MATH PROJECT TOPIC 2 (Income Tax)

Diunggah oleh

avinamakadiaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

MATH PROJECT TOPIC 2 (Income Tax)

Diunggah oleh

avinamakadiaHak Cipta:

Format Tersedia

MATH PROJECT 2: INCOME TAX

Introduction:

The origin of the word "Tax" is from "Taxation" which means an estimate. These were levied either on the sale and purchase of merchandise or livestock and were collected in a haphazard manner from time to time. The "tax net" refers to the types of payment that are taxed, which included personal earnings, capital gains, and business income. The rates for different types of income may vary and some may not be taxed at all. Capital gains may be taxed when realized or when incurred. Business income may only be taxed if it is significant or based on the manner in which it is paid. Some types of income, such as interest on bank savings, may be considered as personal earnings or as a realized property gain. In some tax systems, personal earnings may be strictly defined where labor, skill, or investment is required; in others, they may be defined broadly to include windfalls.

Why income tax is imposed?

Income tax is imposed in almost ever country. The reason why income tax is imposed is because the government needs money. The money is used for improvement for the country. This amount of money is needed for building of public facilities such as roads, trasportation, hospital etc. and for investments. In short the tax collected from the public is used for the well being of the public by the government. This would lead to more investors investing in the country and hence more jobs are created. This in turns benefits the people. The government has to tax income earner so that they have this money for construction and investment. In India, the percentage of charageable income increases with the

amount earned. This is because it would not be fair to ask a low-wage earner to give 30% of his income when he is having diffculity supporting his family even wih all his income. Hence, the richer are taxed more.

Who imposes this tax?

The Central Government has been empowered to levy tax on all income other than agricultural income. It imposes an income tax on taxable income of all persons including individuals, Hindu Undivided Families, companies, firms, association of persons, body of individuals, local authority and any other artificial judicial person. Levy of tax is separate on each of the persons. The levy is governed by the Indian Income Tax Act, 1961. The Indian Income Tax Department is governed by Central Board of Direct Taxes (CBDT) and is part of the Department of Revenue under the Ministry of Finance, Govt. of India. Income tax is a key source of funds that the government uses to fund its activities and serve the public. The Income Tax Department is the biggest revenue mobilizer for the Government.

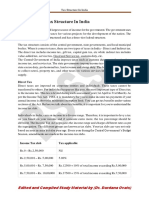

Latest income tax slabs (2013-2014)

India Income tax slabs 2013-2014 for general tax payer and women

Income Slabs

Income Tax Rate

UptoRs. 2,00,000 Rs 2,00,001 to Rs 5,00,000 Rs 5,00,001 to Rs 10,00,000 Rs 10,00,001 and above

Nil 10% on the total income exceeding Rs. 2,00,000 Rs. 30,000 + 20% on the total income exceeding Rs. 5,00,000 Rs. 1,30,000 + 30% on the income exceeding Rs, 10,00,000

India Income tax slabs 2013-2014 for citizen below the age of 60 years

Income Slabs Upto Rs. 2,00,000 Rs 2,00,001 to Rs 5,00,000 Rs 5,00,001 to Rs 10,00,000 Rs 10,00,001 and above

Income Tax Rate Nil 10% on the total income exceeding Rs. 2,00,000 Rs. 30,000 + 20% on the total income exceeding Rs. 5,00,000 Rs. 1,30,000 + 30% on the income exceeding Rs, 10,00,000

India Income tax slabs 2013-2014 for age of 60-79 years

Income Slabs UptoRs. 2,50,000 Rs2,50,001to Rs

Income Tax Rate Nil 10% on the total income exceeding Rs. 2,50,000

5,00,000 Rs 5,00,001 to Rs 10,00,000 Rs 10,00,001 and above Rs. 25,000 + 20% on the total income exceeding Rs. 5,00,000 10,00,000 Rs. 1,25,000 + 30% on the income exceeding Rs,

India Income tax slabs 2013-2014 for age above 80 years Income Slabs UptoRs 5,00,000 Rs 5,00,001 to Rs 10,00,000 Rs 10,00,001 and above Income Tax Rate Nil 20% on the total income exceeding Rs. 5,00,000 Rs. 1,00,000 + 30% on the income exceeding Rs, 10,00,000

Condition-1: A mans gross annual income is 7 lakhs. He pays Rs. 75,000

premium in LIC and has 2 sons whose tuition fees are 20,000 per annum. He he will have to pay. ANS : Income 7,00,000

also has 30,000 money in his fix deposit timed 5 years. Calculate the Income tax

Exempted income under 80C premium + fees + bank fixed deposit scheme - 75,000 + 20,000 + 30,000 = 1,25,000/-

Net taxable income 7,00,000 1,25,000 = 575000/Rate of tax 20% Thus, income tax payable - Rs. 30,000 + 20% on the total income exceeding Rs. 5,00,000 Amount exceeding 5,00,000 = 75,000/Therefore , 30,000 + 20% of 75,000 30,000 + 15,000 = 45,000/Therefore, income tax paid by the man having imcome of 7 lakhs is Rs 45,000.

