Form No. 13

Diunggah oleh

Swarup MukherjeeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Form No. 13

Diunggah oleh

Swarup MukherjeeHak Cipta:

Format Tersedia

FORM NO.

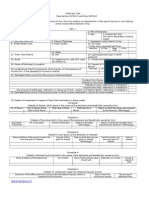

13 [See rules 28 and 37G] Application by a person for a certificate under section 197 and/or 206C(9) of the Income-tax Act, 1961, for no *deduction/collection of tax or *deduction/ collection of tax at a lower rate

To The Assessing Officer,

1. *I,_________________________________________________of__________________do, hereby, request that a certificate may be issued to the person responsible for paying to me the incomes/sum by way of salary/interest on securities/interest other than interest on securities/insurance commission/commission (not being insurance commission) or brokerage/commission, etc., on the sale of lottery tickets/fees for professional or technical services/any sum by way of payment to contractors and sub-contractors/dividends/rent/income in respect of units/sum by way of payment of compensation on acquisition of immovable property (strike out whichever is not applicable) authorising him not to deduct income-tax/to deduct income-tax at the rate of____________per cent at the time of payment to me of such income/sum. The particulars of my income are as per para 2. and/or *I,____________________________________________of__________________________________do, hereby, request that a certificate may be issued to the seller, being the person responsible for collecting the tax from me in respect of the amount payable by me as the buyer of_____________________________[specify the nature of goods referred to in the Table in sub-section (1) of section 206C]/lessee or licensee of_______________________________________________________[specify the nature of contract or licence or lease referred to in the Table in sub-section (1C) of section 206C] (Strike out whichever is not applicable) authorizing him to collect income-tax at the rate of____________________per cent at the time of debit of such amount to my account or receipt thereof from me, as the case may be. The particulars of my income are as per para 2. 2. The particulars of my income/other relevant details are as under : (i.) Status (State whether individual, Hindu undivided family, firm, body of individuals, etc.) (ii.) Residential status (Whether resident / resident but not ordinarily resident / non-resident) (iii.) Permanent Account No. (iv.) Assessment year to which the payments relate. (v.) Estimated total income of the previous year relevant to the assessment year referred to in (iv) above (give the computation and basis thereof) (vi.) Total tax payable on the income at (v) (vii.) Average rate of tax [Col. (vi) 100] [Col. (v) ] (viii.) How the liability determined in col. (vi) is proposed to

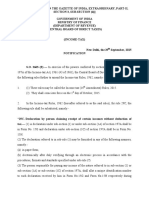

be discharged ? (Specify the amount to be paid by way of advance tax, TDS and TCS) (ix.) Total income assessed in the last three assessment years and the total tax paid for each such year : Assessment year (i) (ii) (iii) (x.) Date and amount of advance tax, tax deducted at source and tax collected at source, if any, already paid so far. (xi.) Details of income claimed to be exempt and not included in the total income (Please append a note giving reason for claiming such exemption). (xii.) Please furnish the particulars in Annexure-I in respect of no deduction of tax or deduction of tax at a lower rate under section 197 and/or in Annexure-II for collection of tax at lower rate under section 206C(9) of the Income-tax Act, as the case may be. *I,___________________________________the trustee/co-trustee of_______________________do hereby declare that the securities/sums/shares, particulars of which are given in the Annexure, are properly held under trust wholly for charitable or religious purposes and that the income therefrom qualifies for exemption under sections 11 and 13 of the Income-tax Act, 1961. *I declare that the securities/sums/shares, particulars of which are given in the Schedules above, stand in my name and are beneficially owned by me, and the income therefrom is not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. I further declare that what is stated in this application is correct. Date________________ Place________________ _______________________ Address *Strike out whichever is not applicable. ANNEXURE I [For the purpose of tax deduction at source] Please furnish the particulars with the Schedules below in respect of the payments for which the certificate is sought. SCHEDULE I Description of securities (1) Number of securities (2) Date of securities (3) Amount of securities (4) Estimated amount of interest to be received (5) ______________________ Signature Total income Total tax

SCHEDULE II Sl. No. Name and address of the person to whom the sums are given on Interest (2) Amount of such sums The date on which such sums were given on interest (4) Period for which such sums were given on Interest (5) Rate of interest Estimated amount of interest to be received (7)

(1)

(3)

(6)

SCHEDULE III Sl. No. (1) Name and address of person responsible for paying insurance commission (2) Estimated amount of insurance commission (3)

SCHEDULE IV Sl. Name and address No. of the company (1) (2) No. of shares (3) Class of shares and face value of each share (4) Total face value of shares (5) Distinctive Estimated amount numbers of shares of dividend to be received (6) (7)

SCHEDULE V Sl No. Name and address of the employer Period of employment Amount of salary received Income from house property Income from sources other than salary and income from house property (6) Estimated total income

(1)

(2)

(3)

(4)

(5)

(7)

SCHEDULE VI Sl. No. (1) Name and address of person responsible for paying rent (2) Estimated amount of rent to be received (3)

