Klein Joseph 009

Diunggah oleh

Chen QingDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Klein Joseph 009

Diunggah oleh

Chen QingHak Cipta:

Format Tersedia

MEMO

To: From: Re: Date: Carlos Ghosn, Chief Operating Officer, Renault-Nissan Joseph Klein, Senior Consultant, Klein Consulting Bolstering Renault-Nissan April 30, 2012

Executive Summary: Renault-Nissan is no longer able to rely on their previous strengths. Nine years after the 1999 alliance we are once again being met with a transforming automotive industry. In order to ensure our place as a future industry leader we must take immediate action. Major trends seem to be concentrating on safety, environmental impact and technological integrations. Renault-Nissan must incorporate another company in order to be successful. But instead of seeking resources within our industry we must search for another channel. As technology, safety, and environmental concerns become major influences in the automotive industry it is essential that Renault-Nissan look for a partner that will allow efficiencies to be achieved in this changing industry.

Competitive Landscape: Renault-Nissan is in the midst of a globalized transformation of the automotive industry. As consumer preferences change and strategic synergies between companies become more common it is becoming increasingly difficult to forecast major trends. Renault has lost its former profitability. They are struggling to stop their decline while Nissan is searching for an avenue for continued sustainable growth. These companies have formed an alliance that allows them to function independently while leveraging common synergies. This alliance has provided a much-needed opportunity for these companies to become major competitors in the global automotive industry. As the industry is transforming, Renault-Nissan must be careful to alter their strategy so it focuses on innovation and advancement. Renault-Nissan is not the only company seeking to leverage synergies. Largely, Toyotas recent merger with Citron should be a main focus, especially for Renault as they rely on the European segment for 72% of their revenues. As seen in Exhibit 1, Toyota has been increasing their R&D significantly and has reached nearly $12 billion this year up 7.6% from 2007 (TMC Annual Report 2008). Toyotas history has given them a reputation of being a technological leader. Their partnership with Citron will align them as a major competitor in Europe as they already have a strong foothold in France. Citrons French manufacturing and distribution facilities along with Toyotas technological competencies will make them a powerful force in Renaults core market. Conversely, Nissan has been doing increasingly well. However, this growth is projected to stall in the near future. The competition in their industry is shifting their strategies. Governments and consumers are driving manufacturers to design and build

safer more efficient vehicles. Safety and environmental benefits are major selling points in which Nissan-Renault should definitely invest. In the United States and many other countries, subsidies have been created which allow consumers to receive significant discounts on electric/hybrid vehicles. It seems to be clear that the automotive industry is being forced to find alternative means to fossil fuels and governments are easing this transition (Hanley). Technological partnerships among automobile manufacturers are becoming more prevalent. Major car manufacturers are finding that innovative technological integrations are becoming key drivers in their value chain. Namely, Ford and Microsofts 2007 partnership has revolutionized the relationship between automobile manufacturers and their consumers. Their development of the Ford Sync system has undoubtedly redefined their position in the industry. Now consumers are interested in peripheral integration and hands free communication. This trend will continue to increase, pushing users to put further consideration into a manufacturers technological signature (SYNC). Technology integration is crossing many borders; no longer are car owners merely focusing on performance but they instead desire a user-friendly digital environment that encompasses their entire vehicle. The Internet has made consumers more informed about their spending habits. Now that consumers have the ability to effortlessly compare prices online it has become difficult for dealers to achieve larger margins on sales. The availability of this information may be part of the reason for the recent decline in Nissans Operating margin (Exhibit 2). The salespersons ability to oversell their vehicles previously compromised a great part of their income. Information has become so easily available that it is changing

the basic avenue revenues of the automotive industry. New means of differentiation must be enforced in order to remain competitive. The automotive industry is in the midst of a globalized transformation. The standard strategies and design features that previously characterized the success of these companies are being challenged. Global shifts are creating opportunities for major leadership changes amongst previously untouchable giants. Cross-national alliances much like Nissan-Renaults are becoming more commonplace. The way in which these alliances are leveraged will determine their success. Large segments are pushing demand for alternative fuels and hybrid technologies as well as other technological integrations. Previous value chains will be tested as this competitive environment evolves (Exhibit 3).

