M&A Synergy

Diunggah oleh

Siva UdJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

M&A Synergy

Diunggah oleh

Siva UdHak Cipta:

Format Tersedia

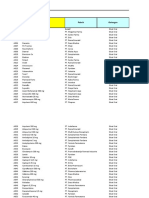

Acquisition Plan - JAKKS Financial Summary of Synergy

Summary of Expected Synergy

(Thousands)

Appendix D

1) Cost Synergy: Saba has offices in 7 locations all over the world of which 5 offices are overlap a. Rent Expense per office per year b. Rent Saving in closing 5 offices per year c. General Administrative Expense per office per year d. Saving on Administrative expense per year PV of Total Saving on closing Extra offices(Discounted with the cost of of Debt of 6.7% as it is a Certain Cost Synergy) Sales and Marketing expense of Saba is currently 44% of its Revenue. There will be minimum 5%(similar M&A result) reduction in S&M expense as a result of Post M&A Integration Revenue of Saba(4% growth rate first 2 years and 10% after that) Yearly Savings on Sales and Marketing Expense PV of Total Savings on S&M Integration( Discounted by using the WACC - 9% of Saba as it is not certain Cost synergy) 2) Revenue Synergy Saba has a Profit Margin of 63% and Salesforce has a profit margin of 77%. Saledforce can have same Profit margin from Saba because of its premium brand name. Increase in Revenue due to premium pricing PV of Total increasein Revenue(Discounted with the rate of equity -10% of Saba as the risk of revenue synergy is more than cost synergy) 3) Base Synergy Acquiring Saba gives Salesforce to make a entry in Cloud services related to e-learning and Talent Management. Salesforce with its expertice in cloud services and with Saba's expertise on Talent Management can new features in Talent managemnt cloud services Revenue of Saba would grow by Average growth rate of Saleforce of 8 % due to product exposure to 104000 of salesforce current customers, New product development by Salesforce) Acquisition Plan JAKKS

2013

2014

2015

2016

2017

571 2,857 2,226 11,129

2,857 11,129

2,857 11,129

2,857 11,129

2,857 11,129

2,857 11,129

57,811

11,809.55

46,001.17

126,175.92 6,308.80

131,222.96 6,561.15

144,345.25 7,217.26

158,779.78 7,938.99

174,657.76 8,732.89

28,183

28,183.28

(Thousands)

2013

2014

2015

2016

2017

17,664.63

18,371.21

20,208.34

22,229.17

24,452.09

76,790

76,790.04

(Thousands)

2013

2014

2015

2016

2017

141,720.79 1 of 5

155,892.87

171,482.16 6/26/2013

Acquisition Plan - JAKKS Financial Summary of Synergy

Incremental Net Income from Net profit margin of Saba PV of Total Incremental Net Income for Saba Calculated with the venture capital rate of return of 30% Sales of Saleforce will increase by 1% for three years cross selling its current products to Saba's customers(800 global customers and 10.2 million users) Incremental revenue of Salesforce Incremental Net Income of Saleforce from Net profit marging of .% PV of Total Incremental Net Income for Sales force Calculated with the venture capital rate of return of 30% 425,162.38 467,678.62

Appendix D

514,446.48

837,940

837,939.51

30501.95 18850.2051

30501.95 18850.2051

30501.95 18850.2051 0

34,234

34,234.10

Total Present Value of Synergy in millions

1,035

Acquisition Plan JAKKS

2 of 5

6/26/2013

Acquisition Plan - JAKKS Financial Summary of Synergy

Appendix D

Acquisition Plan JAKKS

3 of 5

6/26/2013

Saba 2011 Revenues: Subscription License Professional services Total revenues Cost of revenues: Subscription License Professional services Amortization of acquired developed technology Total cost of revenues Gross profit Operating expenses: Research and development Sales and marketing General and administrative Restructuring Amortization of purchased intangible assets Total operating expenses Income (loss) from operations Interest and other income (expense), net Interest expense Income (loss) before provision for income taxes Provision for income taxes Net income (loss) $ $ 64,539 18,189 33,929 116,657 16,089 946 25,186 798 43,019 73,638 18,494 43,705 14,982 2,508 79,689 (6,051) (454) (5) $ $ $ $

Saba Estimate 2012 67,121 18,917 35,286 121,323 16,732.56 983.84 26,193.44 829.92 44,739.76 76,583.52 19,233.76 52,810.21 15,581.28

2,608.32 90,233.57 -13,650.05 (454) (5)

-6,510.00 (753) (7,263)

-14,109.05 0 -14,109.05

Note: 1. Income statement for Saba Softwares Inc on 2012 has been estimated using the analyst report from Alpha street research and company's press release on revenue.

