Amortization

Diunggah oleh

Vishal GajjarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Amortization

Diunggah oleh

Vishal GajjarHak Cipta:

Format Tersedia

Amortization

Amortization is often regarded as being the same as depreciation, but although the two accounting practices can be difficult to distinguish, there are differences between them. Amortization is also used in connection with loans, although that is not the primary focus here.

What It Measures

Amortization is a method of recovering (deducting or writing off) the capital costs of intangible assets over a fixed period of time. Its calculation is virtually identical to the straight-line method of depreciation. Amortization also refers to the establishment of a schedule for repaying the principal and interest on a loan in equal amounts over a period of time. Because computers have made this a simple calculation, business references to amortization tend to focus more on the terms first definition.

Why It Is Important

Amortization enables a company to identify its true costs, and thus its net income, more precisely. In the course of their business, most enterprises acquire intangible assets such as a patent for an invention, or a well-known brand or trademark. Since these assets can contribute to the revenue growth of the business, they can beand are allowed to bededucted against those future revenues over a period of years, provided the procedure conforms to accepted accounting practices. For tax purposes, the distinction is not always made between amortization and depreciation, yet amortization remains a viable financial accounting concept in its own right.

How It Works in Practice

Amortization is computed using the straight-line method of depreciation: divide the initial cost of the intangible asset by the estimated useful life of that asset. For example, if it costs $10,000 to acquire a patent and it has an estimated useful life of 10 years, the amortized amount per year is $1,000. 10,000 10 = $1,000 per year The amount of amortization accumulated since the asset was acquired appears on the organizations balance sheet as a deduction under the amortized asset. While that formula is straightforward, amortization can also incorporate a variety of noncash charges to net earnings and/or asset values, such as depletion, write-offs, prepaid expenses, and deferred charges. Accordingly, there are many rules to regulate how these charges appear on financial statements. The rules are different in each country, and are occasionally changed, so it is necessary to stay abreast of them and rely on expert advice. For financial reporting purposes, an intangible asset is amortized over a period of years. The amortizable life useful lifeof an intangible asset is the period over which it gives economic benefit. Several factors are considered when determining this useful life; for example, demand and competition, effects of obsolescence, legal or contractual limitations, renewal provisions, and service life expectations. Intangibles that can be amortized include: Copyrights, based on the amount paid either to purchase them or to develop them internally, plus the costs incurred in producing the work (wages or materials, for example). At present, a copyright is granted for the life of the author plus 70 years. However, the estimated useful life of a copyright is usually far shorter than its legal life, and it is generally amortized over a fairly short period. Cost of a franchise, including any fees paid to the franchiser, as well legal costs or expenses incurred in the acquisition. A franchise granted for a limited period should be amortized over its life. If the franchise has an indefinite life, it should be amortized over a reasonable period, not to exceed 40 years.

1 of 2 www.qfinance.com

Amortization

Covenants not to compete: an agreement by the seller of a business not to engage in a competing business in a certain area for a specific period of time. The cost of the not-to-compete covenant should be amortized over the period covered by the covenant unless its estimated economic life is expected to be shorter. Easement costs that grant a right of way may be amortized if there is a limited and specified life. Organization costs incurred when forming a corporation or a partnership, including legal fees, accounting services, incorporation fees, and other related services. Organization costs are usually amortized over 60 months. Patents, both those developed internally and those purchased. If developed internally, a patents amortizable basis includes legal fees incurred during the application process. Normally, a patent is amortized over its legal life, or over its remaining life if purchased. However, it should be amortized over its legal life or its economic life, whichever is the shorter. Trademarks, brands, and trade names, which should be written off over a period not to exceed 40 years. However, since the value of these assets depends on the changing tastes of consumers, they are frequently amortized over a shorter period. Other types of property that may be amortized include certain intangible drilling costs, circulation costs, mine development costs, pollution control facilities, and reforestation expenditures. They can even include intangibles such as the value of a market share or a markets composition: an example is the portion of an acquired business that is attributable to the existence of a given customer base.

