is directly or indirectly a beneficiary under such policy. 12. Distinguish false return from fraudulent return A surcharge is imposed for fraudulent returns while the same is not imposed in a false return. There is a deliberate intention of resorting to an illegal method/means in defeating the payment of tax if the return is fraudulent while there is only a mistake or there is no deliberate intent of defeating the payment of tax in a false return. 13. TAX ARBITEAGE SCHEME the taxpayers otherwise allowable deduction for interest expense shall be reduced by an amount equal to 42% of the interest income subjected to final tax. Additional Notes in Taxation Law 1. Articles to Be Imported Only Through Customhouse. All articles imported into the Philippines, whether subject to duty or not, shall be entered through a customhouse at a port of entry. When Importation Begins and Deemed Terminated. Importation begins when the carrying vessel or aircraft enters the jurisdiction of the Philippines with intention to unlade therein. Importation is deemed terminated upon payment of the duties, taxes and other charges due upon the articles, or secured to be paid, at a port of entry and the legal permit for withdrawal shall have been granted, or in case said articles are free of duties, taxes and other charges, until they have legally left the jurisdiction of the customs. 2. Transaction Value. The dutiable value of an imported article subject to an ad valorem rate of duty shall be the transaction value, which shall be the price actually paid or payable for the goods when sold for export to the Philippines, adjusted by adding: (1) The following to the extent that they are incurred by the buyer but are not included in the price actually paid or payable for the imported goods: (a) Commissions and brokerage fees (except buying commissions);

(b) Cost of containers; (c) The cost of packing, whether for labor or materials; (d) The value, apportioned as appropriate, of the following goods and services: materials, components, parts and similar items incorporated in the imported goods; tools; dies; moulds and similar items used in the production of imported goods; materials consumed in the production of the imported goods; and engineering, development, artwork, design work and plans and sketches undertaken elsewhere than in the Philippines and necessary for the production of imported goods, where such goods and services are supplied directly or indirectly by the buyer free of charge or at a reduced cost for use in connection with the production and sale for export of the imported goods; (e) The amount of royalties and license fees related to the goods being valued that the buyer must pay, either directly or indirectly, as a condition of sale of the goods to the buyer; (2) The value of any part of the proceeds of any subsequent resale, disposal or use of the imported goods that accrues directly or indirectly to the seller; (3) The cost of transport of the imported goods from the port of exportation to the port of entry in the Philippines; (4) Loading, unloading and handling charges associated with the transport of the imported goods from the country of exportation to the port of entry in the Philippines; and (5) The cost of insurance. 3. The Court Administrator, in his Evaluation dated February 7 ,2003, stated that the questioned TRO was clearly illegal and issued in excess of jurisdiction. He cited Rallos v. Gako, Jr., which held that Regional Trial Courts are devoid of any competence to pass upon the validity or regularity of seizure and forfeiture proceedings conducted by the Bureau of Customs or to enjoin or otherwise interfere with these proceedings. The rule enunciated in Mison vs. Trinidadis clear: the Collector of Customs has exclusive jurisdiction over seizure and forfeiture proceedings. The RTCs are precluded from assuming cognizance over such matters even through petitions for certiorari, prohibition or mandamus. Moreover, even if the seizure by the Collector of Customs were illegal, which has yet to be proven, such act does not deprive the Bureau of Customs of jurisdiction thereon. The Court Administrator concluded that the act of respondent Judge in issuing the questioned TRO amounted to gross ignorance of the law. Not the only reason why trial courts are enjoined from issuing orders releasing imported articles under seizure and forfeiture proceedings by the Bureau of Customs. Administrative Circular No. 7-99 takes into account the fact that the issuance of TROs and the granting of writs of preliminary injunction in seizure and forfeiture proceedings before the Bureau of Customs may arouse suspicion that the issuance of grant was for considerations other than the strict merits of the case. Furthermore, respondent Judges actuation goes against settled jurisprudence that the Collector of Customs has exclusive jurisdiction over seizure and forfeiture proceedings, and regular courts cannot interfere with his exercise thereof or stifle and put it to naught. Even if it be assumed that in the exercise of the Collector of Customs of its exclusive jurisdiction over seizure and forfeiture cases, a taint of illegality is correctly imputed, the most that can be said is that under these circumstances, grave abuse of discretion may oust it of its jurisdiction. This does not mean, however, that the trial court

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Astm D2000 PDFDokumen38 halamanAstm D2000 PDFMariano Emir Garcia OdriozolaBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Affidavit of Good FaithDokumen1 halamanAffidavit of Good FaithAibo GacuLa100% (1)

- Micro - Systemic Bacteriology Questions PDFDokumen79 halamanMicro - Systemic Bacteriology Questions PDFShashipriya AgressBelum ada peringkat

- eBIR FormsDokumen31 halamaneBIR FormsAibo GacuLa71% (7)

- Rubber Band Arrangements - Concert BandDokumen25 halamanRubber Band Arrangements - Concert BandJonatas Souza100% (1)

- Affidavit of ConsentDokumen1 halamanAffidavit of ConsentAibo GacuLa50% (2)

- Defective Service of SummonDokumen9 halamanDefective Service of SummonAibo GacuLa100% (1)

