Market Watch Daily 21.06.2013

Diunggah oleh

Randora LkDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Market Watch Daily 21.06.2013

Diunggah oleh

Randora LkHak Cipta:

Format Tersedia

DNH Financial (Pvt) Ltd.

www.dnhfinancial.com +94115700777

Daily

21st June 2013

Market Performance

S&P SL20

Market Indices

ASI

6,400 6,300

3,600 3,500 3,400

DNH MARKET WATCH

6,200 6,100

17/06/2013 19/06/2013

18/06/2013

3,300

ASI 20/06/2013 S&P SL20

21/06/2013

3,200

ASPI S&P SL 20 Turnover (mn) Foreign Purchases (mn) Foreign Sales (mn) Traded Companies Market PER (X) Market Cap (LKR bn) Market Cap (US$ bn) Dividend Yield (%) Price to Book (X)

21.06.2013 6,155 3,467 565.0 221.1 53.6 240 16.7 2,364 18.2 2.2 2.3

20.06.2013 6,211 3,492 3,475.9 2,826.4 3,009.4 241 16.9 2,385 18.4 2.2 2.3

%Chg. -0.9 -0.7 -83.7 -92.2 -98.2 -0.4 -1.2 -0.9 -1.0 0.0 0.0

Market Outlook

The market closed the week on a negative note with the ASPI losing 0.9% to end at 6155. Turnover recorded LKR565 mn with trading in Distilleries, Sampath Bank and National Development Bank accounting for 39% of the total. Losers outpaced winners with SMB Leasing(X), Beruwala Walk Inn and Ceylon Leather(W0014) falling by 20.0%, 16.1% and 12.5% and offsetting advances in Good Hope, Colombo Investment Trust and Industrial Asphalts which rose by 19.0%, 14.4% and 11.6% respectively. Meanwhile, global markets fell as investors reacted negatively to the possible scaling back of the Feds stimulus measures later this year.

Market Trajectory In terms of market trajectory, we believe that the current price weakness in the bourse provides an opportunity for medium to long-term investors to pick up attractively priced growth stocks. Although sentiment and liquidity may impact the market in the near term, we believe that Sri Lankas structural story is intact and compelling with a strong multiplier effect on corporate EPS growth. Consequently we advise investors to enter the market in an informed manner carefully selecting sectors and counters that will fully benefit from positive domestic economics.

12

Turnover Composition & Net Foreign Flows

17,500 15,000

39% 61%

LKR Mn

12,500 10,000 7,500 5,000 2,500

Foreign

Domestic

0 YTD MTD WTD

Gainers /Losers (%)

Sigiriya Village Ceylon Leather (W0014) Beruwala Walk Inn SMB Leasing(X) Kalamazoo Industrial Asphalts Colombo Investment Good Hope

-8.9 -12.5 -16.1 -20.0

11.0 11.6

14.4 19.0

Significant Trades

100 80

LKR Mn

While we do admit that companies that have a high import or energy content as part of their cost structure or are significantly leveraged may continue to be challenged, robust volume growth however could enable them to generate firm revenues and cashflows. In this respect, we advise investors to seek high quality growth companies with the domestic focus in order to build a robust portfolio that will perform in a complete market cycle.

60 40 20 0 DIST SAMP NDB HNB

BRICS Performance Vs ASPI (YTD dollarised)

16.0%

Market Liquidity (Turnover)

3000

LKR Mn

8.0% 0.0% -8.0%

-16.0%

2250 1500 750

17/06/2013 20/06/2013 21/06/2013

18/06/2013 19/06/2013

-24.0% -32.0%

0 Brazil Russia India China South Africa Sri Lanka

Global Markets

Sri Lanka - ASPI India - Sensex Pakistan - KSE 100 Taiwan Weighted Singapore - Straits Times Hong Kong - Hang Seng S&P 500 Euro Stoxx 50 MSCI Asia Pacific

Index 6,155 18,774 22,015 7,793 3,124

20,263

1,588 2,606 128

%Chg. -0.90 0.29 -0.55 -1.34 -0.28 -0.59 -2.50 0.76 -4.14

Interest Rates & Currencies

Prime Lending Rate (Avg. Weighted) Deposit Rate (Avg. Weighted) Treasury Bill Rate (360 Days) Dollar Denominated Bond Rate Inflation Rate (Annual Average) LKR/US$ (Selling Rate) LKR/EURO (Selling Rate) Gold (USD/oz) Oil (Brent) (USD/barrel)