Saleforce 2012 2868808

181,387

3,050,195

494,187 189,392

683,579.00 2,366,616.00

429,479 1,614,026 433,821

1.00 0.22 0.775890066

1.00 0.37 0.631235159

0.529155021

0.44

2,477,326.00 -110,710.00

19,562

(5,698) (30,948)

-127,794.00 (142,651) -270,445.00

Anda mungkin juga menyukai

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Mckinsey Origin of StrategyDokumen12 halamanMckinsey Origin of StrategySiva UdBelum ada peringkat

- Competitive Strategy - Michael PorterDokumen422 halamanCompetitive Strategy - Michael Porterx01001932Belum ada peringkat

- 17 ch17 p17-1-17-46Dokumen46 halaman17 ch17 p17-1-17-46ABCBelum ada peringkat

- CB Ratio AnalysisDokumen33 halamanCB Ratio AnalysisSiva UdBelum ada peringkat

- Session 11 - Shareholder EquityDokumen25 halamanSession 11 - Shareholder EquitySiva UdBelum ada peringkat

- Intercompany SalesDokumen7 halamanIntercompany SalesSiva Ud67% (3)

- VI. Significant Aspect of The Problem:: C) Raw MaterialsDokumen1 halamanVI. Significant Aspect of The Problem:: C) Raw MaterialsSiva UdBelum ada peringkat

- Kartik Case Study (With Solution)Dokumen28 halamanKartik Case Study (With Solution)Sachin Yadav100% (1)

- Merger & Acquisition GuidelinesDokumen6 halamanMerger & Acquisition GuidelinesSiva UdBelum ada peringkat

- Big Data Healthcare Analytics For Kaiser Statement of Work: Key DeliverablesDokumen1 halamanBig Data Healthcare Analytics For Kaiser Statement of Work: Key DeliverablesSiva UdBelum ada peringkat

- Target Co. ListDokumen2 halamanTarget Co. ListSiva UdBelum ada peringkat

- Created by Neevia Docuprinter LT Trial VersionDokumen70 halamanCreated by Neevia Docuprinter LT Trial VersionSiva UdBelum ada peringkat

- (Project Name) Project CharterDokumen1 halaman(Project Name) Project CharterSiva UdBelum ada peringkat

- RiskRegister 1Dokumen5 halamanRiskRegister 1Siva UdBelum ada peringkat

- WordProblems ChallengeDokumen60 halamanWordProblems ChallengeMaria PappaBelum ada peringkat

- Statistics SetsDokumen51 halamanStatistics SetsSiva Ud100% (1)

- Hult Behavioral Finance 2013 Midterm SolutionsDokumen6 halamanHult Behavioral Finance 2013 Midterm SolutionsSiva UdBelum ada peringkat

- Employer Mock Interview Feedback FormDokumen1 halamanEmployer Mock Interview Feedback FormSiva UdBelum ada peringkat

- SF: Summer Networking & Pitch Event: General Admission Free OrderDokumen1 halamanSF: Summer Networking & Pitch Event: General Admission Free OrderSiva UdBelum ada peringkat

- GMAT Reading Comprehension Practice TestDokumen5 halamanGMAT Reading Comprehension Practice TestSiva Ud0% (1)

- GMAT Idiom ListDokumen12 halamanGMAT Idiom ListSiva UdBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Toxic RelationshipDokumen1 halamanToxic RelationshipwidyasBelum ada peringkat

- Janssen Vaccine Phase3 Against Coronavirus (Covid-19)Dokumen184 halamanJanssen Vaccine Phase3 Against Coronavirus (Covid-19)UzletiszemBelum ada peringkat

- Nursing Care Plan: Assessment Diagnosis Planning Interventions Rationale EvaluationDokumen11 halamanNursing Care Plan: Assessment Diagnosis Planning Interventions Rationale EvaluationDa NicaBelum ada peringkat

- On How To Design A Low Voltage SwitchboardDokumen11 halamanOn How To Design A Low Voltage SwitchboardsabeerBelum ada peringkat

