No SS Levy For Taxes

Diunggah oleh

fdarteeDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

No SS Levy For Taxes

Diunggah oleh

fdarteeHak Cipta:

Format Tersedia

Buyer: Frank Dartee (frank.dartee@gmail.

com) Transaction ID: jg-mr6m2ka30feede4

How to Stop IRS Levy on Social Security Payments

Background Recently, an individual downloaded from my Website a copy of my suggested Response to an IRS Notice of Intent to Levy. He sent me a note that stated: If you already have a lien or levy on your SS payments, Write TIGTA and tell them. This is the investigative arm of the Treasury Dept. I did this and got results. Everything else had failed. I asked him if hed tell me more and asked if hes be OK with my reviewing any correspondence in this matter and thereafter sharing his concepts with others on the Internet. He agreed and sent me this short note, while he went looking for his documents: It was kind of funny in a way. I had tried several things which should have been successful but were not. I had to write TIGTA twice to get the desired results, then I started to get the full amount of my SS check with NO explanation (do not expect one). I quoted the section of the law which says that SS cannot be levied. IRS only refers to half of the law, conveniently leaving out the part that prohibits levy on SS. Of course the treasury dept. blames it on the IRS and vice a versa. So they divert attention from one to the other. Then, he sent me the two letters that he had sent to TIGTA (Treasury Inspector General for Tax Administration): Letter 1 April 14, 2010 Treasury Inspector General for Tax Administration Hotline P.O. Box 589, Ben Franklin Station Washington, D.C. 20044-0589 Registered Mail #_________________________ Affiant Address Re: Illegal Theft of Social Security Benefit Payments Dear Sir:

Page 1 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

I signed up to receive Social Security in 2000. For approximately the following seven years, I received the full Social Security payments. However, sometime in 2007, a deduction of approximately 15% of my Social Security benefit payments commenced without notice, without due process and without any forewarning. This 15% was withheld from me on a monthly basis and continues to the present day. Allegedly, these deductions are being seized to offset an alleged income tax debt I supposedly have with IRS, pursuant to the Treasury Offset Program (TOP); attached please see copy of most recent notification I received from Department of Treasury, Financial Management Service (FMS) on this matter. Please be advised that I have reviewed the Treasury statutes and regulations pertaining to TOP, specifically 31 U.S.C. 3701 Definitions and application, 31 U.S.C. 3716 Administrative offset, and Treasury regulations at 31 C.F.R. 285.4, 285.5 and 901.3. These statutes and implementing regulations specifically provide that the Offset Program is not to be used to collect taxes. The regulations specifically state that the Offset Program is for non-tax debt owed to the United States. Further, these statutes and regulations specifically state that debt or claim does not include a debt or claim arising under the Internal Revenue Code of 1986. Further, I was never notified by the Social Security Administration that the monies I paid into this program were designated as, federal funds, or that these funds could ever be taken from me without due process of law. I was not under the impression, but was lead to believe, that Social Security was an insurance program with guaranteed premiums, until my death, and that all of the funds I was to receive in the future were funds that I, myself, had paid into the Social Security Program. Had I ever been notified that my funds could be taken from me without due process of law, I would never have participated in this program. In my opinion, such would constitute a blatant violation of Article 1, Section 10 of the federal Constitution of the United States in respect of impairing the obligation of contracts. It appears to me that representatives of the IRS are forcing FMS to apply the TOP program against Social Security benefits in satisfaction of an alleged IRS tax debt. I feel this illegal behavior should be vigorously investigated by your office and, further, that full payments to me should be reinstated immediately. Thank you in advance for your assistance. Sincerely,

Page 2 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

Letter 2 July 15, 2010 Treasury Inspector General for Tax Administration Attn: Mr. [name left out], Complaint Management Team P.O. Box 589, Ben Franklin Station Washington, D.C. 20044-0589 Registered Mail #_____________________ Re: Follow up to your letter of June 10, 2010 Dear Mr. [name withheld]: Im sending you this letter as a follow up to your acknowledgment letter dated June 10, 2010 (see attached copy). You wrote in this letter: This office will review your complaint and evaluate it for appropriate action. Please be apprised that its been over thirty (30) days since I received this acknowledgment letter, which should comprise ample time for your office to evaluate [my] complaint and to take appropriate action. However, my Social Security is still being stolen from me. It is my contention that these ongoing thefts comprise criminal impropriety within Federal tax administration and serious misconduct by Internal Revenue Service (IRS) employees, crimes well within TIGTAs purview. Why are these ongoing thefts permitted to continue? Please be apprised that I am NOT requesting dissemination of information regarding TIGTAs law enforcement activities, including actions taken as a result of [my] complaint filed with TIGTA, which dissemination, you state, may compromise federal confidentially statutes. It is for this reason that Ive not submitted a FOIA request and instead am submitting this follow-up letter. My only question remaining is why is the criminal activity I reported being allowed by your office to continue? Please see to it that my Social Security payments are immediately reinstated in full. In anticipation of TIGTA exercising its congressionally-directed mandate, I remain Respectfully,