SCHEDULE VII Sl. No. (1) Name and address of the mutual fund (2) No. of units (3) Classes of units and face value of each unit (4) Total face value of units (5) Distinctive numbers of units (6) Estimated amount of income to be received (7)

SCHEDULE VIII Sl. No. Name and address of person responsible for paying commission (not being insurance commission referred to in section194D) or brokerage. (2) Estimated amount of commission (not being insurance commission referred to in section194D) or brokerage to be received (3)

(1)

SCHEDULE IX Sl. No. Full name and address of the authority/person with whom the contract was made Date of the contract Nature of the contract Date by which work on the contract would be completed Sums expected to be credited / paid in pursuance of the contract during the current previous year and each of the three immediately succeeding years (6)

(1)

(2)

(3)

(4)

(5)

SCHEDULE X Sl. No. Name and address of person(s) responsible for paying commission, remuneration or prize (by whatever name called) on the sale of lottery tickets (2) Estimated amount of commission/remuneration/prize to be received(strike out whichever is not applicable) (3)

(1)

SCHEDULE XI Sl. No. (1) Name and address of person(s) responsible for paying fees for professional/technical services (2) Estimated amount of fees for professional/technical services to be received (strike out whichever is not applicable) (3)

SCHEDULE XII Sl. No. Name and address of person responsible for paying compensation or enhanced compensation or the consideration or enhanced consideration on account of compulsory acquisition of immovable property (2) Estimated amount of compensation or the enhanced compensation or consideration or the enhanced consideration

(1)

(3)

________________ Date_________________ Place___________________ _________________ (Address) (Signature)

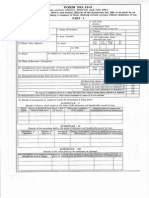

ANNEXURE II [For the purpose of tax collection at source] Please furnish particulars of the amounts payable in respect of which the certificate is sought in the schedules below:SCHEDULE I Sl. No. Full name and address of the seller Date of sale with reference number of such sale Nature and description of the goods sold and details of sale Amounts expected to be debited/ paid in pursuance of the sale during the current financial year and each of the three immediately succeeding years. (5)

(1)

(2)

(3)

(4)

SCHEDULE II Sl. No. Full name and address of the person granting lease or licence Date of grant of lease or licence or contract or transfer of right with reference number Nature of contract or licence or lease and description and details of the contract Amounts expected to be debited/ paid in pursuance of the contract during the current financial year and each of the three immediately succeeding years. (5)

(1)

(2)

(3)

(4)

_____________________ Date___________________ Signature of the buyer Full Name______________ Designation_____________

Form 13 has been printed from Mashbras Income Tax Rules 2008, 11th Edition.

Anda mungkin juga menyukai

- 15G FormDokumen2 halaman15G Formgrover.jatinBelum ada peringkat

- PAN No.Dokumen5 halamanPAN No.haldharkBelum ada peringkat

- 15G FormDokumen2 halaman15G Formsurendar147Belum ada peringkat

- Form No 15HDokumen3 halamanForm No 15HsaymtrBelum ada peringkat

- Form No. 15G: (See Rule 29C)Dokumen4 halamanForm No. 15G: (See Rule 29C)MKBelum ada peringkat

- New Form 15H For Fixed Deposits Editable in PDFDokumen2 halamanNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Belum ada peringkat

- OBC Bank Form - 15H PDFDokumen2 halamanOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Form 15g TaxguruDokumen3 halamanForm 15g Taxguruulhas_nakasheBelum ada peringkat

- "Form No. 15G: AO No. AO Type Range Code Area CodeDokumen2 halaman"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaBelum ada peringkat

- New Form No 15GDokumen4 halamanNew Form No 15GDevang PatelBelum ada peringkat

- Form 15GDokumen2 halamanForm 15GSrinivasa RaghavanBelum ada peringkat

- Form No. 15H: Part - IDokumen2 halamanForm No. 15H: Part - Itoton33Belum ada peringkat

- 15 G Form (Blank)Dokumen2 halaman15 G Form (Blank)nst27Belum ada peringkat

- Form No. 13: (See Rules 28 and 37G)Dokumen7 halamanForm No. 13: (See Rules 28 and 37G)prasantadas13Belum ada peringkat

- 15 G Form (Pre-Filled)Dokumen2 halaman15 G Form (Pre-Filled)Pawan Yadav0% (2)

- TAX SAVING Form 15g Revised1 SBTDokumen2 halamanTAX SAVING Form 15g Revised1 SBTrkssBelum ada peringkat

- "Form No. 15H: Area Code Range Code AO No. AO TypeDokumen2 halaman"Form No. 15H: Area Code Range Code AO No. AO Typepkw007Belum ada peringkat

- 15 G Form (Pre-Filled)Dokumen2 halaman15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Form 15g NewDokumen4 halamanForm 15g NewnazirsayyedBelum ada peringkat

- FORM-15G: (Please Tick The Relevant Box)Dokumen4 halamanFORM-15G: (Please Tick The Relevant Box)Kayam BalajiBelum ada peringkat