Description Annual Income Deduction Insurance Premiume exempted under 80C Tution Fees Net Taxable income Income Tax for less than 5 Lac income Income Tax for income above 5 Lac @ 20% On 80000/- (580000 500000) Total Income Tax Surcharge @ 2% + 1% Net Income Tax payable 30000 16000 75000

Amount 700000 20000 950000 580000

46000 1380 47380

Therefore, income tax paid by the man having imcome of 7 lakhs is Rs. 47380/-

Condition-2: A womans gross annual income is 6 Lakhs. She contributes 80,000 Rs. in her PPF account, pays 25,000 as premium in LIC and has 2 ANS: Income- 6 lakhs Exempted income under 80C- PPF amount + school fees + premium - 80,000 + 50,000 + 25,000 = 1,55,000/Net Taxable income 6,00,000 1,55,000 = 4,45,000 Rate of tax- 10% Thus, income tax payable- 10% of income exceeding 2 lakhs Amount exceeding 2,00,000 2,45,000 Therefore, 10% of amount exceeding 2 lakhs 10% of 2,45,000 24,500/Therefore, income tax paid by the woman having imcome of 6 lakhs is Rs 24,500/children whose school fees are Rs. 50,000. Find the income tax payable by her.

Condition-3: Mohan is a 63 year old person with a gross annual income of 12 lakhs. He has taken a housing loan, the EMI of which is rs. 5000 (rs. 60,000 annually). He paid stamp duties of 20,000 for the purchase of his house. He pays 10,000 for his daughters tution fees. He also pays Rs. 85,000 as premium in LIC. Find the income tax payable by Mohan.

ANS- Income- 12 lakhs Reduction under section 80c- housing loan + tution fees + premium + stamp duties 1,50,000 + 20,000 + 10,000 + 85,000 = 2,65,000/Net taxable income- 1200000 2,65,000 = 935000/Income tax rate- 20% Tax payable - Rs. 25,000 + 20% on the total income exceeding Rs. 5,00,000 25,000 + 20% of 4,35,000 25,000 + 87,000 = 1,12,000/Therefore, income tax paid by Mohan having imcome of 12 lakhs is Rs 1,12,000/-

Anda mungkin juga menyukai

- Taxation ProjectDokumen23 halamanTaxation ProjectAkshata MasurkarBelum ada peringkat

- Overview of TDS: by C.A. Manish JathliyaDokumen21 halamanOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaBelum ada peringkat

- TRA Taxes at Glance - 2016-17Dokumen22 halamanTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDokumen4 halamanTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Bangladesh Income Tax RatesDokumen5 halamanBangladesh Income Tax RatesaadonBelum ada peringkat

- Tax PlanningDokumen12 halamanTax PlanningPrince RajputBelum ada peringkat

- 2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFDokumen18 halaman2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFtendaicrosby100% (1)

- Reducing The Tax Burden - Mahinda RajapaksaDokumen3 halamanReducing The Tax Burden - Mahinda RajapaksaAdaderana OnlineBelum ada peringkat

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDokumen29 halamanWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Business License in CameroonDokumen20 halamanBusiness License in Cameroonjemblem66Belum ada peringkat

- Oracle FAQsDokumen15 halamanOracle FAQsjhakanchanjsrBelum ada peringkat

- Problems of Vat AdiministrationDokumen74 halamanProblems of Vat AdiministrationZelalemBelum ada peringkat

- Residential StatusDokumen17 halamanResidential Statussaif aliBelum ada peringkat

- ArthaKranti Proposal SynopsisDokumen8 halamanArthaKranti Proposal SynopsisRizBelum ada peringkat

- Vat Act-1991 (English Version)Dokumen39 halamanVat Act-1991 (English Version)enamul100% (2)

- Income From SalaryDokumen54 halamanIncome From SalaryMohsin ShaikhBelum ada peringkat

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDokumen26 halamanA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330Belum ada peringkat

- Withholding Taxes 2Dokumen20 halamanWithholding Taxes 2hildaBelum ada peringkat