Tricks of the Trade

Certain intangibles cannot be amortized, but may be depreciated using a straight-line approach if they have a determinable useful life. Because the rules are different in each country and are subject to change, it is essential to rely on specialist advice. Computer software may be amortized under certain conditions, depending on its purpose. Software that is amortized is generally given a 60-month life, but it may be amortized over a shorter period if it can clearly be established that it will be obsolete or no longer used within a shorter time. Under certain conditions, customer lists that were purchased may be amortized if it can be demonstrated that the list has a finite useful life, in that customers on the list are likely to be lost over a period of time. While leasehold improvements are depreciated for income tax purposes, they are amortized when it comes to financial reportingeither over the remaining term of the lease or their expected useful life, whichever is the shorter. Annual payments incurred under a franchise agreement should be expensed when incurred. The internet has many amortization loan calculators that can automatically determine monthly payment figures and the total cost of a loan.

More Info

Websites:

Financial Accounting Standards Board: www.fasb.org US Copyright Office: www.copyright.gov US Patent and Trademark Office: www.uspto.gov

To see this article on-line, please visit

http://www.qfinance.com/balance-sheets-calculations/amortization

Amortization

2 of 2 www.qfinance.com

Anda mungkin juga menyukai

- Intangible Assets AssignmntDokumen5 halamanIntangible Assets AssignmntSuleyman TesfayeBelum ada peringkat

- F9文字Dokumen25 halamanF9文字su cheongBelum ada peringkat

- Interview Related QuestionsDokumen8 halamanInterview Related QuestionsAnshita GargBelum ada peringkat

- Publisher Version (Open Access)Dokumen27 halamanPublisher Version (Open Access)Antinolla LonaBelum ada peringkat

- Leases, Debt and Firm ValueDokumen57 halamanLeases, Debt and Firm ValueHadi P.Belum ada peringkat

- Accounting For Fixed Consideration in Licence Arrangements in The Pharmaceutical and Life Sciences Industry PWC in Brief INT2018-08Dokumen4 halamanAccounting For Fixed Consideration in Licence Arrangements in The Pharmaceutical and Life Sciences Industry PWC in Brief INT2018-08Oscar Fajardo SosaBelum ada peringkat

- Autumn 2011 - Midterm Assessment (25089)Dokumen8 halamanAutumn 2011 - Midterm Assessment (25089)Marwa Nabil Shouman0% (1)

- Kas 15 - Intangible Assets Explanatory Note: Page 1 of 6Dokumen6 halamanKas 15 - Intangible Assets Explanatory Note: Page 1 of 6r4inbowBelum ada peringkat

- Leases, Debt and ValueDokumen57 halamanLeases, Debt and ValueGaurav ThakurBelum ada peringkat

- Audit of Bonds and LoansDokumen5 halamanAudit of Bonds and LoansNEstandaBelum ada peringkat

- VCE SUMMMER INTERNSHIP PROGRAM (Financial Modellimg Task 3)Dokumen10 halamanVCE SUMMMER INTERNSHIP PROGRAM (Financial Modellimg Task 3)Annu KashyapBelum ada peringkat

- Amortization vs Depreciation: Key DifferencesDokumen2 halamanAmortization vs Depreciation: Key DifferenceshumaidjafriBelum ada peringkat

- Fixed Assets and DepreciationDokumen7 halamanFixed Assets and DepreciationArun PeterBelum ada peringkat

- Accounting DefinitinsACCOUNTING DEFINITINDokumen42 halamanAccounting DefinitinsACCOUNTING DEFINITINMohammed Zaheeruddin SamarBelum ada peringkat

- AFS 17th Mar - CapitalisationDokumen5 halamanAFS 17th Mar - CapitalisationhardikBelum ada peringkat

- Sales forecast analysis under 40 charsDokumen8 halamanSales forecast analysis under 40 charsjensebastianBelum ada peringkat

- Master of Business AdministrationDokumen12 halamanMaster of Business Administrationsubanerjee18100% (1)