Page 3 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

My Research As you can imagine, I was very intrigued by this gentlemans letters, his results and by the considerable research he had done. Call me overcautious, but when I put something out to fellow Citizens, I mind my Ps and Qs. I dont want to put out what some may consider to be trashy research, unsupported by authorities that can be relied upon. So, I am going to set forth the trail that I took to validate the great work my anonymous friend sent to me. The Social Security laws are listed in the United States Code (U.S.C.) at 42 U.S.C. Chapter 7 which includes sections 301-1397mm. Subchapter II of Chapter 7 is titled: FEDERAL OLD-AGE, SURVIVORS, AND DISABILITY INSURANCE BENEFITS and runs from Section 401 through Section 434. 42 USC section 407 (Assignment of benefits) provides, in its entirety: (a) In general The right of any person to any future payment under this subchapter shall not be transferable or assignable, at law or in equity, and none of the moneys paid or payable or rights existing under this subchapter shall be subject to execution, levy, attachment, garnishment, or other legal process, or to the operation of any bankruptcy or insolvency law. (b) Amendment of section No other provision of law, enacted before, on, or after April 20, 1983, may be construed to limit, supersede, or otherwise modify the provisions of this section except to the extent that it does so by express reference to this section. (c) Withholding of taxes Nothing in this section shall be construed to prohibit withholding taxes from any benefit under this subchapter, if such withholding is done pursuant to a request made in accordance with section 3402(p)(1) of the Internal Revenue Code of 1986 by the person entitled to such benefit or such persons representative payee. (Bold added). 42 U.S.C. 1383(d)(1) extends these protections to SSI benefits as well. Lopez v. Washington Mutual Bank, 302 F.3rd 900, 12 (9th Cir. 2002) (quoting 42 U.S.C. 407(a)). Similar to the language of Section 407(a), Section 5301(a) provides that veterans benefits shall be exempt from the claim of creditors, and shall not be liable to attachment, levy, or seizure by or under any legal or equitable process whatever, either before or after receipt by the beneficiary. Seems pretty clear to me that the IRS is not allowed to levy any Social Security payment, yet we all know that the IRS does, in fact, levy such payments. Heres the workaround they use to get past this section of the United States Code.

Page 4 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

The Treasury Offset Program (TOP) is a centralized debt collection program administered by the Treasury Department. It uses what it terms administrative offset (read reduction). This means that TOP reduces (offsets) payments owed by the government to companies and individuals in order to collect debts or claims owed to various Federal agencies, as well as debts owed to states. See 31 CFR 285.5 (Centralized offset of Federal payments to collect nontax debts owed to the United States), at subsection (a) (The Department of the Treasurys Financial Management Service (FMS) administers centralized offset through the Treasury Offset Program. Offset occurs when the Federal government withholds part or all of a debtors Federal payment to satisfy the debtors delinquent debt owed to the government.) (Bold added). It also appears that past-due child support cannot be offset against Social Security payments. See 31 CFR 285.1 (Collection of past-due support by administrative offset) at subsection (i) (Payments subject to offset. Federal payments subject to offset under this section include all Federal payments except: (1) Payments due to an individual under (i) Title IV of the Higher Education Act of 1965; (ii) The Social Security Act; (iii) Part B of the Black Lung Benefits Act; (iv) Any law administered by the Railroad Retirement Board). The TOP Overview states, in relevant part: the disbursing official offsets the payment [to the delinquent company or individual], in whole or in part, to satisfy the debt [owed to the federal agency or state], to the extent legally allowed. The disbursing official is required to perform such offset pursuant to 31 U.S.C. 3716(c). (Bold added.) Heres where the tricky part comes into play. 31 U.S.C. 3716(c)(3)(A) provides, in relevant part: (i) Notwithstanding any other provision of law . . ., all payments due to an individual under (I) the Social Security Act . . . shall be subject to offset under this section. I am quite sure that some IRS employees and officials read this far and no farther. They conclude that they can, therefore, use the TOP administrative offset program (collection process) to levy your Social Security payments under this provision for what they deem to be past-due taxes, penalties and interest under the Internal Revenue Code. However, keep in mind that we have jumped from Title 42 (where Social Security sections are located) to Title 31 of the United States Code (31 U.S.C. - MONEY AND FINANCE) where the TOP program is located.

Page 5 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

The TOP program is located in Chapter 37 - Claims of Title 31. (Are you confused, yet? ) Chapter 37 includes 31 U.S.C. 3701-3733. So, looking back to the beginning of Chapter 37, we find 31 U.S.C. 3701 Definitions and application, and read the definitions applicable to this chapter, meaning Chapter 37, which includes the troubling 31 U.S.C. 3716(c)(3)(A) wherein we are informed that Social Security payments shall be subject to offset under this section. However, 31 U.S.C. 3701(d) provides: (d) Sections 3711(e) and 37163719 of this title do not apply to a claim or debt under, or to an amount payable under (1) the Internal Revenue Code of 1986 (26 U.S.C. 1 et seq.), (2) the Social Security Act (42 U.S.C. 301 et seq.), except to the extent provided under sections 204(f) and 1631(b)(4) of such Act and section 3716 (c) of this title, or (3) the tariff laws of the United States. [I added the bold.] Keep in mind that the TOP Overview states clearly that: The disbursing official is required to perform such offset pursuant to 31 U.S.C. 3716(c). 31 U.S.C. 3716(c)(6) provides: (6) Any Federal agency that is owed by a person a past due, legally enforceable nontax debt that is over 180 days delinquent, including nontax debt administered by a third party acting as an agent for the Federal Government, shall notify the Secretary of the Treasury of all such nontax debts for purposes of administrative offset under this subsection. (Bold added.) Under definitions for this Chapter, at 31 U.S.C. 3701(a)(8), we read: (8) nontax means, with respect to any debt or claim, any debt or claim other than a debt or claim under the Internal Revenue Code of 1986. (Bold added.) See also 31 CFR 285.4 (Offset of Federal benefit payments to collect past-due, legally enforceable nontax debt) (Debt or claim means an amount of money, funds, or property which has been determined by an agency official to be due the United States from any person, organization, or entity except another Federal agency. Debt or claim does not include a debt or claim arising under the Internal Revenue Code of 1986 or the tariff laws of the United States); 31 CFR 285.5 (Centralized offset of Federal payments to collect nontax debts owed to the United States) (same). (Bold added.) Couldnt be any clearer, IMO (in my opinion).