- Fit Chap012Dokumen56 halamanFit Chap012djkfhadskjfhksd100% (2)

- IAS#12Dokumen31 halamanIAS#12Shah KamalBelum ada peringkat

- History of Taxation in EthiopiaDokumen6 halamanHistory of Taxation in EthiopiaEdlamu Alemie100% (1)

- Income Tax Chapter-10 NoteDokumen6 halamanIncome Tax Chapter-10 NoteRAGIB SHAHRIAR RAFIBelum ada peringkat

- International Taxation AssignmentDokumen7 halamanInternational Taxation AssignmentSteven TowoBelum ada peringkat

- INCOME TAX AND GST. JURAZ-Module 3Dokumen11 halamanINCOME TAX AND GST. JURAZ-Module 3hisanashanutty2004100% (1)

- Income From House PropertyDokumen26 halamanIncome From House PropertysnehalgaikwadBelum ada peringkat

- Beyond Infinity PresentationDokumen19 halamanBeyond Infinity PresentationSindhu ThomasBelum ada peringkat

- Practice Problems Capital Structure 25-09-2021Dokumen17 halamanPractice Problems Capital Structure 25-09-2021BHAVYA KANDPAL 13BCE02060% (1)

- Introduction To FBRDokumen19 halamanIntroduction To FBRMuhammad Nadeem Mughal0% (1)

- Impact of GST On Warehousing and Supply ChainDokumen39 halamanImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- SMChap004 PDFDokumen57 halamanSMChap004 PDFhshBelum ada peringkat

- Economics Notes For B.tech StudentsDokumen83 halamanEconomics Notes For B.tech Studentsrohith198980% (5)

- Summary of Ifrs 6Dokumen1 halamanSummary of Ifrs 6Divine Epie Ngol'esueh100% (1)

- 2019 ATAF Online Course On Introduction To Tax Audit-Written ExamDokumen4 halaman2019 ATAF Online Course On Introduction To Tax Audit-Written ExamWilson Costa0% (1)

- 51 GST Flyer - Chapter 47 - TDS On GSTDokumen5 halaman51 GST Flyer - Chapter 47 - TDS On GSTRanjanBelum ada peringkat

- Income Tax Divyastra CH 17 Computation of Total Income R 1Dokumen58 halamanIncome Tax Divyastra CH 17 Computation of Total Income R 1Lakshmi NBelum ada peringkat

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Dokumen8 halamanAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuBelum ada peringkat

- Goods and Service TaxDokumen7 halamanGoods and Service TaxNitheesh BBelum ada peringkat

- S 234A, 234B and 234CDokumen5 halamanS 234A, 234B and 234CMahaveer DhelariyaBelum ada peringkat

- Budjet and PlannigDokumen10 halamanBudjet and Plannigprakash009kBelum ada peringkat

- Case Studies On Tax Planning and Double TaxDokumen19 halamanCase Studies On Tax Planning and Double TaxJayaBelum ada peringkat

- Income TAX CalculationDokumen33 halamanIncome TAX CalculationTaharat Ahmed ChowdhuryBelum ada peringkat

- Introduction Unit of Income TaxDokumen5 halamanIntroduction Unit of Income TaxRishabBelum ada peringkat

- Income Tax Guide UgandaDokumen13 halamanIncome Tax Guide UgandaMoses LubangakeneBelum ada peringkat

- HBL Schedule of Bank ChargesDokumen25 halamanHBL Schedule of Bank ChargesJohn Wick60% (5)

- Capital Structure of FMCG, IT, Power and TelecomDokumen20 halamanCapital Structure of FMCG, IT, Power and TelecomPayal Homagni Mondal0% (1)

- Unilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302Dokumen17 halamanUnilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302IfemideBelum ada peringkat

- 2021 Official Revenue EstimateDokumen3 halaman2021 Official Revenue EstimateWSYX/WTTEBelum ada peringkat

- Income Tax (B.com Ii)Dokumen9 halamanIncome Tax (B.com Ii)iramanwarBelum ada peringkat

- Direct Tax: Profits and Gains of Business or ProfessionDokumen41 halamanDirect Tax: Profits and Gains of Business or ProfessionBHRAMARBAR SAHANIBelum ada peringkat

- Accounts Receivables ManagementDokumen11 halamanAccounts Receivables ManagementAli xBelum ada peringkat

- Exide Life Secured Income Insurance RPDokumen10 halamanExide Life Secured Income Insurance RPrahul sarmaBelum ada peringkat

- Acn 305 Final AssignmentDokumen17 halamanAcn 305 Final AssignmentRich KidBelum ada peringkat

