Objection Letter - 6

Diunggah oleh

stockboardguyHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Objection Letter - 6

Diunggah oleh

stockboardguyHak Cipta:

Format Tersedia

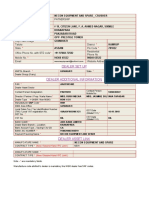

Hearing Date: August 20, 2013 at 11:00 a.m. (Eastern Time) Objection Deadline: August 9, 2013 at 4:00 p.m.

(Eastern Time) Name Address 1 Address 2 Telephone: Fax: Eastman Kodak Shareholder

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: EASTMAN KODAK COMPANY, et al., Debtors. ) ) ) ) ) )

Bankruptcy Case No. 12-10202

SHAREHOLDER OBJECTION TO DEBTORS FIRST AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION Dear Honorable Judge Allan Gropper, I respectfully request the court to deny confirmation of Debtors First Amended Joint Chapter 11 Plan of Reorganization (the Plan), because there is sufficient evidence of potential breaches of fiduciary duty and potential violation of securities laws by Debtors in formulating the Plan. 1. Debtors breached their fiduciary duty when they signed an exclusive Backstop Agreement for the $406M rights offering with four hedge fund groups, who accumulated controlling and blocking positions in Debtors' unsecured notes and claims at prices less than 15% of their face values, without a competitive bidding in the financial markets and excluding the equity holders from this rights offering. 2. Debtors adopted a poison pill on August 1, 2011 to preserve their tax attributes by restricting equity ownership to 5%. This reduced the take over potential of Kodak when the share price was trading at $3. Debtors stated that this action was in the best interests of the equity holders. After the petition, Debtors extended the poison pill with an order from the court until bankruptcy emergence. But, in formulating the Plan, Debtors breached their fiduciary duty by ignoring the substantial value of the preemergence tax attributes and did not provide a comparative earnings and cash flow analysis of the tax attributes under IRC Section 382 (1) (6) as compared to under IRC Section 382 (1) (5). 3. Debtors spent $5.8B cash to buy back Kodak shares at an average share price of $48 during the last ten years (2012 10-K) with a view that this share price did not reflect the true value of the company. On the other hand, in the Plan, Debtors estimate that Kodak is now worth only $72M excluding the $406M rights offering plus fees, and after $2.2B unsecured claims are canceled. How is this possible? 4. Debtors announced a partnership with Uni-Pixel on April 16, 2013, and another partnership with Kingsbury on June 27, 2013 to produce next-generation touch screen sensors which will potentially 1

double their US earnings and cash flows after 2014. But, the Plan is based on an incorrect low reorganization value that does not include any incremental earnings and cash flows in the functional printing business as compared to the earnings and cash flows Debtors reported both in the January 22, 2013 8-K and August 3, 2012 8-K. 5. Debtors earned close to $400M annual profits from the IP licensing business before the petition date. But, the Plan is based on only $20M annual earnings from IP and brand licensing businesses during the 2014-2017 projection period. 6. Debtors licensed their 7,500 remaining patents to the 18 Consortium members, who purchased the imaging patent portfolio of 1,100 patents from the Debtors for $527M. But, the Plan does not include any revenues and earnings from these licensing agreements. 7. Debtors breached their fiduciary duty when they signed an agreement with KPP to sell the Consumer Imaging business for $325M cash proceeds without a competitive bidding to get the best market price. In addition, Debtors did not disclose the future supply revenues and earnings from the KPP deal and did not include these incremental revenues and earnings in the Plan. 8. The information disclosed by Debtors with numerous public statements and several SEC filings are misleading and inconsistent with the Disclosure Statement and the Plan information. There is sufficient evidence of violation of securities laws by Debtors. Some examples are as follows: (a) Debtors reported 20,000+ US patents in the 2010-10K report, and then only a total of 7,100 US and international patents in the Disclosure Statement. (b) Debtors denied bankruptcy rumors on October 3, 2011, and then filed bankruptcy three months later on January 19, 20128. (c) Debtors stated that the tax attributes were important for the company when they announced the Poison Pill on August 1, 2011. Then, they ignored the tax attributes in the Plan. (d) On January 19, 2012, in a Kodak employee Town Hall meeting, Kodak President, Laura Quatela stated that Kodak could rake $6B from the licensing of imaging patents over the next four years and potentially more if it inked a deal with Apple or Google. On December 19, 2012, the imaging patents were sold for $527M. (e) In September 2012, Kodak CEO, Antonio Perez stated We are in the drivers seat, we could have sold the patents earlier, but we wanted to wait to get our price (valued at $2.2B or more). On December 19, 2012, the imaging patents were sold for only $527M. (f) Kodak CEO, Antonio Perez, made several public statements such as Kodak is an asset rich company and investment community misunderstands the objectives of the bankruptcy. Then, in the Plan, Debtors valued the company at only $72M, even after $406M cash from the rights offering and cancellation of $2.2B unsecured liabilities.

