Role of SEBI in Portfolio Management

Diunggah oleh

Gaurav RaneDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Role of SEBI in Portfolio Management

Diunggah oleh

Gaurav RaneHak Cipta:

Format Tersedia

Role of SEBI in Portfolio Management The S.E.B.I. has imposed a number of obligations and a code of conduct on them.

The portfolio manager should have a high standard of integrity, honesty and should not have been convicted of any economic offence or moral turpitude. He should not resort to rigging up of prices, insider trading or creating false markets, etc. their books of accounts are subject to inspection to inspection and audit by S.E.B.I. The observance of the code of conduct and guidelines given by the S.E.B.I. are subject to inspection and penalties for violation are imposed. The manager has to submit periodical returns and documents as may be required by the SEBI from time-to- time.

The difference between a discretionary portfolio manager and a nondiscretionary portfolio manager as per SEBI The discretionary portfolio manager individually and independently manages the funds of each client in accordance with the needs of the client. The non-discretionary portfolio manager manages the funds in accordance with the directions of the client. The procedure of obtaining registration as a portfolio manager from SEBI For registration as a portfolio manager, an applicant is required to pay a nonrefundable application fee of Rs.1, 00,000/- by way of demand draft drawn in favour of Securities and Exchange Board of India, payable at Mumbai. The application in Form A along with additional information submitted to SEBI office at Bandra Office, Mumbai The capital adequacy requirement of a portfolio manager The portfolio manager is required to have a minimum net worth of Rs. 2 crore. Registration fee to be paid by the portfolio managers

Yes. Every portfolio manager is required to pay Rs. 10 lakhs as registration fees at the time of grant of certificate of registration by SEBI. Validity period for the certificate of registration to remain valid The certificate of registration remains valid for three years. The portfolio manager has to apply for renewal of its registration certificate to SEBI, 3 months before the expiry of the validity of the certificate, if it wishes to continue as a registered portfolio manager. The renewal fee to be paid by the portfolio manager The portfolio manager is required to pay Rs. 5 lakh as renewal fees to SEBI. Is there any contract between the portfolio manager and its client? Yes. The portfolio manager, before taking up an assignment of management of funds or portfolio of securities on behalf of the client, enters into an agreement in writing with the client, clearly defining the inter se relationship and setting out their mutual rights, liabilities and obligations relating to the management of funds or portfolio of securities, containing the details as specified in Schedule IV of the SEBI (Portfolio Managers) Regulations, 1993. Fees a portfolio manager can charge from its clients for the services rendered SEBI Portfolio Manager Regulations have not prescribed any scale of fee to be charged by the portfolio manager to its clients. However, the regulations provide that the portfolio manager shall charge a fee as per the agreement with the client for rendering portfolio management services. The fee so charged may be a fixed amount or a return based fee or a combination of both. The portfolio manager shall take specific prior permission from the client for charging such fees for each activity for which service is rendered by the portfolio manager directly or indirectly (where such service is outsourced). Specified value of funds or securities below which a portfolio manager cant accept from the client while opening the account for the purpose of rendering portfolio management service to the client

The portfolio manager is required to accept minimum Rs. 5 lakhs or securities having a minimum worth of Rs. 5 lakhs from the client while opening the account for the purpose of rendering portfolio management service to the client. Portfolio manager can only invest and not borrow on behalf of his clients.

Reports a Portfolio Manager has to keep and show it to client The portfolio manager shall furnish periodically a report to the client, as agreed in the contract, but not exceeding a period of six months and as and when required by the client and such report shall contain the following details, namely:(a) The composition and the value of the portfolio, description of security, number of securities, value of each security held in the portfolio, cash balance and aggregate value of the portfolio as on the date of report; (b) Transactions undertaken during the period of report including date of transaction and details of purchases and sales; (c) Beneficial interest received during that period in respect of interest, dividend, bonus shares, rights shares and debentures; (d) Expenses incurred in managing the portfolio of the client; (e) Details of risk foreseen by the portfolio manager and the risk relating to the securities recommended by the portfolio manager for investment or disinvestment. This report may also be available on the website with restricted access to each client. The portfolio manager shall, in terms of the agreement with the client, also furnish to the client documents and information relating only to the management of a portfolio. The client has right to obtain details of his portfolio from the portfolio managers.

