MBA-4SEM-08 Question Paper

Diunggah oleh

suryavamshirakeshJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

MBA-4SEM-08 Question Paper

Diunggah oleh

suryavamshirakeshHak Cipta:

Format Tersedia

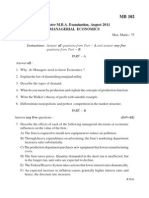

IV Semester M.B.A.

Examination, June/July-2008

Management (New)

Course-19: INTERNATIONAL BUSINESS ENVIRONMENT (Compulsory)

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each sub-question carries two marks. SECTION - A (5X2=10) a) What is an international business? b) What is meant by Greenfield investment? c) What do you mean by transfer price? d) What is franchising? e) What is counter trade? f) What id TRIMS? g) What is ethnocentric approach? SECTION B Answer any four questions. Each question carries 5 marks. 2. What are the differences between domestic and international business? 3. Briefly discus bow legal environment influences upon international business. 4. Give an account on management if political risks in an international business. 5. Distinguish between GATT and WTO. 6. Explain comparative advantage theory. 7. Give an account on appreciation of Indian rupee on textile industry. (4X5=20)

P.T.O

SECTION - C Answer any three questions. Each question carries 10 marks. 8. Discuss the modes of international business. 9. Sketch out how international business is influenced by economic and socio-cultural environment. 10. Explain the proceedings of Singapore-WTO-Ministerial Conference. 11. Discuss how MNC help fostering economic growth of India. 12. Critically evaluate the functioning of foreign exchange market. (3X10=30)

SECTION D 13. Case (Compulsory) : Cultural Factors in an MNC Mr. Karthik Krishna, now 50, was selected as a regional manager by Bata Shoe Organization in 1996 and was appointed in Bombay. He and his family members were very happy for his quick promotions in Bata. Mrs.Rema, Mr.Karthik Krishnas wife, strongly believed in Indian culture. She was a typical Indian housewife, a big chatterbox, who spend much of her time in chit chatting with her friends. Mr. Karthik had been innovative in formulating a number of performance appraisal programmes, cross-cultural training and compensation packages. The management of the company was impressed with his skills and abilities and he was promoted and transferred to its headquarters at Toronto, Canada. Mr. Karthik and his family were very happy to take up the new assignment. They landed in Canada in February 2003. The company provided housing, medical and conveyance facilities to Mr. Karthik and his family. Mr. Karhik liked his new job, as it was highly challenging and rewarding. In addition, he got a number of opportunities to interact with top executives coming from different countries. He and his family were very much excited with the facilities given by the company. Karthik became very busy and had little time for his family. Consequently, his wife was forced to spend most of her time in isolation, since, unlike in India no one in Canada spends their time for their neighbours. She could not adjust with this aspect of the western culture at her late 40s. She was thrown to severe depression. She forced her husband to leave the job and the country. Analyse the above case and identify the strengths and weakness. ------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Management (New)

Course-20: OPERATION MANAGEMENT (Compulsory)

Time:3 Hours Max. Marks: 75

1. Answer any five of the following sub-questions. Each sub-question carries two marks. SECTION - A (5X2=10) a) What is operations decision? b) Define operations strategy. c) What is a productivity measurement? d) What do you mean by quality function development? e) What is concurrent engineering? f) How operational classification of services done? g) Define JIT. SECTION B Answer any four questions. Each question carries 5 marks. 2. What are the approaches to job design? Discuss. 3. What is line balancing? Discuss briefly the methods of line balancing. 4. What is meant by aggregate planning? Explain how do you plan, 8 to 10 types of a product, and schedule these types of product. 5. What is cellular manufacturing? 6. What do you understand by learning curves and its applications? 7. Discuss the factors influencing product development. 4X5=20)

P.T.O

SECTION - C Answer any three questions. Each question carries 10 marks. (3X10=30)

8. The following tasks must be performed on an assembly line in the sequence and times specified: Task

Task Time (Seconds)

: A

: 50

B 40 -

C 20 A

D 45 C

E 20 C

F 25 D

G 10 E

H 35 B,F,G

Task that must precede : -

a) Draw a precedence diagram. b) What is the theoretical minimum number of stations required to meet a forecasted demand of 400 units per 8-hour day? c) Balance the line in any of the methods. 9. In an attempt to increase productivity and reduce costs, RS Corporation is planning to install an incentive pay plan in its manufacturing plant. In developing standards for one operation, time-study analysts observed a worker for a 30-minute period. During that time the worker completed 42 parts. The analysts rated the worker as producing at 130 percent. The base wage rate of the worker is Rs. 100 per hour. The firm has established 15 percent as a fatigue and personal time allowance. a) What is the normal time and standard time for the task? b) If the worker produced 500 units during an eight hour day, what wages would the worked have earned? 10. Why does the operations strategy keep changing for companies that are world class competitors? Discuss with examples. 11. What are some capacity considerations in a service industry? How do they differ from those in a manufacturing firm? 12. Discuss JIT in job-shop layout and in a line layout.

