Agenda 16.05.2013

Diunggah oleh

write2hannanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Agenda 16.05.2013

Diunggah oleh

write2hannanHak Cipta:

Format Tersedia

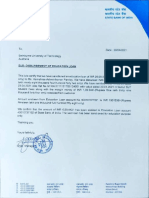

OFFICE OF THE ADDITIONAL COMMISSIONER INLAND REVENUE ENFORCEMENT & COLLECTION RANGE-I, MULTAN ZONE, 6-A+4/3A, OPPOSITE LAHORE

HIGH COURT, MULTAN BENCH, MULTAN.

Telephone: Fax:

061-4588155 061-4588155

No. E&C-R-I/Z-MN/RTO/MN/12-13______ Date: _______________________.

The Commissioner Inland Revenue, Multan Zone, RTO, Multan. Subject:- FORTNIGNTLY MEETINGS WITH ZONAL COMMISSIONERSKindly refer to your office letter No. CIR-MN/RTO/2012-13/4386 dated 18.04.2013 on the subject cited above. The requisite information in respect of this E&C Range-I, Multan Zone, RTO, Multan for meeting scheduled to be held on 29.04.2013, is submitted as under:S.# 1. DECISION Preparation of list of cases of dealers/distributors/whole sellers of sugar mills, fertilizers/ghee/cement etc. for broadening of tax base. ACTION TO BE TAKEN 07 Cases have been identified, and STR-6 have been issued for compulsory Sales Tax Registration for broadening of tax base. (List attached) TIME 23.04.2013

Verification of business activity of NIL and nonfilers of sales tax cases of manufacturers from the electricity/gas Bills and furnishing of certificate by all E&C Units Incharge of three zones regarding initiation of legal action where business is being conducted.

3.

Up-dation of record of non-filers of income tax, non-filers/short filers/Nil filers of sales tax, deregistration and furnishing of certificate by all E&C Unit In charges of three Zones.

The office of Data Base Administrator 26.04.2013 (PRAL) RTO, Multan has been approached for provision of reference Nos. of electricity & Sui Gas bills in respect of Null filer/Non-filer of Sales Tax manufacturer. As said information is received, WAPDA and SNGPL shall be approached for further necessary action as desired. Non Filers Income tax: 25.04.2013 Total No. of Non-filers. Notices issued. Returns received. Non Filers of Sales tax Total No. of Non-filers. Notices issued. Returns received. 19,324 6,220 208 1,226 1,226 40

30 cases are under process for recommendation to Commissioner IR, Multan Zone, RTO, Multan, for suspension of their Sales Tax Registration Numbers. Nil Filers: There are 124 registered persons showing higher input tax as compared with output tax and filing Nil Sales Tax returns. Out of above cases, 50 cases were pointed out in which output tax was greater than input tax. After scrutiny, it has been observed that

none of units is short filer. All 50 units are adjusting their carry forward amounts. Hence list of all 124 cases is being transferred to Audit Range for action u/s 38 of the Sales Tax Act, 1990 to ascertain genuineness of their carry forward amounts. Short Filers: Total No. of Short filers. 85 Notices issued. 85 Amount taken into (-) a/c. Rs.4.35(M) Preparation of list of cases where action u/s 122(5-A) completed during the last year and current year separate indicating latest recovery position/appeal status Updated position of Post Refund Audits, demand created and status of recovery/appeal etc. Tax year wise break up of cases selected audit and completion thereof indicating demand created/recovered/appeal status.

NA

23.04.2013

4. 5.

NA

29.04.2013

6.

NA

29.04.2013

7.

Preparation of lists and latest position of List of arrears attached. recovery out of arrears of Rs.500,000 and above of Income Tax, Sales Tax/FED and making request for early hearing of appeals

29.04.2013

Detail of measure taken for achievement of 1) Focus on recovery 23.04.2013 2) Assessment u/s 122(c) of Income budgetary targets of Income Tax/Sales Tax Tax Ordinance 2001 3) Creation of Sales Tax Demand against the persons liable to registered Case-wise updated list of cases of withholding List attached. 23.04.2013 agents orders u/s 161/205 passed during the last year and this year so far indicating recovery status Committee for tracing and handing over of the record of Sales Tax Orders in original. Orders in appeals, order of tribunals, Orders of High Court and Supreme Court issued prior to the year 2008 NA 25.04.2013

10

11.

Election, 2013 Phase-III, Detailed scrutiny of Compliance is being made accordingly. 1141 case and follow up action.

(MUHAMMAD NAEEM) ADDITIONAL COMMISSIONER INLAND REVENUE.

OFFICE OF THE ADDITIONAL COMMISSIONER INLAND REVENUE ENFORCEMENT & COLLECTION RANGE-I, MULTAN ZONE, 6-A+4/3A, OPPOSITE LAHORE HIGH COURT, MULTAN BENCH, MULTAN. Telephone: Fax: 061-4588155 061-4588155 No. E&C-R-I/Z-MN/RTO/MN/12-13______ Date: _______________________.

