02 FM B35C2 Model Answer

Diunggah oleh

Karthik SureshHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

02 FM B35C2 Model Answer

Diunggah oleh

Karthik SureshHak Cipta:

Format Tersedia

1. Crino Electric has a capital structure that consists of 70 percent equity and 30 percent debt.

The companys long-term bonds have a before-tax yield to maturity of 8.4 percent. The company uses the DCF approach to determine the cost of equity. Crinos common stock currently trades at $45 per share. The year-end dividend (D1) is expected to be $2.50 per share, and the dividend is expected to grow forever at a constant rate of 7 percent a year. The company estimates that it will have to issue new common stock to help fund this years projects. The flotation cost on new common stock issued is 10 percent, and the companys tax rate is 40 percent. What is the companys weighted average cost of capital, WACC? WACC = [0.3 0.084 (1 - 0.4)] + [0.7 ($2.5/($45 (1 - 0.1)) + 0.07)] = 10.73%. 2. Green Grocers is deciding among two mutually exclusive projects. The two projects have the following cash flows: Year 0 1 2 3 4 Project A Cash Flow -$50,000 10,000 15,000 40,000 20,000 Project B Cash Flow -$30,000 6,000 12,000 18,000 12,000

The companys weighted average cost of capital is 10 percent (WACC = 10%). What is the net present value (NPV) of the project with the highest internal rate of return (IRR)? Enter the cash flows for each project into the cash flow register on the calculator as follows: Project A: Inputs: CF0 = -50000; CF1 = 10000; CF2 = 15000; CF3 = 40000; CF4 = 20000; I = 10. Outputs: NPV = $15,200.46 $15,200; IRR = 21.38%. Project B: Inputs: CF0 = -30000; CF1 = 6000; CF2 = 12000; CF3 = 18000; CF4 = 12000; I = 10. Outputs: NPV = $7,091.73 $7,092; IRR = 19.28%.

Project A has the highest IRR, so the answer is $15,200.

3. Navneet Publishing is considering entering a new line of business. In analyzing the potential business, their financial staff has accumulated the following information:

The new business will require a capital expenditure of $5 million at t = 0. This expenditure will be used to purchase new equipment. This equipment will be depreciated according to the following depreciation schedule: MACRS Depreciation Rates 0.33 0.45 0.15 0.07

Year 1 2 3 4

The equipment will have no salvage value after four years. If Navneet goes ahead with the new business, inventories will rise by $500,000 at t = 0, and its accounts payable will rise by $200,000 at t = 0. This increase in net operating working capital will be recovered at t = 4. The new business is expected to have an economic life of four years. The business is expected to generate sales of $3 million at t = 1, $4 million at t = 2, $5 million at t = 3, and $2 million at t = 4. Each year, operating costs excluding depreciation are expected to be 75 percent of sales. The companys tax rate is 40 percent. The companys weighted average cost of capital is 10 percent. The company is very profitable, so any accounting losses on this project can be used to reduce the companys overall tax burden.

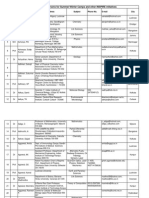

What is the expected net present value (NPV) of the new business? Show the steps in details for the 4 years Depreciation cash flows: MACRS Depreciation Depreciable Annual Year Rates Basis Depreciation 1 0.33 $5,000,000 $1,650,000 2 0.45 $5,000,000 2,250,000 3 0.15 $5,000,000 750,000 4 0.07 $5,000,000 350,000 $5,000,000 Year Project cost NOWC* 0 -$5,000,000 -300,000 1 2 3 4

Sales Operating costs (75%) Depreciation Oper. inc. before taxes Taxes (40%) Oper. inc. after taxes Plus: Depreciation Operating CF

$3,000,000 2,250,000 1,650,000 -$ 900,000 -360,000 -$ 540,000 1,650,000 $1,110,000

$4,000,000 3,000,000 2,250,000 -$1,250,000 -500,000 -$ 750,000 2,250,000 $1,500,000

$5,000,000 3,750,000 750,000 $ 500,000 200,000 $ 300,000 750,000 $1,050,000

$2,000,000 1,500,000 350,000 $ 150,000 60,000 $ 90,000 350,000 $ 440,000

Recovery of NOWC Net CFs -$5,300,000

$1,110,000

$1,500,000

$1,050,000

300,000 $ 740,000

*An increase in inventories is a use of funds for the company, and an increase in accounts payable is a source of funds for the company. Thus, the change in net operating working capital will be $200,000 - $500,000 = -$300,000 at time 0. NPV = -$5,300,000 + $1,110,000/1.10 + $1,500,000/(1.10)2 + $1,050,000/(1.10)3 + $740,000/(1.10)4 NPV = -$5,300,000 + $1,009,091 + $1,239,669 + $788,881 + $505,430 NPV = -$1,756,929.