SECTION D 13. Case (Compulsory) : Alan Engineering Contractors creates six-month rolling schedules, which are recomputed monthly. For competitive reasons, the company does not subcontract. Therefore, its only options to meet customer requirements are 1) work on regular time 2) work on overtime, which is limited to 30 percent of regular time; 3) do customers work early which would cost an additional Rs.100 per hour per month and 4) perform customers work late, which would cost an additional Rs.200 per hour per month penalty as provided by their contract. Alan Engineering has 25 engineers on its staff at an hourly rate of Rs.300. customers hourly requirements for the six months from Jan. to June are: Jan 5,000 Feb 4,000 March 6,000 April 6,000 May 5,000 June 4,000

Develop an aggregate plan using the transportation method of linear programming. Assume 20 working days in each month.

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Management (New)

Course-21: TOTAL QUALITY MANAGEMENT (Compulsory)

Time:3 Hours Max. Marks: 75

1. Answer any five of the following sub-questions. Each sub-question carries two marks. SECTION - A (5X2=10) a) Define Capability Index. b) Define Quality Costs. c) What is Internal Benchmarking? d) What do ASQ and ANSI stand for? e) What id meant by Voice of the Customer? f) Explain the concept of Kanban System. g) What is JIT System? SECTION B Answer any four questions. Each question carries 5 marks. 4X5=20)

2. Explain why quality should be better by following the TQM concept than in a system that depends on final inspection. 3. How can top management communicate the need for quality throughout the organization? 4. What is Deming Cycle? How it is used to improve quality? 5. Construct a Flow Diagram/Chart for the manufacture of a product or providing a service. 6. Explain the concept of Quality is Free. Who is the author of this concept? 7. Explain the key elements of Total Quality Management.

P.T.O

SECTION - C Answer any three questions. Each question carries 10 marks. 8. Explain the concepts of Quality Function Deployment and list its benefits. 9. Explain the key differences between traditional management practices and those in a TQ environment. 10. Explain the benefits of and controversy surrounding ISO 9000. Can ISO 9000 lead an organization to world-class quality? 11. Is Japanese success in attaining higher levels of quality to do with good management practices or with national cultural factors? Justify your answer. 12. What according to Philip Crosby are the four Absolutes of Quality Management? (3X10=30)

SECTION D 13. Case (Compulsory) : Reengineering at A T & T Universal Card Services: In 1992 the Universal Card Services division of AT and T, just 31 months in existence, won the Malcolm Baldrige Quality Award. The divisions strong suit was customer satisfaction, although the much improved customer delight was chosen as the bases for the company values. Despite the award, the found itself with an embarrassment of riches-or more precisely an embarrassment of customers. The success of the companys combination credit card/longdistance phone card was astounding, charter members would receive a reduced rate credit card that charged several points below market interest rates and had a lifetime membership without an annual fee. In addition, the card gave a 10 percent discount on long distance calls. The card was launched on the Academy Awards Show. In the first 24 hours, 250.000 inquiries were received, and at the end of one year 5 .3 million people had become charter members. The response overwhelmed the companys ability to accommodate customer inquires. A major roadblock was information technology. Phone reps were given underperforming dumb terminals manufactured by AT & T, the parent company. The reps were unable to integrate information from multiple mainframes and had to bounce from screen to screen while keeping up a conversation with the caller. These computer hardware problems were subsequently solved by the installation of advanced systems, which are under continuing review and reengineering in search of faster response times and greater flexibility. Currently the phone reps field about 1.2 million inquires per month and answer 95 percent before 20 seconds have elapsed.

Information technology can improve both productivity and quality in a number of ways. For example, the company is testing a voice recognition unit that can reduce costs by more than a factor of 10. A voice response call costs 20 cents as compared to $ 2.50 for a representative to service the same customer. Information technology is also valuable for research and data analysis. By analyzing the call-management database, workload forecasts can be made each day or shift to allow for optimum use of personnel between departments. The company has not overlooked the soft side of information technology. The value system of customer delight demands rapid, accurate and courteous responses to customer calls. One-third of the workforce which operates in self-directed teams focuses on behaviour training, including ways to influence people, how to negotiate, and how to resolve conflicts. These teams have allowed the company to flatten the organization and increase the ratio of associates to supervisors from the current 20 to 1. Questions : 1) What is the role of information technology in productivity improvement? What is its role in reengineering? 2) Choose a process and trace the steps in the process to demonstrate how many separate operations are involved. How could the process be reengineered?

