Monthly PPT July 2013

Diunggah oleh

nit111Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Monthly PPT July 2013

Diunggah oleh

nit111Hak Cipta:

Format Tersedia

Anand Rathi Retail Research

Equities

Make or Break..

(Levels as on 8th July 2013)

A.K. Prabhakar

Sr. VP, Equity Research, Anand Rathi Equities

EQUITY

Anand Rathi Retail Research

Quick thought!!

Nifty has been making higher lows and higher high; Nifty made low of 4521 in December/2011 and subsequently made 5629 in February 2012,

Low of 4770 in June 2012 and high of 5815 in October 2012, 4888 as freak trade in October 2012 was followed with high of 6111 in January 2013, low of 5477 in April 2013 was followed by 6229 high in last 31months and now 5566 is the higher low will 6229 higher high be breached is very important.

Nifty stocks which could outperform if rally takes-off RELIANCE, ITC, SUNPHARMA, M&M, HDFCBANK, HDFC, LUPIN, TCS, ICICIBANK & HINDUNILEVER.

EQUITY

Anand Rathi Retail Research

6111 5815 5629

6229

5566 5477

Freak low of 4888 4770 4531

EQUITY

Anand Rathi Retail Research

Structural changes begin

Volatility continues, from US Federal Reserve statements on slowly winding up of monetary easing to improvement in CAD situation has swung the market and sentiments. Rupee has been volatile with touching all time high and almost losing 9.1% percent against the dollar in the second quarter (Apr-Jun). FIIs have been net sellers to the tune of Rs. 10,500crs in the last month though domestic institutions have turned buyers specially LIC. The advance tax numbers have been better and the next big trigger for the markets are the Q1FY14 result season.

Also the ongoing process of reforms from government front is holding the positive sentiments on streets. The banking licenses, hike in gas prices, FDI approvals for telecom are key trigger in the longer run.

We continue with the stock specific selection as frontline stocks have taken the lead in the momentum market. We like are M&M, Maruti, RIL, HDFC, L&T, Lupin, Infosys, ITC and Hindalco.

EQUITY

Anand Rathi Retail Research

What we like this month..?

Picks of the Last month Reco Price High after Reco Last month Pick Lupin (June 2013) 759 855 Bata India (May 2013) 776 898 Natco Pharma (April 2013) 444 467.0 Rallis India (March 2013) 126 147.0 Cummins India (Feb 2013) 502 525.0 LIC Housing (Jan 2013) 289 291.7 Sun Pharmaceuticals Inds (Dec) 715 1084.0 ING Vysysa Bank (Nov) 471 667.0 BASF (Oct) 665 781.0 Tata coffee (Sep) 993 1673.9 Bayer Cropscience (Aug) 922 1495.0 This month Pick Yes Bank (July 2013) 467 477

CMP 843 882 461.0 140.0 453.0 228.0 1075.0 620.0 543.0 1002.0 1472.0 475

% returns Status till date as on today 11.07 Open 13.66 Open 3.83 Open 11.11 Open -9.76 Open -21.11 Open 50.35 Booked 31.63 Open -18.35 Open 0.91 Open 59.65 Booked 1.71

Open

EQUITY

Anand Rathi Retail Research

Pick of the month Yes Bank

Target :- 12mon Rs.700 & 18mon Rs.800

Rs. In crs

NII PAT NIM (%) ROA (%) ROE (%) PB (x) CAR (%) CASA (%) GNPA (%) NNPA (%)

CMP 467

FY13

2,218.8 1,300.7 2.9 1.5 24.8 2.7 18.3 19.0 0.2 0.0

FY12

1,615.6 977.0 2.8 1.5 23.1 2.8 17.9 15.0 0.2 0.1

FY11

1,246.9 727.1 2.9 1.5 21.1 2.8 16.5 10.3 0.2 0.0

FY10

788.0 477.7 2.3 1.6 20.3 2.8 20.6 10.5 0.3 0.1

FY09

509.3 303.8 2.4 1.5 20.7 0.9 16.6 8.7 0.7 0.3

Consistent performer - The bank has shown a 5 yr CAGR growth of 45.8% in NII and PAT growth of 45.4% in the same period. ROE has been consistently above 20% for last 5 years and 24.8% is the highest among the peers. Earlier bank had large exposure towards bulk deposits which were high cost deposits, but now it is shifting its focus to CASA deposits which will lead to declining in cost and improving the margins for the bank. CASA has improved to 19% for FY13. Bank has total of 430 branches as on FY13.