.>> Sign here 2

Anda mungkin juga menyukai

- Promissory Notes Are Legal Tender BecauseDokumen2 halamanPromissory Notes Are Legal Tender BecauseDUTCH55140091% (23)

- Parking Letter The Co-Op 22nd May PDFDokumen4 halamanParking Letter The Co-Op 22nd May PDFmadtony4464100% (1)

- Legal Writing Complaint (Sample)Dokumen5 halamanLegal Writing Complaint (Sample)gerasjuanBelum ada peringkat

- AQA GCSE Citizenship Revision Guide - FINALDokumen19 halamanAQA GCSE Citizenship Revision Guide - FINALJohn SmithBelum ada peringkat

- Crusades-Worksheet 2014Dokumen2 halamanCrusades-Worksheet 2014api-263356428Belum ada peringkat

- Supreme Court admits to bar corrupt Jackson Lewis Attorneys, Guy P. Tully and Brian M. Childs, from Boston knowing waiver of rights regarded a Petition that showed unquestionable criminal law violations & attorney misconduct. see pg. 819-820 http://www.supremecourt.gov/orders/journal/jnl11.pdfDokumen29 halamanSupreme Court admits to bar corrupt Jackson Lewis Attorneys, Guy P. Tully and Brian M. Childs, from Boston knowing waiver of rights regarded a Petition that showed unquestionable criminal law violations & attorney misconduct. see pg. 819-820 http://www.supremecourt.gov/orders/journal/jnl11.pdftired_of_corruption100% (1)

- Carmack Amendments Cargo ClaimsDokumen9 halamanCarmack Amendments Cargo ClaimsHarmonf4uBelum ada peringkat

- Graysville, TN LawsuitDokumen20 halamanGraysville, TN LawsuitNewsChannel 9 StaffBelum ada peringkat

- Rhino Shield Scam!Dokumen17 halamanRhino Shield Scam!KarlSmith949Belum ada peringkat

- Terms of The ContractDokumen9 halamanTerms of The ContractkeepthyfaithBelum ada peringkat

- Jacobson MotiontoDismiss ShowCauseDokumen10 halamanJacobson MotiontoDismiss ShowCauseBeth Stoops JacobsonBelum ada peringkat

- 047-1 Response Motion SanctionsDokumen19 halaman047-1 Response Motion SanctionsEzekiel KobinaBelum ada peringkat

- Chart - Types of MisconductDokumen1 halamanChart - Types of Misconducttheplatinumlife7364Belum ada peringkat

- Christopher Kozak Statement of Claim Against CBCDokumen12 halamanChristopher Kozak Statement of Claim Against CBCSean CraigBelum ada peringkat

- Practical Guide to Mergers, Acquisitions and Business Sales, 2nd EditionDari EverandPractical Guide to Mergers, Acquisitions and Business Sales, 2nd EditionBelum ada peringkat

- Objection Letter - 5Dokumen3 halamanObjection Letter - 5stockboardguyBelum ada peringkat

- Objection Letter - 5Dokumen3 halamanObjection Letter - 5stockboardguyBelum ada peringkat

- Objection Letter - 6Dokumen2 halamanObjection Letter - 6stockboardguy100% (1)

- Honda CB450 K0 Parts List ManualDokumen130 halamanHonda CB450 K0 Parts List ManualBrandon Parsons100% (1)

- Objection Letter About Court CasesDokumen2 halamanObjection Letter About Court Caseslookthemoon2009Belum ada peringkat

- Textbooks - Filed ComplaintDokumen30 halamanTextbooks - Filed ComplaintAarthi100% (3)

- United States District Court For The Western District of Texas San Antonio DivisionDokumen6 halamanUnited States District Court For The Western District of Texas San Antonio DivisionTexas Public RadioBelum ada peringkat

- Law Firm Strategies for the 21st Century: Strategies for Success, Second EditionDari EverandLaw Firm Strategies for the 21st Century: Strategies for Success, Second EditionChristoph H VaagtBelum ada peringkat