21.06.2013 12.4% 10.7% 10.9% 5.9% 7.3% 130.0 172.8 1,277.8 102.8

Disclaimer

This Review is prepared and issued by DNH Financial (Pvt.) Ltd. (DNH) based on information in the public domain, internally developed and other sources, believed to be correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, DNH and/or its Directors, employees, are not responsible for the correctness, usefulness, reliability of same. DNH may act as a Broker in the investments which are the subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is based, before its publication. DNH and/or its principal , their respective Directors, or Employees may also have a position or be otherwise interested in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against DNH with respect to the Review and agree to indemnify and hold DNH and/or its principal, their respective directors and employees harmless to the fullest extent allowed by law regarding all matters related to your use of this Review.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- 1.a. Taxi Articles of IncorporationDokumen6 halaman1.a. Taxi Articles of IncorporationNyfer JhenBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- 2017 L 3 & L4 Mini Assignments & Summary SolutionsDokumen9 halaman2017 L 3 & L4 Mini Assignments & Summary SolutionsZhiyang Zhou67% (3)

- TQM Multiple Choice QuestionsDokumen14 halamanTQM Multiple Choice Questionskandasamykumar67% (3)

- Trust and CommitmentDokumen11 halamanTrust and CommitmentdjumekenziBelum ada peringkat

- EN ITIL4 FND 2019 Questions PDFDokumen11 halamanEN ITIL4 FND 2019 Questions PDFPhung OngBelum ada peringkat

- Product IdeationDokumen13 halamanProduct IdeationHenry Rock100% (1)

- RIMS School Magazine Project ManagementDokumen40 halamanRIMS School Magazine Project ManagementAditya Vora75% (12)

- Global Market Update - 04 09 2015 PDFDokumen6 halamanGlobal Market Update - 04 09 2015 PDFRandora LkBelum ada peringkat

- Weekly Update 04.09.2015 PDFDokumen2 halamanWeekly Update 04.09.2015 PDFRandora LkBelum ada peringkat

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDokumen4 halamanWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkBelum ada peringkat

- Wei 20150904 PDFDokumen18 halamanWei 20150904 PDFRandora LkBelum ada peringkat

- 03 September 2015 PDFDokumen9 halaman03 September 2015 PDFRandora LkBelum ada peringkat

- Press 20150831ebDokumen2 halamanPress 20150831ebRandora LkBelum ada peringkat

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDokumen3 halamanICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkBelum ada peringkat

- Daily 01 09 2015 PDFDokumen4 halamanDaily 01 09 2015 PDFRandora LkBelum ada peringkat

- Press 20150831ea PDFDokumen1 halamanPress 20150831ea PDFRandora LkBelum ada peringkat

- Global Market Update - 04 09 2015 PDFDokumen6 halamanGlobal Market Update - 04 09 2015 PDFRandora LkBelum ada peringkat

- CCPI - Press Release - August2015 PDFDokumen5 halamanCCPI - Press Release - August2015 PDFRandora LkBelum ada peringkat

- Sri0Lanka000Re0ounting0and0auditing PDFDokumen44 halamanSri0Lanka000Re0ounting0and0auditing PDFRandora LkBelum ada peringkat

- Results Update Sector Summary - Jun 2015 PDFDokumen2 halamanResults Update Sector Summary - Jun 2015 PDFRandora LkBelum ada peringkat

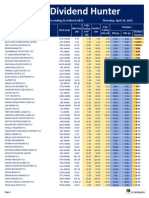

- Dividend Hunter - Apr 2015 PDFDokumen7 halamanDividend Hunter - Apr 2015 PDFRandora LkBelum ada peringkat

- Earnings & Market Returns Forecast - Jun 2015 PDFDokumen4 halamanEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkBelum ada peringkat

- Earnings Update March Quarter 2015 05 06 2015 PDFDokumen24 halamanEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkBelum ada peringkat

- BRS Monthly (March 2015 Edition) PDFDokumen8 halamanBRS Monthly (March 2015 Edition) PDFRandora LkBelum ada peringkat

- Results Update For All Companies - Jun 2015 PDFDokumen9 halamanResults Update For All Companies - Jun 2015 PDFRandora LkBelum ada peringkat