- Mandapat V Add ForceDokumen4 halamanMandapat V Add ForceAibo GacuLaBelum ada peringkat

- Crim Law I Reviewer 2017 Updated Esguerra NotesDokumen132 halamanCrim Law I Reviewer 2017 Updated Esguerra NotesAibo GacuLa100% (3)

- Affidavit of Explanation: Republic of The Philippines) Province of - ) S.S. - )Dokumen1 halamanAffidavit of Explanation: Republic of The Philippines) Province of - ) S.S. - )Aibo GacuLaBelum ada peringkat

- Affidavit of Loss: Republic of The Philippines) - ) S.S. - )Dokumen1 halamanAffidavit of Loss: Republic of The Philippines) - ) S.S. - )Aibo GacuLaBelum ada peringkat

- People Vs BonDokumen15 halamanPeople Vs BonAibo GacuLaBelum ada peringkat

- G.R. No. L-26815 May 26, 19810 ADOLFO L. SANTOS, Petitioner, ABRAHAM SIBUG and COURT OF APPEALS, RespondentsDokumen6 halamanG.R. No. L-26815 May 26, 19810 ADOLFO L. SANTOS, Petitioner, ABRAHAM SIBUG and COURT OF APPEALS, RespondentsAibo GacuLaBelum ada peringkat

- T2-Baliwag Transit vs. CADokumen4 halamanT2-Baliwag Transit vs. CAAibo GacuLaBelum ada peringkat

- Department of Foreign Affairs Vs National Labor Relations CommissionDokumen2 halamanDepartment of Foreign Affairs Vs National Labor Relations CommissionAibo GacuLaBelum ada peringkat

- MotionDokumen2 halamanMotionAibo GacuLaBelum ada peringkat

- Empanelled Hospitals List Updated - 06-12-2022 - 1670482933145Dokumen19 halamanEmpanelled Hospitals List Updated - 06-12-2022 - 1670482933145mechmaster4uBelum ada peringkat

- Taxation Law 1Dokumen7 halamanTaxation Law 1jalefaye abapoBelum ada peringkat

- What Is A Fired Heater in A RefineryDokumen53 halamanWhat Is A Fired Heater in A RefineryCelestine OzokechiBelum ada peringkat

- Sodexo GermanyDokumen13 halamanSodexo GermanySandeep Kumar AgrawalBelum ada peringkat

- What Are Some of The Best Books On Computer ScienceDokumen9 halamanWhat Are Some of The Best Books On Computer ScienceSarthak ShahBelum ada peringkat

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDokumen3 halamanProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefBelum ada peringkat

- Channel & Lomolino 2000 Ranges and ExtinctionDokumen3 halamanChannel & Lomolino 2000 Ranges and ExtinctionKellyta RodriguezBelum ada peringkat

- Property House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusDokumen1 halamanProperty House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusjiminabottleBelum ada peringkat

- JCIPDokumen5 halamanJCIPdinesh.nayak.bbsrBelum ada peringkat

- For ClosureDokumen18 halamanFor Closuremau_cajipeBelum ada peringkat

- PronounsDokumen6 halamanPronounsHải Dương LêBelum ada peringkat

- Angelo (Patrick) Complaint PDFDokumen2 halamanAngelo (Patrick) Complaint PDFPatLohmannBelum ada peringkat

- 7 ElevenDokumen80 halaman7 ElevenakashBelum ada peringkat

- GA Power Capsule For SBI Clerk Mains 2024 (Part-2)Dokumen82 halamanGA Power Capsule For SBI Clerk Mains 2024 (Part-2)aa1904bbBelum ada peringkat

- Modified Airdrop System Poster - CompressedDokumen1 halamanModified Airdrop System Poster - CompressedThiam HokBelum ada peringkat

- Course DescriptionDokumen54 halamanCourse DescriptionMesafint lisanuBelum ada peringkat

- Comparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionDokumen4 halamanComparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionSuril VithalaniBelum ada peringkat

- Process Description of Function For Every Unit OperationDokumen3 halamanProcess Description of Function For Every Unit OperationMauliduni M. AuniBelum ada peringkat

- PR Earth Users Guide EMILY1Dokumen2 halamanPR Earth Users Guide EMILY1Azim AbdoolBelum ada peringkat

- National Employment Policy, 2008Dokumen58 halamanNational Employment Policy, 2008Jeremia Mtobesya0% (1)

- CH 15Dokumen58 halamanCH 15Chala1989Belum ada peringkat

- Forces L2 Measuring Forces WSDokumen4 halamanForces L2 Measuring Forces WSAarav KapoorBelum ada peringkat

- T688 Series Instructions ManualDokumen14 halamanT688 Series Instructions ManualKittiwat WongsuwanBelum ada peringkat

- Design Practical Eden Swithenbank Graded PeDokumen7 halamanDesign Practical Eden Swithenbank Graded Peapi-429329398Belum ada peringkat

- The Serious Student of HistoryDokumen5 halamanThe Serious Student of HistoryCrisanto King CortezBelum ada peringkat

- Physico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegDokumen9 halamanPhysico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegZyuha AiniiBelum ada peringkat

- Risha Hannah I. NazarethDokumen4 halamanRisha Hannah I. NazarethAlpaccino IslesBelum ada peringkat