Orange France Telecom

Diunggah oleh

eng_amoraHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Orange France Telecom

Diunggah oleh

eng_amoraHak Cipta:

Format Tersedia

FRANCE TELECOM GROUP ORANGE Response to an IDA Public Consultation on Request by Singapore Telecommunications Limited for exemption from

Dominant Licensee obligations with respect to the Business and Government Customer Segment and Individual Markets pursuant to Sub-Section 2.5.1 of the Code of Practice for Competition in the Provision of Telecommunication Services 2005 (SingTels Request) 18 January 2008

Respondent contact details: Valerie Tan Hsu Phen Head of Regulatory Affairs, Asia Pacific Blk 750 Oasis, Chai Chee Road #04-02, Technopark @ Chai Chee Singapore 469000 Office: (65) 6419 6341 Email: valerie.tan@orange-ftgroup.com

Setting the context: These comments are submitted by France Telecom Long Distance Singapore Pte Ltd (FTLDS) and Equant Pte Ltd1. FTLDS operates a backhaul network in Singapore under a Facilities Based Operator (FBO) License and provides Backhaul and IPLC services. Equant Pte Ltd holds Service Based Operator (SBO) Licenses and provides IMDS and IPLC services. As the outcome of SingTels Request will have repercussions on Orange France Telecoms interests in Singapore, we thank IDA for this opportunity to provide comments.

Orange France Telecoms overall view: The omission of relevant market data marked as confidential has not allowed respondents to fully assess and comment on SingTels Request. It is also unfair that while SingTel could fully represent its case to IDA, respondents only had the opportunity to make comments on part of the case. Orange France Telecom submits that a follow up consultation where respondents are provided with further facts of the case and an opportunity to comment on IDAs preliminary decision would be necessary. The fact that the telecoms sector is presently excluded from general competition law must be taken into account by the IDA in its assessment of SingTels Request.

On Customer Segment Request The basis on which SingTel had derived the S$250,000 threshold is not clear, as the text is incomprehensible due to the omission of data marked confidential2. Also, an S$250,000 per annum spend is not considered a very high threshold. If an exemption were granted on this basis, it would carve out a substantial segment of the business and government customers and cannot constitute a narrow request as claimed by SingTel.

Equant is a member of the France Telecom Group of companies and operates under the brand name Orange Business Services. SingTels Request, s5.5

Page 2 of 6

On Market Based Request Market 4 Terrestrial International Private Leased Circuits (IPLC) As set out in the IDA Decision 20053, an end-to-end IPLC service consists of the international wet segment and domestic dry segment capacity, i.e. backhaul and local leased circuits4. The existence of multiple operators offering IPLC in direct competition with SingTel is not conclusive evidence of a reduction in SingTels market share or dominant position. Although there may be multiple market players in the international segment, this is not the case for the domestic segment where SingTel is still the dominant supplier of Backhaul and local leased circuit services in Singapore. The IDA should consider this fact in its assessment of the IPLC market. Regional and global carriers provide a wide range of enterprise services which use IPLC as inputs and building blocks for managed enterprise services. In the interest of maintaining Singapores position as a regional communications hub, it is imperative that in provisioning IPLC services, regional and global carriers can obtain competitive Backhaul to their Points-of-Presence (POP). Given the lack of choice of alternative Backhaul providers, any relief on SingTel from dominant licensee obligations would constrain competition in the IPLC market and this could result in regional and global carriers shifting to alternative hub locations such as Hong Kong.

Market 5 International Managed Data Services (IMDS) As the geographic market for IMDS is national5, the extent of a regional or global carriers network reach cannot be used as evidence that the IMDS market is competitive or there has been a dilution of SingTels dominance. Even today, many regional and global carriers continue to rely on SingTel to provide the local leased circuit connecting their POP to end-user premises.

Market 6 Backhaul Service There is no compelling reason for IDA to change its position that both (selfsupplied and third party Backhaul) services are in the same market because self-

Explanatory Memorandum to the Decision of the Info-Communications Development Authority of Singapore on the Request by Singapore Telecommunications Limited for Exemption from Dominant Licensee obligations with respect to the International Capacity Services Market, 12 April 2005