The Commissioner Inland Revenue, Multan Zone, RTO, Multan. Subject:- FORTNIGNTLY MEETINGS WITH ZONAL COMMISSIONERSKindly refer to your office letter No. CIR-MN/RTO/2012-13/4386 dated 18.04.2013 on the subject cited above.

Point wise comments for meeting schedule to be held on 29.04.2013 are submitted as under:-

S.NO 1.

DECISION

Preparation of list of cases of dealers/distributors/whole sellers of sugar mills, fertilizers/ghee/cement etc. for broadening of tax base Verification of business activity of NIL and non-filers of sales tax cases of manufacturers from the electricity/gas Bills and furnishing of certificate by all E&C Units Incharge of three zones regarding initiation of legal action where business is being conducted.

ACTION TO BE TAKEN 07 Cases List Attached.

TIME 23.04.2013

108 notices have been 26.04.2013 issued on the bases of Electricity and Sui Gas bills. Practically information containing Gas and WAPDA bills are having different names as provided by the S.Tax Registered persons. However Show Cause Notices in _____ cases have been issued.

Non Filers: 207 cases of non filers pertain to this unit. Letters has been issued and 21 cases has been recommended for suspension of their Sales Tax No. Nil Filers: 50 cases of nill filers pertains to this unit. After scrutiny it has been obseved that none of unit is short filer. All units are adjusting their carry forwrd amounts. Hence list is being transferred to Audit Range for action u/s 38 of Sales Tax Act1990.. Short Filers: Letters have been issued to 3 cases of short filers. But they have already paid the amount. 25.04.2013

3.

Up-dation of record of non-filers of income tax, non-filers/short filers/Nil filers of sales tax, deregistration and furnishing of certificate by all E&C Unit In charges of three Zones.

4. 5.

Preparation of list of cases where action u/s 122(5-A) completed during the last year and current year separate indicating latest recovery position/appeal status Updated position of Post Refund Audits, demand created and status of recovery/appeal etc. Tax year wise break up of cases selected audit and completion thereof indicating demand created/recovered/appeal status. Preparation of lists and latest position of recovery out of arrears of Rs.500,000 and above of Income Tax, Sales Tax/FED and making request for early hearing of appeals

NA

23.04.2013

NA

29.04.2013

6.

NA

29.04.2013

7.

List of arrears attached

29.04.2013

Detail of measure taken for achievement of budgetary targets of Income Tax/Sales Tax

23.04.2013 1) Focus on recovery 2) Assessment u/s 122(c) of Income Tax Ordinance 2001 3) Creation of Sales Tax Demand against the persons liable to registered NA 23.04.2013

Case-wise updated list of cases of withholding agents orders u/s 161/205 passed during the last year and this year so far indicating recovery status Committee for tracing and handing over of the record of Sales Tax Orders in original. Orders in appeals, order of tribunals, Orders of High Court and Supreme Court issued prior to the year 2008 Election, 2013 Phase-III, Detailed scrutiny of 1141 case and follow up action.

10

NA

25.04.2013

11.

Compliance has been made accordingly.

Anda mungkin juga menyukai

- Too Shy? by Ginger E. Blume, PH.DDokumen2 halamanToo Shy? by Ginger E. Blume, PH.Dwrite2hannanBelum ada peringkat

- Muhammad Shafiq Cloth Merchant Madina Market Andhi Khuimultan. 2009 325600Dokumen2 halamanMuhammad Shafiq Cloth Merchant Madina Market Andhi Khuimultan. 2009 325600write2hannanBelum ada peringkat

- Office of The Additional Commissioner Inland Enforcement & Collection Zone-I, 357-Khanewal Road, MultanDokumen1 halamanOffice of The Additional Commissioner Inland Enforcement & Collection Zone-I, 357-Khanewal Road, Multanwrite2hannanBelum ada peringkat

- Naughty FingersDokumen119 halamanNaughty Fingerslongdragon770% (1)

- ACR FormDokumen8 halamanACR Formwrite2hannanBelum ada peringkat

- List of Top Arrear Cases in Respect of E&C Range-I, Multan Zone, Regional Tax Office MultanDokumen9 halamanList of Top Arrear Cases in Respect of E&C Range-I, Multan Zone, Regional Tax Office Multanwrite2hannanBelum ada peringkat

- Ma0102 13Dokumen59 halamanMa0102 13write2hannanBelum ada peringkat

- Sex 1Dokumen14 halamanSex 1SomVibol50% (4)

- Cost Audit Handbook 3rdDokumen110 halamanCost Audit Handbook 3rdwrite2hannan100% (1)