- Material: Safety Data SheetDokumen3 halamanMaterial: Safety Data SheetMichael JoudalBelum ada peringkat

- Shoulder Joint Position Sense Improves With ElevationDokumen10 halamanShoulder Joint Position Sense Improves With ElevationpredragbozicBelum ada peringkat

- Bartos P. J., Glassfibre Reinforced Concrete - Principles, Production, Properties and Applications, 2017Dokumen209 halamanBartos P. J., Glassfibre Reinforced Concrete - Principles, Production, Properties and Applications, 2017Esmerald100% (3)

- WEEK 7-8: Health 9 Module 4Dokumen8 halamanWEEK 7-8: Health 9 Module 4Heidee BasasBelum ada peringkat

- Method of Toxicity Test 1Dokumen59 halamanMethod of Toxicity Test 1Widya AnggrainiBelum ada peringkat

- Clinical Features, Evaluation, and Diagnosis of Sepsis in Term and Late Preterm Infants - UpToDateDokumen42 halamanClinical Features, Evaluation, and Diagnosis of Sepsis in Term and Late Preterm Infants - UpToDatedocjime9004Belum ada peringkat

- ProAct ISCDokumen120 halamanProAct ISCjhon vergaraBelum ada peringkat

- 2016 Uptown Parksuites D3 PDFDokumen54 halaman2016 Uptown Parksuites D3 PDFArafat Domado100% (1)

- Containers HandbookDokumen26 halamanContainers Handbookrishi vohraBelum ada peringkat

- Ams - 4640-C63000 Aluminium Nickel MNDokumen3 halamanAms - 4640-C63000 Aluminium Nickel MNOrnella MancinelliBelum ada peringkat

- Essence Veda Vyasa Smriti PDFDokumen51 halamanEssence Veda Vyasa Smriti PDFmadhav kiranBelum ada peringkat

- DET Tronics: Unitized UV/IR Flame Detector U7652Dokumen2 halamanDET Tronics: Unitized UV/IR Flame Detector U7652Julio Andres Garcia PabolaBelum ada peringkat

- Ne XT ProtDokumen2 halamanNe XT Protwilliam919Belum ada peringkat

- Natu Es Dsmepa 1ST - 2ND QuarterDokumen38 halamanNatu Es Dsmepa 1ST - 2ND QuarterSenen AtienzaBelum ada peringkat

- Jebao DCP Pump User ManualDokumen3 halamanJebao DCP Pump User ManualSubrata Das100% (1)

- Pescatarian Mediterranean Diet Cookbook 2 - Adele TylerDokumen98 halamanPescatarian Mediterranean Diet Cookbook 2 - Adele Tylerrabino_rojoBelum ada peringkat

- PBL 2 Case PresentationDokumen12 halamanPBL 2 Case PresentationRamish IrfanBelum ada peringkat

- ReferensiDokumen4 halamanReferensiyusri polimengoBelum ada peringkat

- Krispy Kreme Doughnut Recipe - Immaculate BitesDokumen2 halamanKrispy Kreme Doughnut Recipe - Immaculate Bitesdaisydrops6Belum ada peringkat

- Upper Limb OrthosesDokumen29 halamanUpper Limb OrthosesMaryam KhalidBelum ada peringkat

- Data Obat VMedisDokumen53 halamanData Obat VMedismica faradillaBelum ada peringkat

- S108T02 Series S208T02 Series: I (RMS) 8A, Zero Cross Type Low Profile SIP 4pin Triac Output SSRDokumen13 halamanS108T02 Series S208T02 Series: I (RMS) 8A, Zero Cross Type Low Profile SIP 4pin Triac Output SSRnetiksBelum ada peringkat

- Cultivation: Bellis Perennis Is A CommonDokumen2 halamanCultivation: Bellis Perennis Is A CommonpriyankaBelum ada peringkat

- Dynamic Stretching - Stability - Strength.570239Dokumen2 halamanDynamic Stretching - Stability - Strength.570239Sylvia GraceBelum ada peringkat

- Broucher Design - 02Dokumen8 halamanBroucher Design - 02ಉಮೇಶ ಸಿ. ಹುಕ್ಕೇರಿ ಹುಕ್ಕೇರಿBelum ada peringkat

- Qualitative Tests Organic NotesDokumen5 halamanQualitative Tests Organic NotesAdorned. pearlBelum ada peringkat