4 5

ibid, s59, Figure 4 Ibid, s62

Page 3 of 6

providing backhaul is a substitute for purchasing backhaul from another carrier6. The French Regulator, ARCEP7, had also determined that self-supplied capacity was to be included in the market share calculations of France Telecom. More generally, the inclusion of self-supplied capacity in market share calculations is prevalent practice in the US and EU. As the Backhaul market shares submitted by SingTel had only included third party Backhaul services8, IDA should accordingly require SingTel to resubmit its market share data to include self-supplied Backhaul services. IDA cannot base the number of alternative Backhaul providers prima facie, as indicative of the markets competitiveness or a dilution of SingTels dominance. For diversity reasons, most Backhaul customers will have more than one Backhaul provider and will continue to use SingTels Backhaul service even if they were to source from alternative Backhaul providers. Backhaul services are provided exclusively on a wholesale basis to FBO licensees seeking to access capacity on international submarine cables; business and government customers do not purchase Backhaul services. In its assessment, IDA ought to consider how end-to-end Backhaul services are provisioned in Singapore, i.e. from the submarine cable landing station to the requesting partys intended destination, as defined by SingTel9. From the figure below o SingTel is able to set a single price for Backhaul services10 regardless of the customers POP location due to its extensive and superior Backhaul network coverage. In comparison, FTLDS Backhaul pricing is dependent on the customers POP location and a two-part pricing structure ($x + $y) will have to be applied for non coverage locations. This two-part pricing includes the cost of a local leased circuit ($y) which is not covered under the SingTel RIO11.

6 7 8 9

ibid, s50 Autorite de Regulation des Communications electroniques et des Postes, www.art-telecom.fr SingTels Request, s6.230 ibid, s5.88 ibid, s6.219

10 11

The IRS Tail Circuit Service is a dedicated end-to-end digital transmission service connecting the EndUsers site and the Requesting Licensees co-location equipment at the SingTel Exchange Building nearest to and serving the End Users site, SingTel RIO Schedule 4C, 1.2; The IRS Tail Circuit Service will not be provided between (2) two FBO sites or (2) two End User sites, SingTel RIO Schedule 4C, 1.5

Page 4 of 6

It is clear that alternative Backhaul providers do not compete with SingTel on a level playing field.

Wholesale Backhaul Service

SingTel Backhaul Service ($x)

SingTel ADM at CHLS

SingTel Exchange

FBO Customer (Other POP location)

Cable Landing Station (CHLS)

FTLDS ADM at CHLS

FTLDS POP

FTLDS Backhaul ($x)

SingTel local leased circuit ($y) not under RIO

Comparing this to the situation in France, France Telecom is obliged to separately identify and tariff the terminal segment (defined as the circuit between the customers site and first transmission equipment) and complement terrestre or backhaul (defined as the circuit between the submarine cable head landing station and the closest transmission equipment where other carriers can interconnect)12. There are also controls on tariffs applied by France Telecom on the terminal segment, which must not lead to the eviction from the market of alternative carriers and subject to this eviction requirement, the tariffs applied by France Telecom must be cost-oriented. In addition, accounting constraints are imposed on France Telecom, such as the identification of all costs of the services offered on the

ARCEP Decision n06-0592 dated 26 September 2006 on the relevant market for wholesale capacities (in French) in accordance with the European Commission recommendations

12

Page 5 of 6

relevant markets and isolation in the accounts of the regulated activities financial details (transparency of the tariffs applied to external carriers as well as transfer pricing applied to the affiliates to ensure non discrimination). The SingTel RIO co-location and connection services at cable landing stations do not mean that all carriers are authorized to access the submarine cable landing stations. Only carriers who are members / co-owners in the submarine cable consortiums are authorized to access the Tuas and Katong cable landing stations (which are SingTel properties). Even though France Telecom co-owns the submarine cables landing in these cable landing stations, we remain obliged to request access from SingTel. Furthermore, to build and operate a Backhaul network is an infrastructure investment that requires financial commitment with long term impact on the business and strategy. These barriers to Backhaul market entry should not be lightly dismissed. The Telecoms Competition Code13 classifies a Licensee as dominant if it is licensed to operate facilities to provide telecommunication services in Singapore that are costly or difficult to replicate that would create a significant market barrier to rapid and successful entry, or it has the ability to exercise Significant Market Power (SMP) in any market which it provides telecommunication services14. If SingTel were to be exempted from dominant licensee obligations in the Backhaul market, it will have the ability to unilaterally restrict output, raise prices and reduce quality or otherwise act, to a significant extent, independently of competitive market forces. It is submitted that SingTel continues to have the ability to exercise SMP in the Backhaul market and IDAs decision can only be to fully deny SingTels request for exemption from dominant licensee obligations in the Backhaul market.

Closure: Orange France Telecom would welcome further public consultation on SingTels Request and the opportunity to provide comments on IDAs preliminary decision.

