Case Digest For Tax I (Midterm)

Diunggah oleh

Equi TinJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Case Digest For Tax I (Midterm)

Diunggah oleh

Equi TinHak Cipta:

Format Tersedia

Case Digest for August 10, 2013 Victorias Milling v Victorias Doctrine: "License tax" has not acquired

a fixed meaning. It does not refer solely to a license for regulation. In many instances, it refers to "revenue-raising exactions on privileges or activities." But, legally speaking, taxes are "for the purpose of raising revenues," in contrast to license fees which are imposed "in the exercise of police power for purposes of regulation." When no police inspection, supervision, or regulation is provided but any and all persons engaged in the business designated, without qualification or hindrance are required to pay, the presumption is strong that the power of taxation, and not the police power, is being exercised. Thus, the cost of regulation cannot be taken as a gauge, if the municipality intended to enact a revenue ordinance. Double taxation has been otherwise described as "direct duplicate taxation." 48 For double taxation to exist, "the same property must be taxed twice, when it should be taxed but once." Facts: 1.

2. 3. 4.

5.

Ordinance Amending Ordinance No. 25, Series of 1953 and Ordinance No. 18, Series of 1947 on Sugar Central by Increasing the Rates on Sugar Refinery Mill by Increasing the Range of Graduated Schedule on Capacity Annual Output Respectively was enacted pursuant to the taxing power granted by Commonwealth Act 472. It requires persons and corpos operating sugar central or engaged in centrifugal sugar to pay annual municipal license tax quarterly. Payment is based on annual output capacity. Progressively upward. Pet seeks the declaration of nullity of the ordinance bec: a. It exceeds the amounts fixed in Provincial Circular 12-A issued by theDoF b. it is discriminatory since it singles out plaintiff which is the only operator of a sugar central and a sugar refinery within the jurisdiction of defendant municipality; c. it constitutes double taxation; d. the national government has preempted the field of taxation with respect to sugar centrals or refineries RTC: a license tax should be limited to the cost of licensing, regulating and surveillance. If the defendant has the power to tax the plaintiff for purposes of revenue, it may do so by proper municipal legislation, but not in the guise of a license tax

Issues: 1. W/N the ordinance is a regulatory or revenue measure 2. W/N the ordinance is a preemption of respondent from the natl govts power to impose percentage tax on sugar central and refineries (NIRC Sec 189) 3. W/N it singles out petitioner 4. W/N there is double taxation since the cost of raw sugar is not deducted from the amount paid by the refinery Ruling: 1. A. We rule that Ordinance No. 1, series of 1956 was promulgated not in the exercise of the municipality's regulatory power but as a revenue measure a tax on occupation or business. It is within the power of the municipality to impose because Commonwealth Act 472 grants respondent with that taxing authority. B. It is not regulatory because its purpose is to raise revenue for the Municipality due to the heavy obligations which confront it because of the implementation of Minimum Wage Law on the salaries and wages it pays to its municipal employees and laborers. 2. NO. The doctrine of preemption does not apply bec the tax imposed by the ordinace is not a percentage tax. The national govt through Congress, in the wordings of CA 472, allowed municipalities to tax persons engaged in "the same businesses or occupation" on which "fixed internal revenue privilege taxes" are "regularly imposed by the National Government."

3.

NO. Said ordinance is made to apply to any sugar central or sugar refinery which may happen to operate in the municipality. The fact that plaintiff is actually the sole operator of a sugar central and a sugar refinery does not make the ordinance discriminatory. NO. The two taxes cover two different objects. Section 1 of the ordinance taxes a person operating sugar centrals or engaged in the manufacture of centrifugal sugar. While under Section 2, those taxed are the operators of sugar refinery mills. One occupation or business is different from the other.

4.