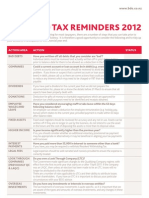

- Year-End Tax Reminders 2012: Action Area Action StatusDokumen2 halamanYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783Belum ada peringkat

- TERMSDokumen30 halamanTERMSHari KrishnaBelum ada peringkat

- Unit - 5 DepreciationDokumen19 halamanUnit - 5 DepreciationGeethaBelum ada peringkat

- Accountancy ProjectDokumen12 halamanAccountancy ProjectAbhey JindalBelum ada peringkat

- Bcom QbankDokumen13 halamanBcom QbankIshaBelum ada peringkat

- Capital Expenditure Analysis GuideDokumen5 halamanCapital Expenditure Analysis GuideAllan SsemujjuBelum ada peringkat

- What Are The Disadvantages of The Perpetual and Period Inventory System?Dokumen4 halamanWhat Are The Disadvantages of The Perpetual and Period Inventory System?Siwei TangBelum ada peringkat

- Working Capital Management Tools and TechniquesDokumen4 halamanWorking Capital Management Tools and TechniquesTeresa Del Campo RodríguezBelum ada peringkat

- PWC New M& A Accounting 2009Dokumen24 halamanPWC New M& A Accounting 2009wallstreetprepBelum ada peringkat

- Mcs April 2011 PaperDokumen46 halamanMcs April 2011 PaperNeeta NainaniBelum ada peringkat

- Static 1Dokumen16 halamanStatic 1Anurag SinghBelum ada peringkat

- Valuation of Spin Offs and Divestiture SDokumen0 halamanValuation of Spin Offs and Divestiture SlunoguBelum ada peringkat

- Lecture 6Dokumen7 halamanLecture 6Andreea Alexandra AntohiBelum ada peringkat

- Fixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ADokumen7 halamanFixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ARandal SchroederBelum ada peringkat

- Balance Sheet and Financial StatementDokumen3 halamanBalance Sheet and Financial StatementRochelle AntoinetteBelum ada peringkat

- Real Estate Glossaryv 1Dokumen20 halamanReal Estate Glossaryv 1san MunBelum ada peringkat

- The Income Statement ExplainedDokumen17 halamanThe Income Statement ExplainedTinashe ChikwenhereBelum ada peringkat

- Q&A FactoringDokumen3 halamanQ&A FactoringRabi BhowmickBelum ada peringkat

- Terminology Asset: Share CapitalDokumen8 halamanTerminology Asset: Share CapitalHenna HussainBelum ada peringkat

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Dokumen10 halamanBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanBelum ada peringkat

- Chapter 10Dokumen33 halamanChapter 10Usman ShabbirBelum ada peringkat

- Accounting Research Memo Proj Acct 540Dokumen9 halamanAccounting Research Memo Proj Acct 540Carolyn Robinson WhitlockBelum ada peringkat

- Prepaid Expenses and Deferred Charges 1. Proper Authorization To IncurDokumen4 halamanPrepaid Expenses and Deferred Charges 1. Proper Authorization To IncurJasmine Iris BautistaBelum ada peringkat

- FSAV3eModules 5-8Dokumen26 halamanFSAV3eModules 5-8bobdoleBelum ada peringkat

- See It, Understand It, Use It: Accounting DefinitionsDokumen29 halamanSee It, Understand It, Use It: Accounting Definitionsbha27111992Belum ada peringkat

- Research Paper Revenue RecognitionDokumen7 halamanResearch Paper Revenue Recognitionorlfgcvkg100% (1)

- FA UNIT 3Dokumen11 halamanFA UNIT 3VTBelum ada peringkat

- Printicomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentDokumen103 halamanPrinticomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentKunal MehtaBelum ada peringkat

- ATO Top 1000 - What Attracts Out AttentionDokumen15 halamanATO Top 1000 - What Attracts Out Attention8nkwv7q272Belum ada peringkat

- Depreciation Is An Accounting Method of Allocating The Cost of A Tangible or Physical AssetDokumen15 halamanDepreciation Is An Accounting Method of Allocating The Cost of A Tangible or Physical AssetReney RajuBelum ada peringkat