- Sacramento Auto Accident AttorneyDokumen5 halamanSacramento Auto Accident AttorneyMona DeldarBelum ada peringkat

- PartnershipDokumen92 halamanPartnershipMary Louise VillegasBelum ada peringkat

- Broker Confirmation LetterDokumen2 halamanBroker Confirmation LetterRocketLawyerBelum ada peringkat

- First Discovery Request in Brown-Dickerson v. City of Philadelphia, Et AlDokumen6 halamanFirst Discovery Request in Brown-Dickerson v. City of Philadelphia, Et AlThe DeclarationBelum ada peringkat

- United States Court of Appeals For The Ninth Circuit: Oral Argument Scheduled For December 6, 2010Dokumen41 halamanUnited States Court of Appeals For The Ninth Circuit: Oral Argument Scheduled For December 6, 2010Kathleen PerrinBelum ada peringkat

- Arizona Foreclosure TimelineDokumen5 halamanArizona Foreclosure TimelineKeith CarrBelum ada peringkat

- City of Columbia Police Department Civil Rights Lawsuit Ahmed SalauDokumen26 halamanCity of Columbia Police Department Civil Rights Lawsuit Ahmed SalauParisAngelsBelum ada peringkat

- Misrep - COM:AW 201Dokumen4 halamanMisrep - COM:AW 201Ethan CashmailBelum ada peringkat

- RoboSignerPlus SampleDokumen53 halamanRoboSignerPlus Sampleagold73Belum ada peringkat

- Application To Set Aside Statutory DemandDokumen4 halamanApplication To Set Aside Statutory DemandLennox Allen Kip100% (1)

- The Pirnia Law Group: Priscila Chamorro - Case ManagerDokumen3 halamanThe Pirnia Law Group: Priscila Chamorro - Case Managerderic makelBelum ada peringkat

- Dupage Nissan ComplaintDokumen50 halamanDupage Nissan Complaintapi-378506466Belum ada peringkat

- Info Shoppee: Eye Hospital Road SITAPUR 261001 Party DetailsDokumen1 halamanInfo Shoppee: Eye Hospital Road SITAPUR 261001 Party DetailsGaurav JaiswalBelum ada peringkat

- Responsive Documents - CREW: IRS: Regarding Policy On Investigating 501 (C) (3) OrganizationsDokumen327 halamanResponsive Documents - CREW: IRS: Regarding Policy On Investigating 501 (C) (3) OrganizationsCREWBelum ada peringkat

- Yukutake Rule 16 Scheduling OrderDokumen6 halamanYukutake Rule 16 Scheduling Orderwolf wood100% (1)

- Complaint For DivorceDokumen3 halamanComplaint For DivorceLaletta BoivinBelum ada peringkat

- Notarial LawDokumen4 halamanNotarial LawChristine Karen BumanlagBelum ada peringkat

- Maricopa County Defendants Motion To DismissDokumen11 halamanMaricopa County Defendants Motion To Dismisspaul weichBelum ada peringkat

- Understanding Whom Real Estate Agents RepresentDokumen2 halamanUnderstanding Whom Real Estate Agents RepresentAnonymous aSzhXxrBelum ada peringkat

- AgreementDokumen9 halamanAgreementbuttercupedBelum ada peringkat

- United States District Court Northern District of California San Jose DivisionDokumen2 halamanUnited States District Court Northern District of California San Jose Divisionnathangrayson100% (1)

- Municipal Bond Risk DisclosureDokumen2 halamanMunicipal Bond Risk Disclosuretonyw87dBelum ada peringkat

- Contingency Fee Retainer Agreement (Personal Injury)Dokumen13 halamanContingency Fee Retainer Agreement (Personal Injury)Venus PangilinanBelum ada peringkat

- Schneiderman - Notice of Intent To SueDokumen8 halamanSchneiderman - Notice of Intent To Suerobertharding22Belum ada peringkat

- Washington Mutual (WMI) - Objection To Disclosure Statement Filed by Dr. Sankarshan AcharyaDokumen3 halamanWashington Mutual (WMI) - Objection To Disclosure Statement Filed by Dr. Sankarshan AcharyameischerBelum ada peringkat

- Notice of Civil Claim 2013.04.26Dokumen10 halamanNotice of Civil Claim 2013.04.26Matt KieltykaBelum ada peringkat