Villanueva v Iloilo Doctrine: A real estate tax is a direct tax on the ownership of lands and buildings or other improvements thereon, not specially exempted, and is payable regardless of whether the property is used or not, although the value may vary in accordance with such factor. It is a fixed proportion of the assessed value of the property taxed, and requires, therefore, the intervention of assessors. it constitutes a superior lien on and is enforceable against the property subject to such taxation, and not by imprisonment of the owner. The same tax may be imposed by the national government as well as by the local government. License tax may be levied upon a business or occupation although the land or property used in connection therewith is subject to property tax. At all events, there is no constitutional prohibition against double taxation in PH. It is not favored but, provided some other constitutional requirement is not thereby violated, such as the requirement that taxes must be uniform. Facts: 1. An Ordinance Imposing Municipal License Tax On Persons Engaged In The Business Of Operating Tenement Houses is being questioned by petitioner 2. Before this case, SC has declared an earlier ordinance imposing license tax fees to tenement house operators null and void for being ultra vires bec the charter of Iloilo did not clearly grant such authority to it 3. A similar ordinance was passed by resp believing that under the Local Autonomy Act, it now has authority to impose license tax to tenement house operators 4. Pets are owners of 5 tenement houses w/43 apartments. 5. They wanted to declare the ordinance null for: a. It is an ultra vires as it imposes a levy "in excess of the one per centum real estate tax allowable under Sec. 38 of the Iloilo City Charter, Com. Act 158."5 b. unconstitutional for being violative of the rule as to uniformity of taxation c. for depriving said plaintiffs of the equal protection clause of the Constitution 6. RTC declared the ordinance null Issues: 1. W/N it is illegal because it imposes double taxation 2. W/N resp is empowered by the Local Autonomy Act to impose tenement taxes 3. W/N it is oppressive and unreasonable because it carries a penal clause 4. W/N it violates the rule of uniformity of taxation 5. W/N it is an mere reproduction of the earlier ordinance declared by the Court null Ruling: 1. NO. Although pets are taxable under the the NIRC as real estate dealers, and still taxable under the ordinance, double taxation may not be invoked. The same tax may be imposed by the national government as well as by the local government. There is nothing inherently obnoxious in the exaction of license fees or taxes with respect to the same occupation, calling or activity by both the State and a political subdivision thereof. Although pets are paying real estate tax and tenement tax, there is no double taxation bec the former is levied upon the property while the latter is upon the use thereof for occupation. 2. YES. The Local Autonomy Act permits all chartered cities, municipalities and municipal districts to impose all municipal license fees except those mentioned in the statute. The tax in question is not a real estate tax bec: a. It is not a tax on the land on which the tenement houses are erected, although both land and tenement houses may belong to the same owner. b. It is not a fixed proportion of the assessed value of the tenement houses, and does not require the intervention of assessors or appraisers. c. It is not payable at a designated time or date, and is not enforceable against the tenement houses either by sale or distraint. On the contrary, it is plain from the context of the ordinance that the intention is to impose a license tax on the operation of tenement houses, which is a form of business. The ordinance finds authority in section 2 of the Local Autonomy Act

which provides that chartered cities have the authority to impose municipal license taxes or fees upon persons engaged in any occupation or business 3. NO. The Charter of Iloilo allows to the municipality to impose fines and imprisonment for violation of its ordinances. It is not against the consti prohibition of imprisonment for non-payment of debt or poll tax bec tax is not a debt, so to speak and is not a poll tax because the latter is a fixed tax on residents regardless of the property or occupation UNTENABLE! Uniformity is met when all subjects of the same class are taxed at the same rate. And tenement house operation constitutes a distinct class. NO. The previous ordinance was enacted pursuant to the Iloilo Charter while the ordinance in question is pursuant to the Local Autonomy Act

4. 5.