The disclosure mechanism of the portfolio managers to their clients The portfolio manager provides to the client the Disclosure Document at least two days prior to entering into an agreement with the client. The Disclosure Document contains the quantum and manner of payment of fees payable by the client for each activity, portfolio risks, complete disclosures in respect of transactions with related parties, the performance of the portfolio manager and the audited financial statements of the portfolio manager for the immediately preceding three years. Please note that the disclosure document is neither approved nor disapproved by SEBI nor does SEBI certify the accuracy or adequacy of the contents of the Documents. Approvation by SEBI of any of the services offered by portfolio managers No. SEBI does not approve any of the services offered by the Portfolio Manager. An investor has to invest in the services based on the terms and conditions laid out in the disclosure document and the agreement between the portfolio manager and the investor. Does SEBI approve the disclosure document of the portfolio manager? The Disclosure Document is neither approved nor disapproved by SEBI. SEBI does not certify the accuracy or adequacy of the contents of the Disclosure Document. The rules governing services of a Portfolio Manager The services of a Portfolio Manager are governed by the agreement between the portfolio manager and the investor. The agreement should cover the minimum details as specified in the SEBI Portfolio Manager Regulations. However, additional requirements can be specified by the Portfolio Manager in the agreement with the client. Hence, an investor is advised to read the agreement carefully before signing it.

Lock-in period a portfolio manager can impose on the investor

Portfolio managers cannot impose a lock-in on the investment of their clients. However, a portfolio manager can charge exit fees from the client for early exit, as laid down in the agreement. The basis on which the performance of the portfolio manager calculated The performance of a discretionary portfolio manager is calculated using weighted average method taking each individual category of investments for the immediately preceding three years and in such cases performance indicator is also disclosed.

Anda mungkin juga menyukai

- Yyy Y: WWW - Sebi.gov - inDokumen5 halamanYyy Y: WWW - Sebi.gov - inparirahulBelum ada peringkat

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingDari EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingBelum ada peringkat

- Who Is A Portfolio ManagerDokumen2 halamanWho Is A Portfolio ManagerAkhil UchilBelum ada peringkat

- PMS Charges & RequirmentsDokumen4 halamanPMS Charges & Requirmentsamansuriyanshi.gacBelum ada peringkat

- Portfolio Management Servic1Dokumen3 halamanPortfolio Management Servic1Dr-Swati SharmaBelum ada peringkat

- Lesson 35: Issue Management: Intermediaries, Regulations and Sebi GuidelinesDokumen4 halamanLesson 35: Issue Management: Intermediaries, Regulations and Sebi GuidelinesGaurav SinhaBelum ada peringkat

- Pms Internal Control ManualDokumen8 halamanPms Internal Control Manualsraichura12131Belum ada peringkat

- Stock BrokingDokumen24 halamanStock BrokingAshay kanchanBelum ada peringkat

- Stock Market Intermediaries For FinanceDokumen54 halamanStock Market Intermediaries For FinancePRIYA PAULBelum ada peringkat

- Stock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujaDokumen53 halamanStock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujanavaggBelum ada peringkat

- Presentation On Stock BrokingDokumen21 halamanPresentation On Stock Brokingocy120% (1)

- Corporate - Governance Report (Audit Committee)Dokumen7 halamanCorporate - Governance Report (Audit Committee)Shweta GuptaBelum ada peringkat

- Sebi Guideline On Merchant BankingDokumen28 halamanSebi Guideline On Merchant BankingSheenam Arora100% (1)