It is also one of the bank which is also giving 6% on the savings account.

Market cap for the bank is Rs. 16,804crs and promoter holding is 25.72% which gives a free float of Rs. 12,603crs. A probable candidate for entering the index, Nifty.

EQUITY

Anand Rathi Retail Research

Nifty Monthly View

NIFTY (5811), Nifty made low of 5566 in June NIFTY after making all time high of 6357 in January 2008, made higher low consistent basis. Nifty 2252 in higher low compared with April low of 5477 and if October 2008, 4531 in December 2011 then 4770 was higher high has to be made then 6229 can be low in June2012 and freak low 4888 made in October crossed. Nifty on daily chart has made inverse Head 2012, in year 2013 low 5477 made in April and recent & Shoulder and close above 5920 could give 280low made in June is 5566. 300points rally. Nifty below 5566 on closing basis only would be major concern for uptrend. Nifty also Market normally takes more time to consolidate while has positive Island reversal if holds Rally can be once break-out is given needs less time to reach desired really fast. levels, now Nifty has entered 66th Month of consolidation and any month we cross 6357 which is all Nifty High for 2008 6357 which is all time high while time high we would take 1/3rd of the time to double 2010 high is 6338 and post which 6229 almost itself from all time high. making 6200-6350 as supply zone.

Nifty Monthly Chart

Nifty Weekly Chart

EQUITY

Anand Rathi Retail Research

Sensex Monthly View

SENSEX (19325) is still same levels as previous month, with Positive Island reversal & Inverse head & Shoulder formation seen. Sensex holding 18925 and crossing 19700 then rally of 1000Points(20700) could take just 3-5weeks. Sensex below 18467 on closing basis only can stop the uptrend. Sensex after making high of 20443 which is last 32 Months high has started to correct and till Sensex holds 18450 things looks positive, Sensex Range 18450 - 21000. Sensex made all time high 21206 in January 2008.

Sensex Monthly Chart

Sensex has consolidated for 66months and each time we have seen correction Sensex has made higher low which indicate higher base formation and this pattern has made Triangle pattern in Monthly charts which is powerful and once 21206 is crossed in 1/3rd of time Sensex can double. Sensex low of October2008 is 7697, March2009 low 8047, December 2011 low 15135 and June2012 low 15748, till now low of 2013 made in April 18144 and recent low 18467 made in June2013 and till that doesnt breach market is really strong.

Sensex Weekly Chart

EQUITY

Monthly views

View Trigger Levels

Anand Rathi Retail Research

What we said in Last Month

Nifty

Market would be in the range of 5560 - 6229 levels

NIFTY (5811), Nifty made low of 5566 in June higher low compared with April low of 5477 and if higher high has to be made then 6229 can be crossed. Nifty on daily chart has made inverse Head & Shoulder and close above 5920 could give 280-300points rally. Nifty below 5566 on closing basis only would be major concern for uptrend. Nifty also has positive Island reversal if holds Rally can be really fast. SENSEX (19325) is still same levels as previous month, with Positive Island reversal & Inverse head & Shoulder formation seen. Sensex holding 18925 and crossing 19700 then rally of 1000Points(20700) could take just 3-5weeks. Sensex below 18467 on closing basis only can stop the uptrend.

Range bound

Sensex

Range Bound Move b/w 1845020900

Range Bound

Be stock specific and accumulate stock with good fundamentals for a longer time horizon. Tata Coffee Cummins India Torrent Pharma

Accumulate good quality stocks

Stock specific movement

Target 1950, Time Horizon 1 Year Target 558, Time Horizon 1 Year Target 990, Time Horizon 1 Year

EQUITY

Anand Rathi Retail Research

THANK YOU

Disclaimer This report has been issued by Anand Rathi Share & Stock Brokers Ltd.(ARSSBL ), which is regulated by SEBI. The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities, options, future or other derivatives related to such securities (related investment). ARSSBL and its affiliated may trade for their own accounts as market maker/ jobber and /or arbitrageur in any securities of this issuer(s) or in related investments, and may be on the opposite side of public orders. ARS, its affiliates, directors, officers, and employees may have a long or short position in any securities of this issuer(s) or in related investment banking or other business from, any entity mentioned in this report. This research report is prepared for private circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial situation and the particular needs of any specific investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's price or value may rise or fall. Past performance is not necessarily a guide to future performance. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report.