Pepsi v Butuan Facts: 1. Pepsis warehouse in Butuan is the storage of products bottled in Cebu and sent to Butuan for distribution 2. Pepsi paid under protest the tax imposed by resp under the ordinance 10 cents per case of 24 bottles to any dealer, agent consignee engaged in selling liquors (including soft drinks) 3. Pepsi contends that the tax is excessive and ordinance unconsti 4. Section 10 of the ordinance provides that the revenue derived therefrom "shall be alloted as follows: 40% for Roads and Bridges Fund; 40% for the General Fund and 20% for the School Fund. Issues: Pepsi maintains that the disputed ordinance is null and void because: 1. it partakes of the nature of an import tax; 2. it amounts to double taxation; 3. it is excessive, oppressive and confiscatory; 4. it is highly unjust and discriminatory; 5. section 2 of Republic Act No. 2264, upon the authority of which it was enacted, is an unconstitutional delegation of legislative powers. Ruling: 1. The ordinance intends to tax agents and/or consignees of another dealer who must be one engaged in business outside the City. Viewed from this angle, the tax partakes of the nature of an import duty, which is beyond defendant's authority to impose by express provision of law. Double taxation, in general, is not forbidden by our fundamental law. The tax of "P0.10 per case of 24 bottles," of soft drinks or carbonated drinks in the production and sale of which plaintiff is engaged or less than P0.0042 per bottle, is manifestly too small to be excessive, oppressive, or confiscatory. It is violative of uniformity of taxation bec only sales by "agents or consignees" of outside dealers would be subject to the tax. Sales by local dealers, not acting for or on behalf of other merchants, regardless of the volume of their sales, and even if the same exceeded those made by said agents or consignees, would be exempt from the disputed tax. the general principle against delegation of legislative powers, in consequence of the theory of separation of powers is subject to one well-established exception, namely: legislative powers may be delegated to local governments to which said theory does not apply in respect of matters of local concern.

2. 3. 4.

5.

Baguio v de Leon Doctrine: A tax is considered uniform when it operates with the same force and effect in every place where the subject may be 15 found. All that is needed as held in another case decided two years later, is that the statute or ordinance in question "applies equally to all persons, firms and corporations placed in similar situation." Facts: 1. An ordinance imposing a license fee on any person, firm, entity or corporation doing business in the City of Baguio is assailed by defendant-appellant Fortunato de Leon. 2. He was held liable as a real estate dealer with a property therein worth more than P10,000, but not in excess of P50,000, and therefore obligated to pay under such ordinance the P50 annual fee. 3. The source of authority for the challenged ordinance is supplied by Republic Act No. 329, amending the city charter of Baguio empowering it to fix the license fee and regulate "businesses, trades and occupations as may be established or practiced in the City." Issues: 1. W/N CFI, not Baguio city court has JD 2. W/N it is ultra vires 3. W/N it costitutes double taxation Ruling: 1. The City Court has jurisdiction. what confers jurisdiction is the amount set forth in the complaint. Here, the sum sought to be recovered was clearly within the jurisdiction of the City Court of Baguio. The fact that the answer questions the constitutionality of the ordinance does not divest City Court of JD 2. NO. RA 329 is sufficient basis. 3. Where, as here, Congress has clearly expressed its intention, the statute must be sustained even though double taxation results argument against double taxation may not be invoked where one tax is imposed by the state and the other is imposed by the city.

Yutivo v CTA Doctrine: Any legal means by the taxpayer to reduce taxes are all right. A man may, therefore, perform an act that he honestly believes to be sufficient to exempt him from taxes. Facts: 1. Pet is a domestic corpo incorporated in PH in 1916 engaged in importation of hardware supplies 2. After WWI, it resumed operation and bought a number of trucks and cars from General Motors (US corpo licensed to o buss in PH) 3. In 1946, Southern Motors Inc was organized to engage in selling car, trucks and spare parts 4. Some of the subscribers of stocks of SM uring its incorporation were sons of the owner of pet 5. After incorpo of SM and until the w/drawal of GM from PH, cars purchased by pet from GM were sold to SM by pet w/c sold them to public 6. Assessment was made upon pet for deficiency sales tax based on retail sales by SM to pub not the wholesale by Yutivo to SM bec CIR says they are one and the same corpo, SM being the subsidiary of Yutivo. Issue: Who should pay the sales tax Should Yutivo pay fraud surcharge for intent to evade tax? Ruling: GM was the importer of the cars and trucks sold to Yutivo, which in turn was sold to SM. GM, as importer was the one solely liable for sales taxes. Neither Yutivo nor SM was subject to the sales taxes. Yutivos liability arose only until July 1, 1947 when it became the importer. No. There was no intent to evade tax although SM is just a branch of Yutivo bec the transactions were transaparent. No intent to defraud.