Nissans Performance: Nissan has been showing signs of recovery. Between 2006 and 2007 sales increased 22.5%, coupled with a long-term SG&A CAGR of -4.87%, Nissan has begun to feel assured that they are in the position to make another move to ensure their competitiveness (Ramaswamy). After a long struggle with profitability they finally found themselves in a promising position at least in comparison to previous periods. Their diverse portfolio consisted of many cars that were showing considerable profits. Nissans growth is keeping the Renault-Nissan alliance alive, but it is built on a weak foundation. In order to maintain this growth Nissan must find a new way to differentiate their vehicles. A key driver in Nissans recent success is their ability to focus their product offering. By slightly narrowing the amount of vehicles offered and by focusing the resources on the promising models, 47.4% of Nissans vehicles were profitable in 2001. This is up a considerable amount from 9.3% in the mid 1990s (Ramaswamy). They have the resources to produce a wide range of vehicles and the means to do so efficiently. Nissan must leverage their manufacturing capabilities in order to be successful. Nissan has been showing promising signs of growth but they must differentiate their strategy in order to ensure their longevity. Short-term gains have shown the instability of the market. In order to maintain this promising outlook they must realize their strengths and focus their resources accordingly. This implies that they must focus on their product offering and their manufacturing capabilities.

Renaults Performance: In 2004 Renaults 44.4% stake in Nissan resulted in 50% of their profits. It seemed as if Renault had helped Nissan but the influence was not reciprocated. Before the alliance Renault had shown great promise in the European marketplace. But, the changing global atmosphere prompted Renault to seek a means to spread their international reach. They chose Nissan to fulfill this need. Renaults recent instability is the result of the misallocation of resources within the alliance. Unlike Nissan, Renaults current strength is derived from their small vehicles, design prowess, and their European stronghold. These strengths aligned them to be successful in their home market. But as competition in Europe increases it is becoming increasingly difficult to maintain their market share. No longer will their previously powerful strengths hold their weight in this transforming industry. Renault must improve upon its ability to leverage new synergies with Nissan in order to, at very least, maintain their market share. Renault has lost sight of their original goal to expand internationally. They were too focused upon Nissans resilience that they failed to advance at all themselves. This eventually slowed and began to reverse their growth. Renaults future performance is dependent on their ability to leverage new synergies with Nissan as well as continuing to promote and further develop their elite design prowess. Their reliance upon Nissan will cause them to lose sight of their immediate personal goals. Growing into a successful international automotive manufacturer will require an alternative strategy with a focus upon unique innovative design.

Alternatives: The three options for Renault-Nissan are: 1. Further combine resources to create single large industry presence. 2. Bolster research and development through a strategic partnership. 3. Increase Renaults North American presence by diversifying product offerings. The pros and cons for each option are summarized below.

Option 1 Not Recommended Blur the company divisions and create a mega-brand Pros Cons Strength through numbers Lose grasp of distinct company identity Simplify the supply chain Will likely result in layoffs Allocate resources through the most Further Japanese-French culture clash effective channels Require significant alterations to the Redundant resources can be sold or corporate structure allocated differently Create a more diversified workforce Option 2 Recommended Seek strategic partnership with company in software industry Pros Cons Leverage new technologies Will require integration of another companys culture Ensure cutting edge integration Differentiate product offerings for both SG&A will increase Renault and Nissan Integration will be costly Introduction of non-traditional technologies will be eased by partners expertise. Option 3 Recommended Bolster Renaults North American presence Pros Cons Geographic diversity lowers risk Renaults brand recognition is weak as compared to European markets Large market potential Manufacturers and dealers will need to Changing automotive environment adapt facilities and be retrained Nissan already has large manufacturing and distributing presence Clean slate for new brand identity