- PMS GuidelinesDokumen5 halamanPMS GuidelinesTrader NepalBelum ada peringkat

- CMR Unit IvDokumen6 halamanCMR Unit Ivirtikahassan111Belum ada peringkat

- Intermediaries in New Issue MarketDokumen10 halamanIntermediaries in New Issue MarketAmitesh TejaswiBelum ada peringkat

- Overview of Stock Broking, Dep, CustDokumen29 halamanOverview of Stock Broking, Dep, Custsameer99rBelum ada peringkat

- Depositories Act 1996: Depository SystemDokumen5 halamanDepositories Act 1996: Depository SystemMukul Kr Singh ChauhanBelum ada peringkat

- Heritage Funds Trade Program Hong KongDokumen5 halamanHeritage Funds Trade Program Hong Kongmunkarobert100% (1)

- Secondary 2Dokumen20 halamanSecondary 2mayank0963Belum ada peringkat

- GL-06 - Laborers Local 190 Investment Agreement 0503Dokumen14 halamanGL-06 - Laborers Local 190 Investment Agreement 0503Albany Times UnionBelum ada peringkat

- Sai1 PDokumen5 halamanSai1 PChandra Wati mamgainBelum ada peringkat

- Registration of Merchant BankerDokumen28 halamanRegistration of Merchant Bankerrthi04Belum ada peringkat

- Merchant BankingDokumen20 halamanMerchant Bankingpranab paulBelum ada peringkat

- Capital Market Analysis and Corporate Laws: Merchant Bankers Short NotesDokumen22 halamanCapital Market Analysis and Corporate Laws: Merchant Bankers Short NotesGagan PreetBelum ada peringkat

- Discretionary Investment Management Is A Form of Investment Management in Which Buy and Sell Decisions Are Made by A Portfolio Manager or Investment Counselor For The ClientDokumen2 halamanDiscretionary Investment Management Is A Form of Investment Management in Which Buy and Sell Decisions Are Made by A Portfolio Manager or Investment Counselor For The ClientSaurav TimilsinaBelum ada peringkat

- Loan Appraisal FormatDokumen7 halamanLoan Appraisal FormatKrishnamoorthySuresh50% (2)

- Mutual Fund RegistrationDokumen4 halamanMutual Fund RegistrationParas MittalBelum ada peringkat

- CFA CaseletsDokumen27 halamanCFA CaseletsArk SrivastavaBelum ada peringkat

- Mutual Fund SEBI RegulationDokumen17 halamanMutual Fund SEBI RegulationSarvesh ShuklaBelum ada peringkat

- SEBI Guidelines For MBDokumen34 halamanSEBI Guidelines For MB9958331534100% (1)

- Regulatory Framework of Merchant BankingDokumen12 halamanRegulatory Framework of Merchant BankingKirti Khattar60% (5)

- Insurance AuditDokumen7 halamanInsurance AuditArpit jainBelum ada peringkat

- Why Do We Need A Regulatory Body For Investor Protection in India?Dokumen17 halamanWhy Do We Need A Regulatory Body For Investor Protection in India?Amrita JhaBelum ada peringkat

- Debenture TrusteeDokumen6 halamanDebenture TrusteeRajesh GoelBelum ada peringkat

- Mem Comp HandbookDokumen35 halamanMem Comp HandbookKalpesh Rathi100% (1)

- Project ReportDokumen28 halamanProject Reportanshul jindalBelum ada peringkat

- Portfolio Manager CompliancesDokumen3 halamanPortfolio Manager CompliancesAvantika ArunBelum ada peringkat

- 0 - NUAC Advisor's Investment Advisory Agreement - 2015-1Dokumen12 halaman0 - NUAC Advisor's Investment Advisory Agreement - 2015-1francis hernandezBelum ada peringkat

- Faqs Member ComplianceDokumen33 halamanFaqs Member ComplianceSunny ChaturvediBelum ada peringkat

