6 Computerized System

Diunggah oleh

Imran MemonHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

6 Computerized System

Diunggah oleh

Imran MemonHak Cipta:

Format Tersedia

GOVERNMENT OF PUNJAB PUNJAB REVENUE AUTHORITY August 01, 2012 NOTIFICATION No.PRA/Orders.06/2012(5).

In exercise of the powers conferred under section 76 of the Punjab Sales Tax on Services Act 2012 (XLIII of 2012), the Punjab Revenue Authority, with the approval of the Government, is pleased to make the following rules: CHAPTER I PRELIMINARY 1. Short title and commencement. (1) These rules may be cited as the Punjab Sales Tax on Services (Computerized System) Rules 2012. (2) They shall come into force at once. CHAPTER II SAFETY OF SYSTEM 2. Responsibility of the user. Every person authorized to use or interact with the computerized system of the Authority shall be responsible for use or interaction with the system only to the extent authorized by the Authority. 3. Protection of business information. Every user of the computerized system shall ensure that no information or data relating to any registered person reaches in any unauthorized hand. 4. Exchange of information between registered persons. A registered person may allow the person authorized to use or interact with the computerized system to share his business information with any other person. 5. Information to associations. The Authority may deliver any information or data stored in or retrievable from the computerized system to any association of trade, business or industry for the purposes of helping out the Authority in the formulation of its policies and carrying out its functions under the laws administered by the Authority. CHAPTER III ACCESS TO SYSTEM 6. Authorization. (l) A person desirous to be authorized as user of the computerized system of the Authority may apply to the Authority by visiting the website https://e.pra.punjab.gov.pk. (2) Upon scrutiny of the information provided by the applicant, the Authority may, subject to such conditions or restrictions as it may impose, grant authorization to the applicant or refuse the application after giving the applicant an opportunity of being heard through an officer of the Authority nominated in this behalf. (3) No person shall have or attempt to have access to the computerized system for transmission to or receipt of information therefrom unless authorized as aforesaid.

7. Unique user identifier. (1) Every person authorized as user of computerized system shall be allotted a 'Unique User Identifier (UUI) for his identification in relation to accessing the computerized system for transmission to or receipt of relevant information therefrom. 8. Access to computerized system. Subject to the conditions and restrictions as may be prescribed by the Authority, the authorized user shall access the computerized system for transmission to or receipt of information therefrom. (2) The Authority may, at any time, impose any additional conditions upon any authorized user or class of authorized users for accessing the computerized system or to maintain confidentiality or security thereof. (3) The Authority may require an authorized user or class of authorized users including their accredited agents to use any additional electronic security including digital certification for electronic filing of return or any other declarations or documents. 9. Responsibility of the user. The authorized user shall be responsible for security and confidentiality of the UUI allotted to him and where any information is transmitted to the computerized system using a 'UUI', the transmission of that information shall be a sufficient evidence that the authorized user to whom such 'UUI' has been issued has transmitted that information. 10. Cancellation of authorization . (1) Where the Authority is satisfied that any user authorized to use the computerized system has: (a) (b) (c) (d) failed to comply with any of the conditions or restrictions prescribed by the Authority; or acted in contravention of any of the provisions of the Act or the rules made thereunder; or failed to take adequate measures for security and confidentiality of the 'UUI'; or been convicted in an offence under the Act or any other law; may cancel the authorization of that user after affording him an opportunity of being heard.

(2) Pending consideration whether an authorization is cancelled under sub-rule (1), the Authority may suspend the authorization. 11. Recording of transmissions. The Authority shall keep record of each transmission sent to or received from an authorized user, for a period of five years from the date of such transmission or receipt. 12. Scrutiny of records. An officer or officers nominated by the Authority, may examine records maintained by an authorized user, whether electronically or otherwise, in relation to a specific transaction or to verify adequacy or integrity of the system or media on which such records are created and stored. CHAPTER IV E-INTERMEDIARIES 13. Appointment of e-intermediary. (1) A person having professional experience in the relevant field of providing taxation service desirous of being