- Dividend Hunter - Mar 2015 PDFDokumen7 halamanDividend Hunter - Mar 2015 PDFRandora LkBelum ada peringkat

- Daily - 23 04 2015 PDFDokumen4 halamanDaily - 23 04 2015 PDFRandora LkBelum ada peringkat

- Dividend Hunter - Mar 2015 PDFDokumen7 halamanDividend Hunter - Mar 2015 PDFRandora LkBelum ada peringkat

- Microfinance Regulatory Model PDFDokumen5 halamanMicrofinance Regulatory Model PDFRandora LkBelum ada peringkat

- GIH Capital Monthly - Mar 2015 PDFDokumen11 halamanGIH Capital Monthly - Mar 2015 PDFRandora LkBelum ada peringkat

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDokumen12 halamanCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkBelum ada peringkat

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDokumen9 halamanJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkBelum ada peringkat

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Dokumen5 halamanN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkBelum ada peringkat

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDokumen9 halamanChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkBelum ada peringkat

- The Morality of Capitalism Sri LankiaDokumen32 halamanThe Morality of Capitalism Sri LankiaRandora LkBelum ada peringkat

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDokumen4 halamanWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkBelum ada peringkat

- Daily Stock Watch 08.04.2015 PDFDokumen9 halamanDaily Stock Watch 08.04.2015 PDFRandora LkBelum ada peringkat

- ERC Non-Conformance Corrective ProcedureDokumen13 halamanERC Non-Conformance Corrective ProcedureAmanuelGirmaBelum ada peringkat

- BBA Syllabus 2013-2016Dokumen59 halamanBBA Syllabus 2013-2016GauravsBelum ada peringkat

- Investors PerceptionDokumen30 halamanInvestors PerceptionAmanNagaliaBelum ada peringkat

- Ticket Number 1235920483363824832Dokumen1 halamanTicket Number 1235920483363824832Mehraj BhatBelum ada peringkat

- Ghani Glass AccountsDokumen28 halamanGhani Glass Accountsumer2118Belum ada peringkat

- Obtained From SQA Difference Between Iso 9001 and As 9100Dokumen44 halamanObtained From SQA Difference Between Iso 9001 and As 9100Kristian GarcidueñasBelum ada peringkat

- P - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaDokumen8 halamanP - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaNurul SyafitriiBelum ada peringkat

- 1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameDokumen3 halaman1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameRose O. DiscalzoBelum ada peringkat

- Erlk CGD enDokumen322 halamanErlk CGD enkabjiBelum ada peringkat

- RM Doberman ContractDokumen8 halamanRM Doberman Contractapi-234521777Belum ada peringkat

- Merger of UBS and SBC in 1997Dokumen20 halamanMerger of UBS and SBC in 1997Zakaria SakibBelum ada peringkat

- MIS AssignmentDokumen16 halamanMIS AssignmentUsman Tariq100% (1)

- BDC 071182 Ec 9Dokumen12 halamanBDC 071182 Ec 9Morty LevinsonBelum ada peringkat

- Purchase confirmation emailDokumen1 halamanPurchase confirmation emailAndrés HidalgoBelum ada peringkat

- Latest Wage OrderDokumen8 halamanLatest Wage OrderSilvano FrechieleneBelum ada peringkat

- ICCFA Magazine January 2016Dokumen116 halamanICCFA Magazine January 2016ICCFA StaffBelum ada peringkat

- Types of TaxesDokumen6 halamanTypes of TaxesRohan DangeBelum ada peringkat

- United States Bankruptcy Court Southern District of New YorkDokumen2 halamanUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsBelum ada peringkat

- Priya ResumeDokumen3 halamanPriya Resumesunnychadha0548Belum ada peringkat

- Modern Systems Analysis and Design: The Sources of SoftwareDokumen39 halamanModern Systems Analysis and Design: The Sources of SoftwareNoratikah JaharudinBelum ada peringkat

- Human Resource Department: Subject: General PolicyDokumen19 halamanHuman Resource Department: Subject: General PolicyAhmad HassanBelum ada peringkat

- Two Pesos v. Taco CabanaDokumen2 halamanTwo Pesos v. Taco CabanaNenzo Cruz100% (1)

- SAP SD Free GoodsDokumen3 halamanSAP SD Free GoodsRahul MohapatraBelum ada peringkat