- 1 Section 80CDokumen2 halaman1 Section 80CcssumanBelum ada peringkat

- PDF Editor: Form No. 15GDokumen2 halamanPDF Editor: Form No. 15GImissYouBelum ada peringkat

- Form2FandInstructions 06062006Dokumen11 halamanForm2FandInstructions 06062006Mnaoj PatelBelum ada peringkat

- New Form 15G Form 15H PDFDokumen6 halamanNew Form 15G Form 15H PDFdevender143Belum ada peringkat

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDokumen3 halaman"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanBelum ada peringkat

- PDFDokumen4 halamanPDFushapadminivadivelswamyBelum ada peringkat

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDokumen3 halaman"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanBelum ada peringkat

- Notificaiton 5Dokumen3 halamanNotificaiton 5Parmeet NainBelum ada peringkat

- 15h Form (1) - CompressedDokumen4 halaman15h Form (1) - Compressedrekha safarirBelum ada peringkat

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Dokumen6 halamanSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiBelum ada peringkat

- Annual Return of Deduction of Tax Under Section 206 of I.T. Act, 1961 in Respect of All Payments Other Than "Salaries" For The Year Ending 31st March.............Dokumen3 halamanAnnual Return of Deduction of Tax Under Section 206 of I.T. Act, 1961 in Respect of All Payments Other Than "Salaries" For The Year Ending 31st March.............Astro Shalleneder GoyalBelum ada peringkat

- ITR62 Form 15 CADokumen5 halamanITR62 Form 15 CAMohit47Belum ada peringkat

- PDF 4Dokumen3 halamanPDF 47ola007Belum ada peringkat

- Income Declaration Scheme Rules, 2016: Form 1Dokumen5 halamanIncome Declaration Scheme Rules, 2016: Form 1DeepaDivyavarthiniBelum ada peringkat

- Formst 1Dokumen3 halamanFormst 1arulantonyBelum ada peringkat

- Saral: ITS-2D Form No. 2DDokumen2 halamanSaral: ITS-2D Form No. 2DPrasanta KarmakarBelum ada peringkat

- Form No. 10Bc: Income-Tax Rules, 1962Dokumen3 halamanForm No. 10Bc: Income-Tax Rules, 1962busuuuBelum ada peringkat

- Rayat Educational & Research TrustDokumen2 halamanRayat Educational & Research Trustvijay_2594Belum ada peringkat

- Tax Form 15H PDFDokumen4 halamanTax Form 15H PDFraviBelum ada peringkat

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen5 halamanIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaBelum ada peringkat

- Form 26 (See Rule 4A)Dokumen11 halamanForm 26 (See Rule 4A)sudhak111Belum ada peringkat

- Form No 15GDokumen2 halamanForm No 15Gnarendra1968Belum ada peringkat

- Form No.15gDokumen2 halamanForm No.15gPrakash GowdaBelum ada peringkat

- AY 2005-06 Saral Form 2DDokumen2 halamanAY 2005-06 Saral Form 2DVinod VarmaBelum ada peringkat

- 15G PDFDokumen2 halaman15G PDFSudhendu ChauhanBelum ada peringkat

- Form 15 HDokumen2 halamanForm 15 Hsingh ramanpreetBelum ada peringkat

- Form No. 15G: Part - IDokumen3 halamanForm No. 15G: Part - ImohanBelum ada peringkat

- Form 27CDokumen2 halamanForm 27CrajdeeppawarBelum ada peringkat

- Form 15 GDokumen2 halamanForm 15 GRahul SahaniBelum ada peringkat

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDokumen28 halamanUnited States Estate (And Generation-Skipping Transfer) Tax ReturnsirpiekBelum ada peringkat

- Form No. 15G: Part - IDokumen2 halamanForm No. 15G: Part - Ibalaji stationersBelum ada peringkat

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnDari EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnBelum ada peringkat

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Dari EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Belum ada peringkat

- Mergers and Acquisitions: A Step-by-Step Legal and Practical GuideDari EverandMergers and Acquisitions: A Step-by-Step Legal and Practical GuideBelum ada peringkat

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionDari EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionBelum ada peringkat

- 1040 Exam Prep: Module II - Basic Tax ConceptsDari Everand1040 Exam Prep: Module II - Basic Tax ConceptsPenilaian: 1.5 dari 5 bintang1.5/5 (2)

- Word AutomatinDokumen1 halamanWord AutomatinRajasekar SivaguruvelBelum ada peringkat

- Database 1Dokumen28 halamanDatabase 1Rajasekar SivaguruvelBelum ada peringkat

- ATOM Apparel FeaturesDokumen4 halamanATOM Apparel FeaturesRajasekar SivaguruvelBelum ada peringkat

- Speedup-PROJECT: Product Name Purpose Technology Designed by Approved by Model Module Details AdminDokumen6 halamanSpeedup-PROJECT: Product Name Purpose Technology Designed by Approved by Model Module Details AdminRajasekar SivaguruvelBelum ada peringkat

- RamcoDokumen16 halamanRamcoRajasekar SivaguruvelBelum ada peringkat