Page 6 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

31 USC 901 (Establishment of agency Chief Financial Officers) sets out the process for the appointment of the Chief Financial Officers of the various federal agencies. Treas. Reg. 901.3 (Collection by administrative offset) established for this section, at subsection (a)(2)(iii), states that This section does not apply to: *** (iii) Debts arising under, or payments made under, the Internal Revenue Code (see 31 CFR 285.2, Tax Refund Offset) or the tariff laws of the United States . . . (bold added) See also Treas. Reg. 901.3(b)(1) (Mandatory centralized administrative offset) (Creditor agencies are required to refer past due, legally enforceable nontax debts which are over 180 days delinquent to the Secretary for collection by centralized administrative offset) (bold added). Once again, we see that the offset program does not apply to tax debts; it applies only to nontax debts. The Chief Financial Officers of the agencies have been given the authority by Congress to offset nontax debts; they do NOT have the authority to use TOP to offset tax debts. So, if your Social Security payments are being offset for nontax debts, TOP is being used properly, unless some other legal provisions provide otherwise. Keep in mind that the protections of 42 U.S.C. 407(a) apply to SSI payments. Finally, courts have ruled that you can waive the protections of 407(a) & 1383(d)(1) (SSI payments). See Lopez v. Washington Mutual Bank, 302 F.3rd 900, 30 (9th Cir. 2002) (Washington Mutuals practice of applying directly deposited Social Security and SSI benefits to overdrafts and overdraft charges does not violate 42 U.S.C. 407(a) & 1383(d)(a) because there was sufficient consent by the plaintiffs to such practice).

Page 7 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

My Sample Letter Name Address SSN Date Address of official Dear ____________ : My Social Security retirement payments (or SSI payments) are being levied by the Internal Revenue Service (IRS). Recently, I became aware that the IRS levy of my Social Security retirement payments (or SSI) is illegal. 42 U.S.C. 407(a) provides that none of my Social Security receipts shall be subject to execution, levy, attachment, garnishment, or other legal process. 42 U.S.C. 1383(d)(1) extends these protections to SSI benefits as well. Lopez v. Washington Mutual Bank, 302 F.3rd 900, 12 (9th Cir. 2002) (quoting 42 U.S.C. 407(a)). Moreover, Social Security funds in my bank account may not be levied. The Supreme Court has affirmed that Social Security benefits, even when converted to funds on deposit [that] [a]re readily withdrawable[,] retain[ ] the quality of moneys within the purview of 407. Id. at 416. Tom v. First American Credit Union, 151 F.3d 1289, 10 (10th Cir. 1998) (quoting Philpott v. Essex County Welfare Bd., 409 U.S. 413, 416 (1973)). What About Commingled Social Security Benefits? Social security benefits are protected even if they are commingled in a savings or checking account with funds from other sources. See Philpott v. Essex County Welfare Board, 409 U.S. 413, 416-17, 34 L. Ed. 2d 608, 93 S. Ct. 590 (1973). If the recipient of social security benefits commingles the benefits with other funds, he is entitled to protection as to those funds that are reasonably traceable to social security income. See Philpott, 409 U.S. at 416-17. NCNB Financial Services, Inc., V. Joseph B. Shumate, Jr., 829 F. Supp. 178, Western District of Virginia, Roanoke Division (1993) Legal Services of Northern Virginia website.

Page 8 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

It appears that, despite this prohibition against levy of my Social Security benefit payments, some unknown IRS official has caused the Treasury Offset Program (TOP) (http://www.fms.treas.gov/debt/top.html) to levy my Social Security monthly benefit payments. The TOP Overview states, in relevant part: the disbursing official offsets the payment [to the delinquent company or individual], in whole or in part, to satisfy the debt [owed to the federal agency or state], to the extent legally allowed. The disbursing official is required to perform such offset pursuant to 31 U.S.C. 3716(c). 31 U.S.C. 3716(c)(3)(A) provides, in relevant part: (i) Notwithstanding any other provision of law . . ., all payments due to an individual under (I) the Social Security Act . . . shall be subject to offset under this section. However, 31 U.S.C. 3701 (Definitions and application), at subsection (d), states, in plain language, that (d) Sections 3711(e) and 37163719 of this title do not apply to a claim or debt under, or to an amount payable under (1) the Internal Revenue Code of 1986 (26 U.S.C. 1 et seq.) [bold added]. Finally, Section 3716 and the regulations pertinent to TOP all refer to the offset of nontax debts or claims. For example, under definitions, at 31 U.S.C. 3701(a)(8), we read: (8) nontax means, with respect to any debt or claim, any debt or claim other than a debt or claim under the Internal Revenue Code of 1986. (Bold added.) See also 31 CFR 285.4 (Offset of Federal benefit payments to collect past-due, legally enforceable nontax debt) (Debt or claim means an amount of money, funds, or property which has been determined by an agency official to be due the United States from any person, organization, or entity except another Federal agency. Debt or claim does not include a debt or claim arising under the Internal Revenue Code of 1986 or the tariff laws of the United States); 31 CFR 285.5 (Centralized offset of Federal payments to collect nontax debts owed to the United States) (same). The plain text of these sections and regulations is clear and unambiguous. 31 USC 901 (Establishment of agency Chief Financial Officers) sets out the process for the appointment of the Chief Financial Officers of the various federal agencies.