- Securitisation of Debt (Loan Assets)Dokumen7 halamanSecuritisation of Debt (Loan Assets)Sanskar YadavBelum ada peringkat

- IPO Process in India An OverviewDokumen15 halamanIPO Process in India An OverviewYash SonkarBelum ada peringkat

- FINTELLIGENCE 6 12 March 2014 Step by Step Guide To NCD IssuanceDokumen5 halamanFINTELLIGENCE 6 12 March 2014 Step by Step Guide To NCD IssuanceAnkit SharmaBelum ada peringkat

- Duties and Responsibilities of The Asset Management CompanyDokumen19 halamanDuties and Responsibilities of The Asset Management Companysumairjawed8116100% (1)

- Guide For Investors:: 1. While Selecting The Broker/ Sub-BrokerDokumen19 halamanGuide For Investors:: 1. While Selecting The Broker/ Sub-BrokerQwertyBelum ada peringkat

- Role of Merchant Banking - : Raising FinanceDokumen10 halamanRole of Merchant Banking - : Raising FinanceAadil KakarBelum ada peringkat

- Mutual Fund and SebiDokumen15 halamanMutual Fund and SebiNishant SharmaBelum ada peringkat

- HDMF Circular 258Dokumen6 halamanHDMF Circular 258Jay O CalubayanBelum ada peringkat

- Assent Advisory Investment Advisory Services AgreementDokumen10 halamanAssent Advisory Investment Advisory Services AgreementNoman Danish ShaikhBelum ada peringkat

- PR 1Dokumen16 halamanPR 1Faixan HashmeeBelum ada peringkat

- Discretionary Pms Agreement FormsDokumen8 halamanDiscretionary Pms Agreement Formsgoldentrade1982Belum ada peringkat

- MF IntroductionDokumen21 halamanMF Introductionutsav mandalBelum ada peringkat

- Fund Structure and ConstituentsDokumen10 halamanFund Structure and Constituentsamoldesh29Belum ada peringkat

- CHP 2 - Issue ManagementDokumen32 halamanCHP 2 - Issue ManagementFalguni MathewsBelum ada peringkat

- Murabah ProfitDokumen15 halamanMurabah ProfitMuhammad ZulkifulBelum ada peringkat

- National Stock Exchange of India Limited Inspection Department CircularDokumen4 halamanNational Stock Exchange of India Limited Inspection Department CircularHARISH GROVERBelum ada peringkat

- A Glimpse of Trustee of Debt Securities in BangladeshDokumen6 halamanA Glimpse of Trustee of Debt Securities in BangladeshMohammad Nazmul IslamBelum ada peringkat

- Sample Investment Management Agreement: (Date)Dokumen14 halamanSample Investment Management Agreement: (Date)jason hutabaratBelum ada peringkat

- Securities and Exchange Board of India: CircularDokumen5 halamanSecurities and Exchange Board of India: CircularSwapnil JagatiBelum ada peringkat

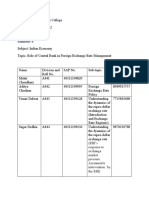

- Presented By:: Gaurav Rane Krishna Gupta Siddhesh Bhaide Shashank Ramteke Prof. Sunil ParkerDokumen7 halamanPresented By:: Gaurav Rane Krishna Gupta Siddhesh Bhaide Shashank Ramteke Prof. Sunil ParkerGaurav RaneBelum ada peringkat

- The Sum of These Is 175Dokumen3 halamanThe Sum of These Is 175Gaurav RaneBelum ada peringkat

- Introduction of Portfolio Management: Product Offering in PMSDokumen4 halamanIntroduction of Portfolio Management: Product Offering in PMSGaurav RaneBelum ada peringkat

- Under Graduate Graduate Master OthersDokumen3 halamanUnder Graduate Graduate Master OthersGaurav RaneBelum ada peringkat