- Tulsi Gabbard's Defamation Lawsuit Against Hillary ClintonDokumen14 halamanTulsi Gabbard's Defamation Lawsuit Against Hillary ClintonHNNBelum ada peringkat

- State of Louisiana vs. Latracus HenryDokumen9 halamanState of Louisiana vs. Latracus HenryThe Town TalkBelum ada peringkat

- TLAW 401 Class 7 (Consumer Law Part 1) (AH) 63: Review Question Week 7Dokumen9 halamanTLAW 401 Class 7 (Consumer Law Part 1) (AH) 63: Review Question Week 7Thapa SonaBelum ada peringkat

- Virginia Board of Bar Examiners Character & Fitness QuestionnaireDokumen24 halamanVirginia Board of Bar Examiners Character & Fitness QuestionnaireSusan MiloserBelum ada peringkat

- Tatuaje MSJ Unclean HandsDokumen6 halamanTatuaje MSJ Unclean HandsFrank HerreraBelum ada peringkat

- Contract To Purchase Agricultural LandDokumen18 halamanContract To Purchase Agricultural LandavsharikaBelum ada peringkat

- Atlantic Permanent Federal Savings and Loan Association v. American Casualty Company of Reading, Pennsylvania, 839 F.2d 212, 4th Cir. (1988)Dokumen12 halamanAtlantic Permanent Federal Savings and Loan Association v. American Casualty Company of Reading, Pennsylvania, 839 F.2d 212, 4th Cir. (1988)Scribd Government Docs100% (1)

- Peter Debbins - Statement of FactsDokumen15 halamanPeter Debbins - Statement of FactsVictor I Nava100% (1)

- S004040 Statement of Claim - As FiledDokumen24 halamanS004040 Statement of Claim - As FiledMichaelBelum ada peringkat

- Security Litigation: Best Practices for Managing and Preventing Security-Related LawsuitsDari EverandSecurity Litigation: Best Practices for Managing and Preventing Security-Related LawsuitsBelum ada peringkat

- Master Service Agreement Management A Complete Guide - 2019 EditionDari EverandMaster Service Agreement Management A Complete Guide - 2019 EditionBelum ada peringkat

- Petition for Certiorari Denied Without Opinion: Patent Case 93-1518Dari EverandPetition for Certiorari Denied Without Opinion: Patent Case 93-1518Belum ada peringkat

- Guiding Rights: Trademarks, Copyright and the InternetDari EverandGuiding Rights: Trademarks, Copyright and the InternetBelum ada peringkat

- Objection Letter - 13Dokumen8 halamanObjection Letter - 13stockboardguyBelum ada peringkat

- Objection Letter - 10Dokumen5 halamanObjection Letter - 10stockboardguyBelum ada peringkat

- Great Shareholder Objection To POR 4737Dokumen68 halamanGreat Shareholder Objection To POR 4737stockboardguyBelum ada peringkat

- Objection Letter - 12Dokumen4 halamanObjection Letter - 12stockboardguyBelum ada peringkat

- Objection Letter - 11Dokumen1 halamanObjection Letter - 11stockboardguyBelum ada peringkat

- Objection Letter - 11Dokumen1 halamanObjection Letter - 11stockboardguyBelum ada peringkat

- Objection Letter - 12Dokumen4 halamanObjection Letter - 12stockboardguyBelum ada peringkat

- Objection Letter - 10Dokumen5 halamanObjection Letter - 10stockboardguyBelum ada peringkat

- Objection Letter - 2aDokumen3 halamanObjection Letter - 2astockboardguyBelum ada peringkat

- Objection Letter - 2aDokumen3 halamanObjection Letter - 2astockboardguyBelum ada peringkat

- Objection Letter - 9Dokumen4 halamanObjection Letter - 9stockboardguyBelum ada peringkat

- Objection Letter - 9Dokumen4 halamanObjection Letter - 9stockboardguyBelum ada peringkat

- Objection Letter - 3Dokumen2 halamanObjection Letter - 3stockboardguyBelum ada peringkat

- Objection Letter - 3Dokumen2 halamanObjection Letter - 3stockboardguyBelum ada peringkat

- Objection Letter - 7Dokumen4 halamanObjection Letter - 7stockboardguyBelum ada peringkat

- Objection Letter - 4Dokumen8 halamanObjection Letter - 4stockboardguyBelum ada peringkat

- Objection Letter - 4Dokumen8 halamanObjection Letter - 4stockboardguyBelum ada peringkat