Page 9 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

Treas. Reg. 901.3 (Collection by administrative offset) for these Officers, at subsection (a)(2)(iii), states that This section does not apply to: (iii) Debts arising under, or payments made under, the Internal Revenue Code (see 31 CFR 285.2, Tax Refund Offset) or the tariff laws of the United States . . . See also Treas. Reg. 901.3(b)(1) (Mandatory centralized administrative offset) (Creditor agencies are required to refer past due, legally enforceable nontax debts which are over 180 days delinquent to the Secretary for collection by centralized administrative offset) (bold added). Once again, it appears that the administrative offset program does not apply to tax debts. The Chief Financial Officers of federal agencies have been given the authority by Congress to offset nontax debts, however, they do NOT have the authority to use TOP to offset tax debts. Moreover, I have not given informed consent to the levy of my Social Security benefits for tax debts. If you believe that I have given such consent, please, provide me with the signed document or other evidence whereby you conclude that I have so consented. CONCLUSION Wherefore, for the reasons set forth herein, I respectfully request that the wrongful levy of my Social Security benefits be released immediately and that the full payments to which I am entitled be sent to me forthwith and in a timely manner, including the amounts that have been erroneously deducted from past payments which were due but not paid to me. Finally, if you do not comply with the foregoing request, it is my intention to institute the civil and criminal legal processes available to me to recover the Social Security funds that have been wrongfully collected under the TOP or other programs. Respectfully, /s/______________________

Page 10 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

To Whom Should You Send This Letter? Here are my thoughts about the people and offices you might want to consider when deciding to whom to send this letter. 1. The IRS office and individual(s) who appear to be responsible for the SS levy these are the folks who can release the SS levy most quickly check here to locate the office nearest you: http://apps.irs.gov/app/officeLocator/index.jsp 2. The office of IRS Chief Counsel he needs to be made aware of the extent of this illegal practice IRS Chief Counsel, 1111 Constitution Ave, NW, Washington, DC 20224 3. IRS Taxpayer Advocate this office also needs to be made aware of the extent of this illegal practice check here for the State office: http://www.irs.gov/uac/Contact-a-LocalTaxpayer-Advocate 4. Treasury Inspector General for Tax Administration (TIGTA) here is the website for TIGTA: http://www.treasury.gov/tigta/contact_report.shtml 5. Social Security Administration: http://oig.ssa.gov/report-fraud-waste-or-abuse/fraudwaste-and-abuse 6. Both U.S. Senators from your State http://www.senate.gov/general/contact_information/senators_cfm.cfm 7. Your U.S. Representative http://www.house.gov/representatives/ I have drafted sample cover letters to all the above HERE. Why Mail All these Officials and Members of Congress? A very popular way to defeat an enemy is to divide and conquer them one by one. That is precisely what the IRS has done in this case: divide Social Security recipients and defraud them one by one. I and a couple of my associates have contacted several individuals whose Social Security benefits are being levied by the IRS for tax debts and asked them about the levy and whether or not they had ever challenged the levy or sought legal counsel regarding the levy. Almost without fail, the response has been negative to both questions. A very common answer has been something like, I dont wanna rattle the cage of the IRS cuz I havent filed and wanna be left alone and not face possible criminal prosecution and prison for failure to file.

Page 11 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

In short, they have not challenged the levy out of fear of retaliation by the IRS. Such an attitude, I rather suspect, may prevail amongst many Social Security recipients whose benefits are being illegally levied. Here is what I told several such folks: You know that your Social Security Benefits cannot legally be levied for tax debts. You also know that the IRS may hold the threat of criminal prosecution for failure to file over your head. Why not, then, go to the IRS office, file all your back tax returns, with the help of the IRS folks, get straight with them, get as clear as you can with any obligations you have with the IRS, then also get the levy lifted and be free of the cloud of fear hanging over you. The universal response I got was that they had no idea that their Social Security benefits were protected by Congress from IRS levy for tax debts. It simply doesnt matter how much you may owe in taxes; IRS cannot levy a single dollar for those taxes without your meaningful consent. I recognize that threats of criminal prosecution and prison can cause people to become paralyzed with fear, afraid to take any action or make any decisions. They become prisoners of their own emotions, their own thoughts. I do not make light of such real fears nor do I think ill of such individuals. So, I am hopeful that, if a sufficiently large number of people across the Nation will send letters to their Members of Congress, petition the Taxpayer Advocates office, as well as the Treasury Inspector Generals office, perhaps even write letters to their newspapers, and other civic groups, the combined efforts of hundreds, maybe thousands of such individuals will cause the issue of illegal tax levies on Social Security benefits to reach such a fevered pitch that Congress may take a serious look at it, especially as the IRS is already under a cloud. In short, individual action by many across the Land will provide cover for those who, if acting alone, might well become targets of real or implied threats by some misguided IRS employees. I have made my research available to all, whether they can afford $5.00 or not. So, if each person who does obtain this short eBook will send 5-10 of his or her friends to my website and thereby let them obtain the research, for whatever they choose to contribute or nothing, the cumulative impact of this knowledge will, IMO, offer an umbrella of protection to those who understandably live in fear of the IRS.