appointed as e-intermediary, shall apply to the Authority or any officer of the Authority authorized in this behalf. Explanation: The professional experience shall mean as follows: (a) a firm or sole proprietorship approved by the Institute of Chartered Accountants of Pakistan or Institute of Cost and Management Accountants of Pakistan, Association of Chartered Certified Accountants (ACCA) or Certified Public Accountants (CPAs); (b) a person or firm approved to practice as Income Tax Practitioner under the Income Tax Ordinance, 1979 (XLIX of 2001); (c) a practicing lawyer; (d) Any other person approved by the Authority. (2) Every application for appointment of an e-intermediary shall be forwarded to the e-declaration administrator of the Authority who, after necessary verifications, shall submit the application along with his specific recommendations to the Authority for appointment of the applicant as e-intermediary. (3) The Authority, after receipt of the recommendations from the edeclaration administrator, may appoint the applicant as an e-intermediary and issue him a unique identifier, subject to such conditions, restrictions and limitations as may be prescribed: Provided that the Authority may refuse to entertain or accept an application for appointment as e-intermediary for reasons to be recorded and conveyed in writing. (4) In case of any change in the particulars or information provided by the e-intermediary in the application for registration, he shall immediately inform the edeclaration Administrator about such change. 14. Cancellation of appointment.(1) Where the Authority is satisfied that the e-intermediary has: (a) (b) (c) (d) failed to comply with any of the conditions, restrictions or limitations prescribed by the Authority; or acted in contravention of any of the provisions of the Act or these rules; or failed to take adequate measures for security and confidentiality of the UUI; or been convicted for an offence under the Act or any other law; it may cancel the appointment of such e-intermediary after affording him an opportunity of being heard.

(2) Pending consideration whether the appointment of the e-intermediary be cancelled under sub-rule (1), the Authority may suspend the appointment. (3) An e-intermediary who intends to surrender his appointment, shall file an application to this effect to the Authority.

(4) The Authority may, on receipt of an application referred to in sub-rule (3), cancel the appointment of the e-intermediary after such necessary inquiry as it may deem proper to conduct. (5) Cancellation of appointment of any e-intermediary shall not absolve him of the obligations and liabilities which may be determined under the Act or rules made thereunder. 15. Authorization to FBRs e-intermediaries. The Authority may through a general order or otherwise and subject to conditions or otherwise allow any eintermediary or class of e-intermediaries already appointed by the Federal Board of Revenue to act or operate as e-intermediary for the purposes of the Act or rules made thereunder. CHAPTER V E-INVOICING 16. Use of e-invoicing system.- Any registered person may, under intimation to the Authority, use an appropriate system of electronic invoicing in respect of taxable services provided by him. 17. Real time transmission of e-invoices. On receipt of intimation under rule 16, the Authority shall take necessary software-related measures to enable the registered person to generate and transmit e-invoices to the computerized system of the Authority on real time basis. 19. Non-inclusion of e-invoicing in monthly return. Where a registered person is issuing e-invoices and transmitting the same to the computerized system on real time basis, such person shall not be required to provide summery of his sale invoices with the return. 20. E-treatment of purchase invoices. Where a registered person is receiving e-invoices for his purchases or has a computer facility to electrify his purchase invoices, he may, with prior general permission from the Authority, transmit his daily purchase invoices to the computerized system of the Authority and such person shall not be required to file summery of his purchase invoices with the monthly return. 21. Validity of invoices. Unless otherwise proved, the sale and purchase invoices electronically transmitted by a registered person to the computerized system of the Authority shall be treated as valid proof of sales and purchases for the purposes of the Act and rules made thereunder. Explanation: For the purpose of this Chapter, invoice shall, where so allowed by the Authority, include cash memos, sale receipts, vouches and similar instruments showing sale or purchase transactions provided they carry the commonly accepted necessary features of an invoice.