- Audit Consideration - Construction & Real StateDokumen6 halamanAudit Consideration - Construction & Real StateAngelica BuenaventuraBelum ada peringkat

- Audit Internal Assignment Anoushka KodeDokumen5 halamanAudit Internal Assignment Anoushka KodeAashna JainBelum ada peringkat

- Chapter 03 Receivable MGTDokumen8 halamanChapter 03 Receivable MGTNitesh BansodeBelum ada peringkat

- Assets Fair ValueDokumen10 halamanAssets Fair ValueArulmani MurugesanBelum ada peringkat

- Accounting For Intangible AssetsDokumen11 halamanAccounting For Intangible AssetsBeldineBelum ada peringkat

- Dissertation On Revenue RecognitionDokumen7 halamanDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- MSMEDokumen3 halamanMSMELrajBelum ada peringkat

- Assets, Liabilities, and The Balance SheetDokumen19 halamanAssets, Liabilities, and The Balance Sheetdebojyoti100% (1)

- Bunwin Residence: Is The Company Profitable??Dokumen6 halamanBunwin Residence: Is The Company Profitable??Pum MineaBelum ada peringkat

- New Accounting Standards For Leases Will Affect The Construction IndustryDokumen5 halamanNew Accounting Standards For Leases Will Affect The Construction IndustryMike KarlinsBelum ada peringkat

- (Ebook) - Business Guide - LawDokumen16 halaman(Ebook) - Business Guide - LawIbrahim AbdulateefBelum ada peringkat

- Earthian 2013 Colleges OptimDokumen11 halamanEarthian 2013 Colleges OptimVishal GajjarBelum ada peringkat

- 5Dokumen6 halaman5Vishal GajjarBelum ada peringkat

- Work StudyDokumen20 halamanWork StudyVishal GajjarBelum ada peringkat

- SONOCODokumen4 halamanSONOCOVishal GajjarBelum ada peringkat

- Before 15th MayDokumen1 halamanBefore 15th MayVishal GajjarBelum ada peringkat

- Sonoco Products CompanyDokumen16 halamanSonoco Products CompanyVishal Gajjar50% (2)

- Sonoco Products CompanyDokumen16 halamanSonoco Products CompanyVishal Gajjar50% (2)

- AmortizationDokumen2 halamanAmortizationVishal GajjarBelum ada peringkat

- JNNSM GJawaharlal Nehru National Solar Mission Phase II - Policy Document UIDLINESDokumen58 halamanJNNSM GJawaharlal Nehru National Solar Mission Phase II - Policy Document UIDLINESsrichanderBelum ada peringkat

- AmortizationDokumen2 halamanAmortizationVishal GajjarBelum ada peringkat

- What Is Pull Supply Chain?Dokumen1 halamanWhat Is Pull Supply Chain?Vishal GajjarBelum ada peringkat

- Indian Textiles Industry Presentation 220708Dokumen22 halamanIndian Textiles Industry Presentation 220708workosaur50% (2)

- Knowledge To Action 100113 WebDokumen87 halamanKnowledge To Action 100113 WebVishal GajjarBelum ada peringkat

- The Everything of MBA in India and Abroad, CAT 2009, GMAT, XAT, MAT - Best Way To Improve Your Vocab1Dokumen8 halamanThe Everything of MBA in India and Abroad, CAT 2009, GMAT, XAT, MAT - Best Way To Improve Your Vocab1Vishal GajjarBelum ada peringkat

- Theory of Elinor OstromDokumen5 halamanTheory of Elinor OstromSanjana KrishnakumarBelum ada peringkat

- Vda. de Consuegra v. Government Service Insurance System (1971)Dokumen1 halamanVda. de Consuegra v. Government Service Insurance System (1971)Andre Philippe RamosBelum ada peringkat

- ABE College Manila. 2578 Legarda Avenue Sampaloc, ManilaDokumen11 halamanABE College Manila. 2578 Legarda Avenue Sampaloc, ManilaRonalie SustuedoBelum ada peringkat