Page 12 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

Subscribe to Future Posts As soon as I get this out, I intend to set to work on drafting two additional short eBooks on the processes by which to obtain two (2) years worth of wrongful IRS tax levies back from the IRS. One will be on the administrative claim required before you can sue for the wrongful levy. The second will be sample court filings required to obtain the wrongful levied Social Security funds returned. I am not an attorney and cannot, therefore, lawfully assist individuals in filing court papers. The best I can do is to show you what I might file, as sample educational material, and let you adapt such material to your needs. Better, by far, if you have access to a licensed attorney who will do this for you. Then, there will be no need to obtain these follow-up eBooks. Your attorney doesnt need me, but I am happy to assist, if he or she so desires. My intent is, once again, to make these two eBooks available in the same manner: Contribute what you like or not. The easiest and most certain way to be alerted to these follow-on eBooks is to subscribe on my Website. You will find a subscribe button on the right side of my Website. I dont sell or give away your email address. However, by subscribing, you will be informed without my having to record your email and send out email notification to massive numbers of folks and run the risk of my Internet service provider or other entities treating such emails as spam, which I, like you, I am sure, detest. My email list is already approaching 1,000, so I dont feel I can personally handle many more addresses without problems. Other eBooks On one of my other websites, I have posted several eBooks setting forth what I and my associate, John w. Benson, believe to be the Truth about Income Taxes in Plain English. John and I intend to publish several additional eBooks, most likely on that website, providing responses to IRS Notices of Intent to Levy, IRS Lien notices, IRS letters seeking delinquent tax returns, Notices of Proposed Deficiencies, IRS seizure notices, what to do after seizure, and responses to similar IRS processes. So, if that kind of information appeals to you or your friends, please, subscribe on that website, as well, so that you will receive timely notification of those eBooks as they are published. Why Do John and I Do Make Our Research Available in this Manner? John is 79 y/o and is recovering from serious health problems: diabetes, retinopathy, cardiovascular disease, and has been classified as legally blind by the VA.

Page 13 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

Although the VA had strongly urged him to have quadruple bypass surgery some two years ago, he chose to utilize natural healing methods to recover his health. Such methods, supplements, vitamins, minerals and the like are not covered by Medicare or the VA. He and I each have been living on less than $800 per month. That does not leave a lot of room for alternative health remedies. I, at 73, have been blessed with great health. My VA primary care physician marvels at my great blood tests, no drugs(legal or illegal!), riding a bike (dont have a car), often 15-20 miles per day, perfect cholesterol, 60-64 heart pulse, etc. So, I have dedicated every single dollar that our books may generate to Johns alternative health remedies. I, personally, have only one great goal remaining in my mortal life, namely, I desire, with all my heart, to complete the course of technology left by L. Ron Hubbard by which to gain spiritual freedom before I pass into the eternities from this lifetime. I believe that there are as many ways to God as there are human beings who have ever lived and who will come to live on this Planet and any other planets where there may exist sentient beings. I also happen to believe that as I give of myself to others, so will I receive back in return. Therefore, I have chosen to give to John all that our combined research and publishing skills may generate, if anything at all, until he has sufficient to obtain such alternative health remedies as he may see fit to use in the recovery of his health. If there remains an overflow, then both he and I will seek to scale the spiritual freedom that Hubbards tech holds out as being available to each human being and thereby be able to give even more to our fellow human beings before we are called the way of all flesh. Therefore, John and I believe that, by laying all we hold dear in this life on the altar of charity toward our fellow human beings, we will be rewarded to that same extent in some way or manner perhaps unknown to us at this time. In short, we have neither gold nor silver, but such as we possess we now lay at the feet of our fellow Countrymen and Countrywomen to use or ignore as they may choose. We ask only three favors: 1) if you like what you read, please, like us on Facebook, Twitter, and other social media (see the social media icons at the bottom of our websites); 2) contact radio talk-show hosts to book us for guest interviews; and 3) send friends and acquaintances to our Social Security website and our Taxation website rather than emailing your copy of our eBooks to them.

Page 14 of 15

Buyer: Frank Dartee (frank.dartee@gmail.com) Transaction ID: jg-mr6m2ka30feede4

As you know, some cannot contribute and still others will refuse to contribute. Both are welcome to our research for FREE. Others may be both able and willing to contribute. All three groups may send others to our sites and thereby grow the number of folks who may choose to cause the IRS back off the illegal levy of Social Security benefits, as well as exercise such rights as we make known in other eBooks now available and to be published over the coming weeks and months. By increasing knowledge and awareness among many Americans, we (meaning you, our readers, and the two of us) may be able to so enlighten and embolden the massive numbers needed to take such lawful actions as may be available and thereby bring the IRS back under the control of the People. John and I are doing all we are capable of. We now need your help in moving our research into the consciousness of the American People!

LETS LOCK ARMS AND FIGHT THE FORCES OF EVIL!