"An assessment of a deficiency is not necessary to a criminal prosecution for wilful attempt to defeat and evade the income tax." FACTS: The BIR filed six criminal charges against Quirico Ungab, a banana saplings producer, for allegedly evading payment of taxes and other violations of the NIRC. Ungab, subsequently filed a motion to quash on the ground that (1) the information are null and void for want of authority on the part of the State Prosecutor to initiate and prosecute the said cases; and (2)that the trial court has no jurisdiction to take cognizance of the case in view of his pending protest against the assessment made by the BIR examiner. The trial court denied the motion prompting the petitioner to file a petition for certiorari and prohibition with preliminary injunction and restraining order to annul and set aside the information filed.

ISSUE: Is the contention that the criminal prosecution is premature since the CIR has not yet resolved the protest against the tax assessment tenable?

HELD: No. The contention is without merit. What is involved here is not the collection of taxes where the assessment of the Commissioner of Internal Revenue may be reviewed by the Court of Tax Appeals, but a criminal prosecution for violations of the National Internal Revenue Code which is within the cognizance of courts of first instance. While there can be no civil action to enforce collection before the assessment procedures provided in the Code have been followed, there is no requirement for the precise computation and assessment of the tax before there can be a criminal prosecution under the Code. An assessment of a deficiency is not necessary to a criminal prosecution for wilful attempt to defeat and evade the income tax. A crime is complete when the violator has knowingly and wilfully filed a fraudulent return with intent to evade and defeat the tax. The perpetration of the crime is grounded upon knowledge on the part of the taxpayer that he has made an inaccurate return, and the government's failure to discover the error and promptly to assess has no connections with the commission of the crime.

CIR V PASCOR REALTY & DEVT CORP et. al. Doctrine: The filing of the criminal complaint with the DOJ cannot be construed as a formal assessment. The filing of the criminal complaint with the DOJ cannot be construed as a formal assessment. However, an assessment is not necessary before criminal charges can be filed. A criminal charge need not only be supported by a prima facie showing of failure to file a required return. The CIR had, in such tax evasion cases, discretion on whether to issue an assessment, or to file a criminal case against the taxpayer, or to do both.

GR No. 128315, June 29, 1999 Facts: The CIR authorized certain BIR officers to examine the books of accounts and otheraccounting records of Pascor Realty and Development Corp. (PRDC) for 1986, 1987 and 1988. The examination resulted in recommendation for the issuance of an assessment of P7,498,434.65 and P3,015,236.35 for 1986 and 1987, respectively. The Commissioner filed acriminal complaint for tax evasion against PRDC, its president and treasurer before the DOJ. Private respondents filed immediately an urgent request for reconsideration on reinvestigation disputing the tax assessment and tax liability. The Commissioner denied private respondents request for reconsideration/reinvestigation on the ground that no formal assessment has been issued which the latter elevated to the CTA on a petition for review. The Commissioners motion to dismiss on the ground of the CTAs lack of jurisdiction denied by CTA and ordered the Commissioner to file an answer. Instead of complying with the order of CTA, Commissioner filed a petition with the CA alleging grave abuse of discretion and lack of jurisdiction on the part of CTA for considering the affidavit/report of the revenue officers and the endorsement of said report as assessment which may be appealed to the CTA. The CA sustained the CTA decision and dismissed the petition. Issues: (1) Whether or not the criminal complaint for tax evasion can be construed as an assessment. (2) Whether or not an assessment is necessary before criminal charges for tax evasion may be instituted. Held: The filing of the criminal complaint with the DOJ cannot be construed as a formal assessment. Neither the Tax Code nor the revenue regulations governing the protest assessments provide a specific definition or form of an assessment. An assessment must be sent to and received by the taxpayer, and must demand payment of the taxes described therein within a specific period. The revenue officers affidavit merely contained a computation of respondents tax liability. It did not state a demand or period for payment. It was addressed to the Secretary of Justice not to the taxpayer. They joint affidavit was meant to support the criminal complaint for tax evasion; it was not meant to be a notice of tax due and a demand to private respondents for the payment thereof. The fact that the complaint was sent to the DOJ, and not to private respondent, shows that commissioner intended to file a criminal complaint for tax evasion, not to issue an assessment. An assessment is not necessary before criminal charges can be filed. A criminal charge need not only be supported by a prima facie showing of failure to file a required return. The CIR had, in such tax evasion cases, discretion on whether to issue an assessment, or to file a criminal case against the taxpayer, or to do both.