- Mulaigal Desi Breast MarpagamDokumen22 halamanMulaigal Desi Breast Marpagamwrite2hannanBelum ada peringkat

- Having A Healthy Pregnancy: The Wisdom and Science of Growing A BabyDokumen20 halamanHaving A Healthy Pregnancy: The Wisdom and Science of Growing A Babywrite2hannanBelum ada peringkat

- Writing Recommendation LettersDokumen2 halamanWriting Recommendation Letterswrite2hannanBelum ada peringkat

- Emoticon SMSDokumen2 halamanEmoticon SMSwrite2hannanBelum ada peringkat

- Icmap Signed Mou 20082k9Dokumen1 halamanIcmap Signed Mou 20082k9write2hannanBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Revised Tax Position Paper ENGDokumen8 halamanRevised Tax Position Paper ENGPedro Dias da SilvaBelum ada peringkat

- Sol Constitution and By-LawsDokumen13 halamanSol Constitution and By-LawsRussel SirotBelum ada peringkat

- ITGC Guidance 2Dokumen15 halamanITGC Guidance 2wggonzaga0% (1)

- Ab-59 Ice SyllabusDokumen44 halamanAb-59 Ice SyllabuscoxshulerBelum ada peringkat

- TCS/BM/9/SE/2022-23 April 11, 2022: Sub: DividendDokumen34 halamanTCS/BM/9/SE/2022-23 April 11, 2022: Sub: DividendACE 2111Belum ada peringkat

- Annual Report 2015 16 Esaar India LimitedDokumen66 halamanAnnual Report 2015 16 Esaar India LimitedRishikesh KashyapBelum ada peringkat

- Project On Oil Palm India KottayamDokumen62 halamanProject On Oil Palm India KottayamAkhilAS82% (11)

- Audit Theory ReviewerDokumen4 halamanAudit Theory ReviewerJust AlexBelum ada peringkat

- Community Project Request Project Title: LocationDokumen9 halamanCommunity Project Request Project Title: LocationRisty Tuballas AdarayanBelum ada peringkat

- Iso13485 QM06 MngResponsibilityDokumen9 halamanIso13485 QM06 MngResponsibilityhitham shehataBelum ada peringkat

- Msiso19011 2011 PrevpdfDokumen5 halamanMsiso19011 2011 PrevpdfFaiz SabianBelum ada peringkat

- Financial Analysis - Apple IncDokumen15 halamanFinancial Analysis - Apple IncJabri Juhinin100% (1)

- Giving Finances Assesment PackDokumen7 halamanGiving Finances Assesment PacksimitimbucBelum ada peringkat

- FR Exam Focus Notes 202021Dokumen169 halamanFR Exam Focus Notes 202021Kevin Ch LiBelum ada peringkat

- Conclusion and Reporting PDFDokumen7 halamanConclusion and Reporting PDFRhn Habib RehmanBelum ada peringkat

- AN Assignment On Nursing Audit SUBJECT: Nursing ManagementDokumen6 halamanAN Assignment On Nursing Audit SUBJECT: Nursing ManagementMansi Dabola100% (1)

- FSSC 22000 Version 5 Quick Start GuideDokumen26 halamanFSSC 22000 Version 5 Quick Start GuideMark Kylo100% (1)

- Bir Form 0605Dokumen2 halamanBir Form 0605crypto RN100% (1)

- Quality AssuranceDokumen22 halamanQuality Assurancenoel1974100% (6)

- BFA 713 Solution Past ExamDokumen17 halamanBFA 713 Solution Past ExamPhuong Anh100% (1)

- Procurement ManualDokumen14 halamanProcurement ManualHussein Taofeek OlalekanBelum ada peringkat

- Atomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response CompositeDokumen16 halamanAtomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response Compositedmcook3Belum ada peringkat

- HBS Case Study - FinanceDokumen8 halamanHBS Case Study - Financerahul84803100% (1)

- 0efd540ca24e3b7470a3673d1307d5adDokumen93 halaman0efd540ca24e3b7470a3673d1307d5adAtiaTahiraBelum ada peringkat

- Internal Control and Fraud PreventionDokumen247 halamanInternal Control and Fraud Preventiondiana_mensah1757100% (3)

- Education Loan & Valuation ReportDokumen23 halamanEducation Loan & Valuation ReportRikhil NairBelum ada peringkat

- Coa R2013-014Dokumen123 halamanCoa R2013-014duskwitchBelum ada peringkat

- Report - Management Accounting Practice & Implement in BangladeshDokumen62 halamanReport - Management Accounting Practice & Implement in Bangladeshjamilrajib88% (8)

- GBIDokumen16 halamanGBIarvindBelum ada peringkat

- COSO CROWE COSO Internal Control Integrated FrameworkDokumen36 halamanCOSO CROWE COSO Internal Control Integrated Frameworkgirish sainiBelum ada peringkat