2013 Glenn Ambort

Page 15 of 15

Anda mungkin juga menyukai

- Constitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxDari EverandConstitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxBelum ada peringkat

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionDari EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionBelum ada peringkat

- Involuntary Servitude: Slavery Is Alive and Well in AmericaDari EverandInvoluntary Servitude: Slavery Is Alive and Well in AmericaBelum ada peringkat

- Common Law Court of The United States of America (Writ of Habeas Corpus) PetitonDokumen5 halamanCommon Law Court of The United States of America (Writ of Habeas Corpus) PetitonIcarUs_sUNBelum ada peringkat

- PDF 20200812 131130 142277012701921Dokumen4 halamanPDF 20200812 131130 142277012701921Lee LienBelum ada peringkat

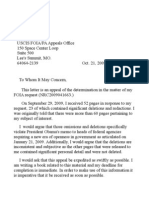

- Sally Jacobs Obama SR USCIS File FOIA AppealDokumen60 halamanSally Jacobs Obama SR USCIS File FOIA AppealhsmathersBelum ada peringkat

- Representing Yourself Before The Administrative Hearing CommissionDokumen8 halamanRepresenting Yourself Before The Administrative Hearing CommissionRicharnellia-RichieRichBattiest-CollinsBelum ada peringkat

- Selling Off Our Freedom The AnswerDokumen20 halamanSelling Off Our Freedom The AnswerDan BartoBelum ada peringkat

- Business Was Established After The Disaster: Pdcrecons@sba - GovDokumen2 halamanBusiness Was Established After The Disaster: Pdcrecons@sba - GovVince KimmetBelum ada peringkat

- The Constitution of The United StatesDokumen50 halamanThe Constitution of The United StatesMichigan News100% (1)

- A. A By: 1. Distinguished From SecuritiesDokumen49 halamanA. A By: 1. Distinguished From SecuritiesRabelais MedinaBelum ada peringkat

- The Lost Right of Redress: Understanding America's Forgotten FreedomDokumen41 halamanThe Lost Right of Redress: Understanding America's Forgotten FreedomKevin HaddockBelum ada peringkat

- 03.19.2010 New Short 10 IssuesDokumen58 halaman03.19.2010 New Short 10 IssuesrodclassteamBelum ada peringkat

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Dokumen17 halamanGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508Belum ada peringkat

- Miller Et Al V Homecomings FinDokumen22 halamanMiller Et Al V Homecomings FinA. CampbellBelum ada peringkat

- Motion For Relief and Stay of Any Collection of Fines or Penalties Pending AppealDokumen6 halamanMotion For Relief and Stay of Any Collection of Fines or Penalties Pending AppealMark JacksonBelum ada peringkat

- Bid, Payment, and Performance Bonds 091125Dokumen19 halamanBid, Payment, and Performance Bonds 091125JOHNBelum ada peringkat

- For Correspondence To Bob: For Subscription and Renewal Technical Support, Log in Problems, Etc.Dokumen40 halamanFor Correspondence To Bob: For Subscription and Renewal Technical Support, Log in Problems, Etc.freedom_lover_k0% (1)

- Text of U.S. Bankruptcy Speech: Because of The Scandal Associated With CongressmanDokumen3 halamanText of U.S. Bankruptcy Speech: Because of The Scandal Associated With CongressmanHorace BatisteBelum ada peringkat

- 2010jun10 - Howard Griswold Conference CallDokumen13 halaman2010jun10 - Howard Griswold Conference CallGemini ResearchBelum ada peringkat

- Gardendale Probation LawsuitDokumen50 halamanGardendale Probation LawsuitMike CasonBelum ada peringkat

- 2014 PA Law Practice and Procedure 2014 Prothonotary Notaries ManualDokumen1.124 halaman2014 PA Law Practice and Procedure 2014 Prothonotary Notaries Manualmaria-bellaBelum ada peringkat

- Admin RemedyDokumen9 halamanAdmin Remedy1 2Belum ada peringkat

- Are You in Bankruptcy Rev 1Dokumen1 halamanAre You in Bankruptcy Rev 1El_NobleBelum ada peringkat

- Language - What To Do - E02961 - PDFDokumen6 halamanLanguage - What To Do - E02961 - PDFAnnette Mulkay100% (1)

- The Criminal Courts and Criminal CasesDokumen40 halamanThe Criminal Courts and Criminal CaseselidnisBelum ada peringkat

- All Home Loans Are FDIC InsuredDokumen3 halamanAll Home Loans Are FDIC InsuredthenjhomebuyerBelum ada peringkat

- Deprivation of Rights Under Color of LawDokumen3 halamanDeprivation of Rights Under Color of Lawjb_uspuBelum ada peringkat

- GSA LetterDokumen4 halamanGSA LetterAustin Denean100% (1)

- 20190804-Press Release MR G. H. Schorel-Hlavka O.W.B. Issue - Re Issue-63-Cash TransactionsDokumen9 halaman20190804-Press Release MR G. H. Schorel-Hlavka O.W.B. Issue - Re Issue-63-Cash TransactionsGerrit Hendrik Schorel-HlavkaBelum ada peringkat

- Section 10 Powers Denied to StatesDokumen4 halamanSection 10 Powers Denied to StatesJusticeBelum ada peringkat

- War Powers Act VetoDokumen3 halamanWar Powers Act VetoChristopher Chiang100% (1)

- Promisary NoteDokumen4 halamanPromisary Notellg8749100% (1)

- Senate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceDokumen53 halamanSenate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceScribd Government DocsBelum ada peringkat

- Bond ComptrollerDokumen88 halamanBond ComptrollertrustkonanBelum ada peringkat

- 18 Usc 1621Dokumen2 halaman18 Usc 1621A. Campbell0% (1)

- Duns #S For Each StateDokumen2 halamanDuns #S For Each StateSteveManningBelum ada peringkat

- Deed of SaleDokumen1 halamanDeed of SaleSantos PinkyBelum ada peringkat

- The Stamps ActDokumen55 halamanThe Stamps ActReal TrekstarBelum ada peringkat

- Uniform Bonding Code (Part 2)Dokumen18 halamanUniform Bonding Code (Part 2)Paschal James BloiseBelum ada peringkat