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Elective A : Finance - Management (New)

Course-22A: INTERNATIONAL FINACNCE MANAGEMENT

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) Write the structure of current account in balance of payments. b) If direct quote is Rs.40.50-40.60/US $, how can this be presented under indirect quote? c) Find the cross for /Euro, if Euro.6035-.6045/US $ and .5025-.5035/US $ (=British Pound) d) Distinguish between call option and put option. e) What is parallel loans? f) Define netting. g) What is mark to market margin? SECTION B Answer any four questions. Each question carries 5 marks. 4X5=20)

2. You receive the following quote for Swiss France against the dollar spot, one month, three months and six months forward 1.6075 to 1.6085, 10 to 15, 14 to 22, 20 to 30. 3. What is location arbitrage? If, Bank X quotes in NY.$0.9650 70/Euro, Bank Y quotes in London $ 0.9630- 40/Euro how the corporate treasury could make geographical arbitrage profit using 1 million Euro? 4. Discuss I.R.P Theory. 5. What are the methods of managing operating exposure? 6. Why should a foreign project be evaluated both from a subsidiary and parent view point? 7. A US importer importing foods for Pound 62500 fears an appreciation of pound. He likes to hedge the risk through options. Options are available to him at two different rates. One is US $ 1.60/ and the other is US $ 1.70/. The premium in both cases is US $ 0.03/. If the spot rate on the maturity goes upto US $ 1.65/, what will be his course of action?

P.T.O

SECTION - C Answer any three questions. Each question carries 10 marks. (3X10=30)

8. Examine different theories of exchange theories of exchange rate determination. 9. Discuss the complexities of international financial management compared to domestic financial management. 10. Describe the concept of leads, lags and transfer pricing. 11. Explain the functions of the foreign exchange market. Who are the participants in the market? 12. Define International Fisher Effect. Assume that one year interest rate 3% in U.S. and 5% in Euro zone. The spot rate between the Euro and the Dollar is .02/$. Assuming I.F.E. holds what should be / $ rate be one year hence? SECTION D 13. Case Study (Compulsory) : Mr. Gupta is the chief financial officer of a manufacturing company. His company has imported a machinery for $ 5 million payable after 90 days. He does not want to take risk. He has collected following information for the analysis of his currency exposure problem. a) b) c) d) e) Spot rate is Rs. 40/US $ 90 days forward rate is Rs. 39.50/US $ Interest rate on borrowing in India and U.S 6% p.a Interest rate on investment-both countries 5% p.a A 90 day call option is having a strike price of Rs.39.60 and premium of Rs.0.05 per dollar. f) g) A 90 day put option strike price is Rs.39.80 and premium of Rs.0.05 per dollar. Spot rate on the 90th day is Rs.39.80/US $. Advice : The finance manager to opt for: a) No Hedge b) Forward market c) Hedge in money market d) Hedge in options market.

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Elective C : Human Resources - Management (New)

Course-22C: MANAGEMENT OF INDUSTRIAL RELATIONS

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) What is industrial relations? b) What is industrial conflict? c) Define a trade union. d) What is collective bargaining? e) What is collective bargaining? f) What is industrial peace? g) What is arbitration? SECTION B Answer any four questions. Each question carries 5 marks. 2. Bring out the importance of trade unions in industrial relations. 3. Describe the nature and significance of industrial relations. 4. What are the different types of trade unions? 5. Comment on the role of outsider in trade unions. 6. What are the causes of industrial disputes? 7. What are the main features of collective bargaining? SECTION - C Answer any three questions. Each question carries 10 marks. 8. Explain the role of state in maintaining industrial relations. 9. Examine the various approaches to trade unionism. 10. Explain the conditions necessary for a strong and successful trade unions. 11. Elucidate the implication of industrial peace and industrial unrest. (3X10=30) 4X5=20)

P.T.O

12. Without the threat of strike in the background collective bargaining cannot exist in India- Comment. SECTION D 13. Case Study (Compulsory) : Arpana Textiles is a leading industry having a workforce of more than 1200 employess, engaged in the manufacture of cotton yarn of different counts. The company has wellestablished distribution network in different parts of country. It has modernised all its plants, with a view to improve the productivity and maintain quality. To maintain good human relations in the plant and the organisation as whole, it has extended all possible facilities to the employees. Compared to other mills the employees of Arpana Textiles are enjoying higher wages and other benefits. The company has a chief executive followed by executives in-charge of different functional areas. The Industrial Relations Department in headed by the Industrial Relations Manager. The employees are represented by five trade unions- A, B, C, D and E (Unions are alphabetically presented based on membership)- out of which the top three unions are recognised by the management for purpose of negotiations. All the unions have maintained good relations with the management individually and collectively. For the past ten years, the company has been distributing bonus to the workers at rates more than the statutory minimum prescribed under the Bonus Act. Last year, for declaration of rate of bonus, the management had a series of discussions. With all recognised unions and finally announced a bonus, which was in turn agreed upon by all the recognised unions. The very next day when the management prepared the settlement and presented it before the union representatives, while unions A and C signed the same, the leader of union B refused to do so and walked out, stating that the rate of bonus declared was not sufficient. The next day, union B issued a strike notice to the management asking for higher bonus. The management tried its level best to avoid the unpleasant situation, but in vain. As a result, the members of unions B went on strike. They were joined by the members of union D. During the strike, the management could probe the reason for the deviant behaviour of union B leader, it was found that leader of union A, soon after the first meeting, had stated in the presence of a group of workers, It is because of me that the management has agreed to declare this much amount of bonus to the employees: union B has miserably failed in its talks with the management for want of initiative and involvement. This observation somehow reached the leader of union B as a result of which he felt insulated. Soon after identifying the reason for union Bs strike call, the Industrial Relations Manager brought about a compromise between the leaders of unions A and B. Immediately after this meeting, the strikers (members of union B and D) resumed work and the settlement was signed for the same of bonus as was originally agreed upon.