13 14

Code of Practice for Competition in the provision of Telecommunication Services 2005 ibid, s2.2.1

Page 6 of 6

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Attachment I - Instructions To Bidders - EEPNL EEPN (OE) L QA QC PDFDokumen24 halamanAttachment I - Instructions To Bidders - EEPNL EEPN (OE) L QA QC PDFMathias OnosemuodeBelum ada peringkat

- 7779 19506 1 PBDokumen24 halaman7779 19506 1 PBAyessa FerrerBelum ada peringkat

- E2 Lab 2 8 2 InstructorDokumen10 halamanE2 Lab 2 8 2 InstructorOkta WijayaBelum ada peringkat

- Case Study ToshibaDokumen6 halamanCase Study ToshibaRachelle100% (1)

- Highly Paid Expert Mini PDFDokumen88 halamanHighly Paid Expert Mini PDFPhuongHung NguyenBelum ada peringkat

- Universal Beams PDFDokumen2 halamanUniversal Beams PDFArjun S SanakanBelum ada peringkat

- Unit I Lesson Ii Roles of A TeacherDokumen7 halamanUnit I Lesson Ii Roles of A TeacherEvergreens SalongaBelum ada peringkat

- Philippine Forest Facts and Figures PDFDokumen34 halamanPhilippine Forest Facts and Figures PDFPamela L. FallerBelum ada peringkat

- Determination of Molecular Radius of Glycerol Molecule by Using R SoftwareDokumen5 halamanDetermination of Molecular Radius of Glycerol Molecule by Using R SoftwareGustavo Dos SantosBelum ada peringkat

- PROCEMAC PT Spare Parts ManualDokumen27 halamanPROCEMAC PT Spare Parts ManualMauricio CruzBelum ada peringkat

- Buyer Persona TemplateDokumen18 halamanBuyer Persona TemplateH ABelum ada peringkat

- Important Dates (PG Students View) Semester 1, 2022-2023 - All Campus (As of 2 October 2022)Dokumen4 halamanImportant Dates (PG Students View) Semester 1, 2022-2023 - All Campus (As of 2 October 2022)AFHAM JAUHARI BIN ALDI (MITI)Belum ada peringkat

- Rfa TB Test2Dokumen7 halamanRfa TB Test2Сиана МихайловаBelum ada peringkat

- Self-Study Guidance - Basic Accounting. 15 Problems With Detailed Solutions.Dokumen176 halamanSelf-Study Guidance - Basic Accounting. 15 Problems With Detailed Solutions.Martin Teguh WibowoBelum ada peringkat

- Sfa 5.22 PDFDokumen36 halamanSfa 5.22 PDFLuis Evangelista Moura PachecoBelum ada peringkat

- 2010 LeftySpeed Oms en 0Dokumen29 halaman2010 LeftySpeed Oms en 0Discord ShadowBelum ada peringkat

- Trabajo Final CERVEZA OLMECADokumen46 halamanTrabajo Final CERVEZA OLMECAramon nemeBelum ada peringkat

- Lululemon Style GuideDokumen15 halamanLululemon Style Guideapi-263257893Belum ada peringkat

- Dump Truck TBTDokumen1 halamanDump Truck TBTLiaquat MuhammadBelum ada peringkat

- IA1 - Mock AssessmentDokumen3 halamanIA1 - Mock AssessmentMohammad Mokhtarul HaqueBelum ada peringkat

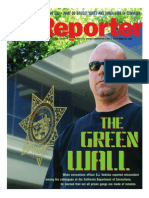

- The Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Dokumen8 halamanThe Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Stephen James - Independent Investigative Journalism & PhotographyBelum ada peringkat

- Tales of Mystery Imagination and Humour Edgar Allan Poe PDFDokumen289 halamanTales of Mystery Imagination and Humour Edgar Allan Poe PDFmatildameisterBelum ada peringkat

- Tran Date Value Date Tran Particular Credit Debit BalanceDokumen96 halamanTran Date Value Date Tran Particular Credit Debit BalanceGenji MaBelum ada peringkat

- Implementation of BS 8500 2006 Concrete Minimum Cover PDFDokumen13 halamanImplementation of BS 8500 2006 Concrete Minimum Cover PDFJimmy Lopez100% (1)

- Businesses ProposalDokumen2 halamanBusinesses ProposalSophia Marielle MacarineBelum ada peringkat

- AccreditationDokumen6 halamanAccreditationmyra delos santosBelum ada peringkat

- MSSQL and Devops DumpsDokumen5 halamanMSSQL and Devops DumpsRishav GuptaBelum ada peringkat

- SignalsVOL 1 SupplementBDokumen67 halamanSignalsVOL 1 SupplementBcdettlingerBelum ada peringkat

- 29!541 Transient Aspects of Unloading Oil and Gas Wells With Coiled TubingDokumen6 halaman29!541 Transient Aspects of Unloading Oil and Gas Wells With Coiled TubingWaode GabriellaBelum ada peringkat

- OpenShift Container Platform-4.6-Installing On vSphere-en-USDokumen189 halamanOpenShift Container Platform-4.6-Installing On vSphere-en-USChinni MunniBelum ada peringkat