- Sales Sample Q Sans F 09Dokumen17 halamanSales Sample Q Sans F 09Tay Mon100% (1)

- Howard Griswold 01Dokumen27 halamanHoward Griswold 01naturalvibesBelum ada peringkat

- Treasury Decision 2313Dokumen3 halamanTreasury Decision 2313John NinetynineBelum ada peringkat

- CFPB Report Financial-Well-Being PDFDokumen48 halamanCFPB Report Financial-Well-Being PDFjoshuamaun1998Belum ada peringkat

- Debits and CreditsDokumen5 halamanDebits and Creditsambari4u1444Belum ada peringkat

- How A Prisoner Funds AmericaDokumen6 halamanHow A Prisoner Funds AmericaronsomBelum ada peringkat

- DraftKings' Motion To Compel ArbitrationDokumen95 halamanDraftKings' Motion To Compel ArbitrationLegalBlitzBelum ada peringkat

- Rent Supplement: Application Form ForDokumen8 halamanRent Supplement: Application Form ForVasile E. UrsBelum ada peringkat

- Brunson Case Gov - Uscourts.utd.139026.1.3Dokumen2 halamanBrunson Case Gov - Uscourts.utd.139026.1.3Freeman LawyerBelum ada peringkat

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDokumen1 halamanCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingMichelle OsbornBelum ada peringkat

- Legal LatinDokumen17 halamanLegal Latinmary engBelum ada peringkat

- Sample Letter - Dispute To A CreditorDokumen2 halamanSample Letter - Dispute To A CreditorTRISTARUSABelum ada peringkat

- Property Tax Opt-Out GuideDokumen4 halamanProperty Tax Opt-Out Guiderussell_lee_1100% (1)

- Enum RightsDokumen24 halamanEnum RightsAkil BeyBelum ada peringkat

- 20 UCC Provisions Bankers Forget 052603Dokumen5 halaman20 UCC Provisions Bankers Forget 052603kakoslipBelum ada peringkat

- Amend Modify Waive PromissoryDokumen3 halamanAmend Modify Waive PromissoryEmman Dumayas100% (1)

- Notice of Dishonor DefinedDokumen9 halamanNotice of Dishonor Definedpanamahunt22Belum ada peringkat

- SupCt Petition For Writ On IRS Tax Fraud On AmericansDokumen88 halamanSupCt Petition For Writ On IRS Tax Fraud On AmericansJeff MaehrBelum ada peringkat

- 1 Quick Start Guide REV 02-06-2019Dokumen6 halaman1 Quick Start Guide REV 02-06-2019Public Knowledge100% (2)

- Borax Booklet Doctors Without BordersDokumen12 halamanBorax Booklet Doctors Without Bordersfdartee100% (3)

- The Right To TravelDokumen167 halamanThe Right To TravelBJSSRS50% (2)

- US Supreme Court Ruling Proving No License NecessaryDokumen11 halamanUS Supreme Court Ruling Proving No License NecessarySheila GBelum ada peringkat

- Vacating Sheriff Sales NJDokumen2 halamanVacating Sheriff Sales NJfdarteeBelum ada peringkat

- Love DareDokumen4 halamanLove DareJohn Done100% (2)

- Nano Domestic Quell DossierDokumen11 halamanNano Domestic Quell DossierfdarteeBelum ada peringkat

- The Love DareDokumen4 halamanThe Love DareJeffrey Portalanza100% (3)

- A Lecture On Divine HealingDokumen1 halamanA Lecture On Divine Healingfdartee0% (1)

- A Note About Money and Foreclosures - Pun IntendedDokumen5 halamanA Note About Money and Foreclosures - Pun IntendedfdarteeBelum ada peringkat

- Chart and UpdateDokumen6 halamanChart and UpdatefdarteeBelum ada peringkat

- Above Below DiagramDokumen1 halamanAbove Below DiagramfdarteeBelum ada peringkat

- Favorite VersesDokumen1 halamanFavorite VersesfdarteeBelum ada peringkat

- Subrogation Case Killer 11-14-2017Dokumen30 halamanSubrogation Case Killer 11-14-2017fdartee100% (5)

- Coast Guard Hearing Petition Challenges Constitutionality of Federal AgenciesDokumen33 halamanCoast Guard Hearing Petition Challenges Constitutionality of Federal Agenciesthenjhomebuyer100% (1)

- The Baptism in The Holy SpiritDokumen3 halamanThe Baptism in The Holy SpiritfdarteeBelum ada peringkat

- Public Law - Chapter 48, 48 StatDokumen3 halamanPublic Law - Chapter 48, 48 Statfdartee43% (7)

- Foreclosure Time LineDokumen4 halamanForeclosure Time LinefdarteeBelum ada peringkat

- Certificate of DissolutionDokumen1 halamanCertificate of DissolutionfdarteeBelum ada peringkat

- JGL Newspaper Clips from 1924 RevivalDokumen5 halamanJGL Newspaper Clips from 1924 RevivalfdarteeBelum ada peringkat

- Completing Collection Agency Bond ApplicationsDokumen9 halamanCompleting Collection Agency Bond ApplicationsfdarteeBelum ada peringkat

- When Is A Defendant Entitled To Notice of A Request-Appellate Law NJ BlogDokumen4 halamanWhen Is A Defendant Entitled To Notice of A Request-Appellate Law NJ BlogfdarteeBelum ada peringkat

- Supplemental Maternity BenefitsDokumen1 halamanSupplemental Maternity BenefitsfdarteeBelum ada peringkat