Questions: 1) Was the leader of union A justified in making remarks which made the leader of union B feel offended? 2) What should be managements long term strategy for avoiding recurrence of interunion differences on such issues? 3) If you were the Industrial Relations Manager, what would have you done had the union B resorted to strike for a reason other than mentioned in the case?

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Elective B : Marketing - Management (New)

Course-23B: INDUSTRIAL MARKETING

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) What is consumer marketing? b) What do you mean by vendor analysis? c) Define strategy planning? d) What is marketing information system? e) What do you mean by product life cycle? f) What is channel strategy? g) Define marketing research. SECTION B Answer any four questions. Each question carries 5 marks. 2. How does the concept of joint demand impact the firm selling to resellers? 3. Explain the nature of industrial buying. 4. What are the components of industrial marketing strategy? 5. How do customer experiences versus inexperience affect marketing segmentation strategy? 6. Explain the relationship of innovation of productivity. 7. Why industrial firms choose their distributors? Explain. SECTION - C Answer any three questions. Each question carries 10 marks. 8. Discuss the strategies for managing the industrial marketing environment. 9. Describe the conflict resolution strategies. 10. Explain the role of qualitative research over quantitative research. (3X10=30) 4X5=20)

P.T.O

11. Explain the relationship between new product development and strategic planning. 12. Discuss the impact of logistical service on channel members.

SECTION D 13. Case Study (Compulsory) : Vinod Nair, sales executive of Zerise Documentation Ltd., encounters the Head, Department of Management Studies of the University, to sell photocopying machine. We already have a photocopying machine. I am sorry Mr.Nair, we dont need any more machine. Says the Head. But that machine you have now is kept in the library and I understand that it is fully employed. You have a very large quantity of course materials to reproduce. I feel that you need some more copiers, suggest Nair. The Head retorts. Look Mr.Nair, we have a typing pool of four time typists and one Section Officer to produce the course materials. We also have a duplicating machine and an operator for that. If we have to make one copy of any document, we photocopy it, if we want four or five copies we type it and if more copies are needed we cut stencil and take copies. The present arrangement can take care of our requirements. We certainly dont need any more photocopying machine. Anybody would like to have additional facilities, but we have financial constraints so that we cant afford the luxury of an additional photocopier. But Sir Although Nair tried to put forward his proposition, he has stopped by the Head who had to leave immediately to meet the Vice Chancellor as per the appointment. Nair pleaded for an appointment some time later when the Head could spare some time. If you are very particular about meeting me you may do so somewhere next week. But, I have already told you that we dont need another copier. So, if you are inclined to waste some time, you may take an appointment and meet me. Saying this Head stands up to leave for the meeting. Questions: 1) Should Nair Regard it as a closed chapter or should he meet the Head again? 2) If you feel that Nair should endeavour again to make a sale, draw up a strategy that would enable him to make the Head favourably disposed.

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Elective A : Finance- Management (New)

Course-23 A: Portfolio Management and Security Analysis

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) Security market line b) Single index model c) Random walk d) Market to book ratio e) Risk aversion f) Arbitrate pricing theory g) Covariance matrix SECTION B Answer any four questions. Each question carries 5 marks. 2. Outline some of the tools of technical analysis. 3. Can portfolio variance be zero? Explain. 4. A stock price on Jan.1 was Rs.748 on March 31 it was Rs.702/-. During that period dividend of Rs.30 was received. What is the holding period return? 5. What factors influence portfolio combination? 6. How do you explain the divergence between market price and intrinsic value of a security 7. What is a securitys alpha? SECTION - C Answer any three questions. Each question carries 10 marks. (3X10=30) 4X5=20)

8. A company has been experiencing on normal dividend growth-rate of 20 percent per year for the last 5 years. This normal growth rate is expected to continue for another 5 years before it levels affect a more normal rate of 6 percent. Companys last dividend was Rs.0.50 per share. Determine the current value of stock if its required rate of return is 15 percent. P.T.O

9. Outline Dons Theory. 10. Carry out a technical analysis using relative strength technique.

Year

Price of Maruthi

Price of Nifty

Price of Automotive Industry

(PM) 1994 1995 1996 Rs.40 45 65

P(N) Rs.250 270 300

P(A) Rs.20 22 25

11. List out the cnomalies to CAPM. 12. Calculate the expected return of risk for the following probability distribution: Probability .2 .4 .3 .1 1.0 SECTION D 13. Case Study (Compulsory) : A company is considering adding a new product division. If a new division is added, it will cover a 20 percent increase in the existing profit margin and 40 percent increase in the existing profit margin and 40 percent increase in total assets. The increase in asset will be financed with debt. Determine the RUE if sales remain constant. Assume the following ratios existed before the change in assets: N1 Profit Margin = Sales Sales Total asset turnover = = 2.5 Total assets Total assets Equity Multiplier(EM) = Equity -----------------------------------------= 1.5 = 1.2 Annual Stock X -5% 10 -4 7 Return Stock Y 6% -2 8 -9