- Case Study On DELL Presentation MIS Management Information SystemDokumen22 halamanCase Study On DELL Presentation MIS Management Information SystemGaurav RaneBelum ada peringkat

- Case Study On DELL Presentation MIS Management Information SystemDokumen22 halamanCase Study On DELL Presentation MIS Management Information SystemGaurav RaneBelum ada peringkat

- Power Supply, Cooling, and ProtectionDokumen34 halamanPower Supply, Cooling, and ProtectionGaurav RaneBelum ada peringkat

- Business ColoursDokumen1 halamanBusiness ColoursamBelum ada peringkat

- Efficient Market Hypothesis: The Collective WisdomDokumen42 halamanEfficient Market Hypothesis: The Collective WisdomAmie Jane MirandaBelum ada peringkat

- General Insurance Corporation of India DRHPDokumen524 halamanGeneral Insurance Corporation of India DRHPAshok YadavBelum ada peringkat

- FAO ParticipatoryComm FishLandings Full PDFDokumen140 halamanFAO ParticipatoryComm FishLandings Full PDFakhmadBelum ada peringkat

- Akhil Vayaliparambath - SAP FI CO - Masters Û Information Technology - 6 Yrs - North of BostonDokumen4 halamanAkhil Vayaliparambath - SAP FI CO - Masters Û Information Technology - 6 Yrs - North of BostonPriya MadhuBelum ada peringkat

- Tax Guide On Philippine Taxation Laws: Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax CodeDokumen6 halamanTax Guide On Philippine Taxation Laws: Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax Code Tax CodeEdzelon CuervoBelum ada peringkat

- Graduate Directory - IoBM - 2013Dokumen137 halamanGraduate Directory - IoBM - 2013Zardar WaseemBelum ada peringkat

- Crypto Trading For Beginner Traders PDFDokumen23 halamanCrypto Trading For Beginner Traders PDFRAJIV KUMAR100% (2)

- Measures To Improve Life Insurance ProfitabilityDokumen9 halamanMeasures To Improve Life Insurance ProfitabilityTirth ShahBelum ada peringkat

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Dokumen8 halamanCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Chapter1-Taxes and DefinitionsDokumen37 halamanChapter1-Taxes and DefinitionsSohael Adel AliBelum ada peringkat

- Tybcom - A - Group No. - 5Dokumen10 halamanTybcom - A - Group No. - 5Mnimi SalesBelum ada peringkat

- What Are The Duties of A Human Resources AssistantDokumen41 halamanWhat Are The Duties of A Human Resources Assistantanuoluwa77Belum ada peringkat

- Ee Announcement Presentation FinalDokumen31 halamanEe Announcement Presentation Finalkoundi_3Belum ada peringkat

- RBS Final Assignment.Dokumen21 halamanRBS Final Assignment.Rabiul AlamBelum ada peringkat

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDokumen15 halamanQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshBelum ada peringkat

- Wayne SamplingDokumen15 halamanWayne SamplingMrTopStep.com100% (1)

- Exam QA - Corporate Finance-1Dokumen38 halamanExam QA - Corporate Finance-1NigarBelum ada peringkat

- Chapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksDokumen25 halamanChapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksAli EmadBelum ada peringkat

- Awfis DRHPDokumen484 halamanAwfis DRHPrahuluecBelum ada peringkat

- Ram Charan - Cash Is KingDokumen4 halamanRam Charan - Cash Is KingSuhayl AbidiBelum ada peringkat

- FINS OTBI Subject Area Documentation R 11Dokumen6 halamanFINS OTBI Subject Area Documentation R 11Satya NBelum ada peringkat

- 3I0-008Dokumen102 halaman3I0-008dafes danielBelum ada peringkat

- AtcpDokumen2 halamanAtcpnavie VBelum ada peringkat

- Feasibility StudyDokumen2 halamanFeasibility Studyarchana.mitcon4979Belum ada peringkat