- Healing Truths That Destroy Traditions - Curry BlakeDokumen15 halamanHealing Truths That Destroy Traditions - Curry Blakefdartee100% (3)

- NJ Debt Collection LawsDokumen10 halamanNJ Debt Collection LawsfdarteeBelum ada peringkat

- Netherlands Totalization Agreement ExplainedDokumen11 halamanNetherlands Totalization Agreement ExplainedfdarteeBelum ada peringkat

- Netherlands Totalization Agreement ExplainedDokumen11 halamanNetherlands Totalization Agreement ExplainedfdarteeBelum ada peringkat

- What We Are in Christ - EW KenyonDokumen8 halamanWhat We Are in Christ - EW KenyonMagumba James83% (12)

- Vision Lake KenyonDokumen4 halamanVision Lake Kenyonlolo533Belum ada peringkat

- Michael LaudrupDokumen3 halamanMichael LaudrupSiddiq AimanBelum ada peringkat

- McKinseys Model 7sDokumen10 halamanMcKinseys Model 7sVipul SinghBelum ada peringkat

- Oedipus Rex TestDokumen5 halamanOedipus Rex TestScribdTranslationsBelum ada peringkat

- Toolbox Talk Eye Protection HS - TBT.04Dokumen3 halamanToolbox Talk Eye Protection HS - TBT.04binczykagBelum ada peringkat

- Dark Market PsychologyDokumen28 halamanDark Market PsychologyEmmanuel100% (1)

- Have You Figured Out by Now, The Answer To The Riddle?: Are These Words About Words Clear To You?Dokumen8 halamanHave You Figured Out by Now, The Answer To The Riddle?: Are These Words About Words Clear To You?Aleah LS KimBelum ada peringkat

- I. Bacalah Teks Berikut Ini!: Tugas IiiDokumen2 halamanI. Bacalah Teks Berikut Ini!: Tugas IiiBintang Andrew SaputraBelum ada peringkat

- Entrepreneurship Education Benefits StudentsDokumen8 halamanEntrepreneurship Education Benefits StudentsPerdon El EmBelum ada peringkat

- Epson SP Gs6000e FDokumen298 halamanEpson SP Gs6000e FrepropBelum ada peringkat

- MICROCURRICULAR 1st PLANNING Unit 2 2016-2017 &Dokumen7 halamanMICROCURRICULAR 1st PLANNING Unit 2 2016-2017 &Alexandra QuishpeBelum ada peringkat

- Posterior Palatal Seal AreaDokumen8 halamanPosterior Palatal Seal Areaayan ravalBelum ada peringkat

- RulesDokumen1 halamanRulesapi-558561561Belum ada peringkat

- Chapter 4 LECTURE 1Dokumen40 halamanChapter 4 LECTURE 1Mohammad BarmawiBelum ada peringkat

- SAP PI Interview Questions 2Dokumen7 halamanSAP PI Interview Questions 2Platina 010203Belum ada peringkat

- Jurnal BTKV Edy CLTI 4 FebruariDokumen10 halamanJurnal BTKV Edy CLTI 4 FebruarimcvuBelum ada peringkat

- Bioresource TechnologyDokumen12 halamanBioresource TechnologyThayna CandidoBelum ada peringkat

- Effect of NAADokumen5 halamanEffect of NAADlieya ZaliaBelum ada peringkat

- Every Nurse An E-Nurse: Insights From A Consultation On The Digital Future of NursingDokumen15 halamanEvery Nurse An E-Nurse: Insights From A Consultation On The Digital Future of NursingAjazbhatBelum ada peringkat

- Poster Making - Class XIDokumen5 halamanPoster Making - Class XIBhavik ChoudharyBelum ada peringkat

- Land Use Planning TermsDokumen17 halamanLand Use Planning TermsiltdfBelum ada peringkat

- Green Ox Case Study Solution: Submitted byDokumen4 halamanGreen Ox Case Study Solution: Submitted byVgsom AlumniCommittee50% (2)

- User Manual APC 750 - 1000 - 1500RM2U English Rev02Dokumen17 halamanUser Manual APC 750 - 1000 - 1500RM2U English Rev02makroBelum ada peringkat

- CitiXsys IVend Training QuizzesDokumen7 halamanCitiXsys IVend Training QuizzesRonald Ortiz100% (1)

- BSTM - Maglaque., Et. Al - Approval SheetDokumen4 halamanBSTM - Maglaque., Et. Al - Approval SheetVincent DelosreyesBelum ada peringkat

- Chapter 3 - The Time Value of Money (Part I)Dokumen20 halamanChapter 3 - The Time Value of Money (Part I)Arin ParkBelum ada peringkat

- Watermelon Man - Poncho SanchezDokumen17 halamanWatermelon Man - Poncho SanchezAlan Ramses RV71% (7)

- MERV vs. MPR vs. FPR Rating Chart Air Filters DeliveredDokumen5 halamanMERV vs. MPR vs. FPR Rating Chart Air Filters DeliveredFaizul ZainudinBelum ada peringkat

- Different Organization Structures 11111Dokumen3 halamanDifferent Organization Structures 11111Đức LợiBelum ada peringkat

- Chapter 4 - Evidential Matter and Its DocumentationDokumen14 halamanChapter 4 - Evidential Matter and Its DocumentationKristine WaliBelum ada peringkat

- FS Sembakung PT Hanergy Power Indoensia-En-20160304-WordDokumen183 halamanFS Sembakung PT Hanergy Power Indoensia-En-20160304-Wordalbiyan100% (1)