IV Semester M.B.A. Examination, June/July-2008

Elective C : HUMAN RESOURCES MANAGEMENT Management (New)

Course-23C: International Human Resource Management

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) Define the term International Human Resource Management. b) Mention three functions of International Human Resource Management. c) What is ethno centric approach? d) Mention three disadvantages of poly centric approach. e) What are the two advantages of Regio-centric approach? f) What do you understand by the term Expatriate Failure? g) Define the term International Performance Management. SECTION B Answer any four questions. Each question carries 5 marks. 2. Explain the factors influencing purchasing performance measurement. 3. Explain the methods of establishing performance standards? 4. State the SCM skills. 5. Explain the supply chain strategies. 6. What factors are to considered while evolving a compensation package by a multinational company? 7. Explain the supply chain management process? SECTION - C Answer any three questions. Each question carries 10 marks. 8. Explain the four major decision areas in supply chain management? (3X10=30) 4X5=20)

P.T.O

9. Why should purchasing performance be measured and evaluated? 10. State the cultural dos and Donts in Japan. 11. Explain the cultural characteristics of USA and Europe. 12. What precautions should an organization take before introducing e-HR?

SECTION D 13. Read the following case and answer the questions given below: 13. Case Study (Compulsory) : Despite the problems with forced ranking systems, first consulting group, an IT health care consulting firm is based in long beach, California, uses a forced ranking system. The company system has five numerical grades that do not mandate the exact proportion of employees to be placed in different categories or what will happen to those employees. Ranking are combined with the results of traditional employee evaluations and project reviews to provide a comprehensive picture of each employees strengths and weaknesses. Managers and coaches discuss each employees performance for about 10 minutes and then each evaluator gives employees a numerical score. The scores for each employee are averaged. In a recent session rating 11 employees on a scale of 1 to 5 almost every employee was placed in the 2s and 3s. After discussion there was one top performer and one bottom performer with the other employees spread out between. Questions: 1) How does this type of performance management system potentially affect training and development of compensation? 2) Why might this type of ranking system work in comparison to those systems discussed in the given case? 3) What recommendations would you give to first consulting group to make this systems even more effective?

------------------------------------------

IV Semester M.B.A. Examination, June/July-2008

Elective A : Finance Management (New)

Course-24A: FINANCIAL DERIVATIVES

Time:3 Hours Max. Marks: 75

1. Answer any five sub-questions. Each question carries two marks. SECTION - A (5X2=10) a) Distinguish between buying and selling forwards. b) Can Forwards be entered into by any two persons? c) Are there margins for forwards? d) Name any stock exchange in India where futures are traded. e) What is shorting the futures? f) How can futures be used to protect against price fall? g) How is speculation done with futures? SECTION B Answer any four questions. Each question carries 5 marks. 2. What is continuous compounding? 3. What can a hedger do if he wants a hedge for 5 months and a futures contract is available only for a 3-month tenure? 4. What is the maximum pay off of a buyer of futures? How is it different from that of a seller of futures? 5. In what way does the mimicking portfolio help a portfolio manager? 6. Protective put strategy does not work in a rising market. Why? 7. How are futures useful in portfolio management? 4X5=20)

P.T.O

SECTION - C Answer any three questions. Each question carries 10 marks. (3X10=30)

8. Will there be circumstances when the upper limit of an American call is different from the upper limit of a corresponding European call? 9. If the difference between the exercise prices of two American call is Rs.8, can the two calls have prices of Rs. 32 and Rs.12? Explain. 10. If the call price is Rs.12, the stock price is Rs. 100 and the present value of the strike price is Rs.98, what should be the corresponding put price? Explain. 11. What is covered call writing? Does it work in real life? 12. Using your own examples explain how options can be used by a portfolio manager.

SECTION D 13. Case Study (Compulsory) : David has a portfolio of securities. In recent months he has started using options to protect/enhance his portfolio. Thus he has indulged in covered call writing, buying protective puts and doing several combinations. Now his portfolio worth is Rs.20 lakhs consisting of 15 companies shares of various quantities. Because the market is volatile, Ram wants to profit from the period of the next 3 months, and at the same time not take undue risk. He is exploring strategies using options. He finds that only American options are available for specific securities. European options are available only for the index options. The Beta of his portfolio is 0.9. Questions: 1) Name possible strategies that are possible. Are these in the nature of profit making or for protection? 2) The fact that securities options are American is both an advantage and disadvantage for David. Explain. 3) How much risk is there in any of the strategies that could be followed?