CIR vs. CA, CTA and FORTUNE TOBACCO CORP. Doctrine: When the administrative rule goes beyond merely providing for the means that can facilitate or render least cumbersome the implementation of the law but substantially increases the burden of those governed, the agency must accord, at least to those directly affected, a chance to be heard, before that new issuance is given the force and effect of law.

G.R. No. 119761; August 29, 1996 Facts: Fortune Tobacco Corporation ("Fortune Tobacco"), engaged in the manufacture of different brands of cigarettes, registered "Champion," "Hope," and "More" cigarettes. BIR classified them as foreign brands since they were listed in the World Tobacco Directory as belonging to foreign companies. However, Fortun changed the names of 'Hope' to 'Hope Luxury'and 'More' to 'Premium More,' thereby removing the said brands from the foreign brand category. A 45% Ad Valorem taxes were imposed on these brands. Then Republic Act ("RA") No. 7654 was enacted 55% for locally manufactured foreign brand while 45% for locally manufactured brands. 2 days before the effectivity of RA 7654, Revenue Memorandum Circular No. 37-93 ("RMC 37-93"), was issued by the BIR saying since there is no showing who the real owner/s are of Champion, Hope and More, it follows that the same shall be considered locally manufactured foreign brand for purposes of determining the ad valorem tax - 55%. BIR sentvia telefax a copy of RMC 37-93 to Fortune Tobacco addressed to no one in particular. Then Fortune Tobacco received, by ordinary mail, a certified xerox copy of RMC 37-93. CIR assessed Fortune Tobacco for ad valorem tax deficiency amounting to P9,598,334.00. Fortune Tobacco filed a petition for review with the CTA. CTA upheld the position of Fortune. CA affirmed. Issue: WON it was necessary for BIR to follow the legal requirements when it issued its RMC Held. YES. CIR may not disregard legal requirements in the exercise of its quasi-legislative powers which publication, filing, and prior hearing. When an administrative rule is merely interpretative in nature, its applicability needs nothing further than its bare issuance for it gives no real consequence more than what the law itself has already prescribed. BUT when, upon the other hand, the administrative rule goes beyond merely providing for the means that can facilitate or render least cumbersome the implementation of the law but substantially increases the burden of those governed, the agency must accord, at least to those directly affected, a chance to be heard, before that new issuance is given the force and effect of law. RMC 37-93 cannot be viewed simply as construing Section 142(c)(1) of the NIRC, as amended, but has, in fact and most importantly, been made in order to place "Hope Luxury," "Premium More" and "Champion" within the classification of locally manufactured cigarettes bearing foreign brands and to thereby have them covered by RA 7654 which subjects mentioned brands to 55% the BIR not simply interpreted the law; verily, it legislated under its quasi-legislativeauthority. The due observance of the requirements of notice, of hearing, and of publication should not have been then ignored.