Recommendation: Option 1 is not recommended because there is too much risk involved in the merger. Renault-Nissan currently functions as two separate entities with their own management and direction. Combining the two companies and focusing their efforts will allow for the further consolidation of resources, create a diversified workforce, and lower the transportation/distribution costs. Although these synergies may lower the companys SG&A costs and allow for seemingly necessary downsizing, the negatives outweigh the benefits. Option 1 will require significant restructuring of the corporate structure and will likely lead to the Japanese-French culture clash that they had feared. Although a diversified workforce will make them competitive globally, their current means of management within the alliance are much less risky. Foremost, Renault-Nissan must seek a strategic partnership with a technological innovator (Option 2). This will require them to reconsider their future strengths. Instead of failing to support R&D as they have in the past, Renault-Nissan will be able to allocate their partners resources. Technological integrations in vehicles are incredibly difficult to predict. The speed at which technologies are being introduced is being shortened. Without a technology leader as a partner we will face falling behind the curve. Without this partnership we will risk spending increasing amounts on R&D with little yield in return. Likely Renault-Nissan will become dependent upon their competitors technological advancements without a partnership. In order to differentiate our brand in the upcoming years we must introduce cutting-edge technologies into our vehicles. A

partnership with a technology company will ensure that we retain a distinct advantage in this increasingly influential field. Option 3 should be sought shortly after technological distinctions are made. Option 2 will boost Nissans resilience by leveraging synergies that will align them as an increasingly high-tech option. The resources provided through Option 2 will align Renault perfectly for their entry into the North American automotive market. In this instance, Renaults weak brand in this market will be an advantage. Their perception as an exotic car company along with their recent technological advancements will allow Renault to reboot their brand in this market. Leveraging many manufacturing assets of Nissan, the synergies developed in Option 2, will allow Renaults emergence to be successful. Renault-Nissan must refocus their strategies. Nissans greatest hope will be in bolstering North American presence of Renault. Via technological advancements through a strategic partnership, this transition will be eased. Nissan may be forced to decrease their global presence but this will be supplemented by Renaults international expansion. Nissans slight global decrease will also be supplemented by their ability to charge higher premiums for their innovative add-ons. As Renault-Nissan seeks a means to ensure their spot in the future automotive industry, it is essential that they more effectively leverage synergies between themselves as well as find a new partner to ensure their spot as a leading innovator in the technological integration of new automobiles.

References: 1. "Ford SYNC." FORD.com. Ford Motor Company. Web. 21 Apr. 2012. <http://www.ford.com/technology/sync/>. 2. Hanley, Michael, and Jeff Henning. "Mega Trends in the Light Vehicle Industry." Global Automotive Industry. Ernst and Young. Web. 25 Apr. 2012. <http://www.ey.com/GL/en/Industries/Automotive/>. 3. Mergent Online Database. 4. "OICA 2008 Statistics." OICA.com. The International Organization of Motor Vehicle Manufacturers. Web. 28 Apr. 2012. <http://oica.net/category/productionstatistics/2008-statistics/>. 5. Ramaswamy, Kannan. "Renault-Nissan: The Challenge of Sustaining Strategic Change." Thunberbird - School of Global Management. Web. 6. TMC Annual Report 2008. Toyota Motor Company, 2008. PDF.

Exhibit 1: `

TMC Annual Report 2008

Exhibit 2:

Data from Mergent Online/Graphed by Thomas Craig

Exhibit 3: PEST Analysis

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- OB Individual AssignmentDokumen21 halamanOB Individual AssignmentChen QingBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Chap 1Dokumen36 halamanChap 1Chen QingBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Chapter 1: Globalization and International LinkagesDokumen21 halamanChapter 1: Globalization and International LinkagesChen QingBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Chapter One: Globalization and International LinkagesDokumen38 halamanChapter One: Globalization and International LinkagesChen QingBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Quantitative Approach: Trend Projection, Econometric Modelling and Multiple Predictive The Qualitative Approach: Delphi Technique and The Nominal Group TechniqueDokumen4 halamanThe Quantitative Approach: Trend Projection, Econometric Modelling and Multiple Predictive The Qualitative Approach: Delphi Technique and The Nominal Group TechniqueChen QingBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- David Jones Limited Days InventoryDokumen1 halamanDavid Jones Limited Days InventoryChen QingBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Entre Pere Nur ShipDokumen4 halamanEntre Pere Nur ShipChen QingBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Summer Internship Report at Future Generali Insurance LTDDokumen44 halamanSummer Internship Report at Future Generali Insurance LTDpratiksha2467% (3)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Management Accounting Level 3/series 2-2009Dokumen16 halamanManagement Accounting Level 3/series 2-2009Hein Linn Kyaw100% (1)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Sr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountDokumen1 halamanSr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountBappi Al MunimBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Daftar An Beralamat Dan Berlokasi Di Panin Bank Centre BuildingDokumen7 halamanDaftar An Beralamat Dan Berlokasi Di Panin Bank Centre BuildingAnthony CaesarBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Week 1 LabDokumen3 halamanWeek 1 LabSara ThompsonBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Industry Analysis On Cloud ServicesDokumen12 halamanIndustry Analysis On Cloud ServicesBaken D DhungyelBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Chapter 5Dokumen35 halamanChapter 5ali.view6910Belum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Coca-Cola Co.: Liquidity RatiosDokumen8 halamanCoca-Cola Co.: Liquidity RatiosDBBelum ada peringkat