------------------------------------------

Anda mungkin juga menyukai

- Mba Oct2011Dokumen119 halamanMba Oct2011Fakhruddin GodhrawalaBelum ada peringkat

- E2 - Enterprise ManagementDokumen8 halamanE2 - Enterprise ManagementmansimangeshBelum ada peringkat

- Assignment-Industrial Engineering and ManagementDokumen7 halamanAssignment-Industrial Engineering and ManagementCharles OndiekiBelum ada peringkat

- 2nd Year Assignment Question Papers 2011 2012Dokumen12 halaman2nd Year Assignment Question Papers 2011 2012Shraveen RajBelum ada peringkat

- MBA 3rd SEM ASSIGNMENT QUESTIONSDokumen7 halamanMBA 3rd SEM ASSIGNMENT QUESTIONSiitmpoolpartyBelum ada peringkat

- Operations Management Assignment PDFDokumen4 halamanOperations Management Assignment PDFanteneh tesfaw0% (2)

- E1 Guide: Operations Management EssentialsDokumen13 halamanE1 Guide: Operations Management Essentialsasdfghjkl007Belum ada peringkat

- P2 Sept2012 QuestionpaperDokumen16 halamanP2 Sept2012 QuestionpaperjoelvalentinorBelum ada peringkat

- Usha Martin University Exam Question Paper on HRMDokumen5 halamanUsha Martin University Exam Question Paper on HRMAakash KrBelum ada peringkat

- IMT 15 Production and Operation Management M3Dokumen4 halamanIMT 15 Production and Operation Management M3solvedcareBelum ada peringkat

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDokumen9 halamanMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamBelum ada peringkat

- Question Bank 4th SemesterDokumen16 halamanQuestion Bank 4th SemesterJeevanandam ShanmugasundaramBelum ada peringkat

- MBA Assignment TopicsDokumen40 halamanMBA Assignment TopicstdhinakaranBelum ada peringkat

- Candidates Are Required To Give Their Answer in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDokumen4 halamanCandidates Are Required To Give Their Answer in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksPujaBelum ada peringkat

- Assignment WEEK 4Dokumen7 halamanAssignment WEEK 4Soumyashis Bhattacharya100% (1)

- SMU MBA Semester 2 AssignmentsDokumen4 halamanSMU MBA Semester 2 AssignmentsRajesh SinghBelum ada peringkat

- M.Com I Semester Model Question Papers (2008-09 BatchDokumen28 halamanM.Com I Semester Model Question Papers (2008-09 Batchrahulcute2011Belum ada peringkat

- University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterDokumen4 halamanUniversity of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterSupriyo BiswasBelum ada peringkat

- TQM Study MaterialDokumen19 halamanTQM Study Materialheba aburayyanBelum ada peringkat

- GE2022 TQM Syllabus BreakdownDokumen21 halamanGE2022 TQM Syllabus BreakdownVadivel AeroBelum ada peringkat

- BA7104 TotalQualityManagementquestionbankDokumen10 halamanBA7104 TotalQualityManagementquestionbankAnonymous uHT7dDBelum ada peringkat

- End Term POMDokumen2 halamanEnd Term POMmanagementBelum ada peringkat

- M03 Study GuideDokumen5 halamanM03 Study GuideMartina Vegel DavidsonBelum ada peringkat

- 2012 Specimen PaperDokumen18 halaman2012 Specimen Paperkevin1811Belum ada peringkat

- MBAThird Semester Winter 2009Dokumen13 halamanMBAThird Semester Winter 2009THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Belum ada peringkat

- Production and Operations Management Exam - AnswerDokumen10 halamanProduction and Operations Management Exam - AnswerKalvin Morales NebrejaBelum ada peringkat

- IESL Part II (b) - 327 Engineering Management examDokumen6 halamanIESL Part II (b) - 327 Engineering Management examUmange RanasingheBelum ada peringkat

- Mcom, MBA (FT) (PT)Dokumen38 halamanMcom, MBA (FT) (PT)bhavikbBelum ada peringkat

- MBAI204 - OM - Assignment No. 2 - 2020Dokumen11 halamanMBAI204 - OM - Assignment No. 2 - 2020Ruchi AryaBelum ada peringkat

- Production Ist Int QP Without KeyDokumen4 halamanProduction Ist Int QP Without Keykingsley_psbBelum ada peringkat

- Cbmec 1 Classes - Total Quality Management: InstructionsDokumen2 halamanCbmec 1 Classes - Total Quality Management: InstructionsJoy Marie CezarBelum ada peringkat

- CBMEC 1 CLASSES - TOTAL QUALITY MANAGEMENT CHAPTER 4Dokumen2 halamanCBMEC 1 CLASSES - TOTAL QUALITY MANAGEMENT CHAPTER 4Joy Marie CezarBelum ada peringkat

- Terminal Report No. 2Dokumen2 halamanTerminal Report No. 2Joy Marie CezarBelum ada peringkat

- Imt 15Dokumen5 halamanImt 15pratiksha1091Belum ada peringkat

- Mbai Oct09Dokumen13 halamanMbai Oct09idhaya_idhayanBelum ada peringkat

- TQM Case Study Summary: How Xerox Corporation Implemented Total Quality ManagementDokumen9 halamanTQM Case Study Summary: How Xerox Corporation Implemented Total Quality ManagementLauren Mae Bulat-agBelum ada peringkat

- QBDokumen34 halamanQBAadeel NooraniBelum ada peringkat

- MbaDokumen159 halamanMbaHasnain Sayad100% (1)