8

Anda mungkin juga menyukai

- Spouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawDokumen3 halamanSpouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawEqui TinBelum ada peringkat

- FBI Vs FSIDokumen2 halamanFBI Vs FSIEqui TinBelum ada peringkat

- Cavilis vs Florendo Partition Agreement Witness QualificationDokumen2 halamanCavilis vs Florendo Partition Agreement Witness QualificationEqui Tin0% (1)

- FBI Vs FSIDokumen2 halamanFBI Vs FSIEqui TinBelum ada peringkat

- North Cotabato Vs GRP Case DigestDokumen5 halamanNorth Cotabato Vs GRP Case DigestEqui TinBelum ada peringkat

- Ermita Vs Mayor of Manila Case DigestDokumen2 halamanErmita Vs Mayor of Manila Case DigestEqui TinBelum ada peringkat

- Supreme Court reverses conviction due to change in law interpretationDokumen10 halamanSupreme Court reverses conviction due to change in law interpretationEqui Tin100% (1)

- Tongco Vs Vianzon (1927) Case Digest in EvidenceDokumen2 halamanTongco Vs Vianzon (1927) Case Digest in EvidenceEqui TinBelum ada peringkat

- Case Digest on Evidence RulesDokumen6 halamanCase Digest on Evidence RulesEqui TinBelum ada peringkat

- Home Remedies For DiabetesDokumen1 halamanHome Remedies For DiabetesEqui TinBelum ada peringkat

- Tañada Vs Angara Case DigestDokumen3 halamanTañada Vs Angara Case DigestEqui Tin100% (2)

- Co Kim Cham V Tan KehDokumen60 halamanCo Kim Cham V Tan KehEqui TinBelum ada peringkat

- Ermita Vs Mayor of Manila Case DigestDokumen2 halamanErmita Vs Mayor of Manila Case DigestEqui TinBelum ada peringkat

- Mejoff Vs Dir of Prisons Case DigestDokumen1 halamanMejoff Vs Dir of Prisons Case DigestEqui TinBelum ada peringkat

- Case Digest BriefsDokumen1 halamanCase Digest BriefsEqui TinBelum ada peringkat

- Pascual Vs Sec of Public Works Case DigestDokumen4 halamanPascual Vs Sec of Public Works Case DigestEqui TinBelum ada peringkat

- Rafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Dokumen2 halamanRafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Equi TinBelum ada peringkat

- Vivas vs Monetary Board ruling on bank receivershipDokumen3 halamanVivas vs Monetary Board ruling on bank receivershipEqui TinBelum ada peringkat

- Tañada Vs Angara Case DigestDokumen3 halamanTañada Vs Angara Case DigestEqui Tin100% (2)

- Khan v Simbillo: Advertising Legal Services Violates CodeDokumen1 halamanKhan v Simbillo: Advertising Legal Services Violates CodeEqui Tin0% (1)

- Dean Coronel Trial Practice TechniquesDokumen13 halamanDean Coronel Trial Practice TechniquesEqui Tin100% (3)

- Depression Among College StudentsDokumen17 halamanDepression Among College StudentsEqui TinBelum ada peringkat

- Modes of Acquiring Ownership PartialDokumen2 halamanModes of Acquiring Ownership PartialEqui TinBelum ada peringkat

- Tax Remedies and ProceduresDokumen2 halamanTax Remedies and ProceduresEqui TinBelum ada peringkat

- Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)Dokumen2 halamanFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)Equi TinBelum ada peringkat

- Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)Dokumen2 halamanFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)Equi Tin50% (2)

- Comm Rev PNB Vs Rodriguez 2008Dokumen1 halamanComm Rev PNB Vs Rodriguez 2008Equi TinBelum ada peringkat

- Corporate PowersDokumen3 halamanCorporate PowersEqui TinBelum ada peringkat

- Problem Areas in Legal Ethics Case DigestsDokumen30 halamanProblem Areas in Legal Ethics Case DigestsEqui Tin100% (1)

- Phil Lawyers Assoc v Agrava patent exam requirementDokumen2 halamanPhil Lawyers Assoc v Agrava patent exam requirementEqui Tin100% (2)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Koala's Motion For Preliminary Injunction Against UCSDDokumen29 halamanThe Koala's Motion For Preliminary Injunction Against UCSDgovernorwattsBelum ada peringkat

- CIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Dokumen12 halamanCIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Iris MendiolaBelum ada peringkat

- International Accounting Standards: IAS 18 RevenueDokumen21 halamanInternational Accounting Standards: IAS 18 RevenueMia CasasBelum ada peringkat