- Software Process & Quality Management: Six SigmaDokumen26 halamanSoftware Process & Quality Management: Six SigmaPhu Phan ThanhBelum ada peringkat

- Rift Valley University Office of The Registrar Registration SlipDokumen2 halamanRift Valley University Office of The Registrar Registration SlipHACHALU FAYEBelum ada peringkat

- Introduction To Global Business 2nd Edition Gaspar Test BankDokumen26 halamanIntroduction To Global Business 2nd Edition Gaspar Test BankJerryGarrettmwsi100% (56)

- PMUY supplementary document titleDokumen1 halamanPMUY supplementary document titleChandan Kumar Jha69% (67)

- IELTS Writing Task 1 Combined Graphs Line Graph and Table 1Dokumen6 halamanIELTS Writing Task 1 Combined Graphs Line Graph and Table 1Sugeng RiadiBelum ada peringkat

- 325W Bifacial Mono PERC Double Glass ModuleDokumen2 halaman325W Bifacial Mono PERC Double Glass ModuleJosue Enriquez EguigurenBelum ada peringkat

- Cs 2032 Data Warehousing and Data Mining Question Bank by GopiDokumen6 halamanCs 2032 Data Warehousing and Data Mining Question Bank by Gopiapi-292373744Belum ada peringkat

- Development Approach PlanDokumen15 halamanDevelopment Approach PlanGaurav UpretiBelum ada peringkat

- Flexi CE in RAS06-NokiaDokumen39 halamanFlexi CE in RAS06-NokiaNikan AminiBelum ada peringkat

- Hofa Iq Limiter Manual enDokumen8 halamanHofa Iq Limiter Manual enDrixBelum ada peringkat

- Sample Demand LetterDokumen3 halamanSample Demand LetterShaniemielle Torres-BairanBelum ada peringkat

- Commissioner of Internal Revenue V CaDokumen3 halamanCommissioner of Internal Revenue V CaJimenez LorenzBelum ada peringkat

- Chapter Three Business PlanDokumen14 halamanChapter Three Business PlanBethelhem YetwaleBelum ada peringkat

- Azubuko v. Motor Vehicles, 95 F.3d 1146, 1st Cir. (1996)Dokumen2 halamanAzubuko v. Motor Vehicles, 95 F.3d 1146, 1st Cir. (1996)Scribd Government DocsBelum ada peringkat

- 18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewDokumen36 halaman18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewMohmmedKhayyumBelum ada peringkat

- Ipocc User Interface enDokumen364 halamanIpocc User Interface enMarthaGutnaraBelum ada peringkat

- Time Division Muliple AccessDokumen4 halamanTime Division Muliple AccessAbhishek RanaBelum ada peringkat

- Neeraj Kumar: Nokia Siemens Networks (Global SDC Chennai)Dokumen4 halamanNeeraj Kumar: Nokia Siemens Networks (Global SDC Chennai)Kuldeep SharmaBelum ada peringkat

- 18mba0044 SCM Da2Dokumen4 halaman18mba0044 SCM Da2Prabhu ShanmugamBelum ada peringkat

- Keltbray Crude Oil and Gas LTDDokumen2 halamanKeltbray Crude Oil and Gas LTDIana LeynoBelum ada peringkat

- Ultrasonic Pulse Velocity or Rebound MeasurementDokumen2 halamanUltrasonic Pulse Velocity or Rebound MeasurementCristina CastilloBelum ada peringkat

- Ascon PhivDokumen48 halamanAscon PhivSDK341431100% (1)

- Chapter 5Dokumen30 halamanChapter 5فاطمه حسينBelum ada peringkat

- Bamboo in AsiaDokumen72 halamanBamboo in Asiafitria lavitaBelum ada peringkat

- Simple Mortgage DeedDokumen6 halamanSimple Mortgage DeedKiran VenugopalBelum ada peringkat

- This Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncDokumen9 halamanThis Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncNguyễn Như QuỳnhBelum ada peringkat

- Presentasi AkmenDokumen18 halamanPresentasi AkmenAnonymous uNgaASBelum ada peringkat