- MB18 TQM Exam QuestionsDokumen2 halamanMB18 TQM Exam QuestionsChandrashekar Mullur ShamannaBelum ada peringkat

- P5 Strategic MGT QADokumen12 halamanP5 Strategic MGT QACLIVEBelum ada peringkat

- E1 May 2011 QPDokumen12 halamanE1 May 2011 QPmavkaziBelum ada peringkat

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 SemesterDokumen3 halamanUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 SemesterSupriyo BiswasBelum ada peringkat

- MBA (International Business)Dokumen52 halamanMBA (International Business)Nazhia KhanBelum ada peringkat

- Trials - Penrith High Business Studies HSC Trial ExamDokumen17 halamanTrials - Penrith High Business Studies HSC Trial ExamqwoneBelum ada peringkat

- Business Environment FinalDokumen12 halamanBusiness Environment FinalNikesh Munankarmi100% (1)

- Business Studies Class XII I Pre-Board Paper (2021-22)Dokumen4 halamanBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalBelum ada peringkat

- NMIMS Sept Latest AssignmentsDokumen42 halamanNMIMS Sept Latest AssignmentsAmanDeep Singh0% (1)

- QuesDokumen12 halamanQuesRajesh UsBelum ada peringkat

- Eastern University Midterm Exam for Managerial EconomicsDokumen1 halamanEastern University Midterm Exam for Managerial EconomicsMeheroze Al HassanBelum ada peringkat

- PGDBM SyllybusDokumen54 halamanPGDBM SyllybusEd ReyBelum ada peringkat

- (Aa33) Business Management and StrategyDokumen5 halaman(Aa33) Business Management and StrategynvjnjBelum ada peringkat

- Shanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015Dokumen7 halamanShanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015SharmaBelum ada peringkat

- Sales and Advertising Management Exam QuestionsDokumen41 halamanSales and Advertising Management Exam QuestionsgauravBelum ada peringkat

- Purbanchal University exam questions on supply chain managementDokumen2 halamanPurbanchal University exam questions on supply chain managementAakash RegmiBelum ada peringkat

- Terms and Conditions of Service 1Dokumen12 halamanTerms and Conditions of Service 1Jamie RossBelum ada peringkat

- MA2 CGA Sept'12 ExamDokumen19 halamanMA2 CGA Sept'12 Examumgilkin0% (1)

- A Study of the Supply Chain and Financial Parameters of a Small BusinessDari EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessBelum ada peringkat

- أسئلة وإجابات فى إدارة المشروعاتDari Everandأسئلة وإجابات فى إدارة المشروعاتPenilaian: 1.5 dari 5 bintang1.5/5 (3)

- Mba 117 (Al)Dokumen1 halamanMba 117 (Al)suryavamshirakeshBelum ada peringkat

- Mba 16-BDokumen3 halamanMba 16-BsuryavamshirakeshBelum ada peringkat

- I Semester Master of Business Administration Examination, August 2011 Management Theory and PracticeDokumen1 halamanI Semester Master of Business Administration Examination, August 2011 Management Theory and PracticesuryavamshirakeshBelum ada peringkat

- Mba 011Dokumen2 halamanMba 011suryavamshirakeshBelum ada peringkat

- MBA02 Corporate Communication and Managerial Economics DocumentDokumen2 halamanMBA02 Corporate Communication and Managerial Economics DocumentsuryavamshirakeshBelum ada peringkat

- Mba 106Dokumen2 halamanMba 106suryavamshirakeshBelum ada peringkat

- Mba 114Dokumen1 halamanMba 114suryavamshirakeshBelum ada peringkat

- II Semester M.B.A. in Aviation Examination, October 2011 Evolution of Aviation (July 2010 Batch) and Re-Sit (January 2010 Batch)Dokumen3 halamanII Semester M.B.A. in Aviation Examination, October 2011 Evolution of Aviation (July 2010 Batch) and Re-Sit (January 2010 Batch)suryavamshirakeshBelum ada peringkat

- Mba 031Dokumen2 halamanMba 031suryavamshirakeshBelum ada peringkat

- MB 104Dokumen2 halamanMB 104suryavamshirakeshBelum ada peringkat

- Managerial Economics: MB102 I Semester M.B.A. ExaminationDokumen2 halamanManagerial Economics: MB102 I Semester M.B.A. ExaminationsuryavamshirakeshBelum ada peringkat

- MB 101Dokumen2 halamanMB 101suryavamshirakeshBelum ada peringkat

- RSK - Assignment Prject Magt Assinmt I &IIDokumen1 halamanRSK - Assignment Prject Magt Assinmt I &IIsuryavamshirakeshBelum ada peringkat

- Mba 117 (Al)Dokumen1 halamanMba 117 (Al)suryavamshirakeshBelum ada peringkat

- MB 101Dokumen2 halamanMB 101suryavamshirakeshBelum ada peringkat

- DBMS and MSS Test Portions AreDokumen1 halamanDBMS and MSS Test Portions AresuryavamshirakeshBelum ada peringkat