Anda mungkin juga menyukai

- Financial Engineering Principles - Perry BeaumontDokumen0 halamanFinancial Engineering Principles - Perry BeaumontShankey Gupta100% (5)

- E Copy 32Dokumen50 halamanE Copy 32nit111Belum ada peringkat

- All News Editorials (Single PDF) - 19nov2019Dokumen23 halamanAll News Editorials (Single PDF) - 19nov2019nit111Belum ada peringkat

- DiwaliPicks2017 PDFDokumen16 halamanDiwaliPicks2017 PDFBalaji PiramalaBelum ada peringkat

- NESCO Stock Data and Business Segments AnalysisDokumen3 halamanNESCO Stock Data and Business Segments Analysisnit111Belum ada peringkat

- Khadim India IPO Watch at Dalal & BroachaDokumen3 halamanKhadim India IPO Watch at Dalal & Broachanit111Belum ada peringkat

- Financial Engineering Principles - Perry BeaumontDokumen0 halamanFinancial Engineering Principles - Perry BeaumontShankey Gupta100% (5)

- AUDITING FRAUD: 22 ASIAN COMPANIES WITH RED FLAGS AND LOW FEESDokumen34 halamanAUDITING FRAUD: 22 ASIAN COMPANIES WITH RED FLAGS AND LOW FEESnit111Belum ada peringkat

- Session 5 Technology Cases IndiaDokumen14 halamanSession 5 Technology Cases Indianit111Belum ada peringkat

- From HaryanaDokumen1 halamanFrom Haryananit111Belum ada peringkat

- Value Investors Group PDFDokumen11 halamanValue Investors Group PDFnit111100% (1)

- SPEECH For TeachersDokumen6 halamanSPEECH For Teachersnit111Belum ada peringkat

- Rahim Ke DoheDokumen24 halamanRahim Ke Doheapi-3708828100% (5)

- Emailing 5 - 6190538961627119826Dokumen42 halamanEmailing 5 - 6190538961627119826ManojThulasidasPaiBelum ada peringkat

- Gujarat Water Summit Brochure 2014Dokumen4 halamanGujarat Water Summit Brochure 2014nit111Belum ada peringkat

- 10 Big Lies Youve Been Told About InvestingDokumen39 halaman10 Big Lies Youve Been Told About Investingnit111Belum ada peringkat

- Wednesday July 31, 2013: Sensex Nifty RS./$Dokumen3 halamanWednesday July 31, 2013: Sensex Nifty RS./$nit111Belum ada peringkat

- Jyoti Structures (JYOSTR) : When Interest Burden Outweighs AllDokumen10 halamanJyoti Structures (JYOSTR) : When Interest Burden Outweighs Allnit111100% (1)

- Corporation Bank ReportDokumen11 halamanCorporation Bank Reportnit111Belum ada peringkat

- Bank of Baroda ResDokumen3 halamanBank of Baroda Resnit111Belum ada peringkat

- DENORAINDIA Firstcall 221112Dokumen12 halamanDENORAINDIA Firstcall 221112nit111100% (1)

- Bank of Baroda ResDokumen3 halamanBank of Baroda Resnit111Belum ada peringkat

- Tata Global Beverages LTDDokumen3 halamanTata Global Beverages LTDnit111Belum ada peringkat

- Vic by Vi - KKP Vps v3.7 Revised2Dokumen27 halamanVic by Vi - KKP Vps v3.7 Revised2nit111Belum ada peringkat

- Bank of Baroda ResDokumen3 halamanBank of Baroda Resnit111Belum ada peringkat

- Investor Presentation Q1FY14Dokumen13 halamanInvestor Presentation Q1FY14nit111Belum ada peringkat

- NMDC - Amc Activity Dec 2012Dokumen1 halamanNMDC - Amc Activity Dec 2012nit111Belum ada peringkat

- Supra JeetDokumen1 halamanSupra Jeetnit111Belum ada peringkat

- India PSU BanksDokumen26 halamanIndia PSU Banksnit111Belum ada peringkat

- NMDC - Amc Activity Dec 2012Dokumen1 halamanNMDC - Amc Activity Dec 2012nit111Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Search For The DanielcodeDokumen12 halamanSearch For The DanielcodeHmt Nmsl100% (1)