Anda mungkin juga menyukai

- Why Bits I Ans Should Apply To CornellDokumen14 halamanWhy Bits I Ans Should Apply To CornellKarthik SureshBelum ada peringkat

- CoumarinDokumen3 halamanCoumarinKarthik SureshBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Birla Institute of Technology and Science, Pilani: Quiz+Mid-Sem 55.00 %Dokumen1 halamanBirla Institute of Technology and Science, Pilani: Quiz+Mid-Sem 55.00 %Karthik SureshBelum ada peringkat

- Daily Menu Plan for Hostel MessDokumen8 halamanDaily Menu Plan for Hostel MessKarthik SureshBelum ada peringkat

- Watson LectureDokumen77 halamanWatson LectureKarthik SureshBelum ada peringkat

- List of MentorsDokumen185 halamanList of MentorsKarthik Suresh100% (1)

- C++ QDokumen4 halamanC++ QKarthik SureshBelum ada peringkat

- SQL Is A Standard Language For Accessing and Manipulating DatabasesDokumen48 halamanSQL Is A Standard Language For Accessing and Manipulating DatabasesKarthik Suresh100% (1)

- (Ed Mir) Irodov - Problems in General Physics (Eng)Dokumen197 halaman(Ed Mir) Irodov - Problems in General Physics (Eng)Divyanshu Gupta100% (1)

- V It SyllabusDokumen3 halamanV It SyllabusKarthik SureshBelum ada peringkat

- Name The Greenish Country in EUROPE ?: Kid's General Knowledge Discussion ForumDokumen6 halamanName The Greenish Country in EUROPE ?: Kid's General Knowledge Discussion ForumKarthik SureshBelum ada peringkat

- Top Western Region Car Accessory Shops in Various CitiesDokumen1 halamanTop Western Region Car Accessory Shops in Various CitiesKarthik SureshBelum ada peringkat

- Operating System GlossaryDokumen2 halamanOperating System GlossaryKarthik SureshBelum ada peringkat

- Ace of PACE Sample PaperDokumen5 halamanAce of PACE Sample PaperAditya Natekar55% (20)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Cindy MYOB 2Dokumen1 halamanCindy MYOB 2SMK NusantaraBelum ada peringkat

- Ch30 Money Growth and InflationDokumen16 halamanCh30 Money Growth and InflationMộc TràBelum ada peringkat

- 11 Sample Papers Accountancy 2Dokumen10 halaman11 Sample Papers Accountancy 2AvcelBelum ada peringkat

- 21 Sian Tuan Avenue ReportDokumen21 halaman21 Sian Tuan Avenue ReportJames YuBelum ada peringkat

- Ax2009 Enus Finii 08Dokumen24 halamanAx2009 Enus Finii 08Timer AngelBelum ada peringkat

- Chapter 1-Introduction To Cost Accounting: Multiple ChoiceDokumen535 halamanChapter 1-Introduction To Cost Accounting: Multiple ChoiceAleena AmirBelum ada peringkat

- Case 10.1Dokumen13 halamanCase 10.1Chin Figura100% (1)

- Chapter Three: Interest Rates and Security ValuationDokumen40 halamanChapter Three: Interest Rates and Security ValuationOwncoebdiefBelum ada peringkat

- M4 Assignment 1Dokumen4 halamanM4 Assignment 1Lorraine CaliwanBelum ada peringkat

- Intro To FCL Accounting Print Format TEXT V 3.1 at Sept 11 - 18 PDFDokumen696 halamanIntro To FCL Accounting Print Format TEXT V 3.1 at Sept 11 - 18 PDFAmy Jessa Odtujan EbinaBelum ada peringkat

- Intengan v. CA DigestDokumen2 halamanIntengan v. CA DigestCaitlin KintanarBelum ada peringkat

- Enterprise Valuation FINAL RevisedDokumen45 halamanEnterprise Valuation FINAL Revisedchandro2007Belum ada peringkat

- Share BuybackDokumen3 halamanShare Buybackurcrazy_mateBelum ada peringkat

- Caltex v COA: No offsetting of taxes against claimsDokumen1 halamanCaltex v COA: No offsetting of taxes against claimsHarvey Leo RomanoBelum ada peringkat

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDokumen3 halamanQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzBelum ada peringkat

- Analysis of Common Business TransactionsDokumen18 halamanAnalysis of Common Business TransactionsClarisse RosalBelum ada peringkat

- Capitalized Cost Eng Econo As1Dokumen8 halamanCapitalized Cost Eng Econo As1Francis Valdez LopezBelum ada peringkat

- General Principles of Income Taxation in The PHDokumen1 halamanGeneral Principles of Income Taxation in The PHJm CruzBelum ada peringkat

- Chapter 2Dokumen4 halamanChapter 2HuyNguyễnQuangHuỳnhBelum ada peringkat

- MamaearthDokumen9 halamanMamaearthAmar Singh100% (1)

- Charge (Short Note)Dokumen3 halamanCharge (Short Note)Srishti GoelBelum ada peringkat

- Finance SOP (Example - 1) (1553)Dokumen4 halamanFinance SOP (Example - 1) (1553)Rindy Murti Dewi100% (1)

- C1 - Guaranty Trust Bank PLC Nigeria (A)Dokumen15 halamanC1 - Guaranty Trust Bank PLC Nigeria (A)Anisha RaiBelum ada peringkat

- Knust Thesis TopicsDokumen5 halamanKnust Thesis TopicsSteven Wallach100% (1)

- Pangea Mortgage Capital Closes $8.5 Million LoanDokumen3 halamanPangea Mortgage Capital Closes $8.5 Million LoanPR.comBelum ada peringkat

- Best Respondent Memorial PDFDokumen38 halamanBest Respondent Memorial PDFPriyanka PriyadarshiniBelum ada peringkat

- A Project Report On Bharti-AXA Life Insurance Co.Dokumen66 halamanA Project Report On Bharti-AXA Life Insurance Co.sushobhanbirtia85% (20)

- Tutsheet 7Dokumen2 halamanTutsheet 7Vikas Kumar PooniaBelum ada peringkat

- Case+Study+AnswerDokumen4 halamanCase+Study+Answercynthia dewiBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurucpe plBelum ada peringkat