- MBA 116 Question PaperDokumen1 halamanMBA 116 Question PapersuryavamshirakeshBelum ada peringkat

- Section Title - Text Runs A Maximum of Two Lines: October 30, 2007 © SKF Group Slide 0Dokumen26 halamanSection Title - Text Runs A Maximum of Two Lines: October 30, 2007 © SKF Group Slide 0suryavamshirakeshBelum ada peringkat

- DBMS and MSS Test Portions AreDokumen1 halamanDBMS and MSS Test Portions AresuryavamshirakeshBelum ada peringkat

- Full Research PaperDokumen31 halamanFull Research PaperMeo ĐenBelum ada peringkat

- 2C 2I 1R Pedagogical ApproachesDokumen9 halaman2C 2I 1R Pedagogical ApproachesMenchelyn MarasiganBelum ada peringkat

- Chapter-1 of F.mensurationDokumen8 halamanChapter-1 of F.mensurationpradeeppoddarBelum ada peringkat

- AntimonyDokumen72 halamanAntimony沈益Belum ada peringkat

- GR 11 SLK Pe 1 Week 2 1ST Sem PDFDokumen10 halamanGR 11 SLK Pe 1 Week 2 1ST Sem PDFwinslet villanuevaBelum ada peringkat

- Scan To Folder Easy Setup GuideDokumen20 halamanScan To Folder Easy Setup GuideJuliana PachecoBelum ada peringkat

- Magic Writ: Textual Amulets Worn On The Body For Protection: Don C. SkemerDokumen24 halamanMagic Writ: Textual Amulets Worn On The Body For Protection: Don C. SkemerAsim HaseljicBelum ada peringkat

- Rubric WordsmithDokumen6 halamanRubric Wordsmithapi-200845891Belum ada peringkat

- Sereno's Dissenting Opinion Re TruthCommDokumen35 halamanSereno's Dissenting Opinion Re TruthCommGerald MagnoBelum ada peringkat

- Chapter 1: Functions and Relations: Precalculus, 1st EdDokumen49 halamanChapter 1: Functions and Relations: Precalculus, 1st EdjakyBelum ada peringkat

- IvanhoeDokumen17 halamanIvanhoeRob Collins100% (4)

- 7 Ways To Shortlist The Right StocksDokumen10 halaman7 Ways To Shortlist The Right Stockskrana26Belum ada peringkat

- Chronic Laryngitis in CHU Yalgado Ouedraogo: Epidemiological and Diagnostic AspectsDokumen4 halamanChronic Laryngitis in CHU Yalgado Ouedraogo: Epidemiological and Diagnostic AspectsMarlina ElvianaBelum ada peringkat

- Department of Information TechnologyDokumen1 halamanDepartment of Information TechnologyMuhammad ZeerakBelum ada peringkat

- HRM in InfosysDokumen11 halamanHRM in Infosysguptarahul27550% (4)

- G11 F2F ScheduleDokumen3 halamanG11 F2F ScheduleQueenie Marie Obial AlasBelum ada peringkat

- HPLC Method for Simultaneous Determination of DrugsDokumen7 halamanHPLC Method for Simultaneous Determination of DrugsWidya Dwi Arini100% (1)

- RMXPRT Manual PDFDokumen481 halamanRMXPRT Manual PDFsch12332163% (16)

- Elliot WaveDokumen8 halamanElliot WaveGateshNdegwahBelum ada peringkat

- 7 STEPS OF Quality Control Pillar: QC Pillar Training MaterialDokumen12 halaman7 STEPS OF Quality Control Pillar: QC Pillar Training MaterialvictorBelum ada peringkat

- Person On The StreetDokumen12 halamanPerson On The StreetalyssajdorazioBelum ada peringkat

- Pulp Fiction DeconstructionDokumen3 halamanPulp Fiction Deconstructiondomatthews09Belum ada peringkat

- IntroDokumen1 halamanIntroaravinthr1989Belum ada peringkat

- Maternal and Perinatal Outcome in Jaundice Complicating PregnancyDokumen10 halamanMaternal and Perinatal Outcome in Jaundice Complicating PregnancymanognaaaaBelum ada peringkat

- Advanced Management Accounting: ConceptsDokumen47 halamanAdvanced Management Accounting: ConceptsGEDDIGI BHASKARREDDYBelum ada peringkat

- [4]Dokumen693 halaman[4]Ali Mohammed AlkafajyBelum ada peringkat

- Soal EnglishDokumen7 halamanSoal EnglishRieZky RamadhaniBelum ada peringkat

- Central Venous Access Devices (Cvads) andDokumen68 halamanCentral Venous Access Devices (Cvads) andFitri ShabrinaBelum ada peringkat

- Certification Exam: Take A Business OnlineDokumen15 halamanCertification Exam: Take A Business OnlineezerkaBelum ada peringkat

- EMship Course ContentDokumen82 halamanEMship Course ContentBecirspahic Almir100% (1)

![[4]](https://imgv2-2-f.scribdassets.com/img/document/396226966/149x198/c657f32573/1545578422?v=1)