- Bank Pembangunan Malaysia BerhadDokumen5 halamanBank Pembangunan Malaysia BerhadkinBelum ada peringkat

- GDP Growth in GujaratDokumen39 halamanGDP Growth in Gujaratmansi sharmaBelum ada peringkat

- Class - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Dokumen9 halamanClass - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Rishav BhattBelum ada peringkat

- Financial ManagementDokumen8 halamanFinancial Managementmandeep_kaur20Belum ada peringkat

- QUIZ 1 Deferred Taxes SolutionDokumen3 halamanQUIZ 1 Deferred Taxes SolutionMohd NuuranBelum ada peringkat

- Summary of Noah Kagan's Million Dollar WeekendDari EverandSummary of Noah Kagan's Million Dollar WeekendPenilaian: 5 dari 5 bintang5/5 (2)

- The 7 Habits of Highly Effective PeopleDari EverandThe 7 Habits of Highly Effective PeoplePenilaian: 4 dari 5 bintang4/5 (2566)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverDari EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverPenilaian: 4.5 dari 5 bintang4.5/5 (186)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsDari EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsPenilaian: 4.5 dari 5 bintang4.5/5 (52)

- The First Minute: How to start conversations that get resultsDari EverandThe First Minute: How to start conversations that get resultsPenilaian: 4.5 dari 5 bintang4.5/5 (57)

- Spark: How to Lead Yourself and Others to Greater SuccessDari EverandSpark: How to Lead Yourself and Others to Greater SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (132)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- High Road Leadership: Bringing People Together in a World That DividesDari EverandHigh Road Leadership: Bringing People Together in a World That DividesBelum ada peringkat

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Dari EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Penilaian: 5 dari 5 bintang5/5 (2)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobDari EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobPenilaian: 4.5 dari 5 bintang4.5/5 (37)

- Sun Tzu: The Art of War for Managers; 50 Strategic RulesDari EverandSun Tzu: The Art of War for Managers; 50 Strategic RulesPenilaian: 5 dari 5 bintang5/5 (5)

- The Emotionally Intelligent LeaderDari EverandThe Emotionally Intelligent LeaderPenilaian: 4.5 dari 5 bintang4.5/5 (204)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceDari EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformancePenilaian: 5 dari 5 bintang5/5 (22)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersDari EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersPenilaian: 4.5 dari 5 bintang4.5/5 (95)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsDari EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsPenilaian: 4.5 dari 5 bintang4.5/5 (28)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- The Introverted Leader: Building on Your Quiet StrengthDari EverandThe Introverted Leader: Building on Your Quiet StrengthPenilaian: 4.5 dari 5 bintang4.5/5 (35)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionDari EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionPenilaian: 5 dari 5 bintang5/5 (337)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tDari EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tPenilaian: 4.5 dari 5 bintang4.5/5 (63)

- Leadership Skills that Inspire Incredible ResultsDari EverandLeadership Skills that Inspire Incredible ResultsPenilaian: 4.5 dari 5 bintang4.5/5 (11)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderDari EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderPenilaian: 4.5 dari 5 bintang4.5/5 (60)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowDari EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowPenilaian: 4.5 dari 5 bintang4.5/5 (27)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionDari Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionPenilaian: 5 dari 5 bintang5/5 (1)

- Superminds: The Surprising Power of People and Computers Thinking TogetherDari EverandSuperminds: The Surprising Power of People and Computers Thinking TogetherPenilaian: 3.5 dari 5 bintang3.5/5 (7)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderDari EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderBelum ada peringkat

- The Effective Executive: The Definitive Guide to Getting the Right Things DoneDari EverandThe Effective Executive: The Definitive Guide to Getting the Right Things DonePenilaian: 4.5 dari 5 bintang4.5/5 (469)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthDari Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthPenilaian: 5 dari 5 bintang5/5 (52)