- Feasib ScriptDokumen3 halamanFeasib ScriptJeremy James AlbayBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- BAB 3 - Marketing For Financial InstitutionsDokumen47 halamanBAB 3 - Marketing For Financial InstitutionsSyai GenjBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Presentation On Money Market BangladeshDokumen25 halamanPresentation On Money Market BangladeshAminul Haque100% (1)

- Gr11 - Worksheet - Demand & SupplyDokumen2 halamanGr11 - Worksheet - Demand & Supplysnsmiddleschool2020Belum ada peringkat

- 651593285MyGov 5th September, 2023 & Agenda KenyaDokumen29 halaman651593285MyGov 5th September, 2023 & Agenda KenyaJudy KarugaBelum ada peringkat

- Macs SPDokumen52 halamanMacs SPAviR14Belum ada peringkat

- Overview Record To ReportDokumen21 halamanOverview Record To Reportsharmavarun01Belum ada peringkat

- Inform Practice Note #30: ContentDokumen8 halamanInform Practice Note #30: ContentTSHEPO DIKOTLABelum ada peringkat

- Somya Bhasin 24years Pune: Professional ExperienceDokumen2 halamanSomya Bhasin 24years Pune: Professional ExperienceS1626Belum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Adb Loan Disbursement Handbook PDFDokumen140 halamanAdb Loan Disbursement Handbook PDFMunir AhmadBelum ada peringkat

- 7-Niranjanamurthy-Analysis of E-Commerce and M-Commerce AdvantagesDokumen13 halaman7-Niranjanamurthy-Analysis of E-Commerce and M-Commerce AdvantagesHuyen NguyenBelum ada peringkat

- SM Fast TrackDokumen93 halamanSM Fast TrackVaishnaviBelum ada peringkat

- Value Chain IPLDokumen1 halamanValue Chain IPLShivaen KatialBelum ada peringkat

- Business PlanDokumen7 halamanBusiness PlanWinz QuitasolBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- R PLC Plans To Invest 1m in New Machinery ToDokumen1 halamanR PLC Plans To Invest 1m in New Machinery ToAmit PandeyBelum ada peringkat

- SDG-9: Industry, Infrastructure, InnovationDokumen13 halamanSDG-9: Industry, Infrastructure, InnovationTahmid Hossain RafidBelum ada peringkat

- Unit-5 Mefa.Dokumen12 halamanUnit-5 Mefa.Perumalla AkhilBelum ada peringkat

- Robert Kiyosaki - Cash Flow QuadrantsDokumen2 halamanRobert Kiyosaki - Cash Flow QuadrantsJamaica AngotBelum ada peringkat

- Evergreen Event Driven Marketing PDFDokumen2 halamanEvergreen Event Driven Marketing PDFEricBelum ada peringkat

- Indiana Free MoneyDokumen226 halamanIndiana Free Moneyjohnadams8814100% (1)

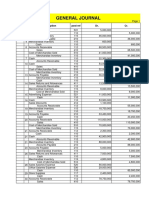

- General Journal: Description Post Ref Dr. Cr. DateDokumen14 halamanGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Jensen-1991-Corporate Control and The Politics of FinanceDokumen23 halamanJensen-1991-Corporate Control and The Politics of Financeebrahimnejad64Belum ada peringkat