- Mutual Fund NISM Mock TestDokumen12 halamanMutual Fund NISM Mock Testsimplypaisa0% (1)

- Importance Diversification SectorsDokumen2 halamanImportance Diversification Sectorsag rBelum ada peringkat

- Anchored VWAP-Take Your Swing Trading To The Next LevelDokumen7 halamanAnchored VWAP-Take Your Swing Trading To The Next Leveldjoiner45Belum ada peringkat

- Industry Status & IDBI Bank's Interface Industry IntroductionDokumen5 halamanIndustry Status & IDBI Bank's Interface Industry IntroductionHoney AliBelum ada peringkat

- SPX Fact Sheet PDFDokumen2 halamanSPX Fact Sheet PDFGaro OhanogluBelum ada peringkat

- Week 7 Week 8 - Intro To Portfolio TheoryDokumen24 halamanWeek 7 Week 8 - Intro To Portfolio TheoryJoshua NemiBelum ada peringkat

- Cost Accounting ProjectDokumen2 halamanCost Accounting Projectaloksemail2011Belum ada peringkat

- ABC Financial Coaching Worksheet Master File V4Dokumen3 halamanABC Financial Coaching Worksheet Master File V4john philipBelum ada peringkat

- Fin-450 CH 13 QUIZDokumen7 halamanFin-450 CH 13 QUIZNick Rydal JensenBelum ada peringkat

- Standard Chartered Global Focus - Economic Outlook Q2-2023Dokumen144 halamanStandard Chartered Global Focus - Economic Outlook Q2-2023Altug OzaslanBelum ada peringkat

- Lesson 7 Asian Regionalism TCWD 111Dokumen30 halamanLesson 7 Asian Regionalism TCWD 111PATRICIA SAN PEDRO100% (2)

- Financial Statement Analysis Lecture v2Dokumen8 halamanFinancial Statement Analysis Lecture v2Yaj CruzadaBelum ada peringkat

- Petrobras - Century BondDokumen4 halamanPetrobras - Century Bond千舞神乐Belum ada peringkat

- Fundamentals of the Indian Capital MarketDokumen37 halamanFundamentals of the Indian Capital MarketBharat TailorBelum ada peringkat

- Fedco Department StoreDokumen7 halamanFedco Department Storeimran_omiBelum ada peringkat

- Forex Profit Supreme System PDFDokumen10 halamanForex Profit Supreme System PDFJhony SukaryawanBelum ada peringkat

- Econmark Outlook 2019 January 2019 PDFDokumen107 halamanEconmark Outlook 2019 January 2019 PDFAkhmad BayhaqiBelum ada peringkat

- News SummaryDokumen21 halamanNews Summaryapi-290371470Belum ada peringkat

- Feasibility Assessment TemplateDokumen28 halamanFeasibility Assessment TemplateAziz Khan Lodhi100% (1)

- Profit BandsDokumen12 halamanProfit BandsAndreea RîşnoveanuBelum ada peringkat

- Book Summary Warren Buffett Invests Like A Girl-And Why You Should TooDokumen6 halamanBook Summary Warren Buffett Invests Like A Girl-And Why You Should TooRajeev BahugunaBelum ada peringkat

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Dokumen27 halamanStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderBelum ada peringkat

- Candlestick Success HandoutsDokumen126 halamanCandlestick Success HandoutselisaBelum ada peringkat

- 10 Biggest Mistakes Options Trading PDFDokumen80 halaman10 Biggest Mistakes Options Trading PDFDanno NBelum ada peringkat

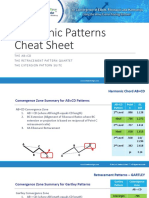

- Harmonics Retracement and Extension Patterns Cheat SheetDokumen19 halamanHarmonics Retracement and Extension Patterns Cheat SheetSharma compBelum ada peringkat

- MF Model - Session 15 and 16Dokumen38 halamanMF Model - Session 15 and 16Varun AhujaBelum ada peringkat

- Tata Corus Case Analysis at GargDokumen20 halamanTata Corus Case Analysis at GargNikhil Garg80% (5)

- Corporate Debt Market Issues and Policy RecommendationsDokumen41 halamanCorporate Debt Market Issues and Policy Recommendations119cBelum ada peringkat

- Practice Questions For Practical Exam-Final PDFDokumen23 halamanPractice Questions For Practical Exam-Final PDFPriyobroto Chokroborty100% (1)