CHAIRPERSON PUNJAB REVENUE AUTHORITY

Anda mungkin juga menyukai

- CGT Presentation Updated March 4 2015 WebsiteDokumen27 halamanCGT Presentation Updated March 4 2015 WebsiteImran MemonBelum ada peringkat

- IR APPELLATE TRIBUNAL RULES ON POWER COMPANY'S SALES TAX APPEALDokumen22 halamanIR APPELLATE TRIBUNAL RULES ON POWER COMPANY'S SALES TAX APPEALImran Memon100% (1)

- The Sindh Finance Bill 2013Dokumen32 halamanThe Sindh Finance Bill 2013Imran MemonBelum ada peringkat

- Annual Employer Statement Import TemplateDokumen6 halamanAnnual Employer Statement Import TemplateTanzeel Ur Rahman GazdarBelum ada peringkat

- Bypass Surgery Guide-Final For PrintingDokumen21 halamanBypass Surgery Guide-Final For PrintingImran MemonBelum ada peringkat

- Owais Ali Khan: Career ObjectiveDokumen2 halamanOwais Ali Khan: Career ObjectiveImran MemonBelum ada peringkat

- Winter Clearance 2013Dokumen18 halamanWinter Clearance 2013Imran MemonBelum ada peringkat

- Second ScheduleDokumen7 halamanSecond ScheduleImran MemonBelum ada peringkat

- The Sindh Finance Bill 2013Dokumen32 halamanThe Sindh Finance Bill 2013Imran MemonBelum ada peringkat

- NTN Application1Dokumen1 halamanNTN Application1Imran MemonBelum ada peringkat

- Fed CorporateDokumen1 halamanFed CorporateImran MemonBelum ada peringkat

- SRB Notification on Sindh Sales Tax Withholding RulesDokumen2 halamanSRB Notification on Sindh Sales Tax Withholding RulesImran MemonBelum ada peringkat

- XyzDokumen10 halamanXyzImran MemonBelum ada peringkat

- Richard FoltzDokumen2 halamanRichard FoltzImran MemonBelum ada peringkat

- The Butterfly MosqueDokumen3 halamanThe Butterfly MosqueImran MemonBelum ada peringkat

- PTCL City Wise Contact Detail For EVO USBDokumen1 halamanPTCL City Wise Contact Detail For EVO USBSandeep Kumar MugriaBelum ada peringkat

- Fasle Ase B Honge by Adem HashmiDokumen63 halamanFasle Ase B Honge by Adem HashmiImran MemonBelum ada peringkat

- SRB 3 4 5 471 2011Dokumen2 halamanSRB 3 4 5 471 2011Imran MemonBelum ada peringkat

- Sorath - Rai - Diyach: Page 1 of 3Dokumen3 halamanSorath - Rai - Diyach: Page 1 of 3Imran MemonBelum ada peringkat

- 10-Alternative Dispute ResolutionDokumen3 halaman10-Alternative Dispute ResolutionImran MemonBelum ada peringkat

- Restaurant Services Rules 09-10-2012Dokumen4 halamanRestaurant Services Rules 09-10-2012Imran MemonBelum ada peringkat

- CV - Chartered Accountant (Word 2007)Dokumen2 halamanCV - Chartered Accountant (Word 2007)Imran MemonBelum ada peringkat

- 7 Authorized RepresentativeDokumen3 halaman7 Authorized RepresentativeImran MemonBelum ada peringkat

- 11-Withholding Rules 2012Dokumen5 halaman11-Withholding Rules 2012Imran MemonBelum ada peringkat

- 8 AuditDokumen4 halaman8 AuditImran MemonBelum ada peringkat

- Government of Punjab Lahore, Dated 2012Dokumen8 halamanGovernment of Punjab Lahore, Dated 2012Imran MemonBelum ada peringkat

- 5 Specific ProvisionsDokumen11 halaman5 Specific ProvisionsImran MemonBelum ada peringkat

- 3-Filing of ReturnsDokumen8 halaman3-Filing of ReturnsImran MemonBelum ada peringkat

- 2 Registration & de RegDokumen8 halaman2 Registration & de RegImran MemonBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Instant Download Ebook PDF Energy Systems Engineering Evaluation and Implementation Third 3rd Edition PDF ScribdDokumen41 halamanInstant Download Ebook PDF Energy Systems Engineering Evaluation and Implementation Third 3rd Edition PDF Scribdmichael.merchant471100% (43)

- The Hittite Name For GarlicDokumen5 halamanThe Hittite Name For GarlictarnawtBelum ada peringkat

- Political Science Assignment PDFDokumen6 halamanPolitical Science Assignment PDFkalari chandanaBelum ada peringkat