- Objection Letter - 8Dokumen1 halamanObjection Letter - 8stockboardguyBelum ada peringkat

- Objection Letter - 7Dokumen4 halamanObjection Letter - 7stockboardguyBelum ada peringkat

- Objection Letter - 8Dokumen1 halamanObjection Letter - 8stockboardguyBelum ada peringkat

- Simoni 4426Dokumen2 halamanSimoni 4426stockboardguyBelum ada peringkat

- DRV 4407Dokumen3 halamanDRV 4407stockboardguyBelum ada peringkat

- Simoni 4425Dokumen1 halamanSimoni 4425stockboardguyBelum ada peringkat

- Bo 4409Dokumen2 halamanBo 4409stockboardguyBelum ada peringkat

- Pillari 4406Dokumen1 halamanPillari 4406stockboardguyBelum ada peringkat

- Dallal 4398Dokumen5 halamanDallal 4398stockboardguyBelum ada peringkat

- Two-Nation TheoryDokumen6 halamanTwo-Nation TheoryAleeha IlyasBelum ada peringkat

- Exclusion Clause AnswerDokumen4 halamanExclusion Clause AnswerGROWBelum ada peringkat

- Nampicuan, Nueva EcijaDokumen2 halamanNampicuan, Nueva EcijaSunStar Philippine NewsBelum ada peringkat

- Application Form For For Testing Labs ISO17025Dokumen14 halamanApplication Form For For Testing Labs ISO17025PK Jha100% (2)

- Audit of A Multi-Site Organization 1. PurposeDokumen4 halamanAudit of A Multi-Site Organization 1. PurposeMonica SinghBelum ada peringkat

- Labour Cost Accounting (For Students)Dokumen19 halamanLabour Cost Accounting (For Students)Srishabh DeoBelum ada peringkat

- Annual Report 17-18Dokumen96 halamanAnnual Report 17-18Sajib Chandra RoyBelum ada peringkat

- Final ReviewDokumen14 halamanFinal ReviewBhavya JainBelum ada peringkat

- Eric Adams' Approval Rating Falls To 29% As Voters Sour On NYC FutureDokumen1 halamanEric Adams' Approval Rating Falls To 29% As Voters Sour On NYC FutureRamonita GarciaBelum ada peringkat

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassDokumen62 halamanGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassIgor GoesBelum ada peringkat

- Sample Balance SheetDokumen22 halamanSample Balance SheetMuhammad MohsinBelum ada peringkat

- CH05 Transaction List by Date 2026Dokumen4 halamanCH05 Transaction List by Date 2026kjoel.ngugiBelum ada peringkat

- SAP PST Keys ReferenceDokumen8 halamanSAP PST Keys ReferenceMilliana0% (1)

- Calalang Vs WilliamsDokumen2 halamanCalalang Vs Williamsczabina fatima delicaBelum ada peringkat

- Soon Singh Bikar v. Perkim Kedah & AnorDokumen18 halamanSoon Singh Bikar v. Perkim Kedah & AnorIeyza AzmiBelum ada peringkat

- NHA V BasaDokumen3 halamanNHA V BasaKayeBelum ada peringkat

- Basic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Dokumen6 halamanBasic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Renjie Azumi Lexus MillanBelum ada peringkat

- Professional Practice of Accounting With AnswerDokumen12 halamanProfessional Practice of Accounting With AnswerRBelum ada peringkat

- 1 Dealer AddressDokumen1 halaman1 Dealer AddressguneshwwarBelum ada peringkat

- EssayDokumen3 halamanEssayapi-358785865100% (3)

- En Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, RespondentsDokumen6 halamanEn Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, Respondentsdoc dacuscosBelum ada peringkat

- C10 Silicone MSDSDokumen8 halamanC10 Silicone MSDSlukasjoBelum ada peringkat

- China National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseDokumen2 halamanChina National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseMd Abdur RahmanBelum ada peringkat

- Bus Ticket Invoice 1465625515Dokumen2 halamanBus Ticket Invoice 1465625515Manthan MarvaniyaBelum ada peringkat

- KB4-Business Assurance Ethics and Audit December 2018 - EnglishDokumen10 halamanKB4-Business Assurance Ethics and Audit December 2018 - EnglishMashi RetrieverBelum ada peringkat

- Passive Voice, Further PracticeDokumen3 halamanPassive Voice, Further PracticeCasianBelum ada peringkat