- Mauritius Tax GuideDokumen14 halamanMauritius Tax GuideVenkatesh GorurBelum ada peringkat

- Sign Now, Save Time LaterDokumen3 halamanSign Now, Save Time LaterAuguste RiedlBelum ada peringkat

- Administrative LawDokumen9 halamanAdministrative LawNvBelum ada peringkat

- Inaugural Lecture Justice Onu FinalDokumen59 halamanInaugural Lecture Justice Onu FinalAnonymous 8kEtuDKFJyBelum ada peringkat

- Rich Dad, Poor DadDokumen10 halamanRich Dad, Poor DadEngrZaptrescunoPauBelum ada peringkat

- GST MCQ MARATHON-SolvedDokumen44 halamanGST MCQ MARATHON-SolvedRudra JhaBelum ada peringkat

- Understanding the Role of Local Government in Rural DevelopmentDokumen18 halamanUnderstanding the Role of Local Government in Rural DevelopmentJames GanaBelum ada peringkat

- 9 Characteristics of FeudalismDokumen6 halaman9 Characteristics of FeudalismIrfan Khan100% (1)

- MARIANO HERBOSA-WPS OfficeDokumen7 halamanMARIANO HERBOSA-WPS OfficeMaturan, Ma. Kayesha Camille A.Belum ada peringkat

- Construction Industry in NepalDokumen13 halamanConstruction Industry in NepalRamesh Pokharel57% (7)

- Itb 11.2 PDFDokumen5 halamanItb 11.2 PDFMaria Erika LomibaoBelum ada peringkat

- OD219666944028845000Dokumen1 halamanOD219666944028845000Imran KhanBelum ada peringkat

- Court upholds CTA jurisdiction over estate tax dispute despite lack of refund claimDokumen5 halamanCourt upholds CTA jurisdiction over estate tax dispute despite lack of refund claimYvon BaguioBelum ada peringkat

- Concept and Purpose of TaxationDokumen5 halamanConcept and Purpose of TaxationNaiza Mae R. Binayao100% (1)

- MI Prelim 2 H2 Econs P2 AnswersDokumen11 halamanMI Prelim 2 H2 Econs P2 AnswersMelissaBelum ada peringkat

- Vat AssessmentsDokumen19 halamanVat AssessmentsPrakash KhaladkarBelum ada peringkat

- Investigation 2024 GR 12Dokumen6 halamanInvestigation 2024 GR 12koekoeorefileBelum ada peringkat

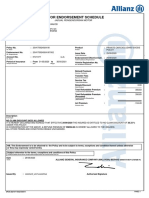

- Motor Endorsement ScheduleDokumen5 halamanMotor Endorsement ScheduleVan De CostaBelum ada peringkat

- Corporate: Advantage ProgrammeDokumen16 halamanCorporate: Advantage ProgrammeVinay RaoBelum ada peringkat

- Statement of Receipts SourcesDokumen3 halamanStatement of Receipts SourcesctoadminBelum ada peringkat

- Property Tax in Himachal PradeshDokumen3 halamanProperty Tax in Himachal PradeshShimon OberoiBelum ada peringkat

- TAXATION 1 Smith V CommissionerDokumen79 halamanTAXATION 1 Smith V CommissionerJoan Margaret GasatanBelum ada peringkat

- Employment AgreementDokumen4 halamanEmployment AgreementFreeza Masculino FabrigasBelum ada peringkat

- Ralls County MO BallotDokumen6 halamanRalls County MO BallotKHQA News100% (1)

- Exam Study Guide for Chapters 5,6,7,9 and 10 on Price Controls and QuotasDokumen40 halamanExam Study Guide for Chapters 5,6,7,9 and 10 on Price Controls and QuotasAhmed MahmoudBelum ada peringkat

- Up Industrial Area Development Act 1976Dokumen19 halamanUp Industrial Area Development Act 1976Shyam SinghBelum ada peringkat

- RR 9-98Dokumen5 halamanRR 9-98matinikkiBelum ada peringkat