- Cycling Coaching Guide. Cycling Rules & Etiquette Author Special OlympicsDokumen20 halamanCycling Coaching Guide. Cycling Rules & Etiquette Author Special Olympicskrishna sundarBelum ada peringkat

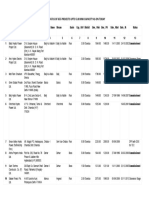

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDokumen45 halamanList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21Belum ada peringkat

- Blood Culture & Sensitivity (2011734)Dokumen11 halamanBlood Culture & Sensitivity (2011734)Najib AimanBelum ada peringkat

- History: The Origin of Kho-KhotheDokumen17 halamanHistory: The Origin of Kho-KhotheIndrani BhattacharyaBelum ada peringkat

- How To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full ChapterDokumen36 halamanHow To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full Chapterandrew.taylor131100% (22)

- Costco Case StudyDokumen3 halamanCostco Case StudyMaong LakiBelum ada peringkat

- Philippine Association of Service Exporters vs Drilon Guidelines on Deployment BanDokumen1 halamanPhilippine Association of Service Exporters vs Drilon Guidelines on Deployment BanRhev Xandra AcuñaBelum ada peringkat

- Symbian Os-Seminar ReportDokumen20 halamanSymbian Os-Seminar Reportitsmemonu100% (1)

- Mariam Kairuz property dispute caseDokumen7 halamanMariam Kairuz property dispute caseReginald Matt Aquino SantiagoBelum ada peringkat

- Effectiveness of Laundry Detergents and Bars in Removing Common StainsDokumen9 halamanEffectiveness of Laundry Detergents and Bars in Removing Common StainsCloudy ClaudBelum ada peringkat

- Eating Disorder Diagnostic CriteriaDokumen66 halamanEating Disorder Diagnostic CriteriaShannen FernandezBelum ada peringkat

- Scantype NNPC AdvertDokumen3 halamanScantype NNPC AdvertAdeshola FunmilayoBelum ada peringkat

- LESSON 2 - Nguyễn Thu Hồng - 1917710050Dokumen2 halamanLESSON 2 - Nguyễn Thu Hồng - 1917710050Thu Hồng NguyễnBelum ada peringkat

- Httpswww.ceec.Edu.twfilesfile Pool10j07580923432342090202 97指考英文試卷 PDFDokumen8 halamanHttpswww.ceec.Edu.twfilesfile Pool10j07580923432342090202 97指考英文試卷 PDFAurora ZengBelum ada peringkat

- MadBeard Fillable Character Sheet v1.12Dokumen4 halamanMadBeard Fillable Character Sheet v1.12DiononBelum ada peringkat

- Web Design Course PPTX Diana OpreaDokumen17 halamanWeb Design Course PPTX Diana Opreaapi-275378856Belum ada peringkat

- General Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsDokumen5 halamanGeneral Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsLeonardo PigaBelum ada peringkat

- I Saw Water Flowing - VaticanDokumen3 halamanI Saw Water Flowing - VaticanChu Gia KhôiBelum ada peringkat

- Cinema Urn NBN Si Doc-Z01y9afrDokumen24 halamanCinema Urn NBN Si Doc-Z01y9afrRyan BrandãoBelum ada peringkat

- Torts and DamagesDokumen63 halamanTorts and DamagesStevensonYuBelum ada peringkat

- Solar Powered Rickshaw PDFDokumen65 halamanSolar Powered Rickshaw PDFPrãvëèñ Hêgådë100% (1)

- Colégio XIX de Março 2a Prova Substitutiva de InglêsDokumen5 halamanColégio XIX de Março 2a Prova Substitutiva de InglêsCaio SenaBelum ada peringkat

- Mitanoor Sultana: Career ObjectiveDokumen2 halamanMitanoor Sultana: Career ObjectiveDebasish DasBelum ada peringkat

- Farm Policy Options ChecklistDokumen2 halamanFarm Policy Options ChecklistJoEllyn AndersonBelum ada peringkat

- Is The Question Too Broad or Too Narrow?Dokumen3 halamanIs The Question Too Broad or Too Narrow?teo100% (1)

- Bpo Segment by Vitthal BhawarDokumen59 halamanBpo Segment by Vitthal Bhawarvbhawar1141100% (1)

- AmulDokumen4 halamanAmulR BBelum ada peringkat