- Unit1 GSTDokumen26 halamanUnit1 GSTAryan SethiBelum ada peringkat

- Basics of GSTDokumen40 halamanBasics of GSTsportnik.in100% (1)

- Income Under The Head "Profits & Gain of Business or Profession"Dokumen56 halamanIncome Under The Head "Profits & Gain of Business or Profession"Niraj Kumar SinhaBelum ada peringkat

- PQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsDokumen6 halamanPQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsL'express Maurice100% (1)

- CPA Regulation (Reg) Notes 2013Dokumen7 halamanCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Dokumen7 halamanTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatBelum ada peringkat

- Notes On DTC BillDokumen5 halamanNotes On DTC Billshikah sidarBelum ada peringkat

- TDS On SalaryDokumen5 halamanTDS On SalaryAato AatoBelum ada peringkat

- Su001 1209en PDFDokumen2 halamanSu001 1209en PDFKimi RaikBelum ada peringkat

- Unit - 4.4 Hawtrey's Theory.Dokumen3 halamanUnit - 4.4 Hawtrey's Theory.Mahima guptaBelum ada peringkat

- Kalyani Steel LimitedDokumen26 halamanKalyani Steel LimitedSHREEYA BHATBelum ada peringkat

- Act 549 Standards of Malaysia Act 1996Dokumen27 halamanAct 549 Standards of Malaysia Act 1996Adam Haida & CoBelum ada peringkat

- CA Power of Attorney FORM & Info 87-68.200Dokumen29 halamanCA Power of Attorney FORM & Info 87-68.200JugyBelum ada peringkat

- Chartbook For Level 3.13170409Dokumen65 halamanChartbook For Level 3.13170409calibertraderBelum ada peringkat

- TAMPA - Vacant Contract (1 Owner)Dokumen2 halamanTAMPA - Vacant Contract (1 Owner)Adam BellaBelum ada peringkat

- LiquidationDokumen21 halamanLiquidationMerlin KBelum ada peringkat

- Hill Gbt6e PPT Chapter07Dokumen17 halamanHill Gbt6e PPT Chapter07Pardis SiamiBelum ada peringkat

- Assignment Two Instructions S2 2021Dokumen2 halamanAssignment Two Instructions S2 2021Dat HuynhBelum ada peringkat

- DOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoDokumen50 halamanDOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoCharlie MegginsonBelum ada peringkat

- Group Segment Revenue Expenses Member MonthsDokumen19 halamanGroup Segment Revenue Expenses Member MonthscrissilleBelum ada peringkat

- Zonal ZamboangaDokumen173 halamanZonal ZamboangaJoelebie Gantonoc Barroca50% (2)

- Civil Engineering Thumb RuleDokumen28 halamanCivil Engineering Thumb Rulecivilsadiq100% (16)

- Caf 6 All PDFDokumen80 halamanCaf 6 All PDFMuhammad Yahya100% (1)

- Marian Grajdan CVDokumen7 halamanMarian Grajdan CVMarian GrajdanBelum ada peringkat

- 20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enDokumen2 halaman20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enPost PictureBelum ada peringkat

- Aud Spec 101Dokumen19 halamanAud Spec 101Yanyan GuadillaBelum ada peringkat

- CS Section: Consulting ServicesDokumen7 halamanCS Section: Consulting ServicesTyra Joyce RevadaviaBelum ada peringkat

- FS PT Acset 31 Maret 2023Dokumen79 halamanFS PT Acset 31 Maret 2023Nanda WulanBelum ada peringkat

- Bhuria Report Vol II CDokumen326 halamanBhuria Report Vol II CMinalJadejaBelum ada peringkat

- IT - Y10 - Y11 - Ver - 7 - With Form 10 EDokumen30 halamanIT - Y10 - Y11 - Ver - 7 - With Form 10 EKirit J Patel100% (1)

- Pip CalculatorDokumen5 halamanPip CalculatorcalvinlcqBelum ada peringkat

- Week 5 - Efficient DiversificationDokumen40 halamanWeek 5 - Efficient DiversificationshanikaBelum ada peringkat

- BS Digi PDFDokumen1 halamanBS Digi PDFFaruq TaufikBelum ada peringkat

- Binghatti Gardenia Sales OfferDokumen5 halamanBinghatti Gardenia Sales OfferrasarivalaBelum ada peringkat

- SBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2Dokumen2 halamanSBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2James BondBelum ada peringkat

- Module 5 Using Mathematical TechniquesDokumen57 halamanModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- How COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyDokumen8 halamanHow COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat